Professional Documents

Culture Documents

MICREC2 A3 Reviewer

MICREC2 A3 Reviewer

Uploaded by

CatherineOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MICREC2 A3 Reviewer

MICREC2 A3 Reviewer

Uploaded by

CatherineCopyright:

Available Formats

MICREC MIDTERM 2 REVIEWER

COURNOT (output-based, simultaneous) BERTRAND (price-based) STACKELBERG (Q-based, leader)

FOC The ORF of each firm satisfies the FOC for a maximum DIFFERENTIATED HOMOGENOUS [coming from COURNOT-homogenous]

MRi MCi qi (q j ) The PRF of each firm satisfies the FOC for a Given the 2 firms have identical products

As leader, Firm i is assumed to know and

profit for where can estimate the follower firm’s (Firm j)

Ri ( p ( q1 q2 )) dCi ( qi ) MRi MCi pi (p j ) Ci

maximum profit for and cost functions =__, then q

MRi MCi ORF: j =__. Firm i’s profit maximizing

qi qi dqi Ri ( pi qi ( p1 , p2 )) dCi ( qi )

, , MRi MCi output (given Firm j’s output) satisfies

q j pi pi dqi the FOC for a maximum profit

where , =__ and the FOC must

0 MRi MCi

qi i 1, 2 i j Ci dCi qi ( p1 , p2 ) satisfy p=MC

and assuming and MCi

HOMOGENOUS DIFFERENTIATED pi dqi pi

, and

p (Q ) The residual pi (qi , p j ) p1 to p2 p j - We substitute Firm j’s ORF to Firm i’s

demand curve of - If , sub 0 market demand curve p= __ to get

either firm is p = pi (Q) assuming

pi i 1, 2 and

i j Firm i’s residual demand curve

and vice versa to get

___ p p (q j )

Q q1 q2

where Ri pqi Ri

p1 (Q ) p2 (Q ) - Since , then __

- Since =_, =_ Ri

ORF Ri pqi pi qi R1 , R2 qi Ri pi qi R1 , R2 MRi

PRF Since or , _ - Since =_, , __ qi

- ___

Ri Ri

MRi MRi dCi

qi pi C C MCi

_. Given 1 =__ and 2 =_, Ci dqi

- Since =__, =__

dCi Ci dCi qi ( p1 , p2 )

MCi MCi

C1 =__ C2 =__, dqi pi dqi pi

Since and =__. Solving

MRi MCi q1 ( q2 ) and

for the FOC/s: to get

MRi MCi

q2 (q1 ) - PRF: Solving for the FOC/s: to

qi We substitute Firm 2’s ORF to Firm 1’s ORF to get p (p ) p (p ) Therefore, the Bertrand equilibrium price MRi MCi qi

get 1 2 and 2 1

*

q1 * , q1 * to for each firm is p1 = p2 = MCi =__ Equating, and *. We

- We substitute Firm 2’s PRF to Firm 1’s PRF to

then substitute Firm 2’s ORF to get qi q

q2 * p1 * p1 * Since p = ___ and p1=p2=[value of substitute * to Firm j’s ORF to get j

get , then substitute to Firm 2’s

MC]=p, then [value of p] = ___ Q = __ *

pi We substitute q1 * and q2 * p2 * . p1 * is the total market output. Since the 2 firms sell identical products,

PRF to get We substitute and

* We substitute to

q1 * and q2 * to p2 * q1 _ and q2 _ to get q1 *

they sell at the same equilibrium price,

p1 __ p2 ___ to and Since prices are the same, the 2 firms q1 *

p=__ where and to get which is obtained by substituting

p1 * and p2 * q2 * qi Q/2=

Q q1 q2 divide the market equally, q1 * to p=__ where Q q1 q2

to __ for i = 1,2 and

get p*

i Ri ( qi ) Ci ( qi ) pqi C i ( qi ) or pi qi Ci ( qi ) i Ri (qi ) Ci ( qi ) pi qi Ci ( qi ) Given identical Cs, p’s and q’s, then i R ( q ) C ( q ) pqi Ci ( qi )

i i i i

1 2 i R ( q ) C ( q ) pqi Ci ( qi ) =0 1 2

1 2 i i i i

CS Q Q Q

p (Q) dQ pQ CSi pi (Q)dqQ pi qi CS p (Q)dQ pQ

0 0 0

Q q1 q2

wh where

where

Q q1 q2 Q q1 q2

ere

PSi pqi VC ( qi ) PSi pi qi VC ( qi ) PSi pqi VC (qi )

W W = CS + PS or CS + PS = CS1 + CS2 + PS1 + PS2 W = CS + PS

CS1

You might also like

- Monopolistic Comp FRQs AnswersDocument4 pagesMonopolistic Comp FRQs AnswersHeizlyn Amyneina100% (1)

- Duke XC SL Race ServiceDocument10 pagesDuke XC SL Race ServicesilverapeNo ratings yet

- Firm Supply: Market Structure & Perfect CompetitionDocument40 pagesFirm Supply: Market Structure & Perfect CompetitionjamesyuNo ratings yet

- ch11 07 08 PDFDocument8 pagesch11 07 08 PDFAnonymous ElyVJjMluXNo ratings yet

- Equilibriumof A: CompetitionDocument21 pagesEquilibriumof A: CompetitionRockyNo ratings yet

- Sessions 4 To 6 Four Market StructuresDocument50 pagesSessions 4 To 6 Four Market StructuresIbrahimNo ratings yet

- Ch05.1Perfect Comp.Document52 pagesCh05.1Perfect Comp.Andualem Begashaw100% (1)

- Problem Set 1Document3 pagesProblem Set 1陳柏字No ratings yet

- Chapter 5Document31 pagesChapter 5Desta EquarNo ratings yet

- Oligopoly - 2020 12 21Document30 pagesOligopoly - 2020 12 21Md. Ashowaad Ibna RaihanNo ratings yet

- Perfectly Competitive ParadigmDocument32 pagesPerfectly Competitive ParadigmBARVE SANKET SANJAY PGP 2018-20 BatchNo ratings yet

- Monopolistic KrugmanDocument22 pagesMonopolistic Krugmanmoshiur.29056No ratings yet

- EC3099 - Industrial Economics - 2003 Examiners Commentaries - Zone-ADocument6 pagesEC3099 - Industrial Economics - 2003 Examiners Commentaries - Zone-AAishwarya PotdarNo ratings yet

- CH 6 Market Structure-1Document36 pagesCH 6 Market Structure-1Ealshady HoneyBee Work ForceNo ratings yet

- Perfectly Competitive MarketsDocument36 pagesPerfectly Competitive MarketsSaurabh SharmaNo ratings yet

- LECTUREDocument22 pagesLECTUREseniorcaptain914No ratings yet

- Traditional Models of Imperfect Competition: Microeconomic TheoryDocument82 pagesTraditional Models of Imperfect Competition: Microeconomic TheorySiti AllifahNo ratings yet

- EC203 - Problem Set 7Document2 pagesEC203 - Problem Set 7Yiğit KocamanNo ratings yet

- Note Cournot ModelDocument2 pagesNote Cournot ModelSara PiccioliNo ratings yet

- Session 10 To 13Document57 pagesSession 10 To 13mamitha.kamaladeviNo ratings yet

- N5 OligopolyDocument11 pagesN5 OligopolyMuhammad RajaNo ratings yet

- OligopolyDocument37 pagesOligopolyAntonio AguiarNo ratings yet

- Eco 301 QuestionsDocument16 pagesEco 301 QuestionsSamuel Ato-MensahNo ratings yet

- Ch06.Imperfect CompetitionDocument55 pagesCh06.Imperfect CompetitionLâm ĐoànNo ratings yet

- Chapter 7 - Cost of ProductionDocument5 pagesChapter 7 - Cost of Productionoyuka oyunbolorNo ratings yet

- Basic Economics: Market Structures: Perfect CompetitionDocument12 pagesBasic Economics: Market Structures: Perfect CompetitionSam SamNo ratings yet

- Long Run Market EquilibriumDocument12 pagesLong Run Market EquilibriumMix MặtNo ratings yet

- Review Questions On Production - Cost Analysis and Market SupplyDocument2 pagesReview Questions On Production - Cost Analysis and Market SupplyLiberatus MpetaNo ratings yet

- Economic Dispatch - Without LossesDocument21 pagesEconomic Dispatch - Without LossesnitalizNo ratings yet

- Lesson: 9.0 Aims and ObjectivesDocument7 pagesLesson: 9.0 Aims and ObjectivesDr.B.ThayumanavarNo ratings yet

- Lecture 4 & 3.2 - Oligopoly Market Structure and Monopolistic Market StructureDocument7 pagesLecture 4 & 3.2 - Oligopoly Market Structure and Monopolistic Market StructureLakmal SilvaNo ratings yet

- Tutorial 5Document4 pagesTutorial 5NurinNo ratings yet

- Microeconomics - CH8 - Profit Maximization and Competitive SupplyDocument44 pagesMicroeconomics - CH8 - Profit Maximization and Competitive SupplyRuben NijsNo ratings yet

- ChapFive PPT Micro (4ch)Document26 pagesChapFive PPT Micro (4ch)Haftom YitbarekNo ratings yet

- Pde Short NotesDocument6 pagesPde Short NotesJitendra SanapNo ratings yet

- Chapter 9 Profit Maximization - Maksimasi KeuntunganDocument76 pagesChapter 9 Profit Maximization - Maksimasi Keuntungan'Kemml Marchhy 'SpearsNo ratings yet

- Market Size and Scale e Ects (Based On BW, ch.6) : PEEU - 1st Module - Lesson 6Document31 pagesMarket Size and Scale e Ects (Based On BW, ch.6) : PEEU - 1st Module - Lesson 6SlicebearNo ratings yet

- Industrial Organization Week 1. Lecture 3. Monopoly: Mikhail DrugovDocument15 pagesIndustrial Organization Week 1. Lecture 3. Monopoly: Mikhail DrugovDiana Zarbailova-ZerubbabelNo ratings yet

- Lecture-6-Market StructuresDocument10 pagesLecture-6-Market StructuresGideon MukuiNo ratings yet

- Production NotesDocument17 pagesProduction NotesRaisha Afreen HaqueNo ratings yet

- Mousumi Saha Assistant Professor Institute of Agribusiness & Development Studies Bangladesh Agricultural UniversityDocument43 pagesMousumi Saha Assistant Professor Institute of Agribusiness & Development Studies Bangladesh Agricultural UniversityArafat RahmanNo ratings yet

- Chap 6.2 - MonopolyDocument9 pagesChap 6.2 - Monopolyk61.2212155131No ratings yet

- Macroeconomics NotesDocument23 pagesMacroeconomics NotesHarkirat SinghNo ratings yet

- Ch5. Pure MonopolyDocument71 pagesCh5. Pure MonopolyUyên TrươngNo ratings yet

- Firms in Competitive MarketsDocument35 pagesFirms in Competitive MarketsAri TamaNo ratings yet

- Lecture 4 Profit Maximising under Perfect Competition-1Document61 pagesLecture 4 Profit Maximising under Perfect Competition-1Hma CCNo ratings yet

- Competition in The Long-RunDocument28 pagesCompetition in The Long-RunRudjun TapalNo ratings yet

- Unit 10 Non-Collusive Oligopoly: 10.0 ObjectivesDocument19 pagesUnit 10 Non-Collusive Oligopoly: 10.0 ObjectivesMuskan Sharma100% (1)

- Unit FiveDocument7 pagesUnit FiveGebyaw Demeke AnileyNo ratings yet

- Microeconomics Lecture - Profit Maximization and Competitive SupplyDocument48 pagesMicroeconomics Lecture - Profit Maximization and Competitive Supplybigjanet100% (1)

- Labor DemandDocument29 pagesLabor DemandBunga AmaliaNo ratings yet

- 2018 5 TH SemDocument15 pages2018 5 TH SemmonuNo ratings yet

- EC203 - Problem Set 8Document2 pagesEC203 - Problem Set 8Yiğit KocamanNo ratings yet

- Industrial Organization 01: Monopoly, Monopoly Regulation, Price DiscriminationDocument44 pagesIndustrial Organization 01: Monopoly, Monopoly Regulation, Price Discriminationheh92No ratings yet

- July 15 PDFDocument4 pagesJuly 15 PDFShimu ShahrearNo ratings yet

- MS 602 - Topic 6 - Revision QuestionsDocument6 pagesMS 602 - Topic 6 - Revision QuestionsPETRONo ratings yet

- CH 5Document29 pagesCH 5lemmademe204No ratings yet

- Perfect Competition: I. What Is A Perfectly Competitive Market?Document10 pagesPerfect Competition: I. What Is A Perfectly Competitive Market?Akinyemi YusufNo ratings yet

- Ind l2Document14 pagesInd l2wzykljmlxsdfndtsdrNo ratings yet

- Work Inspection Checklist: Project DetailsDocument1 pageWork Inspection Checklist: Project Detailsmark lester caluzaNo ratings yet

- The Spirit of Jugaad / Bricolage For Enhanced Corporate EntrepreneurshipDocument20 pagesThe Spirit of Jugaad / Bricolage For Enhanced Corporate EntrepreneurshippanditpreachesNo ratings yet

- ThevoidsummaryDocument6 pagesThevoidsummaryVaibhav Mishra80% (5)

- 1 s2.0 S096098221730708X MainDocument5 pages1 s2.0 S096098221730708X Mainrotinda bilekNo ratings yet

- Chechk List Fokker 50Document1 pageChechk List Fokker 50Felipe PinillaNo ratings yet

- Performance: Task in Math 8 House Floor PlanDocument10 pagesPerformance: Task in Math 8 House Floor PlanJoshua Emmanuel LedesmaNo ratings yet

- Ims555 Grouping Assignment (Ai Deepfakes)Document23 pagesIms555 Grouping Assignment (Ai Deepfakes)NUR A'ISYAH AZIZINo ratings yet

- 13.4.2 WBS 6.6 Cerberus Corperation Case Study Managing Stakeholder ConflictDocument7 pages13.4.2 WBS 6.6 Cerberus Corperation Case Study Managing Stakeholder ConflictJorge Alejandro Betancur JaramilloNo ratings yet

- Dry Concentrator IntroductionDocument6 pagesDry Concentrator Introductionmanuel3021No ratings yet

- GattaniDocument18 pagesGattaniKhushbu NovhalNo ratings yet

- Integration Strategies and New Identities in Vs Naipaul's The Mimic Men and Caryl Phillips's CambridgeDocument7 pagesIntegration Strategies and New Identities in Vs Naipaul's The Mimic Men and Caryl Phillips's CambridgeIjahss JournalNo ratings yet

- On Arushi Murder CaseDocument8 pagesOn Arushi Murder Case0000No ratings yet

- Power Quality Enhancement Using Custom Power DevicesDocument1 pagePower Quality Enhancement Using Custom Power DevicesankitNo ratings yet

- William James - PsychologistDocument5 pagesWilliam James - PsychologistCecilia SusaiNo ratings yet

- Creating A Sample BI Report in Oracle Cloud With Excel Template - TrinamixDocument1 pageCreating A Sample BI Report in Oracle Cloud With Excel Template - TrinamixIshaq Ali KhanNo ratings yet

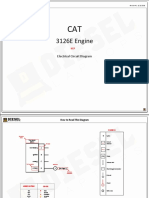

- 3126E Engine: Electrical Circuit DiagramDocument10 pages3126E Engine: Electrical Circuit DiagramPhil B.No ratings yet

- Statistical Methods For Spatial Data AnalysisDocument3 pagesStatistical Methods For Spatial Data Analysissakali ali0% (1)

- Artikel 5Document26 pagesArtikel 5Surya DhNo ratings yet

- RRLsDocument6 pagesRRLsRobot RobotNo ratings yet

- Revit Programming For Beginners: Dan Mapes Senior BIM Coordinator/Developer at ME EngineersDocument17 pagesRevit Programming For Beginners: Dan Mapes Senior BIM Coordinator/Developer at ME EngineersjeanNo ratings yet

- Memory Based Paper Sbi Clerk 11th July 2 266bb4c1Document72 pagesMemory Based Paper Sbi Clerk 11th July 2 266bb4c1SHIVANI chouhanNo ratings yet

- Quest Test 6 Wave Phenomena KEYDocument7 pagesQuest Test 6 Wave Phenomena KEYHa ViNo ratings yet

- Heater: Hydrate PreventionDocument12 pagesHeater: Hydrate PreventionMahmoud Ahmed Ali AbdelrazikNo ratings yet

- Client Name: Well, Max Birthdate: AGE: 7 Years, 8 Months School: Grade: 1 Dates of Assessment: July, 2011 Date of Report: Assessed By: FlamesDocument10 pagesClient Name: Well, Max Birthdate: AGE: 7 Years, 8 Months School: Grade: 1 Dates of Assessment: July, 2011 Date of Report: Assessed By: Flamesapi-160674927No ratings yet

- Commercial Negotiations NotesDocument14 pagesCommercial Negotiations NotesJoan Foster100% (1)

- Manas Arora 3 Year - B Roll No. 3 Vastu Kala AcademyDocument12 pagesManas Arora 3 Year - B Roll No. 3 Vastu Kala AcademyManasAroraNo ratings yet

- Oilfield Products - Valves & Wellheads: YyycwuvtcnkcprkrgnkpgxcnxgeqocwDocument48 pagesOilfield Products - Valves & Wellheads: Yyycwuvtcnkcprkrgnkpgxcnxgeqocwjhonny barrantesNo ratings yet

- Unit 1 Nissim Ezekiel and Eunice de Souza: 1.0 ObjectivesDocument14 pagesUnit 1 Nissim Ezekiel and Eunice de Souza: 1.0 ObjectivesJasmineNo ratings yet

- AMRITA EXAM DatesheetDocument9 pagesAMRITA EXAM DatesheetSARRALLE EQUIPMENT INDIA PVT LTDNo ratings yet