Professional Documents

Culture Documents

FINANCE TEAM PROJECT - Ratio Calculations

FINANCE TEAM PROJECT - Ratio Calculations

Uploaded by

MOHAMED JALEEL MOHAMED SIDDEEK0 ratings0% found this document useful (0 votes)

13 views2 pagesThe document shows financial information for Enbridge Inc. from 2017-2019 including sales, expenses, assets, liabilities, and various financial ratios. Some key details:

- Sales increased from $44.4 billion in 2017 to $50.1 billion in 2019 while costs and expenses also increased.

- Net income grew from $3.3 billion in 2017 to $5.8 billion in 2019.

- Total assets decreased slightly from $162.1 billion in 2017 to $163.3 billion in 2019.

- Current and total liabilities increased over the period while shareholder equity grew from $58.1 billion to $66 billion from 2017-2019.

Original Description:

Original Title

FINANCE TEAM PROJECT- Ratio calculations

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document shows financial information for Enbridge Inc. from 2017-2019 including sales, expenses, assets, liabilities, and various financial ratios. Some key details:

- Sales increased from $44.4 billion in 2017 to $50.1 billion in 2019 while costs and expenses also increased.

- Net income grew from $3.3 billion in 2017 to $5.8 billion in 2019.

- Total assets decreased slightly from $162.1 billion in 2017 to $163.3 billion in 2019.

- Current and total liabilities increased over the period while shareholder equity grew from $58.1 billion to $66 billion from 2017-2019.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

13 views2 pagesFINANCE TEAM PROJECT - Ratio Calculations

FINANCE TEAM PROJECT - Ratio Calculations

Uploaded by

MOHAMED JALEEL MOHAMED SIDDEEKThe document shows financial information for Enbridge Inc. from 2017-2019 including sales, expenses, assets, liabilities, and various financial ratios. Some key details:

- Sales increased from $44.4 billion in 2017 to $50.1 billion in 2019 while costs and expenses also increased.

- Net income grew from $3.3 billion in 2017 to $5.8 billion in 2019.

- Total assets decreased slightly from $162.1 billion in 2017 to $163.3 billion in 2019.

- Current and total liabilities increased over the period while shareholder equity grew from $58.1 billion to $66 billion from 2017-2019.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

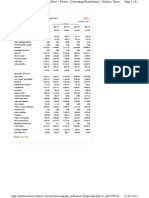

Description Enbridge Inc.

2019 2018 2017

Sales (total operating revenue) 50,069.00 46,378.00 44,378.00

Cost of Sales (total operating expense) 41,809.00 41,562.00 42,807.00

Depriciation 3,391.00 3,246.00 3,163.00

Finance Cost (interest expense) 2,663.00 2,703.00 2,556.00

EBIT (Earnings before Interest & taxes) 10,198.00 6,273.00 3,125.00

Net Income 5,827.00 3,333.00 3,266.00

Fixed Assets 154,444.00 158,333.00 152,878.00

Current Asstes 8,825.00 8,572.00 9,215.00

Inventory 1,299.00 1,339.00 1,528.00

Total Assets 163,269.00 166,905.00 162,093.00

Cash 648.00 518.00 480.00

Current Liabilities 16,010.00 14,855.00 14,624.00

Total Debt 64,963.00 64,610.00 65,180.00

Total Liabilities 93,862.00 93,470.00 92,294.00

Shareholder Equity 66,043.00 69,470.00 58,135.00

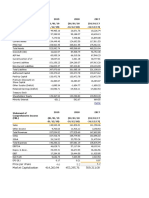

Description Enbridge Inc.

2019 2018 2017

Short Term Liquidity Ratio

Current Ratio 0.55 0.58 0.63

Quick Ratio 0.47 0.49 0.53

Cash Ratio 0.04 0.03 0.03

Net Working Capital (7,185.00) (6,283.00) (5,409.00)

Long Term / Financial Leverage Ratios

Total Debt Ratio 0.57 0.56 0.57

Debit Equity Ratio 0.98 0.93 1.12

Equity Multiplier 2.47 2.40 2.79

Long Term debt ratio 0.50 0.48 0.53

Times Interest Earned 3.83 2.32 1.22

Cash Coverage Ratio 5.10 3.52 2.46

Asstes Utilization Turnover Ratios

Inventory Turnover Ratio 31.70 28.99

Inventory Turnover days 11.52 12.59

Receivable Turnover 7.53 6.84

Receivable Turnover days 48.47 53.40

Fixed Assets Turnover 0.32 0.29 0.29

Total Assets Turnover 0.31 0.28 0.27

Profitability Ratios

Profit Margin 0.12 0.07 0.07

Return on Assets 0.04 0.02 0.02

Return on Equity 0.09 0.05 0.06

Market Value Ratio

Earning Per Share 2.64 1.46 1.65

Share Price 35.10 35.39 35.00

Price Earning Ratio 13.30 24.24 21.21

You might also like

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Abm Fabm2 Module 8 Lesson 2 Income and Business TaxationDocument24 pagesAbm Fabm2 Module 8 Lesson 2 Income and Business TaxationMelody Fabreag77% (26)

- Bain Interactive Interview Briefing PackDocument19 pagesBain Interactive Interview Briefing PackDavid MiguelNo ratings yet

- Mid Term FNCE 2020Document13 pagesMid Term FNCE 2020MOHAMED JALEEL MOHAMED SIDDEEKNo ratings yet

- Assignment 2Document1 pageAssignment 2Sumbal JameelNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- Interactive Production KPI Dashboard-BeatexcelDocument21 pagesInteractive Production KPI Dashboard-BeatexcelWhenYouFailAgainNo ratings yet

- Income Statement Data Year 1 Year 2 Year 3 Year 4 Year 5Document1 pageIncome Statement Data Year 1 Year 2 Year 3 Year 4 Year 5Lester GoNo ratings yet

- Infosys Sources of FinanceDocument6 pagesInfosys Sources of FinanceyargyalNo ratings yet

- Analisis Laporan Keuangan - Prak. ALKDocument2 pagesAnalisis Laporan Keuangan - Prak. ALKAnti HeryantiNo ratings yet

- Financial Ratios of Hero Honda MotorsDocument6 pagesFinancial Ratios of Hero Honda MotorsParag MaheshwariNo ratings yet

- Particulars (All Values in Lakhs Unless Specified Otherwise) 2019 2018Document6 pagesParticulars (All Values in Lakhs Unless Specified Otherwise) 2019 2018MOHIT MARHATTANo ratings yet

- HDFC Bank: PrintDocument1 pageHDFC Bank: PrintBHATT BANSINo ratings yet

- HDFC Bank LTD.: Profit and Loss A/CDocument4 pagesHDFC Bank LTD.: Profit and Loss A/CsureshkarnaNo ratings yet

- Book 3Document62 pagesBook 3pg23ishika.kumariNo ratings yet

- Balance SheetDocument2 pagesBalance SheetSachin SinghNo ratings yet

- Book 1Document18 pagesBook 1Ankit PichholiyaNo ratings yet

- ITM MaricoDocument8 pagesITM MaricoAdarsh ChaudharyNo ratings yet

- ABB India: PrintDocument2 pagesABB India: PrintAbhay Kumar SinghNo ratings yet

- Group Assignment 2Document2 pagesGroup Assignment 2sebsibeboki01No ratings yet

- Consolidated ReportsDocument32 pagesConsolidated ReportsSalman JahangirNo ratings yet

- Sbi Banlce SheetDocument1 pageSbi Banlce SheetANIKET VISHWANATH KURANENo ratings yet

- Balance Sheet of Hero Honda MotorsDocument2 pagesBalance Sheet of Hero Honda MotorsMehul ShuklaNo ratings yet

- Queen SouthDocument16 pagesQueen SouthMohammad Sayad ArmanNo ratings yet

- Comprehensive IT Industry Analysis - ProjectDocument52 pagesComprehensive IT Industry Analysis - ProjectdhruvNo ratings yet

- Company Info - Print FinancialsDocument1 pageCompany Info - Print FinancialsjohnNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsDivya PandeyNo ratings yet

- Balance SheetDocument1 pageBalance SheetMikhil Pranay SinghNo ratings yet

- Balance Sheet PDFDocument1 pageBalance Sheet PDFMikhil Pranay SinghNo ratings yet

- Consolidated Balance Sheet: Wipro TCS InfosysDocument4 pagesConsolidated Balance Sheet: Wipro TCS Infosysvineel kumarNo ratings yet

- Balance Sheet of DR Reddys Laboratories: - in Rs. Cr.Document14 pagesBalance Sheet of DR Reddys Laboratories: - in Rs. Cr.Anand MalashettiNo ratings yet

- Accounting For ManagementDocument26 pagesAccounting For Managementdheivayani kNo ratings yet

- HTTP WWW - MoneycontrolDocument1 pageHTTP WWW - MoneycontrolPavan PoliNo ratings yet

- About The Company: Gati Limited Is Engaged in Providing Distribution and Supply Chain Solutions. To Customers AcrossDocument6 pagesAbout The Company: Gati Limited Is Engaged in Providing Distribution and Supply Chain Solutions. To Customers AcrossAman UpadhyayNo ratings yet

- FMA Group 7 AssDocument20 pagesFMA Group 7 AssWeldu GebruNo ratings yet

- Sources of Funds: Balance Sheet - in Rs. Cr.Document10 pagesSources of Funds: Balance Sheet - in Rs. Cr.mayankjain_90No ratings yet

- Bano of India Bs 1Document1 pageBano of India Bs 1God PlanNo ratings yet

- SBI Life Insurance B - L Sheet 2023Document2 pagesSBI Life Insurance B - L Sheet 2023Kiran MengalNo ratings yet

- Daiz, Kate - Cement Companies - Audited Financial Statement AnalysisDocument100 pagesDaiz, Kate - Cement Companies - Audited Financial Statement AnalysisKate DaizNo ratings yet

- WE FS Analysis 2019-2021Document12 pagesWE FS Analysis 2019-2021saadalchalabiNo ratings yet

- Cash Flow of ICICI Bank - in Rs. Cr.Document12 pagesCash Flow of ICICI Bank - in Rs. Cr.Neethu GesanNo ratings yet

- ICICI Bank Is IndiaDocument6 pagesICICI Bank Is IndiaHarinder PalNo ratings yet

- Payback Period (In Months)Document4 pagesPayback Period (In Months)Reyy ArbolerasNo ratings yet

- F ProjectDocument172 pagesF ProjectManish JaiswalNo ratings yet

- State Bank of India: Balance SheetDocument9 pagesState Bank of India: Balance SheetKatta AshishNo ratings yet

- Managerial Finance AssingmentDocument9 pagesManagerial Finance AssingmentEf AtNo ratings yet

- สำเนา Financial Model 2Document6 pagesสำเนา Financial Model 2Chananya SriromNo ratings yet

- HDFC BankDocument4 pagesHDFC BankKshitiz BhandulaNo ratings yet

- Aditya nuVODocument12 pagesAditya nuVOPriyanshi yadavNo ratings yet

- Ashok Leyland Balane SheetDocument2 pagesAshok Leyland Balane SheetNaresh Kumar NareshNo ratings yet

- BEmlDocument2 pagesBEmlcmit17No ratings yet

- Annual-Report-FY-2019-20 QDocument76 pagesAnnual-Report-FY-2019-20 Qhesax93983No ratings yet

- Print: Previous YearsDocument2 pagesPrint: Previous YearsArun BineshNo ratings yet

- HDFC Bank - FM AssignmentDocument9 pagesHDFC Bank - FM AssignmentaditiNo ratings yet

- 34 - Neha Sabharwal - Panacea BiotechDocument10 pages34 - Neha Sabharwal - Panacea Biotechrajat_singlaNo ratings yet

- Bank Performance Analysis-INDUSIND BANK: Particulars Mar-16Document26 pagesBank Performance Analysis-INDUSIND BANK: Particulars Mar-16Surbhî GuptaNo ratings yet

- Adani PowerDocument2 pagesAdani PowerPriyankar RaiNo ratings yet

- Financial Statements - TATA - MotorsDocument5 pagesFinancial Statements - TATA - MotorsKAVYA GOYAL PGP 2021-23 BatchNo ratings yet

- Indian Bank Bs 1Document1 pageIndian Bank Bs 1God PlanNo ratings yet

- DCF ModelingDocument12 pagesDCF ModelingTabish JamalNo ratings yet

- Vitrox'S Income Statement For Years Ended 2016,2017,2018 2018 2017 2016 (RM) '000 (RM) '000 (RM) '000Document6 pagesVitrox'S Income Statement For Years Ended 2016,2017,2018 2018 2017 2016 (RM) '000 (RM) '000 (RM) '000Hong JunNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsDhruv NarangNo ratings yet

- SohoDocument4 pagesSohoTiara Ayu PratamaNo ratings yet

- Binani Cement LTD Profit and Loss A/c: Mar '06 Mar '07 IncomeDocument8 pagesBinani Cement LTD Profit and Loss A/c: Mar '06 Mar '07 IncomemrupaniNo ratings yet

- Introduction To Corporate Finance: Michele Vincenti, PH.D, MBA, M.A. (HOS), CIM, Fcsi, Sti, CFP, CMC, C.I.M., F.CimDocument19 pagesIntroduction To Corporate Finance: Michele Vincenti, PH.D, MBA, M.A. (HOS), CIM, Fcsi, Sti, CFP, CMC, C.I.M., F.CimMOHAMED JALEEL MOHAMED SIDDEEKNo ratings yet

- Quiz-2 Finance AnswersDocument4 pagesQuiz-2 Finance AnswersMOHAMED JALEEL MOHAMED SIDDEEKNo ratings yet

- Baldwin Company Annual Report Fy 2021 PDFDocument26 pagesBaldwin Company Annual Report Fy 2021 PDFMOHAMED JALEEL MOHAMED SIDDEEK100% (1)

- Hello I Am Jaheer Bijani Ex-Banker From Surat Contact 8849596758 Working As Finance Consultant. Interested To Start Fintech Startup - PresentationDocument39 pagesHello I Am Jaheer Bijani Ex-Banker From Surat Contact 8849596758 Working As Finance Consultant. Interested To Start Fintech Startup - PresentationJAHEER BIJANINo ratings yet

- Revolut LTD Annual Report YE 2020Document81 pagesRevolut LTD Annual Report YE 2020ForkLogNo ratings yet

- Cranium Filament Reductions: Executive SummaryDocument15 pagesCranium Filament Reductions: Executive SummaryRegine IgnacioNo ratings yet

- Top 100 Accounting Interview Questions & AnswersDocument25 pagesTop 100 Accounting Interview Questions & AnswersImdadul Alam Imdad100% (1)

- Basic Accounting Concept: Topic 2Document58 pagesBasic Accounting Concept: Topic 2WAN FATIN IZZATI BINTI WAN NOOR AMAN MoeNo ratings yet

- Amway OpportunityBrochure ENGDocument24 pagesAmway OpportunityBrochure ENGvishalukeyNo ratings yet

- Adjusting Entries Practice Question December 22, 2022Document5 pagesAdjusting Entries Practice Question December 22, 2022Mohammed AhamadNo ratings yet

- BanchMarking STM M-4Document47 pagesBanchMarking STM M-4Nitin KumarNo ratings yet

- FABM1 Q4 Module 8 Terminologies Used in Merchandising BusinessDocument20 pagesFABM1 Q4 Module 8 Terminologies Used in Merchandising BusinessrioNo ratings yet

- Tutorial Questions - Trimester - 2210.Document26 pagesTutorial Questions - Trimester - 2210.premsuwaatiiNo ratings yet

- Tally Sheet Satisfaction SurveyDocument7 pagesTally Sheet Satisfaction SurveyRobelyn SabioNo ratings yet

- Financial AnalysisDocument2 pagesFinancial AnalysisdavewagNo ratings yet

- SNTIC Stadium PresentationDocument30 pagesSNTIC Stadium PresentationLas Vegas Review-JournalNo ratings yet

- Premium Liability: Start of DiscussionDocument3 pagesPremium Liability: Start of DiscussionclarizaNo ratings yet

- Accounting Chapter 6Document2 pagesAccounting Chapter 6Kelvin Rex SumayaoNo ratings yet

- Financial & Corporate Reporting: RequirementDocument6 pagesFinancial & Corporate Reporting: RequirementTawsif HasanNo ratings yet

- Anur DTP Final As Per Erc PDFDocument573 pagesAnur DTP Final As Per Erc PDFnutanmanjuNo ratings yet

- Cost Management - Software Associate CaseDocument7 pagesCost Management - Software Associate CaseVaibhav GuptaNo ratings yet

- Barleta 1701Q Q2 - Page 1Document1 pageBarleta 1701Q Q2 - Page 1Benson Jay AlmonteNo ratings yet

- BGC S4hana1909 BPD en XXDocument13 pagesBGC S4hana1909 BPD en XXBiji Roy100% (2)

- Data Extract From World Development IndicatorsDocument94 pagesData Extract From World Development IndicatorsShiv TNo ratings yet

- Accounting In Business (Service company) Tổng Quan Về Nguyên Lý Kế Toán Trong Dn Dịch VụDocument45 pagesAccounting In Business (Service company) Tổng Quan Về Nguyên Lý Kế Toán Trong Dn Dịch VụHiep Nguyen TuanNo ratings yet

- Topic 2 Part 1 Impairment of PpeDocument37 pagesTopic 2 Part 1 Impairment of PpeXiao XuanNo ratings yet

- Ratios and Their Meanings. Leverage RatioDocument3 pagesRatios and Their Meanings. Leverage RatioNaitik JainNo ratings yet

- BRPT 2014-2018Document3 pagesBRPT 2014-2018Abdur RohmanNo ratings yet

- Business Finance - Brainnest Lecture 3Document28 pagesBusiness Finance - Brainnest Lecture 3Amira Abdulshikur JemalNo ratings yet

- 00 Raport Consolidat 2014 en Final RevizuitDocument16 pages00 Raport Consolidat 2014 en Final RevizuitAnonymous ISxsZmNo ratings yet