Professional Documents

Culture Documents

NSB Taxes Rates 2017-2020

NSB Taxes Rates 2017-2020

Uploaded by

A.Masood AEO M-8 CTNOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NSB Taxes Rates 2017-2020

NSB Taxes Rates 2017-2020

Uploaded by

A.Masood AEO M-8 CTNCopyright:

Available Formats

NSB Taxes Rates 2017-2020

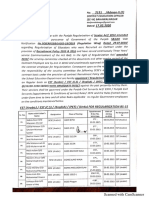

Incom/GST Tax

Sr Sales Tax 153(1)(a) (ii) Services Tax

Year 153(1)(a) (ii)

No

Filers Non Filers Filers Non Filers Filers Non Filers

1 01.07.17 to 30.06.18 17% 19% 4.50% 7.75% 10% 17.50%

2 01.07.18 to 30.06.19 17% 19.50% 4.50% 9% 10% 17.50%

3 01.07.19 to 30.06.20 17% 20% 4.50% 9% 10% 20%

01. On purchasing anything u have to pay two types of Taxes ...... a). Income Tax b). Sales/GST tax

a). Income Tax will be applicable on each and every item (e.g. purchasing, Care giver salary, sweeper

salary) except labour payment (wages) and utility bills

b). Sales Tax will be applicable on all types of purchasing....

but on some items SALES Tax is exempt (not applicable ) as following;

Sand, Soil, Crush, Bricks, Pana Flexes, Banners, Cement, Essential Medicine, Photocopies, Care Giver

Salary, Teacher's salary, utility bills

02. Service tax will be applicable on labour (mazdoori, rent etc) with Receipt wasooli (receiving) with

signature, date and time of that person

03. Totally Non-Tax Paid working (Those items who are totally exempted from any tax) are here as

below:

Electricity Bill, Telephone Bill, Mobile Balance, TA/DA, Coal, Ice...

04. TA/DA...... Jo ap bachon ko competitions k liye bhejty hain, wo rent... Ya aap jo books lene jatay hain

from warehouse for school... Or koi official visit... TA/DA k liye 100% pure logic hona zruri ho ga.... In

case charge sheet performa attested by your immediate officer

You might also like

- GST Act, 2017-SorDocument6 pagesGST Act, 2017-SorMohit NagarNo ratings yet

- GST PRACTICE SET - 6th EDITION - SET JDocument6 pagesGST PRACTICE SET - 6th EDITION - SET JGANESH KUNJAPPA POOJARINo ratings yet

- How to Handle Goods and Service Tax (GST)From EverandHow to Handle Goods and Service Tax (GST)Rating: 4.5 out of 5 stars4.5/5 (4)

- Ca Inter Indirect Tax MCQDocument85 pagesCa Inter Indirect Tax MCQVikramNo ratings yet

- GST Times - Vol.1, Issue-2Document25 pagesGST Times - Vol.1, Issue-2Milna JosephNo ratings yet

- Chapter - 1 GSTDocument6 pagesChapter - 1 GSTbratati.dharNo ratings yet

- Tax SIP 1Document2 pagesTax SIP 1VikrantTandelNo ratings yet

- GST On Builders Write UpDocument8 pagesGST On Builders Write UpAnonymous 66g6J7aNo ratings yet

- Overview-Of-Gst-2 2Document22 pagesOverview-Of-Gst-2 2132 CHETANYANo ratings yet

- GST Presentation FB SCNDocument26 pagesGST Presentation FB SCNPallavi ChawlaNo ratings yet

- Agt GSTDocument28 pagesAgt GSTAmit GuptaNo ratings yet

- Role of CS in GSTDocument66 pagesRole of CS in GSThareshmsNo ratings yet

- GST Intro Unit 1Document6 pagesGST Intro Unit 1AnilBahugunaNo ratings yet

- GOODS AND SERVICE TAX NewDocument14 pagesGOODS AND SERVICE TAX Newaditisrivastava0511No ratings yet

- Goods and Services Tax: B2B - Invoice DetailsDocument1 pageGoods and Services Tax: B2B - Invoice DetailsSOURAV GUPTANo ratings yet

- TDS TRS GST (2) 20211228151919Document38 pagesTDS TRS GST (2) 20211228151919Rishi PriyadarshiNo ratings yet

- Central Taxes Replaced by GSTDocument6 pagesCentral Taxes Replaced by GSTBijosh ThomasNo ratings yet

- Class Notes, Tax Online - ITCDocument29 pagesClass Notes, Tax Online - ITCMuskaan MusthafaNo ratings yet

- Introduction To GST June 24 RevisionDocument47 pagesIntroduction To GST June 24 RevisionNamasviNo ratings yet

- 27 Useful Charts of Service Tax 2016 17 PDFDocument24 pages27 Useful Charts of Service Tax 2016 17 PDFJosef AnthonyNo ratings yet

- Vishu IdtDocument18 pagesVishu IdtVishu DhallNo ratings yet

- Tariff SERC 23.08Document3 pagesTariff SERC 23.08Suresh MaddulaNo ratings yet

- GSTDocument6 pagesGSTPWD r&b nagalandNo ratings yet

- GST Notes GST Notes: LLB 3 Years (Karnataka State Law University) LLB 3 Years (Karnataka State Law University)Document15 pagesGST Notes GST Notes: LLB 3 Years (Karnataka State Law University) LLB 3 Years (Karnataka State Law University)swetha shree chavan mNo ratings yet

- Article - Jobwork Under GST - Ready ReckonerDocument4 pagesArticle - Jobwork Under GST - Ready ReckonersupdtconflNo ratings yet

- ACW291 CHP 10 SST - 231117 - 154211Document70 pagesACW291 CHP 10 SST - 231117 - 154211hemaram2104No ratings yet

- GST 4Document22 pagesGST 4MGBRNo ratings yet

- Income TaxDocument4 pagesIncome TaxVikrant SinghNo ratings yet

- Schedule of Rate and Preparation of EstimateDocument21 pagesSchedule of Rate and Preparation of EstimateExecutive EngineerNo ratings yet

- GSTDocument5 pagesGSTUtkarsh YadavNo ratings yet

- 1 - PRELIMINARY-Q - As - AFTER SESSION 4Document6 pages1 - PRELIMINARY-Q - As - AFTER SESSION 4Mighty SinghNo ratings yet

- Full Syllabus GST Test - 1 Without AnswersDocument19 pagesFull Syllabus GST Test - 1 Without Answersrajbhanushali3981No ratings yet

- Input Tax Credit Mechanism in GSTDocument9 pagesInput Tax Credit Mechanism in GSThanumanthaiahgowdaNo ratings yet

- GST Material New Scheme 1Document354 pagesGST Material New Scheme 1parithinilavan07No ratings yet

- Foreign Trade Policy: A Brief UnderstandingDocument76 pagesForeign Trade Policy: A Brief UnderstandingMilna JosephNo ratings yet

- GST NotesDocument14 pagesGST NotesPremajohnNo ratings yet

- Goods & Services Tax (GST) - User DashboardDocument4 pagesGoods & Services Tax (GST) - User DashboardAVS & AssociatesNo ratings yet

- GST Charts by CA Deep Jain SirDocument41 pagesGST Charts by CA Deep Jain SirVINAY SHARMANo ratings yet

- ReportDocument5 pagesReportsvijayambikeNo ratings yet

- CS Professional GST Summary For Dec 2019Document221 pagesCS Professional GST Summary For Dec 2019Vineela Srinidhi DantuNo ratings yet

- Sy Idt Obj U-3&4Document16 pagesSy Idt Obj U-3&4SNEH MEHTANo ratings yet

- Bhagwati Traders - (From 1-Apr-2011) : Participating in Return Tables 161 No Direct Implication in Return Tables 0Document4 pagesBhagwati Traders - (From 1-Apr-2011) : Participating in Return Tables 161 No Direct Implication in Return Tables 0mukesh singhal537No ratings yet

- Impact of GST On Real Estate SectorDocument22 pagesImpact of GST On Real Estate SectorjunaidNo ratings yet

- Icse Class 10: MathematicsDocument6 pagesIcse Class 10: MathematicsJaldi bolNo ratings yet

- Goods & Service TaxDocument13 pagesGoods & Service TaxRajeev RanjanNo ratings yet

- IncomeTax4PagePDFHindi10102022 1010 95184Document4 pagesIncomeTax4PagePDFHindi10102022 1010 95184Seema PatelNo ratings yet

- Inter GST Chart Book Nov2022Document41 pagesInter GST Chart Book Nov2022Aastha ChauhanNo ratings yet

- IntroductionDocument6 pagesIntroductionpujitha vegesnaNo ratings yet

- Subject: Sanction of Pending IGST Refund Claims Where The Records Have Not Been Transmitted From The GSTN To DG Systems - RegDocument4 pagesSubject: Sanction of Pending IGST Refund Claims Where The Records Have Not Been Transmitted From The GSTN To DG Systems - RegSanjay ChandelNo ratings yet

- Saudiarabia Migration ProfilesDocument4 pagesSaudiarabia Migration ProfilesPushpraj ZalaNo ratings yet

- TYBCom-Sem-VI-Indirect Taxes-GST MCQsDocument10 pagesTYBCom-Sem-VI-Indirect Taxes-GST MCQsMâyúř PäťîĺNo ratings yet

- Meaning and Introduction of GSTDocument6 pagesMeaning and Introduction of GSTAshish BomzanNo ratings yet

- Unit-1: Introduction and Overview of GST Chapter 1: IntroductionDocument6 pagesUnit-1: Introduction and Overview of GST Chapter 1: IntroductionrajneeshkarloopiaNo ratings yet

- Unit-1: Introduction and Overview of GST Chapter 1: IntroductionDocument5 pagesUnit-1: Introduction and Overview of GST Chapter 1: IntroductionASHISH LOYANo ratings yet

- Shubham Construction Dhule 01.07.2017 TO 31.01.2020Document1 pageShubham Construction Dhule 01.07.2017 TO 31.01.2020Sourabh GangradeNo ratings yet

- Tax MCQ 5Document17 pagesTax MCQ 5siddhant.gupta.delhiNo ratings yet

- GST Module 1Document7 pagesGST Module 1mohanraokp2279No ratings yet

- Indirect TaxDocument24 pagesIndirect Taxpradeep100% (1)

- CBDT Issued Revised TDS Rate Chart As Applicable For F.Y. 2020-21 W.E.F May 14, 2020 - A2Z Taxcorp LLPDocument11 pagesCBDT Issued Revised TDS Rate Chart As Applicable For F.Y. 2020-21 W.E.F May 14, 2020 - A2Z Taxcorp LLPpriserve acc4No ratings yet

- EXTENSION SSEs Female 2023 To 2024Document5 pagesEXTENSION SSEs Female 2023 To 2024A.Masood AEO M-8 CTNNo ratings yet

- Sty List of SSTs (M&F) 1994 To 2000Document207 pagesSty List of SSTs (M&F) 1994 To 2000A.Masood AEO M-8 CTNNo ratings yet

- Census 2022-23Document2 pagesCensus 2022-23A.Masood AEO M-8 CTNNo ratings yet

- PMIU Letter For CEOs 17 Aug 2020Document2 pagesPMIU Letter For CEOs 17 Aug 2020A.Masood AEO M-8 CTNNo ratings yet

- Regular Order 2015-16 SESE (Genral)Document8 pagesRegular Order 2015-16 SESE (Genral)A.Masood AEO M-8 CTNNo ratings yet

- Transfer Rules 2020 05 14Document9 pagesTransfer Rules 2020 05 14A.Masood AEO M-8 CTNNo ratings yet

- Manual (Participant) - AEOsDocument101 pagesManual (Participant) - AEOsA.Masood AEO M-8 CTNNo ratings yet

- Minutes of Meeting With CEOs Held On 20-11-20Document2 pagesMinutes of Meeting With CEOs Held On 20-11-20A.Masood AEO M-8 CTNNo ratings yet

- Notification of Teaching of Computer at Elementary LevelDocument1 pageNotification of Teaching of Computer at Elementary LevelA.Masood AEO M-8 CTNNo ratings yet

- Revised Rates For Charge Allowance For Heads in Education DepartmentDocument1 pageRevised Rates For Charge Allowance For Heads in Education DepartmentA.Masood AEO M-8 CTNNo ratings yet

- Departmental Accounts CommitteeDocument1 pageDepartmental Accounts CommitteeA.Masood AEO M-8 CTN100% (1)

- Monthly LND Practice Test For OctoberDocument2 pagesMonthly LND Practice Test For OctoberA.Masood AEO M-8 CTN100% (3)

- Payroll Input FormsDocument35 pagesPayroll Input FormsA.Masood AEO M-8 CTNNo ratings yet

- Certificate PDFDocument1 pageCertificate PDFA.Masood AEO M-8 CTNNo ratings yet

- کھلی کچہریDocument1 pageکھلی کچہریA.Masood AEO M-8 CTNNo ratings yet

- Notification For Empowerment of Heads Dated 05-01-2010Document1 pageNotification For Empowerment of Heads Dated 05-01-2010A.Masood AEO M-8 CTNNo ratings yet