Professional Documents

Culture Documents

PNB MetLife Accidental Death Benefit Rider

PNB MetLife Accidental Death Benefit Rider

Uploaded by

Parul GuleriaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PNB MetLife Accidental Death Benefit Rider

PNB MetLife Accidental Death Benefit Rider

Uploaded by

Parul GuleriaCopyright:

Available Formats

PNB MetLife

Accidental Death Benefit Rider Plus

Health Insurance Rider

Get freedom from

financial worries in

unforeseen accidents

PNB MetLife India Insurance Company Limited, Registered office address: Unit No. 701, 702 & 703, 7th Floor, West Wing,

Raheja Towers, 26/27 M G Road, Bangalore - 560001, Karnataka. IRDAI Registration number 117. CI No:

U66010KA2001PLC028883. PNB MetLife Accidental Death Benefit Rider Plus is a Health Insurance Rider

(UIN: 117B020V03). Please consult your advisor for more details. Please read this Sales brochure carefully before concluding

any sale. Tax benefits are as per the Income Tax Act, 1961, & are subject to amendments made thereto from time to time.

Please consult your tax consultant for more details. Goods and Services Tax (GST) shall be levied as per prevailing tax laws

which are subject to change from time to time. The marks “PNB” and “MetLife” are registered trademarks of Punjab

National Bank and Metropolitan Life Insurance Company, respectively. PNB MetLife India Insurance Company Limited is a

licensed user of these marks. Call us Toll-free at 1-800-425-6969. Phone: 080-66006969, Website: www.pnbmetlife.com,

Email: indiaservice@pnbmetlife.co.in or Write to us: 1st Floor, Techniplex-1, Techniplex Complex, off Veer Savarkar Flyover,

Goregaon (West), Mumbai - 400062, Maharashtra. Phone: +91-22-41790000, Fax: +91-22-41790203. AD-F/2019-20/0092.

BEWARE OF SPURIOUS / FRAUD PHONE CALLS!

• IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such

phone calls are requested to lodge a police complaint.

(3) Subject to the condition that the Rider Sum Assure is less than the Base Policy

Every person has a different need and we at PNB MetLife recognize this. To give Sum Assured.

you the flexibility to customize and enhance your cover, we offer you PNB (4) Exclusive of Taxes

MetLife Accidental Death Benefit Rider Plus - a rider which you may opt for along

with your basic policy and shape your policy to suit your individual needs, for a Note: The Sum Assured under the rider shall not exceed the sum assured under the base

nominal premium. policy it is attached to at inception or later. The aggregate premium for all riders should

not exceed 30% of the Base Premium of that policy.

PREMIUM PAYMENT OPTIONS

WHAT DOES PNB METLIFE ACCIDENTAL DEATH BENEFIT RIDER Premiums can be paid through Single Pay, Yearly, Half–yearly, Quarterly or Monthly as

PLUS OFFER? opted for the Base policy.

In the event of the death of the life insured due to an accident occurring within the policy Following factors are applied to yearly premium when paying premiums other than the

term, 100% of Rider Sum Assured shall be payable. yearly mode:

The death should happen within 180 days from that accident. Mode of Premium Multiplicative Factor

An Accident is defined as “A sudden, unforeseen and involuntary event caused by Semi-Annual 0.5131

external, visible and violent means” Quarterly 0.2605

The Policyholder can opt for this Rider either at inception along with Base Policy or at any Monthly 0.0886

Policy Anniversary under a Base Policy during its tenure. Payroll Savings Program 0.0886

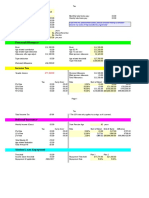

RIDER AT A GLANCE OTHER PROVISIONS

Boundary Suicide Exclusion

Eligibility Criteria

Conditions

In the event the Person Insured commits suicide, within twelve months from the Date of

Age at Entry(1) commencement of the risk or from the Date of Revival of the Policy as applicable, the

Cover Ceasing Age 70 years Nominee or beneficiary of the Policyholder shall be entitled to at least 80% of Total

Policy Term(2) Premium(s) Paid till the date of death or Surrender Value available as on the date of death,

Premium Payment whichever is higher, provided the Policy is in Inforce Status. We shall not be liable to pay

Single, Yearly, Half-yearly, Quarterly, Monthly* & Payroll savings program.

Modes any interest on this amount.

Premium Payment Regular Tax Benefits

Single 5 Pay 7 Pay 10 Pay 12 Pay 15 Pay

Options Pay

Minimum Rider `1,50,000 `50,000

Tax benefits under this plan are available as per the provisions and conditions of the

Sum Assured(3) (`5 lacs for ‘On Line’) (`5 lacs for ‘On Line’) Income Tax Act and are subject to any changes made in the tax laws in future. Please

Maximum Rider `1Crore consult your tax advisor for advice on the availability of tax benefits for the premiums paid

Sum Assured(3) (`2 Crore for ‘On Line’) and proceeds received under the policy.

Min. Annualized Free look period

`465 `285 `285 `60 `60 `60 `37.50

Rider Premium(4)

Please go through the terms and conditions of your Policy very carefully. If you have any

Max. Annualized

`2,79,400 `49,200 `39,800 `30,000 `26,800 `25,600 `16,200 objections to the terms and conditions of your Policy, you may cancel the Policy by giving

Rider Premium(4)

a signed written notice to us within 15 days (30 days in case the Policy is sold to You

*ECS Mandatory through Our Website) from the date of receiving your Policy, stating the reasons for your

(1) Age Last Birthday objection and you will be entitled to a refund of the premium paid, subject to a deduction

(2) The Rider Policy Term can be equal to or Less than the Base Policy Term of proportionate risk premium for the period of cover, stamp duty and/or the expenses

incurred on medical examination (if any).

Grace Period • Engaging in or taking part in professional sport(s) or any hazardous pursuits, including

but not limited to, diving or riding or any kind of race; underwater activities involving

Grace Period means the time granted from the due date for the payment of premium,

the use of breathing apparatus or not; martial arts; hunting; mountaineering;

without any penalty or late fee, during which time the policy is considered to be in-force

parachuting; bungee jumping.

with the risk cover without any interruption, as per the terms and conditions of the policy.

• Alcohol or Solvent abuse or taking of Drugs, narcotics or psychotropic substances

The grace period for payment of the premium is 15 days, where the policyholder pays the unless taken in accordance with the lawful directions and prescription of a registered

premium on a monthly basis and 30 days in all other cases. medical practitioner.

• Participation by the insured person in any flying activity, except as a bonafide, fare

Lapse

paying passenger or pilot and cabin crew of a commercially licensed airline.

If the total due premiums of the Policy along with this Rider is not paid within the grace • During first 48 months of the rider policy, all infections and diseases except gynogenic

period allowed for the Policy, then the benefits of the Policy and the Rider shall lapse. The infection which shall occur with and through an accidental wound shall not be covered.

Policy will acquire Surrender Value as stated in the policy terms and conditions. The Rider • Nuclear contamination: The radioactive, explosive or hazardous nature of nuclear fuel

will acquire Surrender Value as stated below. The lapsed Policy can be revived within five materials or property contaminated by nuclear fuel materials or accident arising from such

years from the due date of first unpaid premium. No policy benefits will be payable if the nature. These exclusions are in addition to the exclusions listed in the Base Policy, if any.

Policy is not revived by paying all due premium together with interest and revival fee as About PNB MetLife

applicable for the Base Policy. Also, no surrender value will be payable if the Policy does

PNB MetLife India Insurance Company Limited (PNB MetLife) is one of the leading life

not qualify for surrender benefit.

insurance companies in India. PNB MetLife has as its shareholders MetLife International

Surrender Value and Paid-up Value Holdings LLC (MIHL), Punjab National Bank Limited (PNB), Jammu & Kashmir Bank Limited

(JKB), M. Pallonji and Company Private Limited and other private investors, MIHL and PNB

Surrender Value on this Rider will be payable for other than Regular Pay i.e. for Single

being the majority shareholders. PNB MetLife has been present in India since 2001.

Premium and Limited Paying Policies. For limited Premium Poaying Policies, Surender

value will be payable only if all instalment premiums for at least two consecutive policy PNB MetLife brings together the financial strength of a leading global life insurance

years’ have been paid from the date of commencement of the Policy. The Surrender provider, MetLife, Inc., and the credibility and reliability of PNB, one of India's oldest and

Value will be higher of Guaranteed Surrender Value (GSV) and Special Surrender Value leading nationalised banks. The vast distribution reach of PNB together with the global

(SSV). Please refer to the Policy Document for the applicable Surrender Value Factors. insurance expertise and product range of MetLife makes PNB MetLife a strong and

trusted insurance provider.

EXCLUSIONS UNDER THIS RIDER; For more information, visit www.pnbmetlife.com

The Insured will not be entitled to any accidental benefits directly or indirectly due to or Extract of Section 41 of the Insurance Act, 1938, as amended from time to time states

caused, occasioned, accelerated or aggravated by any of the following: (1) In accordance with Section 41 of the Insurance Act, 1938, as amended from time to

• Suicide: If the death was due to suicide, time, no person shall allow or offer to allow, either directly or indirectly, as an

• Self-inflicted injury: Intentional self-inflicted injury. inducement to any person to take out or renew or continue an insurance in respect of

• Any condition that is pre-existing at the time of inception of the rider policy any kind of risk relating to lives or property in India, any rebate of the whole or part of

(a) Pre-existing Disease means any condition, ailment, injury or disease:That is/are the commission payable or any rebate of the premium shown on the policy, nor shall

diagnosed by a physician within 48 months prior to the effective date of the any person taking out or renewing or continuing a policy accept any rebate, except

such rebate as may be allowed in accordance with the published prospectuses or

policy issued by the insurer or

tables of the insurer

(b) For which medical advice or treatment was recommended by, or received from, a

(2) Any Person making default in complying with the provisions of this section shall be

physician within 48 months prior to the effective date of the policy or its reinstatement.

punishable with fine which may extend to ten lakh rupees.

(b) A condition for which any symptoms and or signs if presented and have resulted within

three months of the issuance of the policy in a diagnostic illness or medical condition. Fraud and misrepresentation

• War, terrorism, invasion, act of foreign enemy, hostilities, civil war, martial law, Treatment will be as per Section 45 of the Insurance Act, 1938 as amended from time to time.

rebellion, revolution, insurrection, military or usurper power, riot or civil commotion.

ü Please read this Sales brochure carefully before concluding any sale.

War means any war whether declared or not.

ü This product brochure is only indicative of terms, conditions, warranties and

• Taking part in any naval, military or air force operation during peace time.

exceptions contained in the insurance policy. The detailed Terms and Conditions are

• Committing an assault, a criminal offence, an illegal activity or any breach of law with

contained in the Policy Document.

criminal intent.

You might also like

- 2023-Quiz (Income From Salary)Document7 pages2023-Quiz (Income From Salary)SunnyNo ratings yet

- Met Smart Plus BrochureDocument5 pagesMet Smart Plus BrochurenivasiNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/DEC 2019/TAX517Document11 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/DEC 2019/TAX517Diyana NabihahNo ratings yet

- Features of ICICI Pru Saral Jeevan BimaDocument2 pagesFeatures of ICICI Pru Saral Jeevan BimaKriti KaNo ratings yet

- Permanent Disability RiderDocument10 pagesPermanent Disability RiderVaibhav ShirodkarNo ratings yet

- Life Insurance BrouchureDocument2 pagesLife Insurance BrouchureGuru9756No ratings yet

- Accidental Death Benefit Rider7 PDFDocument10 pagesAccidental Death Benefit Rider7 PDFShivaprasad PatilNo ratings yet

- Features of ICICI Pru Saral Jeevan BimaDocument2 pagesFeatures of ICICI Pru Saral Jeevan BimaAshok GNo ratings yet

- Accidental Death and Dismemberment RiderDocument8 pagesAccidental Death and Dismemberment RiderRicha BandraNo ratings yet

- Max Life Saral Jeevan Bima ProspectusDocument9 pagesMax Life Saral Jeevan Bima Prospectusmohan krishnaNo ratings yet

- ICICI Pru Linked WoP Rider BrochureDocument24 pagesICICI Pru Linked WoP Rider BrochureChinna SinghNo ratings yet

- Tata AIA Life Diamond Savings PlanDocument4 pagesTata AIA Life Diamond Savings Plansree db2No ratings yet

- 9.3 Prospects of Agricultural Insurance: YYY YDocument5 pages9.3 Prospects of Agricultural Insurance: YYY YParvati BoraNo ratings yet

- Brochure - Shriram Extra Insurance Cover Rider V03Document6 pagesBrochure - Shriram Extra Insurance Cover Rider V03Anurup PatnaikNo ratings yet

- New PdsDocument5 pagesNew PdsnadiaNo ratings yet

- Why SBI Life - Smart Wealth Assure?: (UIN: 111L077V03)Document2 pagesWhy SBI Life - Smart Wealth Assure?: (UIN: 111L077V03)sunder vermaNo ratings yet

- Life BrochureDocument8 pagesLife BrochureHar DonNo ratings yet

- Future Wealth GainDocument25 pagesFuture Wealth Gainharshad malusareNo ratings yet

- Future Wealth GainDocument23 pagesFuture Wealth GainSudhirGajareNo ratings yet

- Max Life Accidental Death and Dismemberment Rider - 23.07.2021Document3 pagesMax Life Accidental Death and Dismemberment Rider - 23.07.2021Mohammad Kamran SaeedNo ratings yet

- Sample ProposalDocument3 pagesSample ProposalCKhae SumaitNo ratings yet

- BSLI Fortune Elite Plan: FeaturesDocument3 pagesBSLI Fortune Elite Plan: FeaturesChalla RamanamurtyNo ratings yet

- Sales Brochure LIC S Jeevan Lakshya PDFDocument11 pagesSales Brochure LIC S Jeevan Lakshya PDFamit_saxena_10No ratings yet

- Future Wealth Gain PDFDocument23 pagesFuture Wealth Gain PDFviswanathbobby8No ratings yet

- Met Sukh: Accumulation PlanDocument4 pagesMet Sukh: Accumulation PlanShunmuga RajanNo ratings yet

- Future-Wealth-Gain Bajaj BrochureDocument24 pagesFuture-Wealth-Gain Bajaj BrochureVivek SinghalNo ratings yet

- Sales Brochure - LIC S New Children S Money Back PlanDocument11 pagesSales Brochure - LIC S New Children S Money Back Planamit_saxena_10No ratings yet

- Wop Rider BrochureDocument13 pagesWop Rider Brochurea26geniusNo ratings yet

- Business Illustration80015109593Document11 pagesBusiness Illustration80015109593Umesh KanaujiyaNo ratings yet

- Saral Jeevan Bima: Bajaj Allianz LifeDocument8 pagesSaral Jeevan Bima: Bajaj Allianz LifeSuresh MouryaNo ratings yet

- Features of Icici Pru Iprotect Smart: What Are The Benefits of This Policy?Document4 pagesFeatures of Icici Pru Iprotect Smart: What Are The Benefits of This Policy?Soumyaranjan SwainNo ratings yet

- Saral Jeevan Bima Brochure-BRDocument10 pagesSaral Jeevan Bima Brochure-BRprabuNo ratings yet

- MetLife Endowment Savings Plan PRINT Brochure - 2016 V2 - tcm47-27873Document4 pagesMetLife Endowment Savings Plan PRINT Brochure - 2016 V2 - tcm47-27873himanshu goyalNo ratings yet

- Brochure - Accident Benefit Rider V03Document6 pagesBrochure - Accident Benefit Rider V03Anurup PatnaikNo ratings yet

- Product Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life GoalsDocument7 pagesProduct Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life GoalsMcnet WideNo ratings yet

- Icici Pru Icare IIDocument6 pagesIcici Pru Icare IISATISH mNo ratings yet

- ABSLI Fortune Elite Plan: A Unit-Linked Life Insurance PlanDocument20 pagesABSLI Fortune Elite Plan: A Unit-Linked Life Insurance PlanRajan BaaNo ratings yet

- Premier Assured Benefit PPT - 0Document24 pagesPremier Assured Benefit PPT - 0amer.ms2711No ratings yet

- Metlife Group Accident Death Benefit Plus Rider - Sales Literature - tcm47-66271Document4 pagesMetlife Group Accident Death Benefit Plus Rider - Sales Literature - tcm47-66271Amit PrasadNo ratings yet

- Flexi Income IncomeDocument7 pagesFlexi Income Incomeharshad malusareNo ratings yet

- POS Iprotect SmartDocument9 pagesPOS Iprotect SmartRanjan BeheraNo ratings yet

- I Care IIDocument4 pagesI Care IISumit JadhavNo ratings yet

- MaxLife Smart Term PlanDocument44 pagesMaxLife Smart Term PlanAnonymous XVEucVMsENo ratings yet

- Jeevan Kiran BrochureDocument24 pagesJeevan Kiran BrochureIsmailYusufAscJrcollegeNo ratings yet

- Features of Icici Pru Iprotect Smart: What Are The Benefits of This Policy?Document4 pagesFeatures of Icici Pru Iprotect Smart: What Are The Benefits of This Policy?Charan ManchikatlaNo ratings yet

- SampoornSuraksha SchemeDetails14102022190Document1 pageSampoornSuraksha SchemeDetails14102022190Murthy NandulaNo ratings yet

- Aviva Life Shield Plus1Document8 pagesAviva Life Shield Plus1Anoop NimkandeNo ratings yet

- Savings Advantage Plan LeafletDocument2 pagesSavings Advantage Plan LeafletNishanthNo ratings yet

- Enhanced Income Select OverviewDocument2 pagesEnhanced Income Select OverviewdjdazedNo ratings yet

- Sales Brochure LIC S Single Premium Endowment PlanDocument9 pagesSales Brochure LIC S Single Premium Endowment Plansantosh kumarNo ratings yet

- Brochure - Family Income Benefit Rider V03Document6 pagesBrochure - Family Income Benefit Rider V03Anurup PatnaikNo ratings yet

- ABC 50L Pay Till 60Document4 pagesABC 50L Pay Till 60QualityCare InternationalNo ratings yet

- Benefits:: Participation in ProfitsDocument10 pagesBenefits:: Participation in Profitslakshman777No ratings yet

- Smart Protect Goal: Bajaj Allianz LifeDocument6 pagesSmart Protect Goal: Bajaj Allianz Lifebalaji kannanNo ratings yet

- Smart Protect Goal: Bajaj Allianz LifeDocument6 pagesSmart Protect Goal: Bajaj Allianz LifePunkesh TiwaryNo ratings yet

- Smart Protect Goal: Bajaj Allianz LifeDocument6 pagesSmart Protect Goal: Bajaj Allianz LifePulkeet DivekarNo ratings yet

- Smart Protect Goal: Bajaj Allianz LifeDocument6 pagesSmart Protect Goal: Bajaj Allianz LifeVinod BhosaleNo ratings yet

- Max Life Smart - Wealth - Plan - Prospectus - WebDocument24 pagesMax Life Smart - Wealth - Plan - Prospectus - WebRahul NigamNo ratings yet

- Guaranteed Income GoalDocument5 pagesGuaranteed Income GoalKevin NagvekarNo ratings yet

- Guaranteed Income GoalDocument6 pagesGuaranteed Income Goalsb RogerdatNo ratings yet

- Guaranteed Income GoalDocument6 pagesGuaranteed Income GoalSweta ShahniNo ratings yet

- Solar FencingDocument16 pagesSolar FencingParul GuleriaNo ratings yet

- Application For Cancellation or Variation of Nomination in An Account Under National Savings SchemeDocument1 pageApplication For Cancellation or Variation of Nomination in An Account Under National Savings SchemeParul GuleriaNo ratings yet

- Names of Gram Panchyats 3226 Final PDFDocument64 pagesNames of Gram Panchyats 3226 Final PDFParul GuleriaNo ratings yet

- Culture of HimaDocument4 pagesCulture of HimaParul GuleriaNo ratings yet

- BSC HS PHYSICS SEMESTER I To VI CBCEGS PDFDocument43 pagesBSC HS PHYSICS SEMESTER I To VI CBCEGS PDFParul GuleriaNo ratings yet

- FA Student GuideDocument107 pagesFA Student GuideASHUTOSH UPADHYAYNo ratings yet

- During The Current Year Blake Construction Disposed of Plant AssetsDocument1 pageDuring The Current Year Blake Construction Disposed of Plant Assetstrilocksp SinghNo ratings yet

- Activity 2 - Alaska Company - ADEVA, MKADocument3 pagesActivity 2 - Alaska Company - ADEVA, MKAMaria Kathreena Andrea AdevaNo ratings yet

- Week 6Document8 pagesWeek 6Zsazsa100% (1)

- Adjustment FormDocument2 pagesAdjustment Formimtsal ahmadNo ratings yet

- Donation and Donor's TaxationDocument5 pagesDonation and Donor's Taxationyatot carbonelNo ratings yet

- FAC 3701 Exam PackDocument52 pagesFAC 3701 Exam Packartwell MagiyaNo ratings yet

- Your Account Statement: Payment Information Summary of Account ActivityDocument4 pagesYour Account Statement: Payment Information Summary of Account ActivityEduardo PerezNo ratings yet

- Financial Statements of Not-for-Profit Organisations: Meaning of Key Terms Used in The ChapterDocument202 pagesFinancial Statements of Not-for-Profit Organisations: Meaning of Key Terms Used in The ChapterVISHNUKUMAR S VNo ratings yet

- FS - Rayos, Martin Joseph M. 2020Document20 pagesFS - Rayos, Martin Joseph M. 2020Ma Teresa B. CerezoNo ratings yet

- INGETEAM Power Technology India Private LimitedDocument1 pageINGETEAM Power Technology India Private LimitedAmolGonganeNo ratings yet

- Concept Map On IAS 12 - Income TaxesDocument2 pagesConcept Map On IAS 12 - Income TaxesRey OnateNo ratings yet

- Form 16Document1 pageForm 16tdsbolluNo ratings yet

- ACT InvoiceDocument2 pagesACT InvoiceRaghavendra RaoNo ratings yet

- Individual TaxationDocument38 pagesIndividual TaxationannyeongchinguNo ratings yet

- Tax 2 - Midterm Quiz 2-ModifiedDocument6 pagesTax 2 - Midterm Quiz 2-ModifiedUy SamuelNo ratings yet

- Ukpaye-2017-2018 - 18500Document2 pagesUkpaye-2017-2018 - 18500Anonymous jEmTt5o6No ratings yet

- Practice Question 1 VATDocument2 pagesPractice Question 1 VATPhilan Zond Philan ZondNo ratings yet

- Airfreight 2100, Inc.Document2 pagesAirfreight 2100, Inc.ben carlo ramos srNo ratings yet

- Form GSTR 2aDocument2 pagesForm GSTR 2aparam.ginniNo ratings yet

- NeracaDocument3 pagesNeracaanasatriNo ratings yet

- Case Brief AssignmentDocument1 pageCase Brief AssignmentShadi MorakabatiNo ratings yet

- Tax Structure in IndiaDocument17 pagesTax Structure in IndiaDepika MenghaniNo ratings yet

- Easy ProbsDocument5 pagesEasy ProbsjojNo ratings yet

- ACT 184 - QUIZ 3 (SET B) 61 CopiesDocument3 pagesACT 184 - QUIZ 3 (SET B) 61 CopiesAthena Fatmah AmpuanNo ratings yet

- G.R. L-15290 - May 31, 1963: Cases Nos. L-15290 and L-15280Document2 pagesG.R. L-15290 - May 31, 1963: Cases Nos. L-15290 and L-15280Aila AmpNo ratings yet

- Lebanese Association of Certified Public Accountants - IFRS July Exam 2016 Multiple Choice (30%) Use The Following Information For Questions 1 and 2Document14 pagesLebanese Association of Certified Public Accountants - IFRS July Exam 2016 Multiple Choice (30%) Use The Following Information For Questions 1 and 2Kololiko 123No ratings yet

- Company Final Accounts: Solutions To Assignment ProblemsDocument9 pagesCompany Final Accounts: Solutions To Assignment ProblemsPalavesa KrishnanNo ratings yet