Professional Documents

Culture Documents

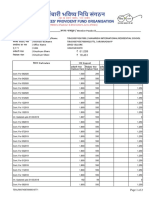

Form 49A: Under Section 139A of The Income-Tax Act, 1961

Form 49A: Under Section 139A of The Income-Tax Act, 1961

Uploaded by

Chellapandi0 ratings0% found this document useful (0 votes)

356 views1 pageGobinath Madasamy paid Rs. 107 to apply for a PAN card. He provided his Aadhaar card as proof of identity, address, and date of birth. However, his Aadhaar details did not match the demographic information provided. His application will need to be resubmitted after successful biometric authentication at a UTIITSL branch office. He was provided a receipt acknowledging his application and informing him that an authorized agent may visit him to verify his identity and address based on the documents submitted.

Original Description:

Original Title

panonline_ipg

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGobinath Madasamy paid Rs. 107 to apply for a PAN card. He provided his Aadhaar card as proof of identity, address, and date of birth. However, his Aadhaar details did not match the demographic information provided. His application will need to be resubmitted after successful biometric authentication at a UTIITSL branch office. He was provided a receipt acknowledging his application and informing him that an authorized agent may visit him to verify his identity and address based on the documents submitted.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

356 views1 pageForm 49A: Under Section 139A of The Income-Tax Act, 1961

Form 49A: Under Section 139A of The Income-Tax Act, 1961

Uploaded by

ChellapandiGobinath Madasamy paid Rs. 107 to apply for a PAN card. He provided his Aadhaar card as proof of identity, address, and date of birth. However, his Aadhaar details did not match the demographic information provided. His application will need to be resubmitted after successful biometric authentication at a UTIITSL branch office. He was provided a receipt acknowledging his application and informing him that an authorized agent may visit him to verify his identity and address based on the documents submitted.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Form 49A

Under section 139A of the Income-Tax Act, 1961

PAN Application Acknowledgment Receipt For 49A Form

( Physical Application )

Received Rs. 107.00/- (incl of taxes) from: SHRI GOBINATH MADASAMY

Application No./Coupon No.: U-N003893813

Name as to be printed on PAN card: GOBINATH MADASAMY

Gender MALE

Date of Birth/Incorporation 17/04/2000

Father's Name: MADASAMY

Aadhaar Number/EID Number: xxxx-xxxx-5933 (NOT, MATCHED)*

Name as per Aadhaar: GOPINATH MADASMY

Applicant's Contact details: 9994696286

Communication Address: RESIDENCE

Residence State: TAMIL NADU

Office State: TAMIL NADU

Proof of Identity: AADHAAR Card issued by UIDAI (In Copy)

Proof of Address: AADHAAR Card issued by UIDAI (In Copy)

Proof of DOB: AADHAAR Card issued by UIDAI (In Copy)

Date of Receipt: 31/12/2020 09:48:38

Mode of Pancard: Both physical PAN and e-PAN Card

Payment Ref No: 9588205945

Payment Date: 31/12/2019 09:52:33

*AADHAAR NOT MATCHED USING DEMOGRAPHIC DETAILS - WILL NOT BE LINKED WITH PAN.

*This Application will be accepted later again for processing, only after a successful Biometric authentication of the applicant's AADHAAR at any/nearest Branch Office of UTIITSL followed by re-submission of the application.

To know your PAN Application status, you may visit our website: http://www.utiitsl.com.

As per instruction from Income Tax Department, an authorized agency's agent may visit you for your identity and address verification as per the documents submitted by you with the PAN application form. You are requested

to ask authorization letter/ID card from the agent before verification.Your cooperation is solicited in this regard.

Edit Close

You might also like

- BN78 BookletDocument31 pagesBN78 Bookletwwlcom67% (3)

- Payment Receipt 14647382Document1 pagePayment Receipt 14647382ChellapandiNo ratings yet

- If Poem Worksheet PDFDocument12 pagesIf Poem Worksheet PDFRaniaGF100% (2)

- ABC's of Relationship Selling: Charles M. FutrellDocument9 pagesABC's of Relationship Selling: Charles M. FutrellAshtika BeharryNo ratings yet

- Holiness by Micah Stampley (Chords)Document1 pageHoliness by Micah Stampley (Chords)Jesse Wilson100% (3)

- Kitchenbrigade 120821195157 Phpapp02Document25 pagesKitchenbrigade 120821195157 Phpapp02Conrado AreolaNo ratings yet

- Erie Flowchart 2Document1 pageErie Flowchart 2diannecl-1No ratings yet

- Case Study F BatchDocument2 pagesCase Study F BatchBalujagadishNo ratings yet

- DownloadDocument1 pageDownloadinfo.globaloverseas.coNo ratings yet

- Untitled Document PDFDocument1 pageUntitled Document PDFSakina BibiNo ratings yet

- Untitled Document PDFDocument1 pageUntitled Document PDFSakina BibiNo ratings yet

- PAN Application Acknowledgement Receipt (Form 49A) : Aadhaar Matched Using Demographic Details - Will Be Linked With PanDocument1 pagePAN Application Acknowledgement Receipt (Form 49A) : Aadhaar Matched Using Demographic Details - Will Be Linked With PanrajaNo ratings yet

- Form 49A: Under Section 139A of The Income-Tax Act, 1961Document1 pageForm 49A: Under Section 139A of The Income-Tax Act, 1961Soul BeatsNo ratings yet

- Kanchan KumariDocument1 pageKanchan Kumaripancard1098No ratings yet

- SomeDocument1 pageSomePAN CARDNo ratings yet

- PAN Application Acknowledgement Receipt (Form 49A) : Aadhaar Matched Using Demographic Details - Will Be Linked With PanDocument1 pagePAN Application Acknowledgement Receipt (Form 49A) : Aadhaar Matched Using Demographic Details - Will Be Linked With Panbapan mondalNo ratings yet

- Chanan Kaur Pan Receipt PDFDocument1 pageChanan Kaur Pan Receipt PDFAman WadhwaNo ratings yet

- Saniya KumariDocument1 pageSaniya Kumaripancard1098No ratings yet

- PAN Application Acknowledgment Receipt For Form 49A (Physical Application)Document1 pagePAN Application Acknowledgment Receipt For Form 49A (Physical Application)focus digital StudioNo ratings yet

- Piyush SharmaDocument1 pagePiyush Sharmapancard1098No ratings yet

- AnkurDocument1 pageAnkurpancard1098No ratings yet

- Manisha DownloadDocument1 pageManisha DownloadONLINE SEVANo ratings yet

- PAN Application Acknowledgement Receipt (Form 49A) : PAN Collection CentreDocument2 pagesPAN Application Acknowledgement Receipt (Form 49A) : PAN Collection Centresv netNo ratings yet

- CSF PAN FormDocument1 pageCSF PAN FormSRI RAMNo ratings yet

- PAN Application Acknowledgement Receipt (For Change/Correction) or (CSF)Document1 pagePAN Application Acknowledgement Receipt (For Change/Correction) or (CSF)software windowsNo ratings yet

- PAN1Document1 pagePAN1Anilkumar ChennamsettiNo ratings yet

- Application Acknowledgment Receipt For CSF (Physical Application)Document1 pageApplication Acknowledgment Receipt For CSF (Physical Application)Zahir ComputersNo ratings yet

- Anita SharmaDocument1 pageAnita Sharmapancard1098No ratings yet

- HASINADocument1 pageHASINAPublic GarbageNo ratings yet

- DownloadDocument1 pageDownloadnicklord749No ratings yet

- Vivek MukhiyaDocument1 pageVivek Mukhiyapancard1098No ratings yet

- Ack K000667649Document1 pageAck K000667649pan phNo ratings yet

- DownloadDocument1 pageDownloadfactknowledgewordNo ratings yet

- T PanDocument1 pageT PanLaxman SidarNo ratings yet

- PAN Application Acknowledgement Receipt (Form 49A) : Aadhaar Matched Using Demographic Details - Will Be Linked With PanDocument1 pagePAN Application Acknowledgement Receipt (Form 49A) : Aadhaar Matched Using Demographic Details - Will Be Linked With PanAman WadhwaNo ratings yet

- PANform PDFDocument1 pagePANform PDFsagar KumarNo ratings yet

- Mita Dhara AckDocument1 pageMita Dhara Acksurajit jatiNo ratings yet

- Untitled DocumentDocument1 pageUntitled DocumentKaruppusamy SamynathanNo ratings yet

- Gufran KhanDocument1 pageGufran KhantquoteszoneNo ratings yet

- Hindu ReceiptDocument1 pageHindu Receiptsvnet vizagNo ratings yet

- download111Document1 pagedownload111Jess RãhùlNo ratings yet

- Madhubala ShuklaDocument1 pageMadhubala Shuklapancard1098No ratings yet

- DownloadDocument1 pageDownloadROKY HALDERNo ratings yet

- SachinDocument1 pageSachinfocus digital StudioNo ratings yet

- Ush AyDocument1 pageUsh AyslvstoresrituNo ratings yet

- PAN Application Acknowledgment Receipt For Form 49A (Physical Application)Document1 pagePAN Application Acknowledgment Receipt For Form 49A (Physical Application)Shamshavali ButaladinniNo ratings yet

- Istkar Saifi Official NNDocument1 pageIstkar Saifi Official NNistakarsaifi22No ratings yet

- PanssDocument1 pagePanssnaveenmeeseva786No ratings yet

- ADITI M NAGENDRA AckDocument1 pageADITI M NAGENDRA AckMOHAN KUMARNo ratings yet

- PAN Application Acknowledgment Receipt For Form 49A (Physical Application)Document1 pagePAN Application Acknowledgment Receipt For Form 49A (Physical Application)tanisq10No ratings yet

- PAN Application Acknowledgement Receipt (Form 49A) : AADHAAR Matched Using Demographic Details - Will Be Linked With PANDocument1 pagePAN Application Acknowledgement Receipt (Form 49A) : AADHAAR Matched Using Demographic Details - Will Be Linked With PANkhalsa computersNo ratings yet

- AbrarDocument1 pageAbrarSdaqt ThanviNo ratings yet

- PAN Application Acknowledgement Receipt (For Change/Correction) or (CSF)Document1 pagePAN Application Acknowledgement Receipt (For Change/Correction) or (CSF)Awinash ChowdaryNo ratings yet

- PAN Application's Kunal GargDocument1 pagePAN Application's Kunal Gargkunal.gNo ratings yet

- CSF Pan FormDocument1 pageCSF Pan FormSrinivas PrabhuNo ratings yet

- Ack R005926416Document1 pageAck R005926416dikendrayadav933No ratings yet

- Redirect SuccessDocument1 pageRedirect Successprakash chetryNo ratings yet

- Dhuran YadavDocument1 pageDhuran Yadavpancard1098No ratings yet

- PAN Application Acknowledgment Receipt For Form 49A (Physical Application)Document1 pagePAN Application Acknowledgment Receipt For Form 49A (Physical Application)Zahir ComputersNo ratings yet

- PAN Application Acknowledgment Receipt For Form 49A (Physical Application)Document1 pagePAN Application Acknowledgment Receipt For Form 49A (Physical Application)kuilashoehouseNo ratings yet

- Aarju SlipDocument1 pageAarju SlipVIMAL KHOBEINNo ratings yet

- DownloadDocument1 pageDownloadGirish KumarNo ratings yet

- PAN Application Acknowledgment Receipt (For Changes or Correction in PAN Data) (Physical Application)Document1 pagePAN Application Acknowledgment Receipt (For Changes or Correction in PAN Data) (Physical Application)Meeseva ndkNo ratings yet

- KARITIDocument1 pageKARITIANIL KUMARNo ratings yet

- B MasthanDocument1 pageB Masthannayeemshaik.129No ratings yet

- PAN Application Acknowledgment Receipt For Form 49A (Physical Application)Document1 pagePAN Application Acknowledgment Receipt For Form 49A (Physical Application)S CYBER CAFENo ratings yet

- Ack R005926615Document1 pageAck R005926615dikendrayadav933No ratings yet

- Karthika MHC ApplicationDocument5 pagesKarthika MHC ApplicationChellapandiNo ratings yet

- C147 Close To AVDD18 - MEMPLL (E1 Ball) & DVDD18 - MC1 (F3 Ball) and Keep Trace Length 150milsDocument18 pagesC147 Close To AVDD18 - MEMPLL (E1 Ball) & DVDD18 - MC1 (F3 Ball) and Keep Trace Length 150milsChellapandiNo ratings yet

- Online Application For DDE AdmissionDocument3 pagesOnline Application For DDE AdmissionChellapandiNo ratings yet

- Cut-Off Marks SI2019Document3 pagesCut-Off Marks SI2019ChellapandiNo ratings yet

- Stock Market Made EasyDocument16 pagesStock Market Made EasyChellapandiNo ratings yet

- Account Statement From 1 May 2020 To 1 Nov 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument9 pagesAccount Statement From 1 May 2020 To 1 Nov 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceChellapandiNo ratings yet

- Cut-Off Marks SI2019Document3 pagesCut-Off Marks SI2019ChellapandiNo ratings yet

- Final Provisional Selection List OpenDocument8 pagesFinal Provisional Selection List OpenChellapandiNo ratings yet

- Maths 7 Days PlanDocument34 pagesMaths 7 Days PlanChellapandiNo ratings yet

- We Need To Find The Expected Return On PortfolioDocument1 pageWe Need To Find The Expected Return On PortfolioChellapandiNo ratings yet

- Police Handling of Domestic Violence Cases in Tamil Nadu, IndiaDocument13 pagesPolice Handling of Domestic Violence Cases in Tamil Nadu, IndiaChellapandiNo ratings yet

- 12th New Samacheer All Article Single PDF WIN SHINE IAS YOUTUBEDocument5 pages12th New Samacheer All Article Single PDF WIN SHINE IAS YOUTUBEChellapandiNo ratings yet

- voter Information: Note 1: This Output Is Computer Generated and Is Provided Only For The Information To The VoterDocument1 pagevoter Information: Note 1: This Output Is Computer Generated and Is Provided Only For The Information To The VoterChellapandiNo ratings yet

- Vinoth KVB CloseDocument1 pageVinoth KVB CloseChellapandiNo ratings yet

- SelfDeclarationForm TN-1620201226459Document1 pageSelfDeclarationForm TN-1620201226459ChellapandiNo ratings yet

- CO VI D Safely: Covid Jagratha Information FolioDocument1 pageCO VI D Safely: Covid Jagratha Information FolioChellapandiNo ratings yet

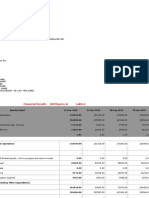

- Company Information: Financial Results (All Figures in Lakhs)Document2 pagesCompany Information: Financial Results (All Figures in Lakhs)ChellapandiNo ratings yet

- LNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareDocument2 pagesLNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareChellapandiNo ratings yet

- Sub - Request Letter For Name Correction PDFDocument1 pageSub - Request Letter For Name Correction PDFChellapandi100% (1)

- LNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareDocument2 pagesLNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareChellapandiNo ratings yet

- SR - No. Company Name Sector WeightageDocument2 pagesSR - No. Company Name Sector WeightageChellapandiNo ratings yet

- 12th Chemistry Unit 8 Model Question Paper English MediumDocument2 pages12th Chemistry Unit 8 Model Question Paper English MediumChellapandiNo ratings yet

- Information: Financial Results (All Figures in Lakhs)Document2 pagesInformation: Financial Results (All Figures in Lakhs)ChellapandiNo ratings yet

- Makati City Ordinance 2002 090H32vmTZOSSbwHa2RYGq0OWjZL9U-2zXIPH3EigH7XcBdXhmx30NqUeYAf8XMmYADocument2 pagesMakati City Ordinance 2002 090H32vmTZOSSbwHa2RYGq0OWjZL9U-2zXIPH3EigH7XcBdXhmx30NqUeYAf8XMmYAMyrna Francisco CasabonNo ratings yet

- Law Abiding Citizen (2009) BluRayExt HighDocument25 pagesLaw Abiding Citizen (2009) BluRayExt HighdamiloakinyemiNo ratings yet

- Md. Hafizur Rahman Arfin: Education ExperienceDocument1 pageMd. Hafizur Rahman Arfin: Education ExperienceMohidul Islam HeeraNo ratings yet

- Fourth Quarterly Test in Mathematics 6Document4 pagesFourth Quarterly Test in Mathematics 6Cher An JieNo ratings yet

- Osgi - Core 5.0.0 PFDDocument408 pagesOsgi - Core 5.0.0 PFDCarlos Salinas GancedoNo ratings yet

- Studio VDocument59 pagesStudio VMd. Enzamul Hoque RahulNo ratings yet

- Environmental AccountingDocument16 pagesEnvironmental AccountingMark SalvaNo ratings yet

- Sword and Sorcery 5eDocument5 pagesSword and Sorcery 5eConstantine PaleologusNo ratings yet

- TLE 10 Agri Crop Prod Q2 Module 4 Week 4Document4 pagesTLE 10 Agri Crop Prod Q2 Module 4 Week 4Jess Anthony Efondo100% (3)

- Disney Research PaperDocument8 pagesDisney Research Paperpurfcgvnd100% (1)

- Deped V San DiegoDocument1 pageDeped V San DiegoAlvaro Luis MadrazoNo ratings yet

- The Fargo Beat 10-21-10Document4 pagesThe Fargo Beat 10-21-10The Fargo BeatNo ratings yet

- 56 5 3 ChemistryDocument24 pages56 5 3 ChemistrygettotonnyNo ratings yet

- A Study of Factors Affecting Travel Decision Making of TouristsDocument10 pagesA Study of Factors Affecting Travel Decision Making of TouristsAmmarah Rajput ParhiarNo ratings yet

- El Diablo II - M. RobinsonDocument277 pagesEl Diablo II - M. RobinsonEdina Szentpéteri100% (2)

- University of . College of .. School/Department of . Syllabus For Economics (Common Course)Document7 pagesUniversity of . College of .. School/Department of . Syllabus For Economics (Common Course)Malasa EjaraNo ratings yet

- Effective Project Management Traditional, Agile, E... - (Appendix C Case Study Pizza Delivered Quickly (PDQ) )Document1 pageEffective Project Management Traditional, Agile, E... - (Appendix C Case Study Pizza Delivered Quickly (PDQ) )Arnaldo Jonathan Alvarado RuizNo ratings yet

- Business Plan Group 4Document13 pagesBusiness Plan Group 4Jennilyn EstilliosoNo ratings yet

- Duck! Rabbit! - SCRIBDDocument32 pagesDuck! Rabbit! - SCRIBDChronicleBooksNo ratings yet

- GCP Command LibrariesDocument2 pagesGCP Command LibrariesIdris AdeniranNo ratings yet

- ThesishnureferalDocument2 pagesThesishnureferalJanice Fuerzas Balmera CuragNo ratings yet

- Task Week 11 - Working at A ShopDocument9 pagesTask Week 11 - Working at A ShopRamiro OjedaNo ratings yet

- Second Quarter Lesson 4Document7 pagesSecond Quarter Lesson 4Jomarie PauleNo ratings yet