Professional Documents

Culture Documents

An Introduction To Finance

An Introduction To Finance

Uploaded by

jhun labangCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Hospitals' EmailsDocument8 pagesHospitals' EmailsAkil eswarNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- MBA Project On Employee Welfare MeasuresDocument92 pagesMBA Project On Employee Welfare MeasuresJebin Jacob93% (15)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Basic BookkeepingDocument25 pagesBasic Bookkeepingjhun labangNo ratings yet

- Obligations and ContractDocument14 pagesObligations and Contractjhun labangNo ratings yet

- The Philippine Financial SystemDocument20 pagesThe Philippine Financial Systemjhun labangNo ratings yet

- Learning Objectives: After Studying This Chapter, You Should Be Able ToDocument57 pagesLearning Objectives: After Studying This Chapter, You Should Be Able Tojhun labangNo ratings yet

- 1st Quarter Business FinanceDocument6 pages1st Quarter Business Financejhun labang100% (1)

- Please Submit Your Paper Immediately After The Class, Late Papers Will Not Be AcceptedDocument1 pagePlease Submit Your Paper Immediately After The Class, Late Papers Will Not Be Acceptedjhun labang100% (1)

- Tax Invoice: Billed To: Invoice DetailsDocument1 pageTax Invoice: Billed To: Invoice DetailsVINAY BANSAL100% (1)

- Introduction To Logistics ManagementDocument61 pagesIntroduction To Logistics ManagementChâu Anh ĐàoNo ratings yet

- Bs en 12Document10 pagesBs en 12Alvin BadzNo ratings yet

- 5ced6438e4b0ef8521f80cbf OriginalDocument101 pages5ced6438e4b0ef8521f80cbf OriginalParth TiwariNo ratings yet

- Supply Chain Management in Brief: Medhi CahyonoDocument7 pagesSupply Chain Management in Brief: Medhi CahyonoSetio TanoeNo ratings yet

- Bealu ThesisDocument56 pagesBealu ThesisTeshaleNo ratings yet

- Bus 305 AOCDocument4 pagesBus 305 AOCOyeniyi farukNo ratings yet

- Account Group AssignmentDocument41 pagesAccount Group Assignmentamira syasyaNo ratings yet

- Terex Simplicity Vibrating Feeders: Terex Minerals Processing SystemsDocument6 pagesTerex Simplicity Vibrating Feeders: Terex Minerals Processing Systemsestramilsolution100% (1)

- Order of Payment: CNC Online Application SystemDocument1 pageOrder of Payment: CNC Online Application SystemEva MarquezNo ratings yet

- Curriculam Vitae: Vemula Govinda Raju Personal DataDocument3 pagesCurriculam Vitae: Vemula Govinda Raju Personal DataAJAYNo ratings yet

- Class PPT DesignsDocument78 pagesClass PPT DesignsZubairNo ratings yet

- Digest - Mendiola Vs CADocument1 pageDigest - Mendiola Vs CAremraseNo ratings yet

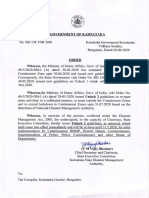

- GOK Unlock 2.0 OrderDocument9 pagesGOK Unlock 2.0 OrderAbhijith PatelNo ratings yet

- KH Concept Catalogue Sep 2023Document39 pagesKH Concept Catalogue Sep 2023Jus StreamingNo ratings yet

- 2044 6175 2 RVDocument12 pages2044 6175 2 RVBambang HaryadiNo ratings yet

- Furniture ManufacturerDocument9 pagesFurniture ManufacturerUniversal PrideNo ratings yet

- About BOBCMABobrand CardDocument2 pagesAbout BOBCMABobrand CardDeepak UpadhyayNo ratings yet

- Ensilo/Fortiedr: Course DescriptionDocument2 pagesEnsilo/Fortiedr: Course DescriptionhoadiNo ratings yet

- FM Cia 1.2 - 2123531Document10 pagesFM Cia 1.2 - 2123531Rohit GoyalNo ratings yet

- Foodrich Philippines Inc - Case-AnalysisDocument29 pagesFoodrich Philippines Inc - Case-AnalysisChiara Mari ManaloNo ratings yet

- Abrar Alam Electrical Foreman CVDocument2 pagesAbrar Alam Electrical Foreman CVGUDDUNo ratings yet

- Gartner's Hype Cycle For BlockchainDocument3 pagesGartner's Hype Cycle For BlockchainLionelPintoNo ratings yet

- Making The Quantum LeapDocument22 pagesMaking The Quantum LeapRJ DeLongNo ratings yet

- Appraisal of Real Estate Development Projects LectureDocument44 pagesAppraisal of Real Estate Development Projects LectureRaymon Prakash50% (2)

- Public Sector Economics Test QuestionsDocument9 pagesPublic Sector Economics Test QuestionsAbdul Hakim MambuayNo ratings yet

- Riphah International University: Faculty of Management Sciences Riphah School of Leadership (Meezan Campus)Document2 pagesRiphah International University: Faculty of Management Sciences Riphah School of Leadership (Meezan Campus)SAL MANNo ratings yet

- He Gave Up A Promising Law Career To Focus On His Public Speaking BusinessDocument6 pagesHe Gave Up A Promising Law Career To Focus On His Public Speaking BusinessFaruque FerdowsNo ratings yet

An Introduction To Finance

An Introduction To Finance

Uploaded by

jhun labangOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Introduction To Finance

An Introduction To Finance

Uploaded by

jhun labangCopyright:

Available Formats

An Introduction to Finance

Section 1 The Role and Scope of Finance

What is Finance?

A term that refers to two main activities;

the actual process of attracting money; and

the management of these funds;

The Functions of Finance

Analysis;

Decision-making;

The Areas of Finance

Business or Corporate Finance-the firm’s ability to make good finance decisions;

Personal Finance-retirement provision, saving plans etc.,;

Public Finance-income distribution, stability plans etc.,;

Finance v Accounting

Financial Accounting concentrates on record keeping and submitting of financial statements;

Finance focuses on making decisions and carrying out analysis based on information

presented by accounting;

Financial Accounting tends to be more concerned with the past;

Finance tend to be more interested in present and the future;

Financial Accounting tends to have an income focus;

Finance tends to have a cash flow focus;

Business Finance Types of Financial Decisions

Investment Decisions;

Financing Decisions;

Asset Management Decisions;

Investment Decisions

Should we built this component or buy it?

What specific assets should be acquired?

Should we introduce a new product?

Which projects should be undertaken?

Financing Decisions

What is the best structure of financing (debt versus equity)?

How much of our debt should be short- term as opposite to long-term?

What is the best dividend policy?

How will the funds be physically acquired?

Asset-Management Decision

How do we manage existing assets efficiently?

Financial Manager has varying degrees of operating responsibility over assets; ]

Greater emphasis on current asset management than fixed asset management;

The Goal of the Business

The target of business is the maximize shareholder’s wealth;

It’s measured as the price of stocks;

Wealth maximization concept adjusts for deficiencies of previous concept;

Profit Maximization

Short-Term Oriented;

Cannot account for risk;

Can lead mismanagement;

Wealth Maximization

Long-term Oriented;

The risk factor is taken account;

Recognizes the timing of returns;

Section 2 An Overview of Business Environment

Types of Businesses Sole Proprietorships

A business that owned and operated by one individual;

The owner and the business are legally identical;

17. The Pros and Cons of Sole Proprietorships 17

18. Partnerships A business that owned and controlled by two or more persons who are

equally liable for losses; Typically governed by partnership agreement; 18

19. The Pros and Cons of Partnerships 19

20. Company • Business that owned by shareholders; • Shareholder liability is limited to nominal

value of shares that they own; • Business is legally separate from it’s owners; 20

21. The Pros and Cons of Company 21

22. Section 3 Corporate Structure 22

23. The Modern Corporation There exists a SEPARATION between owners and managers.

Modern Corporation Shareholders Management 23

24. Organizational Chart of Corporate Structure 24

25. Role of Management An agenagentt is an individual authorized by another person, called

the principal, to act in the latter’s behalf; Management acts as an agentagent for the owners

(shareholders) of the firm; 25

26. Agency Theory Principals must provide incentivesincentives so that management acts in

the principals’ best interests and then monitormonitor results; Incentives include stockstock

options, perquisites,options, perquisites, and bonusesbonuses; 26

27. Section 4 A Quick Tour to Financial Environment 27

28. Financial Markets Businesses interact continually with the financial markets;financial

markets; Composed of all institutions and procedures for bringing buyers and sellers of

financial instruments together; 28

29. The Purpose of Financial Markets Mobilization of savings-uselessly lying fund is made to

flow the place where it is really needed; Facilitate price discovery-the price is determined by

the forces of demand and supply; Provide liquidity to financial assets-buyers or sellers of

securities are available all the times; Reduce the cost of transaction-making all necessary

information available without any cost; 29

30. Flow of Funds in the Economy INVESTMENT SECTOR FINANCIAL INTERMEDIARIES

SAVINGS SECTOR FINANCIAL BROKERS SECONDARY MARKET 30

31. Types of Financial Markets Money Market-market for trading of short-term

securities(Repo, CDO, commercial paper, T-bills); Capital Market-where the transaction of

long-term securities takes place(corporate bonds, government bonds); Primary Market-newly

issued instruments are bid; Secondary Market-already issued stocks are sold and bought; 31

32. Financial Intermediaries Come between ultimate borrowers and lenders by transforming

direct claims to indirect claims; Commercial banks, insurance funds,mutual funds; 32

33. Efficient Allocation of Funds Funds will flow to economic units that are willing to provide

the greatest expected return; The highest expected returns will be offered only by those

economic units with the most promising investment opportunities; Result:Result: Savings tend

to be allocated to the most efficient uses; 33

34. What Influences Security Expected Returns? Default Risk-the failure to meet the terms of

contract;Default Risk-the failure to meet the terms of contract; Marketability-Marketability- is

the ability to sell a significant volume of securities in a short period of time in the secondary

market without significant price concession; 34

35. What Influences Expected Security Returns? Maturity-Maturity- is concerned with the life

of the security; the amount of time before the principal amount of a security becomes due;

Embedded Options-Embedded Options- provide the opportunity to change specific attributes of

the security; InflationInflation -the greater inflation expectations, then the greater the expected

return; 35

36. Risk-Expected Return Profile RISK EXPECTEDRETURN(%) U.S. Treasury Bills (risk-free

securities)U.S. Treasury Bills (risk-free securities) Prime-grade Commercial PaperPrime-grade

Commercial Paper Long-term Government Bonds Investment-grade Corporate Bonds Medium-

grade Corporate Bonds Preferred Stocks Conservative Common Stocks Speculative Common

Stocks 36

37. Term Structure of Interest Rates A yield curve is a graph of the relationship between yields

and term to maturity for particular securities. Upward Sloping Yield CurveUpward Sloping Yield

Curve Downward Sloping Yield Curve 0246810 YIELD(%) 0 5 10 15 20 25 30 (Usual) (Unusual)

YEARS TO MATURITY 37

38. THANK YOU

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Hospitals' EmailsDocument8 pagesHospitals' EmailsAkil eswarNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- MBA Project On Employee Welfare MeasuresDocument92 pagesMBA Project On Employee Welfare MeasuresJebin Jacob93% (15)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Basic BookkeepingDocument25 pagesBasic Bookkeepingjhun labangNo ratings yet

- Obligations and ContractDocument14 pagesObligations and Contractjhun labangNo ratings yet

- The Philippine Financial SystemDocument20 pagesThe Philippine Financial Systemjhun labangNo ratings yet

- Learning Objectives: After Studying This Chapter, You Should Be Able ToDocument57 pagesLearning Objectives: After Studying This Chapter, You Should Be Able Tojhun labangNo ratings yet

- 1st Quarter Business FinanceDocument6 pages1st Quarter Business Financejhun labang100% (1)

- Please Submit Your Paper Immediately After The Class, Late Papers Will Not Be AcceptedDocument1 pagePlease Submit Your Paper Immediately After The Class, Late Papers Will Not Be Acceptedjhun labang100% (1)

- Tax Invoice: Billed To: Invoice DetailsDocument1 pageTax Invoice: Billed To: Invoice DetailsVINAY BANSAL100% (1)

- Introduction To Logistics ManagementDocument61 pagesIntroduction To Logistics ManagementChâu Anh ĐàoNo ratings yet

- Bs en 12Document10 pagesBs en 12Alvin BadzNo ratings yet

- 5ced6438e4b0ef8521f80cbf OriginalDocument101 pages5ced6438e4b0ef8521f80cbf OriginalParth TiwariNo ratings yet

- Supply Chain Management in Brief: Medhi CahyonoDocument7 pagesSupply Chain Management in Brief: Medhi CahyonoSetio TanoeNo ratings yet

- Bealu ThesisDocument56 pagesBealu ThesisTeshaleNo ratings yet

- Bus 305 AOCDocument4 pagesBus 305 AOCOyeniyi farukNo ratings yet

- Account Group AssignmentDocument41 pagesAccount Group Assignmentamira syasyaNo ratings yet

- Terex Simplicity Vibrating Feeders: Terex Minerals Processing SystemsDocument6 pagesTerex Simplicity Vibrating Feeders: Terex Minerals Processing Systemsestramilsolution100% (1)

- Order of Payment: CNC Online Application SystemDocument1 pageOrder of Payment: CNC Online Application SystemEva MarquezNo ratings yet

- Curriculam Vitae: Vemula Govinda Raju Personal DataDocument3 pagesCurriculam Vitae: Vemula Govinda Raju Personal DataAJAYNo ratings yet

- Class PPT DesignsDocument78 pagesClass PPT DesignsZubairNo ratings yet

- Digest - Mendiola Vs CADocument1 pageDigest - Mendiola Vs CAremraseNo ratings yet

- GOK Unlock 2.0 OrderDocument9 pagesGOK Unlock 2.0 OrderAbhijith PatelNo ratings yet

- KH Concept Catalogue Sep 2023Document39 pagesKH Concept Catalogue Sep 2023Jus StreamingNo ratings yet

- 2044 6175 2 RVDocument12 pages2044 6175 2 RVBambang HaryadiNo ratings yet

- Furniture ManufacturerDocument9 pagesFurniture ManufacturerUniversal PrideNo ratings yet

- About BOBCMABobrand CardDocument2 pagesAbout BOBCMABobrand CardDeepak UpadhyayNo ratings yet

- Ensilo/Fortiedr: Course DescriptionDocument2 pagesEnsilo/Fortiedr: Course DescriptionhoadiNo ratings yet

- FM Cia 1.2 - 2123531Document10 pagesFM Cia 1.2 - 2123531Rohit GoyalNo ratings yet

- Foodrich Philippines Inc - Case-AnalysisDocument29 pagesFoodrich Philippines Inc - Case-AnalysisChiara Mari ManaloNo ratings yet

- Abrar Alam Electrical Foreman CVDocument2 pagesAbrar Alam Electrical Foreman CVGUDDUNo ratings yet

- Gartner's Hype Cycle For BlockchainDocument3 pagesGartner's Hype Cycle For BlockchainLionelPintoNo ratings yet

- Making The Quantum LeapDocument22 pagesMaking The Quantum LeapRJ DeLongNo ratings yet

- Appraisal of Real Estate Development Projects LectureDocument44 pagesAppraisal of Real Estate Development Projects LectureRaymon Prakash50% (2)

- Public Sector Economics Test QuestionsDocument9 pagesPublic Sector Economics Test QuestionsAbdul Hakim MambuayNo ratings yet

- Riphah International University: Faculty of Management Sciences Riphah School of Leadership (Meezan Campus)Document2 pagesRiphah International University: Faculty of Management Sciences Riphah School of Leadership (Meezan Campus)SAL MANNo ratings yet

- He Gave Up A Promising Law Career To Focus On His Public Speaking BusinessDocument6 pagesHe Gave Up A Promising Law Career To Focus On His Public Speaking BusinessFaruque FerdowsNo ratings yet