Professional Documents

Culture Documents

Daily Notes: Metropolitan Bank & Trust Com. (pse:MBT)

Daily Notes: Metropolitan Bank & Trust Com. (pse:MBT)

Uploaded by

junOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Notes: Metropolitan Bank & Trust Com. (pse:MBT)

Daily Notes: Metropolitan Bank & Trust Com. (pse:MBT)

Uploaded by

junCopyright:

Available Formats

Daily Notes INDEX

DAILY MARKET STATS

VALUE PTS PCT YTD

Tuesday, July 07, 2020

PSEI 6,328.41 -44.25 -0.69% -19.02%

Reference: Claire T. Alviar ALL 3,702.17 -15.76 -0.42% -20.38%

Metropolitan Bank & Trust Com. [pse:MBT] FIN 1,239.71 -27.85 -2.20% -33.48%

IND 7,929.99 -20.74 -0.26% -17.70%

BUY TP: 49.90 HDG 6,532.53 -33.46 -0.51% -13.96%

PRO 3,140.75 -28.93 -0.91% -24.40%

SVC 1,451.07 18.99 1.33% -5.23%

STOCK SNIPPETS

M&O 5,458.91 152.07 2.87% -32.54%

Last Traded Price (PHP) 37.90

ASIAN MARKETS

P/E Ratio (x) 6.07 • Attractive valuations (AS 03:00 PM)

P/B Ratio (x) 0.55 • Prudent balance sheet INDEX VALUE PTS PCT YTD

Support 36.52 • Increasing footprint to digital space Nikkei 225 22,714.44 407.96 1.83% -3.98%

Reference: Piper Chaucer E. Tan Hang Seng 26,253.12 880.00 3.47% -6.87%

Resistance 40.00

Shanghai 3,328.68 175.87 5.58% 9.13%

MTD Performance (%) 2.43

KOSPI 2,187.93 35.52 1.65% -0.44%

YTD Performance (%) -42.84

HCM 859.97 12.36 1.46% -10.51%

SET 1,372.27 -1.86% -0.14% -13.14%

STI 2,687.80 34.86 1.31% -16.60%

OUR VIEW KLCI 1,573.46 20.81 1.34% -0.96%

JCI 4,991.82 18.03 0.36% -20.76%

INTERNALS

VOL 1,065,953,666 ADV 102

VAL 6,141,081,321.64 DEC 103

BLOCK 344,706,800.12 UNCH 43

Buy on dips as we expect a rebound after the market ended lower yesterday, while investors await

June inflation rate data today. The benign inflation outlook could spur optimism, look for consumer

stocks since this sector will benefit the most on low and steady rise of goods’ prices. We forecast

June inflation rate at 2.3%, slightly higher than 2.1% in May.

TOP 5 GAINERS TOP 5 LOSERS

BLOOM 4.06% FGEN –4.28%

MEG 2.52% SECB –3.38%

MER 1.73% MBT –2.70%

Source: TradingView

TEL 1.71% BDO –2.45%

MARKET WRAP GLO 1.42% SMPH –2.10%

OTHER MARKET SNAPSHOTS

PSEi closed lower reacting on the spike of additional coronavirus cases over the weekend, which Brent Crude 43.45 1.52%

recorded 2,434 cases -the highest in a single day. This brought negative sentiment in the market as

WTI Crude 40.83 0.44%

mounting cases could force the government to impose stricter guidelines which is detrimental to

economy. But we believe that, the Covid-19 cases should be contained first before the economy Gold 1,785.25 -0.17%

gets back to normal. Silver 18.36 0.25%

Copper 2.75 1.25%

The latest forecast of Moody's Investors Service that the economy is expected to shrink by 4.5%

US$:Php 49.37 -0.39%

this year, weighed on the sentiment as well. It is deeper than the 2-3.4% projection of the govern-

ment, which could mean that Moody's expects more damage to the businesses/economy amid the US 10 Yr Yield 0.68% -1.00%

pandemic. Last minute bargain hunting last Friday also triggered profit taking in the session.

Philstocks Research 2020 1 |Page

LOCAL NEWS Philstocks Research

JUSTINO B. CALAYCAY, JR

DOF plans to ban the online sales of cigarettes and alcoholic beverages. According to the AVP-Head, Research & Engagement

Finance Secretary Carlos Dominguez , the Department of Finance may ban selling of cigarettes and +63 (2) 8588-1962

liquors online as it is hard to ensure that they are not being sold to minors. In Lazada, one of the

largest online shopping platform, some sellers are offering cigarettes packs at almost 50% off, the JAPHET LOUIS O. TANTIANGCO

department will get in touch with the platform to verify if the products are fake or counterfeit. The Sr. Research Analyst

government recorded a 39% decline of sin tax collections in January-May period. +63 (2) 8588-1927

If this happened, liquor and cigarette manufacturers [SMC, GSMI, LTG, EMP] would have lower PIPER CHAUCER E. TAN

earnings given the lesser distribution channel amid the current online selling trend. We think that the Engagement Officer/Research Associate

department should impose stricter rules or verification process just to avoid selling these products to +63 (2) 8588-1928

minors, since omitting this channel may weigh further on manufacturers amid weaker demand due to

CLAIRE T. ALVIAR

liquor ban.

Research Associate

+63 (2) 8588-1925

GLOBAL NEWS

Ground Floor, East Tower

Two states in the US hit a record high of daily Covid-19 cases on Fourth of July. Florida and PSE Center, Tektite Towers

Texas have reported a surge on daily coronavirus cases, with 11,445 and 8,258 new cases, Ortigas Center, Pasig City

respectively. Despite the record-high cases, Gov. Ron DeSantis still insists not to close businesses PHILIPPINES

and refuses to order a statewide mask mandate.

DISCLAIMER

This will be detrimental to the health of citizens, as well as to the economy. The economy will not be The opinion, views and recommendations

back to normal as long as the virus lingers. People will be afraid to do more activities to support the contained in this material were prepared by

economy, and businesses may cut operations due to weaker demand. OFWs in the US could lose the Philstocks Research Team, individually

jobs, which would hit remittance inflow in the country. and separately, based on their specific

sector assignments, contextual framework,

personal judgments, biases and prejudices,

time horizons, methods and other factors.

The reader is enjoined to take this into

COMPANY NEWS account when perusing and considering the

contents of the report as a basis for their

stock investment or trading decisions.

BUY Metropolitan Bank & Trust Company [pse:MBT] Furthermore, projection made and presented

in this report may change or be updated in

MBT plans to issue a Reg S only 5.5-year USD-denominated Senior Unsecured Notes. The proceeds between the periods of release. Ergo, the

of which will be used to refinance existing indebtedness. validity of the projections and/or estimates

mentioned are good as of the date indicated

“It has been on the trend among banks right now to tap the fixed income market for fund raising, what I and may be changed without immediate

see here is that companies are taking advantage of cheap cost of money amid series of rate cuts and notification.

policy easing by the Central Bank and this is a way for banks to combat the uncertainties brought by This report is primarily intended for

COVID-19 and also this is a way for companies to have an ample cash supply where the expectation information purposes only and should not be

credit will rise once COVID-19 pandemic diminishes over time.” -Piper Chaucer E. Tan considered as an exclusive basis for making

investment decision. The recommendations

Support is at P36.52 while resistance is peg at P40.00. Watch for the buying signal of EMAs, if the 20- contained in this report is not tailored-fit any

day crosses above the 50-day EMA. particular investor type, situation, or

objective and must not be taken as such.

Target Price: P49.90 Determining the suitability of an investment

remains within the province of the investor.

Our estimates are based on information we

believe to be reliable. Nevertheless, nothing

in this report shall be construed as an offer

of a guarantee of a return of any kind and at

any time.

Rating Definitions:

BUY - More than 15% upside base on the target price

in the next 9-12 months

HOLD - 15% or less upside or downside in the next

9-12 months

SELL - More than 15% downside base on the target

price in the next 9-12 months

TRADE - A potential 10% and above short-term upside

Source: TradingView base on entry price and selling price.

Philstocks Research 2020 2 |Page

You might also like

- 2014 Nissan Maxima 42297 TMDocument195 pages2014 Nissan Maxima 42297 TMPHÁT NGUYỄN THẾNo ratings yet

- Sky & Lakes Auto Sales & Service Centre Business Plan - 28.02.2021 PDFDocument90 pagesSky & Lakes Auto Sales & Service Centre Business Plan - 28.02.2021 PDFHerbert Bushara75% (4)

- Daily Notes: Eagle Cement Corporation (pse:EAGLE)Document2 pagesDaily Notes: Eagle Cement Corporation (pse:EAGLE)Anonymous xcFcOgMiNo ratings yet

- On Balance - Daily Notes For June 23 2020Document2 pagesOn Balance - Daily Notes For June 23 2020Jade SantosNo ratings yet

- Daily Notes: SM Investments Corporation (pse:SM)Document2 pagesDaily Notes: SM Investments Corporation (pse:SM)Anonymous xcFcOgMiNo ratings yet

- Daily Notes: Holcim Philippines, Inc. (pse:HLCM)Document2 pagesDaily Notes: Holcim Philippines, Inc. (pse:HLCM)Anonymous xcFcOgMiNo ratings yet

- Daily Notes: Ginebra San Miguel, Inc. (pse:GSMI)Document2 pagesDaily Notes: Ginebra San Miguel, Inc. (pse:GSMI)Anonymous xcFcOgMiNo ratings yet

- Daily Notes: Philippine Seven Corporation (pse:SEVN)Document2 pagesDaily Notes: Philippine Seven Corporation (pse:SEVN)junNo ratings yet

- Daily Notes: Global-Estate Resorts, Inc. (pse:GERI)Document2 pagesDaily Notes: Global-Estate Resorts, Inc. (pse:GERI)junNo ratings yet

- The Tea Times: Daily Updates On Financial MarketsDocument1 pageThe Tea Times: Daily Updates On Financial Marketsgurudev21No ratings yet

- Daily Notes: Wilcon Depot, Inc. (pse:WLCON)Document2 pagesDaily Notes: Wilcon Depot, Inc. (pse:WLCON)Anonymous xcFcOgMiNo ratings yet

- Financials: Stock Market Price P/B Ave. Target Price Enter Lower Than Possible %changeDocument8 pagesFinancials: Stock Market Price P/B Ave. Target Price Enter Lower Than Possible %changeAndre Mikhail ObierezNo ratings yet

- Daily Notes: Metro Pacific Investments Corp. (pse:MPI)Document2 pagesDaily Notes: Metro Pacific Investments Corp. (pse:MPI)junNo ratings yet

- Mika Securities LTD.: 1203260073546191 29-Aug-2021 102554 Md. Wazidur RahmanDocument2 pagesMika Securities LTD.: 1203260073546191 29-Aug-2021 102554 Md. Wazidur RahmanImran KhanNo ratings yet

- PHINTAS Weekly Report - 20231009Document5 pagesPHINTAS Weekly Report - 20231009Mas Anggoro Tri AtmojoNo ratings yet

- Weekly Notes: BDO Unibank, Inc. (PSE: BDO)Document3 pagesWeekly Notes: BDO Unibank, Inc. (PSE: BDO)junNo ratings yet

- Weekly Report - Xxi - May 23 To 27, 2011Document3 pagesWeekly Report - Xxi - May 23 To 27, 2011JC CalaycayNo ratings yet

- Order: Signal: Tickers:: My Presets Ticker Asc None (All StocksDocument1 pageOrder: Signal: Tickers:: My Presets Ticker Asc None (All StocksAshraful AlamNo ratings yet

- Equity Research Report 13 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 13 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Top Stories:: TUE 22 SEP 2020Document5 pagesTop Stories:: TUE 22 SEP 2020Elcano MirandaNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument8 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- Top Stories:: Ceb: Ceb Increases Flights To Boracay and Bohol Rrhi: Growsari Raises Us$30Mil in FundingDocument3 pagesTop Stories:: Ceb: Ceb Increases Flights To Boracay and Bohol Rrhi: Growsari Raises Us$30Mil in FundingJajahinaNo ratings yet

- Equity Research Report 14 August 2018 Ways2CapitalDocument17 pagesEquity Research Report 14 August 2018 Ways2CapitalWays2CapitalNo ratings yet

- January 29, 2010: Market OverviewDocument9 pagesJanuary 29, 2010: Market OverviewValuEngine.comNo ratings yet

- Interest Income Reasonableness Test:: CY PY1Document2 pagesInterest Income Reasonableness Test:: CY PY1Adam JamesNo ratings yet

- Slumped, Again: Revenues in Billions of Dollars Earnings Per ShareDocument5 pagesSlumped, Again: Revenues in Billions of Dollars Earnings Per ShareAndre SetiawanNo ratings yet

- IDX 2nd Session Review 151223Document2 pagesIDX 2nd Session Review 151223Fb BandingNo ratings yet

- Of Steam: .DJI 12,018.63 (-17.90) .SPX 1,293.77 (-4.61) .IXIC 2,683.87 (-8.22)Document4 pagesOf Steam: .DJI 12,018.63 (-17.90) .SPX 1,293.77 (-4.61) .IXIC 2,683.87 (-8.22)Andre SetiawanNo ratings yet

- Project RequirementDocument4 pagesProject RequirementAlina Binte EjazNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument8 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- ValueResearchFundcard NiftyJuniorBeES 2010aug10Document6 pagesValueResearchFundcard NiftyJuniorBeES 2010aug10GNo ratings yet

- ValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09Document6 pagesValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09ksrygNo ratings yet

- Weekly Stock Recommendation - May 23rd 2022Document7 pagesWeekly Stock Recommendation - May 23rd 2022Ganiyu AzeezNo ratings yet

- Equity Research Report 20 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 20 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- High Brow Market Research Investment Advisor Private LimitedDocument16 pagesHigh Brow Market Research Investment Advisor Private LimitedWays2CapitalNo ratings yet

- OMSEC Morning Note 07 09 2022Document6 pagesOMSEC Morning Note 07 09 2022Ropafadzo KwarambaNo ratings yet

- OMSEC Morning Note 01 09 2022Document6 pagesOMSEC Morning Note 01 09 2022Ropafadzo KwarambaNo ratings yet

- ValueResearchFundcard HDFCEquity 2012jul30Document6 pagesValueResearchFundcard HDFCEquity 2012jul30Rachit GoyalNo ratings yet

- Equity Research Report 27 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 27 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- 9jan 17Document3 pages9jan 17asifNo ratings yet

- Pre-Open MarketDocument3 pagesPre-Open Marketkk ravi KumarNo ratings yet

- Daily 27 December 2019Document2 pagesDaily 27 December 2019hope mfungweNo ratings yet

- Quadro Diário de Rentabilidade: GestoresDocument6 pagesQuadro Diário de Rentabilidade: GestoresGabriela DinizNo ratings yet

- Top Story:: WLCON: WLCON To Have 63 Stores by End-2020Document3 pagesTop Story:: WLCON: WLCON To Have 63 Stores by End-2020JNo ratings yet

- Pi Daily Strategy 24112023 SumDocument7 pagesPi Daily Strategy 24112023 SumPateera Chananti PhoomwanitNo ratings yet

- Orporate Ews: .DJI 12,350.60 (+71.60) .SPX 1,328.26 (+8.82) .IXIC 2,776.79 (+19.90)Document4 pagesOrporate Ews: .DJI 12,350.60 (+71.60) .SPX 1,328.26 (+8.82) .IXIC 2,776.79 (+19.90)Andre SetiawanNo ratings yet

- L&TIndiaValueFund 2017jul25Document4 pagesL&TIndiaValueFund 2017jul25Krishnan ChockalingamNo ratings yet

- Income Paystub TemplateDocument1 pageIncome Paystub Templatetokahontas85No ratings yet

- wk38 Sep2022mktwatchDocument3 pageswk38 Sep2022mktwatchcraftersxNo ratings yet

- Indonesia Technical Pointer: Mixed in The RangeDocument9 pagesIndonesia Technical Pointer: Mixed in The RangeindramaNo ratings yet

- OMSEC Morning Note 13 09 2022Document6 pagesOMSEC Morning Note 13 09 2022Ropafadzo KwarambaNo ratings yet

- Disenchanted: .DJI 12,760.36 (+75.68) .SPX 1,357.16 (+10.87) .IXIC 2,871.89 (+28.64)Document5 pagesDisenchanted: .DJI 12,760.36 (+75.68) .SPX 1,357.16 (+10.87) .IXIC 2,871.89 (+28.64)Andre SetiawanNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument11 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- Asian Paints (Autosaved) 2Document32,767 pagesAsian Paints (Autosaved) 2niteshjaiswal8240No ratings yet

- Pedzisai ZuzeDocument1 pagePedzisai ZuzeLainoNo ratings yet

- Fundcard: ICICI Prudential Bluechip FundDocument4 pagesFundcard: ICICI Prudential Bluechip FundChittaNo ratings yet

- Other NewsDocument3 pagesOther NewsElcano MirandaNo ratings yet

- Up On M&A Speculation: Revenues in Billions of Dollars Earnings Per ShareDocument5 pagesUp On M&A Speculation: Revenues in Billions of Dollars Earnings Per ShareAndre SetiawanNo ratings yet

- Comparison - Ratios - Tyre - DistributionDocument15 pagesComparison - Ratios - Tyre - DistributionParehjuiNo ratings yet

- Top Story:: CHP: Parent To Streamline Operations in The Next 3 YearsDocument4 pagesTop Story:: CHP: Parent To Streamline Operations in The Next 3 YearsJNo ratings yet

- Des 23Document2 pagesDes 23eria rachmawatyNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsNo ratings yet

- Relative Strength DefinedDocument8 pagesRelative Strength DefinedjunNo ratings yet

- Understanding Market Capitalization Versus Market ValueDocument8 pagesUnderstanding Market Capitalization Versus Market ValuejunNo ratings yet

- Commodity Charts Examples Stock Charts ExamplesDocument1 pageCommodity Charts Examples Stock Charts ExamplesjunNo ratings yet

- (Chart Examples of Head and Shoulders Patterns Using Commodity Charts.) (Stock Charts.)Document2 pages(Chart Examples of Head and Shoulders Patterns Using Commodity Charts.) (Stock Charts.)junNo ratings yet

- Understanding Small Cap and Big Cap StocksDocument10 pagesUnderstanding Small Cap and Big Cap StocksjunNo ratings yet

- Daily Notes: Metro Pacific Investments Corp. (pse:MPI)Document2 pagesDaily Notes: Metro Pacific Investments Corp. (pse:MPI)junNo ratings yet

- Commodity Charts Examples Stock Charts Examples: CSC FormDocument1 pageCommodity Charts Examples Stock Charts Examples: CSC FormjunNo ratings yet

- Daily Notes: Philippine Seven Corporation (pse:SEVN)Document2 pagesDaily Notes: Philippine Seven Corporation (pse:SEVN)junNo ratings yet

- Daily Notes: Global-Estate Resorts, Inc. (pse:GERI)Document2 pagesDaily Notes: Global-Estate Resorts, Inc. (pse:GERI)junNo ratings yet

- Weekly Notes: BDO Unibank, Inc. (PSE: BDO)Document3 pagesWeekly Notes: BDO Unibank, Inc. (PSE: BDO)junNo ratings yet

- Mia Electric Uk Brochure 2013Document39 pagesMia Electric Uk Brochure 2013Sasa FriedmanNo ratings yet

- Title Facts Issue/S Ruling Doctrine GR No. 79777: PD 27, Eos 228Document26 pagesTitle Facts Issue/S Ruling Doctrine GR No. 79777: PD 27, Eos 228Carla VirtucioNo ratings yet

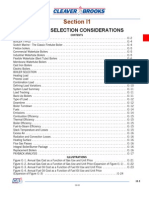

- Section I1: Boiler Selection ConsiderationsDocument28 pagesSection I1: Boiler Selection Considerationsfructora100% (1)

- Experiment 13 PPDocument3 pagesExperiment 13 PPMohit Patil (PC)No ratings yet

- The Importance of Engineering To SocietyDocument29 pagesThe Importance of Engineering To Societybarat378680% (10)

- Mortgage Loan Disclosure Statement - GFEDocument3 pagesMortgage Loan Disclosure Statement - GFEafncorpNo ratings yet

- Trainers - Methodology - 1 - Portfolio - Doc UnfinishedDocument123 pagesTrainers - Methodology - 1 - Portfolio - Doc UnfinishedHarris MalakiNo ratings yet

- Physics HSC Sa 2010 PDFDocument20 pagesPhysics HSC Sa 2010 PDFAmelia RahmawatiNo ratings yet

- Edinzon Fernando Yangua-Calva, A088 190 231 (BIA Nov. 28, 2011)Document5 pagesEdinzon Fernando Yangua-Calva, A088 190 231 (BIA Nov. 28, 2011)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Energy Recovery Council: 2016 Directory of Waste-To-Energy FacilitiesDocument72 pagesEnergy Recovery Council: 2016 Directory of Waste-To-Energy FacilitiesJorge Martinez100% (1)

- Pro Kabaddi League - WikipediaDocument8 pagesPro Kabaddi League - WikipediaDivyank TikkhaNo ratings yet

- Creating MDI Applications and Menu ItemsDocument6 pagesCreating MDI Applications and Menu ItemsMyo Thi HaNo ratings yet

- Furuno GP 1650w Manuales de Servicio PDFDocument96 pagesFuruno GP 1650w Manuales de Servicio PDFPablo Victor EspinozaNo ratings yet

- Rate - Analysis - MaterialsDocument31 pagesRate - Analysis - MaterialsnileshNo ratings yet

- Pakistan PRSP HealthDocument33 pagesPakistan PRSP HealthTanveerNo ratings yet

- Hands On Database 2Nd Edition Steve Conger Solutions Manual Full Chapter PDFDocument36 pagesHands On Database 2Nd Edition Steve Conger Solutions Manual Full Chapter PDFjames.williams932100% (14)

- Overview of DPP Basic Program Self-Paced Elearning CourseDocument44 pagesOverview of DPP Basic Program Self-Paced Elearning CourseAzwar NasutionNo ratings yet

- Fressoli, Dias, Thomas Innovation and Inclusive Develpment in South AmericaDocument16 pagesFressoli, Dias, Thomas Innovation and Inclusive Develpment in South AmericaLorena Paz100% (1)

- Independent Sample T TestDocument27 pagesIndependent Sample T TestManuel YeboahNo ratings yet

- Sewerage System NotesDocument34 pagesSewerage System NotesArshdeep Ashu100% (2)

- EURME 303 (Applied Termo Dynamics 1)Document2 pagesEURME 303 (Applied Termo Dynamics 1)Sri KayNo ratings yet

- Lab 4 Problem Set KeyDocument4 pagesLab 4 Problem Set KeyHirajNo ratings yet

- Name of PracticalDocument3 pagesName of PracticalMiya SharmaNo ratings yet

- Deed of Sale of A Portion of A Parcel of A Registered Land, Manuela To RONEDocument3 pagesDeed of Sale of A Portion of A Parcel of A Registered Land, Manuela To RONEEarl Russell S PaulicanNo ratings yet

- Time Travel: Colonization vs. Globalization: GAC008 Assessment Event 4: Academic Research EssayDocument4 pagesTime Travel: Colonization vs. Globalization: GAC008 Assessment Event 4: Academic Research EssayMiguel BrionesNo ratings yet

- Portfolio Channel BeginnersDocument9 pagesPortfolio Channel BeginnersFerenc BárándiNo ratings yet

- 08-CAB2019 - Part1 Notes - To - FS PDFDocument20 pages08-CAB2019 - Part1 Notes - To - FS PDFJoy AcostaNo ratings yet

- Values and Ethics BBA Unit 1Document23 pagesValues and Ethics BBA Unit 1Gayatri ChopraNo ratings yet