Professional Documents

Culture Documents

Daily Notes: Metro Pacific Investments Corp. (pse:MPI)

Daily Notes: Metro Pacific Investments Corp. (pse:MPI)

Uploaded by

junCopyright:

Available Formats

You might also like

- Gap Analysis CAP 437 6th - 7th EditionsDocument5 pagesGap Analysis CAP 437 6th - 7th EditionsnautelNo ratings yet

- Beware 03122019-1en PDFDocument14 pagesBeware 03122019-1en PDFJose Castro0% (1)

- CSC-211 Multifunction Protection IED Technical Application Manual - V1.01 PDFDocument341 pagesCSC-211 Multifunction Protection IED Technical Application Manual - V1.01 PDFengrdavi Davidean Flores100% (2)

- Daily Notes: Wilcon Depot, Inc. (pse:WLCON)Document2 pagesDaily Notes: Wilcon Depot, Inc. (pse:WLCON)Anonymous xcFcOgMiNo ratings yet

- Weekly Notes: BDO Unibank, Inc. (PSE: BDO)Document3 pagesWeekly Notes: BDO Unibank, Inc. (PSE: BDO)junNo ratings yet

- On Balance - Daily Notes For June 23 2020Document2 pagesOn Balance - Daily Notes For June 23 2020Jade SantosNo ratings yet

- Daily Notes: Ginebra San Miguel, Inc. (pse:GSMI)Document2 pagesDaily Notes: Ginebra San Miguel, Inc. (pse:GSMI)Anonymous xcFcOgMiNo ratings yet

- Daily Notes: Eagle Cement Corporation (pse:EAGLE)Document2 pagesDaily Notes: Eagle Cement Corporation (pse:EAGLE)Anonymous xcFcOgMiNo ratings yet

- Daily Notes: Metropolitan Bank & Trust Com. (pse:MBT)Document2 pagesDaily Notes: Metropolitan Bank & Trust Com. (pse:MBT)junNo ratings yet

- Daily Notes: SM Investments Corporation (pse:SM)Document2 pagesDaily Notes: SM Investments Corporation (pse:SM)Anonymous xcFcOgMiNo ratings yet

- Daily Notes: Holcim Philippines, Inc. (pse:HLCM)Document2 pagesDaily Notes: Holcim Philippines, Inc. (pse:HLCM)Anonymous xcFcOgMiNo ratings yet

- Daily Notes: Philippine Seven Corporation (pse:SEVN)Document2 pagesDaily Notes: Philippine Seven Corporation (pse:SEVN)junNo ratings yet

- Daily Notes: Global-Estate Resorts, Inc. (pse:GERI)Document2 pagesDaily Notes: Global-Estate Resorts, Inc. (pse:GERI)junNo ratings yet

- PHINTAS Weekly Report - 20231009Document5 pagesPHINTAS Weekly Report - 20231009Mas Anggoro Tri AtmojoNo ratings yet

- ValueResearchFundcard UTIMultiAssetFund DirectPlan 2018nov02Document4 pagesValueResearchFundcard UTIMultiAssetFund DirectPlan 2018nov02ravisankarNo ratings yet

- Top Story:: CHP: Parent To Streamline Operations in The Next 3 YearsDocument4 pagesTop Story:: CHP: Parent To Streamline Operations in The Next 3 YearsJNo ratings yet

- L&TIndiaValueFund 2017jul25Document4 pagesL&TIndiaValueFund 2017jul25Krishnan ChockalingamNo ratings yet

- ValueResearchFundcard AxisBluechipFund DirectPlan 2019mar04Document4 pagesValueResearchFundcard AxisBluechipFund DirectPlan 2019mar04ChittaNo ratings yet

- ValueResearchFundcard TataRetirementSavingsFund ModeratePlan DirectPlan 2019jul15Document4 pagesValueResearchFundcard TataRetirementSavingsFund ModeratePlan DirectPlan 2019jul15Ankit ShuklaNo ratings yet

- Top Stories:: FRI 25 SEP 2020Document6 pagesTop Stories:: FRI 25 SEP 2020JNo ratings yet

- Fundcard: ICICI Prudential Multi Asset Fund - Direct PlanDocument4 pagesFundcard: ICICI Prudential Multi Asset Fund - Direct Planmanoj_sitecNo ratings yet

- Top StoriesDocument5 pagesTop StoriesJNo ratings yet

- ValueResearchFundcard HDFCSmallCapFund DirectPlan 2019mar04Document4 pagesValueResearchFundcard HDFCSmallCapFund DirectPlan 2019mar04ChittaNo ratings yet

- Top Stories:: Ceb: Ceb Increases Flights To Boracay and Bohol Rrhi: Growsari Raises Us$30Mil in FundingDocument3 pagesTop Stories:: Ceb: Ceb Increases Flights To Boracay and Bohol Rrhi: Growsari Raises Us$30Mil in FundingJajahinaNo ratings yet

- Value Research Fundcard SBI Small & Midcap Fund Direct Plan 2018 Mar 24Document4 pagesValue Research Fundcard SBI Small & Midcap Fund Direct Plan 2018 Mar 24hotalamNo ratings yet

- Top Story:: URC: URC Gets PCC Nod To Acquire Roxas Holdings' Sugar Mill AssetsDocument4 pagesTop Story:: URC: URC Gets PCC Nod To Acquire Roxas Holdings' Sugar Mill AssetsJNo ratings yet

- ConsolidatedHolding SHASHI 18032020 PDFDocument2 pagesConsolidatedHolding SHASHI 18032020 PDFAnshul GuptaNo ratings yet

- DAILY - May 4-5, 2011Document1 pageDAILY - May 4-5, 2011JC CalaycayNo ratings yet

- Weekly Stock Recommendation - May 23rd 2022Document7 pagesWeekly Stock Recommendation - May 23rd 2022Ganiyu AzeezNo ratings yet

- Top Stories:: TUE 22 SEP 2020Document5 pagesTop Stories:: TUE 22 SEP 2020Elcano MirandaNo ratings yet

- Cipla Limited: Quarterly Result UpdateDocument4 pagesCipla Limited: Quarterly Result UpdatePrajwal JainNo ratings yet

- ValueResearchFundcard ReligareContra 2010dec12Document6 pagesValueResearchFundcard ReligareContra 2010dec12Sivaraman SenapathiNo ratings yet

- Top Story:: Banking Sector: S&P Flags Risks On Philippine BanksDocument4 pagesTop Story:: Banking Sector: S&P Flags Risks On Philippine BanksJNo ratings yet

- ValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Document6 pagesValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Venkatesh VijayakumarNo ratings yet

- The Tea Times: Daily Updates On Financial MarketsDocument1 pageThe Tea Times: Daily Updates On Financial Marketsgurudev21No ratings yet

- ValueResearchFundcard AxisFocused25Fund DirectPlan 2019mar04Document4 pagesValueResearchFundcard AxisFocused25Fund DirectPlan 2019mar04ChittaNo ratings yet

- ValueResearchFundcard MiraeAssetLargeCapFund DirectPlan 2019nov19Document4 pagesValueResearchFundcard MiraeAssetLargeCapFund DirectPlan 2019nov19asddsffdsfNo ratings yet

- Uttarakhand Infographic June 2020Document1 pageUttarakhand Infographic June 2020Bharat KumarNo ratings yet

- Financials: Stock Market Price P/B Ave. Target Price Enter Lower Than Possible %changeDocument8 pagesFinancials: Stock Market Price P/B Ave. Target Price Enter Lower Than Possible %changeAndre Mikhail ObierezNo ratings yet

- Top Story:: MON 17 SEP 2018Document4 pagesTop Story:: MON 17 SEP 2018skynyrd75No ratings yet

- BP PLASTICS HOLDING BHD Income Statement - MYX - BPPLAS - TradingViewDocument4 pagesBP PLASTICS HOLDING BHD Income Statement - MYX - BPPLAS - TradingViewyasmin nabilahNo ratings yet

- ValueResearchFundcard MiraeAssetTaxSaverFund DirectPlan 2019mar08Document4 pagesValueResearchFundcard MiraeAssetTaxSaverFund DirectPlan 2019mar08pqwertyNo ratings yet

- ValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09Document6 pagesValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09ksrygNo ratings yet

- Fundcard: Reliance Small Cap Fund - Direct PlanDocument4 pagesFundcard: Reliance Small Cap Fund - Direct PlanravisankarNo ratings yet

- Infosys Technologies Ltd. Equity: Filing & Other Info Peer Group ChartingDocument26 pagesInfosys Technologies Ltd. Equity: Filing & Other Info Peer Group Chartinglaxmantej77No ratings yet

- MF COMPARISON - Large & Mid 2Document3 pagesMF COMPARISON - Large & Mid 2Rajkumar GNo ratings yet

- ValueResearchFundcard L&TMidcapFund DirectPlanDocument4 pagesValueResearchFundcard L&TMidcapFund DirectPlanreachrajatNo ratings yet

- Quadro Diário de Rentabilidade: GestoresDocument6 pagesQuadro Diário de Rentabilidade: GestoresGabriela DinizNo ratings yet

- Final Press Release Q3fy2024 EnglishDocument3 pagesFinal Press Release Q3fy2024 EnglishsuryaNo ratings yet

- Kotak Standard Multicap Fund (G)Document4 pagesKotak Standard Multicap Fund (G)Rudhra MoorthyNo ratings yet

- ValueResearchFundcard AdityaBirlaSunLifeFrontlineEquityFund 2018jun26Document4 pagesValueResearchFundcard AdityaBirlaSunLifeFrontlineEquityFund 2018jun26James HughesNo ratings yet

- Top Stories:: JFC: JFC Raises Stake in Tim Ho Wan Holding Firm HOME: HOME Plans To Open 2 More Stores This YearDocument4 pagesTop Stories:: JFC: JFC Raises Stake in Tim Ho Wan Holding Firm HOME: HOME Plans To Open 2 More Stores This YearJNo ratings yet

- Other NewsDocument3 pagesOther NewsElcano MirandaNo ratings yet

- UntitledDocument2 pagesUntitledShraboan AmirNo ratings yet

- ValueResearchFundcard DSPSmallCapFund DirectPlan 2019jun29Document4 pagesValueResearchFundcard DSPSmallCapFund DirectPlan 2019jun29Chiman RaoNo ratings yet

- ValueResearchFundcard HDFCChildren'SGiftFund DirectPlan 2018mar04Document4 pagesValueResearchFundcard HDFCChildren'SGiftFund DirectPlan 2018mar04dtr17No ratings yet

- Tata MotorsDocument11 pagesTata MotorsshrishtiNo ratings yet

- Indonesia Technical Pointer: Mixed in The RangeDocument9 pagesIndonesia Technical Pointer: Mixed in The RangeindramaNo ratings yet

- Top Story:: WLCON: WLCON To Have 63 Stores by End-2020Document3 pagesTop Story:: WLCON: WLCON To Have 63 Stores by End-2020JNo ratings yet

- Fundcard: ICICI Prudential Bluechip FundDocument4 pagesFundcard: ICICI Prudential Bluechip FundChittaNo ratings yet

- Review and Assessment of the Indonesia–Malaysia–Thailand Growth Triangle Economic Corridors: Thailand Country ReportFrom EverandReview and Assessment of the Indonesia–Malaysia–Thailand Growth Triangle Economic Corridors: Thailand Country ReportNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Regulatory Assessment Toolkit: A Practical Methodology For Assessing Regulation on Trade and Investment in ServicesFrom EverandRegulatory Assessment Toolkit: A Practical Methodology For Assessing Regulation on Trade and Investment in ServicesNo ratings yet

- Relative Strength DefinedDocument8 pagesRelative Strength DefinedjunNo ratings yet

- Understanding Market Capitalization Versus Market ValueDocument8 pagesUnderstanding Market Capitalization Versus Market ValuejunNo ratings yet

- Understanding Small Cap and Big Cap StocksDocument10 pagesUnderstanding Small Cap and Big Cap StocksjunNo ratings yet

- (Chart Examples of Head and Shoulders Patterns Using Commodity Charts.) (Stock Charts.)Document2 pages(Chart Examples of Head and Shoulders Patterns Using Commodity Charts.) (Stock Charts.)junNo ratings yet

- Commodity Charts Examples Stock Charts ExamplesDocument1 pageCommodity Charts Examples Stock Charts ExamplesjunNo ratings yet

- Commodity Charts Examples Stock Charts Examples: CSC FormDocument1 pageCommodity Charts Examples Stock Charts Examples: CSC FormjunNo ratings yet

- Daily Notes: Metropolitan Bank & Trust Com. (pse:MBT)Document2 pagesDaily Notes: Metropolitan Bank & Trust Com. (pse:MBT)junNo ratings yet

- Weekly Notes: BDO Unibank, Inc. (PSE: BDO)Document3 pagesWeekly Notes: BDO Unibank, Inc. (PSE: BDO)junNo ratings yet

- Daily Notes: Global-Estate Resorts, Inc. (pse:GERI)Document2 pagesDaily Notes: Global-Estate Resorts, Inc. (pse:GERI)junNo ratings yet

- Daily Notes: Philippine Seven Corporation (pse:SEVN)Document2 pagesDaily Notes: Philippine Seven Corporation (pse:SEVN)junNo ratings yet

- Final Denkstatt Report (Vers 1 3) September 2010Document45 pagesFinal Denkstatt Report (Vers 1 3) September 2010Yesid Nieto MuñozNo ratings yet

- Separately Excited Electronic Motor Speed Controller: Model 1268 SepexDocument5 pagesSeparately Excited Electronic Motor Speed Controller: Model 1268 Sepexpavli999No ratings yet

- Modelling and Control of Ball and Beam System Using PID ControllerDocument5 pagesModelling and Control of Ball and Beam System Using PID ControllerMichaelNo ratings yet

- TPA GMT Fuse Panel - /+24 To 48V DCDocument2 pagesTPA GMT Fuse Panel - /+24 To 48V DCJorge MerinoNo ratings yet

- Relay Setting ChartDocument10 pagesRelay Setting Charterkamlakar223467% (3)

- Valmet 634DSBIL ZapchastiDocument48 pagesValmet 634DSBIL ZapchastiValbertg100% (1)

- Q211014 Daikin SkyAir R32 Catalogue-FA - WebDocument35 pagesQ211014 Daikin SkyAir R32 Catalogue-FA - WebabbxmenNo ratings yet

- Culvert Substation (CU-SS01) : (SECTION-1) (SECTION-2)Document1 pageCulvert Substation (CU-SS01) : (SECTION-1) (SECTION-2)ThanveerNo ratings yet

- Moving Charges and MagnetismDocument13 pagesMoving Charges and Magnetismjayaditya soniNo ratings yet

- Metaphysics of TORGDocument17 pagesMetaphysics of TORGBilly WeedNo ratings yet

- AS 1056.1-1991 Storage Water Heaters - General RequirementsDocument43 pagesAS 1056.1-1991 Storage Water Heaters - General RequirementsChetan ChopraNo ratings yet

- Sound Advice - CIE Guide To PA InstallsDocument17 pagesSound Advice - CIE Guide To PA InstallscuongdoducNo ratings yet

- Physics I Problems PDFDocument1 pagePhysics I Problems PDFBOSS BOSSNo ratings yet

- Electricity BillDocument2 pagesElectricity BillShakil AhmedNo ratings yet

- DEWA Circular - General Earthing ArrangementDocument1 pageDEWA Circular - General Earthing Arrangementnirmal mohanNo ratings yet

- Diesel Generator Maintenance Guide (V1.0)Document19 pagesDiesel Generator Maintenance Guide (V1.0)Raafat YounisNo ratings yet

- Moment of A ForceDocument43 pagesMoment of A ForceJohn Kristoffer GimpesNo ratings yet

- Magaldi Bottom Ash RecyleDocument17 pagesMagaldi Bottom Ash RecyleAnonymous wIPMQ5rhNo ratings yet

- SP-1108 (ESOP-15) Boundary Procedure For The InfrastructureDocument4 pagesSP-1108 (ESOP-15) Boundary Procedure For The Infrastructureaslam.ambNo ratings yet

- Assignment Synchronous Generator and Induction MotorDocument20 pagesAssignment Synchronous Generator and Induction MotorSyahril Abdullah100% (1)

- Nortech Trinity Investment Deck 2021-22Document25 pagesNortech Trinity Investment Deck 2021-22NORTECH TRINITYNo ratings yet

- Starting Method For Induction MotorsDocument10 pagesStarting Method For Induction MotorsfebriNo ratings yet

- Electrophilic SubstitutionDocument4 pagesElectrophilic SubstitutionPrasad BidweNo ratings yet

- Mobile Crane Grue Mobile: Technical Data Caractéristiques TechniquesDocument32 pagesMobile Crane Grue Mobile: Technical Data Caractéristiques TechniquesLeonardo Nascente100% (1)

- Justin Snyder ResumeDocument1 pageJustin Snyder Resumeapi-437591351No ratings yet

- Hhoinstructions 3Document5 pagesHhoinstructions 3Stoicescu Cristian100% (1)

- Uen R 24200001Document4 pagesUen R 24200001Williams ArayaNo ratings yet

Daily Notes: Metro Pacific Investments Corp. (pse:MPI)

Daily Notes: Metro Pacific Investments Corp. (pse:MPI)

Uploaded by

junOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Notes: Metro Pacific Investments Corp. (pse:MPI)

Daily Notes: Metro Pacific Investments Corp. (pse:MPI)

Uploaded by

junCopyright:

Available Formats

Daily Notes INDEX

DAILY MARKET STATS

VALUE PTS PCT YTD

Wednesday, July 08, 2020

PSEI 6,267.40 -61.01 -0.96% -19.81%

Reference: Claire T. Alviar ALL 3,677.83 -24.34 -0.66% -20.90%

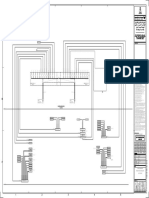

Metro Pacific Investments Corp. [pse:MPI] FIN

IND

1,241.89

7,858.27

2.18

-71.72

0.18%

-0.90%

-33.36%

-18.44%

TRADE TP: Php 3.90—4.30 HDG 6,518.82 -13.71 -0.21% -14.14%

PRO 3,070.28 -70.47 -2.24% -26.10%

SVC 1,432.39 -18.68 -1.29% -6.45%

STOCK SNIPPETS

M&O 5,473.23 14.32 0.26% -32.36%

Last Traded Price (PHP) 3.61

P/E Ratio (x) 5.16

• Its utility segments to support the ASIAN MARKETS (AS 03:30 PM)

company’s earnings. INDEX VALUE PTS PCT YTD

P/B Ratio (x) 0.61

• Through its wholly-owned subsidiary Nikkei 225 22,614.69 -99.75 -0.44% -4.40%

Support 3.60 MPCALA Holdings Inc. (MPCALA), Hang Seng 26,022.24 -316.92 -1.20% -7.69%

Resistance 3.90 it paid the second tranche of con-

Shanghai 3,345.34 12.46 0.37% 9.68%

MTD Performance (%) -2.43

cession fee amounting to P4.36

billion for the Cavite-Laguna Ex- KOSPI 2,164.17 -23.76 -1.09% -1.52%

YTD Performance (%) 3.74 pressway (CALAX). HCM 865.95 4.79 0.56% -9.89%

SET 1,390.59 18.32 1.34% -11.98%

STI 2,670.51 -19.10 -0.71% -17.14%

OUR VIEW KLCI 1,568.78 -8.12 -0.51% -1.26%

JCI 4,991.13 2.27 0.05% -20.77%

INTERNALS

VOL 1,475,446,653 ADV 99

VAL 7,592,056,038.06 DEC 96

BLOCK 267,154,511.55 UNCH 46

Trade cautiously amid the mounting Covid-19 cases in the country which we expect to bring nega-

tive sentiment further. Money supply grew quicker by 16.6% y/y, vs. 16.2% in April. However, slow-

er expansion in bank lending was also recorded.

Psychological support is at 6,000 level, while resistance is around 6,580.00.

TOP 5 GAINERS TOP 5 LOSERS

LTG 2.68% FGEN –5.64%

SM 0.96% SMPH –3.67%

AP 0.89% GLO –3.64%

Source: TradingView

AEV 0.61% MEG –3.07%

MARKET WRAP BDO 0.51% MPI –2.43%

OTHER MARKET SNAPSHOTS

PSEi ended lower by 61.01 points or 0.96%, to 6,267.40 as worries over the rising cases of Covid- Brent Crude 42.69 -0.95%

19 worsened. The uptick on inflation rate of 2.5% in June, added on the negative sentiment as this

WTI Crude 40.19 -1.08%

was driven by the normalization of oil prices and weaker demand. Value turnover was at P7.59

billion. Advancers edged decliners at 99 to 96, while 46 issues were unchanged. Gold 1,792.35 -0.06%

Silver 18.41 -0.88%

Miners had the biggest gain of 0.26% to 5,473.23 while Properties declined the most by 2.24% to

Copper 2.76 -0.71%

3,070.28.

US$:Php 49.53 0.31%

In the index, LT Group, Inc. [pse:LTG] led the index gainers, up 2.68% to P8.44 while First Gen

US 10 Yr Yield 0.69% 1.00%

Corporation [pse:FGEN] was at the bottom, losing 5.64% to P24.25.

Philstocks Research 2020 1 |Page

LOCAL NEWS Philstocks Research

JUSTINO B. CALAYCAY, JR

Consumption remains weak –BSP. Bangko Sentral ng Pilipinas Governor Benjamin E. Diokno AVP-Head, Research & Engagement

sees household spending to remain weak given the uncertainties over the coronavirus pandemic that +63 (2) 8588-1962

weigh on consumer sentiment. He expects that the second quarter of 2020 contraction will be deeper

on the back of dampened domestic demand and lower production activity. For the third quarter, he JAPHET LOUIS O. TANTIANGCO

forecasts the economy to still be in contraction ,but lesser damage than the Q2 following the Sr. Research Analyst

resumption of businesses. +63 (2) 8588-1927

In line with this is the dim outlook for the consumer stocks from firms offering inessential goods even PIPER CHAUCER E. TAN

up to restaurants. For the food and beverage sector in the market, we’re expecting lower earnings for Engagement Officer/Research Associate

this year, particularly in the second quarter. On the bright side, some resilient companies from the +63 (2) 8588-1928

impact of Covidd-19 are the retail stocks such as PGOLD and RRHI, and food manufacturers like

CLAIRE T. ALVIAR

CNPF.

Research Associate

+63 (2) 8588-1925

GLOBAL NEWS

Ground Floor, East Tower

Oil prices abroad increased amid supply cuts, but gains were capped due to weaker demand PSE Center, Tektite Towers

outlook. The oil market is being supported by the drawdown in US crude stockpiles and supply Ortigas Center, Pasig City

cuts by the Organization of the Petroleum Exporting Countries (OPEC) and allies. However, traders PHILIPPINES

are still watching oil prices given the rising cases in the US, which could hamper the demand.

DISCLAIMER

Global oil prices should remain at its level so that it will not much weigh on inflation. But we think The opinion, views and recommendations

that given the rising cases, economic activities will not back to normal, meaning, demand will remain contained in this material were prepared by

weak dragging oil prices. Weak demand will, however, weigh on refineries which we think will report the Philstocks Research Team, individually

lower earnings or net loss this year. and separately, based on their specific

sector assignments, contextual framework,

personal judgments, biases and prejudices,

time horizons, methods and other factors.

The reader is enjoined to take this into

COMPANY NEWS account when perusing and considering the

contents of the report as a basis for their

stock investment or trading decisions.

TRADE Metro Pacific Investments Corp. [pse: MPI] Furthermore, projection made and presented

in this report may change or be updated in

The company paid the Department of Public Works and Highways (DPWH) of concession fee amount- between the periods of release. Ergo, the

ing to P4.36 billion for Cavite-Laguna Expressway (CALAX). This was the second of six tranches validity of the projections and/or estimates

worth P27.3 billion. mentioned are good as of the date indicated

and may be changed without immediate

This will not much affect the operations or share price performance of MPI, although it is a cash out- notification.

flow. But in return, MPI will be able to enjoy the benefits of the expressway, however, during this time This report is primarily intended for

of pandemic where non-essential movement is discourage, it may generate lower sales than expecta- information purposes only and should not be

tion. considered as an exclusive basis for making

investment decision. The recommendations

Support is at P3.60, immediate resistance is at P3.90. It is already trading above the 200-day EMA, contained in this report is not tailored-fit any

which could be a dynamic support. If it breaches the immediate resistance, second is at P4.30. particular investor type, situation, or

objective and must not be taken as such.

Target Price (TA): Php 3.90-4.30 Determining the suitability of an investment

remains within the province of the investor.

Our estimates are based on information we

believe to be reliable. Nevertheless, nothing

in this report shall be construed as an offer

of a guarantee of a return of any kind and at

any time.

Rating Definitions:

BUY - More than 15% upside base on the target price

in the next 9-12 months

HOLD - 15% or less upside or downside in the next

9-12 months

SELL - More than 15% downside base on the target

price in the next 9-12 months

Source: TradingView TRADE - A potential 10% and above short-term upside

base on entry price and selling price.

Philstocks Research 2020 2 |Page

You might also like

- Gap Analysis CAP 437 6th - 7th EditionsDocument5 pagesGap Analysis CAP 437 6th - 7th EditionsnautelNo ratings yet

- Beware 03122019-1en PDFDocument14 pagesBeware 03122019-1en PDFJose Castro0% (1)

- CSC-211 Multifunction Protection IED Technical Application Manual - V1.01 PDFDocument341 pagesCSC-211 Multifunction Protection IED Technical Application Manual - V1.01 PDFengrdavi Davidean Flores100% (2)

- Daily Notes: Wilcon Depot, Inc. (pse:WLCON)Document2 pagesDaily Notes: Wilcon Depot, Inc. (pse:WLCON)Anonymous xcFcOgMiNo ratings yet

- Weekly Notes: BDO Unibank, Inc. (PSE: BDO)Document3 pagesWeekly Notes: BDO Unibank, Inc. (PSE: BDO)junNo ratings yet

- On Balance - Daily Notes For June 23 2020Document2 pagesOn Balance - Daily Notes For June 23 2020Jade SantosNo ratings yet

- Daily Notes: Ginebra San Miguel, Inc. (pse:GSMI)Document2 pagesDaily Notes: Ginebra San Miguel, Inc. (pse:GSMI)Anonymous xcFcOgMiNo ratings yet

- Daily Notes: Eagle Cement Corporation (pse:EAGLE)Document2 pagesDaily Notes: Eagle Cement Corporation (pse:EAGLE)Anonymous xcFcOgMiNo ratings yet

- Daily Notes: Metropolitan Bank & Trust Com. (pse:MBT)Document2 pagesDaily Notes: Metropolitan Bank & Trust Com. (pse:MBT)junNo ratings yet

- Daily Notes: SM Investments Corporation (pse:SM)Document2 pagesDaily Notes: SM Investments Corporation (pse:SM)Anonymous xcFcOgMiNo ratings yet

- Daily Notes: Holcim Philippines, Inc. (pse:HLCM)Document2 pagesDaily Notes: Holcim Philippines, Inc. (pse:HLCM)Anonymous xcFcOgMiNo ratings yet

- Daily Notes: Philippine Seven Corporation (pse:SEVN)Document2 pagesDaily Notes: Philippine Seven Corporation (pse:SEVN)junNo ratings yet

- Daily Notes: Global-Estate Resorts, Inc. (pse:GERI)Document2 pagesDaily Notes: Global-Estate Resorts, Inc. (pse:GERI)junNo ratings yet

- PHINTAS Weekly Report - 20231009Document5 pagesPHINTAS Weekly Report - 20231009Mas Anggoro Tri AtmojoNo ratings yet

- ValueResearchFundcard UTIMultiAssetFund DirectPlan 2018nov02Document4 pagesValueResearchFundcard UTIMultiAssetFund DirectPlan 2018nov02ravisankarNo ratings yet

- Top Story:: CHP: Parent To Streamline Operations in The Next 3 YearsDocument4 pagesTop Story:: CHP: Parent To Streamline Operations in The Next 3 YearsJNo ratings yet

- L&TIndiaValueFund 2017jul25Document4 pagesL&TIndiaValueFund 2017jul25Krishnan ChockalingamNo ratings yet

- ValueResearchFundcard AxisBluechipFund DirectPlan 2019mar04Document4 pagesValueResearchFundcard AxisBluechipFund DirectPlan 2019mar04ChittaNo ratings yet

- ValueResearchFundcard TataRetirementSavingsFund ModeratePlan DirectPlan 2019jul15Document4 pagesValueResearchFundcard TataRetirementSavingsFund ModeratePlan DirectPlan 2019jul15Ankit ShuklaNo ratings yet

- Top Stories:: FRI 25 SEP 2020Document6 pagesTop Stories:: FRI 25 SEP 2020JNo ratings yet

- Fundcard: ICICI Prudential Multi Asset Fund - Direct PlanDocument4 pagesFundcard: ICICI Prudential Multi Asset Fund - Direct Planmanoj_sitecNo ratings yet

- Top StoriesDocument5 pagesTop StoriesJNo ratings yet

- ValueResearchFundcard HDFCSmallCapFund DirectPlan 2019mar04Document4 pagesValueResearchFundcard HDFCSmallCapFund DirectPlan 2019mar04ChittaNo ratings yet

- Top Stories:: Ceb: Ceb Increases Flights To Boracay and Bohol Rrhi: Growsari Raises Us$30Mil in FundingDocument3 pagesTop Stories:: Ceb: Ceb Increases Flights To Boracay and Bohol Rrhi: Growsari Raises Us$30Mil in FundingJajahinaNo ratings yet

- Value Research Fundcard SBI Small & Midcap Fund Direct Plan 2018 Mar 24Document4 pagesValue Research Fundcard SBI Small & Midcap Fund Direct Plan 2018 Mar 24hotalamNo ratings yet

- Top Story:: URC: URC Gets PCC Nod To Acquire Roxas Holdings' Sugar Mill AssetsDocument4 pagesTop Story:: URC: URC Gets PCC Nod To Acquire Roxas Holdings' Sugar Mill AssetsJNo ratings yet

- ConsolidatedHolding SHASHI 18032020 PDFDocument2 pagesConsolidatedHolding SHASHI 18032020 PDFAnshul GuptaNo ratings yet

- DAILY - May 4-5, 2011Document1 pageDAILY - May 4-5, 2011JC CalaycayNo ratings yet

- Weekly Stock Recommendation - May 23rd 2022Document7 pagesWeekly Stock Recommendation - May 23rd 2022Ganiyu AzeezNo ratings yet

- Top Stories:: TUE 22 SEP 2020Document5 pagesTop Stories:: TUE 22 SEP 2020Elcano MirandaNo ratings yet

- Cipla Limited: Quarterly Result UpdateDocument4 pagesCipla Limited: Quarterly Result UpdatePrajwal JainNo ratings yet

- ValueResearchFundcard ReligareContra 2010dec12Document6 pagesValueResearchFundcard ReligareContra 2010dec12Sivaraman SenapathiNo ratings yet

- Top Story:: Banking Sector: S&P Flags Risks On Philippine BanksDocument4 pagesTop Story:: Banking Sector: S&P Flags Risks On Philippine BanksJNo ratings yet

- ValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Document6 pagesValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Venkatesh VijayakumarNo ratings yet

- The Tea Times: Daily Updates On Financial MarketsDocument1 pageThe Tea Times: Daily Updates On Financial Marketsgurudev21No ratings yet

- ValueResearchFundcard AxisFocused25Fund DirectPlan 2019mar04Document4 pagesValueResearchFundcard AxisFocused25Fund DirectPlan 2019mar04ChittaNo ratings yet

- ValueResearchFundcard MiraeAssetLargeCapFund DirectPlan 2019nov19Document4 pagesValueResearchFundcard MiraeAssetLargeCapFund DirectPlan 2019nov19asddsffdsfNo ratings yet

- Uttarakhand Infographic June 2020Document1 pageUttarakhand Infographic June 2020Bharat KumarNo ratings yet

- Financials: Stock Market Price P/B Ave. Target Price Enter Lower Than Possible %changeDocument8 pagesFinancials: Stock Market Price P/B Ave. Target Price Enter Lower Than Possible %changeAndre Mikhail ObierezNo ratings yet

- Top Story:: MON 17 SEP 2018Document4 pagesTop Story:: MON 17 SEP 2018skynyrd75No ratings yet

- BP PLASTICS HOLDING BHD Income Statement - MYX - BPPLAS - TradingViewDocument4 pagesBP PLASTICS HOLDING BHD Income Statement - MYX - BPPLAS - TradingViewyasmin nabilahNo ratings yet

- ValueResearchFundcard MiraeAssetTaxSaverFund DirectPlan 2019mar08Document4 pagesValueResearchFundcard MiraeAssetTaxSaverFund DirectPlan 2019mar08pqwertyNo ratings yet

- ValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09Document6 pagesValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09ksrygNo ratings yet

- Fundcard: Reliance Small Cap Fund - Direct PlanDocument4 pagesFundcard: Reliance Small Cap Fund - Direct PlanravisankarNo ratings yet

- Infosys Technologies Ltd. Equity: Filing & Other Info Peer Group ChartingDocument26 pagesInfosys Technologies Ltd. Equity: Filing & Other Info Peer Group Chartinglaxmantej77No ratings yet

- MF COMPARISON - Large & Mid 2Document3 pagesMF COMPARISON - Large & Mid 2Rajkumar GNo ratings yet

- ValueResearchFundcard L&TMidcapFund DirectPlanDocument4 pagesValueResearchFundcard L&TMidcapFund DirectPlanreachrajatNo ratings yet

- Quadro Diário de Rentabilidade: GestoresDocument6 pagesQuadro Diário de Rentabilidade: GestoresGabriela DinizNo ratings yet

- Final Press Release Q3fy2024 EnglishDocument3 pagesFinal Press Release Q3fy2024 EnglishsuryaNo ratings yet

- Kotak Standard Multicap Fund (G)Document4 pagesKotak Standard Multicap Fund (G)Rudhra MoorthyNo ratings yet

- ValueResearchFundcard AdityaBirlaSunLifeFrontlineEquityFund 2018jun26Document4 pagesValueResearchFundcard AdityaBirlaSunLifeFrontlineEquityFund 2018jun26James HughesNo ratings yet

- Top Stories:: JFC: JFC Raises Stake in Tim Ho Wan Holding Firm HOME: HOME Plans To Open 2 More Stores This YearDocument4 pagesTop Stories:: JFC: JFC Raises Stake in Tim Ho Wan Holding Firm HOME: HOME Plans To Open 2 More Stores This YearJNo ratings yet

- Other NewsDocument3 pagesOther NewsElcano MirandaNo ratings yet

- UntitledDocument2 pagesUntitledShraboan AmirNo ratings yet

- ValueResearchFundcard DSPSmallCapFund DirectPlan 2019jun29Document4 pagesValueResearchFundcard DSPSmallCapFund DirectPlan 2019jun29Chiman RaoNo ratings yet

- ValueResearchFundcard HDFCChildren'SGiftFund DirectPlan 2018mar04Document4 pagesValueResearchFundcard HDFCChildren'SGiftFund DirectPlan 2018mar04dtr17No ratings yet

- Tata MotorsDocument11 pagesTata MotorsshrishtiNo ratings yet

- Indonesia Technical Pointer: Mixed in The RangeDocument9 pagesIndonesia Technical Pointer: Mixed in The RangeindramaNo ratings yet

- Top Story:: WLCON: WLCON To Have 63 Stores by End-2020Document3 pagesTop Story:: WLCON: WLCON To Have 63 Stores by End-2020JNo ratings yet

- Fundcard: ICICI Prudential Bluechip FundDocument4 pagesFundcard: ICICI Prudential Bluechip FundChittaNo ratings yet

- Review and Assessment of the Indonesia–Malaysia–Thailand Growth Triangle Economic Corridors: Thailand Country ReportFrom EverandReview and Assessment of the Indonesia–Malaysia–Thailand Growth Triangle Economic Corridors: Thailand Country ReportNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Regulatory Assessment Toolkit: A Practical Methodology For Assessing Regulation on Trade and Investment in ServicesFrom EverandRegulatory Assessment Toolkit: A Practical Methodology For Assessing Regulation on Trade and Investment in ServicesNo ratings yet

- Relative Strength DefinedDocument8 pagesRelative Strength DefinedjunNo ratings yet

- Understanding Market Capitalization Versus Market ValueDocument8 pagesUnderstanding Market Capitalization Versus Market ValuejunNo ratings yet

- Understanding Small Cap and Big Cap StocksDocument10 pagesUnderstanding Small Cap and Big Cap StocksjunNo ratings yet

- (Chart Examples of Head and Shoulders Patterns Using Commodity Charts.) (Stock Charts.)Document2 pages(Chart Examples of Head and Shoulders Patterns Using Commodity Charts.) (Stock Charts.)junNo ratings yet

- Commodity Charts Examples Stock Charts ExamplesDocument1 pageCommodity Charts Examples Stock Charts ExamplesjunNo ratings yet

- Commodity Charts Examples Stock Charts Examples: CSC FormDocument1 pageCommodity Charts Examples Stock Charts Examples: CSC FormjunNo ratings yet

- Daily Notes: Metropolitan Bank & Trust Com. (pse:MBT)Document2 pagesDaily Notes: Metropolitan Bank & Trust Com. (pse:MBT)junNo ratings yet

- Weekly Notes: BDO Unibank, Inc. (PSE: BDO)Document3 pagesWeekly Notes: BDO Unibank, Inc. (PSE: BDO)junNo ratings yet

- Daily Notes: Global-Estate Resorts, Inc. (pse:GERI)Document2 pagesDaily Notes: Global-Estate Resorts, Inc. (pse:GERI)junNo ratings yet

- Daily Notes: Philippine Seven Corporation (pse:SEVN)Document2 pagesDaily Notes: Philippine Seven Corporation (pse:SEVN)junNo ratings yet

- Final Denkstatt Report (Vers 1 3) September 2010Document45 pagesFinal Denkstatt Report (Vers 1 3) September 2010Yesid Nieto MuñozNo ratings yet

- Separately Excited Electronic Motor Speed Controller: Model 1268 SepexDocument5 pagesSeparately Excited Electronic Motor Speed Controller: Model 1268 Sepexpavli999No ratings yet

- Modelling and Control of Ball and Beam System Using PID ControllerDocument5 pagesModelling and Control of Ball and Beam System Using PID ControllerMichaelNo ratings yet

- TPA GMT Fuse Panel - /+24 To 48V DCDocument2 pagesTPA GMT Fuse Panel - /+24 To 48V DCJorge MerinoNo ratings yet

- Relay Setting ChartDocument10 pagesRelay Setting Charterkamlakar223467% (3)

- Valmet 634DSBIL ZapchastiDocument48 pagesValmet 634DSBIL ZapchastiValbertg100% (1)

- Q211014 Daikin SkyAir R32 Catalogue-FA - WebDocument35 pagesQ211014 Daikin SkyAir R32 Catalogue-FA - WebabbxmenNo ratings yet

- Culvert Substation (CU-SS01) : (SECTION-1) (SECTION-2)Document1 pageCulvert Substation (CU-SS01) : (SECTION-1) (SECTION-2)ThanveerNo ratings yet

- Moving Charges and MagnetismDocument13 pagesMoving Charges and Magnetismjayaditya soniNo ratings yet

- Metaphysics of TORGDocument17 pagesMetaphysics of TORGBilly WeedNo ratings yet

- AS 1056.1-1991 Storage Water Heaters - General RequirementsDocument43 pagesAS 1056.1-1991 Storage Water Heaters - General RequirementsChetan ChopraNo ratings yet

- Sound Advice - CIE Guide To PA InstallsDocument17 pagesSound Advice - CIE Guide To PA InstallscuongdoducNo ratings yet

- Physics I Problems PDFDocument1 pagePhysics I Problems PDFBOSS BOSSNo ratings yet

- Electricity BillDocument2 pagesElectricity BillShakil AhmedNo ratings yet

- DEWA Circular - General Earthing ArrangementDocument1 pageDEWA Circular - General Earthing Arrangementnirmal mohanNo ratings yet

- Diesel Generator Maintenance Guide (V1.0)Document19 pagesDiesel Generator Maintenance Guide (V1.0)Raafat YounisNo ratings yet

- Moment of A ForceDocument43 pagesMoment of A ForceJohn Kristoffer GimpesNo ratings yet

- Magaldi Bottom Ash RecyleDocument17 pagesMagaldi Bottom Ash RecyleAnonymous wIPMQ5rhNo ratings yet

- SP-1108 (ESOP-15) Boundary Procedure For The InfrastructureDocument4 pagesSP-1108 (ESOP-15) Boundary Procedure For The Infrastructureaslam.ambNo ratings yet

- Assignment Synchronous Generator and Induction MotorDocument20 pagesAssignment Synchronous Generator and Induction MotorSyahril Abdullah100% (1)

- Nortech Trinity Investment Deck 2021-22Document25 pagesNortech Trinity Investment Deck 2021-22NORTECH TRINITYNo ratings yet

- Starting Method For Induction MotorsDocument10 pagesStarting Method For Induction MotorsfebriNo ratings yet

- Electrophilic SubstitutionDocument4 pagesElectrophilic SubstitutionPrasad BidweNo ratings yet

- Mobile Crane Grue Mobile: Technical Data Caractéristiques TechniquesDocument32 pagesMobile Crane Grue Mobile: Technical Data Caractéristiques TechniquesLeonardo Nascente100% (1)

- Justin Snyder ResumeDocument1 pageJustin Snyder Resumeapi-437591351No ratings yet

- Hhoinstructions 3Document5 pagesHhoinstructions 3Stoicescu Cristian100% (1)

- Uen R 24200001Document4 pagesUen R 24200001Williams ArayaNo ratings yet