Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

12 viewsAssignment of SM

Assignment of SM

Uploaded by

M ASIFCorporation ABC has a total market value of $1 million, with $600,000 in equity from 6,000 shares of stock and $400,000 in debt from 400 bonds. Its corporate tax rate is 35%. Using the WACC formula, the weighted average cost of capital is calculated to be 4.9%, accounting for the costs of equity, debt, and tax rate. This means that for every $1 raised from investors, Corporation ABC will pay $0.049 in return.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Solution For Chapter 15Document9 pagesSolution For Chapter 15Shin Cucu100% (2)

- Solutions BD3 SM15 GEDocument9 pagesSolutions BD3 SM15 GEAgnes Chew100% (1)

- Cap 15Document9 pagesCap 15Nicol Escobar HerreraNo ratings yet

- FM Assignment 7 - Group 4Document7 pagesFM Assignment 7 - Group 4Puspita RamadhaniaNo ratings yet

- FM AssignmentDocument4 pagesFM AssignmentDuren JayaNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Cost Accounting by Matz and Usry 7th Edition Manual PDFDocument4 pagesCost Accounting by Matz and Usry 7th Edition Manual PDFM ASIF0% (1)

- Mgt201 Solved SubjectiveDocument17 pagesMgt201 Solved Subjectivezahidwahla1No ratings yet

- Some Exercises On Capital Structure and Dividend PolicyDocument3 pagesSome Exercises On Capital Structure and Dividend PolicyAdi AliNo ratings yet

- PacificDocument3 pagesPacificThanh SangNo ratings yet

- FMCF Group Assignment1Document8 pagesFMCF Group Assignment1Harshit GaurNo ratings yet

- Numerical Example:: Calculating Cost of CapitalDocument5 pagesNumerical Example:: Calculating Cost of CapitalurdestinyNo ratings yet

- Practice MC Questions CH 16Document3 pagesPractice MC Questions CH 16business docNo ratings yet

- Capital Structure and LeverageDocument51 pagesCapital Structure and LeverageGian Alexis FernandezNo ratings yet

- Cost of Capital Pretax and After-TaxDocument18 pagesCost of Capital Pretax and After-TaxBob MarshellNo ratings yet

- MGT201 Subj SHortnotesDocument15 pagesMGT201 Subj SHortnotesmaryamNo ratings yet

- Practice Problems SolutionsDocument13 pagesPractice Problems SolutionsEMILY100% (1)

- Chapter # 10 - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinDocument19 pagesChapter # 10 - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinMusa'b100% (1)

- ShitDocument6 pagesShitgejayan memanggilNo ratings yet

- WACC - Lecture NotesDocument4 pagesWACC - Lecture Noteszayan mustafaNo ratings yet

- Capital StructureDocument21 pagesCapital StructureRameen Jawad MalikNo ratings yet

- Cap Struc TheoriesjDocument19 pagesCap Struc TheoriesjPratik AhluwaliaNo ratings yet

- Solution of 16 &17Document15 pagesSolution of 16 &17Jabed GuruNo ratings yet

- Miki Niki SolutionCenterDocument4 pagesMiki Niki SolutionCenterteraz2810No ratings yet

- Tutorial 5Document4 pagesTutorial 5Mohamed HamedNo ratings yet

- CH 2 SolutionDocument7 pagesCH 2 SolutionJohnNo ratings yet

- Solution 6Document11 pagesSolution 6askdgasNo ratings yet

- Year Opening Balance Interest Paid Repayme NTDocument6 pagesYear Opening Balance Interest Paid Repayme NTChessking Siew HeeNo ratings yet

- Huzaima Jamal-1Document11 pagesHuzaima Jamal-1Fatima ZehraNo ratings yet

- Individual Assignment 1 Solutions 1Document5 pagesIndividual Assignment 1 Solutions 1JimmyNo ratings yet

- Chapter3 ExercisesDocument6 pagesChapter3 ExercisesNguyễn PhươngNo ratings yet

- Case 5Document26 pagesCase 5ibrahim ahmedNo ratings yet

- Capital Structure: Aamer ShahzadDocument52 pagesCapital Structure: Aamer Shahzadmaham qaiserNo ratings yet

- Capital Structure Decisions: Part I: Answers To End-Of-Chapter QuestionsDocument8 pagesCapital Structure Decisions: Part I: Answers To End-Of-Chapter Questionssalehin1969No ratings yet

- Capital Structure and Gearing - Solutions To The Remaining QuestionsDocument4 pagesCapital Structure and Gearing - Solutions To The Remaining QuestionsGadafi FuadNo ratings yet

- FIN 301 B Porter Rachna Exam III - Review I Soln.Document3 pagesFIN 301 B Porter Rachna Exam III - Review I Soln.Wilna Caryll V. DaulatNo ratings yet

- Meseleler 100Document9 pagesMeseleler 100Elgun ElgunNo ratings yet

- Capital StructureDocument52 pagesCapital StructureIbrar IshaqNo ratings yet

- AC6101 Lecture 3 - Capital Structure (M&M) - Xid-2956908 - 1Document28 pagesAC6101 Lecture 3 - Capital Structure (M&M) - Xid-2956908 - 1Kelsey GaoNo ratings yet

- CONFUSEDDocument1 pageCONFUSEDLâm Thanh Huyền NguyễnNo ratings yet

- Bmmf5103 861024465000 Managerial Finance - RedoDocument14 pagesBmmf5103 861024465000 Managerial Finance - Redomicu_san100% (1)

- Chapter15 LengkapDocument7 pagesChapter15 LengkapSulistyonoNo ratings yet

- Weighted Average Cost of CapitalDocument3 pagesWeighted Average Cost of Capital1abhishek1No ratings yet

- CTM Tutorial 3Document4 pagesCTM Tutorial 3crsNo ratings yet

- Chapter 13 SolutionsDocument5 pagesChapter 13 SolutionsrahidarzooNo ratings yet

- Report p2Document58 pagesReport p2Roland Jay DelfinNo ratings yet

- Tutorial Solutions Week 5Document9 pagesTutorial Solutions Week 5Mangala PrasetiaNo ratings yet

- Assignment Part A - Short Case of DavidDocument6 pagesAssignment Part A - Short Case of DavidZUBAIR100% (2)

- Capital StructureDocument54 pagesCapital StructurerupaliNo ratings yet

- Cost Capital2Document33 pagesCost Capital2hwezvamunyaradziNo ratings yet

- CH19Document8 pagesCH19Lyana Del Arroyo OliveraNo ratings yet

- Week 8 and 9 CostofcapitalandinvestmenttheoryDocument35 pagesWeek 8 and 9 CostofcapitalandinvestmenttheoryQurat SaboorNo ratings yet

- Capital Structure TheoriesDocument12 pagesCapital Structure Theoriesganesh gowthamNo ratings yet

- Evaluate Earnings Per ShareDocument1 pageEvaluate Earnings Per ShareSivakumar KanchirajuNo ratings yet

- Homework Set IvDocument3 pagesHomework Set IvSteven HouNo ratings yet

- Chapter 9 FinalizedDocument13 pagesChapter 9 FinalizedSaeed Ahmed (Father Name:Jamal Ud Din)No ratings yet

- Company Structure. Q1) A Company S Balance Sheet Shows The Following Capital StructureDocument6 pagesCompany Structure. Q1) A Company S Balance Sheet Shows The Following Capital StructureDullah AllyNo ratings yet

- Capital Structure: Basic Concepts: No TaxesDocument27 pagesCapital Structure: Basic Concepts: No TaxesamsaNo ratings yet

- Name: Curie Falentina Pandiangan Class: International MBA - 10 NIM: 20/465214/PEK/26217 Financial Management AssignmentsDocument4 pagesName: Curie Falentina Pandiangan Class: International MBA - 10 NIM: 20/465214/PEK/26217 Financial Management AssignmentsDuren JayaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Economics of Pakistan ECO 211Document2 pagesEconomics of Pakistan ECO 211M ASIFNo ratings yet

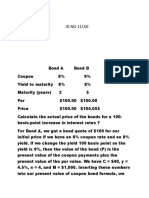

- Bond A Bond BDocument2 pagesBond A Bond BM ASIFNo ratings yet

- Merger and Acqusition Paper FinalDocument3 pagesMerger and Acqusition Paper FinalM ASIFNo ratings yet

- Major Assignment 11150Document9 pagesMajor Assignment 11150M ASIFNo ratings yet

- Firm Valuation, and Value CreationDocument3 pagesFirm Valuation, and Value CreationM ASIFNo ratings yet

- Id No 11150Document1 pageId No 11150M ASIFNo ratings yet

- Strategy Formulation: Situation Analysis & Business StrategyDocument32 pagesStrategy Formulation: Situation Analysis & Business StrategyM ASIFNo ratings yet

- Muhammad Asif Id NO 11150Document5 pagesMuhammad Asif Id NO 11150M ASIFNo ratings yet

- Id No 11150Document1 pageId No 11150M ASIFNo ratings yet

- Muhammad Asif ID NO 11150 Assignment of Mergers / Acquistions DATE 21/05/2020Document1 pageMuhammad Asif ID NO 11150 Assignment of Mergers / Acquistions DATE 21/05/2020M ASIFNo ratings yet

- Burj Bank Limited, Formerly Known As Dawood Islamic Bank Limited (DIBL), Now Part of AlDocument1 pageBurj Bank Limited, Formerly Known As Dawood Islamic Bank Limited (DIBL), Now Part of AlM ASIFNo ratings yet

- Curriculam Vitae: Irfan Ahmad (Registered Electrical Engineer With Pakistan Engineering Council)Document2 pagesCurriculam Vitae: Irfan Ahmad (Registered Electrical Engineer With Pakistan Engineering Council)M ASIFNo ratings yet

- Muhammad Asif AssignimentDocument2 pagesMuhammad Asif AssignimentM ASIFNo ratings yet

- Muhammad Umar:: As An Engineer Looking For An Environment That May Help Me To Become A ValuableDocument3 pagesMuhammad Umar:: As An Engineer Looking For An Environment That May Help Me To Become A ValuableM ASIFNo ratings yet

- Career Objective:: As An Engineer Looking For An Environment That May Help Me To Become A ValuableDocument2 pagesCareer Objective:: As An Engineer Looking For An Environment That May Help Me To Become A ValuableM ASIFNo ratings yet

- Muhammad Asif AssignimentDocument2 pagesMuhammad Asif AssignimentM ASIFNo ratings yet

Assignment of SM

Assignment of SM

Uploaded by

M ASIF0 ratings0% found this document useful (0 votes)

12 views1 pageCorporation ABC has a total market value of $1 million, with $600,000 in equity from 6,000 shares of stock and $400,000 in debt from 400 bonds. Its corporate tax rate is 35%. Using the WACC formula, the weighted average cost of capital is calculated to be 4.9%, accounting for the costs of equity, debt, and tax rate. This means that for every $1 raised from investors, Corporation ABC will pay $0.049 in return.

Original Description:

Original Title

ASSIGNMENT OF SM.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCorporation ABC has a total market value of $1 million, with $600,000 in equity from 6,000 shares of stock and $400,000 in debt from 400 bonds. Its corporate tax rate is 35%. Using the WACC formula, the weighted average cost of capital is calculated to be 4.9%, accounting for the costs of equity, debt, and tax rate. This means that for every $1 raised from investors, Corporation ABC will pay $0.049 in return.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views1 pageAssignment of SM

Assignment of SM

Uploaded by

M ASIFCorporation ABC has a total market value of $1 million, with $600,000 in equity from 6,000 shares of stock and $400,000 in debt from 400 bonds. Its corporate tax rate is 35%. Using the WACC formula, the weighted average cost of capital is calculated to be 4.9%, accounting for the costs of equity, debt, and tax rate. This means that for every $1 raised from investors, Corporation ABC will pay $0.049 in return.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

MUHAMMAD ASIF

ID NO 11150

ASSIGNMENT OF STRATEGIC MANAGMENT

DATE 21/05/2020

Corporation ABS’s total market value is ( $600,000 equity + $400,000 debt )=$1 million and

its corporate tax rate is 35%.

WAAC formula = Wd.Rd (1-T) +Wps.Rps+We.Re

Wd= (debt/ total capital)

Rate of return = 0.06%

Cost of debt =0.05%

Corporate Tax = 35%

400 bonds for $ 1.000 = 400,000

6,000 shares of stock at $100=600,000

WACC=$600,000/$1,000,000) x.06) +($400,000/$1,000,000) x .05) *(1-0.35)=0.049=4.9%.

Corporation ABC’s weighted average cost of capital is 4.9% it show that for every $1

corporation ABC raises from investors, it will pay its investors almost 50.05 in return.

You might also like

- Solution For Chapter 15Document9 pagesSolution For Chapter 15Shin Cucu100% (2)

- Solutions BD3 SM15 GEDocument9 pagesSolutions BD3 SM15 GEAgnes Chew100% (1)

- Cap 15Document9 pagesCap 15Nicol Escobar HerreraNo ratings yet

- FM Assignment 7 - Group 4Document7 pagesFM Assignment 7 - Group 4Puspita RamadhaniaNo ratings yet

- FM AssignmentDocument4 pagesFM AssignmentDuren JayaNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Cost Accounting by Matz and Usry 7th Edition Manual PDFDocument4 pagesCost Accounting by Matz and Usry 7th Edition Manual PDFM ASIF0% (1)

- Mgt201 Solved SubjectiveDocument17 pagesMgt201 Solved Subjectivezahidwahla1No ratings yet

- Some Exercises On Capital Structure and Dividend PolicyDocument3 pagesSome Exercises On Capital Structure and Dividend PolicyAdi AliNo ratings yet

- PacificDocument3 pagesPacificThanh SangNo ratings yet

- FMCF Group Assignment1Document8 pagesFMCF Group Assignment1Harshit GaurNo ratings yet

- Numerical Example:: Calculating Cost of CapitalDocument5 pagesNumerical Example:: Calculating Cost of CapitalurdestinyNo ratings yet

- Practice MC Questions CH 16Document3 pagesPractice MC Questions CH 16business docNo ratings yet

- Capital Structure and LeverageDocument51 pagesCapital Structure and LeverageGian Alexis FernandezNo ratings yet

- Cost of Capital Pretax and After-TaxDocument18 pagesCost of Capital Pretax and After-TaxBob MarshellNo ratings yet

- MGT201 Subj SHortnotesDocument15 pagesMGT201 Subj SHortnotesmaryamNo ratings yet

- Practice Problems SolutionsDocument13 pagesPractice Problems SolutionsEMILY100% (1)

- Chapter # 10 - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinDocument19 pagesChapter # 10 - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinMusa'b100% (1)

- ShitDocument6 pagesShitgejayan memanggilNo ratings yet

- WACC - Lecture NotesDocument4 pagesWACC - Lecture Noteszayan mustafaNo ratings yet

- Capital StructureDocument21 pagesCapital StructureRameen Jawad MalikNo ratings yet

- Cap Struc TheoriesjDocument19 pagesCap Struc TheoriesjPratik AhluwaliaNo ratings yet

- Solution of 16 &17Document15 pagesSolution of 16 &17Jabed GuruNo ratings yet

- Miki Niki SolutionCenterDocument4 pagesMiki Niki SolutionCenterteraz2810No ratings yet

- Tutorial 5Document4 pagesTutorial 5Mohamed HamedNo ratings yet

- CH 2 SolutionDocument7 pagesCH 2 SolutionJohnNo ratings yet

- Solution 6Document11 pagesSolution 6askdgasNo ratings yet

- Year Opening Balance Interest Paid Repayme NTDocument6 pagesYear Opening Balance Interest Paid Repayme NTChessking Siew HeeNo ratings yet

- Huzaima Jamal-1Document11 pagesHuzaima Jamal-1Fatima ZehraNo ratings yet

- Individual Assignment 1 Solutions 1Document5 pagesIndividual Assignment 1 Solutions 1JimmyNo ratings yet

- Chapter3 ExercisesDocument6 pagesChapter3 ExercisesNguyễn PhươngNo ratings yet

- Case 5Document26 pagesCase 5ibrahim ahmedNo ratings yet

- Capital Structure: Aamer ShahzadDocument52 pagesCapital Structure: Aamer Shahzadmaham qaiserNo ratings yet

- Capital Structure Decisions: Part I: Answers To End-Of-Chapter QuestionsDocument8 pagesCapital Structure Decisions: Part I: Answers To End-Of-Chapter Questionssalehin1969No ratings yet

- Capital Structure and Gearing - Solutions To The Remaining QuestionsDocument4 pagesCapital Structure and Gearing - Solutions To The Remaining QuestionsGadafi FuadNo ratings yet

- FIN 301 B Porter Rachna Exam III - Review I Soln.Document3 pagesFIN 301 B Porter Rachna Exam III - Review I Soln.Wilna Caryll V. DaulatNo ratings yet

- Meseleler 100Document9 pagesMeseleler 100Elgun ElgunNo ratings yet

- Capital StructureDocument52 pagesCapital StructureIbrar IshaqNo ratings yet

- AC6101 Lecture 3 - Capital Structure (M&M) - Xid-2956908 - 1Document28 pagesAC6101 Lecture 3 - Capital Structure (M&M) - Xid-2956908 - 1Kelsey GaoNo ratings yet

- CONFUSEDDocument1 pageCONFUSEDLâm Thanh Huyền NguyễnNo ratings yet

- Bmmf5103 861024465000 Managerial Finance - RedoDocument14 pagesBmmf5103 861024465000 Managerial Finance - Redomicu_san100% (1)

- Chapter15 LengkapDocument7 pagesChapter15 LengkapSulistyonoNo ratings yet

- Weighted Average Cost of CapitalDocument3 pagesWeighted Average Cost of Capital1abhishek1No ratings yet

- CTM Tutorial 3Document4 pagesCTM Tutorial 3crsNo ratings yet

- Chapter 13 SolutionsDocument5 pagesChapter 13 SolutionsrahidarzooNo ratings yet

- Report p2Document58 pagesReport p2Roland Jay DelfinNo ratings yet

- Tutorial Solutions Week 5Document9 pagesTutorial Solutions Week 5Mangala PrasetiaNo ratings yet

- Assignment Part A - Short Case of DavidDocument6 pagesAssignment Part A - Short Case of DavidZUBAIR100% (2)

- Capital StructureDocument54 pagesCapital StructurerupaliNo ratings yet

- Cost Capital2Document33 pagesCost Capital2hwezvamunyaradziNo ratings yet

- CH19Document8 pagesCH19Lyana Del Arroyo OliveraNo ratings yet

- Week 8 and 9 CostofcapitalandinvestmenttheoryDocument35 pagesWeek 8 and 9 CostofcapitalandinvestmenttheoryQurat SaboorNo ratings yet

- Capital Structure TheoriesDocument12 pagesCapital Structure Theoriesganesh gowthamNo ratings yet

- Evaluate Earnings Per ShareDocument1 pageEvaluate Earnings Per ShareSivakumar KanchirajuNo ratings yet

- Homework Set IvDocument3 pagesHomework Set IvSteven HouNo ratings yet

- Chapter 9 FinalizedDocument13 pagesChapter 9 FinalizedSaeed Ahmed (Father Name:Jamal Ud Din)No ratings yet

- Company Structure. Q1) A Company S Balance Sheet Shows The Following Capital StructureDocument6 pagesCompany Structure. Q1) A Company S Balance Sheet Shows The Following Capital StructureDullah AllyNo ratings yet

- Capital Structure: Basic Concepts: No TaxesDocument27 pagesCapital Structure: Basic Concepts: No TaxesamsaNo ratings yet

- Name: Curie Falentina Pandiangan Class: International MBA - 10 NIM: 20/465214/PEK/26217 Financial Management AssignmentsDocument4 pagesName: Curie Falentina Pandiangan Class: International MBA - 10 NIM: 20/465214/PEK/26217 Financial Management AssignmentsDuren JayaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Economics of Pakistan ECO 211Document2 pagesEconomics of Pakistan ECO 211M ASIFNo ratings yet

- Bond A Bond BDocument2 pagesBond A Bond BM ASIFNo ratings yet

- Merger and Acqusition Paper FinalDocument3 pagesMerger and Acqusition Paper FinalM ASIFNo ratings yet

- Major Assignment 11150Document9 pagesMajor Assignment 11150M ASIFNo ratings yet

- Firm Valuation, and Value CreationDocument3 pagesFirm Valuation, and Value CreationM ASIFNo ratings yet

- Id No 11150Document1 pageId No 11150M ASIFNo ratings yet

- Strategy Formulation: Situation Analysis & Business StrategyDocument32 pagesStrategy Formulation: Situation Analysis & Business StrategyM ASIFNo ratings yet

- Muhammad Asif Id NO 11150Document5 pagesMuhammad Asif Id NO 11150M ASIFNo ratings yet

- Id No 11150Document1 pageId No 11150M ASIFNo ratings yet

- Muhammad Asif ID NO 11150 Assignment of Mergers / Acquistions DATE 21/05/2020Document1 pageMuhammad Asif ID NO 11150 Assignment of Mergers / Acquistions DATE 21/05/2020M ASIFNo ratings yet

- Burj Bank Limited, Formerly Known As Dawood Islamic Bank Limited (DIBL), Now Part of AlDocument1 pageBurj Bank Limited, Formerly Known As Dawood Islamic Bank Limited (DIBL), Now Part of AlM ASIFNo ratings yet

- Curriculam Vitae: Irfan Ahmad (Registered Electrical Engineer With Pakistan Engineering Council)Document2 pagesCurriculam Vitae: Irfan Ahmad (Registered Electrical Engineer With Pakistan Engineering Council)M ASIFNo ratings yet

- Muhammad Asif AssignimentDocument2 pagesMuhammad Asif AssignimentM ASIFNo ratings yet

- Muhammad Umar:: As An Engineer Looking For An Environment That May Help Me To Become A ValuableDocument3 pagesMuhammad Umar:: As An Engineer Looking For An Environment That May Help Me To Become A ValuableM ASIFNo ratings yet

- Career Objective:: As An Engineer Looking For An Environment That May Help Me To Become A ValuableDocument2 pagesCareer Objective:: As An Engineer Looking For An Environment That May Help Me To Become A ValuableM ASIFNo ratings yet

- Muhammad Asif AssignimentDocument2 pagesMuhammad Asif AssignimentM ASIFNo ratings yet