Professional Documents

Culture Documents

Form No. 10ccaba: Necessary Particulars Are Given Hereunder

Form No. 10ccaba: Necessary Particulars Are Given Hereunder

Uploaded by

busuuuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form No. 10ccaba: Necessary Particulars Are Given Hereunder

Form No. 10ccaba: Necessary Particulars Are Given Hereunder

Uploaded by

busuuuCopyright:

Available Formats

1

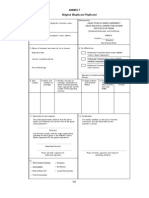

FORM NO. 10CCABA

[See rule 18BBA(2A)]

[Now redundant]

Certificate to be issued by an undertaking in the Special Economic Zone to the manufacturer

undertaking referred to in sub-section (4C) of section 80HHC, for purposes of proviso to

sub-section (4) of section 80HHC

This is to certify that I/we* (name and

address of the undertaking in the Special Economic Zone with permanent account number) have during the previous year

relevant to the assessment year for the purpose of manufacturing or producing any articles or things or

computer software for export, purchased goods or merchandise sold to us by M/s

(name and address of the undertaking referred to in sub-section (4C) of section 80HHC with

permanent account number)

NECESSARY PARTICULARS ARE GIVEN HEREUNDER

Particulars relating to undertaking in the Special Economic Zone Particulars relating to undertaking referred to in sub-section (4C) of

section 80HHC

Sl. Whether Nature of goods Amount of export Bill No. Nature of goods Amount of Amount of goods

No. eligible for manufactured for turnover (in and date of and quantity purchase of referred to in

deduction export rupees) purchase the goods column 6 used

under referred to in for

section10A column 6 (in manufacturing

rupees) the goods for

export (in

rupees)

1 2 3 4 5 6 7 8

Verification I

I, principal officer/proprietor*/partner* of M/s

(Name and address of the undertaking in the Special Economic Zone) do hereby declare that what is stated above is

true and correct.

Verified today, the day of

Place:

Date :

Signature of the principal

officer*/proprietor/*partner

of the undertaking in the

Special Economic Zone

Verification II

I/We* have examined the Accounts and records of

(name and address of the undertaking in the Special Economic Zone) relating to the business of

export out of India of any articles or things or computer software manufactured or produced by it during the previous year

relevant to the assessment year is Rs.

In *my/our opinion and to the best of my/our information and according to the explanation given to *me/us, the

particulars given above are true and correct and the undertaking is eligible for deduction under section 10A. It is also

certified that the undertaking has during the previous year purchased goods/merchandise from the undertaking

situated outside the Special Economic Zone,

(name and address of the undertaking situated outside the Special Economic Zone) for the

Printed from incometaxindia.gov.in

2

purpose of manufacturing the goods/merchandise for export. Such goods have been utilized or are intended to be utilized

for the purpose of manufacturing of goods for export and are not/not likely to be utilized for any other purpose.

Date:

Signed

Accountant

Note: *Delete whichever is not applicable.

Printed from incometaxindia.gov.in

You might also like

- Express Private TrustDocument39 pagesExpress Private TrustFarah ArzemanNo ratings yet

- QIS-ForM I, II, III Manufacturing FormatDocument9 pagesQIS-ForM I, II, III Manufacturing FormatAshish Gupta67% (3)

- White ComedyDocument2 pagesWhite ComedyVanya Danyella BarachitaNo ratings yet

- AG MR Aug 10 2021 T-1862-15-Doc57Document45 pagesAG MR Aug 10 2021 T-1862-15-Doc57Howard KnopfNo ratings yet

- EOU Regulations Act and GuidelinesDocument90 pagesEOU Regulations Act and Guidelinesascii02No ratings yet

- Christian Life Program - CLP OrientationDocument3 pagesChristian Life Program - CLP OrientationVin Desilyo100% (3)

- SR0-218 Amendment in Jammu & Kashmir Value Added Tax Rules, 2005Document25 pagesSR0-218 Amendment in Jammu & Kashmir Value Added Tax Rules, 2005vinay dixitNo ratings yet

- 9 Instruction 11Document4 pages9 Instruction 11TRI City GujaratNo ratings yet

- Form No. 3ae: Audit Report Under Section 35D (4) /35E (6) of The Income-Tax Act, 1961Document2 pagesForm No. 3ae: Audit Report Under Section 35D (4) /35E (6) of The Income-Tax Act, 1961Anonymous 2evaoXKKdNo ratings yet

- 9 Central Excise Notifications 2009Document17 pages9 Central Excise Notifications 2009aveeramani@yahoo.comNo ratings yet

- ANF5ADocument9 pagesANF5ACharles JacobNo ratings yet

- Report Under Secion 80HHC (4), 80HHC (4a) of The Income-Tax Act, 1961Document2 pagesReport Under Secion 80HHC (4), 80HHC (4a) of The Income-Tax Act, 1961kinnari bhutaNo ratings yet

- Form No. 10C: (Now Redundant) Audit Report Under Section 80HH of The Income-Tax Act, 1961Document1 pageForm No. 10C: (Now Redundant) Audit Report Under Section 80HH of The Income-Tax Act, 1961Anonymous 2evaoXKKdNo ratings yet

- Form AIDocument8 pagesForm AITrịnh Huyền LinhNo ratings yet

- Republic of The Philippines Philippine Economic Zone AuthorityDocument1 pageRepublic of The Philippines Philippine Economic Zone AuthorityJude ItutudNo ratings yet

- Application For Duty Free Import Authorisation (DFIADocument9 pagesApplication For Duty Free Import Authorisation (DFIAakashaggarwal88No ratings yet

- CA Audit Report Format-1Document88 pagesCA Audit Report Format-1nuudmNo ratings yet

- GST CT 30 2023 4Document12 pagesGST CT 30 2023 4cadeepaksingh4No ratings yet

- 7.guideline For Application For Provisional Eligibility CertificateDocument14 pages7.guideline For Application For Provisional Eligibility CertificateKumar SrinivasanNo ratings yet

- Operational Procedures For Imports Under The Asean-India Free Trade Area (Aifta) Trade in Goods (Tig) AgreementDocument4 pagesOperational Procedures For Imports Under The Asean-India Free Trade Area (Aifta) Trade in Goods (Tig) AgreementDio MaulanaNo ratings yet

- (Vide Rule Part II) To, The Deputy Assessor and Collector (Octroi), Municipal Corporation of Greater MumbaiDocument2 pages(Vide Rule Part II) To, The Deputy Assessor and Collector (Octroi), Municipal Corporation of Greater Mumbaibmanojkumar16No ratings yet

- Companies - Cost - Records - and - Audit - Amdt - Rules - 2015Document15 pagesCompanies - Cost - Records - and - Audit - Amdt - Rules - 2015Saif Ali JamadarNo ratings yet

- 00 49 0557tender G&P (BCI) PDFDocument25 pages00 49 0557tender G&P (BCI) PDFHemanth AgarwalNo ratings yet

- (Now Redundant) : Report Under Section 80HHD of The Income-Tax Act, 1961Document1 page(Now Redundant) : Report Under Section 80HHD of The Income-Tax Act, 1961busuuuNo ratings yet

- Application Form For Advance Authorisation (Including AdvanceDocument6 pagesApplication Form For Advance Authorisation (Including Advanceakashaggarwal88No ratings yet

- Garda Application FormDocument2 pagesGarda Application Formumarshoukat075No ratings yet

- Schedule 2Document3 pagesSchedule 2anilbsnl1990No ratings yet

- Sub Section VIDocument9 pagesSub Section VIdvnambNo ratings yet

- Application Participation in FairDocument2 pagesApplication Participation in FairRahib JaskaniNo ratings yet

- List of DocumentsDocument3 pagesList of DocumentsAparimith ChauhanNo ratings yet

- CO Form D AtigaDocument2 pagesCO Form D AtigaDustin SangNo ratings yet

- Form No. 10Cc: (Now Redundant) Audit Report Under Section 80HHA of The Income-Tax Act, 1961Document1 pageForm No. 10Cc: (Now Redundant) Audit Report Under Section 80HHA of The Income-Tax Act, 1961Anonymous 2evaoXKKdNo ratings yet

- Application For SBI CapGains Plus-Form-A PDFDocument4 pagesApplication For SBI CapGains Plus-Form-A PDFPrajesh SrivastavaNo ratings yet

- ITR-A Released - Wef - 01.11.2022Document2 pagesITR-A Released - Wef - 01.11.2022sai charanNo ratings yet

- Government of India Ministry of Corporate Affairs NotificationDocument38 pagesGovernment of India Ministry of Corporate Affairs NotificationAshok GNo ratings yet

- Form 10 CDocument1 pageForm 10 CPulkit DhingraNo ratings yet

- Anf 5A Application Form For Epcg Authorisation IssueDocument6 pagesAnf 5A Application Form For Epcg Authorisation IssuesrinivasNo ratings yet

- Form 23ACDocument6 pagesForm 23ACNikkhil GuptaaNo ratings yet

- FinaltenderDocument85 pagesFinaltenderRiyaz ShaikhNo ratings yet

- The National Small Industries Corporation LTD.: Enter GST Number of The ApplicantDocument6 pagesThe National Small Industries Corporation LTD.: Enter GST Number of The Applicantauritro tarafdarNo ratings yet

- Revised Form EDocument3 pagesRevised Form EazkaNo ratings yet

- Form 3ad: Audit Report Under Section 33ABADocument3 pagesForm 3ad: Audit Report Under Section 33ABARajshree GuptaNo ratings yet

- Application Form FormatDocument4 pagesApplication Form FormatDS SystemsNo ratings yet

- MAS Form 22ADocument14 pagesMAS Form 22AKit DesiderioNo ratings yet

- Application by Company To ROC For Removing Its Name From Register of CompaniesDocument9 pagesApplication by Company To ROC For Removing Its Name From Register of CompaniesDNo ratings yet

- Kanya KarungalDocument13 pagesKanya KarungalramNo ratings yet

- Home Previous: Customs Chapter 10-BDocument5 pagesHome Previous: Customs Chapter 10-Bశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- 1form No. IoccadDocument1 page1form No. Ioccadkinnari bhutaNo ratings yet

- Tax Declaration Form 2021Document1 pageTax Declaration Form 2021Jessica SantosNo ratings yet

- Republic of The Philippines: Quezon CityDocument1 pageRepublic of The Philippines: Quezon CityCharina Marie CaduaNo ratings yet

- Appendix 35 Formats For Claiming Duty Drawback On All Industry Rates/Fixation of Drawback Rates/ Refund of Terminal Excise Duty DBK I StatementDocument6 pagesAppendix 35 Formats For Claiming Duty Drawback On All Industry Rates/Fixation of Drawback Rates/ Refund of Terminal Excise Duty DBK I StatementdaljitkaurNo ratings yet

- SMC-SEC FORM 17A 04 16 2021 Part 1 - FINALDocument355 pagesSMC-SEC FORM 17A 04 16 2021 Part 1 - FINALFrost GarisonNo ratings yet

- Format For Supplier MSME StatusDocument1 pageFormat For Supplier MSME StatusgauravNo ratings yet

- Sro 792Document34 pagesSro 792asfand yarNo ratings yet

- Application Form by A Co-Operative Society For Licence To Commence Banking Business As A Central Co-Operative BankDocument4 pagesApplication Form by A Co-Operative Society For Licence To Commence Banking Business As A Central Co-Operative BankVIRTUAL WORLDNo ratings yet

- ASEAN India OCP PDFDocument2 pagesASEAN India OCP PDFCha CahNo ratings yet

- MAT For Ind ASDocument18 pagesMAT For Ind AScgaurav50No ratings yet

- Application For Setting Up EouDocument9 pagesApplication For Setting Up EouS Radhakrishna BhandaryNo ratings yet

- Dividend Tax ExemptionDocument3 pagesDividend Tax ExemptionGOI 19No ratings yet

- Form No 3CEDocument3 pagesForm No 3CE123vidyaNo ratings yet

- Application Form For: To Be Submitted in Duplicate (2 Sets) Along With Bank Demand Draft / ChequeDocument5 pagesApplication Form For: To Be Submitted in Duplicate (2 Sets) Along With Bank Demand Draft / ChequeRock RamNo ratings yet

- 2go Group, Inc. - Dis 2018. - DDEE3 PDFDocument184 pages2go Group, Inc. - Dis 2018. - DDEE3 PDFAlaine DobleNo ratings yet

- 07 Instruction To BidderDocument2 pages07 Instruction To BidderPratik DiyoraNo ratings yet

- Cost PDFDocument2 pagesCost PDFbusuuuNo ratings yet

- CDSL Modification Request FormDocument2 pagesCDSL Modification Request FormbusuuuNo ratings yet

- PM Kisan Application Form in English 10 02 2020Document1 pagePM Kisan Application Form in English 10 02 2020busuuuNo ratings yet

- Most Important Terms & Conditions (MitcsDocument1 pageMost Important Terms & Conditions (MitcsbusuuuNo ratings yet

- The Modern Indian Art: Introduction To Modernism in IndiaDocument28 pagesThe Modern Indian Art: Introduction To Modernism in IndiabusuuuNo ratings yet

- The Deccani Schools of PaintingDocument12 pagesThe Deccani Schools of PaintingbusuuuNo ratings yet

- Annexure 1 FATCA-CRS Annexure For Individual AccountsDocument6 pagesAnnexure 1 FATCA-CRS Annexure For Individual AccountsbusuuuNo ratings yet

- The Pahari Schools of Painting: Ahari Denotes Hilly or Mountainous' in Origin. PahariDocument18 pagesThe Pahari Schools of Painting: Ahari Denotes Hilly or Mountainous' in Origin. PaharibusuuuNo ratings yet

- The Bengal School and Cultural Nationalism: Company PaintingDocument14 pagesThe Bengal School and Cultural Nationalism: Company PaintingbusuuuNo ratings yet

- Hysical Ducation: Do You Know?Document14 pagesHysical Ducation: Do You Know?busuuuNo ratings yet

- P P A P E S: Hysical and Hysiological Spects of Hysical Ducation and PortsDocument17 pagesP P A P E S: Hysical and Hysiological Spects of Hysical Ducation and PortsbusuuuNo ratings yet

- The Living Art Traditions of IndiaDocument17 pagesThe Living Art Traditions of IndiabusuuuNo ratings yet

- Kehp105 PDFDocument81 pagesKehp105 PDFbusuuuNo ratings yet

- NCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 10Document34 pagesNCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 10busuuuNo ratings yet

- Nderstanding Ealth: Physical DimensionDocument17 pagesNderstanding Ealth: Physical DimensionbusuuuNo ratings yet

- Afety and Ecurity: S M P, G S PDocument21 pagesAfety and Ecurity: S M P, G S PbusuuuNo ratings yet

- Ndividual Ames: HistoryDocument80 pagesNdividual Ames: HistorybusuuuNo ratings yet

- Ournaments and Ompetitions: Activity 10.1Document28 pagesOurnaments and Ompetitions: Activity 10.1busuuuNo ratings yet

- Y R M T: Oga and Its Elevance in The Odern ImesDocument41 pagesY R M T: Oga and Its Elevance in The Odern ImesbusuuuNo ratings yet

- H R P F: Ealth Elated Hysical ItnessDocument16 pagesH R P F: Ealth Elated Hysical ItnessbusuuuNo ratings yet

- NCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 11Document33 pagesNCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 11busuuuNo ratings yet

- NCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 9 PDFDocument27 pagesNCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 9 PDFbusuuuNo ratings yet

- Dventure Ports: Fig. 11.1: ParaglidingDocument11 pagesDventure Ports: Fig. 11.1: ParaglidingbusuuuNo ratings yet

- Easurement and Valuation: W T, M E ?Document12 pagesEasurement and Valuation: W T, M E ?busuuuNo ratings yet

- NCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 8Document17 pagesNCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 8busuuuNo ratings yet

- NCR CompressedDocument27 pagesNCR Compressedapi-276345322No ratings yet

- LRD Term Sheet - Priyami CommentsDocument11 pagesLRD Term Sheet - Priyami Commentslaxmikanth.goturNo ratings yet

- Ohio Rules of Appellate ProcedureDocument73 pagesOhio Rules of Appellate ProcedureBrotherBrunoNo ratings yet

- 2022 01 Pricelist Servicetools enDocument20 pages2022 01 Pricelist Servicetools enkritonNo ratings yet

- Nemo Outdoor 8.40 User Guide PDFDocument392 pagesNemo Outdoor 8.40 User Guide PDFXxbugmenotxXNo ratings yet

- SparkNotes Much Ado About Nothing Full Book Quiz PDFDocument1 pageSparkNotes Much Ado About Nothing Full Book Quiz PDFEvan SandovalNo ratings yet

- Metro Manila Shopping v. ToledoDocument4 pagesMetro Manila Shopping v. ToledoAnonymous OOJEg67vL100% (1)

- 2021-04-15 St. Mary's County TimesDocument40 pages2021-04-15 St. Mary's County TimesSouthern Maryland Online100% (1)

- AnshikaDocument1 pageAnshikaRakesh KumarNo ratings yet

- Form AJDocument6 pagesForm AJkatacumiNo ratings yet

- IIDA Code of Ethics For Professional and Associate Member ConductDocument3 pagesIIDA Code of Ethics For Professional and Associate Member ConductSEJAL JAINNo ratings yet

- LAW, POLITICS, AND THE BHOPAL TRAGEDY: CONTRASTING AMERICAN PERSPECTIVES AFTER 35 YEARS by Julie M. Bunck & Michael R. FowlerDocument25 pagesLAW, POLITICS, AND THE BHOPAL TRAGEDY: CONTRASTING AMERICAN PERSPECTIVES AFTER 35 YEARS by Julie M. Bunck & Michael R. FowlerNihal SahuNo ratings yet

- TD Esc 02 de en 15 033 Rev000 Work Schedule Grid Connection E 101Document14 pagesTD Esc 02 de en 15 033 Rev000 Work Schedule Grid Connection E 101Felipe SilvaNo ratings yet

- Chapter 1 and 2 Colonial America Quiz With Answer KeyDocument7 pagesChapter 1 and 2 Colonial America Quiz With Answer Key1012219No ratings yet

- Contextualized School Child Protection and Anti-Bullying PolicyDocument46 pagesContextualized School Child Protection and Anti-Bullying Policykarim100% (2)

- JCJ-2022 - Screening Test Question PaperDocument40 pagesJCJ-2022 - Screening Test Question PaperPAVANKUMAR GOVINDULANo ratings yet

- Data Collection - Consent and Release Form For Project (Ake-Multiple Language Recording)Document4 pagesData Collection - Consent and Release Form For Project (Ake-Multiple Language Recording)Bisma IbestNo ratings yet

- Fees StructureDocument3 pagesFees StructureFightAgainst CorruptionNo ratings yet

- Civ Digests (Dean Del Castillo)Document138 pagesCiv Digests (Dean Del Castillo)Jan Eidrienne De Luis100% (1)

- Thesis Abstract 1. TitleDocument50 pagesThesis Abstract 1. TitleHuay ZiNo ratings yet

- Crimpro Consolidated Cases For DigestsDocument6 pagesCrimpro Consolidated Cases For DigestsClarisse-joan GarmaNo ratings yet

- He May Be Subject To VATDocument6 pagesHe May Be Subject To VATThe makas AbababaNo ratings yet

- Members Update Data FormDocument2 pagesMembers Update Data FormSittie Aimah DPundoma ModasirNo ratings yet

- Case Study PPDocument18 pagesCase Study PPNabila IbrahimNo ratings yet

- Leaving A Lasting Legacy Dejando Un Legado Duradero: KDOT Revises Kansas Transportation PlanDocument8 pagesLeaving A Lasting Legacy Dejando Un Legado Duradero: KDOT Revises Kansas Transportation PlanInformative Hispanic AmericanNo ratings yet

- 2021 38 3 32025 Judgement 11-Dec-2021Document14 pages2021 38 3 32025 Judgement 11-Dec-2021Debopriyaa SensharmaNo ratings yet

- Republics Vs Mega Pacific EsolutionsDocument12 pagesRepublics Vs Mega Pacific EsolutionsTherese JavierNo ratings yet