Professional Documents

Culture Documents

Pension

Pension

Uploaded by

Hiếu Nguyễn Minh HoàngCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pension

Pension

Uploaded by

Hiếu Nguyễn Minh HoàngCopyright:

Available Formats

Mini-Case 4

Postemployment Benefit Plans

United Parcel Service (“UPS”)

A) From a purely economic point of view define what constitutes the following: (i)

pension obligation, (ii) pension plan assets, (iii) net economic position of the

pension plan, and (iv) economic pension cost.

Response:

Pension obligation: This is the present value of expected benefit payments to

the employees based on current service.

Pension asset: This is the fair market value of the plan assets on the date of

the balance sheet.

Net economic position of the plan: This is the difference between the fair

market value of the pension assets and the pension obligation. When this

difference is positive the plan is referred to as overfunded and when negative

the plan is termed underfunded.

Economic pension cost: This is the net cost arising from changes in net

economic position (or funded status) for the period. Economic pension cost

includes both recurring (or normal) and nonrecurring (or abnormal)

components. Any return on pension plan assets is used to offset these costs in

arriving at a net economic pension cost.

B) The pension cost included in net income is the net periodic pension cost. How

does it differ from the economic pension cost? What is the rationale for

recognizing the smoothed net periodic pension cost instead of the economic

pension cost?

Response:

The net periodic pension cost is a smoothed version of the economic pension cost. For

determining net periodic pension cost, all non-recurring or unusual components of

economic pension cost (e.g. actuarial gain/loss, prior service cost, excess of actual

plan return over expected return) are deferred and amortized over a period of time.

The difference between economic pension cost and net periodic pension cost is

included in accumulated other comprehensive income.

The rationale for this smoothing mechanism is that the economic pension cost is very

volatile. Including this in income would cause income to be very volatile, masking the

true operating profitability of the firm.

ACTG 553 Mini-Case 4 (JE Solution) Page 1

C) What is the funded status of UPS’s employee benefit plans at December 31, 2018

(i.e., the “U.S. Pension Benefits,” “U.S. Postretirement Medical Benefits” and

“International Pension Benefits” plans are collectively referred to as employee

benefit plans)? How is the asset or liability reported on the Consolidated Balance

Sheet?

Response:

The benefit plans are underfunded as follows (in millions) (Footnote 5 - Page ):

U.S. Pension Benefits ($5,779)

U.S. Postretirement Medical Benefits (2,484)

International Pension Benefits (268)

Net liability ($8,531)

The asset and liabilities are reported on the Consolidated Balance Sheets as follows

U.S.

Postretirement International

U.S. Pension Medical Pension

Benefits Benefits Benefits

Other non-current assets $ 0 $ 0 $ 35

Other current liabilities (20) (195) (4)

Pension and postretirement

benefit obligations (5,759) (2,289) (299)

Net liability ($5,779) ($2,484) ($268)

D) What does UPS report on its Statements of Consolidated Income for the year

ended December 31, 2018 for costs arising from its employee benefit plans?

Response:

UPS reports the following net periodic benefit cost on its Statements of Consolidated

Income (in millions):

U.S. Pension Benefits $2,055

U.S. Postretirement Medical Benefits 132

International Pension Benefits 55

Net periodic benefit cost $2,242

ACTG 553 Mini-Case 4 (JE Solution) Page 2

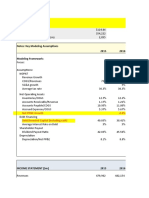

E) UPS reports $272 gain, net of tax, in its Statements of Consolidated

Comprehensive Income for the year ended December 31, 2018. Assume this is a

$460 gain pre-tax. Show in detail how UPS arrived at the $460 amount (i.e.,

show the amount related to the smoothing of actuarial gain or loss, plan

amendments, actual versus expected return on assets, etc.).

Response:

DR (CR)

Balance Income

Sheet Statement OCI

U.S. Pension Benefits

Service cost ($1,661) $ 1,661 $ 0

Interest cost (1,799) 1,799 0

Return on plan assets (1,007) (3,201) 4,208

Prior service cost (331) 193 138

Actuarial (gain) or loss 2,915 1,603 (4,518)

Subtotal (172)

U.S. Postretirement Medical Benefits

Service cost (29) 29 0

Interest cost (104) 104 0

Return on plan assets (7) (8) 15

Prior service cost 0 7 (7)

Actuarial (gain) or loss 178 0 (178)

Subtotal (170)

International Pension Benefits

Service cost (62) 62 0

Interest cost (45) 45 0

Return on plan assets (6) (77) 83

Prior service cost (13) 1 12

Actuarial (gain) or loss 81 24 (105)

Foreign currency changes and other 108 0 (108)

Subtotal (118)

Total, pre-tax gain $ (460)

ACTG 553 Mini-Case 4 (JE Solution) Page 3

F) Compare the fair value of the plan assets at December 31, 2018 to the expected

benefit payments for 2019 and assess UPS’s ability to make those payments for

its employee benefit plans.

Response:

UPS’s fair value of plan assets and expected 2019 payments are as follows (in

millions):

U.S.

Postretirement International

U.S. Pension Medical Pension

Benefits Benefits Benefits

Fair value of plan assets $39,554 $ 26 $1,284

Expected benefit payments in 2019 1,505 227 29

The U.S. Pension Benefits and the International Pension Benefits funds have more

than sufficient funds to meet current demands. The Company is also expected to

have sufficient cash on hand to meet the U.S. Postretirement Medical Benefit

requirements, based on $4,225 million of cash reserves and strong operating cash

flows ($12,711 million for 2018).

G) Discuss UPS’s pension intensity and the extent to which the risk profile of the

employee benefit plans assets is matched to that of the pension obligation (as

those terms are defined in the textbook).

Response:

Pension intensity is defined as the size of the pension obligation in relation to the size

of the Company’s other assets. The Company’s pension and postretirement benefit

obligations are sizable at $8,347 million. This constitutes almost 17% of total assets

at December 31, 2018. With net income at almost $5,000 a year and strong cash

flows, while sizable the pension obligations will not negatively impact the company.

In reviewing the risk profile of the plan assets, the Company has significant

investments in U.S. Government and Corporate Bonds (approximately 42%) and a

mixture of equity securities (approximately 35%). The risk profile is conservative and

matches well to the pension obligation.

ACTG 553 Mini-Case 4 (JE Solution) Page 4

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Income Tax Singhania Student EditionDocument1,002 pagesIncome Tax Singhania Student Editionsangita86% (14)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Walmart Valuation ModelDocument179 pagesWalmart Valuation ModelHiếu Nguyễn Minh HoàngNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Death ChecklistDocument4 pagesDeath ChecklistEvoni Soxfan100% (2)

- ct52005 2009Document181 pagesct52005 2009Bob100% (1)

- OINP Document Checklists - Ontario's Express Entry Human Capital Priorities Stream - Applicant Checklist - Ontario - CaDocument2 pagesOINP Document Checklists - Ontario's Express Entry Human Capital Priorities Stream - Applicant Checklist - Ontario - Cajmm01004No ratings yet

- Treasury Hand BookDocument213 pagesTreasury Hand Bookvenudreamer67% (3)

- HR QuestionsDocument2 pagesHR QuestionsHiếu Nguyễn Minh HoàngNo ratings yet

- Market Risk PremiumDocument1 pageMarket Risk PremiumHiếu Nguyễn Minh HoàngNo ratings yet

- ACGT Term PaperDocument11 pagesACGT Term PaperHiếu Nguyễn Minh HoàngNo ratings yet

- HieuNguyen - ACTG 560 - Written Analysis 2Document1 pageHieuNguyen - ACTG 560 - Written Analysis 2Hiếu Nguyễn Minh HoàngNo ratings yet

- Seven Components of Strategic Staffing Workforce Planning DescriptionDocument6 pagesSeven Components of Strategic Staffing Workforce Planning DescriptionHiếu Nguyễn Minh HoàngNo ratings yet

- Name: Hieu Nguyen FIN 516: Managerial Macroeconomic Prof. Jessica RutledgeDocument10 pagesName: Hieu Nguyen FIN 516: Managerial Macroeconomic Prof. Jessica RutledgeHiếu Nguyễn Minh HoàngNo ratings yet

- Prepare Standard and Customized Investment Performance Reports Communicate With Internal and External Clients Collect, Input, Analyze, and Reconcile Data Market ResearchDocument2 pagesPrepare Standard and Customized Investment Performance Reports Communicate With Internal and External Clients Collect, Input, Analyze, and Reconcile Data Market ResearchHiếu Nguyễn Minh HoàngNo ratings yet

- Hieu Nguyen Cutting Through The Fog-Case OverviewDocument2 pagesHieu Nguyen Cutting Through The Fog-Case OverviewHiếu Nguyễn Minh HoàngNo ratings yet

- MGMT 471 Final Paper RubricDocument3 pagesMGMT 471 Final Paper RubricHiếu Nguyễn Minh HoàngNo ratings yet

- Hieu Nguyen Valuation Description: Domino Pizza (DPZ)Document3 pagesHieu Nguyen Valuation Description: Domino Pizza (DPZ)Hiếu Nguyễn Minh HoàngNo ratings yet

- Total Factors Supplyings Reserve Funds: Securities Held OutrightDocument3 pagesTotal Factors Supplyings Reserve Funds: Securities Held OutrightHiếu Nguyễn Minh HoàngNo ratings yet

- MidtermDocument8 pagesMidtermHiếu Nguyễn Minh HoàngNo ratings yet

- Odel Canvas: Key Partners Key Activities Value Proposition Customer Relationships Customer SegmentsDocument2 pagesOdel Canvas: Key Partners Key Activities Value Proposition Customer Relationships Customer SegmentsHiếu Nguyễn Minh HoàngNo ratings yet

- Final Exam PreparationDocument4 pagesFinal Exam PreparationHiếu Nguyễn Minh HoàngNo ratings yet

- Walgreens Boots Alliance, Inc. and Subsidiaries: Capitalize STMT of Op Lease ReclassDocument7 pagesWalgreens Boots Alliance, Inc. and Subsidiaries: Capitalize STMT of Op Lease ReclassHiếu Nguyễn Minh HoàngNo ratings yet

- Additional Instructions For Mailing Your Package: Drop Off LocatorDocument1 pageAdditional Instructions For Mailing Your Package: Drop Off LocatorHiếu Nguyễn Minh HoàngNo ratings yet

- Chapter 5: Option Pricing Models: The Black-Scholes-Merton ModelDocument47 pagesChapter 5: Option Pricing Models: The Black-Scholes-Merton ModelHiếu Nguyễn Minh HoàngNo ratings yet

- Ms Finance EssayDocument1 pageMs Finance EssayHiếu Nguyễn Minh HoàngNo ratings yet

- PSU Code of Student Conduct: School of Business Honors Program - Student Behavior ExpectationsDocument2 pagesPSU Code of Student Conduct: School of Business Honors Program - Student Behavior ExpectationsHiếu Nguyễn Minh HoàngNo ratings yet

- FIN 456 International Financial Management: The Market For Foreign ExchangeDocument35 pagesFIN 456 International Financial Management: The Market For Foreign ExchangeHiếu Nguyễn Minh HoàngNo ratings yet

- Small Savings Scheme in IndiaDocument16 pagesSmall Savings Scheme in IndiasomashekhareddyNo ratings yet

- Pension Benefits Can Be Attached For MaintenanceDocument8 pagesPension Benefits Can Be Attached For MaintenanceAnonymous 1Ye0Go7KuNo ratings yet

- Salary Slip TemplateDocument1 pageSalary Slip TemplatesaurabhNo ratings yet

- Tax Review QuestionsDocument11 pagesTax Review QuestionsAbigail Regondola BonitaNo ratings yet

- Old Age Homes FinalDocument18 pagesOld Age Homes FinalLavina Jain100% (1)

- Non-Banking Financial InstitutionDocument14 pagesNon-Banking Financial InstitutionPhil Raeken FornollesNo ratings yet

- PRTC - Final PREBOARD Solution Guide (2 of 2)Document37 pagesPRTC - Final PREBOARD Solution Guide (2 of 2)Anonymous Lih1laaxNo ratings yet

- National Pension Scheme (NPS) Guidelines FY 2019-20Document21 pagesNational Pension Scheme (NPS) Guidelines FY 2019-20harrishNo ratings yet

- Double Taxation TreatiesDocument40 pagesDouble Taxation Treatiesstiffie123No ratings yet

- Latest PCDA Circular Feb 09Document13 pagesLatest PCDA Circular Feb 09navdeepsingh.india884991% (46)

- Pas 19Document38 pagesPas 19Justine VeralloNo ratings yet

- Taxation LawDocument9 pagesTaxation LawAshish Singh0% (1)

- Ex-Servicemen Contributory Health Scheme (Echs) Application Form For MembershipDocument14 pagesEx-Servicemen Contributory Health Scheme (Echs) Application Form For Membershipojas nimbusNo ratings yet

- 61a38d5c7b74a - INcome Tax and ETA HandwrittenDocument15 pages61a38d5c7b74a - INcome Tax and ETA HandwrittenAnuska ThapaNo ratings yet

- Income From Other SourcesDocument29 pagesIncome From Other SourcesSatish BhadaniNo ratings yet

- Taxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxDocument32 pagesTaxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxnikkiNo ratings yet

- Year12 General Maths Practice TestDocument20 pagesYear12 General Maths Practice TestShairuz Caesar Briones DugayNo ratings yet

- PerquisitesDocument6 pagesPerquisitesArgha DeySarkarNo ratings yet

- AnnuityDocument24 pagesAnnuityMelvel John Nobleza Amarillo100% (2)

- Assignment - TaxationDocument2 pagesAssignment - TaxationMuskan MittalNo ratings yet

- 17 Altprob 7eDocument6 pages17 Altprob 7eAshish BhallaNo ratings yet

- Rialto Unified Superintendent Cuauhtémoc Avila's ContractDocument9 pagesRialto Unified Superintendent Cuauhtémoc Avila's ContractBeau YarbroughNo ratings yet

- Texas Judicial Retirement SystemDocument12 pagesTexas Judicial Retirement SystemTexas WatchdogNo ratings yet

- Tax Final Part 5Document37 pagesTax Final Part 5Angelica Jane AradoNo ratings yet

- Taxation PDFDocument69 pagesTaxation PDFcpasl123No ratings yet