Professional Documents

Culture Documents

Advanced Banking Law - November 2014

Advanced Banking Law - November 2014

Uploaded by

Basilio MaliwangaCopyright:

Available Formats

You might also like

- 101 Weapons of Spiritual Warfar - D. K. Olukoya-1Document557 pages101 Weapons of Spiritual Warfar - D. K. Olukoya-1Basilio Maliwanga100% (16)

- Trade Me ProspectusDocument257 pagesTrade Me Prospectusbernardchickey100% (1)

- Building A Successful Marriage - Bishop David OyedepoDocument117 pagesBuilding A Successful Marriage - Bishop David Oyedepoemmanueloduor83% (12)

- General Mathematics: LAS, Week 5 - Quarter 2Document16 pagesGeneral Mathematics: LAS, Week 5 - Quarter 2Prince Joshua SumagitNo ratings yet

- Boy Meets Girl - Say Hello To Courtship - 180532 PDFDocument570 pagesBoy Meets Girl - Say Hello To Courtship - 180532 PDFNash Perez100% (1)

- Letter of CreditDocument5 pagesLetter of CreditnavreenNo ratings yet

- Law Relating To Banking November 2015Document4 pagesLaw Relating To Banking November 2015Basilio MaliwangaNo ratings yet

- Advanced Banking Law Nov 2016Document4 pagesAdvanced Banking Law Nov 2016Basilio MaliwangaNo ratings yet

- Advanced Banking Law Nov 2010 Main PaperDocument4 pagesAdvanced Banking Law Nov 2010 Main PaperBasilio MaliwangaNo ratings yet

- Advanced Banking Law MAY 2014 PAPERDocument4 pagesAdvanced Banking Law MAY 2014 PAPERBasilio MaliwangaNo ratings yet

- Advanced Banking Law - May 2015Document4 pagesAdvanced Banking Law - May 2015Basilio MaliwangaNo ratings yet

- Advanced Banking Law May 2013 ExamsDocument5 pagesAdvanced Banking Law May 2013 ExamsBasilio MaliwangaNo ratings yet

- Law Relating To Banking May 2010 Main PaperDocument5 pagesLaw Relating To Banking May 2010 Main PaperBasilio MaliwangaNo ratings yet

- Law Relating To Banking May 2015Document5 pagesLaw Relating To Banking May 2015Basilio MaliwangaNo ratings yet

- Law Relating To Banking Nov 2014Document4 pagesLaw Relating To Banking Nov 2014Basilio MaliwangaNo ratings yet

- Advanced Banking Law May 2016Document3 pagesAdvanced Banking Law May 2016Basilio MaliwangaNo ratings yet

- International Trade Finance Stella - Nov 2016Document4 pagesInternational Trade Finance Stella - Nov 2016Basilio MaliwangaNo ratings yet

- Law Relating To Banking May 2014Document4 pagesLaw Relating To Banking May 2014Basilio MaliwangaNo ratings yet

- Advanced Banking Law May 2010 Main PaperDocument3 pagesAdvanced Banking Law May 2010 Main PaperBasilio MaliwangaNo ratings yet

- Law Relating To Banking - Nov 2013Document4 pagesLaw Relating To Banking - Nov 2013Basilio MaliwangaNo ratings yet

- Credit Risk Assessment 1 May 2011Document5 pagesCredit Risk Assessment 1 May 2011Basilio MaliwangaNo ratings yet

- Credit Risk Assessment 1 May 2013Document4 pagesCredit Risk Assessment 1 May 2013Basilio MaliwangaNo ratings yet

- International Trade Finance November 2014Document5 pagesInternational Trade Finance November 2014Basilio MaliwangaNo ratings yet

- International Trade Finance - May 2015Document6 pagesInternational Trade Finance - May 2015Basilio MaliwangaNo ratings yet

- International Trade Finance Nov 2010 Main PaperDocument6 pagesInternational Trade Finance Nov 2010 Main PaperBasilio MaliwangaNo ratings yet

- Credit Risk Assessment 2 - November 2015Document4 pagesCredit Risk Assessment 2 - November 2015Basilio MaliwangaNo ratings yet

- International Trade Finance Nov 2011 Main PaperDocument6 pagesInternational Trade Finance Nov 2011 Main PaperBasilio MaliwangaNo ratings yet

- Credit Risk Assessment 1 - November 2015Document8 pagesCredit Risk Assessment 1 - November 2015Basilio MaliwangaNo ratings yet

- BF 130Document4 pagesBF 130Dixie CheeloNo ratings yet

- Go To and Click Sing Up To RegisterDocument6 pagesGo To and Click Sing Up To RegisterRimsha TariqNo ratings yet

- The University of The South Pacific: School of Accounting and FinanceDocument3 pagesThe University of The South Pacific: School of Accounting and FinanceTetzNo ratings yet

- Credit Risk Assessment 1 Nov 2013Document4 pagesCredit Risk Assessment 1 Nov 2013Basilio MaliwangaNo ratings yet

- Basic Rules of BankingDocument6 pagesBasic Rules of BankingBabla MondalNo ratings yet

- Answer: Government of India Finance Lok SabhaDocument2 pagesAnswer: Government of India Finance Lok Sabhamunu ojhaNo ratings yet

- BFSI Training Manual - PDF - 20230810 - 164502 - 0000Document136 pagesBFSI Training Manual - PDF - 20230810 - 164502 - 0000deepak643aNo ratings yet

- Risk Analysis & Management - May 2016Document5 pagesRisk Analysis & Management - May 2016mukonahannleckNo ratings yet

- Banking Awareness For SBI PODocument12 pagesBanking Awareness For SBI POsruthyaNo ratings yet

- Credit Risk Ass 2 Nov 2014Document4 pagesCredit Risk Ass 2 Nov 2014Basilio MaliwangaNo ratings yet

- Credit Risk Assessment 1 - November 2016Document5 pagesCredit Risk Assessment 1 - November 2016Basilio MaliwangaNo ratings yet

- Banking LawDocument3 pagesBanking LawtrizahNo ratings yet

- Bar Exam Questions in Banking LawsDocument54 pagesBar Exam Questions in Banking LawsKayzer SabaNo ratings yet

- MBA4013 Management of Banking andDocument7 pagesMBA4013 Management of Banking andNurfaiqah AmniNo ratings yet

- Expected Imp. Banking QuestionsDocument10 pagesExpected Imp. Banking Questionskramit16No ratings yet

- Question and AnswerDocument14 pagesQuestion and AnswerrajagctNo ratings yet

- Ibps Clerk 3 GK Capsule PDFDocument48 pagesIbps Clerk 3 GK Capsule PDFg24uallNo ratings yet

- BANKING Math Project by PranayDocument37 pagesBANKING Math Project by Pranay;LDSKFJ ;No ratings yet

- International Trade Finance - May 2013Document4 pagesInternational Trade Finance - May 2013Basilio MaliwangaNo ratings yet

- Banking Awareness QuizDocument4 pagesBanking Awareness QuizGurjinder SinghNo ratings yet

- The Tip of Indian Banking Part I To Part 26my ScribdDocument144 pagesThe Tip of Indian Banking Part I To Part 26my ScribdambujchinuNo ratings yet

- Banking Awareness For SBI PO Mains 2017 - Gradeup - pdf-47Document9 pagesBanking Awareness For SBI PO Mains 2017 - Gradeup - pdf-47Mathew ChackoNo ratings yet

- Banking G K NotesDocument58 pagesBanking G K NotesSowmiyiaNo ratings yet

- Amity University Haryana: Page 1 of 2Document2 pagesAmity University Haryana: Page 1 of 2nidhi malikNo ratings yet

- SBI PO Interview CapsuleDocument19 pagesSBI PO Interview CapsulevanajaNo ratings yet

- Al Arafah Islami Bank Limited General BaDocument9 pagesAl Arafah Islami Bank Limited General Bakhansha ComputersNo ratings yet

- Examination Paper - Principles and Practices of Banking & Financial ServicesDocument9 pagesExamination Paper - Principles and Practices of Banking & Financial ServicesJesjames123No ratings yet

- Careerpower - in Images Ibps Clerk 3 GK CapsuleDocument48 pagesCareerpower - in Images Ibps Clerk 3 GK CapsuleyrikkiNo ratings yet

- Sec B Banking Law Midterm ExaminationDocument2 pagesSec B Banking Law Midterm Examinationhazelvmu.lawNo ratings yet

- Banking Awareness Quiz 2014 - Set 37: Search Your Topic HERE...Document8 pagesBanking Awareness Quiz 2014 - Set 37: Search Your Topic HERE...gangadhar sheelaNo ratings yet

- FRA Test Papers: Archive - Sem VDocument32 pagesFRA Test Papers: Archive - Sem VBharatSirveeNo ratings yet

- BF 140Document3 pagesBF 140Dixie CheeloNo ratings yet

- NBPDocument25 pagesNBPShaikh JunaidNo ratings yet

- Bank AuditDocument18 pagesBank AuditPranav HariharanNo ratings yet

- MMG Guide to Banking Basics for International StudentsFrom EverandMMG Guide to Banking Basics for International StudentsRating: 5 out of 5 stars5/5 (1)

- Financial Soundness Indicators for Financial Sector Stability in Viet NamFrom EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamNo ratings yet

- Englisch Schwer Letter-Of-Motivation Audio-1Document2 pagesEnglisch Schwer Letter-Of-Motivation Audio-1Basilio MaliwangaNo ratings yet

- A Closer Talk With God - Prayers - Kim TrujilloDocument70 pagesA Closer Talk With God - Prayers - Kim TrujilloBasilio MaliwangaNo ratings yet

- Breakthrough! Develop The 7 HabitsDocument182 pagesBreakthrough! Develop The 7 HabitsBasilio Maliwanga100% (1)

- Your Spiritual Weapons and How - Terry LawDocument64 pagesYour Spiritual Weapons and How - Terry LawBasilio MaliwangaNo ratings yet

- English As A Medium of Instruction (EMI)Document1 pageEnglish As A Medium of Instruction (EMI)Basilio MaliwangaNo ratings yet

- The New Drawing On The Right Side of The BrainDocument314 pagesThe New Drawing On The Right Side of The BrainBasilio MaliwangaNo ratings yet

- Are Your Finances Ready For A Stressful Life Event?: Also InsideDocument8 pagesAre Your Finances Ready For A Stressful Life Event?: Also InsideBasilio MaliwangaNo ratings yet

- Capital Structure and Firm Performance EDocument12 pagesCapital Structure and Firm Performance EBasilio MaliwangaNo ratings yet

- Rule: HUD-owned Properties: HUD-acquired Single Family Property Disposition— Good Neighbor Next Door Sales ProgramDocument8 pagesRule: HUD-owned Properties: HUD-acquired Single Family Property Disposition— Good Neighbor Next Door Sales ProgramJustia.comNo ratings yet

- Mandiri KusnoDocument2 pagesMandiri KusnoANGGUNNo ratings yet

- A Study On Consumer's Preference Towards Gold As An Investment With Reference To Coimbatore CityDocument4 pagesA Study On Consumer's Preference Towards Gold As An Investment With Reference To Coimbatore CityRiyaz AliNo ratings yet

- BR Act, 1949Document7 pagesBR Act, 1949aki16288No ratings yet

- Gdp-New Vendor Registration Form Black Bear Resources IndonesiaDocument1 pageGdp-New Vendor Registration Form Black Bear Resources Indonesiabatara wajo123No ratings yet

- Indian Money MarketDocument79 pagesIndian Money MarketParth Shah100% (5)

- Payment NotificationDocument1 pagePayment Notificationmarkmafu7No ratings yet

- Voucher 2023 03 01Document1 pageVoucher 2023 03 01Mir Mazhar Ali MagsiNo ratings yet

- XXSW Iex Cust Trends RPT EngDocument2 pagesXXSW Iex Cust Trends RPT Engmastanvali.shaik84359No ratings yet

- ﺍﻷﻫﻠﻲ ﺇﻱ ﻛﻮﺭﺏDocument2 pagesﺍﻷﻫﻠﻲ ﺇﻱ ﻛﻮﺭﺏصيانة الآتNo ratings yet

- Chapter-6 Allotment of SecuritiesDocument8 pagesChapter-6 Allotment of SecuritiesCA CS Umang RataniNo ratings yet

- A Report ON: by Saurav Sharma A0101918286Document76 pagesA Report ON: by Saurav Sharma A0101918286Akshay Akki GuptaNo ratings yet

- Section C Group II Parameters For Customer SatisfactionDocument6 pagesSection C Group II Parameters For Customer SatisfactionBhartiyam SushilNo ratings yet

- Mfs Question BankDocument2 pagesMfs Question Bankpateljitendra2136No ratings yet

- HDFC FinalDocument19 pagesHDFC FinalLavina JainNo ratings yet

- Cash & Cash EquivalentDocument3 pagesCash & Cash Equivalentdeborah grace sagarioNo ratings yet

- YES TRANSACT Smart Trade OfferingDocument1 pageYES TRANSACT Smart Trade OfferingAndorran ExpressNo ratings yet

- The Karur Vysya Bank LimitedDocument11 pagesThe Karur Vysya Bank LimitedmithradharunNo ratings yet

- Electronic Payment SystemsDocument8 pagesElectronic Payment SystemsAbhishek NayakNo ratings yet

- Appraisal of The Effect of Electronic Payment System On Customer Satisfaction in Nigeria Banking SystemDocument5 pagesAppraisal of The Effect of Electronic Payment System On Customer Satisfaction in Nigeria Banking SystemIPROJECCTNo ratings yet

- Quant Checklist 168 PDF 2022 by Aashish AroraDocument70 pagesQuant Checklist 168 PDF 2022 by Aashish Arorarajnish sharmaNo ratings yet

- 6.chapter 4 Research MethodologyDocument6 pages6.chapter 4 Research MethodologySmitha K BNo ratings yet

- Hit Me UpDocument20 pagesHit Me Upapi-374831403No ratings yet

- Access To Finance Presentation On Success Story of NCI FundDocument18 pagesAccess To Finance Presentation On Success Story of NCI FundGeoid AnalyticsNo ratings yet

- 03 January 2017 Maiah Beatrice R. Dinglasan University of Santo Tomas - Manila 0917 550 0003Document3 pages03 January 2017 Maiah Beatrice R. Dinglasan University of Santo Tomas - Manila 0917 550 0003Maiah DinglasanNo ratings yet

- BSP Circular No. 925-16Document77 pagesBSP Circular No. 925-16Helena HerreraNo ratings yet

- 20230AC262AA710CDocument1 page20230AC262AA710CMaqsood Ashtam FroshNo ratings yet

Advanced Banking Law - November 2014

Advanced Banking Law - November 2014

Uploaded by

Basilio MaliwangaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advanced Banking Law - November 2014

Advanced Banking Law - November 2014

Uploaded by

Basilio MaliwangaCopyright:

Available Formats

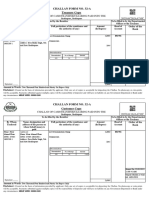

INSTITUTE OF BANKERS IN MALAWI

ADVANCED DIPLOMA IN BANKING EXAMINATION

SUBJECT: ADVANCED BANKING LAW (AD318)

Date: Monday, 17th November 2014

Time Allocated: 3 hours (13:30 – 16:30 hours)

INSTRUCTIONS TO CANDIDATES

1 This paper consists of TWO Sections, A and B.

2 Section A consists of 4 questions, each question carries 15 marks.

Answer ALL questions.

3 Section B consists of 4 questions, each question carries 20 marks. Answer

ANY TWO questions.

4 You will be allowed 10 minutes to go through the paper before the start of the

examination, you may write on this paper but not in the answer book.

5 Begin each answer on a new page.

6 Please write your examination number on each answer book used.

Answer books without examination numbers will not be marked.

7 All persons writing examinations without payment will risk expulsion from the

Institute.

8 If you are caught cheating, you will be automatically disqualified in all subjects

seated this semester.

9 DO NOT open this question paper until instructed to do so.

SECTION A (60 MARKS)

Answer ALL questions from this section.

QUESTION 1

Define a bank, using reference to cases and Legislation (i.e. An Act of Parliament).

(Total 15 marks)

QUESTION 2

Identify the ‘Know Your Customer’ procedures that must be followed by a bank in its

cross-border correspondent banking as per the Money Laundering and Proceeds of

Serious Crime and Terrorist Financing Act, 2006. (15 marks)

. (Total 15 marks)

QUESTION 3

Don Phiri is a member of the ruling party and wants to open an account at your bank.

What are the Know Your Client Obligations of a bank your bank has to comply with

before opening the account and after opening the account? (Total 15 marks)

QUESTION 4

Write brief notes on the following:

i) Post dated cheque. (5 marks)

ii) Cheque truncation. (5 marks)

iii) Countermand of a cheque. (5 marks)

(Total 15 marks)

A qualification examined by the Institute of Bankers in Malawi 2

SECTION B (40 MARKS)

Answer ANY TWO questions from this section

QUESTION 5

Explain the following objects of the Reserve Bank of Malawi;

(i) To maintain external reserves so as to safeguard the inter-national value of

the Malawi currency. (5 marks)

(ii) To promote a money and capital market in Malawi. (5 marks)

(iii) To act as lender of last resort to the banking system. (5 marks)

(iv) To supervise banks and other financial institutions (5 marks)

(Total 20 marks)

QUESTION 6

Rambele has an Auto Teller Machine Card from his bankers, namely Swift & Swift

Bank. The ATM is compatible for use on Auto Teller Machines of all the other banks.

Rambele is failing to withdraw funds from Zochedwa Bank’s Auto Teller Machines.

Rambele has gone inside Zochedwa Bank to enquire about his bank balance on the

account. The officers at Zochedwa Bank have refused to assist him stating that he is

not their customer. Advise Rambele on his status. (Total 20 marks)

A qualification examined by the Institute of Bankers in Malawi 3

QUESTION 7

The Malawi Revenue Authority has written Chinsinsi Bank to provide the bank

statements of Mrs. Zofuna who is widely reported in the local media of fraudulent

activities. Advise the bank on their obligations to Mrs. Zofuna and the Malawi Revenue

Authority.

(Total 20 marks)

QUESTION 8

What are the conditions that the Reserve Bank of Malawi will consider before it issues

a banking license? (Total 20 marks)

END OF THE EXAMINATION PAPER

A qualification examined by the Institute of Bankers in Malawi 4

You might also like

- 101 Weapons of Spiritual Warfar - D. K. Olukoya-1Document557 pages101 Weapons of Spiritual Warfar - D. K. Olukoya-1Basilio Maliwanga100% (16)

- Trade Me ProspectusDocument257 pagesTrade Me Prospectusbernardchickey100% (1)

- Building A Successful Marriage - Bishop David OyedepoDocument117 pagesBuilding A Successful Marriage - Bishop David Oyedepoemmanueloduor83% (12)

- General Mathematics: LAS, Week 5 - Quarter 2Document16 pagesGeneral Mathematics: LAS, Week 5 - Quarter 2Prince Joshua SumagitNo ratings yet

- Boy Meets Girl - Say Hello To Courtship - 180532 PDFDocument570 pagesBoy Meets Girl - Say Hello To Courtship - 180532 PDFNash Perez100% (1)

- Letter of CreditDocument5 pagesLetter of CreditnavreenNo ratings yet

- Law Relating To Banking November 2015Document4 pagesLaw Relating To Banking November 2015Basilio MaliwangaNo ratings yet

- Advanced Banking Law Nov 2016Document4 pagesAdvanced Banking Law Nov 2016Basilio MaliwangaNo ratings yet

- Advanced Banking Law Nov 2010 Main PaperDocument4 pagesAdvanced Banking Law Nov 2010 Main PaperBasilio MaliwangaNo ratings yet

- Advanced Banking Law MAY 2014 PAPERDocument4 pagesAdvanced Banking Law MAY 2014 PAPERBasilio MaliwangaNo ratings yet

- Advanced Banking Law - May 2015Document4 pagesAdvanced Banking Law - May 2015Basilio MaliwangaNo ratings yet

- Advanced Banking Law May 2013 ExamsDocument5 pagesAdvanced Banking Law May 2013 ExamsBasilio MaliwangaNo ratings yet

- Law Relating To Banking May 2010 Main PaperDocument5 pagesLaw Relating To Banking May 2010 Main PaperBasilio MaliwangaNo ratings yet

- Law Relating To Banking May 2015Document5 pagesLaw Relating To Banking May 2015Basilio MaliwangaNo ratings yet

- Law Relating To Banking Nov 2014Document4 pagesLaw Relating To Banking Nov 2014Basilio MaliwangaNo ratings yet

- Advanced Banking Law May 2016Document3 pagesAdvanced Banking Law May 2016Basilio MaliwangaNo ratings yet

- International Trade Finance Stella - Nov 2016Document4 pagesInternational Trade Finance Stella - Nov 2016Basilio MaliwangaNo ratings yet

- Law Relating To Banking May 2014Document4 pagesLaw Relating To Banking May 2014Basilio MaliwangaNo ratings yet

- Advanced Banking Law May 2010 Main PaperDocument3 pagesAdvanced Banking Law May 2010 Main PaperBasilio MaliwangaNo ratings yet

- Law Relating To Banking - Nov 2013Document4 pagesLaw Relating To Banking - Nov 2013Basilio MaliwangaNo ratings yet

- Credit Risk Assessment 1 May 2011Document5 pagesCredit Risk Assessment 1 May 2011Basilio MaliwangaNo ratings yet

- Credit Risk Assessment 1 May 2013Document4 pagesCredit Risk Assessment 1 May 2013Basilio MaliwangaNo ratings yet

- International Trade Finance November 2014Document5 pagesInternational Trade Finance November 2014Basilio MaliwangaNo ratings yet

- International Trade Finance - May 2015Document6 pagesInternational Trade Finance - May 2015Basilio MaliwangaNo ratings yet

- International Trade Finance Nov 2010 Main PaperDocument6 pagesInternational Trade Finance Nov 2010 Main PaperBasilio MaliwangaNo ratings yet

- Credit Risk Assessment 2 - November 2015Document4 pagesCredit Risk Assessment 2 - November 2015Basilio MaliwangaNo ratings yet

- International Trade Finance Nov 2011 Main PaperDocument6 pagesInternational Trade Finance Nov 2011 Main PaperBasilio MaliwangaNo ratings yet

- Credit Risk Assessment 1 - November 2015Document8 pagesCredit Risk Assessment 1 - November 2015Basilio MaliwangaNo ratings yet

- BF 130Document4 pagesBF 130Dixie CheeloNo ratings yet

- Go To and Click Sing Up To RegisterDocument6 pagesGo To and Click Sing Up To RegisterRimsha TariqNo ratings yet

- The University of The South Pacific: School of Accounting and FinanceDocument3 pagesThe University of The South Pacific: School of Accounting and FinanceTetzNo ratings yet

- Credit Risk Assessment 1 Nov 2013Document4 pagesCredit Risk Assessment 1 Nov 2013Basilio MaliwangaNo ratings yet

- Basic Rules of BankingDocument6 pagesBasic Rules of BankingBabla MondalNo ratings yet

- Answer: Government of India Finance Lok SabhaDocument2 pagesAnswer: Government of India Finance Lok Sabhamunu ojhaNo ratings yet

- BFSI Training Manual - PDF - 20230810 - 164502 - 0000Document136 pagesBFSI Training Manual - PDF - 20230810 - 164502 - 0000deepak643aNo ratings yet

- Risk Analysis & Management - May 2016Document5 pagesRisk Analysis & Management - May 2016mukonahannleckNo ratings yet

- Banking Awareness For SBI PODocument12 pagesBanking Awareness For SBI POsruthyaNo ratings yet

- Credit Risk Ass 2 Nov 2014Document4 pagesCredit Risk Ass 2 Nov 2014Basilio MaliwangaNo ratings yet

- Credit Risk Assessment 1 - November 2016Document5 pagesCredit Risk Assessment 1 - November 2016Basilio MaliwangaNo ratings yet

- Banking LawDocument3 pagesBanking LawtrizahNo ratings yet

- Bar Exam Questions in Banking LawsDocument54 pagesBar Exam Questions in Banking LawsKayzer SabaNo ratings yet

- MBA4013 Management of Banking andDocument7 pagesMBA4013 Management of Banking andNurfaiqah AmniNo ratings yet

- Expected Imp. Banking QuestionsDocument10 pagesExpected Imp. Banking Questionskramit16No ratings yet

- Question and AnswerDocument14 pagesQuestion and AnswerrajagctNo ratings yet

- Ibps Clerk 3 GK Capsule PDFDocument48 pagesIbps Clerk 3 GK Capsule PDFg24uallNo ratings yet

- BANKING Math Project by PranayDocument37 pagesBANKING Math Project by Pranay;LDSKFJ ;No ratings yet

- International Trade Finance - May 2013Document4 pagesInternational Trade Finance - May 2013Basilio MaliwangaNo ratings yet

- Banking Awareness QuizDocument4 pagesBanking Awareness QuizGurjinder SinghNo ratings yet

- The Tip of Indian Banking Part I To Part 26my ScribdDocument144 pagesThe Tip of Indian Banking Part I To Part 26my ScribdambujchinuNo ratings yet

- Banking Awareness For SBI PO Mains 2017 - Gradeup - pdf-47Document9 pagesBanking Awareness For SBI PO Mains 2017 - Gradeup - pdf-47Mathew ChackoNo ratings yet

- Banking G K NotesDocument58 pagesBanking G K NotesSowmiyiaNo ratings yet

- Amity University Haryana: Page 1 of 2Document2 pagesAmity University Haryana: Page 1 of 2nidhi malikNo ratings yet

- SBI PO Interview CapsuleDocument19 pagesSBI PO Interview CapsulevanajaNo ratings yet

- Al Arafah Islami Bank Limited General BaDocument9 pagesAl Arafah Islami Bank Limited General Bakhansha ComputersNo ratings yet

- Examination Paper - Principles and Practices of Banking & Financial ServicesDocument9 pagesExamination Paper - Principles and Practices of Banking & Financial ServicesJesjames123No ratings yet

- Careerpower - in Images Ibps Clerk 3 GK CapsuleDocument48 pagesCareerpower - in Images Ibps Clerk 3 GK CapsuleyrikkiNo ratings yet

- Sec B Banking Law Midterm ExaminationDocument2 pagesSec B Banking Law Midterm Examinationhazelvmu.lawNo ratings yet

- Banking Awareness Quiz 2014 - Set 37: Search Your Topic HERE...Document8 pagesBanking Awareness Quiz 2014 - Set 37: Search Your Topic HERE...gangadhar sheelaNo ratings yet

- FRA Test Papers: Archive - Sem VDocument32 pagesFRA Test Papers: Archive - Sem VBharatSirveeNo ratings yet

- BF 140Document3 pagesBF 140Dixie CheeloNo ratings yet

- NBPDocument25 pagesNBPShaikh JunaidNo ratings yet

- Bank AuditDocument18 pagesBank AuditPranav HariharanNo ratings yet

- MMG Guide to Banking Basics for International StudentsFrom EverandMMG Guide to Banking Basics for International StudentsRating: 5 out of 5 stars5/5 (1)

- Financial Soundness Indicators for Financial Sector Stability in Viet NamFrom EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamNo ratings yet

- Englisch Schwer Letter-Of-Motivation Audio-1Document2 pagesEnglisch Schwer Letter-Of-Motivation Audio-1Basilio MaliwangaNo ratings yet

- A Closer Talk With God - Prayers - Kim TrujilloDocument70 pagesA Closer Talk With God - Prayers - Kim TrujilloBasilio MaliwangaNo ratings yet

- Breakthrough! Develop The 7 HabitsDocument182 pagesBreakthrough! Develop The 7 HabitsBasilio Maliwanga100% (1)

- Your Spiritual Weapons and How - Terry LawDocument64 pagesYour Spiritual Weapons and How - Terry LawBasilio MaliwangaNo ratings yet

- English As A Medium of Instruction (EMI)Document1 pageEnglish As A Medium of Instruction (EMI)Basilio MaliwangaNo ratings yet

- The New Drawing On The Right Side of The BrainDocument314 pagesThe New Drawing On The Right Side of The BrainBasilio MaliwangaNo ratings yet

- Are Your Finances Ready For A Stressful Life Event?: Also InsideDocument8 pagesAre Your Finances Ready For A Stressful Life Event?: Also InsideBasilio MaliwangaNo ratings yet

- Capital Structure and Firm Performance EDocument12 pagesCapital Structure and Firm Performance EBasilio MaliwangaNo ratings yet

- Rule: HUD-owned Properties: HUD-acquired Single Family Property Disposition— Good Neighbor Next Door Sales ProgramDocument8 pagesRule: HUD-owned Properties: HUD-acquired Single Family Property Disposition— Good Neighbor Next Door Sales ProgramJustia.comNo ratings yet

- Mandiri KusnoDocument2 pagesMandiri KusnoANGGUNNo ratings yet

- A Study On Consumer's Preference Towards Gold As An Investment With Reference To Coimbatore CityDocument4 pagesA Study On Consumer's Preference Towards Gold As An Investment With Reference To Coimbatore CityRiyaz AliNo ratings yet

- BR Act, 1949Document7 pagesBR Act, 1949aki16288No ratings yet

- Gdp-New Vendor Registration Form Black Bear Resources IndonesiaDocument1 pageGdp-New Vendor Registration Form Black Bear Resources Indonesiabatara wajo123No ratings yet

- Indian Money MarketDocument79 pagesIndian Money MarketParth Shah100% (5)

- Payment NotificationDocument1 pagePayment Notificationmarkmafu7No ratings yet

- Voucher 2023 03 01Document1 pageVoucher 2023 03 01Mir Mazhar Ali MagsiNo ratings yet

- XXSW Iex Cust Trends RPT EngDocument2 pagesXXSW Iex Cust Trends RPT Engmastanvali.shaik84359No ratings yet

- ﺍﻷﻫﻠﻲ ﺇﻱ ﻛﻮﺭﺏDocument2 pagesﺍﻷﻫﻠﻲ ﺇﻱ ﻛﻮﺭﺏصيانة الآتNo ratings yet

- Chapter-6 Allotment of SecuritiesDocument8 pagesChapter-6 Allotment of SecuritiesCA CS Umang RataniNo ratings yet

- A Report ON: by Saurav Sharma A0101918286Document76 pagesA Report ON: by Saurav Sharma A0101918286Akshay Akki GuptaNo ratings yet

- Section C Group II Parameters For Customer SatisfactionDocument6 pagesSection C Group II Parameters For Customer SatisfactionBhartiyam SushilNo ratings yet

- Mfs Question BankDocument2 pagesMfs Question Bankpateljitendra2136No ratings yet

- HDFC FinalDocument19 pagesHDFC FinalLavina JainNo ratings yet

- Cash & Cash EquivalentDocument3 pagesCash & Cash Equivalentdeborah grace sagarioNo ratings yet

- YES TRANSACT Smart Trade OfferingDocument1 pageYES TRANSACT Smart Trade OfferingAndorran ExpressNo ratings yet

- The Karur Vysya Bank LimitedDocument11 pagesThe Karur Vysya Bank LimitedmithradharunNo ratings yet

- Electronic Payment SystemsDocument8 pagesElectronic Payment SystemsAbhishek NayakNo ratings yet

- Appraisal of The Effect of Electronic Payment System On Customer Satisfaction in Nigeria Banking SystemDocument5 pagesAppraisal of The Effect of Electronic Payment System On Customer Satisfaction in Nigeria Banking SystemIPROJECCTNo ratings yet

- Quant Checklist 168 PDF 2022 by Aashish AroraDocument70 pagesQuant Checklist 168 PDF 2022 by Aashish Arorarajnish sharmaNo ratings yet

- 6.chapter 4 Research MethodologyDocument6 pages6.chapter 4 Research MethodologySmitha K BNo ratings yet

- Hit Me UpDocument20 pagesHit Me Upapi-374831403No ratings yet

- Access To Finance Presentation On Success Story of NCI FundDocument18 pagesAccess To Finance Presentation On Success Story of NCI FundGeoid AnalyticsNo ratings yet

- 03 January 2017 Maiah Beatrice R. Dinglasan University of Santo Tomas - Manila 0917 550 0003Document3 pages03 January 2017 Maiah Beatrice R. Dinglasan University of Santo Tomas - Manila 0917 550 0003Maiah DinglasanNo ratings yet

- BSP Circular No. 925-16Document77 pagesBSP Circular No. 925-16Helena HerreraNo ratings yet

- 20230AC262AA710CDocument1 page20230AC262AA710CMaqsood Ashtam FroshNo ratings yet