Professional Documents

Culture Documents

Beximco Pharmaceuticals Limited

Beximco Pharmaceuticals Limited

Uploaded by

samia0akter-228864Copyright:

Available Formats

You might also like

- Musical Acoustics PDFDocument26 pagesMusical Acoustics PDFGino Mendoza0% (1)

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Professional Practice Session 1Document23 pagesProfessional Practice Session 1Dina HawashNo ratings yet

- Jolly Grammar Programme P1-6Document8 pagesJolly Grammar Programme P1-6Mandy Whorlow100% (3)

- Kohinoor 181 11 5851 FacDocument37 pagesKohinoor 181 11 5851 FacSharif KhanNo ratings yet

- E Voting SystemDocument68 pagesE Voting Systemkeisha baby100% (1)

- Profit & Loss Statement: O' Lites RestaurantDocument7 pagesProfit & Loss Statement: O' Lites RestaurantNoorulain Adnan100% (1)

- FIN254 Project NSU (Excel File)Document6 pagesFIN254 Project NSU (Excel File)Sirazum SaadNo ratings yet

- Excel File SuzukiDocument18 pagesExcel File SuzukiMahnoor AfzalNo ratings yet

- Hira Textile Mill Horizontal Analysis 2015-13Document9 pagesHira Textile Mill Horizontal Analysis 2015-13sumeer shafiqNo ratings yet

- Balance Sheet: Particulars 2014 2015 AssetsDocument11 pagesBalance Sheet: Particulars 2014 2015 AssetsTaiba SarmadNo ratings yet

- Hira Textile Mill Horizontal Analysis 2014-13 1Document8 pagesHira Textile Mill Horizontal Analysis 2014-13 1sumeer shafiqNo ratings yet

- BF1 Package Ratios ForecastingDocument16 pagesBF1 Package Ratios ForecastingBilal Javed JafraniNo ratings yet

- Ratio Analysis of Engro Vs NestleDocument24 pagesRatio Analysis of Engro Vs NestleMuhammad SalmanNo ratings yet

- Rak Ceramics: Income StatementDocument27 pagesRak Ceramics: Income StatementRafsan JahangirNo ratings yet

- Payment For Interest and Income Taxes Cash Payment For InterestDocument5 pagesPayment For Interest and Income Taxes Cash Payment For InterestsenNo ratings yet

- Excel TopgloveDocument21 pagesExcel Topglovearil azharNo ratings yet

- Finance NFL & MitchelsDocument10 pagesFinance NFL & Mitchelsrimshaanwar617No ratings yet

- Ratio Analysis of Fuel Company-3Document21 pagesRatio Analysis of Fuel Company-3Zakaria ShuvoNo ratings yet

- Attock Refinery FM Assignment#3Document13 pagesAttock Refinery FM Assignment#3Vishal MalhiNo ratings yet

- Horizental Analysis On Income StatementDocument21 pagesHorizental Analysis On Income StatementMuhib NoharioNo ratings yet

- Financial Report - ShyamDocument14 pagesFinancial Report - ShyamYaswanth MaripiNo ratings yet

- M Saeed 20-26 ProjectDocument30 pagesM Saeed 20-26 ProjectMohammed Saeed 20-26No ratings yet

- Restaurant BusinessDocument14 pagesRestaurant BusinessSAKIBNo ratings yet

- Sir Sarwar AFSDocument41 pagesSir Sarwar AFSawaischeemaNo ratings yet

- Finacial Position FINALDocument4 pagesFinacial Position FINALLenard TaberdoNo ratings yet

- DCF 2 CompletedDocument4 pagesDCF 2 CompletedPragathi T NNo ratings yet

- Al Fajar WorkingDocument3 pagesAl Fajar WorkingsureniimbNo ratings yet

- Ratio AnalysisDocument35 pagesRatio AnalysisMd. Sakib HossainNo ratings yet

- Ratio AnalysisDocument9 pagesRatio AnalysisGg JjNo ratings yet

- Assessment WorkbookDocument7 pagesAssessment WorkbookMiguel Pacheco ChicaNo ratings yet

- PIOC Data For Corporate ValuationDocument6 pagesPIOC Data For Corporate ValuationMuhammad Ali SamarNo ratings yet

- Assets: Balance SheetDocument4 pagesAssets: Balance SheetAsadvirkNo ratings yet

- FIN440 Phase 2 ExcelDocument27 pagesFIN440 Phase 2 ExcelRiddo BadhonNo ratings yet

- Berger Paints Excel SheetDocument27 pagesBerger Paints Excel SheetHamza100% (1)

- Confidence Cement LTD: Income StatementDocument20 pagesConfidence Cement LTD: Income StatementIftekar Hasan SajibNo ratings yet

- Alk SidoDocument2 pagesAlk SidoRebertha HerwinNo ratings yet

- Indus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsDocument12 pagesIndus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsSaad NaeemNo ratings yet

- Indus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsDocument12 pagesIndus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsSaad NaeemNo ratings yet

- Financial Statements Analysis: Arsalan FarooqueDocument31 pagesFinancial Statements Analysis: Arsalan FarooqueMuhib NoharioNo ratings yet

- 5 Cs of Credit - Caskey Trucking FinancialsDocument5 pages5 Cs of Credit - Caskey Trucking FinancialsHazem ElsherifNo ratings yet

- Beximco Pharmaceuticals LTDDocument14 pagesBeximco Pharmaceuticals LTDIftekar Hasan SajibNo ratings yet

- BUS 635 Project On BD LampsDocument24 pagesBUS 635 Project On BD LampsNazmus Sakib PlabonNo ratings yet

- Berger Paints: Statement of Financial PositionDocument6 pagesBerger Paints: Statement of Financial PositionMuhammad Hamza ZahidNo ratings yet

- Atlas Honda Motor Company LimitedDocument10 pagesAtlas Honda Motor Company LimitedAyesha RazzaqNo ratings yet

- Vitrox'S Income Statement For Years Ended 2016,2017,2018 2018 2017 2016 (RM) '000 (RM) '000 (RM) '000Document6 pagesVitrox'S Income Statement For Years Ended 2016,2017,2018 2018 2017 2016 (RM) '000 (RM) '000 (RM) '000Hong JunNo ratings yet

- Smic - DCF - de Asis - Gomez - TriviñoDocument36 pagesSmic - DCF - de Asis - Gomez - TriviñoDiana De AsisNo ratings yet

- Smic - DCF & Computations - de Asis - Gomez - TriviñoDocument47 pagesSmic - DCF & Computations - de Asis - Gomez - TriviñoDiana De AsisNo ratings yet

- Home Depot DCFDocument16 pagesHome Depot DCFAntoni BallaunNo ratings yet

- Netflix Spreadsheet - SMG ToolsDocument9 pagesNetflix Spreadsheet - SMG ToolsJohn AngNo ratings yet

- Financial Analysis and ControlDocument7 pagesFinancial Analysis and ControlabhikNo ratings yet

- Biar Bisa DownloadDocument4 pagesBiar Bisa DownloadIndra Ramdana SaputraNo ratings yet

- Askari Bank Limited Financial Statement AnalysisDocument16 pagesAskari Bank Limited Financial Statement AnalysisAleeza FatimaNo ratings yet

- Ali Asghar Report ..Document7 pagesAli Asghar Report ..Ali AzgarNo ratings yet

- DCF 3 CompletedDocument3 pagesDCF 3 CompletedPragathi T NNo ratings yet

- Filinvest Land 2006-2010Document18 pagesFilinvest Land 2006-2010Christian VillarNo ratings yet

- Financial Ratio AnalysisDocument6 pagesFinancial Ratio AnalysisSatishNo ratings yet

- Financial Statements and Ratios Flashcards QuizletDocument14 pagesFinancial Statements and Ratios Flashcards QuizletDanish HameedNo ratings yet

- Finance End Term ProjectDocument11 pagesFinance End Term Projectrabia zulfiqarNo ratings yet

- Trend AnalysisDocument42 pagesTrend AnalysisMd. Tauhidur Rahman 07-18-45No ratings yet

- Ghandhara NissanDocument7 pagesGhandhara NissanShamsuddin SoomroNo ratings yet

- Millat Tractors - Final (Sheraz)Document20 pagesMillat Tractors - Final (Sheraz)Adeel SajidNo ratings yet

- Explanation 2015 2014: Akij Food and Beverage Statement of Financial Position (June31,2015)Document5 pagesExplanation 2015 2014: Akij Food and Beverage Statement of Financial Position (June31,2015)jisansalehin1No ratings yet

- Company Financial StatementsDocument3 pagesCompany Financial StatementsNarasimha Jammigumpula0% (1)

- Final Journal 2Document2 pagesFinal Journal 2samia0akter-228864No ratings yet

- Epistemology AssignmentDocument4 pagesEpistemology Assignmentsamia0akter-228864No ratings yet

- Final Journal 1Document2 pagesFinal Journal 1samia0akter-228864No ratings yet

- Beximco-Pharmacutical-LtdDocument24 pagesBeximco-Pharmacutical-Ltdsamia0akter-228864No ratings yet

- Beximco-Pharmacutical-LtdDocument23 pagesBeximco-Pharmacutical-Ltdsamia0akter-228864No ratings yet

- SPOUSES SALVADOR ABELLA v. SPOUSES ROMEO ABELLADocument2 pagesSPOUSES SALVADOR ABELLA v. SPOUSES ROMEO ABELLAAlia Arnz-Dragon100% (1)

- A320 PedestalDocument14 pagesA320 PedestalAiman ZabadNo ratings yet

- DO - 159 - S2015 Duration of SchoolDocument2 pagesDO - 159 - S2015 Duration of SchoolAnonymous qg3W2rsRcGNo ratings yet

- Common AddictionsDocument13 pagesCommon AddictionsMaría Cecilia CarattoliNo ratings yet

- Grade 5 CommentsDocument17 pagesGrade 5 Commentsreza anggaNo ratings yet

- PBL KaleidoscopeDocument3 pagesPBL KaleidoscopeWilson Tie Wei ShenNo ratings yet

- Loi Bayanihan PCR ReviewerDocument15 pagesLoi Bayanihan PCR Reviewerailexcj20No ratings yet

- p-37 Recovery of Gold From Its OresDocument33 pagesp-37 Recovery of Gold From Its OresRussell Hartill100% (6)

- A Biblical Philosophy of MinistryDocument11 pagesA Biblical Philosophy of MinistryDavid Salazar100% (4)

- OX App Suite User Guide English v7.6.0Document180 pagesOX App Suite User Guide English v7.6.0Ranveer SinghNo ratings yet

- Module 3 Segmentation Targeting Positioning FINAL PDFDocument13 pagesModule 3 Segmentation Targeting Positioning FINAL PDFLusiana Lie100% (1)

- Year3 GL Style Maths Practice Paper PrintableDocument4 pagesYear3 GL Style Maths Practice Paper PrintableLolo ImgNo ratings yet

- Process of Concept Formation: ReferencesDocument1 pageProcess of Concept Formation: ReferencesRamani SwarnaNo ratings yet

- What Love Is ThisDocument2 pagesWhat Love Is Thisapi-3700222No ratings yet

- Consultancy - Software DeveloperDocument2 pagesConsultancy - Software DeveloperImadeddinNo ratings yet

- Cutoff1 101020 0Document3 pagesCutoff1 101020 0ghi98183No ratings yet

- Risk Assessment - COVID 19 Restart of Activities Mina Justa-V3Document81 pagesRisk Assessment - COVID 19 Restart of Activities Mina Justa-V3Shmi HectorNo ratings yet

- Legal Reasoning For Seminal U S Texts Constitutional PrinciplesDocument13 pagesLegal Reasoning For Seminal U S Texts Constitutional PrinciplesOlga IgnatyukNo ratings yet

- Absorption Costing PDFDocument10 pagesAbsorption Costing PDFAnonymous leF4GPYNo ratings yet

- INTRODUCTIONDocument11 pagesINTRODUCTIONMmNo ratings yet

- Chinas Legal Strategy To Cope With US Export ContDocument9 pagesChinas Legal Strategy To Cope With US Export Contb19fd0013No ratings yet

- Metals and Non Metals NotesDocument3 pagesMetals and Non Metals NotesVUDATHU SHASHIK MEHERNo ratings yet

- NT Organic FarmingDocument17 pagesNT Organic FarmingSai Punith Reddy100% (1)

- Dedication Certificate John Clyde D. Cristobal: This Certifies ThatDocument1 pageDedication Certificate John Clyde D. Cristobal: This Certifies ThatAGSAOAY JASON F.No ratings yet

- The Law On Obligations and Contracts (Notes From Youtube) - PrelimDocument36 pagesThe Law On Obligations and Contracts (Notes From Youtube) - PrelimGwyneth ArabelaNo ratings yet

- Company Feasibility StudyDocument21 pagesCompany Feasibility StudyDesiree Raot RaotNo ratings yet

Beximco Pharmaceuticals Limited

Beximco Pharmaceuticals Limited

Uploaded by

samia0akter-228864Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Beximco Pharmaceuticals Limited

Beximco Pharmaceuticals Limited

Uploaded by

samia0akter-228864Copyright:

Available Formats

Beximco Pharmaceuticals Limited

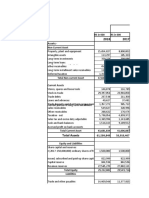

Particulars/ Year 2014 2015 2016

Assets

Non current assets: 20,634,246,854 22,443,457,489 23,197,141,000

Property, plant & equipment 20,393,278,737 22,168,184,597 22,777,806,000

Intangible assets 235,208,190 269,864,103 403,253,000

Investment in shares 5,759,927 5,408,789 16,082,000

Current assets: 8,366,279,107 8,392,093,095 8,958,250,000

Inventories 2,493,657,338 2,817,185,843 2,875,287,000

Spares and supplies 554,183,898 556,974,583 617,882,000

Accounts Receivables 1,397,498,648 1,546,921,772 1,956,579,000

Loans, advances and deposits 1,223,673,153 1,784,104,778 1,877,035,000

Short term investment 2,475,026,831 1,539,430,008 1,312,011,000

Cash and cash equivalents 222,239,239 147,476,111 319,456,000

Total assets 29,000,525,961 30,835,550,584 32,155,391,000

Equity 20,920,185,325 22,478,627,583 23,955,155,000

Issued share capital 3,678,516,520 3,862,442,340 4,055,564,000

Share premium 5,269,474,690 5,269,474,690 5,269,475,000

Excess of issue price over face value of GDRs 1,689,636,958 1,689,636,958 1,689,637,000

Capital reserve on merger 294,950,950 294,950,950 294,951,000

Revaluation surplus 1,299,220,315 1,257,422,946 1,195,359,000

Fair value gain on investment 2,308,651 1,957,513 2,076,000

Retained earnings 8,686,077,241 10,102,742,186 11,448,093,000

Liabilities 8,080,340,636 8,356,923,001 8,200,236,000

Non current liabilities: 3,372,593,206 3,494,915,017 5,040,890,000

Long term borrowings 901,709,327 916,927,763 2,253,586,000

Liability for gratuity, WPPF & welfare funds 741,522,518 864,107,790 989,833,000

Deferred tax liability 1,729,361,361 1,713,879,464 1,797,471,000

Current liabilities: 4,707,747,430 4,862,007,984 3,159,346,000

Short term borrowings 3,153,121,293 3,163,551,475 1,443,887,000

Long term borrowings - current maturity 663,838,072 724,603,464 726,699,000

Creditors and other payables 357,710,839 439,018,016 428,194,000

Accrued expenses 164,283,115 206,228,496 120,633,000

Dividend payable 454,720 412,480 50,710,000

Income tax payable 368,339,391 328,194,053 389,223,000

Total liabilities and equity 29,000,525,961 30,835,550,584 32,155,391,000

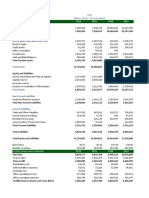

Sales 11,206,885,677 12,965,506,873 14,699,586,719

Less: Cost of goods sold 6,102,694,323 6,965,167,704 7,914,711,654

Gross profit 5,104,191,354 6,000,339,169 6,784,875,065

Less: Operating expenses 2,686,014,518 3,149,060,695 3,412,236,236

Earnings before interest and taxes 2,418,176,836 2,851,278,474 3,372,638,829

Earnings before tax 2,109,555,733 2,337,130,063 2,784,773,866

Less: Income tax expense 581,258,160 382,845,547 678,063,528

Net profit after tax 1,528,297,573 1,954,284,516 2,106,710,338

Tax rate 25% 25% 25%

Depreciation 0 0 0

WACC 10% 10% 10%

Days in a period 365 365 365

2014 2015

LIQUIDITY RATIO

1. Current ratio 1.78 1.73

2. Quick ratio 1.25 1.15

3. Net working capital (NWC) 3,658,531,677 3,530,085,111

ASSET MANAGEMENT RATIO

1. Inventory turnover ratio 2.45 2.47

2. Total asset turnover ratio 0.39 0.42

3. Accounts receivables turnover 8.02 8.38

4. Accounts payable turnover 17.06 15.87

Days inventory held (DIH) 149.14 147.63

Days sales outstanding (DSO) 45.52 43.55

Days payables outstanding (DPO) 21.39 23.01

Operating cycle 194.66 191.18

Cash conversion period 173.27 168.17

CASH BASED LIQUIDITY MEASURES

1. Operating cash flow 1813632627.00 2138458855.50

2. Cash conversion efficiency 0.16 0.16

3. Cash ratio 0.01 0.00

4. Cash burn rate 13.29 7.73

NPV calculation:

NPV (daily) 4572334444.38 5398660547.30

NPV (perpetuity) 16689020721973.20 19705110997642.30

NPV Outflow (daily) -6067131690.294 -6921540884.43323

NPV Inflow (daily) 10639466134.6702 12320201431.7325

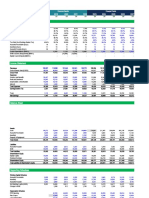

2016

2.84

1.93

5,798,904,000

2.75

0.46

7.51

18.48

132.60

48.58

19.75

181.18

161.43

2529479121.75

0.17

0.01

14.73

6132300970.12

22382898540950.80

-7872122664.78997

14004423634.9135

You might also like

- Musical Acoustics PDFDocument26 pagesMusical Acoustics PDFGino Mendoza0% (1)

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Professional Practice Session 1Document23 pagesProfessional Practice Session 1Dina HawashNo ratings yet

- Jolly Grammar Programme P1-6Document8 pagesJolly Grammar Programme P1-6Mandy Whorlow100% (3)

- Kohinoor 181 11 5851 FacDocument37 pagesKohinoor 181 11 5851 FacSharif KhanNo ratings yet

- E Voting SystemDocument68 pagesE Voting Systemkeisha baby100% (1)

- Profit & Loss Statement: O' Lites RestaurantDocument7 pagesProfit & Loss Statement: O' Lites RestaurantNoorulain Adnan100% (1)

- FIN254 Project NSU (Excel File)Document6 pagesFIN254 Project NSU (Excel File)Sirazum SaadNo ratings yet

- Excel File SuzukiDocument18 pagesExcel File SuzukiMahnoor AfzalNo ratings yet

- Hira Textile Mill Horizontal Analysis 2015-13Document9 pagesHira Textile Mill Horizontal Analysis 2015-13sumeer shafiqNo ratings yet

- Balance Sheet: Particulars 2014 2015 AssetsDocument11 pagesBalance Sheet: Particulars 2014 2015 AssetsTaiba SarmadNo ratings yet

- Hira Textile Mill Horizontal Analysis 2014-13 1Document8 pagesHira Textile Mill Horizontal Analysis 2014-13 1sumeer shafiqNo ratings yet

- BF1 Package Ratios ForecastingDocument16 pagesBF1 Package Ratios ForecastingBilal Javed JafraniNo ratings yet

- Ratio Analysis of Engro Vs NestleDocument24 pagesRatio Analysis of Engro Vs NestleMuhammad SalmanNo ratings yet

- Rak Ceramics: Income StatementDocument27 pagesRak Ceramics: Income StatementRafsan JahangirNo ratings yet

- Payment For Interest and Income Taxes Cash Payment For InterestDocument5 pagesPayment For Interest and Income Taxes Cash Payment For InterestsenNo ratings yet

- Excel TopgloveDocument21 pagesExcel Topglovearil azharNo ratings yet

- Finance NFL & MitchelsDocument10 pagesFinance NFL & Mitchelsrimshaanwar617No ratings yet

- Ratio Analysis of Fuel Company-3Document21 pagesRatio Analysis of Fuel Company-3Zakaria ShuvoNo ratings yet

- Attock Refinery FM Assignment#3Document13 pagesAttock Refinery FM Assignment#3Vishal MalhiNo ratings yet

- Horizental Analysis On Income StatementDocument21 pagesHorizental Analysis On Income StatementMuhib NoharioNo ratings yet

- Financial Report - ShyamDocument14 pagesFinancial Report - ShyamYaswanth MaripiNo ratings yet

- M Saeed 20-26 ProjectDocument30 pagesM Saeed 20-26 ProjectMohammed Saeed 20-26No ratings yet

- Restaurant BusinessDocument14 pagesRestaurant BusinessSAKIBNo ratings yet

- Sir Sarwar AFSDocument41 pagesSir Sarwar AFSawaischeemaNo ratings yet

- Finacial Position FINALDocument4 pagesFinacial Position FINALLenard TaberdoNo ratings yet

- DCF 2 CompletedDocument4 pagesDCF 2 CompletedPragathi T NNo ratings yet

- Al Fajar WorkingDocument3 pagesAl Fajar WorkingsureniimbNo ratings yet

- Ratio AnalysisDocument35 pagesRatio AnalysisMd. Sakib HossainNo ratings yet

- Ratio AnalysisDocument9 pagesRatio AnalysisGg JjNo ratings yet

- Assessment WorkbookDocument7 pagesAssessment WorkbookMiguel Pacheco ChicaNo ratings yet

- PIOC Data For Corporate ValuationDocument6 pagesPIOC Data For Corporate ValuationMuhammad Ali SamarNo ratings yet

- Assets: Balance SheetDocument4 pagesAssets: Balance SheetAsadvirkNo ratings yet

- FIN440 Phase 2 ExcelDocument27 pagesFIN440 Phase 2 ExcelRiddo BadhonNo ratings yet

- Berger Paints Excel SheetDocument27 pagesBerger Paints Excel SheetHamza100% (1)

- Confidence Cement LTD: Income StatementDocument20 pagesConfidence Cement LTD: Income StatementIftekar Hasan SajibNo ratings yet

- Alk SidoDocument2 pagesAlk SidoRebertha HerwinNo ratings yet

- Indus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsDocument12 pagesIndus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsSaad NaeemNo ratings yet

- Indus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsDocument12 pagesIndus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsSaad NaeemNo ratings yet

- Financial Statements Analysis: Arsalan FarooqueDocument31 pagesFinancial Statements Analysis: Arsalan FarooqueMuhib NoharioNo ratings yet

- 5 Cs of Credit - Caskey Trucking FinancialsDocument5 pages5 Cs of Credit - Caskey Trucking FinancialsHazem ElsherifNo ratings yet

- Beximco Pharmaceuticals LTDDocument14 pagesBeximco Pharmaceuticals LTDIftekar Hasan SajibNo ratings yet

- BUS 635 Project On BD LampsDocument24 pagesBUS 635 Project On BD LampsNazmus Sakib PlabonNo ratings yet

- Berger Paints: Statement of Financial PositionDocument6 pagesBerger Paints: Statement of Financial PositionMuhammad Hamza ZahidNo ratings yet

- Atlas Honda Motor Company LimitedDocument10 pagesAtlas Honda Motor Company LimitedAyesha RazzaqNo ratings yet

- Vitrox'S Income Statement For Years Ended 2016,2017,2018 2018 2017 2016 (RM) '000 (RM) '000 (RM) '000Document6 pagesVitrox'S Income Statement For Years Ended 2016,2017,2018 2018 2017 2016 (RM) '000 (RM) '000 (RM) '000Hong JunNo ratings yet

- Smic - DCF - de Asis - Gomez - TriviñoDocument36 pagesSmic - DCF - de Asis - Gomez - TriviñoDiana De AsisNo ratings yet

- Smic - DCF & Computations - de Asis - Gomez - TriviñoDocument47 pagesSmic - DCF & Computations - de Asis - Gomez - TriviñoDiana De AsisNo ratings yet

- Home Depot DCFDocument16 pagesHome Depot DCFAntoni BallaunNo ratings yet

- Netflix Spreadsheet - SMG ToolsDocument9 pagesNetflix Spreadsheet - SMG ToolsJohn AngNo ratings yet

- Financial Analysis and ControlDocument7 pagesFinancial Analysis and ControlabhikNo ratings yet

- Biar Bisa DownloadDocument4 pagesBiar Bisa DownloadIndra Ramdana SaputraNo ratings yet

- Askari Bank Limited Financial Statement AnalysisDocument16 pagesAskari Bank Limited Financial Statement AnalysisAleeza FatimaNo ratings yet

- Ali Asghar Report ..Document7 pagesAli Asghar Report ..Ali AzgarNo ratings yet

- DCF 3 CompletedDocument3 pagesDCF 3 CompletedPragathi T NNo ratings yet

- Filinvest Land 2006-2010Document18 pagesFilinvest Land 2006-2010Christian VillarNo ratings yet

- Financial Ratio AnalysisDocument6 pagesFinancial Ratio AnalysisSatishNo ratings yet

- Financial Statements and Ratios Flashcards QuizletDocument14 pagesFinancial Statements and Ratios Flashcards QuizletDanish HameedNo ratings yet

- Finance End Term ProjectDocument11 pagesFinance End Term Projectrabia zulfiqarNo ratings yet

- Trend AnalysisDocument42 pagesTrend AnalysisMd. Tauhidur Rahman 07-18-45No ratings yet

- Ghandhara NissanDocument7 pagesGhandhara NissanShamsuddin SoomroNo ratings yet

- Millat Tractors - Final (Sheraz)Document20 pagesMillat Tractors - Final (Sheraz)Adeel SajidNo ratings yet

- Explanation 2015 2014: Akij Food and Beverage Statement of Financial Position (June31,2015)Document5 pagesExplanation 2015 2014: Akij Food and Beverage Statement of Financial Position (June31,2015)jisansalehin1No ratings yet

- Company Financial StatementsDocument3 pagesCompany Financial StatementsNarasimha Jammigumpula0% (1)

- Final Journal 2Document2 pagesFinal Journal 2samia0akter-228864No ratings yet

- Epistemology AssignmentDocument4 pagesEpistemology Assignmentsamia0akter-228864No ratings yet

- Final Journal 1Document2 pagesFinal Journal 1samia0akter-228864No ratings yet

- Beximco-Pharmacutical-LtdDocument24 pagesBeximco-Pharmacutical-Ltdsamia0akter-228864No ratings yet

- Beximco-Pharmacutical-LtdDocument23 pagesBeximco-Pharmacutical-Ltdsamia0akter-228864No ratings yet

- SPOUSES SALVADOR ABELLA v. SPOUSES ROMEO ABELLADocument2 pagesSPOUSES SALVADOR ABELLA v. SPOUSES ROMEO ABELLAAlia Arnz-Dragon100% (1)

- A320 PedestalDocument14 pagesA320 PedestalAiman ZabadNo ratings yet

- DO - 159 - S2015 Duration of SchoolDocument2 pagesDO - 159 - S2015 Duration of SchoolAnonymous qg3W2rsRcGNo ratings yet

- Common AddictionsDocument13 pagesCommon AddictionsMaría Cecilia CarattoliNo ratings yet

- Grade 5 CommentsDocument17 pagesGrade 5 Commentsreza anggaNo ratings yet

- PBL KaleidoscopeDocument3 pagesPBL KaleidoscopeWilson Tie Wei ShenNo ratings yet

- Loi Bayanihan PCR ReviewerDocument15 pagesLoi Bayanihan PCR Reviewerailexcj20No ratings yet

- p-37 Recovery of Gold From Its OresDocument33 pagesp-37 Recovery of Gold From Its OresRussell Hartill100% (6)

- A Biblical Philosophy of MinistryDocument11 pagesA Biblical Philosophy of MinistryDavid Salazar100% (4)

- OX App Suite User Guide English v7.6.0Document180 pagesOX App Suite User Guide English v7.6.0Ranveer SinghNo ratings yet

- Module 3 Segmentation Targeting Positioning FINAL PDFDocument13 pagesModule 3 Segmentation Targeting Positioning FINAL PDFLusiana Lie100% (1)

- Year3 GL Style Maths Practice Paper PrintableDocument4 pagesYear3 GL Style Maths Practice Paper PrintableLolo ImgNo ratings yet

- Process of Concept Formation: ReferencesDocument1 pageProcess of Concept Formation: ReferencesRamani SwarnaNo ratings yet

- What Love Is ThisDocument2 pagesWhat Love Is Thisapi-3700222No ratings yet

- Consultancy - Software DeveloperDocument2 pagesConsultancy - Software DeveloperImadeddinNo ratings yet

- Cutoff1 101020 0Document3 pagesCutoff1 101020 0ghi98183No ratings yet

- Risk Assessment - COVID 19 Restart of Activities Mina Justa-V3Document81 pagesRisk Assessment - COVID 19 Restart of Activities Mina Justa-V3Shmi HectorNo ratings yet

- Legal Reasoning For Seminal U S Texts Constitutional PrinciplesDocument13 pagesLegal Reasoning For Seminal U S Texts Constitutional PrinciplesOlga IgnatyukNo ratings yet

- Absorption Costing PDFDocument10 pagesAbsorption Costing PDFAnonymous leF4GPYNo ratings yet

- INTRODUCTIONDocument11 pagesINTRODUCTIONMmNo ratings yet

- Chinas Legal Strategy To Cope With US Export ContDocument9 pagesChinas Legal Strategy To Cope With US Export Contb19fd0013No ratings yet

- Metals and Non Metals NotesDocument3 pagesMetals and Non Metals NotesVUDATHU SHASHIK MEHERNo ratings yet

- NT Organic FarmingDocument17 pagesNT Organic FarmingSai Punith Reddy100% (1)

- Dedication Certificate John Clyde D. Cristobal: This Certifies ThatDocument1 pageDedication Certificate John Clyde D. Cristobal: This Certifies ThatAGSAOAY JASON F.No ratings yet

- The Law On Obligations and Contracts (Notes From Youtube) - PrelimDocument36 pagesThe Law On Obligations and Contracts (Notes From Youtube) - PrelimGwyneth ArabelaNo ratings yet

- Company Feasibility StudyDocument21 pagesCompany Feasibility StudyDesiree Raot RaotNo ratings yet