Professional Documents

Culture Documents

Brace20for20Impact20 20GST20 20The20Nielsen20View PDF

Brace20for20Impact20 20GST20 20The20Nielsen20View PDF

Uploaded by

Nihar DeyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Brace20for20Impact20 20GST20 20The20Nielsen20View PDF

Brace20for20Impact20 20GST20 20The20Nielsen20View PDF

Uploaded by

Nihar DeyCopyright:

Available Formats

BRACE FOR IMPACT: GST –

THE NIELSEN VIEW

FMCG market recoups after demonetisation but GST shifts the

goal post again

The Indian FMCG industry has been faced with black swan events in recent times, which might prove to be

th

obstacles for some and opportunities for others. The demonetisation announcement of Nov 8 saw 86% of

the currency exit the market overnight. However, resilient Indian consumers, manufacturers and trade in

general adjusted rapidly, resulting in a timid impact of around 1.5% on overall FMCG sales in the months of

November and December 2016. Cushioning the fall was the stock level in trade pipelines that continued to

feed the robust consumer demand, despite the temporary drop in shipments.

Notwithstanding the constant flux, the FMCG industry has continued to grow well with manufacturers and

retailers adapting to change with nimbleness. There has been widespread growth in the FMCG sector across

all population strata. The macroeconomic trends also seem to be in the same direction with prediction of a

th

good monsoon, low food inflation levels, the 7 Pay Commission announcement of a 23.5% (approx.) hike in

Income for central government employees and pensioners and higher outlay commitments for MGNREGA.

GOODS AND SERVICES TAX

Economists and business strategists agree that the GST will increase compliance with tax regulations. The

GST mechanism has a self-policing impact, so the entire value chain will be incentivised to be GST-

compliant.

Of interest is the short-term impact, the medium-term (“settling-in” period) and the long-term steady state.

In the long-term, with uniform taxation for the whole country, inter-state movement of goods will be facilitated,

resulting in a major change in sourcing and supply chain infrastructure and consequently, greater

efficiencies.

The new regime is likely to improve efficiencies and lower cost of production for a majority of FMCG

products. However, the unorganised market and the wholesale sector are likely to face challenges during the

implementation in the short term.

ARE WE ALREADY WITNESSING A PRE-GST IMPACT?

With the GST rates announced for most FMCG products, manufacturers are now anxious to know the input

tax credit norms. The possible loss of tax on the ‘stock in pipeline’ was a trade concern, which is leading to

some destocking across multiple FMCG categories.

Nielsen Retail Measurement Services (RMS) has observed a lower average age of stock than a year ago, on

retailers’ shelves in Q1 2017, calculating from the month of production to the current date. For instance, the

indexed age of stock for laundry was at 81% of the category average.

Copyright © 2017 The Nielsen Company. 1

This lower age of stock indicates that distributors and retailers are holding leaner supply as the front end

awaits clarity on the impact of GST on pricing, and its implementation at the ground level, the latter being key

to avoiding major disruptions to trade.

Consumer demand did not drop significantly during demonetisation. Leading to the lesson that

manufacturers and trade should continue to build supply to meet the demand and steal share.

During this time, manufacturers should keep in mind that GST-compliance for wholesalers might be more

challenging than direct trade, making it important to support them to ensure that the trade pipeline remains at

healthy levels. Similarly, organised trade channels like ecommerce and modern trade should continue to be

backed. Learning from demonetisation suggests derisking the total Channel play by planning for higher

throughput through direct distribution and MT.

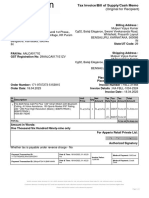

GRADUAL DECLINE IN STOCK LEVELS FROM JAN 2017, WHILE SALES

REMAIN STRONG.

35

25

15

Jan-17

Mar-17

May-17

Jan-15

Mar-15

Jan-16

Mar-16

May-14

May-15

May-16

Sep-16

Sep-14

Sep-15

Dec-16

Feb-17

Dec-14

Feb-15

Dec-15

Feb-16

Jul-16

Jul-14

Jul-15

Nov-16

Nov-14

Apr-15

Nov-15

Apr-16

Oct-15

Oct-16

Jun-16

Aug-16

Apr-17

Jun-14

Aug-14

Oct-14

Jun-15

Aug-15

Sales Wt '000(tons) Purchase Wt '000 (Tons) Stock Wt '000(Tons)

Representative category illustration

Source: Nielsen

Copyright © 2017 The Nielsen Company. 2

Here are Nielsen’s points of view on likely scenarios in pre-GST and post-GST implementation:

CATEGORY PRICE SENSITIVITY CAN PROVIDE A GLIMPSE OF

WHAT TO EXPECT

Using meta-analysis on price elasticity across various FMCG categories and pairing it with the net tax

change due to new GST rates we draw out scenarios below.

Categories with net tax increase

For price-sensitive categories like Soft Drinks and Chocolate, which face a net tax increase, manufacturers

would need to work with consumption occasions, grammage or access pack innovations. At the same time,

there could be a shift within the price tiers resulting in the squeezing of the top tier.

Copyright © 2017 The Nielsen Company. 3

Categories with net tax decrease

• Categories with some price elasticity like Toilet soaps might see an opportunity for premiumisation and

packaging innovations, including multi-packs, while keeping within the standard pack guidelines.

• Categories with relatively low price elasticity like the Hair Oils could witness category upgradation. In

this category, consumers frequently use unbranded oils, and the drop in taxes could result in consumers

moving to branded oil as the price-gap reduces.

While categories will play out differently depending on their particular dynamics, manufacturers should

mindful of anti-profiteering clauses and standard pack norms, while changing gears.

PRICE ELASTICITY VS. NET TAX CHANGE

On X Axis: Net tax Change: Net tax decrease is where the taxes in GST regime are less than previous total taxes applied, whereas net

tax Increase is where the tax in GST regime is more than before.

On Y Axis: Price Elasticity - this indicates how sensitive the consumers are to changing prices in this category. Low elasticity is low

price sensitivity.

Source: Nielsen

These are our measured hypotheses based on the likelihood of various scenarios in different categories,

price points and operational efficiencies. Success would lie in assessing the situation quickly and adapting

swiftly to gain that crucial early competitive advantage.

Copyright © 2017 The Nielsen Company. 4

ABOUT NIELSEN

Nielsen Holdings plc (NYSE: NLSN) is a global performance management company that

provides a comprehensive understanding of what consumers watch and buy. Nielsen’s

Watch segment provides media and advertising clients with Nielsen Total Audience

measurement services for all devices on which content — video, audio and text — is

consumed. The Buy segment offers consumer packaged goods manufacturers and retailers

the industry’s only global view of retail performance measurement. By integrating

information from its Watch and Buy segments and other data sources, Nielsen also provides

its clients with analytics that help improve performance. Nielsen, an S&P 500 company, has

operations in over 100 countries, covering more than 90% of the world’s population. For

more information, visit www.nielsen.com

Copyright © 2017 The Nielsen Company. 5

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Unit Iii Marketing Mix Decisions: Product Planning and DevelopmentDocument22 pagesUnit Iii Marketing Mix Decisions: Product Planning and DevelopmentLords PorseenaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Final Case StudyDocument4 pagesFinal Case StudyChaela CeuxNo ratings yet

- Presented By: Asish Kumar Swain Rahul Kumar Singh Arpit AggarwalDocument50 pagesPresented By: Asish Kumar Swain Rahul Kumar Singh Arpit Aggarwalashu me86% (7)

- Business Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsDocument1 pageBusiness Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentspriyankaNo ratings yet

- US Federal Reserve System (Central Bank of America)Document2 pagesUS Federal Reserve System (Central Bank of America)Nihar DeyNo ratings yet

- BSE Index: 12 December 2016: Change in US Fed Rate From 1% To 1.25%Document5 pagesBSE Index: 12 December 2016: Change in US Fed Rate From 1% To 1.25%Nihar DeyNo ratings yet

- Monte Carlo Simulation - StudentsDocument3 pagesMonte Carlo Simulation - StudentsNihar DeyNo ratings yet

- Managerial Economics: MBA 2019 - 2021 Section - BDocument1 pageManagerial Economics: MBA 2019 - 2021 Section - BNihar DeyNo ratings yet

- Telecom IndustryDocument3 pagesTelecom IndustryNihar DeyNo ratings yet

- Challenges Faced by FMCG Sector in Implementing GSTDocument10 pagesChallenges Faced by FMCG Sector in Implementing GSTNihar DeyNo ratings yet

- Under The Able Guidance ofDocument13 pagesUnder The Able Guidance ofNihar DeyNo ratings yet

- Initial Information Report (Iir) : I. Internship Program DetailsDocument2 pagesInitial Information Report (Iir) : I. Internship Program DetailsNihar DeyNo ratings yet

- NML Project Task # 3Document17 pagesNML Project Task # 3bakhtawar soniaNo ratings yet

- Vmart FinalDocument24 pagesVmart FinalAkash JainNo ratings yet

- Supply Chain McqsDocument22 pagesSupply Chain McqsJustice OwusuNo ratings yet

- Activity 3Document2 pagesActivity 3Princess CondesNo ratings yet

- Accounting 2Document28 pagesAccounting 2cherryannNo ratings yet

- Brand Revitalization AND RejuvenationDocument19 pagesBrand Revitalization AND RejuvenationGopi KrishnanNo ratings yet

- InvoiceDocument1 pageInvoiceMulpuri Vijaya KumarNo ratings yet

- Bacc 402 Financial Stat 1Document9 pagesBacc 402 Financial Stat 1ItdarareNo ratings yet

- MultifamilyDocument4 pagesMultifamilyKevin ParkerNo ratings yet

- Economics For ManagersDocument26 pagesEconomics For ManagersAnkur KumarNo ratings yet

- Stock Status (RM + WIP + Plating + FG)Document2 pagesStock Status (RM + WIP + Plating + FG)Raja DuraiNo ratings yet

- New Supplier Application FormDocument2 pagesNew Supplier Application Formclem.sales.hmNo ratings yet

- Breakeven Analysis UnderstandingDocument12 pagesBreakeven Analysis UnderstandingSamreen LodhiNo ratings yet

- Carrier: Blue Dart: Deliver To FromDocument2 pagesCarrier: Blue Dart: Deliver To FromAbcNo ratings yet

- Revenue From Contracts With Customers Application of Basic ConceptsDocument6 pagesRevenue From Contracts With Customers Application of Basic ConceptsSharon AnchetaNo ratings yet

- MKT Ca3Document5 pagesMKT Ca3Saqlain MustaqeNo ratings yet

- Nippon Paint Group Medium-Term Plan (FY2021-2023) Update ReportDocument36 pagesNippon Paint Group Medium-Term Plan (FY2021-2023) Update ReportRahiNo ratings yet

- International Shipping OffersDocument1 pageInternational Shipping Offersone powerNo ratings yet

- BusinessModel Complete PDFDocument30 pagesBusinessModel Complete PDFAleena ShahNo ratings yet

- Supply Chain Managment Mini ReportDocument38 pagesSupply Chain Managment Mini ReportSantosh JhaNo ratings yet

- LAW ON SALES (Part 1)Document27 pagesLAW ON SALES (Part 1)She RCNo ratings yet

- Cost Accounting - ABC Vs Variable CostingDocument3 pagesCost Accounting - ABC Vs Variable CostingJaycel Yam-Yam VerancesNo ratings yet

- WESM 101 by Melinda Ocampo PEMC PresidentDocument23 pagesWESM 101 by Melinda Ocampo PEMC PresidentBeth HtebNo ratings yet

- Revenue Status Report FY 2011-2012 - General Fund 20111231Document19 pagesRevenue Status Report FY 2011-2012 - General Fund 20111231Infosys GriffinNo ratings yet

- Week 12 AY2021-2022 Forensic Accounting & Insurance v2Document35 pagesWeek 12 AY2021-2022 Forensic Accounting & Insurance v2Chloe NgNo ratings yet

- Unit 1: DEAL WITH Someone/something: Study These SentencesDocument7 pagesUnit 1: DEAL WITH Someone/something: Study These SentencesHuysymNo ratings yet