Professional Documents

Culture Documents

Financial Management Midterm Quiz 407

Financial Management Midterm Quiz 407

Uploaded by

Agna AegeanCopyright:

Available Formats

You might also like

- Nicholls David One DayDocument112 pagesNicholls David One DayJuan Perez100% (6)

- JDA For LayoutDocument6 pagesJDA For Layoutbhatvms100% (10)

- MFAAssessment IDocument10 pagesMFAAssessment IManoj PNo ratings yet

- Case Write Up - Asahi Glass - Group9Document5 pagesCase Write Up - Asahi Glass - Group9Tina Gupta100% (1)

- Mid Term Test: MM 5007: Financial ManagementDocument6 pagesMid Term Test: MM 5007: Financial ManagementFriendly AlfriusNo ratings yet

- Case Summary FMDocument7 pagesCase Summary FMnrngshshNo ratings yet

- Performance Evaluation of Eastern Bank LTDDocument15 pagesPerformance Evaluation of Eastern Bank LTDMehedi HasanNo ratings yet

- Assignment 2 LuceroDocument3 pagesAssignment 2 LuceroJessa100% (1)

- Attempt All QuestionsDocument5 pagesAttempt All QuestionsApurva SrivastavaNo ratings yet

- FIN 410 Final REport PDFDocument30 pagesFIN 410 Final REport PDFrakibahmed82000No ratings yet

- Financial Decision Making (FINM036) : Student Name: Melvin NG Chu Kong Student ID: 20416185Document21 pagesFinancial Decision Making (FINM036) : Student Name: Melvin NG Chu Kong Student ID: 20416185MelvinNo ratings yet

- Report For The Directors of Glan NI Cheese LTDDocument17 pagesReport For The Directors of Glan NI Cheese LTDErikasNo ratings yet

- KPIM05EFA Financial Analysis Coursework Divya Darshini 9654866Document20 pagesKPIM05EFA Financial Analysis Coursework Divya Darshini 9654866P U Divya DarshiniNo ratings yet

- Group Assignment - ACC101Document14 pagesGroup Assignment - ACC101suminguyen5182No ratings yet

- Finn 22 - Financial Management Questions For Chapter 2 QuestionsDocument4 pagesFinn 22 - Financial Management Questions For Chapter 2 QuestionsJoongNo ratings yet

- ACCT2105 - Assignemnt 3 - Part A - Tran Tung Linh - s3750075Document5 pagesACCT2105 - Assignemnt 3 - Part A - Tran Tung Linh - s3750075Tùng Linh TrầnNo ratings yet

- B1 Free Solving Nov 2019) - Set 3Document5 pagesB1 Free Solving Nov 2019) - Set 3paul sagudaNo ratings yet

- $ROIWW4XDocument80 pages$ROIWW4XGourav VallakattiNo ratings yet

- Tutorial 5 - Ratio Analysis - AnswerDocument6 pagesTutorial 5 - Ratio Analysis - AnswerSaravanan KandasamyNo ratings yet

- Corporate Finance-Darko Jovanović 2015Document17 pagesCorporate Finance-Darko Jovanović 2015Darko JovanovicNo ratings yet

- Midterm Exam - Esecon 1ST Sem. 2021-2022Document3 pagesMidterm Exam - Esecon 1ST Sem. 2021-2022raymond moscosoNo ratings yet

- Hemas Annual Report 2010 - 11Document110 pagesHemas Annual Report 2010 - 11sam713No ratings yet

- Profile of Endurance TechnologiesDocument11 pagesProfile of Endurance TechnologiespriyaNo ratings yet

- Acct1511 Final VersionDocument33 pagesAcct1511 Final VersioncarolinetsangNo ratings yet

- Profile of Endurance TechnologiesDocument11 pagesProfile of Endurance TechnologiespriyaNo ratings yet

- Accounting Lab - Annual Report AssignmentDocument5 pagesAccounting Lab - Annual Report AssignmentSausan SaniaNo ratings yet

- Financial Ratio Analysis Final-No in TextDocument32 pagesFinancial Ratio Analysis Final-No in TextMini8912No ratings yet

- Basic To Understanding StocksDocument3 pagesBasic To Understanding StocksDavidNo ratings yet

- FN301 - Ch.1: Functions of The Financial Manager: Lecturer: Mr. TumongDocument13 pagesFN301 - Ch.1: Functions of The Financial Manager: Lecturer: Mr. TumongGrace Chiang KoNo ratings yet

- Reading 24 Private Company Valuation - AnswersDocument33 pagesReading 24 Private Company Valuation - Answerstristan.riolsNo ratings yet

- 2955-11724-1-PB Analisis Laporan Keuangan PT Bentoel Investama TBKDocument10 pages2955-11724-1-PB Analisis Laporan Keuangan PT Bentoel Investama TBKanon_781586824No ratings yet

- Earning Management and Operating PerformanceDocument9 pagesEarning Management and Operating Performancesita deliyana FirmialyNo ratings yet

- Acc Company Profile of Endurance TechnologiesDocument12 pagesAcc Company Profile of Endurance TechnologiesPriya piyankaNo ratings yet

- Manajemen Investasi Summary Chapter 15 & 16: Dr. Vinola Herawaty, Ak.,MscDocument13 pagesManajemen Investasi Summary Chapter 15 & 16: Dr. Vinola Herawaty, Ak.,Mscmutia rasyaNo ratings yet

- Company Name:Itc: Business Finance Assignment Sectio NCDocument13 pagesCompany Name:Itc: Business Finance Assignment Sectio NCDIVYANG AGARWAL 2023291No ratings yet

- IDD276 EditedDocument14 pagesIDD276 EditedMeena DasNo ratings yet

- Assignment May2011 ADocument6 pagesAssignment May2011 AZyn Wann HoNo ratings yet

- Kohinoor Chemical Assumptions, ConstrainsDocument6 pagesKohinoor Chemical Assumptions, ConstrainsFYAJ ROHANNo ratings yet

- Analysis and AssessmentDocument1 pageAnalysis and Assessmentjorgoca2No ratings yet

- Chapter 9 - Analysis & Intrepretation of Financial StatementsDocument10 pagesChapter 9 - Analysis & Intrepretation of Financial StatementsrathaNo ratings yet

- CAM Annual Report 2013Document50 pagesCAM Annual Report 2013ashkanfashamiNo ratings yet

- BSMA FM Final ExamDocument1 pageBSMA FM Final ExamFranz Ana Marie CuaNo ratings yet

- HO No. 3 - Working Capital ManagementDocument2 pagesHO No. 3 - Working Capital ManagementGrace Chavez ManaliliNo ratings yet

- Business FinanceDocument7 pagesBusiness Financeparthasdhar8No ratings yet

- Pma FacsDocument27 pagesPma FacsGopi NathanNo ratings yet

- Integrated Problem CH 2Document30 pagesIntegrated Problem CH 2paula100% (1)

- Epwin GroupDocument4 pagesEpwin GroupgayathriNo ratings yet

- Financial Management Tutorial QuestionsDocument8 pagesFinancial Management Tutorial QuestionsStephen Olieka100% (2)

- Security Valuation of British American Tobacco: Presentation OnDocument18 pagesSecurity Valuation of British American Tobacco: Presentation OnshahinNo ratings yet

- Peoples Merchant Annual Report 2010-11Document98 pagesPeoples Merchant Annual Report 2010-11jkdjfaljdkjfkdsjfdNo ratings yet

- Working Capital and Fund Flow Statement of Modest Infrastucture LTDDocument27 pagesWorking Capital and Fund Flow Statement of Modest Infrastucture LTDMegha HumbalNo ratings yet

- It Governance Technology-Chapter 01Document4 pagesIt Governance Technology-Chapter 01IQBAL MAHMUDNo ratings yet

- Assessing Financial Health (Part-A)Document17 pagesAssessing Financial Health (Part-A)kohacNo ratings yet

- Accf 2204Document7 pagesAccf 2204Avi StrikyNo ratings yet

- MAQT AssignmentDocument11 pagesMAQT AssignmentSahan RodrigoNo ratings yet

- Exam Reviewer FINMGTDocument8 pagesExam Reviewer FINMGTMary Elisha PinedaNo ratings yet

- Associated British FoodsDocument16 pagesAssociated British FoodsMohd Shahbaz Husain100% (1)

- Jimma UniversityDocument37 pagesJimma Universitymubarek oumerNo ratings yet

- ACTIVITY 5 CBE Module 4Document5 pagesACTIVITY 5 CBE Module 4Christian John Resabal BiolNo ratings yet

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNo ratings yet

- Guide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017From EverandGuide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017No ratings yet

- Guide to Japan-Born Inventory and Accounts Receivable Freshness Control for Managers 2017 (English Version)From EverandGuide to Japan-Born Inventory and Accounts Receivable Freshness Control for Managers 2017 (English Version)No ratings yet

- Fishery Company Surabaya-SidoarjoDocument4 pagesFishery Company Surabaya-SidoarjoTigana OscarNo ratings yet

- 5 F Jazz Blues LicksDocument2 pages5 F Jazz Blues LicksElpidio AmorosoNo ratings yet

- Schwa Worksheets 1Document5 pagesSchwa Worksheets 1mohammedNo ratings yet

- AP World History Summer AssignmentDocument9 pagesAP World History Summer AssignmentAnonymous tvG8tBNo ratings yet

- 60 Free TB ActivitiesDocument11 pages60 Free TB ActivitiesochioreanuNo ratings yet

- Sol. Man. Chapter 9 Income Taxes 2021Document18 pagesSol. Man. Chapter 9 Income Taxes 2021Kim HanbinNo ratings yet

- Carlsberg Sustainability Report 2018Document62 pagesCarlsberg Sustainability Report 2018Mike MichaelidesNo ratings yet

- Wearable Technologies: Scott Mcgregor President & Ceo, Broadcom CorporationDocument23 pagesWearable Technologies: Scott Mcgregor President & Ceo, Broadcom CorporationRavi PilgarNo ratings yet

- Archived: Chapel Facilities Design GuideDocument30 pagesArchived: Chapel Facilities Design GuideIvy AbrahamNo ratings yet

- Book 3 SuccessionDocument189 pagesBook 3 SuccessiontatatalaNo ratings yet

- People v. BariquitDocument3 pagesPeople v. BariquitAbby PerezNo ratings yet

- Ada Blackjack Answers (11-09-2021)Document4 pagesAda Blackjack Answers (11-09-2021)Blob BlobbyNo ratings yet

- Christmas SongsDocument7 pagesChristmas SongsRocíoTanzolaPisaniNo ratings yet

- EHSPL Msme Reg CertificateDocument1 pageEHSPL Msme Reg Certificatemukherjeemohul25No ratings yet

- Inbound 5135419190087357453Document13 pagesInbound 5135419190087357453gorgshae228No ratings yet

- Rohini 20313798233Document5 pagesRohini 20313798233Hari HaranNo ratings yet

- Law Question BankDocument82 pagesLaw Question Bankram narseshNo ratings yet

- Seismic Analysis of Residential Building With Short Column Effect A ThesisDocument98 pagesSeismic Analysis of Residential Building With Short Column Effect A ThesisheshamNo ratings yet

- Management Games Andrews Industry 24Document9 pagesManagement Games Andrews Industry 24Rahul ChauhanNo ratings yet

- Manager Purchasing Business Development in Lancaster PA Resume Greg ZimmermanDocument2 pagesManager Purchasing Business Development in Lancaster PA Resume Greg ZimmermanGregZimmermanNo ratings yet

- 2012 Oregon Sport Fish RegsDocument112 pages2012 Oregon Sport Fish RegsRoeHuntingResourcesNo ratings yet

- Unit 3 Part 4Document19 pagesUnit 3 Part 4Pooja PatilNo ratings yet

- 14410628-Ta-Muhammad Ilham Agus Salim-Legal Protection For User Data in Fintech Peer To Peer Lending Rupiah CepatDocument115 pages14410628-Ta-Muhammad Ilham Agus Salim-Legal Protection For User Data in Fintech Peer To Peer Lending Rupiah CepatHam AgsaNo ratings yet

- Autobiography RubricDocument1 pageAutobiography Rubricapi-264460605No ratings yet

- Technical Interview Study GuideDocument18 pagesTechnical Interview Study GuideRutvij MehtaNo ratings yet

- Structuralism (De Saussure), A Language vs. The Human Language Faculty (Chomsky) ... Etc SummaryDocument5 pagesStructuralism (De Saussure), A Language vs. The Human Language Faculty (Chomsky) ... Etc SummaryMarijana Lopec100% (3)

- Sync3 U6 STDocument6 pagesSync3 U6 STAna CondeNo ratings yet

- How To Be A SpeakerDocument6 pagesHow To Be A SpeakerGabor KovacsNo ratings yet

Financial Management Midterm Quiz 407

Financial Management Midterm Quiz 407

Uploaded by

Agna AegeanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Management Midterm Quiz 407

Financial Management Midterm Quiz 407

Uploaded by

Agna AegeanCopyright:

Available Formats

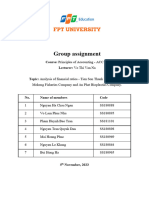

Midterm Quiz

Financial Management PKN STAN 4.07

Instructor: Agung Endika Satyadini, S.S.T, M.P.F

This quiz consists of two parts. You must answer all components of all two parts of the Quiz.

A. Short Answer

1. It is often argued that in a firm’s liquidity financial analysis a higher “inventory turnover”

depicts a better profitability. Do you agree or disagree? Please explain!

2. Please explain the difference between Mutual Funds and Exchange Traded Funds (ETFs)!

3. Please explain the difference between Effective Annual Rate (EAR) and Annual Percentage

Rate (APR)! Further, please identify the circumstance when an investor should use EAR instead

of APR!

B. Essay

1. Mulling over the OECD (2005) concept in tax administration to carefully examine the taxpayer’s

compliance risk, it is agreed that the financial ratio indicators should be carefully analyzed. In

this brain area, Pak Suryo Utomo as the new DGT’s Chairman asked you to analyze the

financial statement of PT Kalimongso Jaya and affiliated enterprises. Your team observed the

following information:

Financial Ratios PT Kalimongso Jaya Industry Average

Current ratio 1.18 1.30

Debt ratio 0.65 0.42

Inventory turnover 18.3 16.8

Operating return on assets 15.2% 42.5%

Operating profit margin 11.3% 24.5%

Return on equity 18.2% 37.4%

However, PT Kalimongso Jaya’s financial manager argued that the company is heading a very

optimistic year and then requested a tax allowance.

Question:

a. What do you think about the real condition of the company? Explain!

b. Hinge on your analysis result above, what is your best suggestion for PT Kalimongso Jaya’s

financial manager to maintain company’s performance? Explain!

2. Considering the OECD (2018) concept of efficient financial management, it is worth

acknowledging that optimum point of mixed efficiency and outcome should be attained. Once

again, the DGT’s Chairman asked you to analyze the project finance of PT Ceger Oil Exploration

(PT COE) to estimate the level of tax compliance. Based on PT COE’s proposal, oil exploration

project will cost $900.000 with estimation of revenue approx. $150.000 per year for the first 13

years (net operating costs). It is worth noting that interest rate is 13% per year.

Question:

a. Please estimate the Net Present Value of the oil exploration project! (Hint: you can estimate

the gap between present value of cash inflow and outflow).

b. You received a statement from the PT COE’s finance manager, explained that PT COE ‘s

project revenue will be taken over by PT Exxon Oil Bintaro at the end of year-8 for $700.000.

Does it sound logical? Explain!

You might also like

- Nicholls David One DayDocument112 pagesNicholls David One DayJuan Perez100% (6)

- JDA For LayoutDocument6 pagesJDA For Layoutbhatvms100% (10)

- MFAAssessment IDocument10 pagesMFAAssessment IManoj PNo ratings yet

- Case Write Up - Asahi Glass - Group9Document5 pagesCase Write Up - Asahi Glass - Group9Tina Gupta100% (1)

- Mid Term Test: MM 5007: Financial ManagementDocument6 pagesMid Term Test: MM 5007: Financial ManagementFriendly AlfriusNo ratings yet

- Case Summary FMDocument7 pagesCase Summary FMnrngshshNo ratings yet

- Performance Evaluation of Eastern Bank LTDDocument15 pagesPerformance Evaluation of Eastern Bank LTDMehedi HasanNo ratings yet

- Assignment 2 LuceroDocument3 pagesAssignment 2 LuceroJessa100% (1)

- Attempt All QuestionsDocument5 pagesAttempt All QuestionsApurva SrivastavaNo ratings yet

- FIN 410 Final REport PDFDocument30 pagesFIN 410 Final REport PDFrakibahmed82000No ratings yet

- Financial Decision Making (FINM036) : Student Name: Melvin NG Chu Kong Student ID: 20416185Document21 pagesFinancial Decision Making (FINM036) : Student Name: Melvin NG Chu Kong Student ID: 20416185MelvinNo ratings yet

- Report For The Directors of Glan NI Cheese LTDDocument17 pagesReport For The Directors of Glan NI Cheese LTDErikasNo ratings yet

- KPIM05EFA Financial Analysis Coursework Divya Darshini 9654866Document20 pagesKPIM05EFA Financial Analysis Coursework Divya Darshini 9654866P U Divya DarshiniNo ratings yet

- Group Assignment - ACC101Document14 pagesGroup Assignment - ACC101suminguyen5182No ratings yet

- Finn 22 - Financial Management Questions For Chapter 2 QuestionsDocument4 pagesFinn 22 - Financial Management Questions For Chapter 2 QuestionsJoongNo ratings yet

- ACCT2105 - Assignemnt 3 - Part A - Tran Tung Linh - s3750075Document5 pagesACCT2105 - Assignemnt 3 - Part A - Tran Tung Linh - s3750075Tùng Linh TrầnNo ratings yet

- B1 Free Solving Nov 2019) - Set 3Document5 pagesB1 Free Solving Nov 2019) - Set 3paul sagudaNo ratings yet

- $ROIWW4XDocument80 pages$ROIWW4XGourav VallakattiNo ratings yet

- Tutorial 5 - Ratio Analysis - AnswerDocument6 pagesTutorial 5 - Ratio Analysis - AnswerSaravanan KandasamyNo ratings yet

- Corporate Finance-Darko Jovanović 2015Document17 pagesCorporate Finance-Darko Jovanović 2015Darko JovanovicNo ratings yet

- Midterm Exam - Esecon 1ST Sem. 2021-2022Document3 pagesMidterm Exam - Esecon 1ST Sem. 2021-2022raymond moscosoNo ratings yet

- Hemas Annual Report 2010 - 11Document110 pagesHemas Annual Report 2010 - 11sam713No ratings yet

- Profile of Endurance TechnologiesDocument11 pagesProfile of Endurance TechnologiespriyaNo ratings yet

- Acct1511 Final VersionDocument33 pagesAcct1511 Final VersioncarolinetsangNo ratings yet

- Profile of Endurance TechnologiesDocument11 pagesProfile of Endurance TechnologiespriyaNo ratings yet

- Accounting Lab - Annual Report AssignmentDocument5 pagesAccounting Lab - Annual Report AssignmentSausan SaniaNo ratings yet

- Financial Ratio Analysis Final-No in TextDocument32 pagesFinancial Ratio Analysis Final-No in TextMini8912No ratings yet

- Basic To Understanding StocksDocument3 pagesBasic To Understanding StocksDavidNo ratings yet

- FN301 - Ch.1: Functions of The Financial Manager: Lecturer: Mr. TumongDocument13 pagesFN301 - Ch.1: Functions of The Financial Manager: Lecturer: Mr. TumongGrace Chiang KoNo ratings yet

- Reading 24 Private Company Valuation - AnswersDocument33 pagesReading 24 Private Company Valuation - Answerstristan.riolsNo ratings yet

- 2955-11724-1-PB Analisis Laporan Keuangan PT Bentoel Investama TBKDocument10 pages2955-11724-1-PB Analisis Laporan Keuangan PT Bentoel Investama TBKanon_781586824No ratings yet

- Earning Management and Operating PerformanceDocument9 pagesEarning Management and Operating Performancesita deliyana FirmialyNo ratings yet

- Acc Company Profile of Endurance TechnologiesDocument12 pagesAcc Company Profile of Endurance TechnologiesPriya piyankaNo ratings yet

- Manajemen Investasi Summary Chapter 15 & 16: Dr. Vinola Herawaty, Ak.,MscDocument13 pagesManajemen Investasi Summary Chapter 15 & 16: Dr. Vinola Herawaty, Ak.,Mscmutia rasyaNo ratings yet

- Company Name:Itc: Business Finance Assignment Sectio NCDocument13 pagesCompany Name:Itc: Business Finance Assignment Sectio NCDIVYANG AGARWAL 2023291No ratings yet

- IDD276 EditedDocument14 pagesIDD276 EditedMeena DasNo ratings yet

- Assignment May2011 ADocument6 pagesAssignment May2011 AZyn Wann HoNo ratings yet

- Kohinoor Chemical Assumptions, ConstrainsDocument6 pagesKohinoor Chemical Assumptions, ConstrainsFYAJ ROHANNo ratings yet

- Analysis and AssessmentDocument1 pageAnalysis and Assessmentjorgoca2No ratings yet

- Chapter 9 - Analysis & Intrepretation of Financial StatementsDocument10 pagesChapter 9 - Analysis & Intrepretation of Financial StatementsrathaNo ratings yet

- CAM Annual Report 2013Document50 pagesCAM Annual Report 2013ashkanfashamiNo ratings yet

- BSMA FM Final ExamDocument1 pageBSMA FM Final ExamFranz Ana Marie CuaNo ratings yet

- HO No. 3 - Working Capital ManagementDocument2 pagesHO No. 3 - Working Capital ManagementGrace Chavez ManaliliNo ratings yet

- Business FinanceDocument7 pagesBusiness Financeparthasdhar8No ratings yet

- Pma FacsDocument27 pagesPma FacsGopi NathanNo ratings yet

- Integrated Problem CH 2Document30 pagesIntegrated Problem CH 2paula100% (1)

- Epwin GroupDocument4 pagesEpwin GroupgayathriNo ratings yet

- Financial Management Tutorial QuestionsDocument8 pagesFinancial Management Tutorial QuestionsStephen Olieka100% (2)

- Security Valuation of British American Tobacco: Presentation OnDocument18 pagesSecurity Valuation of British American Tobacco: Presentation OnshahinNo ratings yet

- Peoples Merchant Annual Report 2010-11Document98 pagesPeoples Merchant Annual Report 2010-11jkdjfaljdkjfkdsjfdNo ratings yet

- Working Capital and Fund Flow Statement of Modest Infrastucture LTDDocument27 pagesWorking Capital and Fund Flow Statement of Modest Infrastucture LTDMegha HumbalNo ratings yet

- It Governance Technology-Chapter 01Document4 pagesIt Governance Technology-Chapter 01IQBAL MAHMUDNo ratings yet

- Assessing Financial Health (Part-A)Document17 pagesAssessing Financial Health (Part-A)kohacNo ratings yet

- Accf 2204Document7 pagesAccf 2204Avi StrikyNo ratings yet

- MAQT AssignmentDocument11 pagesMAQT AssignmentSahan RodrigoNo ratings yet

- Exam Reviewer FINMGTDocument8 pagesExam Reviewer FINMGTMary Elisha PinedaNo ratings yet

- Associated British FoodsDocument16 pagesAssociated British FoodsMohd Shahbaz Husain100% (1)

- Jimma UniversityDocument37 pagesJimma Universitymubarek oumerNo ratings yet

- ACTIVITY 5 CBE Module 4Document5 pagesACTIVITY 5 CBE Module 4Christian John Resabal BiolNo ratings yet

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNo ratings yet

- Guide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017From EverandGuide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017No ratings yet

- Guide to Japan-Born Inventory and Accounts Receivable Freshness Control for Managers 2017 (English Version)From EverandGuide to Japan-Born Inventory and Accounts Receivable Freshness Control for Managers 2017 (English Version)No ratings yet

- Fishery Company Surabaya-SidoarjoDocument4 pagesFishery Company Surabaya-SidoarjoTigana OscarNo ratings yet

- 5 F Jazz Blues LicksDocument2 pages5 F Jazz Blues LicksElpidio AmorosoNo ratings yet

- Schwa Worksheets 1Document5 pagesSchwa Worksheets 1mohammedNo ratings yet

- AP World History Summer AssignmentDocument9 pagesAP World History Summer AssignmentAnonymous tvG8tBNo ratings yet

- 60 Free TB ActivitiesDocument11 pages60 Free TB ActivitiesochioreanuNo ratings yet

- Sol. Man. Chapter 9 Income Taxes 2021Document18 pagesSol. Man. Chapter 9 Income Taxes 2021Kim HanbinNo ratings yet

- Carlsberg Sustainability Report 2018Document62 pagesCarlsberg Sustainability Report 2018Mike MichaelidesNo ratings yet

- Wearable Technologies: Scott Mcgregor President & Ceo, Broadcom CorporationDocument23 pagesWearable Technologies: Scott Mcgregor President & Ceo, Broadcom CorporationRavi PilgarNo ratings yet

- Archived: Chapel Facilities Design GuideDocument30 pagesArchived: Chapel Facilities Design GuideIvy AbrahamNo ratings yet

- Book 3 SuccessionDocument189 pagesBook 3 SuccessiontatatalaNo ratings yet

- People v. BariquitDocument3 pagesPeople v. BariquitAbby PerezNo ratings yet

- Ada Blackjack Answers (11-09-2021)Document4 pagesAda Blackjack Answers (11-09-2021)Blob BlobbyNo ratings yet

- Christmas SongsDocument7 pagesChristmas SongsRocíoTanzolaPisaniNo ratings yet

- EHSPL Msme Reg CertificateDocument1 pageEHSPL Msme Reg Certificatemukherjeemohul25No ratings yet

- Inbound 5135419190087357453Document13 pagesInbound 5135419190087357453gorgshae228No ratings yet

- Rohini 20313798233Document5 pagesRohini 20313798233Hari HaranNo ratings yet

- Law Question BankDocument82 pagesLaw Question Bankram narseshNo ratings yet

- Seismic Analysis of Residential Building With Short Column Effect A ThesisDocument98 pagesSeismic Analysis of Residential Building With Short Column Effect A ThesisheshamNo ratings yet

- Management Games Andrews Industry 24Document9 pagesManagement Games Andrews Industry 24Rahul ChauhanNo ratings yet

- Manager Purchasing Business Development in Lancaster PA Resume Greg ZimmermanDocument2 pagesManager Purchasing Business Development in Lancaster PA Resume Greg ZimmermanGregZimmermanNo ratings yet

- 2012 Oregon Sport Fish RegsDocument112 pages2012 Oregon Sport Fish RegsRoeHuntingResourcesNo ratings yet

- Unit 3 Part 4Document19 pagesUnit 3 Part 4Pooja PatilNo ratings yet

- 14410628-Ta-Muhammad Ilham Agus Salim-Legal Protection For User Data in Fintech Peer To Peer Lending Rupiah CepatDocument115 pages14410628-Ta-Muhammad Ilham Agus Salim-Legal Protection For User Data in Fintech Peer To Peer Lending Rupiah CepatHam AgsaNo ratings yet

- Autobiography RubricDocument1 pageAutobiography Rubricapi-264460605No ratings yet

- Technical Interview Study GuideDocument18 pagesTechnical Interview Study GuideRutvij MehtaNo ratings yet

- Structuralism (De Saussure), A Language vs. The Human Language Faculty (Chomsky) ... Etc SummaryDocument5 pagesStructuralism (De Saussure), A Language vs. The Human Language Faculty (Chomsky) ... Etc SummaryMarijana Lopec100% (3)

- Sync3 U6 STDocument6 pagesSync3 U6 STAna CondeNo ratings yet

- How To Be A SpeakerDocument6 pagesHow To Be A SpeakerGabor KovacsNo ratings yet