Professional Documents

Culture Documents

NPS Transaction Statement For Tier I Account

NPS Transaction Statement For Tier I Account

Uploaded by

thilaksafaryCopyright:

Available Formats

You might also like

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountAkash Rahangdale0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAmit Gupta50% (2)

- Payment ReceiptDocument1 pagePayment ReceiptSkb VigneshNo ratings yet

- Get Her Back Action PlanDocument1 pageGet Her Back Action Planthilaksafary50% (2)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRaj Bharath33% (3)

- Jul 2021 Payment - ReceiptDocument1 pageJul 2021 Payment - ReceiptSandeepNayak0% (2)

- Education Loan Interest CertDocument1 pageEducation Loan Interest Certshekismail mvjNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRahul PanwarNo ratings yet

- Car Loan Nagendra StatementDocument1 pageCar Loan Nagendra Statementnavengg521No ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRajakumar Reddy25% (4)

- NPS Contribution 2019 20 PDFDocument1 pageNPS Contribution 2019 20 PDFbindhu lingalaNo ratings yet

- National Pension SchemeDocument1 pageNational Pension SchemeHarish Ghorpade67% (6)

- Payment ReceiptDocument1 pagePayment ReceiptPranay Kumar0% (1)

- 80G Certificate: Donation ReceiptDocument1 page80G Certificate: Donation ReceiptNeeraj Raushan KanthNo ratings yet

- Nps 2021Document3 pagesNps 2021Joyanto Saha100% (2)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencePullakiranreddy ReddyNo ratings yet

- NPS CertificateDocument2 pagesNPS CertificateSatish Tiwari100% (1)

- PPF e Receipt PDFDocument1 pagePPF e Receipt PDFManoj KumarNo ratings yet

- Housing Laon (0726675100007849) Provisional Certificate PDFDocument1 pageHousing Laon (0726675100007849) Provisional Certificate PDFanon_1747268810% (1)

- HDFC ERGO General Insurance Company LimitedDocument5 pagesHDFC ERGO General Insurance Company LimitedChiranjib PatraNo ratings yet

- ELSS Tax ReceiptDocument1 pageELSS Tax ReceiptPawan Bang100% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument1 pageNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRajakumar ReddyNo ratings yet

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferenceVikash ChetiwalNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencekids funNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceGaurav SrivastavNo ratings yet

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferencePradeep KumarNo ratings yet

- PPFDocument1 pagePPFArnab RoyNo ratings yet

- Donation Detail Partner Ngo Program Donation Giveindia Retention TotalDocument1 pageDonation Detail Partner Ngo Program Donation Giveindia Retention TotalHarshit SinghNo ratings yet

- Repay CertificateDocument1 pageRepay Certificateacrajesh50% (2)

- Pay Particulars: Pay and Pension Directorate - Sri Lanka NavyDocument1 pagePay Particulars: Pay and Pension Directorate - Sri Lanka NavySLNS RUHUNA100% (1)

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountabhishekNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountabhishekNo ratings yet

- NPS Fy23Document5 pagesNPS Fy23Sudhir Kumar SinghNo ratings yet

- Nps 123Document3 pagesNps 123Md Sharma SharmaNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceLaya DonthulaNo ratings yet

- PDFDocument3 pagesPDFKritarth KapoorNo ratings yet

- Centralrecordkeepingagency: National Pension System Transaction Statement - Tier IDocument2 pagesCentralrecordkeepingagency: National Pension System Transaction Statement - Tier Izuheb0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountQC&ISD1 LMD COLONYNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument3 pagesNPS Transaction Statement For Tier I Accountvikas0207ikash0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencevikas_2No ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceKuldeep JadhavNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceNIkhil GuptaNo ratings yet

- Payment ReceiptDocument1 pagePayment Receiptnizamsagar tsgenco75% (4)

- 80G Tax Receipt 1671527933 GowthamDocument1 page80G Tax Receipt 1671527933 Gowthamgautam thotaNo ratings yet

- Online Payment Acknowledgement Receipt CDocument1 pageOnline Payment Acknowledgement Receipt CSatyanarayana BalusaNo ratings yet

- PPF E-Receipt: Reference Number Name of Account Holder PPF Account Number Transaction Date RemarksDocument1 pagePPF E-Receipt: Reference Number Name of Account Holder PPF Account Number Transaction Date Remarksanurag srivastavaNo ratings yet

- NPSPayment ReceiptDocument1 pageNPSPayment ReceiptSanthosh DamaNo ratings yet

- Donation 80GDocument1 pageDonation 80Gmanoj kumarNo ratings yet

- Donatekart Foundation: Tax Exempt ReceiptDocument1 pageDonatekart Foundation: Tax Exempt ReceiptSunilSingh100% (1)

- PPF Receipt Jan 2020Document1 pagePPF Receipt Jan 2020prasad_batheNo ratings yet

- Education Loan Interest CertificateDocument1 pageEducation Loan Interest CertificatePavan KumarNo ratings yet

- NPS2Document1 pageNPS2tejaNo ratings yet

- PnewDocument1 pagePnewPartha100% (1)

- 80G Certificate: Donation ReceiptDocument1 page80G Certificate: Donation Receiptqwert0% (1)

- KK EV Auto Loan CertificateDocument1 pageKK EV Auto Loan CertificateKranthi Kumar KingNo ratings yet

- Naresh Kumar: Customer Care CenterDocument2 pagesNaresh Kumar: Customer Care Centernaresh2912275% (4)

- View CertificateDocument1 pageView CertificateGopal PenjarlaNo ratings yet

- DocumentDocument1 pageDocumentkalyan0% (1)

- Sbi Loan Certificate 2023Document1 pageSbi Loan Certificate 2023Pradeep Chauhan100% (1)

- Screenshot 2023-12-28 at 12.33.51 PMDocument1 pageScreenshot 2023-12-28 at 12.33.51 PMburriprashanthkumarNo ratings yet

- The PrologueDocument2 pagesThe Prologueanuprabhakara.gNo ratings yet

- Film238-2008-T1 210818 040644Document6 pagesFilm238-2008-T1 210818 040644thilaksafaryNo ratings yet

- ProductNote Micro MarvelDocument3 pagesProductNote Micro MarvelthilaksafaryNo ratings yet

- Formal Elements of Film Chart 210815 000424Document2 pagesFormal Elements of Film Chart 210815 000424thilaksafaryNo ratings yet

- All in - and More! Gambling in The James Bond Films - 210817 - 235622Document20 pagesAll in - and More! Gambling in The James Bond Films - 210817 - 235622thilaksafaryNo ratings yet

- 1 Baker - 210818 - 002951Document5 pages1 Baker - 210818 - 002951thilaksafaryNo ratings yet

- How To Improve Your Online Dating Profile and Get MORE MATCHESDocument11 pagesHow To Improve Your Online Dating Profile and Get MORE MATCHESthilaksafaryNo ratings yet

- PDFDocument1 pagePDFthilaksafaryNo ratings yet

- Literature 221115 231515Document2 pagesLiterature 221115 231515thilaksafaryNo ratings yet

- United India Insurance Company LimitedDocument11 pagesUnited India Insurance Company LimitedthilaksafaryNo ratings yet

- Lord Dattatreya JayanthiDocument5 pagesLord Dattatreya JayanthithilaksafaryNo ratings yet

- 45504Document7 pages45504thilaksafaryNo ratings yet

- Calling Men: "What Should You Do When He Tells You To Call Him?"Document4 pagesCalling Men: "What Should You Do When He Tells You To Call Him?"thilaksafaryNo ratings yet

- Account Statement From 1 Mar 2020 To 20 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Mar 2020 To 20 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancethilaksafaryNo ratings yet

- The Ultimate Secret To Getting Good With Women: by ThundercatDocument4 pagesThe Ultimate Secret To Getting Good With Women: by ThundercatthilaksafaryNo ratings yet

- Intro Stock Market PDFDocument65 pagesIntro Stock Market PDFthilaksafaryNo ratings yet

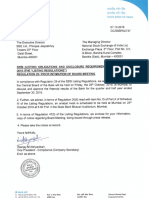

- FTD Fid .Ffi-Dq Fte: (Listing ObligationsDocument2 pagesFTD Fid .Ffi-Dq Fte: (Listing ObligationsthilaksafaryNo ratings yet

- Payment ReceiptDocument1 pagePayment ReceiptthilaksafaryNo ratings yet

- XG F Elto¡IffÿDocument1 pageXG F Elto¡IffÿthilaksafaryNo ratings yet

- 3IHq8e4nQ How To Conquer Yourself Discipline Willpower For HoDocument2 pages3IHq8e4nQ How To Conquer Yourself Discipline Willpower For HothilaksafaryNo ratings yet

- Text Messages To Send To Your Ex Girlfriend To Get Her BackDocument4 pagesText Messages To Send To Your Ex Girlfriend To Get Her BackthilaksafaryNo ratings yet

- Intercontinental Broadcasting Corp. vs. Noemi B. Amarilla, Et Al., G.R. No. 162775, October 27, 2006Document2 pagesIntercontinental Broadcasting Corp. vs. Noemi B. Amarilla, Et Al., G.R. No. 162775, October 27, 2006xxxaaxxxNo ratings yet

- All About GST REFUNDS - Refrence ManualDocument451 pagesAll About GST REFUNDS - Refrence ManualSwarnadevi GanesanNo ratings yet

- Filling Up Forms AccuratelyDocument51 pagesFilling Up Forms AccuratelydanteNo ratings yet

- GST-Assessment and Audit RulesDocument4 pagesGST-Assessment and Audit RulesvishalankitNo ratings yet

- TP 1.r V (2016 05) DxiDocument2 pagesTP 1.r V (2016 05) DxiSunil DhageNo ratings yet

- PT Karya Mandiri SejahteraDocument4 pagesPT Karya Mandiri SejahteraImroatul MufidaNo ratings yet

- Report Report 23Document9 pagesReport Report 23Pran piyaNo ratings yet

- Ganraj ConstructionDocument2 pagesGanraj ConstructionSUNIL GAIKWADNo ratings yet

- Special Power of Attorney For PropertyDocument2 pagesSpecial Power of Attorney For PropertyCy BalabaNo ratings yet

- Sales Tax Appel Form 00219FORM-310 - EnglishDocument3 pagesSales Tax Appel Form 00219FORM-310 - EnglishsawshivNo ratings yet

- Group Project - Impact of GST On Supply Chain ManagementDocument20 pagesGroup Project - Impact of GST On Supply Chain ManagementArpit Shah83% (6)

- Bir Ruling 197-93 (May 7, 1993)Document5 pagesBir Ruling 197-93 (May 7, 1993)matinikkiNo ratings yet

- Salary Slip (30356680 April, 2019) PDFDocument1 pageSalary Slip (30356680 April, 2019) PDFMuhammad Farukh IbtasamNo ratings yet

- EPF Contribution Calculation: Key-In Your Basic Pay HereDocument1 pageEPF Contribution Calculation: Key-In Your Basic Pay Heree_arasanNo ratings yet

- Dwnload Full Corporate Partnership Estate and Gift Taxation 6th Edition Pratt Solutions Manual PDFDocument36 pagesDwnload Full Corporate Partnership Estate and Gift Taxation 6th Edition Pratt Solutions Manual PDFlinzigaumond2915z100% (17)

- Week 8 Scope and Taxation Reforms of The PhilippinesDocument4 pagesWeek 8 Scope and Taxation Reforms of The PhilippinesAngie Olpos Boreros BaritugoNo ratings yet

- Solid Q 50 KW InvoiceDocument1 pageSolid Q 50 KW InvoiceTrisha RawatNo ratings yet

- HMRC V BlackRock HoldcoDocument7 pagesHMRC V BlackRock HoldcobasakevNo ratings yet

- Seven9 Sky Brochure-1Document1 pageSeven9 Sky Brochure-1Thakor MistryNo ratings yet

- Prestige Atlas 3.0 Induction Cooktop: Grand Total 999.00Document1 pagePrestige Atlas 3.0 Induction Cooktop: Grand Total 999.00Alok KumarNo ratings yet

- 4.constitutional and Statutory Basis of Taxation PDFDocument50 pages4.constitutional and Statutory Basis of Taxation PDFVikas ChaudharyNo ratings yet

- Types of ProportionDocument2 pagesTypes of ProportionDon McArthney TugaoenNo ratings yet

- 146Document2 pages146Krishna TiwariNo ratings yet

- Sep 08Document1 pageSep 08api-19587360No ratings yet

- Departmental Interpretation and Practice Notes NO. 32 (Revised)Document51 pagesDepartmental Interpretation and Practice Notes NO. 32 (Revised)Difanny KooNo ratings yet

- Dino v. CIRDocument28 pagesDino v. CIRMadame DaminNo ratings yet

- February 19, 2018 G.R. No. 222428 Coca-Cola Bottlers Philippines, Inc., Petitioner Commissioner of Internal Revenue, Respondent Decision Peralta, J.Document6 pagesFebruary 19, 2018 G.R. No. 222428 Coca-Cola Bottlers Philippines, Inc., Petitioner Commissioner of Internal Revenue, Respondent Decision Peralta, J.jacq17No ratings yet

- Fy 20-21Document5 pagesFy 20-21Pranav PandeyNo ratings yet

- New Form 15G PDFDocument2 pagesNew Form 15G PDFSoma Sundar50% (2)

NPS Transaction Statement For Tier I Account

NPS Transaction Statement For Tier I Account

Uploaded by

thilaksafaryOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NPS Transaction Statement For Tier I Account

NPS Transaction Statement For Tier I Account

Uploaded by

thilaksafaryCopyright:

Available Formats

NPS Transaction Statement for Tier I Account

Statement Period: From April 01, 2020 to May 10, 2020 Statement Generation Date : May 10, 2020

PRAN 110085483702 Registration Date 01-Oct-15

Subscriber Name SHRI THILAK C R Tier I Status Active

153 Tier II Status Not Activated

CHINDAGIRI KOPPALU Scheme Choice DEFAULT SCHEME SET-UP

SRIRANGAPATNATALUK CBO Registration No 6501445

CBO Name STATE BANK OF INDIA

Address BALLENA HALLY POST

CBO Address P.P.G. DEPARTMENT, SBI, LOCAL HEAD OFFICE

MANDYA 65, ST. MARKS ROAD, BANGALORE, 560001

KARNATAKA - 571401 CHO Registration No 5501344

INDIA CHO Name STATE BANK OF INDIA

CORPORATE CENTRE, PPG DEPT, 16TH FLR,

Mobile Number +919844718122 CHO Address MADAME CAMA ROAD

NARIMAN POINT, MUMBAI, 400021

Email ID THILAK22R@GMAIL.COM

IRA Status IRA compliant Tier I Nominee Name/s Percentage

RAMU 100%

Summary

The total contribution to your pension account till May 10, 2020 was Rs. 257901.48.

The total value of your contributions as on May 10, 2020 was Rs. 308586.67.

Your contributions have earned a return of Rs.50685.19 till May 10, 2020.

Current Scheme Preference

Investment Option Scheme Details Percentage

Scheme 1 SBI PENSION FUNDS PVT. LTD. SCHEME - CORPORATE-CG 100.00%

Investment Details Summary

Notional Gain /

Total Contribution

No of Contribution Total Withdrawal

Current Valuation Return of

(Rs) (Rs) (Rs) Loss FY XIRR Invesment(XIRR)

(Rs)

257901.48 42 0.0000 308586.67 50685.19 FY XIRR 9.49%

Investment Details - Scheme Wise Summary

Total Net Latest NAV Value at NAV Unrealized Gain /

PFM/Scheme Contribution Total Units (Rs) Loss

(Rs) Date (Rs)

SBI PENSION FUNDS PVT. LTD. SCHEME - 20.2200

257498.93 15261.4578 308586.67 51087.74

CORPORATE-CG 08-May-2020

Total 257498.93 308586.67 51087.74

Changes made during the selected period

No change affected in this period

Contribution/ Redemption Details

Contribution

Date Particulars Uploaded By Employee Employer's Total

Contribution Contribution (Rs)

(Rs) (Rs)

01-Apr-2020 Opening balance 2,48,891.48

09-Apr-2020 For March, 2020 State Bank of India (5000214), 1371.00 1371.00 2742.00

05-May- For April, 2020 State Bank of India (5000214), 3134.00 3134.00 6268.00

2020

10-May-2020 Closing Balance at NSDL CRA 2,57,901.48

Transaction Details

SBI PENSION FUNDS PVT. LTD. SCHEME - CORPORATE-CG

Date Particulars Amount (Rs)

Units

NAV (Rs)

01-Apr-2020 Opening Balance 14808.8520

2742.00

09-Apr-2020 By Contribution for March,2020 140.8457

19.4681

6268.00

05-May-2020 By Contribution for April,2020 311.7601

20.1052

10-May-2020 Closing Balance at NSDL CRA 257498.93 15261.4578

Notes

1. The 'Investment Details' section gives an overall status of the total contribution processed under the account and the returns accrued

2. 'Notional Gain / Loss' indicates the overall gain or loss after factoring for the withdrawals processed in the account.

3. 'Total Net Contributions' indicates the cost of units currently held in the PRAN account

4. 'Unrealized Gain / Loss' indicates the gain / loss in the account for the current units balance in the account.

Returns based on Inflows' gives the annualized effective compounded return rate in PRAN account and is calculated using the formula of XIRR. The

5. calculation is done considering all the contribution / redemptions processed in PRAN account since inception and the latest valuation of the

investments. The transactions are sorted based on the NAV date.

6.

'Changes made during the selected period' indicates all the change requests processed in PRAN account during the period for which the

statement is generated

The section 'Contribution / Redemption Details' gives the details of the contributions and redemption processed in subscribers' account during the

7. period for which the statement is generated. While contribution amount indicates the amount invested in subscribers account, the redemption

amount indicates the cost of units redeemed from the account. The cost of units is calculated on a First-In-First-Out (FIFO) basis. The details are

sorted based on date when the transaction is posted in PRAN account, which may / may not be the date for allotment of the NAV.

'Transaction Details' gives the units allotted under different schemes / asset classes for each of the contributions processed in subscribers'

8. account during the period for which the statement is generated. It also contains units debited from the account for redemption and rectification. The

details are sorted based on date when the transaction is posted in PRAN account, which may / may not be the date for allotment of the NAV.

The Amount in the Closing Balance under the section 'Transaction Details' refers to the Units Balance in the books of NSDL CRA and it gives the

9. cost of investment of the balance units and not a sum total of all contributions and withdrawals. The cost of units is calculated on a First-In-First-Out

(FIFO) basis.

For transactions with the remarks "To Unit Redemption", the cost of units redeemed are adjusted against the total contribution in the Investment

10. Details section. Further, the cost of units is calculated on a First-In-First-Out (FIFO) basis. For calculating the 'Returns based on Inflows', the actual

redemption value corresponding to the units redeemed has been considered.

11. The Transaction statement is dynamic. The value and other computations in the Transaction statement depend upon the generation date.

12. The above returns are calculated based on scheme NAVs and the securities held under the scheme portfolio are valued on mark to market basis

and are subject to change on NAV fluctuations.

If you are an employee or if you are self-employed , you will be able to avail of deduction on contribution made from your taxable income to the extent

of (u/s 80 CCD (1) of income Tax Act, 1961)

- 10% of salary (Basic + DA ) - if you are salaried employee

- 10% of your gross income - if you are self-employed

However, please note that the maximum deduction from your taxable income is limited to RS.1.50 lac, as permitted under Sec 80 CCE of the

13.

Income Tax Act.

Further, an additional deduction from your taxable income to the extent of Rs. 50,000/- is available only for contribution in NPS u/s Sec. 80 CCD (1B).

To give an example, your salary is Rs.15 lac per annum. On contribution of Rs. 2 lac, you can avail:

Deduction under Sec. 80 CCD (1) - Rs. 1.50 lac

Deduction under Sec. 80 CCD (1B) - Rs. 0.50 lac

Total deduction - Rs. 2.00 lac

Also note that your employer's contribution upto 10% of your salary is fully deductible from your taxable income.

14. Best viewed in Internet Explorer 9.0 & above or Mozilla Firefox Ver 3 & above with a resolution of 1024 X 768.

Retired life ka sahara, NPS hamara

Home | Contact Us | System Configuration / Best Viewed | Entrust Secured | Privacy Policy | Grievance Redressal Policy

You might also like

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountAkash Rahangdale0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAmit Gupta50% (2)

- Payment ReceiptDocument1 pagePayment ReceiptSkb VigneshNo ratings yet

- Get Her Back Action PlanDocument1 pageGet Her Back Action Planthilaksafary50% (2)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRaj Bharath33% (3)

- Jul 2021 Payment - ReceiptDocument1 pageJul 2021 Payment - ReceiptSandeepNayak0% (2)

- Education Loan Interest CertDocument1 pageEducation Loan Interest Certshekismail mvjNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRahul PanwarNo ratings yet

- Car Loan Nagendra StatementDocument1 pageCar Loan Nagendra Statementnavengg521No ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRajakumar Reddy25% (4)

- NPS Contribution 2019 20 PDFDocument1 pageNPS Contribution 2019 20 PDFbindhu lingalaNo ratings yet

- National Pension SchemeDocument1 pageNational Pension SchemeHarish Ghorpade67% (6)

- Payment ReceiptDocument1 pagePayment ReceiptPranay Kumar0% (1)

- 80G Certificate: Donation ReceiptDocument1 page80G Certificate: Donation ReceiptNeeraj Raushan KanthNo ratings yet

- Nps 2021Document3 pagesNps 2021Joyanto Saha100% (2)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencePullakiranreddy ReddyNo ratings yet

- NPS CertificateDocument2 pagesNPS CertificateSatish Tiwari100% (1)

- PPF e Receipt PDFDocument1 pagePPF e Receipt PDFManoj KumarNo ratings yet

- Housing Laon (0726675100007849) Provisional Certificate PDFDocument1 pageHousing Laon (0726675100007849) Provisional Certificate PDFanon_1747268810% (1)

- HDFC ERGO General Insurance Company LimitedDocument5 pagesHDFC ERGO General Insurance Company LimitedChiranjib PatraNo ratings yet

- ELSS Tax ReceiptDocument1 pageELSS Tax ReceiptPawan Bang100% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument1 pageNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRajakumar ReddyNo ratings yet

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferenceVikash ChetiwalNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencekids funNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceGaurav SrivastavNo ratings yet

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferencePradeep KumarNo ratings yet

- PPFDocument1 pagePPFArnab RoyNo ratings yet

- Donation Detail Partner Ngo Program Donation Giveindia Retention TotalDocument1 pageDonation Detail Partner Ngo Program Donation Giveindia Retention TotalHarshit SinghNo ratings yet

- Repay CertificateDocument1 pageRepay Certificateacrajesh50% (2)

- Pay Particulars: Pay and Pension Directorate - Sri Lanka NavyDocument1 pagePay Particulars: Pay and Pension Directorate - Sri Lanka NavySLNS RUHUNA100% (1)

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountabhishekNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountabhishekNo ratings yet

- NPS Fy23Document5 pagesNPS Fy23Sudhir Kumar SinghNo ratings yet

- Nps 123Document3 pagesNps 123Md Sharma SharmaNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceLaya DonthulaNo ratings yet

- PDFDocument3 pagesPDFKritarth KapoorNo ratings yet

- Centralrecordkeepingagency: National Pension System Transaction Statement - Tier IDocument2 pagesCentralrecordkeepingagency: National Pension System Transaction Statement - Tier Izuheb0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountQC&ISD1 LMD COLONYNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument3 pagesNPS Transaction Statement For Tier I Accountvikas0207ikash0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencevikas_2No ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceKuldeep JadhavNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceNIkhil GuptaNo ratings yet

- Payment ReceiptDocument1 pagePayment Receiptnizamsagar tsgenco75% (4)

- 80G Tax Receipt 1671527933 GowthamDocument1 page80G Tax Receipt 1671527933 Gowthamgautam thotaNo ratings yet

- Online Payment Acknowledgement Receipt CDocument1 pageOnline Payment Acknowledgement Receipt CSatyanarayana BalusaNo ratings yet

- PPF E-Receipt: Reference Number Name of Account Holder PPF Account Number Transaction Date RemarksDocument1 pagePPF E-Receipt: Reference Number Name of Account Holder PPF Account Number Transaction Date Remarksanurag srivastavaNo ratings yet

- NPSPayment ReceiptDocument1 pageNPSPayment ReceiptSanthosh DamaNo ratings yet

- Donation 80GDocument1 pageDonation 80Gmanoj kumarNo ratings yet

- Donatekart Foundation: Tax Exempt ReceiptDocument1 pageDonatekart Foundation: Tax Exempt ReceiptSunilSingh100% (1)

- PPF Receipt Jan 2020Document1 pagePPF Receipt Jan 2020prasad_batheNo ratings yet

- Education Loan Interest CertificateDocument1 pageEducation Loan Interest CertificatePavan KumarNo ratings yet

- NPS2Document1 pageNPS2tejaNo ratings yet

- PnewDocument1 pagePnewPartha100% (1)

- 80G Certificate: Donation ReceiptDocument1 page80G Certificate: Donation Receiptqwert0% (1)

- KK EV Auto Loan CertificateDocument1 pageKK EV Auto Loan CertificateKranthi Kumar KingNo ratings yet

- Naresh Kumar: Customer Care CenterDocument2 pagesNaresh Kumar: Customer Care Centernaresh2912275% (4)

- View CertificateDocument1 pageView CertificateGopal PenjarlaNo ratings yet

- DocumentDocument1 pageDocumentkalyan0% (1)

- Sbi Loan Certificate 2023Document1 pageSbi Loan Certificate 2023Pradeep Chauhan100% (1)

- Screenshot 2023-12-28 at 12.33.51 PMDocument1 pageScreenshot 2023-12-28 at 12.33.51 PMburriprashanthkumarNo ratings yet

- The PrologueDocument2 pagesThe Prologueanuprabhakara.gNo ratings yet

- Film238-2008-T1 210818 040644Document6 pagesFilm238-2008-T1 210818 040644thilaksafaryNo ratings yet

- ProductNote Micro MarvelDocument3 pagesProductNote Micro MarvelthilaksafaryNo ratings yet

- Formal Elements of Film Chart 210815 000424Document2 pagesFormal Elements of Film Chart 210815 000424thilaksafaryNo ratings yet

- All in - and More! Gambling in The James Bond Films - 210817 - 235622Document20 pagesAll in - and More! Gambling in The James Bond Films - 210817 - 235622thilaksafaryNo ratings yet

- 1 Baker - 210818 - 002951Document5 pages1 Baker - 210818 - 002951thilaksafaryNo ratings yet

- How To Improve Your Online Dating Profile and Get MORE MATCHESDocument11 pagesHow To Improve Your Online Dating Profile and Get MORE MATCHESthilaksafaryNo ratings yet

- PDFDocument1 pagePDFthilaksafaryNo ratings yet

- Literature 221115 231515Document2 pagesLiterature 221115 231515thilaksafaryNo ratings yet

- United India Insurance Company LimitedDocument11 pagesUnited India Insurance Company LimitedthilaksafaryNo ratings yet

- Lord Dattatreya JayanthiDocument5 pagesLord Dattatreya JayanthithilaksafaryNo ratings yet

- 45504Document7 pages45504thilaksafaryNo ratings yet

- Calling Men: "What Should You Do When He Tells You To Call Him?"Document4 pagesCalling Men: "What Should You Do When He Tells You To Call Him?"thilaksafaryNo ratings yet

- Account Statement From 1 Mar 2020 To 20 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Mar 2020 To 20 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancethilaksafaryNo ratings yet

- The Ultimate Secret To Getting Good With Women: by ThundercatDocument4 pagesThe Ultimate Secret To Getting Good With Women: by ThundercatthilaksafaryNo ratings yet

- Intro Stock Market PDFDocument65 pagesIntro Stock Market PDFthilaksafaryNo ratings yet

- FTD Fid .Ffi-Dq Fte: (Listing ObligationsDocument2 pagesFTD Fid .Ffi-Dq Fte: (Listing ObligationsthilaksafaryNo ratings yet

- Payment ReceiptDocument1 pagePayment ReceiptthilaksafaryNo ratings yet

- XG F Elto¡IffÿDocument1 pageXG F Elto¡IffÿthilaksafaryNo ratings yet

- 3IHq8e4nQ How To Conquer Yourself Discipline Willpower For HoDocument2 pages3IHq8e4nQ How To Conquer Yourself Discipline Willpower For HothilaksafaryNo ratings yet

- Text Messages To Send To Your Ex Girlfriend To Get Her BackDocument4 pagesText Messages To Send To Your Ex Girlfriend To Get Her BackthilaksafaryNo ratings yet

- Intercontinental Broadcasting Corp. vs. Noemi B. Amarilla, Et Al., G.R. No. 162775, October 27, 2006Document2 pagesIntercontinental Broadcasting Corp. vs. Noemi B. Amarilla, Et Al., G.R. No. 162775, October 27, 2006xxxaaxxxNo ratings yet

- All About GST REFUNDS - Refrence ManualDocument451 pagesAll About GST REFUNDS - Refrence ManualSwarnadevi GanesanNo ratings yet

- Filling Up Forms AccuratelyDocument51 pagesFilling Up Forms AccuratelydanteNo ratings yet

- GST-Assessment and Audit RulesDocument4 pagesGST-Assessment and Audit RulesvishalankitNo ratings yet

- TP 1.r V (2016 05) DxiDocument2 pagesTP 1.r V (2016 05) DxiSunil DhageNo ratings yet

- PT Karya Mandiri SejahteraDocument4 pagesPT Karya Mandiri SejahteraImroatul MufidaNo ratings yet

- Report Report 23Document9 pagesReport Report 23Pran piyaNo ratings yet

- Ganraj ConstructionDocument2 pagesGanraj ConstructionSUNIL GAIKWADNo ratings yet

- Special Power of Attorney For PropertyDocument2 pagesSpecial Power of Attorney For PropertyCy BalabaNo ratings yet

- Sales Tax Appel Form 00219FORM-310 - EnglishDocument3 pagesSales Tax Appel Form 00219FORM-310 - EnglishsawshivNo ratings yet

- Group Project - Impact of GST On Supply Chain ManagementDocument20 pagesGroup Project - Impact of GST On Supply Chain ManagementArpit Shah83% (6)

- Bir Ruling 197-93 (May 7, 1993)Document5 pagesBir Ruling 197-93 (May 7, 1993)matinikkiNo ratings yet

- Salary Slip (30356680 April, 2019) PDFDocument1 pageSalary Slip (30356680 April, 2019) PDFMuhammad Farukh IbtasamNo ratings yet

- EPF Contribution Calculation: Key-In Your Basic Pay HereDocument1 pageEPF Contribution Calculation: Key-In Your Basic Pay Heree_arasanNo ratings yet

- Dwnload Full Corporate Partnership Estate and Gift Taxation 6th Edition Pratt Solutions Manual PDFDocument36 pagesDwnload Full Corporate Partnership Estate and Gift Taxation 6th Edition Pratt Solutions Manual PDFlinzigaumond2915z100% (17)

- Week 8 Scope and Taxation Reforms of The PhilippinesDocument4 pagesWeek 8 Scope and Taxation Reforms of The PhilippinesAngie Olpos Boreros BaritugoNo ratings yet

- Solid Q 50 KW InvoiceDocument1 pageSolid Q 50 KW InvoiceTrisha RawatNo ratings yet

- HMRC V BlackRock HoldcoDocument7 pagesHMRC V BlackRock HoldcobasakevNo ratings yet

- Seven9 Sky Brochure-1Document1 pageSeven9 Sky Brochure-1Thakor MistryNo ratings yet

- Prestige Atlas 3.0 Induction Cooktop: Grand Total 999.00Document1 pagePrestige Atlas 3.0 Induction Cooktop: Grand Total 999.00Alok KumarNo ratings yet

- 4.constitutional and Statutory Basis of Taxation PDFDocument50 pages4.constitutional and Statutory Basis of Taxation PDFVikas ChaudharyNo ratings yet

- Types of ProportionDocument2 pagesTypes of ProportionDon McArthney TugaoenNo ratings yet

- 146Document2 pages146Krishna TiwariNo ratings yet

- Sep 08Document1 pageSep 08api-19587360No ratings yet

- Departmental Interpretation and Practice Notes NO. 32 (Revised)Document51 pagesDepartmental Interpretation and Practice Notes NO. 32 (Revised)Difanny KooNo ratings yet

- Dino v. CIRDocument28 pagesDino v. CIRMadame DaminNo ratings yet

- February 19, 2018 G.R. No. 222428 Coca-Cola Bottlers Philippines, Inc., Petitioner Commissioner of Internal Revenue, Respondent Decision Peralta, J.Document6 pagesFebruary 19, 2018 G.R. No. 222428 Coca-Cola Bottlers Philippines, Inc., Petitioner Commissioner of Internal Revenue, Respondent Decision Peralta, J.jacq17No ratings yet

- Fy 20-21Document5 pagesFy 20-21Pranav PandeyNo ratings yet

- New Form 15G PDFDocument2 pagesNew Form 15G PDFSoma Sundar50% (2)