Professional Documents

Culture Documents

Form No. 10Bc: Income-Tax Rules, 1962

Form No. 10Bc: Income-Tax Rules, 1962

Uploaded by

busuuuCopyright:

Available Formats

You might also like

- Oracle RMCS and All You Want To KnowDocument15 pagesOracle RMCS and All You Want To KnowMohammad Shaniaz IslamNo ratings yet

- SBI Life InsuranceDocument73 pagesSBI Life Insuranceiloveyoujaan50% (6)

- Pooja MishraDocument7 pagesPooja MishrasmsmbaNo ratings yet

- 15G FormDocument2 pages15G Formgrover.jatinNo ratings yet

- LifeFoundation AuditorReport2006Document10 pagesLifeFoundation AuditorReport2006cachandhiranNo ratings yet

- Securities and Exchange Commission (SEC) - Form18-KDocument3 pagesSecurities and Exchange Commission (SEC) - Form18-Khighfinance100% (1)

- PCNC Accreditation For NGODocument2 pagesPCNC Accreditation For NGOalexjalecoNo ratings yet

- Form No. 3aaa (Now Redundant) Audit Report Under Section 32ABDocument4 pagesForm No. 3aaa (Now Redundant) Audit Report Under Section 32ABAnonymous 2evaoXKKdNo ratings yet

- Application Form For 35ac ApprovalDocument4 pagesApplication Form For 35ac ApprovalHimanshuNo ratings yet

- Steps and Requirements PCNC AccreditationDocument3 pagesSteps and Requirements PCNC AccreditationOmar Jayson Siao Vallejera73% (11)

- PCNC ChecklistDocument3 pagesPCNC Checklistmrbsespkmg LawNo ratings yet

- InformationBookletonAIR 11072008Document13 pagesInformationBookletonAIR 11072008Santhosh Kumar BaswaNo ratings yet

- ITR62 Form 15 CADocument5 pagesITR62 Form 15 CAMohit47No ratings yet

- Resident Individual Shareholders Valid PanDocument4 pagesResident Individual Shareholders Valid Panharikrishnan176No ratings yet

- Income Tax DepartmentDocument6 pagesIncome Tax DepartmentRajasekar SivaguruvelNo ratings yet

- Form No. 3ac: Audit Report Under Section 33ABDocument3 pagesForm No. 3ac: Audit Report Under Section 33ABAnonymous 2evaoXKKdNo ratings yet

- Form No 15GDocument2 pagesForm No 15Gnarendra1968No ratings yet

- Steps & Requirements - UpdatedDocument4 pagesSteps & Requirements - Updatedalfx216No ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Pawan Yadav0% (2)

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Palaniappan Meyyappan83% (6)

- Income Tax Exemption RegimesDocument6 pagesIncome Tax Exemption RegimesNOBERT NYAKUNINo ratings yet

- Steps & Requirements - UpdatedDocument3 pagesSteps & Requirements - UpdatedKaren LabasanNo ratings yet

- Bonds Form 15gDocument3 pagesBonds Form 15gRishi TNo ratings yet

- PDF 4Document3 pagesPDF 47ola007No ratings yet

- New Form 15G Form 15H PDFDocument6 pagesNew Form 15G Form 15H PDFdevender143No ratings yet

- Form No.10bDocument4 pagesForm No.10bKeith RobbinsNo ratings yet

- Annual Report Small CooperativeDocument6 pagesAnnual Report Small CooperativeGift MesaNo ratings yet

- CBDT Notifies Forms For Accumulation of Income by A TrustDocument4 pagesCBDT Notifies Forms For Accumulation of Income by A TrustBibhuChhotrayNo ratings yet

- Form No 15HDocument3 pagesForm No 15HsaymtrNo ratings yet

- OBC Bank Form - 15H PDFDocument2 pagesOBC Bank Form - 15H PDFKrishnan Vaidyanathan100% (1)

- CPAR - Filing Penalties Remedies of TaxationDocument25 pagesCPAR - Filing Penalties Remedies of Taxationwendygilbuela2022No ratings yet

- CPAR Filing, Penalties, Remedies (Batch 92) - HandoutDocument25 pagesCPAR Filing, Penalties, Remedies (Batch 92) - HandoutNikkoNo ratings yet

- Form No. 3C-O: Printed From WWW - Incometaxindia.gov - in Page 1 of 2Document2 pagesForm No. 3C-O: Printed From WWW - Incometaxindia.gov - in Page 1 of 2Rajshree GuptaNo ratings yet

- Audit ReportDocument10 pagesAudit Reportsomnathsingh_hydNo ratings yet

- Form No. 15H: Part - IDocument2 pagesForm No. 15H: Part - Itoton33No ratings yet

- CPAR Lecture Filing and Penalties (Batch 90) HandoutDocument25 pagesCPAR Lecture Filing and Penalties (Batch 90) HandoutAljur SalamedaNo ratings yet

- Guidelines 1702-EX June 2013Document4 pagesGuidelines 1702-EX June 2013Julio Gabriel AseronNo ratings yet

- TAX-CPAR Lecture Filing and Penalties Version 2Document23 pagesTAX-CPAR Lecture Filing and Penalties Version 2YamateNo ratings yet

- 15 G Form (Pre-Filled)Document8 pages15 G Form (Pre-Filled)pankaj_electricalNo ratings yet

- BIR Ruling No. 634-19Document5 pagesBIR Ruling No. 634-19SGNo ratings yet

- 1 CWF Application FormDocument5 pages1 CWF Application FormShubham Jain ModiNo ratings yet

- The Political Contributions Tax Credit ActDocument12 pagesThe Political Contributions Tax Credit Actsachin goreNo ratings yet

- PAN No.Document5 pagesPAN No.haldharkNo ratings yet

- 12345Document8 pages12345induchellamNo ratings yet

- LRSFormDocument3 pagesLRSFormtirthendu senNo ratings yet

- GST Note & Faqs Jan. 2018Document29 pagesGST Note & Faqs Jan. 2018Prakash C RaavudiNo ratings yet

- Securities and Exchange Commission (SEC) - Formn-18f-1Document3 pagesSecurities and Exchange Commission (SEC) - Formn-18f-1highfinanceNo ratings yet

- Form No. 15H: (IT Dept. Copy)Document9 pagesForm No. 15H: (IT Dept. Copy)jpsmu09No ratings yet

- WPI SEC 17-LC v2-2-6Document2 pagesWPI SEC 17-LC v2-2-6dawijawof awofnafawNo ratings yet

- Tally Erp 9.0 Material Tax Collected at Source Tally Erp 9.0Document25 pagesTally Erp 9.0 Material Tax Collected at Source Tally Erp 9.0Raghavendra yadav KMNo ratings yet

- 14 GST Audit Report Format PDFDocument56 pages14 GST Audit Report Format PDFShalu Maria GeorgeNo ratings yet

- Page 26 of 151Document6 pagesPage 26 of 151jibsonly4uNo ratings yet

- FCI - GST - Manual On Returns and PaymentsDocument30 pagesFCI - GST - Manual On Returns and PaymentsAmber ChaturvediNo ratings yet

- Interim-Dividen-2021-22 - TDS-on-dividend-CommunicationDocument4 pagesInterim-Dividen-2021-22 - TDS-on-dividend-CommunicationNimesh PatelNo ratings yet

- All About GST Annual ReturnsDocument9 pagesAll About GST Annual ReturnsinfoNo ratings yet

- Sr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidDocument7 pagesSr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidKartikey RanaNo ratings yet

- New Delhi,: (I) The Total Income of Such Fund or Institution or Trust or University or Other Educational Institution orDocument24 pagesNew Delhi,: (I) The Total Income of Such Fund or Institution or Trust or University or Other Educational Institution orCA.Shreehari KutsaNo ratings yet

- CPAR Filing, Penalties, and Remedies (Batch 89) HandoutDocument25 pagesCPAR Filing, Penalties, and Remedies (Batch 89) HandoutlllllNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Most Important Terms & Conditions (MitcsDocument1 pageMost Important Terms & Conditions (MitcsbusuuuNo ratings yet

- CDSL Modification Request FormDocument2 pagesCDSL Modification Request FormbusuuuNo ratings yet

- PM Kisan Application Form in English 10 02 2020Document1 pagePM Kisan Application Form in English 10 02 2020busuuuNo ratings yet

- Annexure 1 FATCA-CRS Annexure For Individual AccountsDocument6 pagesAnnexure 1 FATCA-CRS Annexure For Individual AccountsbusuuuNo ratings yet

- Kehp105 PDFDocument81 pagesKehp105 PDFbusuuuNo ratings yet

- Cost PDFDocument2 pagesCost PDFbusuuuNo ratings yet

- The Bengal School and Cultural Nationalism: Company PaintingDocument14 pagesThe Bengal School and Cultural Nationalism: Company PaintingbusuuuNo ratings yet

- The Deccani Schools of PaintingDocument12 pagesThe Deccani Schools of PaintingbusuuuNo ratings yet

- The Modern Indian Art: Introduction To Modernism in IndiaDocument28 pagesThe Modern Indian Art: Introduction To Modernism in IndiabusuuuNo ratings yet

- The Living Art Traditions of IndiaDocument17 pagesThe Living Art Traditions of IndiabusuuuNo ratings yet

- P P A P E S: Hysical and Hysiological Spects of Hysical Ducation and PortsDocument17 pagesP P A P E S: Hysical and Hysiological Spects of Hysical Ducation and PortsbusuuuNo ratings yet

- The Pahari Schools of Painting: Ahari Denotes Hilly or Mountainous' in Origin. PahariDocument18 pagesThe Pahari Schools of Painting: Ahari Denotes Hilly or Mountainous' in Origin. PaharibusuuuNo ratings yet

- Hysical Ducation: Do You Know?Document14 pagesHysical Ducation: Do You Know?busuuuNo ratings yet

- Nderstanding Ealth: Physical DimensionDocument17 pagesNderstanding Ealth: Physical DimensionbusuuuNo ratings yet

- H R P F: Ealth Elated Hysical ItnessDocument16 pagesH R P F: Ealth Elated Hysical ItnessbusuuuNo ratings yet

- Ndividual Ames: HistoryDocument80 pagesNdividual Ames: HistorybusuuuNo ratings yet

- Afety and Ecurity: S M P, G S PDocument21 pagesAfety and Ecurity: S M P, G S PbusuuuNo ratings yet

- Y R M T: Oga and Its Elevance in The Odern ImesDocument41 pagesY R M T: Oga and Its Elevance in The Odern ImesbusuuuNo ratings yet

- Dventure Ports: Fig. 11.1: ParaglidingDocument11 pagesDventure Ports: Fig. 11.1: ParaglidingbusuuuNo ratings yet

- Ournaments and Ompetitions: Activity 10.1Document28 pagesOurnaments and Ompetitions: Activity 10.1busuuuNo ratings yet

- NCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 9 PDFDocument27 pagesNCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 9 PDFbusuuuNo ratings yet

- Easurement and Valuation: W T, M E ?Document12 pagesEasurement and Valuation: W T, M E ?busuuuNo ratings yet

- NCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 11Document33 pagesNCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 11busuuuNo ratings yet

- NCR CompressedDocument27 pagesNCR Compressedapi-276345322No ratings yet

- NCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 8Document17 pagesNCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 8busuuuNo ratings yet

- NCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 10Document34 pagesNCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 10busuuuNo ratings yet

- IFRS 16 Examples, Summary, & How To Transition From IAS 17Document13 pagesIFRS 16 Examples, Summary, & How To Transition From IAS 17Bruce ChengNo ratings yet

- List of Labuan BanksDocument6 pagesList of Labuan Bankseddie0611No ratings yet

- GSIS Members Request Form 2asDocument1 pageGSIS Members Request Form 2asaerosmith_julio6627100% (1)

- Acc 107 Finals Quiz 3Document1 pageAcc 107 Finals Quiz 3Jezz CulangNo ratings yet

- PDF - ChallanList - 1-15-2017 12-00-00 AMDocument1 pagePDF - ChallanList - 1-15-2017 12-00-00 AMvimalNo ratings yet

- Sayllabus of Financial Advisors CertificationDocument6 pagesSayllabus of Financial Advisors Certificationrizwan matloobNo ratings yet

- FAR.3207 PPE-RevaluationDocument2 pagesFAR.3207 PPE-RevaluationMira Louise HernandezNo ratings yet

- Fabm Module 6Document4 pagesFabm Module 6Ruvie Mae Paglinawan100% (1)

- Seabank Statement 20240404Document15 pagesSeabank Statement 20240404solehaananNo ratings yet

- Salma Barkah - Dasar Akuntansi - Latihan E2-9 & E2-10Document6 pagesSalma Barkah - Dasar Akuntansi - Latihan E2-9 & E2-10Salma BarkahNo ratings yet

- Electronic BankingDocument11 pagesElectronic BankingMd.Abdulla All ShafiNo ratings yet

- CertificationDocument2 pagesCertificationChiz-Chiz GesiteNo ratings yet

- FINS2624 Problem Set 5Document3 pagesFINS2624 Problem Set 5IsyNo ratings yet

- QUIZ AccountingDocument5 pagesQUIZ AccountingEzy Tri TANo ratings yet

- Manulife FutureBoost BrochureDocument4 pagesManulife FutureBoost BrochureJohn Mark MontanoNo ratings yet

- Mrunal's Economy Win22 Updates For UPSC & Other Competitive ExamsDocument21 pagesMrunal's Economy Win22 Updates For UPSC & Other Competitive ExamsTrial UserNo ratings yet

- Commerce: Accounting & Taxation: Learning OutcomeDocument1 pageCommerce: Accounting & Taxation: Learning Outcomecostumercare85No ratings yet

- Disbursement Process and Documentation: I) Ii) Iii)Document31 pagesDisbursement Process and Documentation: I) Ii) Iii)mr9_apeceNo ratings yet

- FLW00005 - Disbursement Transaction Cycle 2Document2 pagesFLW00005 - Disbursement Transaction Cycle 2Rafael SampayanNo ratings yet

- Project Topic - Bancassurance: Presented by - Abhishek ParkarDocument11 pagesProject Topic - Bancassurance: Presented by - Abhishek ParkarAbhishek ParkarNo ratings yet

- Lecture NotesDocument36 pagesLecture NotesAmritNo ratings yet

- Dia 01 Block 01Document46 pagesDia 01 Block 01Sam RockerNo ratings yet

- Small Finance Bank 1Document5 pagesSmall Finance Bank 1Yerrolla MadhuravaniNo ratings yet

- Credit Cards in VietnamDocument15 pagesCredit Cards in Vietnamquinn100% (1)

- On March 20 2011 Finetouch Corporation Purchased Two Machines atDocument1 pageOn March 20 2011 Finetouch Corporation Purchased Two Machines atFreelance WorkerNo ratings yet

- Module-5 Roll-49Document12 pagesModule-5 Roll-49SUBHECHHA MOHAPATRANo ratings yet

- PF Return Monthly, Yearly & ChallanDocument9 pagesPF Return Monthly, Yearly & ChallanSatyam mishra100% (1)

Form No. 10Bc: Income-Tax Rules, 1962

Form No. 10Bc: Income-Tax Rules, 1962

Uploaded by

busuuuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form No. 10Bc: Income-Tax Rules, 1962

Form No. 10Bc: Income-Tax Rules, 1962

Uploaded by

busuuuCopyright:

Available Formats

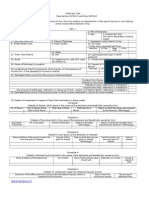

INCOME-TAX RULES, 1962

FORM NO. 10BC

[See rule 17CA]

Audit report under (sub-rule (12) of rule 17CA) of the Income-tax Rules, 1962, in the case

of an electoral trust

* I/We have examined the Balance Sheet of ___________________________ [name of the

electoral trust] as at ________________________ and the Income and Expenditure Account for

the year ended on that date and certify that the Balance Sheet and the Income and Expenditure

Account are in agreement with the books of account maintained by the said electoral Trust.

* I/We have obtained all the information and explanations which to the best of * my/our

knowledge and belief were necessary for the purposes of the audit.

In * my/our opinion, proper books of account have been kept by the head office and the branches

of the above named electoral trust visited by * me/us so far as appears from* my/our

examination of the books, and proper documents adequate for the purposes of audit have been

received from branches not visited by * me/us, subject to the comments given below:

In * my/our opinion and to the best of * my/our information, and according to information given

to *me/us, the said accounts give a true and fair view-

(i) in the case of the Balance Sheet, of the state of affairs of the above named electoral trust as

at...................... and

(ii) in the case of the Income and Expenditure Account, of the surplus or deficit for its

accounting year ending on that date.

The prescribed particulars are annexed hereto.

Place. __________________ (Signed)

Date __________________

Accountant†

Name

Membership No.

Address

Notes :

1. *Strike out whichever is not applicable.

2. †This report has to be given by-

Printed from www.incometaxindia.gov.in Page 1 of 3

(i) a chartered accountant within the meaning of the Chartered Accountants Act, 1949 (38

of 1949); or

(ii) any person who, in relation to any State, is, by virtue of the provisions of sub-section

(2) of section 226 of the Companies Act, 1956 (1 of 1956), entitled to be appointed to

act as an auditor of the companies registered in that State.

3. Where any of the matters stated in this report is answered in the negative, or with a

qualification, the report shall state the reasons for the same.

ANNEXURE: TO FORM NO. 10BC

I. Details of contributions received and distributed:-

(1) Total amount of contributions received in the previous year.

(2) Total amount of contributions distributed to eligible political parties.

(3) Amount of contributions utilised for administrative or management functions.

(4) Surplus brought forward.

(5) Distributable Contributions for the Financial Year.

(6) Whether the contributions received in the previous year have been distributed to eligible

political parties?

Name of the Political Party with permanent account Amount Date Mode

number distributed

(7) Surplus to be carried forward.

(8) Whether all contributions have been received by account payee cheque or demand draft? If

no; the details thereof.

Name of the person Permanent account Amount of Date Mode

number contribution

(9) Whether receipts in respect of all distributions made to political parties have been obtained?

(10) Whether the list of all contributors has been maintained?

(11) Whether the list of all political parties, to whom the amount distributed, has been

maintained?

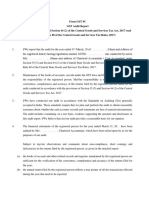

II. Application or use of income or property for the benefit of persons referred to in sub-rule (10)

of rule 17CA:-

1. Details of any transaction in excess of Rs. 20,000 with a person referred to in sub-rule (10)

of rule 17CA (hereinafter referred to in this Annexure as "interested person").

2. Whether any payment was made to any interested person during the previous year by way

of salary, allowance or otherwise? If so, details thereof.

Printed from www.incometaxindia.gov.in Page 2 of 3

3. Whether any part of the contributions received by the trust was lent, or continues to be lent,

in the previous year to any interested person?

If so, details of the amount, rate of interest charged and the nature of security, if any.

4. Whether any income or property of the electoral trust was diverted during the previous year

in favour of any interested person? If so, details thereof together with the amount of income

or value of property so diverted.

III. Information pertaining to expenditure incurred by the electoral trust towards administration

or management of its affairs:-

1. Whether the administrative or management expenses pertaining to the electoral trust are in

accordance with sub-rule (8) of rule 17CA?

2. If yes, whether the required details are adequately maintained?

3. If no, what is the percentage of expenditure incurred by the electoral trust vis-a-vis the total

contributions received?

Place: Signature of the Accountant:______________________

Date: Accountant Membership No. ______________________

Printed from www.incometaxindia.gov.in Page 3 of 3

You might also like

- Oracle RMCS and All You Want To KnowDocument15 pagesOracle RMCS and All You Want To KnowMohammad Shaniaz IslamNo ratings yet

- SBI Life InsuranceDocument73 pagesSBI Life Insuranceiloveyoujaan50% (6)

- Pooja MishraDocument7 pagesPooja MishrasmsmbaNo ratings yet

- 15G FormDocument2 pages15G Formgrover.jatinNo ratings yet

- LifeFoundation AuditorReport2006Document10 pagesLifeFoundation AuditorReport2006cachandhiranNo ratings yet

- Securities and Exchange Commission (SEC) - Form18-KDocument3 pagesSecurities and Exchange Commission (SEC) - Form18-Khighfinance100% (1)

- PCNC Accreditation For NGODocument2 pagesPCNC Accreditation For NGOalexjalecoNo ratings yet

- Form No. 3aaa (Now Redundant) Audit Report Under Section 32ABDocument4 pagesForm No. 3aaa (Now Redundant) Audit Report Under Section 32ABAnonymous 2evaoXKKdNo ratings yet

- Application Form For 35ac ApprovalDocument4 pagesApplication Form For 35ac ApprovalHimanshuNo ratings yet

- Steps and Requirements PCNC AccreditationDocument3 pagesSteps and Requirements PCNC AccreditationOmar Jayson Siao Vallejera73% (11)

- PCNC ChecklistDocument3 pagesPCNC Checklistmrbsespkmg LawNo ratings yet

- InformationBookletonAIR 11072008Document13 pagesInformationBookletonAIR 11072008Santhosh Kumar BaswaNo ratings yet

- ITR62 Form 15 CADocument5 pagesITR62 Form 15 CAMohit47No ratings yet

- Resident Individual Shareholders Valid PanDocument4 pagesResident Individual Shareholders Valid Panharikrishnan176No ratings yet

- Income Tax DepartmentDocument6 pagesIncome Tax DepartmentRajasekar SivaguruvelNo ratings yet

- Form No. 3ac: Audit Report Under Section 33ABDocument3 pagesForm No. 3ac: Audit Report Under Section 33ABAnonymous 2evaoXKKdNo ratings yet

- Form No 15GDocument2 pagesForm No 15Gnarendra1968No ratings yet

- Steps & Requirements - UpdatedDocument4 pagesSteps & Requirements - Updatedalfx216No ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Pawan Yadav0% (2)

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Palaniappan Meyyappan83% (6)

- Income Tax Exemption RegimesDocument6 pagesIncome Tax Exemption RegimesNOBERT NYAKUNINo ratings yet

- Steps & Requirements - UpdatedDocument3 pagesSteps & Requirements - UpdatedKaren LabasanNo ratings yet

- Bonds Form 15gDocument3 pagesBonds Form 15gRishi TNo ratings yet

- PDF 4Document3 pagesPDF 47ola007No ratings yet

- New Form 15G Form 15H PDFDocument6 pagesNew Form 15G Form 15H PDFdevender143No ratings yet

- Form No.10bDocument4 pagesForm No.10bKeith RobbinsNo ratings yet

- Annual Report Small CooperativeDocument6 pagesAnnual Report Small CooperativeGift MesaNo ratings yet

- CBDT Notifies Forms For Accumulation of Income by A TrustDocument4 pagesCBDT Notifies Forms For Accumulation of Income by A TrustBibhuChhotrayNo ratings yet

- Form No 15HDocument3 pagesForm No 15HsaymtrNo ratings yet

- OBC Bank Form - 15H PDFDocument2 pagesOBC Bank Form - 15H PDFKrishnan Vaidyanathan100% (1)

- CPAR - Filing Penalties Remedies of TaxationDocument25 pagesCPAR - Filing Penalties Remedies of Taxationwendygilbuela2022No ratings yet

- CPAR Filing, Penalties, Remedies (Batch 92) - HandoutDocument25 pagesCPAR Filing, Penalties, Remedies (Batch 92) - HandoutNikkoNo ratings yet

- Form No. 3C-O: Printed From WWW - Incometaxindia.gov - in Page 1 of 2Document2 pagesForm No. 3C-O: Printed From WWW - Incometaxindia.gov - in Page 1 of 2Rajshree GuptaNo ratings yet

- Audit ReportDocument10 pagesAudit Reportsomnathsingh_hydNo ratings yet

- Form No. 15H: Part - IDocument2 pagesForm No. 15H: Part - Itoton33No ratings yet

- CPAR Lecture Filing and Penalties (Batch 90) HandoutDocument25 pagesCPAR Lecture Filing and Penalties (Batch 90) HandoutAljur SalamedaNo ratings yet

- Guidelines 1702-EX June 2013Document4 pagesGuidelines 1702-EX June 2013Julio Gabriel AseronNo ratings yet

- TAX-CPAR Lecture Filing and Penalties Version 2Document23 pagesTAX-CPAR Lecture Filing and Penalties Version 2YamateNo ratings yet

- 15 G Form (Pre-Filled)Document8 pages15 G Form (Pre-Filled)pankaj_electricalNo ratings yet

- BIR Ruling No. 634-19Document5 pagesBIR Ruling No. 634-19SGNo ratings yet

- 1 CWF Application FormDocument5 pages1 CWF Application FormShubham Jain ModiNo ratings yet

- The Political Contributions Tax Credit ActDocument12 pagesThe Political Contributions Tax Credit Actsachin goreNo ratings yet

- PAN No.Document5 pagesPAN No.haldharkNo ratings yet

- 12345Document8 pages12345induchellamNo ratings yet

- LRSFormDocument3 pagesLRSFormtirthendu senNo ratings yet

- GST Note & Faqs Jan. 2018Document29 pagesGST Note & Faqs Jan. 2018Prakash C RaavudiNo ratings yet

- Securities and Exchange Commission (SEC) - Formn-18f-1Document3 pagesSecurities and Exchange Commission (SEC) - Formn-18f-1highfinanceNo ratings yet

- Form No. 15H: (IT Dept. Copy)Document9 pagesForm No. 15H: (IT Dept. Copy)jpsmu09No ratings yet

- WPI SEC 17-LC v2-2-6Document2 pagesWPI SEC 17-LC v2-2-6dawijawof awofnafawNo ratings yet

- Tally Erp 9.0 Material Tax Collected at Source Tally Erp 9.0Document25 pagesTally Erp 9.0 Material Tax Collected at Source Tally Erp 9.0Raghavendra yadav KMNo ratings yet

- 14 GST Audit Report Format PDFDocument56 pages14 GST Audit Report Format PDFShalu Maria GeorgeNo ratings yet

- Page 26 of 151Document6 pagesPage 26 of 151jibsonly4uNo ratings yet

- FCI - GST - Manual On Returns and PaymentsDocument30 pagesFCI - GST - Manual On Returns and PaymentsAmber ChaturvediNo ratings yet

- Interim-Dividen-2021-22 - TDS-on-dividend-CommunicationDocument4 pagesInterim-Dividen-2021-22 - TDS-on-dividend-CommunicationNimesh PatelNo ratings yet

- All About GST Annual ReturnsDocument9 pagesAll About GST Annual ReturnsinfoNo ratings yet

- Sr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidDocument7 pagesSr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidKartikey RanaNo ratings yet

- New Delhi,: (I) The Total Income of Such Fund or Institution or Trust or University or Other Educational Institution orDocument24 pagesNew Delhi,: (I) The Total Income of Such Fund or Institution or Trust or University or Other Educational Institution orCA.Shreehari KutsaNo ratings yet

- CPAR Filing, Penalties, and Remedies (Batch 89) HandoutDocument25 pagesCPAR Filing, Penalties, and Remedies (Batch 89) HandoutlllllNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Most Important Terms & Conditions (MitcsDocument1 pageMost Important Terms & Conditions (MitcsbusuuuNo ratings yet

- CDSL Modification Request FormDocument2 pagesCDSL Modification Request FormbusuuuNo ratings yet

- PM Kisan Application Form in English 10 02 2020Document1 pagePM Kisan Application Form in English 10 02 2020busuuuNo ratings yet

- Annexure 1 FATCA-CRS Annexure For Individual AccountsDocument6 pagesAnnexure 1 FATCA-CRS Annexure For Individual AccountsbusuuuNo ratings yet

- Kehp105 PDFDocument81 pagesKehp105 PDFbusuuuNo ratings yet

- Cost PDFDocument2 pagesCost PDFbusuuuNo ratings yet

- The Bengal School and Cultural Nationalism: Company PaintingDocument14 pagesThe Bengal School and Cultural Nationalism: Company PaintingbusuuuNo ratings yet

- The Deccani Schools of PaintingDocument12 pagesThe Deccani Schools of PaintingbusuuuNo ratings yet

- The Modern Indian Art: Introduction To Modernism in IndiaDocument28 pagesThe Modern Indian Art: Introduction To Modernism in IndiabusuuuNo ratings yet

- The Living Art Traditions of IndiaDocument17 pagesThe Living Art Traditions of IndiabusuuuNo ratings yet

- P P A P E S: Hysical and Hysiological Spects of Hysical Ducation and PortsDocument17 pagesP P A P E S: Hysical and Hysiological Spects of Hysical Ducation and PortsbusuuuNo ratings yet

- The Pahari Schools of Painting: Ahari Denotes Hilly or Mountainous' in Origin. PahariDocument18 pagesThe Pahari Schools of Painting: Ahari Denotes Hilly or Mountainous' in Origin. PaharibusuuuNo ratings yet

- Hysical Ducation: Do You Know?Document14 pagesHysical Ducation: Do You Know?busuuuNo ratings yet

- Nderstanding Ealth: Physical DimensionDocument17 pagesNderstanding Ealth: Physical DimensionbusuuuNo ratings yet

- H R P F: Ealth Elated Hysical ItnessDocument16 pagesH R P F: Ealth Elated Hysical ItnessbusuuuNo ratings yet

- Ndividual Ames: HistoryDocument80 pagesNdividual Ames: HistorybusuuuNo ratings yet

- Afety and Ecurity: S M P, G S PDocument21 pagesAfety and Ecurity: S M P, G S PbusuuuNo ratings yet

- Y R M T: Oga and Its Elevance in The Odern ImesDocument41 pagesY R M T: Oga and Its Elevance in The Odern ImesbusuuuNo ratings yet

- Dventure Ports: Fig. 11.1: ParaglidingDocument11 pagesDventure Ports: Fig. 11.1: ParaglidingbusuuuNo ratings yet

- Ournaments and Ompetitions: Activity 10.1Document28 pagesOurnaments and Ompetitions: Activity 10.1busuuuNo ratings yet

- NCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 9 PDFDocument27 pagesNCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 9 PDFbusuuuNo ratings yet

- Easurement and Valuation: W T, M E ?Document12 pagesEasurement and Valuation: W T, M E ?busuuuNo ratings yet

- NCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 11Document33 pagesNCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 11busuuuNo ratings yet

- NCR CompressedDocument27 pagesNCR Compressedapi-276345322No ratings yet

- NCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 8Document17 pagesNCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 8busuuuNo ratings yet

- NCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 10Document34 pagesNCERT-Books-for-class 11-Maths-Hindi-Medium-Chapter 10busuuuNo ratings yet

- IFRS 16 Examples, Summary, & How To Transition From IAS 17Document13 pagesIFRS 16 Examples, Summary, & How To Transition From IAS 17Bruce ChengNo ratings yet

- List of Labuan BanksDocument6 pagesList of Labuan Bankseddie0611No ratings yet

- GSIS Members Request Form 2asDocument1 pageGSIS Members Request Form 2asaerosmith_julio6627100% (1)

- Acc 107 Finals Quiz 3Document1 pageAcc 107 Finals Quiz 3Jezz CulangNo ratings yet

- PDF - ChallanList - 1-15-2017 12-00-00 AMDocument1 pagePDF - ChallanList - 1-15-2017 12-00-00 AMvimalNo ratings yet

- Sayllabus of Financial Advisors CertificationDocument6 pagesSayllabus of Financial Advisors Certificationrizwan matloobNo ratings yet

- FAR.3207 PPE-RevaluationDocument2 pagesFAR.3207 PPE-RevaluationMira Louise HernandezNo ratings yet

- Fabm Module 6Document4 pagesFabm Module 6Ruvie Mae Paglinawan100% (1)

- Seabank Statement 20240404Document15 pagesSeabank Statement 20240404solehaananNo ratings yet

- Salma Barkah - Dasar Akuntansi - Latihan E2-9 & E2-10Document6 pagesSalma Barkah - Dasar Akuntansi - Latihan E2-9 & E2-10Salma BarkahNo ratings yet

- Electronic BankingDocument11 pagesElectronic BankingMd.Abdulla All ShafiNo ratings yet

- CertificationDocument2 pagesCertificationChiz-Chiz GesiteNo ratings yet

- FINS2624 Problem Set 5Document3 pagesFINS2624 Problem Set 5IsyNo ratings yet

- QUIZ AccountingDocument5 pagesQUIZ AccountingEzy Tri TANo ratings yet

- Manulife FutureBoost BrochureDocument4 pagesManulife FutureBoost BrochureJohn Mark MontanoNo ratings yet

- Mrunal's Economy Win22 Updates For UPSC & Other Competitive ExamsDocument21 pagesMrunal's Economy Win22 Updates For UPSC & Other Competitive ExamsTrial UserNo ratings yet

- Commerce: Accounting & Taxation: Learning OutcomeDocument1 pageCommerce: Accounting & Taxation: Learning Outcomecostumercare85No ratings yet

- Disbursement Process and Documentation: I) Ii) Iii)Document31 pagesDisbursement Process and Documentation: I) Ii) Iii)mr9_apeceNo ratings yet

- FLW00005 - Disbursement Transaction Cycle 2Document2 pagesFLW00005 - Disbursement Transaction Cycle 2Rafael SampayanNo ratings yet

- Project Topic - Bancassurance: Presented by - Abhishek ParkarDocument11 pagesProject Topic - Bancassurance: Presented by - Abhishek ParkarAbhishek ParkarNo ratings yet

- Lecture NotesDocument36 pagesLecture NotesAmritNo ratings yet

- Dia 01 Block 01Document46 pagesDia 01 Block 01Sam RockerNo ratings yet

- Small Finance Bank 1Document5 pagesSmall Finance Bank 1Yerrolla MadhuravaniNo ratings yet

- Credit Cards in VietnamDocument15 pagesCredit Cards in Vietnamquinn100% (1)

- On March 20 2011 Finetouch Corporation Purchased Two Machines atDocument1 pageOn March 20 2011 Finetouch Corporation Purchased Two Machines atFreelance WorkerNo ratings yet

- Module-5 Roll-49Document12 pagesModule-5 Roll-49SUBHECHHA MOHAPATRANo ratings yet

- PF Return Monthly, Yearly & ChallanDocument9 pagesPF Return Monthly, Yearly & ChallanSatyam mishra100% (1)