Professional Documents

Culture Documents

I. Distribution of Profits: Required

I. Distribution of Profits: Required

Uploaded by

Jennette ToCopyright:

Available Formats

You might also like

- Dublin Resume Template ModernDocument1 pageDublin Resume Template ModernxyzNo ratings yet

- C10 - PAS 7 Statement of Cash FlowsDocument15 pagesC10 - PAS 7 Statement of Cash FlowsAllaine Elfa100% (2)

- Management and LeadershipDocument7 pagesManagement and LeadershipJoyae ChavezNo ratings yet

- Chapter 2 - Intro To ITDocument12 pagesChapter 2 - Intro To ITMakiri Sajili IINo ratings yet

- RA 9298 Accountancy LawDocument15 pagesRA 9298 Accountancy LawniqdelrosarioNo ratings yet

- Cost-Volume-Profit Analysis: 2,000 Units and $100,000 of RevenuesDocument14 pagesCost-Volume-Profit Analysis: 2,000 Units and $100,000 of RevenuesMa. Alexandra Teddy BuenNo ratings yet

- First Exam Review WithSolutionDocument6 pagesFirst Exam Review WithSolutionLexter Dave C EstoqueNo ratings yet

- DownloadfileDocument6 pagesDownloadfileLouisAnthonyHabaradasCantillonNo ratings yet

- NF Jpia Mas Cup PDF FreeDocument6 pagesNF Jpia Mas Cup PDF FreeAnne Marieline BuenaventuraNo ratings yet

- ReviewerDocument4 pagesReviewerCon LamugNo ratings yet

- As 12 - Full Notes For Accounting For Government GrantDocument6 pagesAs 12 - Full Notes For Accounting For Government GrantShrey KunjNo ratings yet

- Midterm Exam 2021-NoDocument10 pagesMidterm Exam 2021-NoAndrei GoNo ratings yet

- RuelDocument2 pagesRuelCloudKielGuiang0% (1)

- Forms of Statement of Financial PositionDocument7 pagesForms of Statement of Financial PositionRocel DomingoNo ratings yet

- AGAP Scholarship ProgramDocument3 pagesAGAP Scholarship ProgramDaneen GastarNo ratings yet

- Practice Problems - Transfer TaxesDocument2 pagesPractice Problems - Transfer Taxesuchishai100% (1)

- Financial ManagementDocument6 pagesFinancial ManagementDaniel HunksNo ratings yet

- Nfjpia Nmbe MS 2017 AnsDocument9 pagesNfjpia Nmbe MS 2017 AnsMicka EllahNo ratings yet

- Learning Resource 12 Lesson 3Document7 pagesLearning Resource 12 Lesson 3Vianca Marella SamonteNo ratings yet

- Taxation: Far Eastern University - ManilaDocument4 pagesTaxation: Far Eastern University - ManilacamilleNo ratings yet

- ObliCon Part 4Document2 pagesObliCon Part 4Wawex DavisNo ratings yet

- 3 ACCT 2AB P. DissolutionDocument6 pages3 ACCT 2AB P. DissolutionMary Angeline LopezNo ratings yet

- TBCH09Document6 pagesTBCH09Samit TandukarNo ratings yet

- Article 1599Document9 pagesArticle 1599Yvonne Kristine EstacioNo ratings yet

- C8 Statement of Financial PositionDocument14 pagesC8 Statement of Financial PositionAllaine ElfaNo ratings yet

- Midterm ExaminationDocument11 pagesMidterm ExaminationAntonette CaspeNo ratings yet

- Ac3a Qe Oct2014 (TQ)Document15 pagesAc3a Qe Oct2014 (TQ)Julrick Cubio EgbusNo ratings yet

- Requirements: Prepare Journal Entries To Record The Foregoing Transactions. Identify The Entries by Letter (A - F)Document2 pagesRequirements: Prepare Journal Entries To Record The Foregoing Transactions. Identify The Entries by Letter (A - F)happy240823No ratings yet

- ExamDocument7 pagesExamKristen WalshNo ratings yet

- Acco 20063 Midterm ExamDocument7 pagesAcco 20063 Midterm Examyugyeom rojasNo ratings yet

- Ms 03 - CVP AnalysisDocument10 pagesMs 03 - CVP AnalysisDin Rose GonzalesNo ratings yet

- Drills Exercises 18-Jan-2020Document2 pagesDrills Exercises 18-Jan-2020MCPS Operations BranchNo ratings yet

- Great DepressionDocument5 pagesGreat DepressionDarrelNo ratings yet

- Taxation Report - Valuation of Properties - Vanishing DeductionDocument49 pagesTaxation Report - Valuation of Properties - Vanishing DeductionAnonymous S6CQnxuJcINo ratings yet

- Module 2 - Individuals Estates and Trusts Without Answer-2Document12 pagesModule 2 - Individuals Estates and Trusts Without Answer-2KarenFayeBadillesNo ratings yet

- Warranty Expense and Bonds PayableDocument3 pagesWarranty Expense and Bonds PayableAira Jaimee GonzalesNo ratings yet

- Assignment - Audit of Ppe1Document4 pagesAssignment - Audit of Ppe1Wam OwnNo ratings yet

- Chapter 4 - Deductions From Gross EstateDocument32 pagesChapter 4 - Deductions From Gross EstateJayvee Felipe100% (1)

- Audit of ReceivablesDocument20 pagesAudit of ReceivablesDethzaida AsebuqueNo ratings yet

- Chapter 1 - Partnership Formation PDFDocument33 pagesChapter 1 - Partnership Formation PDFAldrin ZolinaNo ratings yet

- Kunci Jawaban Intermediate AccountingDocument41 pagesKunci Jawaban Intermediate AccountingbelindaNo ratings yet

- The Role of Accountants in Nation Building Through TaxationDocument2 pagesThe Role of Accountants in Nation Building Through TaxationJoshua Ryan CanatuanNo ratings yet

- Cash and Accrual Discussion301302Document2 pagesCash and Accrual Discussion301302Gloria BeltranNo ratings yet

- Process CostingDocument6 pagesProcess Costingbae joohyun0% (2)

- Afar - Partnership Formation - BagayaoDocument2 pagesAfar - Partnership Formation - BagayaoRejay VillamorNo ratings yet

- 8Document80 pages8Hannah Khamil MirandaNo ratings yet

- PUP Review Handout 1 OfficialDocument3 pagesPUP Review Handout 1 OfficialDonalyn CalipusNo ratings yet

- Exercise 4-6 Case StudyDocument13 pagesExercise 4-6 Case Studymariyha PalangganaNo ratings yet

- AFARDocument15 pagesAFARBetchelyn Dagwayan BenignosNo ratings yet

- Assignment 3Document6 pagesAssignment 3Triechia LaudNo ratings yet

- Ch28 Test Bank 4-5-10Document14 pagesCh28 Test Bank 4-5-10KarenNo ratings yet

- MANSCI Final Exam QuestionnaireDocument10 pagesMANSCI Final Exam QuestionnaireChristine NionesNo ratings yet

- Questions p2Document15 pagesQuestions p2Let it be100% (1)

- PART I: True or False: Management Accounting Quiz 1 BsmaDocument4 pagesPART I: True or False: Management Accounting Quiz 1 BsmaAngelyn SamandeNo ratings yet

- Assignment 1 Caro Coleen Sec27Document2 pagesAssignment 1 Caro Coleen Sec27Alyssa TordesillasNo ratings yet

- Question Bank - Financial Reporting and AnalysisDocument8 pagesQuestion Bank - Financial Reporting and AnalysisSagar BhandareNo ratings yet

- Pamantasan NG Lungsod NG Maynila Intermediate Accounting 3 Quiz No. 1Document5 pagesPamantasan NG Lungsod NG Maynila Intermediate Accounting 3 Quiz No. 1Trixie HicaldeNo ratings yet

- Corporate Liquidation & Joint Venture2Document5 pagesCorporate Liquidation & Joint Venture2jjjjjjjjjjjjjjjNo ratings yet

- Prepare Financial Report AssignmentDocument7 pagesPrepare Financial Report AssignmentBiruk HabtamuNo ratings yet

- 01 Long QuizDocument6 pages01 Long Quizgiana riveraNo ratings yet

- Accounting 2Document18 pagesAccounting 2cherryannNo ratings yet

- Corporation LiquidationDocument1 pageCorporation LiquidationMelisa DomingoNo ratings yet

- List of TREC Holders 220722Document36 pagesList of TREC Holders 220722Abdullah IlyasNo ratings yet

- Pre-Construction Information Checklist: Project Title Project Number Project Manager LocationDocument2 pagesPre-Construction Information Checklist: Project Title Project Number Project Manager Locationnilesh kumar VermaNo ratings yet

- Bay'-Salam: Musharakah and Mudarabah Are Two of Several Financial Instruments Which Are Used inDocument5 pagesBay'-Salam: Musharakah and Mudarabah Are Two of Several Financial Instruments Which Are Used inAbdelnasir HaiderNo ratings yet

- A Model of Competitive AdvantageDocument19 pagesA Model of Competitive Advantagejojo1974No ratings yet

- Case KIRKDocument9 pagesCase KIRKmilyNo ratings yet

- Competency Framework & Assessment Centres: Competitive Advantage. RealizedDocument66 pagesCompetency Framework & Assessment Centres: Competitive Advantage. Realizedpranjal92pandeyNo ratings yet

- Bratianu Zbuchea Anghel Hrib Strategica 2020Document929 pagesBratianu Zbuchea Anghel Hrib Strategica 2020Miruna IliescuNo ratings yet

- P6 MYE 2016 Paper 2 - Apr15Document16 pagesP6 MYE 2016 Paper 2 - Apr15Bernard ChanNo ratings yet

- Collab Coworking Space: Brief Background of The StudyDocument4 pagesCollab Coworking Space: Brief Background of The StudyGlydel DelaragaNo ratings yet

- Three Steps To More Productive Sales TerritoriesDocument7 pagesThree Steps To More Productive Sales Territoriespraveerao8203No ratings yet

- Bac CreationDocument4 pagesBac Creationbanlickapjong.calambaNo ratings yet

- Becoming A Bulldozer EntrepreneurDocument53 pagesBecoming A Bulldozer EntrepreneurOlanrewaju Ololade JoelNo ratings yet

- Assingment SCM SEM4 - 1Document17 pagesAssingment SCM SEM4 - 1KARTHIYAENI VNo ratings yet

- 100 Defination of Terms in Business Finance - CDocument8 pages100 Defination of Terms in Business Finance - CJudy Ann CapiñaNo ratings yet

- Dwnload Full Macroeconomics Canadian 6th Edition Abel Test Bank PDFDocument35 pagesDwnload Full Macroeconomics Canadian 6th Edition Abel Test Bank PDFmichelettigeorgianna100% (12)

- Rangkuman Bab 12 Market EfficiencyDocument4 pagesRangkuman Bab 12 Market Efficiencyindah oliviaNo ratings yet

- Mark Scheme Unit 2 (WAC02) June 2014Document20 pagesMark Scheme Unit 2 (WAC02) June 2014RafaNo ratings yet

- Cambridge International AS & A Level: ECONOMICS 9708/42Document4 pagesCambridge International AS & A Level: ECONOMICS 9708/42Lewis HankinNo ratings yet

- Question & Answers: Commercial NegotiationDocument12 pagesQuestion & Answers: Commercial Negotiationpearl100% (1)

- Comparative Study On Mango Drink in Regards To Maaza, Frooti and SliceDocument149 pagesComparative Study On Mango Drink in Regards To Maaza, Frooti and Slices_zama198890% (10)

- The Routine Information Letter: The "Yes" Letter/ "A" Type LetterDocument34 pagesThe Routine Information Letter: The "Yes" Letter/ "A" Type LetterMotor-ELS- Nasim Mahmud TusherNo ratings yet

- Corporate Financial Management 6Th New Edition Edition Glen Arnold Deborah Lewis Full ChapterDocument51 pagesCorporate Financial Management 6Th New Edition Edition Glen Arnold Deborah Lewis Full Chapterwm.baker518100% (10)

- Kualitas Pelayanan Bus Rapid Trans Semarang (BRT) Koridor Ii Di Kota Semarang (Dengan Rute Terminal Terboyo Semarang-Terminal Sisemut Ungaran)Document11 pagesKualitas Pelayanan Bus Rapid Trans Semarang (BRT) Koridor Ii Di Kota Semarang (Dengan Rute Terminal Terboyo Semarang-Terminal Sisemut Ungaran)Masyithoh NNo ratings yet

- C14 - PAS 2 InventoriesDocument20 pagesC14 - PAS 2 InventoriesAllaine ElfaNo ratings yet

- 2022-2 Gi2 - Ee5gDocument17 pages2022-2 Gi2 - Ee5gAlvaro Marcel Hostiliano VeraNo ratings yet

- T NG H PDocument31 pagesT NG H PPhúc Hưng Thịnh NguyễnNo ratings yet

- BigMart Sale Prediction Using Machine LearningDocument2 pagesBigMart Sale Prediction Using Machine LearningInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Group 1: Maru Batting Center: Customer Lifetime Value Case Study AnalysisDocument16 pagesGroup 1: Maru Batting Center: Customer Lifetime Value Case Study AnalysisBhawna MalhotraNo ratings yet

I. Distribution of Profits: Required

I. Distribution of Profits: Required

Uploaded by

Jennette ToOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

I. Distribution of Profits: Required

I. Distribution of Profits: Required

Uploaded by

Jennette ToCopyright:

Available Formats

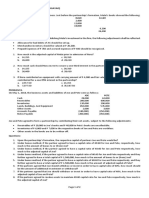

I.

Distribution of profits

The following is the statement of financial position of MEC Partnership as of June 30,

2013:

MEC Partnership

Statement of Financial Position

June 30, 2013

ASSETS LIABILITIES & PARTNERS’ EQUITY

Cash P 175,000 Liabilities P108,000

Other Assets 495,000 Margaret,Capital 250,000

Elizabeth, Capital 200,000

Cecilia, Capital 112,000

Total P 670,000 Total P 670,000

========= =========

The partners agreed to distribute the profits as follows:

1. Interest on ending capital of 10%.

2. Annual salaries to Elizabeth and Cecilia of P120,000 each.

3. Remainder: Margaret- 40%; Elizabeth-30% and Cecilia-30%..

Required:

Record the distribution of the net income amounting to P250,000 generated by the

partnership during the six-month period ending June 30, 2013.

II. Preparation of financial statements

The following adjusted balances were taken from the books of

RGem Trading as of December 31, 2011.

Accounts Payable P93,033

Accounts Receivable 143,000

Accumulated Depreciation- Delivery Equipment 140,000

Allowance for Doubtful Accounts 5,000

Cash 150,000

Delivery Equipment 350,000

Freight in 18,000

Gem, Capital 80,000

Romy, Capital 70,000

Gem, Drawing 10,000

Romy, Drawing 5,000

Administrative Expenses 112,700

Investment in Trading Securities 26,000

Merchandise Inventory, January 1 100,000

Notes Payable (due 2015) 413,100

Notes Receivable 36,700

Prepaid Expenses 7,633

Purchase Discounts 3,000

Purchase Returns and Allowances 5,000

Purchases 520,000

Sales 758,000

Sales Discounts 11,000

Sales Returns & Allowances 15,000

Distribution Costs 103,100

SSS & Medicare Contributions Payable 2,000

Unearned Commission Income 39,000

Merchandise Inventory as of December 31, 2011 amounted to P145,000.

Required:

1. Prepare the Income Statement, Statement of Changes in Partners' Equity, and Statement of Financial

Position of RGem Trading

2.The Articles of Co-Partnership provide that net income shall be divided as

follows: (a) 5% interest on beginning capital of each partner and (b) the balance

to be divided equally.

III. Problem Solving

1. United Company started its operations on March 1, 2012. Partners Elsie,

.Nim and Mavic agree to share in the profits and losses as follows:

The partners will receive monthly salary allowance of P6,500, P5,000, and P4,000,

respectivelyMavic, the managing partner, will receive bonus equal to 50% of net income after

salary allowanceAll remaining profit or losses will be shared 2:2:1 by the partners,

respectively.

Assuming a net income in 2012 of P 280,000, what is the total share of Nim?

.

2. A partnership’s articles of co-partnership provide that partners may increase or decrease their capital

balances through additional investment and permanent withdrawals, respectively. Margaret, one of the

partners, had a capital balance of P350,000 on January 1 and made additional investments of P50,000

each on April 1, July 1 and October 1 of the current year. She permanently withdrew cash of P25,000 on

June 1 and November 1. Her drawing account reflected debits of P10,000 and P5,000 on March 1 and

August 1, respectively. If the partners agreed to allow themselves 20% interest based on ending

capital, how much interest is to be given to Margaret at year end?

3 . In its first nine months of operation, the partnership of Christian,

. Michael, and Angelo made a net income of P80,000, before providing for 20% annual interest on

beginning capital balances and monthly salary allowance of P5,000, P3,500, and P2,000, respectively.

The beginning capital contributions of the partners are as follows: Christian, P50,000; Michael, P30,000;

and Angelo, P20,000. How much is the share of Christian in the partnership profit?

4. Floyd and Greg are partners who share profits and losses after salary

allowance and interest in the ratio of 3:2, respectively. Floyd’s monthly salary is P2,000

whileGreg’sis P15,000 per annum. The partners are also paid interest on their average capital balances.

In 2012, Floyd received P18,000 in interest and Greg P12,000. If Greg’s share of partnership income

was P30,000 in 2012, what was the total partnershipincome?

You might also like

- Dublin Resume Template ModernDocument1 pageDublin Resume Template ModernxyzNo ratings yet

- C10 - PAS 7 Statement of Cash FlowsDocument15 pagesC10 - PAS 7 Statement of Cash FlowsAllaine Elfa100% (2)

- Management and LeadershipDocument7 pagesManagement and LeadershipJoyae ChavezNo ratings yet

- Chapter 2 - Intro To ITDocument12 pagesChapter 2 - Intro To ITMakiri Sajili IINo ratings yet

- RA 9298 Accountancy LawDocument15 pagesRA 9298 Accountancy LawniqdelrosarioNo ratings yet

- Cost-Volume-Profit Analysis: 2,000 Units and $100,000 of RevenuesDocument14 pagesCost-Volume-Profit Analysis: 2,000 Units and $100,000 of RevenuesMa. Alexandra Teddy BuenNo ratings yet

- First Exam Review WithSolutionDocument6 pagesFirst Exam Review WithSolutionLexter Dave C EstoqueNo ratings yet

- DownloadfileDocument6 pagesDownloadfileLouisAnthonyHabaradasCantillonNo ratings yet

- NF Jpia Mas Cup PDF FreeDocument6 pagesNF Jpia Mas Cup PDF FreeAnne Marieline BuenaventuraNo ratings yet

- ReviewerDocument4 pagesReviewerCon LamugNo ratings yet

- As 12 - Full Notes For Accounting For Government GrantDocument6 pagesAs 12 - Full Notes For Accounting For Government GrantShrey KunjNo ratings yet

- Midterm Exam 2021-NoDocument10 pagesMidterm Exam 2021-NoAndrei GoNo ratings yet

- RuelDocument2 pagesRuelCloudKielGuiang0% (1)

- Forms of Statement of Financial PositionDocument7 pagesForms of Statement of Financial PositionRocel DomingoNo ratings yet

- AGAP Scholarship ProgramDocument3 pagesAGAP Scholarship ProgramDaneen GastarNo ratings yet

- Practice Problems - Transfer TaxesDocument2 pagesPractice Problems - Transfer Taxesuchishai100% (1)

- Financial ManagementDocument6 pagesFinancial ManagementDaniel HunksNo ratings yet

- Nfjpia Nmbe MS 2017 AnsDocument9 pagesNfjpia Nmbe MS 2017 AnsMicka EllahNo ratings yet

- Learning Resource 12 Lesson 3Document7 pagesLearning Resource 12 Lesson 3Vianca Marella SamonteNo ratings yet

- Taxation: Far Eastern University - ManilaDocument4 pagesTaxation: Far Eastern University - ManilacamilleNo ratings yet

- ObliCon Part 4Document2 pagesObliCon Part 4Wawex DavisNo ratings yet

- 3 ACCT 2AB P. DissolutionDocument6 pages3 ACCT 2AB P. DissolutionMary Angeline LopezNo ratings yet

- TBCH09Document6 pagesTBCH09Samit TandukarNo ratings yet

- Article 1599Document9 pagesArticle 1599Yvonne Kristine EstacioNo ratings yet

- C8 Statement of Financial PositionDocument14 pagesC8 Statement of Financial PositionAllaine ElfaNo ratings yet

- Midterm ExaminationDocument11 pagesMidterm ExaminationAntonette CaspeNo ratings yet

- Ac3a Qe Oct2014 (TQ)Document15 pagesAc3a Qe Oct2014 (TQ)Julrick Cubio EgbusNo ratings yet

- Requirements: Prepare Journal Entries To Record The Foregoing Transactions. Identify The Entries by Letter (A - F)Document2 pagesRequirements: Prepare Journal Entries To Record The Foregoing Transactions. Identify The Entries by Letter (A - F)happy240823No ratings yet

- ExamDocument7 pagesExamKristen WalshNo ratings yet

- Acco 20063 Midterm ExamDocument7 pagesAcco 20063 Midterm Examyugyeom rojasNo ratings yet

- Ms 03 - CVP AnalysisDocument10 pagesMs 03 - CVP AnalysisDin Rose GonzalesNo ratings yet

- Drills Exercises 18-Jan-2020Document2 pagesDrills Exercises 18-Jan-2020MCPS Operations BranchNo ratings yet

- Great DepressionDocument5 pagesGreat DepressionDarrelNo ratings yet

- Taxation Report - Valuation of Properties - Vanishing DeductionDocument49 pagesTaxation Report - Valuation of Properties - Vanishing DeductionAnonymous S6CQnxuJcINo ratings yet

- Module 2 - Individuals Estates and Trusts Without Answer-2Document12 pagesModule 2 - Individuals Estates and Trusts Without Answer-2KarenFayeBadillesNo ratings yet

- Warranty Expense and Bonds PayableDocument3 pagesWarranty Expense and Bonds PayableAira Jaimee GonzalesNo ratings yet

- Assignment - Audit of Ppe1Document4 pagesAssignment - Audit of Ppe1Wam OwnNo ratings yet

- Chapter 4 - Deductions From Gross EstateDocument32 pagesChapter 4 - Deductions From Gross EstateJayvee Felipe100% (1)

- Audit of ReceivablesDocument20 pagesAudit of ReceivablesDethzaida AsebuqueNo ratings yet

- Chapter 1 - Partnership Formation PDFDocument33 pagesChapter 1 - Partnership Formation PDFAldrin ZolinaNo ratings yet

- Kunci Jawaban Intermediate AccountingDocument41 pagesKunci Jawaban Intermediate AccountingbelindaNo ratings yet

- The Role of Accountants in Nation Building Through TaxationDocument2 pagesThe Role of Accountants in Nation Building Through TaxationJoshua Ryan CanatuanNo ratings yet

- Cash and Accrual Discussion301302Document2 pagesCash and Accrual Discussion301302Gloria BeltranNo ratings yet

- Process CostingDocument6 pagesProcess Costingbae joohyun0% (2)

- Afar - Partnership Formation - BagayaoDocument2 pagesAfar - Partnership Formation - BagayaoRejay VillamorNo ratings yet

- 8Document80 pages8Hannah Khamil MirandaNo ratings yet

- PUP Review Handout 1 OfficialDocument3 pagesPUP Review Handout 1 OfficialDonalyn CalipusNo ratings yet

- Exercise 4-6 Case StudyDocument13 pagesExercise 4-6 Case Studymariyha PalangganaNo ratings yet

- AFARDocument15 pagesAFARBetchelyn Dagwayan BenignosNo ratings yet

- Assignment 3Document6 pagesAssignment 3Triechia LaudNo ratings yet

- Ch28 Test Bank 4-5-10Document14 pagesCh28 Test Bank 4-5-10KarenNo ratings yet

- MANSCI Final Exam QuestionnaireDocument10 pagesMANSCI Final Exam QuestionnaireChristine NionesNo ratings yet

- Questions p2Document15 pagesQuestions p2Let it be100% (1)

- PART I: True or False: Management Accounting Quiz 1 BsmaDocument4 pagesPART I: True or False: Management Accounting Quiz 1 BsmaAngelyn SamandeNo ratings yet

- Assignment 1 Caro Coleen Sec27Document2 pagesAssignment 1 Caro Coleen Sec27Alyssa TordesillasNo ratings yet

- Question Bank - Financial Reporting and AnalysisDocument8 pagesQuestion Bank - Financial Reporting and AnalysisSagar BhandareNo ratings yet

- Pamantasan NG Lungsod NG Maynila Intermediate Accounting 3 Quiz No. 1Document5 pagesPamantasan NG Lungsod NG Maynila Intermediate Accounting 3 Quiz No. 1Trixie HicaldeNo ratings yet

- Corporate Liquidation & Joint Venture2Document5 pagesCorporate Liquidation & Joint Venture2jjjjjjjjjjjjjjjNo ratings yet

- Prepare Financial Report AssignmentDocument7 pagesPrepare Financial Report AssignmentBiruk HabtamuNo ratings yet

- 01 Long QuizDocument6 pages01 Long Quizgiana riveraNo ratings yet

- Accounting 2Document18 pagesAccounting 2cherryannNo ratings yet

- Corporation LiquidationDocument1 pageCorporation LiquidationMelisa DomingoNo ratings yet

- List of TREC Holders 220722Document36 pagesList of TREC Holders 220722Abdullah IlyasNo ratings yet

- Pre-Construction Information Checklist: Project Title Project Number Project Manager LocationDocument2 pagesPre-Construction Information Checklist: Project Title Project Number Project Manager Locationnilesh kumar VermaNo ratings yet

- Bay'-Salam: Musharakah and Mudarabah Are Two of Several Financial Instruments Which Are Used inDocument5 pagesBay'-Salam: Musharakah and Mudarabah Are Two of Several Financial Instruments Which Are Used inAbdelnasir HaiderNo ratings yet

- A Model of Competitive AdvantageDocument19 pagesA Model of Competitive Advantagejojo1974No ratings yet

- Case KIRKDocument9 pagesCase KIRKmilyNo ratings yet

- Competency Framework & Assessment Centres: Competitive Advantage. RealizedDocument66 pagesCompetency Framework & Assessment Centres: Competitive Advantage. Realizedpranjal92pandeyNo ratings yet

- Bratianu Zbuchea Anghel Hrib Strategica 2020Document929 pagesBratianu Zbuchea Anghel Hrib Strategica 2020Miruna IliescuNo ratings yet

- P6 MYE 2016 Paper 2 - Apr15Document16 pagesP6 MYE 2016 Paper 2 - Apr15Bernard ChanNo ratings yet

- Collab Coworking Space: Brief Background of The StudyDocument4 pagesCollab Coworking Space: Brief Background of The StudyGlydel DelaragaNo ratings yet

- Three Steps To More Productive Sales TerritoriesDocument7 pagesThree Steps To More Productive Sales Territoriespraveerao8203No ratings yet

- Bac CreationDocument4 pagesBac Creationbanlickapjong.calambaNo ratings yet

- Becoming A Bulldozer EntrepreneurDocument53 pagesBecoming A Bulldozer EntrepreneurOlanrewaju Ololade JoelNo ratings yet

- Assingment SCM SEM4 - 1Document17 pagesAssingment SCM SEM4 - 1KARTHIYAENI VNo ratings yet

- 100 Defination of Terms in Business Finance - CDocument8 pages100 Defination of Terms in Business Finance - CJudy Ann CapiñaNo ratings yet

- Dwnload Full Macroeconomics Canadian 6th Edition Abel Test Bank PDFDocument35 pagesDwnload Full Macroeconomics Canadian 6th Edition Abel Test Bank PDFmichelettigeorgianna100% (12)

- Rangkuman Bab 12 Market EfficiencyDocument4 pagesRangkuman Bab 12 Market Efficiencyindah oliviaNo ratings yet

- Mark Scheme Unit 2 (WAC02) June 2014Document20 pagesMark Scheme Unit 2 (WAC02) June 2014RafaNo ratings yet

- Cambridge International AS & A Level: ECONOMICS 9708/42Document4 pagesCambridge International AS & A Level: ECONOMICS 9708/42Lewis HankinNo ratings yet

- Question & Answers: Commercial NegotiationDocument12 pagesQuestion & Answers: Commercial Negotiationpearl100% (1)

- Comparative Study On Mango Drink in Regards To Maaza, Frooti and SliceDocument149 pagesComparative Study On Mango Drink in Regards To Maaza, Frooti and Slices_zama198890% (10)

- The Routine Information Letter: The "Yes" Letter/ "A" Type LetterDocument34 pagesThe Routine Information Letter: The "Yes" Letter/ "A" Type LetterMotor-ELS- Nasim Mahmud TusherNo ratings yet

- Corporate Financial Management 6Th New Edition Edition Glen Arnold Deborah Lewis Full ChapterDocument51 pagesCorporate Financial Management 6Th New Edition Edition Glen Arnold Deborah Lewis Full Chapterwm.baker518100% (10)

- Kualitas Pelayanan Bus Rapid Trans Semarang (BRT) Koridor Ii Di Kota Semarang (Dengan Rute Terminal Terboyo Semarang-Terminal Sisemut Ungaran)Document11 pagesKualitas Pelayanan Bus Rapid Trans Semarang (BRT) Koridor Ii Di Kota Semarang (Dengan Rute Terminal Terboyo Semarang-Terminal Sisemut Ungaran)Masyithoh NNo ratings yet

- C14 - PAS 2 InventoriesDocument20 pagesC14 - PAS 2 InventoriesAllaine ElfaNo ratings yet

- 2022-2 Gi2 - Ee5gDocument17 pages2022-2 Gi2 - Ee5gAlvaro Marcel Hostiliano VeraNo ratings yet

- T NG H PDocument31 pagesT NG H PPhúc Hưng Thịnh NguyễnNo ratings yet

- BigMart Sale Prediction Using Machine LearningDocument2 pagesBigMart Sale Prediction Using Machine LearningInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Group 1: Maru Batting Center: Customer Lifetime Value Case Study AnalysisDocument16 pagesGroup 1: Maru Batting Center: Customer Lifetime Value Case Study AnalysisBhawna MalhotraNo ratings yet