Professional Documents

Culture Documents

Itabi's ASS

Itabi's ASS

Uploaded by

Prince-SimonJohnMwanza0 ratings0% found this document useful (0 votes)

10 views2 pagesDefined Benefit Plan: A pension plan where the employer is responsible for investing contributions to ensure there is enough money to pay monthly benefits based on a formula of the employee's age, pay, and length of service. The employer bears the risks of funding shortfalls and market performance and must provide survivor benefits.

Defined Contribution Plan: A retirement savings plan where contributions from the employer and/or employee are invested for growth and the eventual payout depends on contribution amounts and investment performance. Employees choose whether to participate and bear the risks of funding their own retirement. Upon leaving employment, the employee owns their account.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDefined Benefit Plan: A pension plan where the employer is responsible for investing contributions to ensure there is enough money to pay monthly benefits based on a formula of the employee's age, pay, and length of service. The employer bears the risks of funding shortfalls and market performance and must provide survivor benefits.

Defined Contribution Plan: A retirement savings plan where contributions from the employer and/or employee are invested for growth and the eventual payout depends on contribution amounts and investment performance. Employees choose whether to participate and bear the risks of funding their own retirement. Upon leaving employment, the employee owns their account.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

10 views2 pagesItabi's ASS

Itabi's ASS

Uploaded by

Prince-SimonJohnMwanzaDefined Benefit Plan: A pension plan where the employer is responsible for investing contributions to ensure there is enough money to pay monthly benefits based on a formula of the employee's age, pay, and length of service. The employer bears the risks of funding shortfalls and market performance and must provide survivor benefits.

Defined Contribution Plan: A retirement savings plan where contributions from the employer and/or employee are invested for growth and the eventual payout depends on contribution amounts and investment performance. Employees choose whether to participate and bear the risks of funding their own retirement. Upon leaving employment, the employee owns their account.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Defined Benefit Plan

• Definition & Nature:

It is a pension plan that relates to payment of specific benefits on a monthly basis. This is based

on a formula that includes the employee’s age at the time of retirement, rate of pay, and length of

service.

The employer is responsible for investing the contributions to ensure there’s enough money to pay

the future pensions for all plan members. If there’s a shortfall in the money needed, the employer

must pay the difference.

➢ Generally, all employees participate in these plans.

➢ The employer is responsible for keeping the fund sufficiently funded and for paying the

monthly benefits promised by the plan.

➢ The employer bears both Longevity Risks and Investment Risk.

➢ It provides survivor benefits for the spouses of retirees. This means that, when the retiree

dies, the retiree’s spouse receives a certain percentage of the monthly benefit the retiree

had been receiving for the rest of the widow or widower’s life.

➢ A defined benefit pension is generally not assignable to third parties.

Defined Contribution Plan

• Definition & Nature:

It is a plan that is based on a defined amount which is contributed either by an employer or

employee. In some cases, both the employer and employee tend to contribute.

Employees are responsible for investing all contributions to grow their savings whereas the

employer matches some of the contributions made by the employees.

➢ Employees may choose to participate or not in this retirement savings plan.

➢ Eventual payout depends on the amount contributed and the investment performance of the

account.

➢ The “longevity risk” is completely on the employee.

➢ An employee may elect any surviving beneficiary to receive the remaining value of

the account upon his or her death.

➢ Higher level of portability is available with defined contribution plans. The employee may

have the option to take a loan or hardship withdrawal while employed, and will be able to

withdraw or roll over the account into some other plan or investment vehicle when he

leaves employment with the plan sponsor.

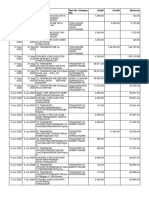

Differences Between Defined Benefit Plan & Defined Contribution Plan

Summary Table

ATTRIBUTES Defined Benefit Defined Contribution

i). Participation • All employees • Choice of employee

ii). Formula for Benefits • Uses formula • No formula is used

iii). Funding Responsibility • Employer • Employee or Employer

• Both

iv). Survivor’s Protection • Yes • No

v). Cost of Living Adjustments • Very Possible • impossible

vi). Portability • No • Yes

vii). Risk Bearer • Employer • Employee

You might also like

- August Bank StatementDocument4 pagesAugust Bank StatementAlexander Barno Alex100% (2)

- Act 8Document6 pagesAct 8Carlos MartinezNo ratings yet

- Employee Benefits Related Standards: Pas 19 - Employee Benefits Pas 26 - Accounting & Reporting by Retirement Benefit PlansDocument10 pagesEmployee Benefits Related Standards: Pas 19 - Employee Benefits Pas 26 - Accounting & Reporting by Retirement Benefit PlansallyssajabsNo ratings yet

- Pension Plans.Document8 pagesPension Plans.onenerdNo ratings yet

- DB Domain AssessmentDocument2 pagesDB Domain Assessmentankitanand12121No ratings yet

- Types of Pension PlansDocument46 pagesTypes of Pension PlansAasthaNo ratings yet

- Acivity Module 4Document2 pagesAcivity Module 4Honey TolentinoNo ratings yet

- Course Materials-IA3-Week 1-M. ManayaoDocument17 pagesCourse Materials-IA3-Week 1-M. ManayaoMitchie FaustinoNo ratings yet

- CH 09Document10 pagesCH 09Md.Rakib MiaNo ratings yet

- Module 7 - Ia2 Final CBLDocument22 pagesModule 7 - Ia2 Final CBLErika EsguerraNo ratings yet

- Public and Private PensionDocument7 pagesPublic and Private PensionMelvyn LedesmaNo ratings yet

- 10 Group InsuranceDocument37 pages10 Group InsuranceShiv PratapNo ratings yet

- Personal Wealth ManagementDocument33 pagesPersonal Wealth ManagementVaibhav ArwadeNo ratings yet

- Lectures 2 and 3 - The Solow Growth ModelDocument4 pagesLectures 2 and 3 - The Solow Growth ModelDarrelNo ratings yet

- Pensions and Other Employee Future BenefitsDocument50 pagesPensions and Other Employee Future BenefitsBic NgoNo ratings yet

- CH 28 - Employee Benefits PDFDocument7 pagesCH 28 - Employee Benefits PDFJm SevallaNo ratings yet

- Income Protection PlanDocument16 pagesIncome Protection Planmandiegmd10No ratings yet

- Employee Benefits and ServicesDocument22 pagesEmployee Benefits and ServicesMD.Rakibul HasanNo ratings yet

- Lecture 10 - Retirement PlanningDocument33 pagesLecture 10 - Retirement PlanningHiền NguyễnNo ratings yet

- Unit 7 E-Tutor PresentationDocument18 pagesUnit 7 E-Tutor PresentationKatrina EustaceNo ratings yet

- Life Insu Class-14Document23 pagesLife Insu Class-14saroj aashmanfoundationNo ratings yet

- 3.PAK QFIPME TOPIC5 MIP 3 Managing Institutional Investor PortfoliosDocument35 pages3.PAK QFIPME TOPIC5 MIP 3 Managing Institutional Investor PortfoliosNoodles FSANo ratings yet

- CM 6th ChapterDocument3 pagesCM 6th ChapterMd Mahmudul HasanNo ratings yet

- RMI Chapter 16Document21 pagesRMI Chapter 16Jayvee M FelipeNo ratings yet

- Lesson Employee BenefitDocument18 pagesLesson Employee BenefitDesiree GalletoNo ratings yet

- TaxDocument4 pagesTaxGia Serilla100% (1)

- Power To People: Indiafirst Employee Benefit PlanDocument14 pagesPower To People: Indiafirst Employee Benefit PlanBhawzNo ratings yet

- USA Full-Time Employee Benefits Summary - All GradesDocument2 pagesUSA Full-Time Employee Benefits Summary - All Gradesvktm9r2x7nNo ratings yet

- Day 2-Participating PlansDocument19 pagesDay 2-Participating Plansm_dattaiasNo ratings yet

- Employee Benefits Ias19Document42 pagesEmployee Benefits Ias19krishnaguptaNo ratings yet

- IncentivesDocument31 pagesIncentivessayaliNo ratings yet

- Ias 19 - Employee Benefits QUESTION 57-17Document9 pagesIas 19 - Employee Benefits QUESTION 57-17Janella Gail ArenasNo ratings yet

- Valix 17 20 MCQ and Theory Emp Ben She PDFDocument48 pagesValix 17 20 MCQ and Theory Emp Ben She PDFMitchie FaustinoNo ratings yet

- Demographic Bases Investment Linked Insurance Plan Insurance Products Pensions & Annuities Risks and Solvency of InsuranceDocument24 pagesDemographic Bases Investment Linked Insurance Plan Insurance Products Pensions & Annuities Risks and Solvency of InsurancePraveen PanigrahiNo ratings yet

- Lesson 11 Discussion ForumDocument2 pagesLesson 11 Discussion Forumsteven linNo ratings yet

- Q2 WordDocument22 pagesQ2 WordNishita DagaNo ratings yet

- Learning Objective Life Insurance ProductsDocument25 pagesLearning Objective Life Insurance ProductsHelpdeskNo ratings yet

- HRM - Unit 3Document24 pagesHRM - Unit 3Asees KaurNo ratings yet

- Sept Briefing National Institute For Retirement SecurityDocument37 pagesSept Briefing National Institute For Retirement Securitypcapineri8399No ratings yet

- Employee Benefits TheoryDocument8 pagesEmployee Benefits TheoryMicaela EncinasNo ratings yet

- Financial PlaningDocument11 pagesFinancial PlaningSunil SinghNo ratings yet

- Employee Stock Ownership Plan (ESOP) :: The EmployerDocument1 pageEmployee Stock Ownership Plan (ESOP) :: The EmployerThanu SuthatharanNo ratings yet

- Labor Relations Process 11Th Edition Holley Solutions Manual Full Chapter PDFDocument38 pagesLabor Relations Process 11Th Edition Holley Solutions Manual Full Chapter PDFNancyWardDDSrods100% (13)

- Labor Relations Process 11th Edition Holley Solutions ManualDocument17 pagesLabor Relations Process 11th Edition Holley Solutions Manualhanhgiaoghhr100% (35)

- E.Types of Retirement Plans-1Document13 pagesE.Types of Retirement Plans-1Madhu dollyNo ratings yet

- Monika Rehman Roll No 10Document19 pagesMonika Rehman Roll No 10Monika RehmanNo ratings yet

- Int. HRM Ch07Document14 pagesInt. HRM Ch07Z KhanNo ratings yet

- International CompensationDocument60 pagesInternational CompensationDhanis IshwarNo ratings yet

- Far28 Employee BenefitsDocument26 pagesFar28 Employee BenefitsCzar John JaudNo ratings yet

- Personal Loan Policy 672Document1 pagePersonal Loan Policy 672Manager HR Shalya XcellanceNo ratings yet

- VillanuevaJohnLloydA Module4ActivityDocument2 pagesVillanuevaJohnLloydA Module4ActivityJan JanNo ratings yet

- IA2 10 01 Employee Benefits PDFDocument17 pagesIA2 10 01 Employee Benefits PDFAzaria MatiasNo ratings yet

- MyBenefits - Program Brochure (FY21-22)Document27 pagesMyBenefits - Program Brochure (FY21-22)Manan ChaniyaraNo ratings yet

- HR Chapter-10 (A)Document17 pagesHR Chapter-10 (A)Wai Yun MoeNo ratings yet

- What You Should Know About Your Retirement PlanDocument44 pagesWhat You Should Know About Your Retirement PlanLucíaNo ratings yet

- 11.benefits and ServicesDocument21 pages11.benefits and Servicesabdullah islamNo ratings yet

- Pfin 4 4th Edition Gitman Solutions ManualDocument20 pagesPfin 4 4th Edition Gitman Solutions Manualthoabangt69100% (32)

- Compensation As Retention StrategyDocument6 pagesCompensation As Retention StrategyHarris VS100% (1)

- IAS 19 NotesDocument16 pagesIAS 19 NotesArsalan AliNo ratings yet

- Employee Benefits and ServicesDocument11 pagesEmployee Benefits and ServicesElenita AkosiNo ratings yet

- Acct 462 Assignments Two Case Study Developing FindingsDocument2 pagesAcct 462 Assignments Two Case Study Developing FindingsPrince-SimonJohnMwanzaNo ratings yet

- Q1. Patson Corp: Journal EntriesDocument2 pagesQ1. Patson Corp: Journal EntriesPrince-SimonJohnMwanzaNo ratings yet

- Mando PDFDocument12 pagesMando PDFPrince-SimonJohnMwanzaNo ratings yet

- CASE STUDY - Developing Findings Attributes Number of Working Paper Notes Working Papers FilesDocument1 pageCASE STUDY - Developing Findings Attributes Number of Working Paper Notes Working Papers FilesPrince-SimonJohnMwanzaNo ratings yet

- BMG AssignmentDocument3 pagesBMG AssignmentPrince-SimonJohnMwanza100% (1)

- Factors Reducing Business Activities For SMEs in Chelston Market of Lusaka, ZambiaDocument2 pagesFactors Reducing Business Activities For SMEs in Chelston Market of Lusaka, ZambiaPrince-SimonJohnMwanzaNo ratings yet

- Spray Programme For Broccoli, Cabbage, Kales and CauliflowerDocument3 pagesSpray Programme For Broccoli, Cabbage, Kales and CauliflowerPrince-SimonJohnMwanzaNo ratings yet

- Final Examination Bio 112-Molecular Biology and GeneticsDocument15 pagesFinal Examination Bio 112-Molecular Biology and GeneticsPrince-SimonJohnMwanza100% (1)

- Ca Q&a Dec 2018 PDFDocument392 pagesCa Q&a Dec 2018 PDFBruce GomaNo ratings yet

- BMG 101 1 ETHIC Chillax-1Document143 pagesBMG 101 1 ETHIC Chillax-1Prince-SimonJohnMwanzaNo ratings yet

- Solutions and Their Properties: Mulungushi UniversityDocument33 pagesSolutions and Their Properties: Mulungushi UniversityPrince-SimonJohnMwanzaNo ratings yet

- Answer Template - For MergeDocument1 pageAnswer Template - For MergePrince-SimonJohnMwanzaNo ratings yet

- Pproved: JULY 2017 Course Title Cross Cultural Management Course Code BUSI 1313 Page 3 of 3Document2 pagesPproved: JULY 2017 Course Title Cross Cultural Management Course Code BUSI 1313 Page 3 of 3Prince-SimonJohnMwanzaNo ratings yet

- The Depreciation MethodsDocument9 pagesThe Depreciation MethodsPrince-SimonJohnMwanzaNo ratings yet

- Exercise 16-11: Part 1: Prepare The Journal Entry(s) To Record Payne's Income Tax ForDocument1 pageExercise 16-11: Part 1: Prepare The Journal Entry(s) To Record Payne's Income Tax ForPrince-SimonJohnMwanzaNo ratings yet

- MGMT 375 Trial ExamDocument2 pagesMGMT 375 Trial ExamPrince-SimonJohnMwanzaNo ratings yet

- ACCT 451 Advanced Accounting Trial ExamDocument4 pagesACCT 451 Advanced Accounting Trial ExamPrince-SimonJohnMwanzaNo ratings yet

- BMG AssignmentDocument3 pagesBMG AssignmentPrince-SimonJohnMwanza100% (1)

- ACCT 261 Taxation I Trial ExamDocument3 pagesACCT 261 Taxation I Trial ExamPrince-SimonJohnMwanza50% (2)

- Final Xam BAC 212 BAF 112Document3 pagesFinal Xam BAC 212 BAF 112Prince-SimonJohnMwanzaNo ratings yet

- DepreciationDocument3 pagesDepreciationPrince-SimonJohnMwanza100% (1)

- Accounting Job ResponsibilitiesDocument3 pagesAccounting Job ResponsibilitiesPrince-SimonJohnMwanzaNo ratings yet

- e-StatementBRImo 371601017596539 Dec2023 20240222 164634Document4 pagese-StatementBRImo 371601017596539 Dec2023 20240222 164634mnlgideonNo ratings yet

- Veeraiyan 02Document10 pagesVeeraiyan 02Unlimited AppsNo ratings yet

- Saving Cum Salary Account 3Document5 pagesSaving Cum Salary Account 3Ashwani KumarNo ratings yet

- Bank and Banking PerspectiveDocument10 pagesBank and Banking PerspectiveDennilyn TanchicoNo ratings yet

- Bank StatementDocument1 pageBank StatementRudo DewaNo ratings yet

- OM 3 - 1 - 86-Estt-Pay-ii PDFDocument17 pagesOM 3 - 1 - 86-Estt-Pay-ii PDFmfg1984No ratings yet

- UntitledDocument19 pagesUntitledTejaas MageshNo ratings yet

- KK - JeevanUtsav - 30-1-2024 9.31.47Document6 pagesKK - JeevanUtsav - 30-1-2024 9.31.47mouli4454No ratings yet

- A1 Loan Application FormDocument1 pageA1 Loan Application FormAngie DuranNo ratings yet

- EPF Circular On Pension For Full Salary 23.3.17Document11 pagesEPF Circular On Pension For Full Salary 23.3.17Vishal IngleNo ratings yet

- PF Claim VinodDocument2 pagesPF Claim VinodAlok NathNo ratings yet

- Dacion en PagoDocument2 pagesDacion en Pagohailglee1925No ratings yet

- Income Tax History - Check Your Income Tax - GOV - UK - Check Your Income Tax - GOV - UKDocument5 pagesIncome Tax History - Check Your Income Tax - GOV - UK - Check Your Income Tax - GOV - UKChris CritchNo ratings yet

- PYKRP00356350000014517 NewDocument3 pagesPYKRP00356350000014517 NewVenu MadhuriNo ratings yet

- Interbank MarketDocument30 pagesInterbank Marketdeniseanne clementeNo ratings yet

- Kotak Program Pitch - Optima PDFDocument1 pageKotak Program Pitch - Optima PDFbhaktiNo ratings yet

- AccountStatement MAR 2023Document4 pagesAccountStatement MAR 2023Abdelrahman shetaNo ratings yet

- Venmo 20Document5 pagesVenmo 20ebiznz1No ratings yet

- Bank Statement SantoniDocument1 pageBank Statement SantoniBinance Cutie0% (1)

- Statement Bank MBBDocument12 pagesStatement Bank MBBminyak bidara01No ratings yet

- Loan Application FormDocument1 pageLoan Application FormMukalele RogersNo ratings yet

- Credit Card DetailsDocument5 pagesCredit Card DetailsSyed Farid AliNo ratings yet

- Bri Ribut Jan 24Document2 pagesBri Ribut Jan 24ptdsppropertiNo ratings yet

- MD Zulhaidi 1Document1 pageMD Zulhaidi 1limcheeshin94No ratings yet

- Bonus - Rates Lic Jeevan Surbhi 2009 - 2010 PDFDocument5 pagesBonus - Rates Lic Jeevan Surbhi 2009 - 2010 PDFVipul KaushikNo ratings yet

- TCF Personal Unsecured Secured Loan Application FormDocument1 pageTCF Personal Unsecured Secured Loan Application FormMichael DavidNo ratings yet

- Students Profile G 12 - CallalilyDocument25 pagesStudents Profile G 12 - CallalilyAu Gust BelleNo ratings yet

- 2022 BP Form 205 (Mandatory and Optional) - DSSC-2Document3 pages2022 BP Form 205 (Mandatory and Optional) - DSSC-2Charles D. FloresNo ratings yet