Professional Documents

Culture Documents

Nov PMS Performance

Nov PMS Performance

Uploaded by

YASHCopyright:

Available Formats

You might also like

- Nine For Ix QuestionsDocument5 pagesNine For Ix Questionsapi-3308374980% (1)

- ADOPT - UT - Miller Levine Biology - 2014Document10 pagesADOPT - UT - Miller Levine Biology - 2014Diana Macias0% (1)

- Bill - Hyundai - Santro Xing - MH12DE4121Document7 pagesBill - Hyundai - Santro Xing - MH12DE4121Neeraj CharateNo ratings yet

- Next Generation Demand Management: People, Process, Analytics, and TechnologyFrom EverandNext Generation Demand Management: People, Process, Analytics, and TechnologyNo ratings yet

- Treasure Trophy CompanyDocument12 pagesTreasure Trophy CompanyArslan ShaikhNo ratings yet

- Pms Performance 30 JUNE 2019: Large Cap OrientedDocument3 pagesPms Performance 30 JUNE 2019: Large Cap Orientedmaheshtech76No ratings yet

- Monthly Performance Report: MonthDocument16 pagesMonthly Performance Report: Monthkumarprasoon99No ratings yet

- New Malls Contribute: Capitamalls AsiaDocument7 pagesNew Malls Contribute: Capitamalls AsiaNicholas AngNo ratings yet

- Roic Revenue Growth: Appendix 1: Key Business DriversDocument7 pagesRoic Revenue Growth: Appendix 1: Key Business DriversPeter LiNo ratings yet

- Equity FundsDocument2 pagesEquity FundsMahesh SainiNo ratings yet

- March-PMS-Performance-Newsletter (PMS AIF World)Document5 pagesMarch-PMS-Performance-Newsletter (PMS AIF World)maheshtech76No ratings yet

- PMS June2022Document13 pagesPMS June2022Project AtomNo ratings yet

- EQUITY - Focused Funds For APR - JUNE 2020-1Document2 pagesEQUITY - Focused Funds For APR - JUNE 2020-1Raj PatilNo ratings yet

- Dividend Yield Stocks 300410Document1 pageDividend Yield Stocks 300410kunalprasherNo ratings yet

- GCC StrategyDocument132 pagesGCC StrategyAmedo MosayNo ratings yet

- Ενότητα 1.2.2 - Παράδειγμα μοντέλων αποτίμησηςDocument43 pagesΕνότητα 1.2.2 - Παράδειγμα μοντέλων αποτίμησηςagis.condtNo ratings yet

- BSE Sensex S&P Nifty BSE 200 CNX500 CNX Midcap BSE500Document2 pagesBSE Sensex S&P Nifty BSE 200 CNX500 CNX Midcap BSE500dsankalaNo ratings yet

- Kenyan Brokerage & Investment Banking Financial Results 2009Document83 pagesKenyan Brokerage & Investment Banking Financial Results 2009moneyedkenyaNo ratings yet

- DM22118 - Dinakaran SDocument11 pagesDM22118 - Dinakaran SDinakaranNo ratings yet

- Session 3 ADocument10 pagesSession 3 AAashishNo ratings yet

- Porfolio Rebalancing ReportDocument3 pagesPorfolio Rebalancing ReportAayushi ChandwaniNo ratings yet

- Study Of: Prof. Neeraj AmarnaniDocument20 pagesStudy Of: Prof. Neeraj Amarnanipankil_dalalNo ratings yet

- Bankmanagement AssignmentDocument4 pagesBankmanagement AssignmentHasan Motiur RahmanNo ratings yet

- IAPM AssignmentsDocument29 pagesIAPM AssignmentsMUKESH KUMARNo ratings yet

- Fundamentals of Corporate Finance 7th Edition Ross Solutions ManualDocument10 pagesFundamentals of Corporate Finance 7th Edition Ross Solutions Manualomicronelegiac8k6st100% (20)

- Submission v2Document32 pagesSubmission v2MUKESH KUMARNo ratings yet

- Fundamentals of Corporate Finance Australian 7Th Edition Ross Solutions Manual Full Chapter PDFDocument31 pagesFundamentals of Corporate Finance Australian 7Th Edition Ross Solutions Manual Full Chapter PDFRussellFischerqxcj100% (13)

- Tamzidul Islam Portfolio Optimization MidtermDocument24 pagesTamzidul Islam Portfolio Optimization MidtermTamzidul IslamNo ratings yet

- SubrosDocument31 pagesSubrossumit3902No ratings yet

- KSL StockmeterDocument5 pagesKSL StockmeterAn AntonyNo ratings yet

- Portfolio Data For TableauDocument4 pagesPortfolio Data For TableauSai PavanNo ratings yet

- Quantletter Q30Document3 pagesQuantletter Q30pareshpatel99No ratings yet

- Markett Mojo Dump - NewDocument32 pagesMarkett Mojo Dump - NewBasant Kumar SaxenaNo ratings yet

- Portfolio Optimization: BSRM Brac Beximco GP RAKDocument27 pagesPortfolio Optimization: BSRM Brac Beximco GP RAKFarsia Binte AlamNo ratings yet

- Investments Problem SetDocument5 pagesInvestments Problem Setzer0fxz8209No ratings yet

- SN Date Wipro Kotak Bank TechmahindrDocument7 pagesSN Date Wipro Kotak Bank TechmahindrnavNo ratings yet

- JP Morgan Best Equity Ideas 2014Document61 pagesJP Morgan Best Equity Ideas 2014Sara Lim100% (1)

- Name Daily 1 Week 1 Month YTD 1 Year 3 YearsDocument54 pagesName Daily 1 Week 1 Month YTD 1 Year 3 Yearsmdyakubhnk85No ratings yet

- Fundamentals of Corporate Finance Australian 7th Edition Ross Solutions ManualDocument10 pagesFundamentals of Corporate Finance Australian 7th Edition Ross Solutions Manualelizabethmitchelldajfiqwory100% (30)

- Particulars FY15 FY16 FY17 FY18 FY19 RevenueDocument14 pagesParticulars FY15 FY16 FY17 FY18 FY19 RevenueShivang KalraNo ratings yet

- ValuEngine Weekly NewsletterDocument14 pagesValuEngine Weekly NewsletterValuEngine.comNo ratings yet

- Pms bazaar-PMS Performance - May 2020Document10 pagesPms bazaar-PMS Performance - May 2020ChristianStefanNo ratings yet

- PDF CropDocument2 pagesPDF CropDevesh BalkoteNo ratings yet

- Historic ReturnsDocument3 pagesHistoric ReturnsNatal KumarNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Ariansyah NobelNo ratings yet

- Company Current Price (RS) % Change Equity Face Value Market Cap (Rs CR)Document5 pagesCompany Current Price (RS) % Change Equity Face Value Market Cap (Rs CR)Nikesh BeradiyaNo ratings yet

- Historic Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument3 pagesHistoric Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsAayushNo ratings yet

- Weekly Wrap For The Week Ended 270919Document1 pageWeekly Wrap For The Week Ended 270919Dilkaran SinghNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Ariansyah NobelNo ratings yet

- Daily FNO Overview: Retail ResearchDocument5 pagesDaily FNO Overview: Retail ResearchjaimaaganNo ratings yet

- A Fuller OFC: K-REIT AsiaDocument5 pagesA Fuller OFC: K-REIT Asiacentaurus553587No ratings yet

- Name Daily 1 Week 1 Month YTD 1 Year 3 YearsDocument24 pagesName Daily 1 Week 1 Month YTD 1 Year 3 Yearsyakubpasha.mohdNo ratings yet

- SCBG (Latest Version) 3Document21 pagesSCBG (Latest Version) 3Azhar HussainNo ratings yet

- Dividend Yield Stocks - HDFC Sec - 26 09 09Document1 pageDividend Yield Stocks - HDFC Sec - 26 09 09vishalknoxNo ratings yet

- Aggressive Recommended Basket 02 Mar 16Document25 pagesAggressive Recommended Basket 02 Mar 16nnsriniNo ratings yet

- Kalbe Vs TempoDocument18 pagesKalbe Vs Temporiskaamalia298No ratings yet

- AnnexuresDocument23 pagesAnnexuresMohit AnandNo ratings yet

- Casa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqDocument3 pagesCasa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqErica ZulianaNo ratings yet

- Currency (Yearly) TrendDocument3 pagesCurrency (Yearly) Trendismun nadhifahNo ratings yet

- Maybank BautoDocument7 pagesMaybank BautoPaul TanNo ratings yet

- Tài liệu không có tiêu đềDocument24 pagesTài liệu không có tiêu đềVũ Minh HoàngNo ratings yet

- Top 17 Stocks BuyDocument13 pagesTop 17 Stocks BuySushilNo ratings yet

- ValuEngine Weekly Newsletter March 30, 2010Document15 pagesValuEngine Weekly Newsletter March 30, 2010ValuEngine.comNo ratings yet

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019From EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019No ratings yet

- Paul Craig RobertsDocument4 pagesPaul Craig RobertsMimis CopanoglouNo ratings yet

- Class 7Document6 pagesClass 7selef1234No ratings yet

- 802.11b Wireless Networking StandardDocument20 pages802.11b Wireless Networking StandardagustianNo ratings yet

- FAWDE 30 kVA 4DW92-39DDocument2 pagesFAWDE 30 kVA 4DW92-39DckondoyNo ratings yet

- Adoption Questionnaire 2020Document4 pagesAdoption Questionnaire 2020Katie AdamsNo ratings yet

- Auditing and Taxation: B) Sec 2Document7 pagesAuditing and Taxation: B) Sec 2Kadam KartikeshNo ratings yet

- Anne Hathaway Carol Ann DuffyDocument1 pageAnne Hathaway Carol Ann Duffyrobertdudley95No ratings yet

- Super Food Ideas May 2017Document100 pagesSuper Food Ideas May 2017Francisco Bustos-GonzálezNo ratings yet

- ACS Rules For Offshore Fixed Platform InstallationDocument31 pagesACS Rules For Offshore Fixed Platform Installationsaeed ghafooriNo ratings yet

- Cisco'S SMB Strategy & Commitment To The SMB ChannelDocument15 pagesCisco'S SMB Strategy & Commitment To The SMB ChannelagdfhhfgdjNo ratings yet

- Mapping The Intellectual Structure of Scientometrics: A Co-Word Analysis of The Journal Scientometrics (2005-2010)Document27 pagesMapping The Intellectual Structure of Scientometrics: A Co-Word Analysis of The Journal Scientometrics (2005-2010)sandra milena bernal rubioNo ratings yet

- MysterioDocument1 pageMysterioAaditya JoshiNo ratings yet

- A Day in The WorkshopDocument2 pagesA Day in The WorkshopjeisonNo ratings yet

- Robustness 2Document18 pagesRobustness 2Jovenil BacatanNo ratings yet

- Exercise Chapter 3Document6 pagesExercise Chapter 3CikFasyareena MaoNo ratings yet

- Ami Patern PDFDocument18 pagesAmi Patern PDFKamal Semboy100% (1)

- Adjudication Sheet (British Parliamentary)Document1 pageAdjudication Sheet (British Parliamentary)sitirochmahs0502No ratings yet

- Modernity and Social Crisis in Bengali PoetryDocument5 pagesModernity and Social Crisis in Bengali PoetryRindon KNo ratings yet

- Ecobank Financial Report For 2017Document180 pagesEcobank Financial Report For 2017Fuaad DodooNo ratings yet

- Bussiness Stats UNITDocument2 pagesBussiness Stats UNITsinghsaurabhh91No ratings yet

- MT Application - Supply Chain PDFDocument3 pagesMT Application - Supply Chain PDFSouvik BardhanNo ratings yet

- Cold Chain Distribution Issues at Indo-Euro PharmaDocument19 pagesCold Chain Distribution Issues at Indo-Euro Pharmaely100% (2)

- 01.04 - Director-Lmb vs. CA (324 Scra 757)Document10 pages01.04 - Director-Lmb vs. CA (324 Scra 757)JMarc100% (1)

- Violet Evergarden Vol 3 GaidenDocument223 pagesViolet Evergarden Vol 3 GaidenHiroki Ishikawa100% (2)

- The Rise and Fall of Baly Keds AssignmentDocument8 pagesThe Rise and Fall of Baly Keds AssignmentN HNo ratings yet

- Standard 1 Lesson Plan Eeu 304 - PilgrimsDocument8 pagesStandard 1 Lesson Plan Eeu 304 - Pilgrimsapi-279746822No ratings yet

Nov PMS Performance

Nov PMS Performance

Uploaded by

YASHOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nov PMS Performance

Nov PMS Performance

Uploaded by

YASHCopyright:

Available Formats

PMS PERFORMANCE 31 st OCTOBER 2019

(ARRANGED IN THE ORDER OF LARGECAP, MIDCAP A N D MULTICAP)

Dear All,

We’re Alternatives focused, analytics backed and content driven new age wealth management firm

offering informed investments in concentrated portfolios managed by experienced money managers

aiming stupendous performance in long term. At 350+ Cr of total assets, we thank industry for all the

support. Our vision is to tremendously contribute to the growing eco system of Alternatives.

Investors value diligence in reporting of PMS data. When we started, we aimed at releasing PMS Monthly

performance data by 11th of every month, we’re happy to release the PMS Performance data 1 week

before time lines. We hope to bring this down to 1st of every month.

The data as of 31st Oct 2019, is updated on our platform (www.pms-aif.com) as well

PMS AIF WORLD Market Commentary

The ruling government's reaction to the unfolding economic crisis has followed five stages. It has moved from

denial, to anger, to bargaining, to acknowledging, and finally to taking measures. With all this gone by and not

un-known anymore, past is incorporated. Today government is geared to reviving the economy and boosting the

growth as its top most agenda items. Reforms and economic measures are thus expected in full-swing; tax cuts

is just the beginning. India’s economy which is highly sensitive to crude prices benefits from bearish outlook on

crude. Plus, a good rainfall this monsoon also augurs well for the rural demand. The govt’s decision to slash

corporate tax rates, is seen as a big structural reform and a positive move for long term. This increases

competitiveness of India among emerging economies and we’re likely to be the major beneficiary of US-China

trade war. More economic reforms and growth focused measures are expected around next year’s budget. The

market is hopeful that the lower base effect and tax stimulus will ensure increase in earnings going ahead. FIIs

which were sellers till Aug, 19, have turned buyers but, liquidity has been chasing primarily high conviction

stocks, and valuations in large caps is quite high, and should be thus played with caution. Valuations wise mid-

caps and small caps look far more attractive. We have presented the valuations table on the last sheet. We

recommend investors to stick to asset allocation, invest for long term, and follow earnings over the price.

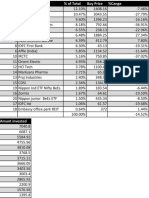

Large Cap Oriented

Strategy Name AUM (cr.) 1M 3M 6M 1Y 2Y 3Y 5Y SI

Accuracap Alpha 10 608 3.54% 12.68% 6.19% 20.14% 8.46% 11.13% 12.43% 15.09%

Ambit Coffee CAN 390 4.90% 22.30% 19.10% 27.80% 23.10% - - 24.30%

ICICI Prudential Large Cap Portfolio - 4.67% 4.19% 0.98% 11.87% 5.99% 10.34% 8.67%

Invesco India Large Cap Core - 3.25% 9.49% 4.11% 15.66% 9.53% 14.20% 11.50% 17.19%

Marcellus Consistent Compounders 553 5.40% 24.30% 22.50% - - - - 28.90%

Motilal Oswal Value 2265 3.07% 12.84% 10.50% 24.82% 5.57% 9.35% 9.39% 22.43%

Nippon India Absolute Freedom - 3.09% 8.99% 6.60% 20.21% 5.91% 10.29% 10.37% 15.04%

Nippon India High Conviction - 3.82% 9.94% 7.57% 25.11% 4.38% 9.68% 11.30% 17.67%

Tata AMC Bluechip Strategy - 3.00% 8.20% 6.20% 19.00% 8.00% 11.50% 9.10% 9.93%

Tata AMC Bluechip Plus - 3.10% 9.20% 7.00% 18.70% 7.90% 10.10% 7.30% 10.30%

Nifty50 - 3.51% 6.83% 1.10% 14.35% 7.20% 11.25% 7.37% -

PMS PERFORMANCE 31 st OCTOBER 2019

(ARRANGED IN THE ORDER OF LARGECAP, MIDCAP A N D MULTICAP)

Mid & Small Cap Oriented

Strategy Name AUM (cr.) 1M 3M 6M 1Y 2Y 3Y 5Y SI

Accuracap Dynamo 4.66 -3.74% 5.29% -14.09% -31.36% -21.92% - - 7.99%

Accuracap Pico Power 323.39 1.43% 10.52% -3.15% -4.26% -13.01% 1.01% 7.93% 19.54%

Ambit Emerging Giants 58 0.80% 12.00% -1.10% -0.30% - - - -3.20%

Ambit Good and Clean 140 1.00% 11.10% 4.60% 22.00% - 12.50% - 12.40%

Care PMS Growth Plus Value 239 -3.60% 5.60% -9.90% -22.10% -22.90% -11.93% 4.73% 17.50%

Edelweiss Focused Small Cap 204 4.00% 5.30% -8.40% -8.10% -19.90% -4.20% - 3.40%

Invesco India Caterpillar 47 2.94% 7.74% -7.42% -1.92% -3.66% 4.80% 11.57% 16.48%

Motilal Oswal IOP Sr 1 2994 0.54% 5.28% -7.59% -0.67% -13.31% -2.87% 8.68% 10.87%

Motilal Oswal IOP Sr 2 523 4.26% 9.54% -7.70% -5.99% - - - -10.08%

Prabhudas Liladhar Fortune 22 - 7.40% - -2.10% - - - -6.70%

Nippon Emerging India - 3.15% 9.72% 1.69% 9.06% -1.56% - - 6.45%

Renaissance Midcap - 1.00% - -2.90% 6.70% - - - -7.80%

Sundaram Emerging Leaders Fund - 2.10% 13.00% 2.10% 13.90% 0.50% 7.00% 11.70% 15.80%

Tata AMC Emerging Opp - 4.10% 12.30% 6.20% 12.90% 5.80% 10.70% 13.10% 9.90%

Nifty Midcap 100 - 4.95% 5.64% -4.26% -2.15% -7.32% 1.87% 7.27% -

Multi Cap Oriented

Strategy Name AUM (cr.) 1M 3M 6M 1Y 2Y 3Y 5Y SI

2Point2 Capital Long Term Value 338.9 -0.10% 6.50% 2.20% 19.10% 8.40% 15.30% - 17.60%

Accuracap Alphagen 145.03 2.25% 10.41% 1.35% 6.29% -4.20% 6.06% - 9.37%

Aditya Birla SSP 544 2.17% 12.32% 0.02% 5.09% -8.60% 1.11% 9.95% 14.85%

Aditya Birla Core Equity Portfolio 838 3.88% 13.26% 5.60% 17.93% -3.20% 1.60% 10.84% 16.60%

Alchemy High Growth 2698 3.30% 8.60% 0.80% 8.50% 1.40% 7.70% 10.80% 23.00%

Alchemy Select Stock 3411 2.90% 10.60% 1.60% 11.60% 6.00% 10.80% 14.90% 21.70%

ALFAccurate Advisors AAA PMS 601 - - - 5.30% -2.80% 6.60% 12.30% 18.20%

ASK India Entrepreneur Portfolio 10262 1.80% 13.80% 7.60% 19.40% 9.30% 11.20% 14.40% 18.70%

ASK Growth Strategy 2868 5.60% 18.30% 12.20% 24.70% 5.80% 12.60% 15.30% 20.30%

ASK India Select Portfolio 3268 4.40% 18.60% 12.60% 25.50% 5.50% 10.10% 15.10% 17.30%

Buoyant Capital Opp Multi-Cap - 6.60% 8.00% 2.20% 8.70% 0.50% 17.50% - 21.10%

Credent Growth Portfolio - 3.10% 6.93% 4.19% 13.72% - - - 0.99%

Edelweiss Rubik - 0.20% -0.90% -10.60% -6.60% - - - -10.60%

ICICI Prudential Contra PMS - 2.40% 4.35% 2.04% 16.78% - - - 13.13%

ICICI Prudential Flexicap Portfolio - 5.08% 7.60% 5.83% 12.58% 3.98% 8.63% 10.01% 19.03%

ICICI Prudential Value Portfolio - 2.86% 5.09% -0.12% 7.91% 0.19% 6.55% 8.08% 15.77%

IIFL Multicap 1400 3.27% 10.47% 9.58% 27.27% 12.73% 13.84% - 18.87%

IIFL Multicap Advantage 400 3.07% 9.16% 8.65% 21.89% - - - 10.82%

PMS PERFORMANCE 31 st OCTOBER 2019

(ARRANGED IN THE ORDER OF LARGECAP, MIDCAP A N D MULTICAP)

Strategy Name AUM (cr.) 1M 3M 6M 1Y 2Y 3Y 5Y SI

Invesco India DAWN 514 2.72% 5.89% 1.41% 9.92% 3.00% - - 5.20%

Invesco India R.I.S.E 673 3.08% 4.89% -5.01% -3.20% -5.11% 9.04% - 12.87%

Invesco Sector Opportunities - 1.30% 2.15% -10.74% -8.42% -8.61% 1.15% 6.05% 11.29%

Kotak SSV Sr 1 2124.8 3.50% 1.90% -10.40% -8.00% -16.90% -4.70% 8.40% 16.30%

Kotak SSV Sr 2 1003.8 4.20% 9.70% -5.80% -3.60% -12.50% - - -8.50%

Marathon Trends Mega Trends 159.15 3.37% 15.54% 11.96% 24.27% 6.60% - - 6.61%

Motilal Oswal BOP 416 4.91% 18.92% 14.71% 28.07% - - - 7.66%

Motilal Oswal NTDOP 9310 2.99% 11.53% 3.95% 8.22% 1.39% 0.0692 0.1616 16.10%

O3 Capital Core Value Regular - 5.02% 11.73% - - - - - 9.26%

O3 Capital Core Value Concentrated - 5.45% 10.21% 8.59% - - - - 7.40%

Phillip Capital Signature India - 2.17% 13.36% 4.98% 18.92% 4.39% 9.12% - 13.09%

Prabhudas Liladhar Equigrow 16 - 18.10% - 20.80% - 8.90% 13.10% 20.60%

Prabhudas Liladhar Multi 105 - 18.10% - 18.00% - 10.40% 14.80% 22.60%

Purnartha Research & Advisory 6000 -1.18% 16.48% 14.97% 33.92% 11.05% 18.23% 21.05% 40.54%

Renaissance India Opp PMS - 6.50% - 0.80% 11.30% - - - 6.00%

Sameeksha Capital Equity PMS 253 -0.10% 12.30% 8.70% 29.90% 4.30% 10.20% - 13.80%

SBI Growth with Values - 2.30% 10.10% 8.19% 20.10% 4.93% 9.43% - 9.91%

Sundaram PACE - 3.70% 13.10% 6.90% 20.90% 3.00% 9.10% 11.50% 18.80%

Sundaram SISOP - 4.80% 19.70% 12.70% 27.10% 11.10% 10.70% 14.30% 23.10%

TATA AMC ACT - 2.10% 9.10% 7.60% - - - - 9.80%

Nifty 500 - 3.73% 7.13% 0.26% 10.70% 2.89% 8.91% 7.70% -

*Purnartha Research & Advisory is a SEBI Registered Investment Advisory Service

Valuations

PE - Current

Index PE - 3 Year High PE - 3 Year Low

(as on 31st OCT 2019)

Nifty 50 29.90 27.38 21.25

Nifty 500 34.66 29.28 24.37

Nifty Midcap 100 62.07 24.87 22.96

“DISCLAIMER: - The performance data has been captured from the latest factsheets procured from respective PMS companies.

The data is as of 31st October 2019. Performance up to 1 Year is absolute and above 1 Year is Annualised.

PMS AIF WORLD has taken due care in collating the data from respective providers. It has been done on best effort basis and

the accuracy of the data cannot be guarranteed. PMS AIF WORLD should not be held responsible for any errors for the results

arising from the use of this data whatsoever.

Investments are subject to market related risks. Past Performance may or may not be sustained in future and should not be used

as a basis for comparison with other investments. Please read the disclosure documnets carefully before investing. Portfolio

Management Services are market linked and donot offer any guaranteed/assured returns”

You might also like

- Nine For Ix QuestionsDocument5 pagesNine For Ix Questionsapi-3308374980% (1)

- ADOPT - UT - Miller Levine Biology - 2014Document10 pagesADOPT - UT - Miller Levine Biology - 2014Diana Macias0% (1)

- Bill - Hyundai - Santro Xing - MH12DE4121Document7 pagesBill - Hyundai - Santro Xing - MH12DE4121Neeraj CharateNo ratings yet

- Next Generation Demand Management: People, Process, Analytics, and TechnologyFrom EverandNext Generation Demand Management: People, Process, Analytics, and TechnologyNo ratings yet

- Treasure Trophy CompanyDocument12 pagesTreasure Trophy CompanyArslan ShaikhNo ratings yet

- Pms Performance 30 JUNE 2019: Large Cap OrientedDocument3 pagesPms Performance 30 JUNE 2019: Large Cap Orientedmaheshtech76No ratings yet

- Monthly Performance Report: MonthDocument16 pagesMonthly Performance Report: Monthkumarprasoon99No ratings yet

- New Malls Contribute: Capitamalls AsiaDocument7 pagesNew Malls Contribute: Capitamalls AsiaNicholas AngNo ratings yet

- Roic Revenue Growth: Appendix 1: Key Business DriversDocument7 pagesRoic Revenue Growth: Appendix 1: Key Business DriversPeter LiNo ratings yet

- Equity FundsDocument2 pagesEquity FundsMahesh SainiNo ratings yet

- March-PMS-Performance-Newsletter (PMS AIF World)Document5 pagesMarch-PMS-Performance-Newsletter (PMS AIF World)maheshtech76No ratings yet

- PMS June2022Document13 pagesPMS June2022Project AtomNo ratings yet

- EQUITY - Focused Funds For APR - JUNE 2020-1Document2 pagesEQUITY - Focused Funds For APR - JUNE 2020-1Raj PatilNo ratings yet

- Dividend Yield Stocks 300410Document1 pageDividend Yield Stocks 300410kunalprasherNo ratings yet

- GCC StrategyDocument132 pagesGCC StrategyAmedo MosayNo ratings yet

- Ενότητα 1.2.2 - Παράδειγμα μοντέλων αποτίμησηςDocument43 pagesΕνότητα 1.2.2 - Παράδειγμα μοντέλων αποτίμησηςagis.condtNo ratings yet

- BSE Sensex S&P Nifty BSE 200 CNX500 CNX Midcap BSE500Document2 pagesBSE Sensex S&P Nifty BSE 200 CNX500 CNX Midcap BSE500dsankalaNo ratings yet

- Kenyan Brokerage & Investment Banking Financial Results 2009Document83 pagesKenyan Brokerage & Investment Banking Financial Results 2009moneyedkenyaNo ratings yet

- DM22118 - Dinakaran SDocument11 pagesDM22118 - Dinakaran SDinakaranNo ratings yet

- Session 3 ADocument10 pagesSession 3 AAashishNo ratings yet

- Porfolio Rebalancing ReportDocument3 pagesPorfolio Rebalancing ReportAayushi ChandwaniNo ratings yet

- Study Of: Prof. Neeraj AmarnaniDocument20 pagesStudy Of: Prof. Neeraj Amarnanipankil_dalalNo ratings yet

- Bankmanagement AssignmentDocument4 pagesBankmanagement AssignmentHasan Motiur RahmanNo ratings yet

- IAPM AssignmentsDocument29 pagesIAPM AssignmentsMUKESH KUMARNo ratings yet

- Fundamentals of Corporate Finance 7th Edition Ross Solutions ManualDocument10 pagesFundamentals of Corporate Finance 7th Edition Ross Solutions Manualomicronelegiac8k6st100% (20)

- Submission v2Document32 pagesSubmission v2MUKESH KUMARNo ratings yet

- Fundamentals of Corporate Finance Australian 7Th Edition Ross Solutions Manual Full Chapter PDFDocument31 pagesFundamentals of Corporate Finance Australian 7Th Edition Ross Solutions Manual Full Chapter PDFRussellFischerqxcj100% (13)

- Tamzidul Islam Portfolio Optimization MidtermDocument24 pagesTamzidul Islam Portfolio Optimization MidtermTamzidul IslamNo ratings yet

- SubrosDocument31 pagesSubrossumit3902No ratings yet

- KSL StockmeterDocument5 pagesKSL StockmeterAn AntonyNo ratings yet

- Portfolio Data For TableauDocument4 pagesPortfolio Data For TableauSai PavanNo ratings yet

- Quantletter Q30Document3 pagesQuantletter Q30pareshpatel99No ratings yet

- Markett Mojo Dump - NewDocument32 pagesMarkett Mojo Dump - NewBasant Kumar SaxenaNo ratings yet

- Portfolio Optimization: BSRM Brac Beximco GP RAKDocument27 pagesPortfolio Optimization: BSRM Brac Beximco GP RAKFarsia Binte AlamNo ratings yet

- Investments Problem SetDocument5 pagesInvestments Problem Setzer0fxz8209No ratings yet

- SN Date Wipro Kotak Bank TechmahindrDocument7 pagesSN Date Wipro Kotak Bank TechmahindrnavNo ratings yet

- JP Morgan Best Equity Ideas 2014Document61 pagesJP Morgan Best Equity Ideas 2014Sara Lim100% (1)

- Name Daily 1 Week 1 Month YTD 1 Year 3 YearsDocument54 pagesName Daily 1 Week 1 Month YTD 1 Year 3 Yearsmdyakubhnk85No ratings yet

- Fundamentals of Corporate Finance Australian 7th Edition Ross Solutions ManualDocument10 pagesFundamentals of Corporate Finance Australian 7th Edition Ross Solutions Manualelizabethmitchelldajfiqwory100% (30)

- Particulars FY15 FY16 FY17 FY18 FY19 RevenueDocument14 pagesParticulars FY15 FY16 FY17 FY18 FY19 RevenueShivang KalraNo ratings yet

- ValuEngine Weekly NewsletterDocument14 pagesValuEngine Weekly NewsletterValuEngine.comNo ratings yet

- Pms bazaar-PMS Performance - May 2020Document10 pagesPms bazaar-PMS Performance - May 2020ChristianStefanNo ratings yet

- PDF CropDocument2 pagesPDF CropDevesh BalkoteNo ratings yet

- Historic ReturnsDocument3 pagesHistoric ReturnsNatal KumarNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Ariansyah NobelNo ratings yet

- Company Current Price (RS) % Change Equity Face Value Market Cap (Rs CR)Document5 pagesCompany Current Price (RS) % Change Equity Face Value Market Cap (Rs CR)Nikesh BeradiyaNo ratings yet

- Historic Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument3 pagesHistoric Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsAayushNo ratings yet

- Weekly Wrap For The Week Ended 270919Document1 pageWeekly Wrap For The Week Ended 270919Dilkaran SinghNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Ariansyah NobelNo ratings yet

- Daily FNO Overview: Retail ResearchDocument5 pagesDaily FNO Overview: Retail ResearchjaimaaganNo ratings yet

- A Fuller OFC: K-REIT AsiaDocument5 pagesA Fuller OFC: K-REIT Asiacentaurus553587No ratings yet

- Name Daily 1 Week 1 Month YTD 1 Year 3 YearsDocument24 pagesName Daily 1 Week 1 Month YTD 1 Year 3 Yearsyakubpasha.mohdNo ratings yet

- SCBG (Latest Version) 3Document21 pagesSCBG (Latest Version) 3Azhar HussainNo ratings yet

- Dividend Yield Stocks - HDFC Sec - 26 09 09Document1 pageDividend Yield Stocks - HDFC Sec - 26 09 09vishalknoxNo ratings yet

- Aggressive Recommended Basket 02 Mar 16Document25 pagesAggressive Recommended Basket 02 Mar 16nnsriniNo ratings yet

- Kalbe Vs TempoDocument18 pagesKalbe Vs Temporiskaamalia298No ratings yet

- AnnexuresDocument23 pagesAnnexuresMohit AnandNo ratings yet

- Casa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqDocument3 pagesCasa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqErica ZulianaNo ratings yet

- Currency (Yearly) TrendDocument3 pagesCurrency (Yearly) Trendismun nadhifahNo ratings yet

- Maybank BautoDocument7 pagesMaybank BautoPaul TanNo ratings yet

- Tài liệu không có tiêu đềDocument24 pagesTài liệu không có tiêu đềVũ Minh HoàngNo ratings yet

- Top 17 Stocks BuyDocument13 pagesTop 17 Stocks BuySushilNo ratings yet

- ValuEngine Weekly Newsletter March 30, 2010Document15 pagesValuEngine Weekly Newsletter March 30, 2010ValuEngine.comNo ratings yet

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019From EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019No ratings yet

- Paul Craig RobertsDocument4 pagesPaul Craig RobertsMimis CopanoglouNo ratings yet

- Class 7Document6 pagesClass 7selef1234No ratings yet

- 802.11b Wireless Networking StandardDocument20 pages802.11b Wireless Networking StandardagustianNo ratings yet

- FAWDE 30 kVA 4DW92-39DDocument2 pagesFAWDE 30 kVA 4DW92-39DckondoyNo ratings yet

- Adoption Questionnaire 2020Document4 pagesAdoption Questionnaire 2020Katie AdamsNo ratings yet

- Auditing and Taxation: B) Sec 2Document7 pagesAuditing and Taxation: B) Sec 2Kadam KartikeshNo ratings yet

- Anne Hathaway Carol Ann DuffyDocument1 pageAnne Hathaway Carol Ann Duffyrobertdudley95No ratings yet

- Super Food Ideas May 2017Document100 pagesSuper Food Ideas May 2017Francisco Bustos-GonzálezNo ratings yet

- ACS Rules For Offshore Fixed Platform InstallationDocument31 pagesACS Rules For Offshore Fixed Platform Installationsaeed ghafooriNo ratings yet

- Cisco'S SMB Strategy & Commitment To The SMB ChannelDocument15 pagesCisco'S SMB Strategy & Commitment To The SMB ChannelagdfhhfgdjNo ratings yet

- Mapping The Intellectual Structure of Scientometrics: A Co-Word Analysis of The Journal Scientometrics (2005-2010)Document27 pagesMapping The Intellectual Structure of Scientometrics: A Co-Word Analysis of The Journal Scientometrics (2005-2010)sandra milena bernal rubioNo ratings yet

- MysterioDocument1 pageMysterioAaditya JoshiNo ratings yet

- A Day in The WorkshopDocument2 pagesA Day in The WorkshopjeisonNo ratings yet

- Robustness 2Document18 pagesRobustness 2Jovenil BacatanNo ratings yet

- Exercise Chapter 3Document6 pagesExercise Chapter 3CikFasyareena MaoNo ratings yet

- Ami Patern PDFDocument18 pagesAmi Patern PDFKamal Semboy100% (1)

- Adjudication Sheet (British Parliamentary)Document1 pageAdjudication Sheet (British Parliamentary)sitirochmahs0502No ratings yet

- Modernity and Social Crisis in Bengali PoetryDocument5 pagesModernity and Social Crisis in Bengali PoetryRindon KNo ratings yet

- Ecobank Financial Report For 2017Document180 pagesEcobank Financial Report For 2017Fuaad DodooNo ratings yet

- Bussiness Stats UNITDocument2 pagesBussiness Stats UNITsinghsaurabhh91No ratings yet

- MT Application - Supply Chain PDFDocument3 pagesMT Application - Supply Chain PDFSouvik BardhanNo ratings yet

- Cold Chain Distribution Issues at Indo-Euro PharmaDocument19 pagesCold Chain Distribution Issues at Indo-Euro Pharmaely100% (2)

- 01.04 - Director-Lmb vs. CA (324 Scra 757)Document10 pages01.04 - Director-Lmb vs. CA (324 Scra 757)JMarc100% (1)

- Violet Evergarden Vol 3 GaidenDocument223 pagesViolet Evergarden Vol 3 GaidenHiroki Ishikawa100% (2)

- The Rise and Fall of Baly Keds AssignmentDocument8 pagesThe Rise and Fall of Baly Keds AssignmentN HNo ratings yet

- Standard 1 Lesson Plan Eeu 304 - PilgrimsDocument8 pagesStandard 1 Lesson Plan Eeu 304 - Pilgrimsapi-279746822No ratings yet