Professional Documents

Culture Documents

Chapter One Wealth Creation: Invisible Hand Supported by Hand of Trust

Chapter One Wealth Creation: Invisible Hand Supported by Hand of Trust

Uploaded by

Karambir Singh DhayalCopyright:

Available Formats

You might also like

- Elizabeth Chin - My Life With Things - The Consumer Diaries-Duke University Press (2016) PDFDocument248 pagesElizabeth Chin - My Life With Things - The Consumer Diaries-Duke University Press (2016) PDFKatia Alaei100% (1)

- The Golden ConstantDocument368 pagesThe Golden Constantiaint100% (1)

- Thomas W. Pogge-World Poverty and Human Rights-Polity (2002)Document147 pagesThomas W. Pogge-World Poverty and Human Rights-Polity (2002)Hosszu Alexandra100% (2)

- Read Sanders Remarks in Defense of Democratic SocialismDocument14 pagesRead Sanders Remarks in Defense of Democratic SocialismAnonymous 7cl3c7Ch100% (1)

- Gist of Economic Survey 2019-20: Wealth Creation: The Invisible Hand Supported by The Hand of TrustDocument50 pagesGist of Economic Survey 2019-20: Wealth Creation: The Invisible Hand Supported by The Hand of TrustSiddharth WorkNo ratings yet

- Chapter 1Document42 pagesChapter 1Abhijeet JhaNo ratings yet

- What Is The Role of An Entrepreneur in Economic DevelopmentDocument6 pagesWhat Is The Role of An Entrepreneur in Economic DevelopmentSandeep KodanNo ratings yet

- Capital Formation: Definitions, Process & FactorsDocument5 pagesCapital Formation: Definitions, Process & FactorsSharad ParteNo ratings yet

- Possile Questions EdDocument7 pagesPossile Questions EdEaswar PandiNo ratings yet

- Management of Financial Institutions - Unit IDocument7 pagesManagement of Financial Institutions - Unit ISudha MuralinathNo ratings yet

- Class Notes - Economics 3Document15 pagesClass Notes - Economics 3Kanchan VermaNo ratings yet

- Development of Entreprenuership in PakistanDocument21 pagesDevelopment of Entreprenuership in PakistanSaba ZiaNo ratings yet

- Entrep Mind Chapter 2Document2 pagesEntrep Mind Chapter 2Yeho ShuaNo ratings yet

- Resources MobilizationDocument16 pagesResources MobilizationPratikNo ratings yet

- Dr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaDocument19 pagesDr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in Indiaaayaksh chadhaNo ratings yet

- Economic and Non-Economic FactorsDocument19 pagesEconomic and Non-Economic FactorsPriyanshu Sekhar0912No ratings yet

- Chapter - 1Document48 pagesChapter - 1seepi345No ratings yet

- Indian Capital MarketDocument70 pagesIndian Capital MarketSudha Devendran100% (10)

- Dr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaDocument19 pagesDr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaAayaksh ChadhaNo ratings yet

- Role and Challenges of Capital Market in India: An Overview: Rakesh KumarDocument4 pagesRole and Challenges of Capital Market in India: An Overview: Rakesh KumarSuman QueenNo ratings yet

- "India Is A Rich Coutry Where Poor People Live": Rohan Sehgal 18bal050Document6 pages"India Is A Rich Coutry Where Poor People Live": Rohan Sehgal 18bal050rohanNo ratings yet

- Dr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaDocument19 pagesDr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaJuhi AwasthiNo ratings yet

- Investors Attitude Towards Secondary MarketDocument13 pagesInvestors Attitude Towards Secondary MarketManiyaa KambojNo ratings yet

- Disinvestment in IndiaDocument32 pagesDisinvestment in IndiaDixita ParmarNo ratings yet

- Course - Note - 3 - Dang Gia Vung - RA6127378Document4 pagesCourse - Note - 3 - Dang Gia Vung - RA6127378Gia Vững ĐặngNo ratings yet

- EconomicsDocument19 pagesEconomicsujj04No ratings yet

- Egr3101 Lecture Notes V1.1Document21 pagesEgr3101 Lecture Notes V1.1BenjaminNo ratings yet

- Thesis Swati PatilDocument237 pagesThesis Swati PatilbhartiNo ratings yet

- Introduction To Business: Course Code: BUSI-1101Document36 pagesIntroduction To Business: Course Code: BUSI-1101hasib_ahsanNo ratings yet

- Role of Entrepreneurs in Economic Development. Entrepreneurs Create Organizations That OfferDocument5 pagesRole of Entrepreneurs in Economic Development. Entrepreneurs Create Organizations That OfferjujuNo ratings yet

- INSTA Summary: Economic Survey 2019-20: Volume 1Document50 pagesINSTA Summary: Economic Survey 2019-20: Volume 1Sri Harsha DannanaNo ratings yet

- Entrepreneurship: The Indian StoryDocument4 pagesEntrepreneurship: The Indian StoryHimani KhatriNo ratings yet

- Capital MarketDocument36 pagesCapital Marketmayuri chaudhariNo ratings yet

- Cases of Entrepreneurs After IndependenceDocument12 pagesCases of Entrepreneurs After IndependenceParmesh PandeyNo ratings yet

- Entrepreneurship Is The Act of Being An Entrepreneur, Which Is A French Word Meaning "One WhoDocument3 pagesEntrepreneurship Is The Act of Being An Entrepreneur, Which Is A French Word Meaning "One WhonanimdpNo ratings yet

- Dr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaDocument19 pagesDr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiayamatoNo ratings yet

- Indian Financial System Project 3sem (Priyank)Document35 pagesIndian Financial System Project 3sem (Priyank)priyank chourasiyaNo ratings yet

- A Study On Investor Attitude Towards Primary MarketDocument63 pagesA Study On Investor Attitude Towards Primary MarketAnkit BissaNo ratings yet

- 2018-Ag-3423 ALi SHERDocument11 pages2018-Ag-3423 ALi SHERALI SHER HaidriNo ratings yet

- Role of An EntrepreneurDocument11 pagesRole of An EntrepreneurNoorain FirdouseNo ratings yet

- Theme of Economic Survey - 2019-20 - PIBDocument4 pagesTheme of Economic Survey - 2019-20 - PIBUtkarsh GuptaNo ratings yet

- Features of Indian Economy and Economic Systems (5983)Document3 pagesFeatures of Indian Economy and Economic Systems (5983)Hitisha agrawalNo ratings yet

- Merchant Banking and Financial Services Question PaperDocument248 pagesMerchant Banking and Financial Services Question Paperexecutivesenthilkumar100% (1)

- Business Enivironment Qs.1: Write A Note On The Following A. Socialistic Economy B. Capitalistic EconomyDocument8 pagesBusiness Enivironment Qs.1: Write A Note On The Following A. Socialistic Economy B. Capitalistic EconomyDaminiSarafNo ratings yet

- Indian Economy: What Is Economics-?Document16 pagesIndian Economy: What Is Economics-?Indrajeet ChavanNo ratings yet

- What Is The Role of An Entrepreneur in Economic DevelopmentDocument6 pagesWhat Is The Role of An Entrepreneur in Economic DevelopmentSurya Reddy75% (12)

- 08 Chapter 1Document33 pages08 Chapter 1suvarediveshNo ratings yet

- Econ Semis NotesDocument4 pagesEcon Semis NotesManuel CuycoNo ratings yet

- Stand Up India - Start Up IndiaDocument28 pagesStand Up India - Start Up IndiaJo JaladdNo ratings yet

- Yash P. (FINAL Project)Document96 pagesYash P. (FINAL Project)Elizabeth AlvarezNo ratings yet

- Globalization and The Indian Capital Market: KeywordsDocument8 pagesGlobalization and The Indian Capital Market: KeywordsSangram PandaNo ratings yet

- Ent 1Document64 pagesEnt 1Ankit AnuragNo ratings yet

- Chapter 10 ReportDocument19 pagesChapter 10 ReportDarwin SolanoyNo ratings yet

- Entrepreneurship in PakistanDocument87 pagesEntrepreneurship in PakistanMuazzam Mughal100% (1)

- Banking Awareness by Disha PublicationDocument293 pagesBanking Awareness by Disha PublicationBalachandarMahadevan100% (1)

- NEW. Entrepreneurship CH IDocument14 pagesNEW. Entrepreneurship CH Ibetsega shiferaNo ratings yet

- 108INUNIT4A Inequality and Economic Power in IndiaDocument97 pages108INUNIT4A Inequality and Economic Power in IndiaDr. Rakesh BhatiNo ratings yet

- (Economics) : Managing Within The Dynamic Business Environment: Taking Risks and Making ProfitsDocument42 pages(Economics) : Managing Within The Dynamic Business Environment: Taking Risks and Making ProfitsRafayet Omar ShuvoNo ratings yet

- Cap Markets in PakDocument37 pagesCap Markets in PakKamran ArmaniNo ratings yet

- Dr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaDocument19 pagesDr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaAnushka SinghNo ratings yet

- IBTDocument3 pagesIBTHeart EspineliNo ratings yet

- Lessons from the Poor: Triumph of the Entrepreneurial SpiritFrom EverandLessons from the Poor: Triumph of the Entrepreneurial SpiritRating: 4 out of 5 stars4/5 (1)

- Its All in the Price: A Business Solution to the EconomyFrom EverandIts All in the Price: A Business Solution to the EconomyNo ratings yet

- IDFC Factsheet March 2021Document72 pagesIDFC Factsheet March 2021Karambir Singh DhayalNo ratings yet

- 379 Indian Climate Indiashastra PDFDocument2 pages379 Indian Climate Indiashastra PDFKarambir Singh DhayalNo ratings yet

- Smart.: ScoreDocument5 pagesSmart.: ScoreKarambir Singh DhayalNo ratings yet

- Dialects Raj 3Document29 pagesDialects Raj 3Karambir Singh DhayalNo ratings yet

- Dialects in Rajasthan-: - Mother Tongue of Rajasthan - U/A Indo-European Group Gurjar Apbhransh of ShoursainiDocument9 pagesDialects in Rajasthan-: - Mother Tongue of Rajasthan - U/A Indo-European Group Gurjar Apbhransh of ShoursainiKarambir Singh DhayalNo ratings yet

- 380 Natural Vegetation Indiashastra PDFDocument2 pages380 Natural Vegetation Indiashastra PDFKarambir Singh DhayalNo ratings yet

- ACFRASFairsof RajasthanDocument46 pagesACFRASFairsof RajasthanKarambir Singh DhayalNo ratings yet

- Adeup CoDocument6 pagesAdeup CoKarambir Singh DhayalNo ratings yet

- Lok Devtas of Rajasthan:: Ramdev JiDocument35 pagesLok Devtas of Rajasthan:: Ramdev JiKarambir Singh DhayalNo ratings yet

- 381 Soils of India Indiashastra PDFDocument2 pages381 Soils of India Indiashastra PDFKarambir Singh DhayalNo ratings yet

- 377 Islands of India Indiashastra PDFDocument2 pages377 Islands of India Indiashastra PDFKarambir Singh DhayalNo ratings yet

- 382 Major Lakes of India IndiashastraDocument3 pages382 Major Lakes of India IndiashastraKarambir Singh DhayalNo ratings yet

- 378 Factors Affecting Climate India Indiashastra PDFDocument1 page378 Factors Affecting Climate India Indiashastra PDFKarambir Singh DhayalNo ratings yet

- 384 Major Passes of India IndiashastraDocument3 pages384 Major Passes of India IndiashastraKarambir Singh DhayalNo ratings yet

- 383 Major Dams of India IndiashastraDocument2 pages383 Major Dams of India IndiashastraKarambir Singh Dhayal100% (1)

- 389 Pollution Indiashastra PDFDocument1 page389 Pollution Indiashastra PDFKarambir Singh DhayalNo ratings yet

- 381 Soils of India IndiashastraDocument2 pages381 Soils of India IndiashastraKarambir Singh DhayalNo ratings yet

- Cool Temperate Western Margin / British ClimateDocument1 pageCool Temperate Western Margin / British ClimateKarambir Singh DhayalNo ratings yet

- Cool Temperate Continental / Taiga ClimateDocument1 pageCool Temperate Continental / Taiga ClimateKarambir Singh DhayalNo ratings yet

- 394 Cool Temperate Eastern Laurentian Climate IndiashastraDocument1 page394 Cool Temperate Eastern Laurentian Climate IndiashastraKarambir Singh DhayalNo ratings yet

- 393 Tropical Monsoon Climate IndiashastraDocument1 page393 Tropical Monsoon Climate IndiashastraKarambir Singh DhayalNo ratings yet

- Chapter Two Entrepreneurship and Wealth Creation at The GrassrootsDocument2 pagesChapter Two Entrepreneurship and Wealth Creation at The GrassrootsKarambir Singh DhayalNo ratings yet

- Application of Robotics: Industrial ApplicationsDocument2 pagesApplication of Robotics: Industrial ApplicationsKarambir Singh DhayalNo ratings yet

- India Growth Overstated: This Chapter Provides Defence To This Type of Similar ConcernsDocument1 pageIndia Growth Overstated: This Chapter Provides Defence To This Type of Similar ConcernsKarambir Singh DhayalNo ratings yet

- 425 Vitamins Minerals IndiashastraDocument2 pages425 Vitamins Minerals IndiashastraKarambir Singh DhayalNo ratings yet

- 420 Economic Survey Chapter 11 Thalinomics IndiashastraDocument1 page420 Economic Survey Chapter 11 Thalinomics IndiashastraKarambir Singh DhayalNo ratings yet

- Normal: Fluoroquinolones 2ndDocument2 pagesNormal: Fluoroquinolones 2ndKarambir Singh DhayalNo ratings yet

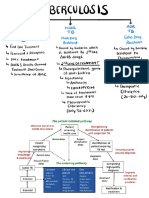

- 427 Tuberculosis India PlanDocument1 page427 Tuberculosis India PlanKarambir Singh DhayalNo ratings yet

- Bluetooth and Wireless Technology: NFC (Near Field Communication)Document4 pagesBluetooth and Wireless Technology: NFC (Near Field Communication)Karambir Singh DhayalNo ratings yet

- 423 Artificial Intelligence IndiashastraDocument1 page423 Artificial Intelligence IndiashastraKarambir Singh DhayalNo ratings yet

- Final Draft - Mainstreaming ManualDocument42 pagesFinal Draft - Mainstreaming ManualRamilNo ratings yet

- Comparison of Capitalism Socialism &islamic Economic SystemDocument13 pagesComparison of Capitalism Socialism &islamic Economic SystemAbdul MaroofNo ratings yet

- PovertyDocument25 pagesPovertyApollon Phebo100% (1)

- Act Ch03 l02 EnglishDocument6 pagesAct Ch03 l02 EnglishChris CunhaNo ratings yet

- Dec'23 Profit - and - Loss - OdooDocument1 pageDec'23 Profit - and - Loss - OdooPeer MohideenNo ratings yet

- 7 Tips To Becoming A MillionaireDocument24 pages7 Tips To Becoming A MillionaireefsdfsdafsdNo ratings yet

- Evaluating Major Events and Avoiding The Mercantialist FallacyDocument12 pagesEvaluating Major Events and Avoiding The Mercantialist FallacyNiclas HellNo ratings yet

- Autoethnographic Capstone Final DraftDocument23 pagesAutoethnographic Capstone Final Draftapi-446919348No ratings yet

- Ind As 34Document3 pagesInd As 34qwertyNo ratings yet

- The Economist Explains CapitalDocument2 pagesThe Economist Explains CapitalBharat Shah100% (1)

- Notes On The Meaning of Management:: Terry and FranklinDocument38 pagesNotes On The Meaning of Management:: Terry and FranklinKamran Ali AbbasiNo ratings yet

- Exploratory Research Into Islamic Financial Literacy in Brunei DarussalamDocument28 pagesExploratory Research Into Islamic Financial Literacy in Brunei DarussalamMuhammad BadyNo ratings yet

- PDF 309648880270623Document1 pagePDF 309648880270623Vinay PatelNo ratings yet

- Bapuji Project ModifyDocument74 pagesBapuji Project ModifyMichael WellsNo ratings yet

- Annual Report 2021 22Document137 pagesAnnual Report 2021 22MANSI POKARNANo ratings yet

- Conservatism: Pros & ConsDocument7 pagesConservatism: Pros & ConsPete100% (1)

- Taxation Is Theft PDFDocument2 pagesTaxation Is Theft PDFAranya KhuranaNo ratings yet

- Launching - New Product: 1 For Internal Training Circulation OnlyDocument15 pagesLaunching - New Product: 1 For Internal Training Circulation Onlyshoba vNo ratings yet

- Financial LiteracyDocument7 pagesFinancial LiteracyRochelle Ann Galvez Gabaldon100% (1)

- Mankind United by Arthur BellDocument144 pagesMankind United by Arthur BellSkyNo ratings yet

- 6503e25bfb6075001956a888 - ## - E-Notes Business and Commercial Knowledge-An IntroductionDocument16 pages6503e25bfb6075001956a888 - ## - E-Notes Business and Commercial Knowledge-An IntroductionGaurav SinghNo ratings yet

- Laws and Practices of Income TaxDocument34 pagesLaws and Practices of Income TaxNibir RahmanNo ratings yet

- Ack Cafpk4156a 2022-23 489614981130922Document1 pageAck Cafpk4156a 2022-23 489614981130922aditya_kavangalNo ratings yet

- 05 PartnershipDocument20 pages05 Partnershipjustine reine cornicoNo ratings yet

- Gratuity CalculationDocument4 pagesGratuity CalculationmeetushekhawatNo ratings yet

- Using Behavioral Investor TypesDocument8 pagesUsing Behavioral Investor TypesVidushi Bonomaully100% (1)

Chapter One Wealth Creation: Invisible Hand Supported by Hand of Trust

Chapter One Wealth Creation: Invisible Hand Supported by Hand of Trust

Uploaded by

Karambir Singh DhayalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter One Wealth Creation: Invisible Hand Supported by Hand of Trust

Chapter One Wealth Creation: Invisible Hand Supported by Hand of Trust

Uploaded by

Karambir Singh DhayalCopyright:

Available Formats

WWW.INDIASHASTRA.

COM

CHAPTER ONE WEALTH CREATION

INVISIBLE HAND SUPPORTED BY HAND OF TRUST

Historically, Indian economy relied on the invisible hand of the market with the support of the hand

of trust

- Invisible hand, of the market reflected in openness in economic transactions.

- Hand of trust appealed to ethical and philosophical dimensions.

IMPORTANCE OF WEALTH CREATION

- WEALTH CREATION: In general, wealth refers to your basket of assets; cash, land, property,

gold, shares, bonds all added together. For investors, wealth is created by buying or investing in

these assets with an expectation that the price will move higher. This rise in price over a period

of time is what will lead to growth in wealth. At macroeconomic level wealth creation is another

word for Economic Growth

- WEALTH CREATION BENEFITS ALL: When firm creates wealth —> earn profits —> growth in

salary of employees —> Raw material supplier also benefits —> Foreign exchange revenue —>

More people pay direct taxes —> Government receipts increase —> More resources at

disposal in short win win situation.

Instagram @iupscaspirant https://t.me/indiashastra

WWW.INDIASHASTRA.COM

INDIA’S ECONOMIC DOMINANCE THROUGHOUT HISTORY

- Historically India has been dominant economic power and significant contributor to world’s

GDP so a major wealth creator throughput. Our old age traditions have always commented on

the wealth creation for example -

• Kautilya’s Arthashastra: “The root of wealth is economic activity and a lack of it brings

material distress. In the absence of fruitful economic activity, both current prosperity and

future growth are in danger of destruction”. Kautilya advocates economic freedom by asking

the King to “remove all obstructions to economic activity”

• Thirukural, a treatise on enriching human life, written by Thiruvalluvar: “Wealth, the lamp

unfailing, speeds to every land, dispensing darkness, at its Lord’s command”. He advocates

Make money – there is no weapon sharper than it to sever the pride of your foes.” Needless

to say, Thirukural advocates wealth creation through ethical means

- Despite such a rich tradition of emphasising wealth creation, India deviated from traditional

model after the Independence. India focused more on socialism, closed economy, self reliance,

licence raj, red-tapism in industries. India returned to this model in 1991, GDP, Sensex grown

after 1991.

Instagram @iupscaspirant https://t.me/indiashastra

WWW.INDIASHASTRA.COM

WEALTH CREATION THROUGH INVISIBLE HAND OF MARKETS

- Freedom of choice —> wealth creation i.e. Invisible hand helps in wealth creation.

- Invisible hand is philosophy of Adam Smith.

- Invisible hand —> Free hand —> Economic Development —> Wealth Creation

- LPG reforms in India 1991 —> Enabled invisible hand —> Economic openness increased

- Liberalised sector grew significantly faster than those remained closed

- Free Market Economy = Optimal allocation of resources. The freedom to choose is best

expressed in an economy through the market where buyers and sellers come together and

strike a bargain via a price mechanism.

- Unlike in command economies where prices are determined by the government, in a market

economy, price of a good is determined by the interaction of the forces of supply and demand.

The survey finds that unshackling the economic freedom for markets augments wealth creation.

- See the graphs - Exponential rise in India’s GDP and GDP per capita post-liberalisation

coincides with wealth generation.

- Survey shows that the liberalised sectors grew significantly faster than the closed ones.

- In open sector, citizen can choose among various producers unlike closed sector

- As discussed earlier, when entrepreneur creates wealth —> salaries paid to employee correlates

—> employee create wealth —> raw material suppliers reap benefits —> also supplementary

industries grow

Instagram @iupscaspirant https://t.me/indiashastra

WWW.INDIASHASTRA.COM

THE INSTRUMENTS FOR THE WEALTH CREATION

- Provide equal opportunities for new entrants against old bosses or already established

enterprises (Discussed in chapter Pro Business vs Pro Crony)

- Enable fair competition and ease doing business. The ease of doing business has increased

substantially in the last five years from reforms that provided greater economic freedom.India

continues to trail in parameters such as Ease of Starting Business, Registering Property, Paying

Taxes, and Enforcing Contracts.

- Eliminate policies unnecessarily undermining markets through government intervention.

Kautilya advocates economic freedom by asking the King to “remove all obstructions to

economic activity” As we discussed earlier post LPG liberalised sector grew significantly faster

than those remained closed

- Enable trade for job creation. Since resources are limited, a nation has to make choices. For

example, given its demographic dividend, should India focus on labour-intensive industries or

on capital intensive industries? The Survey calls for integrating “Assemble in India” into “Make

In India” to focus on labour-intensive exports and thereby create jobs at large scale.

- EFFICIENTLY SCALE UP THE BANKING SECTOR The support of the U.S. Banking system in

making the U.S. an economic superpower is well documented. Similarly, in the eighties during

the heydays of the Japanese economy, Japan had 15 of the top 25 largest banks then. In

recent times, as China has emerged as an economic superpower, it has been ably supported

by its banks—the top four largest banks globally are all Chinese banks. The largest bank in the

world—Industrial and Commercial Bank of China—is nearly two times as big as the 5th or 6th

largest bank, which are Japanese and American banks respectively. India’s banking sector is

disproportionately under-developed given the size of its economy. For instance, India has only

one bank in the global top 100

- SHADOW BANKING: The practice of banking like activities performed by non-banking finance

companies, which are not subject to strict regulation. However, these institutions function as

intermediaries between the investors and the borrowers, providing credit and generating

liquidity in the system.

Instagram @iupscaspirant https://t.me/indiashastra

WWW.INDIASHASTRA.COM

THE BREAKDOWN OF TRUST

In a market economy too, there is need for state to ensure a moral hand to support the invisible

hand. As Sandel (2012) argues, markets are liable to debase (degrade) ethics in the pursuit of

profits at all cost. Trust contributes positively to access of both formal and informal financing -

Trust can be furthered by appealing to ethical and philosophical dimensions. Philosophers such

as Aristotle and Confucius (implicitly) viewed trust as a public good by explaining that “good laws

make good citizens.”

- Friedrich Hayek, who advocated not only economic freedom but also a set of general rules and

social norms that applies evenly to everyone.

- Wilful defaults, Audit failures, NPAs, Fallout of events like Global Financial Crisis can trigger

panic among investors and trust deficit in long turn —> Investor confidence erodes —>

- WILFUL DEFAULTERS: Large corporations wilfully defaulted - Credit boom and bust -

Business, Banking institutions, someone from govt and auditor are at fault etc. When corporate

intentionally misreports financial services —> trust deficit increases —> negative externalities

—> malpractices etc.

- THE BREAKDOWN OF TRUST IN THE EARLY YEARS OF THIS MILLENNIUM: State should

ensure moral hand supports invisible hands, trust contributes positively to access both formal

and informal financing, Trust is public good.

- Bank should check on defaulters and recognise corporates who pay their interest and principal

in time in non- monetary ways, use Artificial Intelligence and Machine Learning to track and flag

market malpractices, wilful defaults, malpractices such as financial mis-reporting and market

manipulation needs to be detected early because these are termites that eat away investor’s

faith in financial markets, diminishes portfolio investments and crowd-out important national

investments. Such malpractices drives away investments, law abiding market participation and

therefore jobs in the economy.

- The government needs to support the hand of trust by being a good referee of the economy.

government’s role as a referee is to ensure fair-play for all wealth creators.

- Significant enhancement in the quantity and quality of manpower in our regulators (CCI, RBI,

SEBI, IBBI) together with significant investments in technology (to use AI and Machine Learning

to track malpractices) and analytics needs to be made.

- The Survey suggests that policies must empower transparency and effective enforcement using

data and technology to enhance this public good.

Instagram @iupscaspirant https://t.me/indiashastra

You might also like

- Elizabeth Chin - My Life With Things - The Consumer Diaries-Duke University Press (2016) PDFDocument248 pagesElizabeth Chin - My Life With Things - The Consumer Diaries-Duke University Press (2016) PDFKatia Alaei100% (1)

- The Golden ConstantDocument368 pagesThe Golden Constantiaint100% (1)

- Thomas W. Pogge-World Poverty and Human Rights-Polity (2002)Document147 pagesThomas W. Pogge-World Poverty and Human Rights-Polity (2002)Hosszu Alexandra100% (2)

- Read Sanders Remarks in Defense of Democratic SocialismDocument14 pagesRead Sanders Remarks in Defense of Democratic SocialismAnonymous 7cl3c7Ch100% (1)

- Gist of Economic Survey 2019-20: Wealth Creation: The Invisible Hand Supported by The Hand of TrustDocument50 pagesGist of Economic Survey 2019-20: Wealth Creation: The Invisible Hand Supported by The Hand of TrustSiddharth WorkNo ratings yet

- Chapter 1Document42 pagesChapter 1Abhijeet JhaNo ratings yet

- What Is The Role of An Entrepreneur in Economic DevelopmentDocument6 pagesWhat Is The Role of An Entrepreneur in Economic DevelopmentSandeep KodanNo ratings yet

- Capital Formation: Definitions, Process & FactorsDocument5 pagesCapital Formation: Definitions, Process & FactorsSharad ParteNo ratings yet

- Possile Questions EdDocument7 pagesPossile Questions EdEaswar PandiNo ratings yet

- Management of Financial Institutions - Unit IDocument7 pagesManagement of Financial Institutions - Unit ISudha MuralinathNo ratings yet

- Class Notes - Economics 3Document15 pagesClass Notes - Economics 3Kanchan VermaNo ratings yet

- Development of Entreprenuership in PakistanDocument21 pagesDevelopment of Entreprenuership in PakistanSaba ZiaNo ratings yet

- Entrep Mind Chapter 2Document2 pagesEntrep Mind Chapter 2Yeho ShuaNo ratings yet

- Resources MobilizationDocument16 pagesResources MobilizationPratikNo ratings yet

- Dr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaDocument19 pagesDr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in Indiaaayaksh chadhaNo ratings yet

- Economic and Non-Economic FactorsDocument19 pagesEconomic and Non-Economic FactorsPriyanshu Sekhar0912No ratings yet

- Chapter - 1Document48 pagesChapter - 1seepi345No ratings yet

- Indian Capital MarketDocument70 pagesIndian Capital MarketSudha Devendran100% (10)

- Dr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaDocument19 pagesDr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaAayaksh ChadhaNo ratings yet

- Role and Challenges of Capital Market in India: An Overview: Rakesh KumarDocument4 pagesRole and Challenges of Capital Market in India: An Overview: Rakesh KumarSuman QueenNo ratings yet

- "India Is A Rich Coutry Where Poor People Live": Rohan Sehgal 18bal050Document6 pages"India Is A Rich Coutry Where Poor People Live": Rohan Sehgal 18bal050rohanNo ratings yet

- Dr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaDocument19 pagesDr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaJuhi AwasthiNo ratings yet

- Investors Attitude Towards Secondary MarketDocument13 pagesInvestors Attitude Towards Secondary MarketManiyaa KambojNo ratings yet

- Disinvestment in IndiaDocument32 pagesDisinvestment in IndiaDixita ParmarNo ratings yet

- Course - Note - 3 - Dang Gia Vung - RA6127378Document4 pagesCourse - Note - 3 - Dang Gia Vung - RA6127378Gia Vững ĐặngNo ratings yet

- EconomicsDocument19 pagesEconomicsujj04No ratings yet

- Egr3101 Lecture Notes V1.1Document21 pagesEgr3101 Lecture Notes V1.1BenjaminNo ratings yet

- Thesis Swati PatilDocument237 pagesThesis Swati PatilbhartiNo ratings yet

- Introduction To Business: Course Code: BUSI-1101Document36 pagesIntroduction To Business: Course Code: BUSI-1101hasib_ahsanNo ratings yet

- Role of Entrepreneurs in Economic Development. Entrepreneurs Create Organizations That OfferDocument5 pagesRole of Entrepreneurs in Economic Development. Entrepreneurs Create Organizations That OfferjujuNo ratings yet

- INSTA Summary: Economic Survey 2019-20: Volume 1Document50 pagesINSTA Summary: Economic Survey 2019-20: Volume 1Sri Harsha DannanaNo ratings yet

- Entrepreneurship: The Indian StoryDocument4 pagesEntrepreneurship: The Indian StoryHimani KhatriNo ratings yet

- Capital MarketDocument36 pagesCapital Marketmayuri chaudhariNo ratings yet

- Cases of Entrepreneurs After IndependenceDocument12 pagesCases of Entrepreneurs After IndependenceParmesh PandeyNo ratings yet

- Entrepreneurship Is The Act of Being An Entrepreneur, Which Is A French Word Meaning "One WhoDocument3 pagesEntrepreneurship Is The Act of Being An Entrepreneur, Which Is A French Word Meaning "One WhonanimdpNo ratings yet

- Dr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaDocument19 pagesDr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiayamatoNo ratings yet

- Indian Financial System Project 3sem (Priyank)Document35 pagesIndian Financial System Project 3sem (Priyank)priyank chourasiyaNo ratings yet

- A Study On Investor Attitude Towards Primary MarketDocument63 pagesA Study On Investor Attitude Towards Primary MarketAnkit BissaNo ratings yet

- 2018-Ag-3423 ALi SHERDocument11 pages2018-Ag-3423 ALi SHERALI SHER HaidriNo ratings yet

- Role of An EntrepreneurDocument11 pagesRole of An EntrepreneurNoorain FirdouseNo ratings yet

- Theme of Economic Survey - 2019-20 - PIBDocument4 pagesTheme of Economic Survey - 2019-20 - PIBUtkarsh GuptaNo ratings yet

- Features of Indian Economy and Economic Systems (5983)Document3 pagesFeatures of Indian Economy and Economic Systems (5983)Hitisha agrawalNo ratings yet

- Merchant Banking and Financial Services Question PaperDocument248 pagesMerchant Banking and Financial Services Question Paperexecutivesenthilkumar100% (1)

- Business Enivironment Qs.1: Write A Note On The Following A. Socialistic Economy B. Capitalistic EconomyDocument8 pagesBusiness Enivironment Qs.1: Write A Note On The Following A. Socialistic Economy B. Capitalistic EconomyDaminiSarafNo ratings yet

- Indian Economy: What Is Economics-?Document16 pagesIndian Economy: What Is Economics-?Indrajeet ChavanNo ratings yet

- What Is The Role of An Entrepreneur in Economic DevelopmentDocument6 pagesWhat Is The Role of An Entrepreneur in Economic DevelopmentSurya Reddy75% (12)

- 08 Chapter 1Document33 pages08 Chapter 1suvarediveshNo ratings yet

- Econ Semis NotesDocument4 pagesEcon Semis NotesManuel CuycoNo ratings yet

- Stand Up India - Start Up IndiaDocument28 pagesStand Up India - Start Up IndiaJo JaladdNo ratings yet

- Yash P. (FINAL Project)Document96 pagesYash P. (FINAL Project)Elizabeth AlvarezNo ratings yet

- Globalization and The Indian Capital Market: KeywordsDocument8 pagesGlobalization and The Indian Capital Market: KeywordsSangram PandaNo ratings yet

- Ent 1Document64 pagesEnt 1Ankit AnuragNo ratings yet

- Chapter 10 ReportDocument19 pagesChapter 10 ReportDarwin SolanoyNo ratings yet

- Entrepreneurship in PakistanDocument87 pagesEntrepreneurship in PakistanMuazzam Mughal100% (1)

- Banking Awareness by Disha PublicationDocument293 pagesBanking Awareness by Disha PublicationBalachandarMahadevan100% (1)

- NEW. Entrepreneurship CH IDocument14 pagesNEW. Entrepreneurship CH Ibetsega shiferaNo ratings yet

- 108INUNIT4A Inequality and Economic Power in IndiaDocument97 pages108INUNIT4A Inequality and Economic Power in IndiaDr. Rakesh BhatiNo ratings yet

- (Economics) : Managing Within The Dynamic Business Environment: Taking Risks and Making ProfitsDocument42 pages(Economics) : Managing Within The Dynamic Business Environment: Taking Risks and Making ProfitsRafayet Omar ShuvoNo ratings yet

- Cap Markets in PakDocument37 pagesCap Markets in PakKamran ArmaniNo ratings yet

- Dr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaDocument19 pagesDr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaAnushka SinghNo ratings yet

- IBTDocument3 pagesIBTHeart EspineliNo ratings yet

- Lessons from the Poor: Triumph of the Entrepreneurial SpiritFrom EverandLessons from the Poor: Triumph of the Entrepreneurial SpiritRating: 4 out of 5 stars4/5 (1)

- Its All in the Price: A Business Solution to the EconomyFrom EverandIts All in the Price: A Business Solution to the EconomyNo ratings yet

- IDFC Factsheet March 2021Document72 pagesIDFC Factsheet March 2021Karambir Singh DhayalNo ratings yet

- 379 Indian Climate Indiashastra PDFDocument2 pages379 Indian Climate Indiashastra PDFKarambir Singh DhayalNo ratings yet

- Smart.: ScoreDocument5 pagesSmart.: ScoreKarambir Singh DhayalNo ratings yet

- Dialects Raj 3Document29 pagesDialects Raj 3Karambir Singh DhayalNo ratings yet

- Dialects in Rajasthan-: - Mother Tongue of Rajasthan - U/A Indo-European Group Gurjar Apbhransh of ShoursainiDocument9 pagesDialects in Rajasthan-: - Mother Tongue of Rajasthan - U/A Indo-European Group Gurjar Apbhransh of ShoursainiKarambir Singh DhayalNo ratings yet

- 380 Natural Vegetation Indiashastra PDFDocument2 pages380 Natural Vegetation Indiashastra PDFKarambir Singh DhayalNo ratings yet

- ACFRASFairsof RajasthanDocument46 pagesACFRASFairsof RajasthanKarambir Singh DhayalNo ratings yet

- Adeup CoDocument6 pagesAdeup CoKarambir Singh DhayalNo ratings yet

- Lok Devtas of Rajasthan:: Ramdev JiDocument35 pagesLok Devtas of Rajasthan:: Ramdev JiKarambir Singh DhayalNo ratings yet

- 381 Soils of India Indiashastra PDFDocument2 pages381 Soils of India Indiashastra PDFKarambir Singh DhayalNo ratings yet

- 377 Islands of India Indiashastra PDFDocument2 pages377 Islands of India Indiashastra PDFKarambir Singh DhayalNo ratings yet

- 382 Major Lakes of India IndiashastraDocument3 pages382 Major Lakes of India IndiashastraKarambir Singh DhayalNo ratings yet

- 378 Factors Affecting Climate India Indiashastra PDFDocument1 page378 Factors Affecting Climate India Indiashastra PDFKarambir Singh DhayalNo ratings yet

- 384 Major Passes of India IndiashastraDocument3 pages384 Major Passes of India IndiashastraKarambir Singh DhayalNo ratings yet

- 383 Major Dams of India IndiashastraDocument2 pages383 Major Dams of India IndiashastraKarambir Singh Dhayal100% (1)

- 389 Pollution Indiashastra PDFDocument1 page389 Pollution Indiashastra PDFKarambir Singh DhayalNo ratings yet

- 381 Soils of India IndiashastraDocument2 pages381 Soils of India IndiashastraKarambir Singh DhayalNo ratings yet

- Cool Temperate Western Margin / British ClimateDocument1 pageCool Temperate Western Margin / British ClimateKarambir Singh DhayalNo ratings yet

- Cool Temperate Continental / Taiga ClimateDocument1 pageCool Temperate Continental / Taiga ClimateKarambir Singh DhayalNo ratings yet

- 394 Cool Temperate Eastern Laurentian Climate IndiashastraDocument1 page394 Cool Temperate Eastern Laurentian Climate IndiashastraKarambir Singh DhayalNo ratings yet

- 393 Tropical Monsoon Climate IndiashastraDocument1 page393 Tropical Monsoon Climate IndiashastraKarambir Singh DhayalNo ratings yet

- Chapter Two Entrepreneurship and Wealth Creation at The GrassrootsDocument2 pagesChapter Two Entrepreneurship and Wealth Creation at The GrassrootsKarambir Singh DhayalNo ratings yet

- Application of Robotics: Industrial ApplicationsDocument2 pagesApplication of Robotics: Industrial ApplicationsKarambir Singh DhayalNo ratings yet

- India Growth Overstated: This Chapter Provides Defence To This Type of Similar ConcernsDocument1 pageIndia Growth Overstated: This Chapter Provides Defence To This Type of Similar ConcernsKarambir Singh DhayalNo ratings yet

- 425 Vitamins Minerals IndiashastraDocument2 pages425 Vitamins Minerals IndiashastraKarambir Singh DhayalNo ratings yet

- 420 Economic Survey Chapter 11 Thalinomics IndiashastraDocument1 page420 Economic Survey Chapter 11 Thalinomics IndiashastraKarambir Singh DhayalNo ratings yet

- Normal: Fluoroquinolones 2ndDocument2 pagesNormal: Fluoroquinolones 2ndKarambir Singh DhayalNo ratings yet

- 427 Tuberculosis India PlanDocument1 page427 Tuberculosis India PlanKarambir Singh DhayalNo ratings yet

- Bluetooth and Wireless Technology: NFC (Near Field Communication)Document4 pagesBluetooth and Wireless Technology: NFC (Near Field Communication)Karambir Singh DhayalNo ratings yet

- 423 Artificial Intelligence IndiashastraDocument1 page423 Artificial Intelligence IndiashastraKarambir Singh DhayalNo ratings yet

- Final Draft - Mainstreaming ManualDocument42 pagesFinal Draft - Mainstreaming ManualRamilNo ratings yet

- Comparison of Capitalism Socialism &islamic Economic SystemDocument13 pagesComparison of Capitalism Socialism &islamic Economic SystemAbdul MaroofNo ratings yet

- PovertyDocument25 pagesPovertyApollon Phebo100% (1)

- Act Ch03 l02 EnglishDocument6 pagesAct Ch03 l02 EnglishChris CunhaNo ratings yet

- Dec'23 Profit - and - Loss - OdooDocument1 pageDec'23 Profit - and - Loss - OdooPeer MohideenNo ratings yet

- 7 Tips To Becoming A MillionaireDocument24 pages7 Tips To Becoming A MillionaireefsdfsdafsdNo ratings yet

- Evaluating Major Events and Avoiding The Mercantialist FallacyDocument12 pagesEvaluating Major Events and Avoiding The Mercantialist FallacyNiclas HellNo ratings yet

- Autoethnographic Capstone Final DraftDocument23 pagesAutoethnographic Capstone Final Draftapi-446919348No ratings yet

- Ind As 34Document3 pagesInd As 34qwertyNo ratings yet

- The Economist Explains CapitalDocument2 pagesThe Economist Explains CapitalBharat Shah100% (1)

- Notes On The Meaning of Management:: Terry and FranklinDocument38 pagesNotes On The Meaning of Management:: Terry and FranklinKamran Ali AbbasiNo ratings yet

- Exploratory Research Into Islamic Financial Literacy in Brunei DarussalamDocument28 pagesExploratory Research Into Islamic Financial Literacy in Brunei DarussalamMuhammad BadyNo ratings yet

- PDF 309648880270623Document1 pagePDF 309648880270623Vinay PatelNo ratings yet

- Bapuji Project ModifyDocument74 pagesBapuji Project ModifyMichael WellsNo ratings yet

- Annual Report 2021 22Document137 pagesAnnual Report 2021 22MANSI POKARNANo ratings yet

- Conservatism: Pros & ConsDocument7 pagesConservatism: Pros & ConsPete100% (1)

- Taxation Is Theft PDFDocument2 pagesTaxation Is Theft PDFAranya KhuranaNo ratings yet

- Launching - New Product: 1 For Internal Training Circulation OnlyDocument15 pagesLaunching - New Product: 1 For Internal Training Circulation Onlyshoba vNo ratings yet

- Financial LiteracyDocument7 pagesFinancial LiteracyRochelle Ann Galvez Gabaldon100% (1)

- Mankind United by Arthur BellDocument144 pagesMankind United by Arthur BellSkyNo ratings yet

- 6503e25bfb6075001956a888 - ## - E-Notes Business and Commercial Knowledge-An IntroductionDocument16 pages6503e25bfb6075001956a888 - ## - E-Notes Business and Commercial Knowledge-An IntroductionGaurav SinghNo ratings yet

- Laws and Practices of Income TaxDocument34 pagesLaws and Practices of Income TaxNibir RahmanNo ratings yet

- Ack Cafpk4156a 2022-23 489614981130922Document1 pageAck Cafpk4156a 2022-23 489614981130922aditya_kavangalNo ratings yet

- 05 PartnershipDocument20 pages05 Partnershipjustine reine cornicoNo ratings yet

- Gratuity CalculationDocument4 pagesGratuity CalculationmeetushekhawatNo ratings yet

- Using Behavioral Investor TypesDocument8 pagesUsing Behavioral Investor TypesVidushi Bonomaully100% (1)