Professional Documents

Culture Documents

FAR.2854 - Cash To Accrual.

FAR.2854 - Cash To Accrual.

Uploaded by

stephen poncianoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAR.2854 - Cash To Accrual.

FAR.2854 - Cash To Accrual.

Uploaded by

stephen poncianoCopyright:

Available Formats

Since 1977

FAR OCAMPO/CABARLES/SOLIMAN/OCAMPO

FAR.2854-Cash to Accrual and Single Entry MAY 2020

DISCUSSION PROBLEMS

1. The following relate to Panda Company’s patents LECTURE NOTES:

assigned to other entities:

January 1 December 31 Cash to Accrual - Expense

Royalties receivable P500,000 P1,500,000

Cash basis expense (Disbursements) Pxx

Unearned royalties 200,000 600,000

Accrued expense (Payable), ending xx

During the year, Panda received royalty remittance of Accrued expense (Payable), beginning ( xx)

P5,000,000. In its income statement for the current Prepaid expense, ending ( xx)

year, Panda should report royalty income of Prepaid expense, beginning xx

a. P6,400,000 c. P4,400,000 Accrual basis expense Pxx

b. P5,600,000 d. P3,600,000

4. Lane Company acquires copyrights from authors,

paying advance royalties in some cases, and in others,

LECTURE NOTES: paying royalties within 30 days of year-end. Lane

reported royalty expense of P375,000 for the current

Income and Expense Recognition year ended December 31. The following data are

included in Lane’s balance sheets.

Cash Basis Accrual Basis

January 1 December 31

Income Received Earned

Prepaid royalties P60,000 P50,000

Expense Paid Incurred

Royalties payable 75,000 90,000

Cash to Accrual - Income During the year, Lane made royalty payments totaling

a. P350,000 c. P380,000

Cash basis income (Receipts) Pxx

b. P370,000 d. P400,000

Accrued income (Receivable), ending xx

Accrued income (Receivable), beginning ( xx)

Unearned income, ending ( xx)

Use the following information for the next three questions.

Unearned income, beginning xx

Accrual basis income Pxx Poole Company paid or collected during the current year

the following items:

Insurance premiums paid P 15,400

2. Under the accrual basis, rental income of Macho

Interest collected 30,900

Company for the current calendar year is P60,000.

Salaries paid 135,200

Additional information regarding rental income are:

Accrued rental income, Dec. 31 P4,000 The following balances have been excerpted from Poole's

Accrued rental income, Jan. 1 3,000 balance sheets:

Unearned rental income, Dec. 31 7,500 December 31 January 1

Unearned rental income, Jan. 1 5,000 Prepaid insurance P 1,200 P 1,500

How much actual cash rental was received by Macho Interest receivable 3,700 2,900

Company in the current year? Salaries payable 12,300 10,600

a. P58,500 c. P62,500 5. The insurance expense on the income statement for

b. P61,500 d. P65,500 the current year was

a. P12,700 c. P15,100

3. Peak Company borrows money under various loan b. P15,700 d. P18,100

agreement involving notes discounted and notes

requiring interest payments at maturity. During the 6. The interest revenue on the income statement for the

current year ended December 31, Peak paid interest current year was

totaling P5,000,000. The balance sheets included the a. P24,300 c. P30,100

following: b. P31,700 d. P37,500

December 31 January 1

7. The salary expense on the income statement for the

Interest payable P2,500,000 P2,000,000

current year was

Prepaid interest 1,500,000 500,000

a. P112,300 c. P133,500

How much interest expense should Peak report for the b. P136,900 d. P158,100

current year?

a. P4,500,000 c. P3,500,000

b. P6,500,000 d. P5,500,000 8. The following balances were reported by Mall Co. at

January 1 and December 31 of the current year:

1/1 12/31

Inventory P290,000 P260,000

Accounts payable 50,000 75,000

Mall paid suppliers P490,000 during the year. What

amount should Mall report for cost of goods sold for

the current year?

Page 1 of 3 www.prtc.com.ph FAR.2854

EXCEL PROFESSIONAL SERVICES, INC.

a. P545,000 c. P285,000 Use the following information for the next five questions.

b. P495,000 d. P435,000

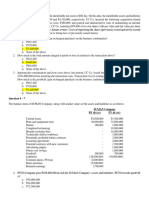

You were given the following information obtained from

the single-entry records of Jessie Company:

9. The following data are from a comparison of the Jan. 1 Dec. 31

balance sheets of Alyssa Company as of December 31, Interest receivable P 1,500 P 1,200

2020, and December 31, 2019: Accounts receivable 67,500 132,000

Accounts Receivable increase P7,600 Notes receivable 22,500 18,000

Inventory decrease 4,500 Merchandise inventories 57,000 15,000

Accounts Payable increase 2,400 Store and office equipment (net) 48,750 45,000

Prepaid operating expenses 3,750 3,300

The following data are from Alyssa's 2020 income Interest payable 450 750

statement: Accounts payable 52,500 37,500

Notes payable 15,000 18,000

Sales P200,000

Accrued operating expenses 4,050 7,500

Cost of Goods Sold 110,000

How much cash was paid for inventory purchases? An analysis of the cashbook shows the following:

a. P116,900 c. P112,100 Balance, January 1 P22,500

b. P103,100 d. P107,900 Receipts:

Interest income P 3,000

Accounts receivable 54,000

10. Class Corp. maintains its accounting records on the Notes receivable 22,500

cash basis but restates its financial statements to the Share capital issuance 9,000 88,500

accrual method of accounting. Class had P60,000 in 111,000

cash-basis pretax income for the current year. The Disbursements:

following balances at January 1 and December 31 of Interest expense P 2,250

the current year are available: Accounts payable 78,000

12/31 1/1 Notes payable 12,000

Accounts receivable P40,000 P20,000 Operating expenses 25,500 117,750

Accounts payable 15,000 30,000 Balance, December 31 –

Under the accrual method, what amount of income bank overdraft (P6,750)

before taxes should Class report in its current year

income statement? QUESTIONS:

a. P25,000 c. P65,000 Based on the above and the result of your audit, determine

b. P55,000 d. P95,000 the following for the current year:

LECTURE NOTES: 12. Sales

a. P141,000 c. P118,500

Cash to Accrual – Net Income b. P145,500 d. P136,500

Cash basis net income (Receipts - Disbursements) Pxx 13. Cost of goods sold

Increase in assets xx a. P120,000 c. P105,000

Decrease in assets ( xx) b. P150,000 d. P 78,000

Increase in liabilities ( xx)

14. Operating expenses, excluding depreciation

Decrease in liabilities xx

a. P24,900 c. P28,500

Accrual basis net income Pxx

b. P28,950 d. P29,400

15. Interest income

11. The Retry Company uses cash-basis accounting for a. P2,700 c. P3,000

their records. During the year, Retry collected b. P2,550 d. P3,300

P500,000 from its customers, made payments of

16. Loss before tax

P200,000 to its suppliers for inventory, and paid

a. P12,000 c. P16,500

P140,000 for operating costs. Retry wants to prepare

b. P12,750 d. P10,200

accrual-basis statements. In gathering information for

the accrual-basis financial statements, Retry

discovered the following:

17. The following information relates to the Gates

a. Customers owed Retry P50,000 at the beginning

Corporation:

and P35,000 at the end of the year.

b. Retry owed suppliers P20,000 at the beginning and Net assets, end of year P650,000

P27,000 at the end of the year. Net assets, beginning of year 300,000

c. Retry's beginning inventory was P42,000, and its Additional investment by shareholders 100,000

ending inventory was P44,000. Dividends paid 150,000

d. Retry had prepaid expenses of P5,000 at the Other comprehensive income for the year 80,000

beginning and P7,400 at the end of the year.

Profit for the year is

e. Retry had accrued expenses of P12,000 at the

a. P480,000 c. P350,000

beginning and P19,000 at the end of the year.

b. P400,000 d. P320,000

f. Depreciation for the year was P51,000.

Determine the accrual basis net income of Retry

Company for the current year.

a. P79,600 c. P91,400

b. P84,400 d. P98,400

Page 2 of 3 www.prtc.com.ph FAR.2854

EXCEL PROFESSIONAL SERVICES, INC.

SOLUTION GUIDE: Increase

(Decrease)

Equity, ending Pxx Cash P95,500

Equity, beginning ( xx) Accounts receivable, net 92,000

Net change in equity – Increase (Decrease) xx Inventory (30,000)

Contributions from owners ( xx) Buildings and Equipment (net) 190,000

Distribution to owners xx Patents (5,000)

Comprehensive income xx Accounts payable (75,000)

Other comprehensive income (OCI) ( xx) Bonds payable 150,000

Profit or loss Pxx Share capital 100,000

Share premium 50,000

18. Changes in the statement of financial position account Calculate the net income for the year assuming that no

balances for the Peak Sales Co. during the year follow. transactions other than the dividends affected retained

Dividends declared during the year were P25,000. earnings.

a. P117,500 c. P267,500

b. P142,500 d. P292,500

- now do the DIY drill -

DO-IT-YOURSELF (DIY) DRILL

1. Tsuen Company which began operations on January 1, Use the following information for the next three questions.

2019 has elected to use cash basis accounting for tax

The income statement of Carsen Corporation for 2020

purposes and accrual accounting for its financial

included the following items:

statements. Tsuen reported sales of P6,000,000 and

P5,000,000 in its tax return for years 2020 and 2019 Interest income P95,500

respectively. Tsuen reported accounts receivable of Salaries expense 75,000

P1,500,000 and P500,000 in its balance sheets as of Insurance expense 12,600

December 31, 2020 and 2019 respectively. What

amount should Tsuen report as sales in its income The following balances have been excerpted from Carsen

statement for 2020? Corporation's balance sheets:

a. P7,000,000 c. P5,000,000

b. P6,000,000 d. P4,000,000 12/31/2020 12/31/2019

Accrued interest receivable P9,100 P7,500

2. Tsing Company reported collections from customers of Accrued salaries payable 8,900 4,200

P6,000,000 for the year ended December 31, 2020. Prepaid insurance 1,100 1,500

Additional information follows: 5. The cash received for interest during 2020 was

12/31/2019 12/31/2020 a. P86,400 c. P93,900

Accounts receivable P1,000,000 P3,000,000 b. P95,500 d. P97,100

Allowance for doubtful 6. The cash paid for salaries during 2020 was

accounts ( 100,000) (150,000) a. P79,700 c. P70,300

Tsing wrote off uncollectible accounts totaling b. P70,800 d. P83,900

P500,000 during 2020. Under accrual basis, Tsing 7. The cash paid for insurance premiums during 2020 was

would report 2020 sales of a. P11,500 c. P11,100

a. P8,500,000 c. P8,000,000 b. P13,000 d. P12,200

b. P4,500,000 d. P8,550,000

8. The company's accounting records show that changes

3. During 2020, Kew Company, a service organization, in ledger account balances occurred during 2020 as

had P200,000 in cash sales and P3,000,000 in credit follows:

sales. The accounts receivable balances were

Increase Decrease

P400,000 and P485,000 at December 31, 2019 and

Cash P800,000

2020, respectively. If Kew desires to prepare a cash

Accounts receivable (net) P40,000

basis income statement, how much should be reported

Inventories 300,000

as sales for 2020 on a cash basis?

Equipment (net) 360,000

a. P3,285,000 c. P3,115,000

Building (net) 600,000

b. P3,200,000 d. P2,915,000

Loans payable 1,000,000

Accounts payable 300,000

4. During the year ended December 31, 2020. Pine

Share capital, P10 par 600,000

Company paid P46,000 for interest, but Pine's 2020

Share premium 200,000

income statement properly reported interest expense

Retained earnings ?

of P50,000. There was no prepaid interest either at

the beginning or at the end of 2020. Accrued interest Assuming that there were no transactions affecting

at December 31, 2020 amounted to P5,000. How retained earnings other than the P250,000 cash

much was the accrued interest at December 31, 2019? dividends, compute the net income for 2020.

a. P5,000 c. P4,000 a. P770,000 c. P2,170,000

b. P1,000 d. P 0 b. P520,000 d. P 270,000

J - end of FAR.2854 - J

Page 3 of 3 www.prtc.com.ph FAR.2854

You might also like

- Exercise Answers - IfRS 5 - Discontinued OperationsDocument3 pagesExercise Answers - IfRS 5 - Discontinued OperationsJohn Philip L Concepcion100% (1)

- TB19 Earnings Per ShareDocument20 pagesTB19 Earnings Per Sharescrapped prince100% (3)

- Cash and Accrual Basis, Single Entry SystemDocument6 pagesCash and Accrual Basis, Single Entry SystemEuniceChung100% (1)

- SMEs - TOA - VALIX 2018 PDFDocument17 pagesSMEs - TOA - VALIX 2018 PDFHarvey Dienne Quiambao100% (1)

- Chapters 6-7 and DerivativesDocument68 pagesChapters 6-7 and DerivativesLouise0% (1)

- Accounting For Income TaxDocument4 pagesAccounting For Income Taxchowchow123No ratings yet

- Chapter 17-Statement of Cash FlowsDocument4 pagesChapter 17-Statement of Cash Flowselizabeth angel100% (1)

- Chapter 20 - Current Cost Acctg. Valix ReviewerDocument11 pagesChapter 20 - Current Cost Acctg. Valix ReviewerDesiree Sogo-an PolicarpioNo ratings yet

- FAR.2847 Operating-Segments PDFDocument4 pagesFAR.2847 Operating-Segments PDFPhoeza Espinosa VillanuevaNo ratings yet

- AUDP ROB REV-Correction of Errors Wit Ans KeyDocument12 pagesAUDP ROB REV-Correction of Errors Wit Ans KeyJohn Emerson PatricioNo ratings yet

- Change in Accounting Policy and EstimatesDocument6 pagesChange in Accounting Policy and EstimatesMark IlanoNo ratings yet

- 6.1 Non-Current Asset Held For Sale and Discontinued OperationDocument9 pages6.1 Non-Current Asset Held For Sale and Discontinued OperationMica R.100% (3)

- Cash Basis Accrual BasisDocument4 pagesCash Basis Accrual BasisForkenstein0% (1)

- 1911 Investments Investment in Associate and Bond InvestmentDocument13 pages1911 Investments Investment in Associate and Bond InvestmentCykee Hanna Quizo LumongsodNo ratings yet

- 38 - Segment and Interim ReportingDocument2 pages38 - Segment and Interim ReportingralphalonzoNo ratings yet

- Responsibility Acctg, Transfer Pricing & GP AnalysisDocument21 pagesResponsibility Acctg, Transfer Pricing & GP AnalysisGelyn CruzNo ratings yet

- EXERCISES On EARNINGS PER SHAREDocument4 pagesEXERCISES On EARNINGS PER SHAREChristine AltamarinoNo ratings yet

- Interim and Segment ReportingDocument3 pagesInterim and Segment ReportingLui100% (2)

- CASH TO ACCRUAL SINGLE ENTRY With ANSWERSDocument8 pagesCASH TO ACCRUAL SINGLE ENTRY With ANSWERSRaven SiaNo ratings yet

- Chapter 13: Operating Segment Segment Reporting - Core PrincipleDocument10 pagesChapter 13: Operating Segment Segment Reporting - Core PrinciplePaula BautistaNo ratings yet

- Cpa Review School of The Philippines ManilaDocument3 pagesCpa Review School of The Philippines ManilaAljur SalamedaNo ratings yet

- SMEs (Students Guide)Document11 pagesSMEs (Students Guide)Erica CaliuagNo ratings yet

- Orca Share Media1522073458763 PDFDocument15 pagesOrca Share Media1522073458763 PDFHannah Yncierto100% (1)

- I Am Sharing 'SIM-ANSWERS - 6th-Exam-Topics - Hyperinflation - PABRES' With YouDocument9 pagesI Am Sharing 'SIM-ANSWERS - 6th-Exam-Topics - Hyperinflation - PABRES' With YouJeric TorionNo ratings yet

- Cash and Accrual BasisDocument4 pagesCash and Accrual BasisBwwwiiiii100% (1)

- Iac 11 Employee BenefitsDocument5 pagesIac 11 Employee BenefitsNacelleNo ratings yet

- Employee Benefits P201Document17 pagesEmployee Benefits P201krisha milloNo ratings yet

- Chapter 7 Current Liabilities: 7.1 Trade and Other PayableDocument11 pagesChapter 7 Current Liabilities: 7.1 Trade and Other PayableMaryrose SumulongNo ratings yet

- P1 1.3CashBasisAccrualBasisSingleEntryZETADocument3 pagesP1 1.3CashBasisAccrualBasisSingleEntryZETASophia AprilNo ratings yet

- Ap-100Q: Quizzer On Accounting Changes, Error Corrections, Cash/Accrual and Single EntryDocument8 pagesAp-100Q: Quizzer On Accounting Changes, Error Corrections, Cash/Accrual and Single EntryJohn Paulo SamonteNo ratings yet

- MODULE FinalTerm FAR 3 Cash and Accrual and Single EntryDocument23 pagesMODULE FinalTerm FAR 3 Cash and Accrual and Single EntryKezNo ratings yet

- FAR.2845 Statement of Profit or Loss and OCI PDFDocument6 pagesFAR.2845 Statement of Profit or Loss and OCI PDFGabriel OrolfoNo ratings yet

- C. Either A or B.: Discussion ProblemsDocument8 pagesC. Either A or B.: Discussion ProblemsGlen JavellanaNo ratings yet

- Discontinued Operations Acctg. Test BankDocument12 pagesDiscontinued Operations Acctg. Test BankDalrymple CasballedoNo ratings yet

- Morales, Jonalyn M.Document7 pagesMorales, Jonalyn M.Jonalyn MoralesNo ratings yet

- Intermacc Inventories and Bio Assets Postlec WaDocument2 pagesIntermacc Inventories and Bio Assets Postlec WaClarice Awa-aoNo ratings yet

- SegmentDocument8 pagesSegmentChelsea Anne Vidallo100% (1)

- Practice AcctngDocument7 pagesPractice AcctngRubiliza GailoNo ratings yet

- Operating Segment.Document14 pagesOperating Segment.Honey LimNo ratings yet

- AfarDocument18 pagesAfarFleo GardivoNo ratings yet

- Chapter 37-Presentation of FsDocument8 pagesChapter 37-Presentation of FsEmma Mariz GarciaNo ratings yet

- 2019 100,000 2 200,000 Eps (2020) 410,00/230,000 Eps (2019) 350,000/200,000 2020 100,000 3/12 25,000 120,000 9/12 90,000 115,000 2 230,000Document5 pages2019 100,000 2 200,000 Eps (2020) 410,00/230,000 Eps (2019) 350,000/200,000 2020 100,000 3/12 25,000 120,000 9/12 90,000 115,000 2 230,000XienaNo ratings yet

- Inventories, Biological Assets, Etc.Document3 pagesInventories, Biological Assets, Etc.Jobelle Candace Flores AbreraNo ratings yet

- Quiz Ins Sales Oct5Document6 pagesQuiz Ins Sales Oct5AlexNo ratings yet

- Ia 3 Chapter 4 Related PartiesDocument7 pagesIa 3 Chapter 4 Related PartiesBukhani MacabanganNo ratings yet

- Exercise - Part 2Document5 pagesExercise - Part 2lois martinNo ratings yet

- CORRECTION OF ERRORS Theories PDFDocument7 pagesCORRECTION OF ERRORS Theories PDFJoy Miraflor AlinoodNo ratings yet

- Accrev1 FINAL EXAM 19 20 NO ANSWERSDocument15 pagesAccrev1 FINAL EXAM 19 20 NO ANSWERSGray JavierNo ratings yet

- Chapter 3Document2 pagesChapter 3Shane LAnuza100% (1)

- Accounting ChangesDocument3 pagesAccounting ChangesAbby NavarroNo ratings yet

- Chapter 13 QuizDocument8 pagesChapter 13 QuizValeria RozzaNo ratings yet

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument3 pagesDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- FAR.0747 - Cash To AccrualDocument8 pagesFAR.0747 - Cash To Accrualandrew dacullaNo ratings yet

- UEDocument1 pageUEfastslowerNo ratings yet

- Cebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekDocument23 pagesCebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekIzzy BNo ratings yet

- AA 4101 Midterm With AnswersDocument9 pagesAA 4101 Midterm With AnswersAlyssa AnnNo ratings yet

- Accounting Process 3Document2 pagesAccounting Process 3Glen JavellanaNo ratings yet

- 1.6.1 Quiz 3 Problems Accounting ProcessDocument4 pages1.6.1 Quiz 3 Problems Accounting ProcessyelenaNo ratings yet

- P 1Document13 pagesP 1Ryan Joseph Agluba DimacaliNo ratings yet

- Ia2 QuestionsDocument6 pagesIa2 QuestionsSharjaaahNo ratings yet

- Human Resource Management Gaining A Competitive AdvantageDocument22 pagesHuman Resource Management Gaining A Competitive AdvantagelinhNo ratings yet

- Irrigation Engineering: Course Instructor: Engr. Arif Asghar GopangDocument22 pagesIrrigation Engineering: Course Instructor: Engr. Arif Asghar GopangArif AsgharNo ratings yet

- CH 8Document14 pagesCH 8Ajay Kumar GangulyNo ratings yet

- A Theoretical Framework of Flood InducedDocument5 pagesA Theoretical Framework of Flood InducedPete PuertoNo ratings yet

- A. Where Will You Be During An Earthquake?Document1 pageA. Where Will You Be During An Earthquake?Kezia Dawn Del SocorroNo ratings yet

- Engineers Report PtoDocument5 pagesEngineers Report PtoLito LeonardoNo ratings yet

- Investment Management Interview Tips Summer 2013Document11 pagesInvestment Management Interview Tips Summer 2013Silviu TrebuianNo ratings yet

- An Architecture of PLC Ls XBC Dr30e Based Clean Water Controlling SystemDocument11 pagesAn Architecture of PLC Ls XBC Dr30e Based Clean Water Controlling SystemThe Candid MechanicNo ratings yet

- Colonialism and The CountrysideDocument31 pagesColonialism and The CountrysideJyoti SharmaNo ratings yet

- Copper Testing For Adsl/2/2+Document8 pagesCopper Testing For Adsl/2/2+markNo ratings yet

- Afeef Sheikh, Ashley Yang, Sachin Kasetti, Travis Arnold, Dr. Ashish DeshpandeDocument1 pageAfeef Sheikh, Ashley Yang, Sachin Kasetti, Travis Arnold, Dr. Ashish DeshpandeSachNo ratings yet

- MPU3512-Topic 5Document10 pagesMPU3512-Topic 5Thivya JayanthiNo ratings yet

- Huxley Brand Introduction ENGDocument36 pagesHuxley Brand Introduction ENGBaghiuNo ratings yet

- Humbucker EMG 35HZ InstructionsDocument4 pagesHumbucker EMG 35HZ InstructionsGábor SajczNo ratings yet

- IR7243 en ModuloDocument2 pagesIR7243 en ModuloAitor Tapia SaavedraNo ratings yet

- PL BT enDocument304 pagesPL BT enOssian89No ratings yet

- Spouses Mamaril v. Boy Scouts of The Phils., G.R. No. 179382, January 14, 2013Document2 pagesSpouses Mamaril v. Boy Scouts of The Phils., G.R. No. 179382, January 14, 2013Revina EstradaNo ratings yet

- Bidding Document Lot 16B. Gondanglegi-Sp. Balekambang (B) - 101-201Document101 pagesBidding Document Lot 16B. Gondanglegi-Sp. Balekambang (B) - 101-201Nusantara GroupNo ratings yet

- One Pager v2Document2 pagesOne Pager v2JuanCarlosMarrufoNo ratings yet

- Business Bay MSDocument14 pagesBusiness Bay MSM UMER KHAN YOUSAFZAINo ratings yet

- HMS - EVO - ST - M00964Document4 pagesHMS - EVO - ST - M00964Nguyễn Thống NhấtNo ratings yet

- Presentation 1Document15 pagesPresentation 1sruthi_k7776No ratings yet

- Roohafza - PresentationDocument28 pagesRoohafza - PresentationzainjamilNo ratings yet

- Evidencia - 3 - Introducing Yourself To A Prospective EmployerDocument2 pagesEvidencia - 3 - Introducing Yourself To A Prospective EmployerMarcelaNo ratings yet

- Form REN-01 Application For REN RegistrationDocument2 pagesForm REN-01 Application For REN RegistrationNajib MohamedNo ratings yet

- PDF r41 ArcotronicsDocument2 pagesPDF r41 ArcotronicsM Nouman KhanNo ratings yet

- Simple Amharic SentencesDocument5 pagesSimple Amharic SentencesTsegaye AndargieNo ratings yet

- "Satellite Based Field Analysing System": Department of Electronics and Communication Engineering (NBA Accredited)Document25 pages"Satellite Based Field Analysing System": Department of Electronics and Communication Engineering (NBA Accredited)ashwiniNo ratings yet

- CASE STUDY E-Commerce Warehousing Learning A Storage PolicyDocument19 pagesCASE STUDY E-Commerce Warehousing Learning A Storage PolicyArijit DuttaNo ratings yet

- Skip To Primary NavigationDocument118 pagesSkip To Primary NavigationMclin Jhon Marave MabalotNo ratings yet