Professional Documents

Culture Documents

Lease Payment MV of Lease MV of lease+MV of Additional Services × Payment

Lease Payment MV of Lease MV of lease+MV of Additional Services × Payment

Uploaded by

Ali RazaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lease Payment MV of Lease MV of lease+MV of Additional Services × Payment

Lease Payment MV of Lease MV of lease+MV of Additional Services × Payment

Uploaded by

Ali RazaCopyright:

Available Formats

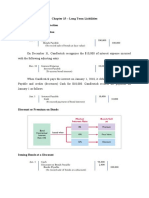

IFRS 16- Leases:

Company A Company B

Lessor Lessee

Legal owner of asset Uses of asset

Receive income Pay expenses/capital

Combined contract:

Lessor may offer asset for lease along with additional services to lessee against a combined payment.

For accounting purpose both costs should be separate using costs offered by same lessor for each item

as:

MV of lease

Lease payment = × Payment

MV of lease+ MV of additional services

MV of additional services

Nonlease payment= × Payment

MV of lease+ MV of additional services

Low value exemption:

Low value exemption leases are expensed through profit and loss, LVE apply on leases where:

- Asset has very low value, e.g. laptop, chair etc,

- There is no purchase option,

- Lease term is ≤ 12 month,

- Lease payment is spread over lease period on straight line basis,

- There is no free period in lease, if there is first period is free then it means,

- Payment of first month is spread over remaining lease period,

- This first payment will be recorded as accrued income (income receivable),

- Each payment will include first month’s payment on straight line basis, and monthly payment.

- Same method is used for lessor’s accounting, where:

- Lessor record lease payments as income instead of expense.

Accounting for lessee:

Simple LVE lease:

LVE lease expense Dr.

LVE lease expense payable Cr.

LVE lease expense payable Dr.

Cash/Bank Cr.

LVE with free period:

Find average lease payment for each period:

( Payment × No . of payments )

Average lease payment ( ALP)=

No. of periods

Recognize free period expense payable:

LVE free period expense @ALP Dr.

LVE free period expense Cr.

At reporting date from period 2 to onward:

LVE lease expense @ALP Dr.

LVE lease expense payable Cr.

At payment date:

LVE lease expense payable @ALP Dr.

LVE free period expense (β) Dr.

Cash/Bank Cr.

Lessor accounting:

Simple LVE lease:

LVE lease expense Dr.

LVE lease expense payable Cr.

LVE lease expense payable Dr.

Cash/Bank @ Actual payment Cr.

LVE with free period:

Find average lease payment for each period:

( Payment × No . of payments )

Average lease Income( ALI )=

No. of periods

Recognize free period income receivables:

LVE free period income receivables Dr.

LVE free period income @ALI Cr.

At reporting date from period 2 to onward:

LVE free period income receivables @ALI Dr.

LVE lease expense Income Cr.

At payment date:

Cash/Bank @ Actual payment Dr.

LVE lease income @ALI Cr.

LVE free period income receivables (β) Cr.

Finance and operating lease:

- For lessee, there is no difference between finance lease or operating lease, but

- Lessor still categorized lease into finance and operating lease.

Lessee accounting:

For each lease, lessee recognize following two items:

- Right of use asset (asset being leased), and

- Lease liability (as it is payable against leased asset use).

Lease liability includes:

- PV of lease payments payable that includes:

- Fixed payment,

- Variable payments,

- Expected residual value guaranteed,

- Penalty on termination,

- Exercise price of purchase option.

- Over the lease period,

- Discount factor is implicit rate, if available otherwise incremental borrowing rate,

- Lease liability is carried on amortized cost.

Right of use asset includes:

- Lease liability,

- Initial direct cost,

- Estimated cost for dismantling,

- Payment less incentives before commence date,

- Right of use asset is depreciated over lower of:

- Lease period, or

- Useful life.

Payment modes:

- Advance payment,

- Arrears payment.

Advance payment:

- At the start of each period cash is paid,

- Cash paid is deducted from lease liability,

- Interest is charge on lease liability,

- Interest is added into lease liability,

- Each year lease liability is amortized,

- Right of use asset is depreciate.

Recognize the lease:

Right of use asset Dr.

Lease liability Cr.

Reporting date: Recognize cash payable:

Lease liability Dr.

Lease expense payable Cr.

Reporting date: Recognize interest expense and amortization of right of use and lease liability:

Lease expense @lease payment Dr.

Lease liability @LL × Int. Rate Cr.

Right of use asset (β) Cr.

Payment date: Recognize cash payment:

Lease liability @ Actual payment Dr.

Cash/Bank Cr.

Arrears payment:

- At the end of each period cash is paid,

- Interest is charge on lease liability,

- Interest is added into lease liability,

- Each year lease liability is amortized,

- Right of use asset is depreciate,

- Cash paid is deducted from lease liability.

Recognize the lease:

Right of use asset Dr.

Lease liability Cr.

Reporting date: Recognize interest expense and amortization of right of use and lease liability:

Lease expense @lease payment Dr.

Lease liability @LL × Int. Rate Cr.

Right of use asset (β) Cr.

Reporting date: Recognize cash payable:

Lease liability Dr.

Lease expense payable Cr.

Payment date: Recognize cash payment:

Lease liability @ Actual payment Dr.

Cash/Bank Cr.

Lessor accounting:

For lessor’s account, lease is categorized in any one of the following lease:

- Operating lease, or

- Finance lease.

Operating lease:

Operating lease is:

- If there is no purchase option,

- Lessor still has substantial control over asset,

- All leases other than finance lease.

Operating lease accounting:

Operating lease’s treatment is same as low value exemption accounting.

Finance lease:

Finance lease is:

- Risk and reward transferred to lease,

- Ownership passes at end of lease,

- Reasonable certain option to buy the asset below its FV,

- Lease asset is specialized in nature,

- Lease term represents major life of asset.

Finance lease accounting:

- Asset is derecognized,

- Recognize:

- Receivables @ net investment in lease,

- Finance lease receipts are a reduction in receivables,

- Interest income on receivables.

Lease investment =Grossinvestment discounted @ implicit rate

Gorss investment =Money receivable ¿ lessee+ scrap value

Recognize the lease:

Lease receivables @ PV Dr.

Leased asset Cr.

Recognize payment as finance income and capital repayment:

Cash Actual payment Dr.

Lease receivables (β) Cr.

Finance income @ Cash × Int. Rate Cr.

Sales and leaseback:

- If company A, sells the asset to company B,

- Company B provide same asset to company A on lease immediately, then

- It is not classified as lease but it will be considered as:

- Company A received loan against asset security from company B, and

- Company B provided loan to company A against security of asset.

If this is the case, then:

Company A-Seller Company-B Buyer

Continue to recognize the asset Never recognize the asset

Recognize a finance liability Recognize a finance asset

You might also like

- (2011) Markstrat Final Report - Team ADocument21 pages(2011) Markstrat Final Report - Team AFilippo Vescovo33% (3)

- Beechy 7ce v2 Ch18Document89 pagesBeechy 7ce v2 Ch18منیر سادات0% (2)

- Lecture Week 5Document56 pagesLecture Week 5朱潇妤100% (1)

- The Blackstone Group's IPODocument5 pagesThe Blackstone Group's IPOAnkit AvishekNo ratings yet

- An Analysis of The Business and Financial Performance of Tesco PLCDocument17 pagesAn Analysis of The Business and Financial Performance of Tesco PLCbanardsNo ratings yet

- Leasing: An OverviewDocument18 pagesLeasing: An OverviewNeha GoyalNo ratings yet

- Corporate Reporting - SPRING 2021 ACC-344 Assignment # 03 Submitted ToDocument5 pagesCorporate Reporting - SPRING 2021 ACC-344 Assignment # 03 Submitted ToAliyya TaimurNo ratings yet

- Week 05 2022 Topic 5 Lecture Leases Part ADocument20 pagesWeek 05 2022 Topic 5 Lecture Leases Part AErnest LeongNo ratings yet

- f1 Unit 4 Part 3 Leases SlidesDocument34 pagesf1 Unit 4 Part 3 Leases Slidesjeridah99No ratings yet

- Accounting For LeasesDocument12 pagesAccounting For LeasesvladsteinarminNo ratings yet

- IFRS16 LeasesDocument179 pagesIFRS16 LeasesValeria PetrovNo ratings yet

- Lease AccountingDocument5 pagesLease AccountingmarietorianoNo ratings yet

- LeasesDocument9 pagesLeasesCris Joy BiabasNo ratings yet

- Auditing Problems IAS 17: LEASES (0ld Standard) Dr. Glen de Leon, CPADocument29 pagesAuditing Problems IAS 17: LEASES (0ld Standard) Dr. Glen de Leon, CPAArcelli Dela CruzNo ratings yet

- Leases: Accounting For Leases by LESSEEDocument7 pagesLeases: Accounting For Leases by LESSEERedNo ratings yet

- 25 LeasingDocument9 pages25 Leasingddrechsler9No ratings yet

- Assignment IA 2 - Week 15 PDFDocument39 pagesAssignment IA 2 - Week 15 PDFViola JovitaNo ratings yet

- S Intermediate3 2014 Spring Notes LeasesDocument10 pagesS Intermediate3 2014 Spring Notes LeasesLakshithaNo ratings yet

- LeaseDocument8 pagesLeaseAlyssa AnnNo ratings yet

- 4222 CH 20 Slides From PDFDocument17 pages4222 CH 20 Slides From PDFAn NaNo ratings yet

- IFRS 16: Lessor & Lessee Accounting Treatment in The Finance LeaseDocument2 pagesIFRS 16: Lessor & Lessee Accounting Treatment in The Finance LeaseboygarfanNo ratings yet

- IFRS 16 - LeasesDocument3 pagesIFRS 16 - LeasesDawar Hussain (WT)No ratings yet

- CH 15 Study GuideDocument6 pagesCH 15 Study GuideStephanie RobinsonNo ratings yet

- Leasing1 AspectsDocument19 pagesLeasing1 AspectssakshiNo ratings yet

- Ifrs 16 LeasesDocument70 pagesIfrs 16 Leasessikute kamongwaNo ratings yet

- Accounting For LeasesDocument12 pagesAccounting For LeasesJacy VykeNo ratings yet

- Lesson 2 LeaseDocument26 pagesLesson 2 Leaselil telNo ratings yet

- LeasesDocument30 pagesLeasesREIGN EBONY ANNE AGUSTINNo ratings yet

- Leasing: Financial AccountingDocument6 pagesLeasing: Financial AccountingLinh HoangNo ratings yet

- Ipsas 13 LeaseDocument23 pagesIpsas 13 LeasezelalemNo ratings yet

- FinanceDocument7 pagesFinanceAyesha GuptaNo ratings yet

- Lease and Hire PurchaseDocument26 pagesLease and Hire PurchaseMahesh RangaswamyNo ratings yet

- Leases and Employee BenefitsDocument7 pagesLeases and Employee BenefitsRedNo ratings yet

- Week 7 - ch21Document63 pagesWeek 7 - ch21bafsvideo4100% (1)

- CH 21Document32 pagesCH 21maeconomics2010No ratings yet

- Unit 9 LeasingDocument21 pagesUnit 9 LeasingAnuska JayswalNo ratings yet

- Chapter 15 - Long Term Liabilities Journalizing Bond Transaction Issuing Bonds at Face ValueDocument11 pagesChapter 15 - Long Term Liabilities Journalizing Bond Transaction Issuing Bonds at Face Valueowais khanNo ratings yet

- Lease and HPDocument27 pagesLease and HPpreetimaurya100% (1)

- Lesson 5 - Notes and Loans ReceivableDocument5 pagesLesson 5 - Notes and Loans ReceivableKatrina MarzanNo ratings yet

- Tutor LeaseDocument18 pagesTutor LeaseHimawan TanNo ratings yet

- Hire Purchase Finance and Consumer CreditDocument18 pagesHire Purchase Finance and Consumer Creditchaudhary9240% (5)

- IFRS 16 LeasesDocument3 pagesIFRS 16 Leasesrifa14142008No ratings yet

- Leasing As A Financing AlternativeDocument35 pagesLeasing As A Financing AlternativeHamza Najmi100% (1)

- Non Banking Financial Institutions: by Sudev Jyothisi FN-92 Scms-CochinDocument18 pagesNon Banking Financial Institutions: by Sudev Jyothisi FN-92 Scms-CochinSUDEVJYOTHISINo ratings yet

- IAS AND IFRS Short NotesDocument37 pagesIAS AND IFRS Short NotesughaniNo ratings yet

- RMK Akm 2-CH 21Document14 pagesRMK Akm 2-CH 21Rio Capitano0% (1)

- Basics of LeasingDocument10 pagesBasics of LeasingNeeraj PariharNo ratings yet

- Accounting For Leases: Studying Paper F7? Performance Objectives 10 and 11 Are Relevant To This ExamDocument32 pagesAccounting For Leases: Studying Paper F7? Performance Objectives 10 and 11 Are Relevant To This ExamKazi Sohel MasudNo ratings yet

- Chapter 22Document5 pagesChapter 22Jos NibinNo ratings yet

- Accounting For LeasingDocument36 pagesAccounting For LeasingAKSHAJ GOENKANo ratings yet

- The Saint Augustine University of Tanzania: QuestionsDocument7 pagesThe Saint Augustine University of Tanzania: QuestionsIssa AdiemaNo ratings yet

- Banking and NBFC - Module 5 NBFC Produtcs Lending BasedDocument89 pagesBanking and NBFC - Module 5 NBFC Produtcs Lending Basednandhakumark152No ratings yet

- CHAPTER FOUR LeaseDocument27 pagesCHAPTER FOUR LeaseDawit AmahaNo ratings yet

- Unit-4Leasing and Hire PurchaseDocument25 pagesUnit-4Leasing and Hire Purchasetanishq8807No ratings yet

- STDocument13 pagesSTmastermahmedNo ratings yet

- PFRS 16 - Leases With AnnotationsDocument7 pagesPFRS 16 - Leases With AnnotationsKatrina MarzanNo ratings yet

- Indian Financial System M. Com Semester Ii Leasing and Hire PurchaseDocument26 pagesIndian Financial System M. Com Semester Ii Leasing and Hire PurchaseAjayNo ratings yet

- Fee Simple Estate - Represents Most Complete Form of Ownership of Real Estate. Right To Sell, Lease, and Use As CollateralDocument2 pagesFee Simple Estate - Represents Most Complete Form of Ownership of Real Estate. Right To Sell, Lease, and Use As CollateralitzharryNo ratings yet

- 1-Ifrs16 Leases SBRDocument2 pages1-Ifrs16 Leases SBRahmedfouad0712No ratings yet

- Real Estate Terminology: Property Management, Financing, Construction, Agents and Brokers TermsFrom EverandReal Estate Terminology: Property Management, Financing, Construction, Agents and Brokers TermsNo ratings yet

- MS1-Final Exams For StudentsDocument6 pagesMS1-Final Exams For StudentsNikki Estores GonzalesNo ratings yet

- State Bank of India: Balance Sheet As On 31 March, 2018Document103 pagesState Bank of India: Balance Sheet As On 31 March, 2018Anonymous ckTjn7RCq8No ratings yet

- Tute2 Sol StudentsDocument10 pagesTute2 Sol StudentsAAA820No ratings yet

- Intermarket Analysis DefinitionDocument7 pagesIntermarket Analysis DefinitionGerald HandersonNo ratings yet

- Ap.03 Shareholders EquityDocument9 pagesAp.03 Shareholders EquityRhea Royce CabuhatNo ratings yet

- New Central Bank ActDocument34 pagesNew Central Bank ActKLNo ratings yet

- FMI7e ch25Document61 pagesFMI7e ch25lehoangthuchienNo ratings yet

- Introduction To ValuationDocument11 pagesIntroduction To ValuationThe GravityNo ratings yet

- BCG Value Management Framework An Overview For Mba StudentsDocument49 pagesBCG Value Management Framework An Overview For Mba Studentskn0q00No ratings yet

- May 2020 - AP Drill 1 (SHE & Liabs) - FinalDocument10 pagesMay 2020 - AP Drill 1 (SHE & Liabs) - FinalROMAR A. PIGANo ratings yet

- Landmark Capital - Fund BrochureDocument37 pagesLandmark Capital - Fund BrochureSandeep BorseNo ratings yet

- 5 M's of ManagementDocument3 pages5 M's of ManagementrajtulyaNo ratings yet

- Retail BankingDocument103 pagesRetail BankingRamesh BabuNo ratings yet

- Barclays AAA Handbook.6.2010Document701 pagesBarclays AAA Handbook.6.2010john.gjata6585No ratings yet

- 2080bs Financial Performance Analysis of Standard Chartered Bank Nepal LTDDocument51 pages2080bs Financial Performance Analysis of Standard Chartered Bank Nepal LTDBikeshNo ratings yet

- Entrepreneurship PeriodicDocument2 pagesEntrepreneurship PeriodicMildred Peña TolentinoNo ratings yet

- Martin J Pring PDFDocument64 pagesMartin J Pring PDFAlvianKrisnhaDewanggaNo ratings yet

- File'5: GAIL (India) LimitedDocument2 pagesFile'5: GAIL (India) Limitedvirupakshudu kodiyalaNo ratings yet

- I. Objective: Property Held Under An Operating LeaseDocument5 pagesI. Objective: Property Held Under An Operating Leasemusic niNo ratings yet

- Souter InvestmentsDocument20 pagesSouter InvestmentsjesussesiNo ratings yet

- Pygmy Deposit System Through Android CloudDocument4 pagesPygmy Deposit System Through Android CloudInternational Journal of Research in Engineering and TechnologyNo ratings yet

- Financial MathDocument50 pagesFinancial Mathfabricioace1978No ratings yet

- Financial Management: Study TextDocument10 pagesFinancial Management: Study TextTimo Paul100% (1)

- Glossary: Aviation Terminology Financial TerminologyDocument2 pagesGlossary: Aviation Terminology Financial Terminologyamitc5No ratings yet

- Shiko Busness PlanDocument38 pagesShiko Busness PlanmosesNo ratings yet

- PN F7i 001Document143 pagesPN F7i 001Iheanyi Achareke100% (1)

- Brigham EFM5 ch07 PPTDocument22 pagesBrigham EFM5 ch07 PPTFaris ZulkifliNo ratings yet