Professional Documents

Culture Documents

Differences Be SOCPA and IFRS

Differences Be SOCPA and IFRS

Uploaded by

Khaled SherifCopyright:

Available Formats

You might also like

- Ifrs 18Document2 pagesIfrs 18fluffy fluff100% (1)

- Agriculture Farm Business PlanDocument19 pagesAgriculture Farm Business PlanDhara Mehta75% (4)

- Impact of CovidDocument5 pagesImpact of CovidObisike EmeziNo ratings yet

- Ifrs CH 1-2Document3 pagesIfrs CH 1-2Khaled SherifNo ratings yet

- Past MA Exams by Lecture Topic - Solutions PDFDocument59 pagesPast MA Exams by Lecture Topic - Solutions PDFbooks_sumiNo ratings yet

- Epicor 9 Release GuideDocument80 pagesEpicor 9 Release GuideRamadhan SengatiNo ratings yet

- 47 Branch AccountsDocument53 pages47 Branch AccountsShivaram Krishnan70% (10)

- VALUE IFRS PLC Interim June 2022 Final 26 MarchDocument45 pagesVALUE IFRS PLC Interim June 2022 Final 26 MarchKatarina GojkovicNo ratings yet

- Ind As ImplementationDocument5 pagesInd As ImplementationrohitNo ratings yet

- Ifrs Updates August 2019Document9 pagesIfrs Updates August 2019obedNo ratings yet

- M2. Performance ReportingDocument31 pagesM2. Performance ReportingZHI KANG KONGNo ratings yet

- NOTES 12 InterimDocument6 pagesNOTES 12 InterimWinny PoeNo ratings yet

- Ifrs Top20 Tracker 2013Document44 pagesIfrs Top20 Tracker 2013ingridbachNo ratings yet

- PWC IFRS 18 SummaryDocument6 pagesPWC IFRS 18 SummaryMohammad IslamNo ratings yet

- AAU February 2015Document28 pagesAAU February 2015RakeshkargwalNo ratings yet

- 6 - IasDocument25 pages6 - Iasking brothersNo ratings yet

- Ca IfrsDocument7 pagesCa IfrsyogeshNo ratings yet

- IFRS-Change in 2019Document10 pagesIFRS-Change in 2019johny SahaNo ratings yet

- Advanced Accounting - DISCLOSURE OF ACCOUNTING POLICIESDocument4 pagesAdvanced Accounting - DISCLOSURE OF ACCOUNTING POLICIESGedie RocamoraNo ratings yet

- Adamay International Co., Inc.: Note 1 - General InformationDocument36 pagesAdamay International Co., Inc.: Note 1 - General Informationgrecelyn bianesNo ratings yet

- AfmDocument15 pagesAfmabcd dcbaNo ratings yet

- India Converging To IfrsDocument16 pagesIndia Converging To IfrsANSHI MALAIYANo ratings yet

- As1 171222Document6 pagesAs1 171222spikysanchitNo ratings yet

- IAS1Document31 pagesIAS1mohajansanjoy1975No ratings yet

- Individual AssignmentDocument6 pagesIndividual AssignmentFurkanNo ratings yet

- Ind-AS PDFDocument4 pagesInd-AS PDFManish MalikNo ratings yet

- Value Ifrs PLC 2023 Final November 2 RevisedDocument235 pagesValue Ifrs PLC 2023 Final November 2 RevisedHongHaNguyenNo ratings yet

- June-2018 Investor UpdatedDocument7 pagesJune-2018 Investor UpdatedAlfredo Alejandro Chavez LarreaNo ratings yet

- Account Assign 2Document4 pagesAccount Assign 2shan khanNo ratings yet

- Full IFRS Vs IFRS For SMEs PDFDocument72 pagesFull IFRS Vs IFRS For SMEs PDFAra E. CaballeroNo ratings yet

- Business Accounting Assignment: Submitted By: Akash Yadav Course: Bms 1 Year ROLL No.: 6538Document9 pagesBusiness Accounting Assignment: Submitted By: Akash Yadav Course: Bms 1 Year ROLL No.: 6538akash yadavNo ratings yet

- CH 24Document30 pagesCH 24Iris MaNo ratings yet

- Value Ifrs PLC 2022 Final 30 JuneDocument230 pagesValue Ifrs PLC 2022 Final 30 Junetunlinoo.067433No ratings yet

- 1 As Disclouser of Accounting PoliciesDocument6 pages1 As Disclouser of Accounting Policiesanisahemad1178No ratings yet

- Introduction To IFRSDocument13 pagesIntroduction To IFRSgovindsekharNo ratings yet

- Interim Financial ReportingDocument15 pagesInterim Financial ReportingReetika VaidNo ratings yet

- Transportation & Logistics Transportation & Logistics: Impacts of The Annual Improvements ProjectDocument6 pagesTransportation & Logistics Transportation & Logistics: Impacts of The Annual Improvements ProjectSo LokNo ratings yet

- Accounting Standard (AS) 1: (Issued 1979)Document7 pagesAccounting Standard (AS) 1: (Issued 1979)anoop_mishra1986No ratings yet

- Illustrative Condensed Interim Financial StatemenstDocument44 pagesIllustrative Condensed Interim Financial Statemenstalina6523305No ratings yet

- Reaction Paper PAS 18 To PFRS 15Document1 pageReaction Paper PAS 18 To PFRS 15AmanteNo ratings yet

- 01.introductory Materia... 03-07-2020 7.32 PMDocument20 pages01.introductory Materia... 03-07-2020 7.32 PMوليد محمد فكري عبيدNo ratings yet

- Benefits Associated With Implementation of IFRSDocument8 pagesBenefits Associated With Implementation of IFRSchinkijsrNo ratings yet

- NZ en Accounting Alertdec 2020Document15 pagesNZ en Accounting Alertdec 2020Ike FinchNo ratings yet

- List of International Financial Reporting Standards in 2022 Updated - 62f2074aDocument18 pagesList of International Financial Reporting Standards in 2022 Updated - 62f2074aCA Naveen Kumar BalanNo ratings yet

- SABS - Impending IFRS Convergence - Vinayak PaiDocument7 pagesSABS - Impending IFRS Convergence - Vinayak PaiBasappaSarkarNo ratings yet

- IFRS1Document33 pagesIFRS1Ejiemen OkunegaNo ratings yet

- UK Corporate Governance Update New Reporting Requirements and The Wates PrinciplesDocument28 pagesUK Corporate Governance Update New Reporting Requirements and The Wates PrinciplesYing YingNo ratings yet

- IFRS For Small and Medium-Sized Entities: Pocket Guide 2009Document10 pagesIFRS For Small and Medium-Sized Entities: Pocket Guide 2009Robin SicatNo ratings yet

- IFRS Illustrative Banks 2009Document148 pagesIFRS Illustrative Banks 2009mithilesh1984100% (1)

- F1 - Financial Reporting - M2 - Summary - NotesDocument41 pagesF1 - Financial Reporting - M2 - Summary - NotesSyaznee IdrisNo ratings yet

- EY Step Up To Ind AsDocument35 pagesEY Step Up To Ind AsRakeshkargwalNo ratings yet

- KPMG IFRS Notes IndAS PDFDocument13 pagesKPMG IFRS Notes IndAS PDFJagadish ChaudharyNo ratings yet

- Final CHP T 2Document152 pagesFinal CHP T 2Marikrishna Chandran CA100% (1)

- Accounting Standards 32Document91 pagesAccounting Standards 32bathinisridhar100% (3)

- 5 SEM BCOM - International Financial Reporting StandardsDocument49 pages5 SEM BCOM - International Financial Reporting StandardsMadhu kumarNo ratings yet

- EBITDA, Luc MartyDocument4 pagesEBITDA, Luc MartyFouzi TahiNo ratings yet

- Petron PDFDocument71 pagesPetron PDFEliza MapaNo ratings yet

- Ifrs 8 Segment InformationDocument6 pagesIfrs 8 Segment InformationMovies OnlyNo ratings yet

- ROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.From EverandROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.No ratings yet

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- 3 PDFDocument9 pages3 PDFKhaled SherifNo ratings yet

- P7 Notes Training CostsDocument8 pagesP7 Notes Training CostsKhaled SherifNo ratings yet

- IFRS - Transformation Agenda For Saudi CorporatesDocument21 pagesIFRS - Transformation Agenda For Saudi CorporatesKhaled SherifNo ratings yet

- Ifrs CH 13Document2 pagesIfrs CH 13Khaled SherifNo ratings yet

- CH7-Intangible Assets and Goodwill: HSCS Training & ConsultingDocument2 pagesCH7-Intangible Assets and Goodwill: HSCS Training & ConsultingKhaled SherifNo ratings yet

- FCCF and ERMF Introduction FinalDocument12 pagesFCCF and ERMF Introduction FinalKhaled Sherif100% (1)

- James Hampson - Acting Director: SabbaghDocument1 pageJames Hampson - Acting Director: SabbaghKhaled SherifNo ratings yet

- The ManagerDocument1 pageThe ManagerKhaled SherifNo ratings yet

- IFRS 16 Effects AnalysisDocument104 pagesIFRS 16 Effects AnalysisKhaled SherifNo ratings yet

- Egypt Debtor PolicyDocument13 pagesEgypt Debtor PolicyKhaled SherifNo ratings yet

- Acca Part QualififedDocument1 pageAcca Part QualififedKhaled SherifNo ratings yet

- Chapter-2 Income TaxDocument11 pagesChapter-2 Income TaxJaya GuptaNo ratings yet

- Lecture On RPGT - Res611Document57 pagesLecture On RPGT - Res611NUR AINA AISHAH MOHD ASHURNo ratings yet

- Chapter 6-Earnings Management: Multiple ChoiceDocument22 pagesChapter 6-Earnings Management: Multiple ChoiceLeonardoNo ratings yet

- Practical Accounting 1 Mockboard 2014Document8 pagesPractical Accounting 1 Mockboard 2014Jonathan Tumamao Fernandez100% (1)

- Performance Evaluation - Accounting ManagementDocument17 pagesPerformance Evaluation - Accounting ManagementEka DarmadiNo ratings yet

- Z SAP FICO Module Training TutorialsDocument4 pagesZ SAP FICO Module Training TutorialssuyotoliveNo ratings yet

- 2009-05-01 063811 Multiple Choice-2Document12 pages2009-05-01 063811 Multiple Choice-2Andrea RobinsonNo ratings yet

- Rogger Septrya P2Document10 pagesRogger Septrya P2Lydia limNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocument158 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.No ratings yet

- Coa C2017-004Document8 pagesCoa C2017-004Tom Louis HerreraNo ratings yet

- Sample Income STMTDocument5 pagesSample Income STMTcherwoodNo ratings yet

- Mark Scheme (Results) Summer 2016: Pearson Edexcel IAL in Accounting (WAC11) Paper 01 The Accounting System and CostingDocument30 pagesMark Scheme (Results) Summer 2016: Pearson Edexcel IAL in Accounting (WAC11) Paper 01 The Accounting System and CostingFarhad AhmedNo ratings yet

- HD - ACC101-Financial Statement-Day 4-31.7.2023 July Intake-BUCDocument9 pagesHD - ACC101-Financial Statement-Day 4-31.7.2023 July Intake-BUCwtote404No ratings yet

- Ch.10 Branch AccountingDocument30 pagesCh.10 Branch AccountingMalayaranjan PanigrahiNo ratings yet

- Project Report For DicDocument4 pagesProject Report For DicEr. Rajesh ChatterjeeNo ratings yet

- Ifrs For SmesDocument130 pagesIfrs For SmesDharren Rojan Garvida AgullanaNo ratings yet

- Chapter 3 Lesson 2 - Economic Study MethodsDocument14 pagesChapter 3 Lesson 2 - Economic Study MethodsLeojhun PalisocNo ratings yet

- Finance Pre-Read 2023Document30 pagesFinance Pre-Read 2023Kshitij SinghalNo ratings yet

- Daf1102 Fundamentals of Accounting IDocument93 pagesDaf1102 Fundamentals of Accounting IJames MuthuriNo ratings yet

- Discussion Questions Risks and Audit ProceduresDocument16 pagesDiscussion Questions Risks and Audit ProceduresLoo Bee YeokNo ratings yet

- Advanced Accounting Full Notes 11022021 RLDocument335 pagesAdvanced Accounting Full Notes 11022021 RLSivapriya Kamat100% (1)

- Working Capital Management 3Document11 pagesWorking Capital Management 3fatimabiriq799No ratings yet

- Capital BudgetingDocument120 pagesCapital BudgetingAnn Kristine Trinidad100% (1)

- Accounting For Managers Sample PaperDocument10 pagesAccounting For Managers Sample Paperghogharivipul0% (1)

- Chapter 12 PracticeProblemsDocument7 pagesChapter 12 PracticeProblemsDaniel OngNo ratings yet

Differences Be SOCPA and IFRS

Differences Be SOCPA and IFRS

Uploaded by

Khaled SherifOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Differences Be SOCPA and IFRS

Differences Be SOCPA and IFRS

Uploaded by

Khaled SherifCopyright:

Available Formats

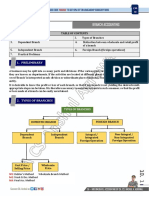

A few differences that almost all of the companies following SOCPA might have are the

following:

Presentation of financial statements in accordance with IFRS is definitely the biggest

difference all companies converting to IFRS will have to face. The presentation

guidance is included in the IFRS 1 first time adoption of IFRS. That includes 3 years

comparative statement of financial position. For example 31 December 2018, 31

December 2017 and 1 January 2017. The other statements are similar to SOCPA

standards having two years comparatives, except for the statement of other

comprehensive income which is normally not presented under SOCPA and may

need to be included in IFRS financial statements. In the notes to the financial

statements, a reconciliation of equity and income statements from the date of

transition will need to be disclosed.

Statement of compliance that the financial statements have been prepared in

accordance with International Financial Reporting Standards (IFRS).

Revenue recognition, under IFRS 15. This impacts the businesses that have

complex revenue recognition, and deliver goods and services with risks being

transferred and performance obligations being settled. This might include contracts

that have multiple stages and payment terms involved. Simple consultancy and

grocery stores may have same revenue recognition as in SOCPA.

End of service benefits, under IAS 19, is the next major difference. End of Service

Benefit provision includes three main assumptions:

1. Salary increase rate per annum (for example, a letter approved by

management for the salary increase)

2. Average expected future years of service

3. Discount rate % per annum. (According to IFRS the discount rate used is

determined by reference to market yields at the end of the reporting period on

high-quality corporate bonds, or where there is no deep market in such

bonds, by reference to market yields on government bonds i.e. High-Quality

Market Corporate Bond Spot rate).

Intangible assets are categorised separately. The software is included in this

category if it is not an integral part of the hardware. For example, an accounting

software is intangible assets.

Significant accounting policies have to be in greater depth. Such as these additional

notes included in significant additional accounting policies:

o New Standards, Amendment to Standards and Interpretations

o Financial instruments

o Capital management

Comments

1.

FarhanNovember 26, 2018 at 1:09 AM

Additional important line items that are treated differently by Full version IFRS include but are

not limited to:

Property Plant and Equipment-

Review of useful life and estimated salvage value at least annually.

Depreciation of minimum value assets, such as prayer rugs should be treated in accordance with

the capitalization policy of the company. A capitalization policy could be like to expense out any

fixed asset with value lower than SAR 500.

Employees End of Service Benefits provision-

The Company is required to account for its defined benefit obligation computed based on

actuarial valuation. An acceptable IAS 19 actuarial report can be obtained from

info@naumanassociates.com

Note* IFRS for SME: As per section 28.18 of IFRS for SMEs, actuarial valuation is required of

post-retirement benefits, given the cost of actuarial valuation is not significant for the company.

GOSI expenses amount should be disclosed separately in the notes to the financial statements

because they fall under IAS 19 defined contribution plans.

You might also like

- Ifrs 18Document2 pagesIfrs 18fluffy fluff100% (1)

- Agriculture Farm Business PlanDocument19 pagesAgriculture Farm Business PlanDhara Mehta75% (4)

- Impact of CovidDocument5 pagesImpact of CovidObisike EmeziNo ratings yet

- Ifrs CH 1-2Document3 pagesIfrs CH 1-2Khaled SherifNo ratings yet

- Past MA Exams by Lecture Topic - Solutions PDFDocument59 pagesPast MA Exams by Lecture Topic - Solutions PDFbooks_sumiNo ratings yet

- Epicor 9 Release GuideDocument80 pagesEpicor 9 Release GuideRamadhan SengatiNo ratings yet

- 47 Branch AccountsDocument53 pages47 Branch AccountsShivaram Krishnan70% (10)

- VALUE IFRS PLC Interim June 2022 Final 26 MarchDocument45 pagesVALUE IFRS PLC Interim June 2022 Final 26 MarchKatarina GojkovicNo ratings yet

- Ind As ImplementationDocument5 pagesInd As ImplementationrohitNo ratings yet

- Ifrs Updates August 2019Document9 pagesIfrs Updates August 2019obedNo ratings yet

- M2. Performance ReportingDocument31 pagesM2. Performance ReportingZHI KANG KONGNo ratings yet

- NOTES 12 InterimDocument6 pagesNOTES 12 InterimWinny PoeNo ratings yet

- Ifrs Top20 Tracker 2013Document44 pagesIfrs Top20 Tracker 2013ingridbachNo ratings yet

- PWC IFRS 18 SummaryDocument6 pagesPWC IFRS 18 SummaryMohammad IslamNo ratings yet

- AAU February 2015Document28 pagesAAU February 2015RakeshkargwalNo ratings yet

- 6 - IasDocument25 pages6 - Iasking brothersNo ratings yet

- Ca IfrsDocument7 pagesCa IfrsyogeshNo ratings yet

- IFRS-Change in 2019Document10 pagesIFRS-Change in 2019johny SahaNo ratings yet

- Advanced Accounting - DISCLOSURE OF ACCOUNTING POLICIESDocument4 pagesAdvanced Accounting - DISCLOSURE OF ACCOUNTING POLICIESGedie RocamoraNo ratings yet

- Adamay International Co., Inc.: Note 1 - General InformationDocument36 pagesAdamay International Co., Inc.: Note 1 - General Informationgrecelyn bianesNo ratings yet

- AfmDocument15 pagesAfmabcd dcbaNo ratings yet

- India Converging To IfrsDocument16 pagesIndia Converging To IfrsANSHI MALAIYANo ratings yet

- As1 171222Document6 pagesAs1 171222spikysanchitNo ratings yet

- IAS1Document31 pagesIAS1mohajansanjoy1975No ratings yet

- Individual AssignmentDocument6 pagesIndividual AssignmentFurkanNo ratings yet

- Ind-AS PDFDocument4 pagesInd-AS PDFManish MalikNo ratings yet

- Value Ifrs PLC 2023 Final November 2 RevisedDocument235 pagesValue Ifrs PLC 2023 Final November 2 RevisedHongHaNguyenNo ratings yet

- June-2018 Investor UpdatedDocument7 pagesJune-2018 Investor UpdatedAlfredo Alejandro Chavez LarreaNo ratings yet

- Account Assign 2Document4 pagesAccount Assign 2shan khanNo ratings yet

- Full IFRS Vs IFRS For SMEs PDFDocument72 pagesFull IFRS Vs IFRS For SMEs PDFAra E. CaballeroNo ratings yet

- Business Accounting Assignment: Submitted By: Akash Yadav Course: Bms 1 Year ROLL No.: 6538Document9 pagesBusiness Accounting Assignment: Submitted By: Akash Yadav Course: Bms 1 Year ROLL No.: 6538akash yadavNo ratings yet

- CH 24Document30 pagesCH 24Iris MaNo ratings yet

- Value Ifrs PLC 2022 Final 30 JuneDocument230 pagesValue Ifrs PLC 2022 Final 30 Junetunlinoo.067433No ratings yet

- 1 As Disclouser of Accounting PoliciesDocument6 pages1 As Disclouser of Accounting Policiesanisahemad1178No ratings yet

- Introduction To IFRSDocument13 pagesIntroduction To IFRSgovindsekharNo ratings yet

- Interim Financial ReportingDocument15 pagesInterim Financial ReportingReetika VaidNo ratings yet

- Transportation & Logistics Transportation & Logistics: Impacts of The Annual Improvements ProjectDocument6 pagesTransportation & Logistics Transportation & Logistics: Impacts of The Annual Improvements ProjectSo LokNo ratings yet

- Accounting Standard (AS) 1: (Issued 1979)Document7 pagesAccounting Standard (AS) 1: (Issued 1979)anoop_mishra1986No ratings yet

- Illustrative Condensed Interim Financial StatemenstDocument44 pagesIllustrative Condensed Interim Financial Statemenstalina6523305No ratings yet

- Reaction Paper PAS 18 To PFRS 15Document1 pageReaction Paper PAS 18 To PFRS 15AmanteNo ratings yet

- 01.introductory Materia... 03-07-2020 7.32 PMDocument20 pages01.introductory Materia... 03-07-2020 7.32 PMوليد محمد فكري عبيدNo ratings yet

- Benefits Associated With Implementation of IFRSDocument8 pagesBenefits Associated With Implementation of IFRSchinkijsrNo ratings yet

- NZ en Accounting Alertdec 2020Document15 pagesNZ en Accounting Alertdec 2020Ike FinchNo ratings yet

- List of International Financial Reporting Standards in 2022 Updated - 62f2074aDocument18 pagesList of International Financial Reporting Standards in 2022 Updated - 62f2074aCA Naveen Kumar BalanNo ratings yet

- SABS - Impending IFRS Convergence - Vinayak PaiDocument7 pagesSABS - Impending IFRS Convergence - Vinayak PaiBasappaSarkarNo ratings yet

- IFRS1Document33 pagesIFRS1Ejiemen OkunegaNo ratings yet

- UK Corporate Governance Update New Reporting Requirements and The Wates PrinciplesDocument28 pagesUK Corporate Governance Update New Reporting Requirements and The Wates PrinciplesYing YingNo ratings yet

- IFRS For Small and Medium-Sized Entities: Pocket Guide 2009Document10 pagesIFRS For Small and Medium-Sized Entities: Pocket Guide 2009Robin SicatNo ratings yet

- IFRS Illustrative Banks 2009Document148 pagesIFRS Illustrative Banks 2009mithilesh1984100% (1)

- F1 - Financial Reporting - M2 - Summary - NotesDocument41 pagesF1 - Financial Reporting - M2 - Summary - NotesSyaznee IdrisNo ratings yet

- EY Step Up To Ind AsDocument35 pagesEY Step Up To Ind AsRakeshkargwalNo ratings yet

- KPMG IFRS Notes IndAS PDFDocument13 pagesKPMG IFRS Notes IndAS PDFJagadish ChaudharyNo ratings yet

- Final CHP T 2Document152 pagesFinal CHP T 2Marikrishna Chandran CA100% (1)

- Accounting Standards 32Document91 pagesAccounting Standards 32bathinisridhar100% (3)

- 5 SEM BCOM - International Financial Reporting StandardsDocument49 pages5 SEM BCOM - International Financial Reporting StandardsMadhu kumarNo ratings yet

- EBITDA, Luc MartyDocument4 pagesEBITDA, Luc MartyFouzi TahiNo ratings yet

- Petron PDFDocument71 pagesPetron PDFEliza MapaNo ratings yet

- Ifrs 8 Segment InformationDocument6 pagesIfrs 8 Segment InformationMovies OnlyNo ratings yet

- ROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.From EverandROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.No ratings yet

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- 3 PDFDocument9 pages3 PDFKhaled SherifNo ratings yet

- P7 Notes Training CostsDocument8 pagesP7 Notes Training CostsKhaled SherifNo ratings yet

- IFRS - Transformation Agenda For Saudi CorporatesDocument21 pagesIFRS - Transformation Agenda For Saudi CorporatesKhaled SherifNo ratings yet

- Ifrs CH 13Document2 pagesIfrs CH 13Khaled SherifNo ratings yet

- CH7-Intangible Assets and Goodwill: HSCS Training & ConsultingDocument2 pagesCH7-Intangible Assets and Goodwill: HSCS Training & ConsultingKhaled SherifNo ratings yet

- FCCF and ERMF Introduction FinalDocument12 pagesFCCF and ERMF Introduction FinalKhaled Sherif100% (1)

- James Hampson - Acting Director: SabbaghDocument1 pageJames Hampson - Acting Director: SabbaghKhaled SherifNo ratings yet

- The ManagerDocument1 pageThe ManagerKhaled SherifNo ratings yet

- IFRS 16 Effects AnalysisDocument104 pagesIFRS 16 Effects AnalysisKhaled SherifNo ratings yet

- Egypt Debtor PolicyDocument13 pagesEgypt Debtor PolicyKhaled SherifNo ratings yet

- Acca Part QualififedDocument1 pageAcca Part QualififedKhaled SherifNo ratings yet

- Chapter-2 Income TaxDocument11 pagesChapter-2 Income TaxJaya GuptaNo ratings yet

- Lecture On RPGT - Res611Document57 pagesLecture On RPGT - Res611NUR AINA AISHAH MOHD ASHURNo ratings yet

- Chapter 6-Earnings Management: Multiple ChoiceDocument22 pagesChapter 6-Earnings Management: Multiple ChoiceLeonardoNo ratings yet

- Practical Accounting 1 Mockboard 2014Document8 pagesPractical Accounting 1 Mockboard 2014Jonathan Tumamao Fernandez100% (1)

- Performance Evaluation - Accounting ManagementDocument17 pagesPerformance Evaluation - Accounting ManagementEka DarmadiNo ratings yet

- Z SAP FICO Module Training TutorialsDocument4 pagesZ SAP FICO Module Training TutorialssuyotoliveNo ratings yet

- 2009-05-01 063811 Multiple Choice-2Document12 pages2009-05-01 063811 Multiple Choice-2Andrea RobinsonNo ratings yet

- Rogger Septrya P2Document10 pagesRogger Septrya P2Lydia limNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocument158 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.No ratings yet

- Coa C2017-004Document8 pagesCoa C2017-004Tom Louis HerreraNo ratings yet

- Sample Income STMTDocument5 pagesSample Income STMTcherwoodNo ratings yet

- Mark Scheme (Results) Summer 2016: Pearson Edexcel IAL in Accounting (WAC11) Paper 01 The Accounting System and CostingDocument30 pagesMark Scheme (Results) Summer 2016: Pearson Edexcel IAL in Accounting (WAC11) Paper 01 The Accounting System and CostingFarhad AhmedNo ratings yet

- HD - ACC101-Financial Statement-Day 4-31.7.2023 July Intake-BUCDocument9 pagesHD - ACC101-Financial Statement-Day 4-31.7.2023 July Intake-BUCwtote404No ratings yet

- Ch.10 Branch AccountingDocument30 pagesCh.10 Branch AccountingMalayaranjan PanigrahiNo ratings yet

- Project Report For DicDocument4 pagesProject Report For DicEr. Rajesh ChatterjeeNo ratings yet

- Ifrs For SmesDocument130 pagesIfrs For SmesDharren Rojan Garvida AgullanaNo ratings yet

- Chapter 3 Lesson 2 - Economic Study MethodsDocument14 pagesChapter 3 Lesson 2 - Economic Study MethodsLeojhun PalisocNo ratings yet

- Finance Pre-Read 2023Document30 pagesFinance Pre-Read 2023Kshitij SinghalNo ratings yet

- Daf1102 Fundamentals of Accounting IDocument93 pagesDaf1102 Fundamentals of Accounting IJames MuthuriNo ratings yet

- Discussion Questions Risks and Audit ProceduresDocument16 pagesDiscussion Questions Risks and Audit ProceduresLoo Bee YeokNo ratings yet

- Advanced Accounting Full Notes 11022021 RLDocument335 pagesAdvanced Accounting Full Notes 11022021 RLSivapriya Kamat100% (1)

- Working Capital Management 3Document11 pagesWorking Capital Management 3fatimabiriq799No ratings yet

- Capital BudgetingDocument120 pagesCapital BudgetingAnn Kristine Trinidad100% (1)

- Accounting For Managers Sample PaperDocument10 pagesAccounting For Managers Sample Paperghogharivipul0% (1)

- Chapter 12 PracticeProblemsDocument7 pagesChapter 12 PracticeProblemsDaniel OngNo ratings yet