Professional Documents

Culture Documents

AFM Sample Model - 2 (Horizontal)

AFM Sample Model - 2 (Horizontal)

Uploaded by

munaftOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AFM Sample Model - 2 (Horizontal)

AFM Sample Model - 2 (Horizontal)

Uploaded by

munaftCopyright:

Available Formats

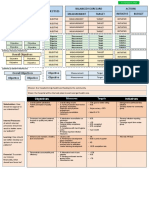

FINANCIAL MODELING INSTITUTE

LEVEL 1: ADVANCED FINANCIAL MODELER (AFM)

Henderson Manufacturing

August 14, 2018

Sample Exam Solution - Horizontal Orientation

This model is designed to given an indication of what a successful candidate may produce during the 4-hour AFM exam.

Henderson Manufacturing

Summary Outputs and Credit Statistics

SUMMARY VALUES: BEST CASE

Projected

2015A 2016A 2017A 2018 2019 2020 2021 2022

($ Millions)

Income Statement Items

Net Revenue 213.5 236.6 204.8 264.1 244.7 297.2 300.4 281.5

Growth (%) - 10.8% (13.4%) 29.0% (7.4%) 21.5% 1.1% (6.3%)

EBITDA 50.1 68.3 33.0 85.5 58.5 102.1 95.3 70.6

Margin (%) 23.5% 28.9% 16.1% 32.4% 23.9% 34.3% 31.7% 25.1%

Growth (%) - 36.4% (51.7%) 158.9% (31.5%) 74.3% (6.7%) (25.9%)

Net Income 14.0 23.6 2.1 37.8 20.9 49.8 46.1 30.7

Margin (%) 6.6% 10.0% 1.0% 14.3% 8.5% 16.8% 15.3% 10.9%

Growth (%) - 68.9% (91.0%) 1,672.4% (44.7%) 138.5% (7.5%) (33.4%)

Credit Statistics

Net Debt / EBITDA 6.0x 2.0x 2.5x 1.0x 0.7x 0.5x

Interest Coverage (EBITDA / Interest) 2.4x 7.6x 6.0x 12.6x 14.7x 14.4x

Net Debt / Capitalization 43.6% 36.9% 32.0% 23.5% 15.3% 8.5%

Financial Modeling Institute

C:\My Documents\Henderson Model.xls Page 2 of 18 8/14/2018 2:54 PM

Henderson Manufacturing

Inputs & Assumptions

GENERAL EQUITY

- First year of forecast in financial model: 2018 Stock Price - 08/13/18 $11.50

- Three scenarios have been used for Inflation, Product Pricing Fully Diluted Shares O/S (million) - Dec. 31, 2017 14.80

and Sales Volume growth Common Dividend Payout Rate 20.0%

PRODUCT PRICING OPERATIONS

- The product pricing cases used in the model are as follows: - Annual Factory Capacity (000's units) 420.0

Pricing Case YoY Change for next 5 Years

Base Case Research Forecast TAXES

Best Case 4.0% - Tax Rate 35.0%

Worst Case (4.0%) - Additional Tax Asumptions mentioned in "Other Assumptions" box

COSTS INTEREST RATE AND DEBT COVENANTS

Cost Item 2017 Value Increase Basis Interest Rates

Raw Materials 226.0 $/unit Inflation Interest Rate earned on Cash balances 1.0%

Utilities 66.2 $/unit Inflation Interest Rate on the Bank Revolver 6.0%

Rent 23.5 $ million Inflation Interest Rate on Senior Secured Debt 6.0%

Operating Labour 43.5 $ million Inflation

Other Costs 2.0 $ million Inflation

SG&A 3.9 $ million Inflation Debt Covenants

Net Debt / EBITDA Tripped < 4.5x

DEPRECIATION Interest Coverage (EBITDA / Interest) OK > 1.5x

- Depreciation Methodology Used Straight Line Net Debt / Capitalization OK < 40.0%

- Years remaining for Depreciation of exisiting Assets 25 years

- Years used for Depreciation of new Assets 30 years Net Debt / Capitalization 2017 32.0%

Financial Modeling Institute

C:\My Documents\Henderson Model.xls Page 3 of 18 8/14/2018 2:54 PM

Henderson Manufacturing

Inputs & Assumptions (cont'd)

OTHER ASSUMPTIONS 2015A 2016A 2017A 2018 2019 2020 2021 2022

($ Millions)

Days in Year 365.0 365.0 365.0 366.0 365.0 365.0

Income Statement

Cost Adjustments - Gain / (Loss) - - - - -

Cash Flow Statement

Investing Activities - Other ($5.0) $4.0 $3.0 - - - - -

Capital Expenditure $14.1 $15.0 $15.5 $16.0 $17.0 $17.3 $17.5 $18.0

Income Tax

Reduction in EBT for timing differences $5.0 $5.0 $5.0 $5.0 $5.0

Working Capital Days

Accounts Receivable (days) 45.0 40.0 40.0 40.0 40.0

Inventories (days) 70.0 65.0 60.0 60.0 55.0

Prepaid Expenses (days) 30.0 30.0 30.0 30.0 30.0

Other Assets (days) 3.0 3.0 3.0 3.0 3.0

Accounts Payable (days) 40.0 40.0 40.0 40.0 40.0

Other Liabilities (days) 10.0 10.0 10.0 10.0 10.0

Change in Debt and Equity

Senior Term Debt Issuance / (Repayment) ($25.0) ($25.0) ($25.0) ($25.0) ($25.0)

Common Shares in issuance ($)

Common Stock Issuance / (Buy-back) - - - - -

Financial Modeling Institute

C:\My Documents\Henderson Model.xls Page 4 of 18 8/14/2018 2:54 PM

Henderson Manufacturing

Inputs & Assumptions (cont'd)

OTHER ASSUMPTIONS (cont'd) 2015A 2016A 2017A 2018 2019 2020 2021 2022

($ Millions)

Pricing

Gross Sales Price ($/unit) $750.0 $805.9 $694.4

Cost Inflation (%) 2.0% 2.1% 2.0%

Freight and Warehousing ($/unit) $96.0 $98.0 $100.0

Net Sales Price ($/unit) $654.0 $707.9 $594.4

Sales Volume

Annual Factory Capacity (000's units) 420.0 420.0 420.0 420.0 420.0 420.0 420.0 420.0

Sales Volume Growth (%) 2.0% 2.4% 3.1%

Annual Sales Volume (000's units) 326.4 334.2 344.5

Implied Operating Range 77.7% 79.6% 82.0%

COSTS PER UNIT

Variable Costs

Raw Materials ($/unit) $228.0 $234.2 $228.0 $226.0

Utilities ($/unit) $63.0 $64.0 $65.0 $66.2

Total Variable Costs ($/unit) $291.0 $298.2 $293.0 $292.2

Fixed Costs

Rent ($) $22.0 $22.0 $23.0 $23.5

Operating Labour ($) $41.0 $41.0 $41.0 $43.5

Other Fixed Costs ($) $2.0 $2.0 $3.0 $2.0

Total Fixed Costs ($) $65.0 $65.0 $67.0 $69.0

SG&A costs $3.4 $3.6 $3.8 $3.9

Interest, Taxation and Depreciation

Interest Expense $15.0 $15.0 $14.0

Current Income Taxes $3.0 $8.0 -

Deferred income Taxes $2.7 $6.2 $1.1

Total Income Taxes $5.7 $14.2 $1.1

Depreciation to Existing Assets $15.4 $15.5 $15.8

Financial Modeling Institute

C:\My Documents\Henderson Model.xls Page 5 of 18 8/14/2018 2:54 PM

Henderson Manufacturing

Inputs & Assumptions (cont'd)

OTHER ASSUMPTIONS (cont'd) 2015A 2016A 2017A 2018 2019 2020 2021 2022

($ Millions)

ASSETS

Cash $0.3

Accounts Receivable $28.3

Inventory $35.1

Prepaid Expenses $14.9

Other Current Assets $1.2

Total Current Assets $79.8

Net PP&E $397.7

Other Assets $12.0

Total Non - Current Assets $409.7

Total Assets $489.5

LIABILITIES AND EQUITY

Bank Debt - Revolver -

Accounts Payable $18.2

Other Current Liabilities $4.8

Total Current Liabilities $23.0

Deferred Income Taxes $8.0

Senior Secured Term Debt $200.0

Total Non-Current Liabilities $208.0

Total Liabilities $231.0

Common Shares $120.0

Retained Earnings $138.5

Shareholders' Equity $258.5

Total Liabilities & Equity $489.5

Balance Sheet Check 0.000

Financial Modeling Institute

C:\My Documents\Henderson Model.xls Page 6 of 18 8/14/2018 2:54 PM

Henderson Manufacturing

Economic and Pricing Scenarios

2018 2019 2020 2021 2022

SCENARIO SWITCH: Best Case

ECONOMIC SCENARIOS

Cost Inflation 1.8% 1.8% 1.8% 2.0% 2.0%

Base Case 2.0% 2.0% 2.0% 2.5% 2.5%

Best Case 1.8% 1.8% 1.8% 2.0% 2.0%

Worst Case 2.5% 2.5% 2.5% 2.5% 2.5%

SALES SCENARIOS

Sales Price ($/unit) 832.0 754.0 858.0 832.0 780.0

Base Case 800.0 725.0 825.0 800.0 750.0

Best Case 4.0% 832.0 754.0 858.0 832.0 780.0

Worst Case (4.0%) 768.0 696.0 792.0 768.0 720.0

Sales Volume Growth (%) 5.0% 4.0% 5.0% 5.0% 4.0%

Base Case 5.0% 4.0% 4.0% 4.0% 4.0%

Best Case 5.0% 4.0% 5.0% 5.0% 4.0%

Worst Case 4.0% 4.0% 3.0% 3.0% 2.0%

Financial Modeling Institute

C:\My Documents\Henderson Model.xls Page 7 of 18 8/14/2018 2:54 PM

CURRENTLY RUNNING: BEST CASE SCENARIO

Henderson Manufacturing

Revenue Schedule

($ Millions)

Projected

2015A 2016A 2017A 2018 2019 2020 2021 2022

Pricing

Gross Sales Price ($/unit) $750.0 $805.9 $694.4 $832.0 $754.0 $858.0 $832.0 $780.0

Cost Inflation (%) 2.0% 2.1% 2.0% 1.8% 1.8% 1.8% 2.0% 2.0%

Freight and Warehousing ($/unit) $96.0 $98.0 $100.0 $101.8 $103.6 $105.5 $107.6 $109.8

Net Sales Price ($/unit) $654.0 $707.9 $594.4 $730.2 $650.4 $752.5 $724.4 $670.2

Sales Volume

Annual Factory Capacity (000's units) 420.0 420.0 420.0 420.0 420.0 420.0 420.0 420.0

Sales Volume Growth (%) 2.0% 2.4% 3.1% 5.0% 4.0% 5.0% 5.0% 4.0%

Annual Sales Volume (000's units) 326.4 334.2 344.5 361.7 376.2 395.0 414.8 420.0

Implied Operating Range 77.7% 79.6% 82.0% 86.1% 89.6% 94.0% 98.8% 100.0%

Revenue

Gross Revenue $244.8 $269.3 $239.2 $301.0 $283.7 $338.9 $345.1 $327.6

Less: Freight and Warehousing Cost ($31.3) ($32.8) ($34.5) ($36.8) ($39.0) ($41.7) ($44.6) ($46.1)

Net Revenue $213.5 $236.6 $204.8 $264.1 $244.7 $297.2 $300.4 $281.5

Financial Modeling Institute

C:\My Documents\Henderson Model.xls Page 8 of 18 8/14/2018 2:54 PM

CURRENTLY RUNNING: BEST CASE SCENARIO

Henderson Manufacturing

Costs of Production

($ Millions)

Projected

2015A 2016A 2017A 2018 2019 2020 2021 2022

Annual Sales Volume (000's units) 326.4 334.2 344.5 361.7 376.2 395.0 414.8 420.0

Cost Inflation (%) 1.8% 1.8% 1.8% 2.0% 2.0%

COSTS PER UNIT

Variable Costs

Raw Materials ($/unit) $228.0 $234.2 $228.0 $226.0 $230.1 $234.2 $238.9 $243.7

Utilities ($/unit) $63.0 $64.0 $65.0 $66.2 $67.4 $68.6 $70.0 $71.4

Total Variable Costs ($/unit) $291.0 $298.2 $293.0 $292.2 $297.5 $302.8 $308.9 $315.0

Fixed Costs

Rent ($/unit) $67.4 $65.8 $66.8 $65.0 $63.6 $61.7 $59.9 $60.3

Operating Labour ($/unit) $125.6 $122.7 $119.0 $120.3 $117.7 $114.1 $110.9 $111.7

Other Fixed Costs ($/unit) $6.1 $6.0 $8.7 $5.5 $5.4 $5.2 $5.1 $5.1

Total Fixed Costs ($/unit) $199.1 $194.5 $194.5 $190.8 $186.7 $181.0 $175.9 $177.1

Total Costs per Unit $490.1 $492.7 $487.5 $483.0 $484.2 $483.8 $484.7 $492.2

TOTAL COSTS

Variable Costs

Raw Materials $74.4 $78.3 $78.5 $81.7 $86.6 $92.5 $99.1 $102.3

Utilities $20.6 $21.4 $22.4 $23.9 $25.4 $27.1 $29.0 $30.0

Total Variable Costs $95.0 $99.7 $100.9 $105.7 $111.9 $119.6 $128.1 $132.3

Fixed Costs

Rent ($) $22.0 $22.0 $23.0 $23.5 $23.9 $24.4 $24.8 $25.3

Operating Labour ($) $41.0 $41.0 $41.0 $43.5 $44.3 $45.1 $46.0 $46.9

Other Fixed Costs ($) $2.0 $2.0 $3.0 $2.0 $2.0 $2.1 $2.1 $2.2

Total Fixed Costs $65.0 $65.0 $67.0 $69.0 $70.2 $71.5 $72.9 $74.4

Total Costs of Sales $160.0 $164.7 $167.9 $174.7 $182.1 $191.1 $201.0 $206.7

Financial Modeling Institute

C:\My Documents\Henderson Model.xls Page 9 of 18 8/14/2018 2:54 PM

CURRENTLY RUNNING: BEST CASE SCENARIO

Henderson Manufacturing

Income Statement

($ Millions)

Projected

2015A 2016A 2017A 2018 2019 2020 2021 2022

Revenue

Gross Revenue $244.8 $269.3 $239.2 $301.0 $283.7 $338.9 $345.1 $327.6

Less: Freight and Warehousing Cost ($31.3) ($32.8) ($34.5) ($36.8) ($39.0) ($41.7) ($44.6) ($46.1)

Net Revenue $213.5 $236.6 $204.8 $264.1 $244.7 $297.2 $300.4 $281.5

Cost of Sales $160.0 $164.7 $167.9 $174.7 $182.1 $191.1 $201.0 $206.7

SG&A $3.4 $3.6 $3.8 $3.9 $4.0 $4.0 $4.1 $4.2

Total Costs $163.4 $168.3 $171.7 $178.6 $186.1 $195.2 $205.2 $210.9

Cost Adjustments - Gain / (Loss) - - - - - - - -

EBITDA $50.1 $68.3 $33.0 $85.5 $58.5 $102.1 $95.3 $70.6

Depreciation $15.4 $15.5 $15.8 $16.2 $16.7 $17.3 $17.9 $18.5

EBIT $34.7 $52.8 $17.2 $69.4 $41.8 $84.8 $77.4 $52.1

Interest Expense $15.0 $15.0 $14.0 $11.2 $9.7 $8.1 $6.5 $4.9

EBT $19.7 $37.8 $3.2 $58.1 $32.1 $76.7 $70.9 $47.2

Current Income Taxes $3.0 $8.0 - $18.6 $9.5 $25.1 $23.1 $14.8

Deferred income Taxes $2.7 $6.2 $1.1 $1.8 $1.8 $1.8 $1.8 $1.8

Total Income Taxes $5.7 $14.2 $1.1 $20.3 $11.3 $26.8 $24.8 $16.5

Net Income $14.0 $23.6 $2.1 $37.8 $20.9 $49.8 $46.1 $30.7

Margins

EBITDA Margin 23.5% 28.9% 16.1% 32.4% 23.9% 34.3% 31.7% 25.1%

EBIT Margin 16.2% 22.3% 8.4% 26.3% 17.1% 28.5% 25.8% 18.5%

Net Income Margin 6.6% 10.0% 1.0% 14.3% 8.5% 16.8% 15.3% 10.9%

Return on Equity - 9.1% 0.8% 13.1% 6.8% 14.4% 12.1% 7.5%

Financial Modeling Institute

C:\My Documents\Henderson Model.xls Page 10 of 18 8/14/2018 2:54 PM

CURRENTLY RUNNING: BEST CASE SCENARIO

Henderson Manufacturing

Cash Flow Statement

($ Millions)

Projected

2015A 2016A 2017A 2018 2019 2020 2021 2022

Operating Activities

Net Income $14.0 $23.6 $2.1 $37.8 $20.9 $49.8 $46.1 $30.7

Depreciation and Amortization $15.4 $15.5 $15.8 $16.2 $16.7 $17.3 $17.9 $18.5

Deferred Income Taxes $2.7 $6.2 $1.1 $1.8 $1.8 $1.8 $1.8 $1.8

Changes in Working Capital - - - ($1.4) $7.2 ($4.2) ($1.7) $4.2

Operating Cash Flow $32.1 $45.3 $19.0 $54.3 $46.5 $64.7 $64.0 $55.1

Investing Activities

Capital Expenditure ($14.1) ($15.0) ($15.5) ($16.0) ($17.0) ($17.3) ($17.5) ($18.0)

Investing Activities - Other ($5.0) $4.0 $3.0 - - - - -

Investing Cash Flow ($19.1) ($11.0) ($12.5) ($16.0) ($17.0) ($17.3) ($17.5) ($18.0)

Financing Activities

Revolver Issuance / (Repayment) - - - - -

Term Debt Issuance / (Repayment) ($25.0) ($25.0) ($25.0) ($25.0) ($25.0)

Common Shres Issuance / (Buy-back) - - - - -

Common Dividends ($7.6) ($4.2) ($10.0) ($9.2) ($6.1)

Financial Cash Flows ($32.6) ($29.2) ($35.0) ($34.2) ($31.1)

Change in the Cash Position $5.7 $0.3 $12.4 $12.3 $6.0

Beginning Cash $0.3 $6.0 $6.4 $18.8 $31.1

Ending Cash $6.0 $6.4 $18.8 $31.1 $37.1

Financial Modeling Institute

C:\My Documents\Henderson Model.xls Page 11 of 18 8/14/2018 2:54 PM

CURRENTLY RUNNING: BEST CASE SCENARIO

Henderson Manufacturing

Balance Sheet

($ Millions)

Projected

2015A 2016A 2017A 2018 2019 2020 2021 2022

ASSETS

Cash $0.3 $6.0 $6.4 $18.8 $31.1 $37.1

Accounts Receivable $28.3 $32.6 $26.8 $32.5 $32.9 $30.8

Inventory $35.1 $33.5 $32.4 $31.3 $33.0 $31.1

Prepaid Expenses $14.9 $14.4 $15.0 $15.7 $16.5 $17.0

Other Current Assets $1.2 $1.4 $1.5 $1.6 $1.7 $1.7

Total Current Assets $79.8 $87.9 $82.1 $99.9 $115.3 $117.8

Net PP&E $397.7 $397.5 $397.8 $397.8 $397.4 $397.0

Other Assets $12.0 $12.0 $12.0 $12.0 $12.0 $12.0

Total Non - Current Assets $409.7 $409.5 $409.8 $409.8 $409.4 $409.0

Total Assets $489.5 $497.4 $491.9 $509.7 $524.7 $526.8

LIABILITIES AND EQUITY

Bank Debt - Revolver - - - - - -

Accounts Payable $18.2 $19.1 $20.0 $20.9 $22.0 $22.7

Other Current Liabilities $4.8 $4.8 $5.0 $5.2 $5.5 $5.7

Total Current Liabilities $23.0 $23.9 $25.0 $26.1 $27.5 $28.3

Deferred Income Taxes $8.0 $9.8 $11.5 $13.3 $15.0 $16.8

Senior Secured Term Debt $200.0 $175.0 $150.0 $125.0 $100.0 $75.0

Total Non-Current Liabilities $208.0 $184.8 $161.5 $138.3 $115.0 $91.8

Total Liabilities $231.0 $208.7 $186.5 $164.4 $142.5 $120.1

Common Shares $120.0 $120.0 $120.0 $120.0 $120.0 $120.0

Retained Earnings $138.5 $168.7 $185.4 $225.3 $262.2 $286.7

Shareholders' Equity $258.5 $288.7 $305.4 $345.3 $382.2 $406.7

Total Liabilities & Equity $489.5 $497.4 $491.9 $509.7 $524.7 $526.8

Interest Paste Value check 0.000 0.000 0.000 0.000 0.000 0.000

Balance Sheet Check 0.000 0.000 0.000 0.000 0.000 0.000

Total Check 0.000 0.000 0.000 0.000 0.000 0.000 0.000

Financial Modeling Institute

C:\My Documents\Henderson Model.xls Page 12 of 18 8/14/2018 2:54 PM

CURRENTLY RUNNING: BEST CASE SCENARIO

Henderson Manufacturing

Depreciation Schedule

($ Millions)

Projected

2015A 2016A 2017A 2018 2019 2020 2021 2022

Years Remaining on Existing Assets 25.0

Depreciation Years on New Assets 30.0

Depreciation to Existing Assets $15.4 $15.5 $15.8 $15.9 $15.9 $15.9 $15.9 $15.9

CAPEX

2018 16.0 - - - $0.3 $0.5 $0.5 $0.5 $0.5

2019 17.0 - - - - $0.3 $0.6 $0.6 $0.6

2020 17.3 - - - - - $0.3 $0.6 $0.6

2021 17.5 - - - - - - $0.3 $0.6

2022 18.0 - - - - - - - $0.3

Total Depreciation $15.4 $15.5 $15.8 $16.2 $16.7 $17.3 $17.9 $18.5

Financial Modeling Institute

C:\My Documents\Henderson Model.xls Page 13 of 18 8/14/2018 2:54 PM

CURRENTLY RUNNING: BEST CASE SCENARIO

Henderson Manufacturing

Income Tax Schedule

($ Millions)

Projected

2018 2019 2020 2021 2022

Tax Rate 35.0%

Accounting EBT $58.1 $32.1 $76.7 $70.9 $47.2

(1)

Less: Reduction in EBT for timing differences $5.0 $5.0 $5.0 $5.0 $5.0

Government EBT $53.1 $27.1 $71.7 $65.9 $42.2

Taxes as Appearing on Income Statement

Current Income Tax $18.6 $9.5 $25.1 $23.1 $14.8

Increase / (Decrease) in Deferred Income Taxes $1.8 $1.8 $1.8 $1.8 $1.8

Total Income Tax (Accounting Taxes) $20.3 $11.3 $26.8 $24.8 $16.5

(1) Assumes aggregate reduction in government pre-tax earnings due to timing differences between accounting and government rules.

Financial Modeling Institute

C:\My Documents\Henderson Model.xls Page 14 of 18 8/14/2018 2:54 PM

CURRENTLY RUNNING: BEST CASE SCENARIO

Henderson Manufacturing

Working Capital Schedule

($ Millions)

Projected

2015A 2016A 2017A 2018 2019 2020 2021 2022

Days in Year 365.0 365.0 365.0 366.0 365.0 365.0

Income Statement Items

Net Revenue $213.5 $236.6 $204.8 $264.1 $244.7 $297.2 $300.4 $281.5

Cost of Sales $160.0 $164.7 $167.9 $174.7 $182.1 $191.1 $201.0 $206.7

Days In

Accounts Receivable (days) 45.0 40.0 40.0 40.0 40.0

Inventories (days) 70.0 65.0 60.0 60.0 55.0

Prepaid Expenses (days) 30.0 30.0 30.0 30.0 30.0

Other Assets (days) 3.0 3.0 3.0 3.0 3.0

Accounts Payable (days) 40.0 40.0 40.0 40.0 40.0

Other Liabilities (days) 10.0 10.0 10.0 10.0 10.0

Account Balances

Accounts Receivable $28.3 $32.6 $26.8 $32.5 $32.9 $30.8

Inventory $35.1 $33.5 $32.4 $31.3 $33.0 $31.1

Prepaid Expenses $14.9 $14.4 $15.0 $15.7 $16.5 $17.0

Other Current Assets $1.2 $1.4 $1.5 $1.6 $1.7 $1.7

Accounts Payable $18.2 $19.1 $20.0 $20.9 $22.0 $22.7

Other Liabilities $4.8 $4.8 $5.0 $5.2 $5.5 $5.7

Net Working Capital $56.5 $57.9 $50.8 $54.9 $56.6 $52.4

Change in Working Capital ($1.4) $7.2 ($4.2) ($1.7) $4.2

Financial Modeling Institute

C:\My Documents\Henderson Model.xls Page 15 of 18 8/14/2018 2:54 PM

CURRENTLY RUNNING: BEST CASE SCENARIO

Henderson Manufacturing

Debt and Interest Schedule

($ Millions)

Projected

2017A 2018 2019 2020 2021 2022

Cash

Amount Outstanding - Beginning $0.3 $6.0 $6.4 $18.8 $31.1

Change in Cash $5.7 $0.3 $12.4 $12.3 $6.0

Amount Outstanding - Ending $0.3 $6.0 $6.4 $18.8 $31.1 $37.1

Interest Rate 1.0% 1.0% 1.0% 1.0% 1.0% 1.0%

Annual Interest Income - calculation (COPY) $0.0 $0.1 $0.1 $0.2 $0.3

Annual Interest Income - (PASTE VALUES) $0.0 $0.1 $0.1 $0.2 $0.3

Copy Paste Check - 0.000 0.000 0.000 0.000 0.000

Revolver

Operating Cash Flow $54.3 $46.5 $64.7 $64.0 $55.1

Investing cash Flow ($16.0) ($17.0) ($17.3) ($17.5) ($18.0)

Mandatory Debt Repayments ($25.0) ($25.0) ($25.0) ($25.0) ($25.0)

Common Stock Issuances / (Buy-back) - - - - -

Dividends ($7.6) ($4.2) ($10.0) ($9.2) ($6.1)

FCF After Mandatory Debt Repayment and Dividend $5.7 $0.3 $12.4 $12.3 $6.0

Revolver Outstanding - Beginning - - - - -

Additions / (Repayments) - - - - -

Revolver Outstanding - Ending - - - - - -

Interest Rate 6.0% 6.0% 6.0% 6.0% 6.0% 6.0%

Annual Revolver Interest Expense - calculation (COPY) - - - - -

Annual Revolver Interest Expense - (PASTE VALUES) - - - - -

Copy Paste Check - 0.000 0.000 0.000 0.000 0.000

Senor Secured Term Debt (SSTD)

Amount Outstanding - Beginning $200.0 $175.0 $150.0 $125.0 $100.0

Additions / (Repayments) ($25.0) ($25.0) ($25.0) ($25.0) ($25.0)

Amount Outstanding - Ending $200.0 $175.0 $150.0 $125.0 $100.0 $75.0

Interest Rate 6.0% 6.0% 6.0% 6.0% 6.0% 6.0%

Annual SSTD Interest Income $11.3 $9.8 $8.3 $6.8 $5.3

Net Interest Expense $11.2 $9.7 $8.1 $6.5 $4.9

Financial Modeling Institute

C:\My Documents\Henderson Model.xls Page 16 of 18 8/14/2018 2:54 PM

CURRENTLY RUNNING: BEST CASE SCENARIO

Henderson Manufacturing

Shareholders' Equity Schedule

($ Millions)

Projected

2017A 2018 2019 2020 2021 2022

Common Shares

Amount Outstanding - Beginning $120.0 $120.0 $120.0 $120.0 $120.0

New Issuance / (Buy-back) - - - - -

Amount Outstanding - Ending $120.0 $120.0 $120.0 $120.0 $120.0 $120.0

Dividend Payout Rate 20.0% 20.0% 20.0% 20.0% 20.0%

Net Income 37.8 20.9 49.8 46.1 30.7

Common Dividend $7.6 $4.2 $10.0 $9.2 $6.1

Retained Earnings

Amount Outstanding - Beginning $138.5 $168.7 $185.4 $225.3 $262.2

Net Income $37.8 $20.9 $49.8 $46.1 $30.7

Common Dividend ($7.6) ($4.2) ($10.0) ($9.2) ($6.1)

Amount Outstanding - Ending $138.5 $168.7 $185.4 $225.3 $262.2 $286.7

Financial Modeling Institute

C:\My Documents\Henderson Model.xls Page 17 of 18 8/14/2018 2:54 PM

CURRENTLY RUNNING: BEST CASE SCENARIO

Henderson Manufacturing

Covenants

($ Millions)

Projected

2017A 2018 2019 2020 2021 2022

Credit Statistics Values

EBITDA $33.0 $85.5 $58.5 $102.1 $95.3 $70.6

Net Debt (debt less cash) $199.7 $169.0 $143.6 $106.2 $68.9 $37.9

Interest Expense $14.0 $11.2 $9.7 $8.1 $6.5 $4.9

Total Book Capitalization $458.2 $457.7 $449.1 $451.5 $451.0 $444.6

Consolidated Ratios

Net Debt / EBITDA Covenant < 4.5x 6.0x 2.0x 2.5x 1.0x 0.7x 0.5x

EBITDA Cushion (11.3) 48.0 26.6 78.5 80.0 62.2

Interest Coverage (EBITDA / Interest) Covenant > 1.5x 2.4x 7.6x 6.0x 12.6x 14.7x 14.4x

EBITDA Cushion 12.0 68.7 44.0 89.9 85.5 63.2

Net Debt / Capitalization Covenant < 40.0% 32.0% 36.9% 32.0% 23.5% 15.3% 8.5%

Financial Modeling Institute

C:\My Documents\Henderson Model.xls Page 18 of 18 8/14/2018 2:54 PM

You might also like

- Task 1 AnswerDocument9 pagesTask 1 AnswerSiddhant Aggarwal20% (5)

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersFrom EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo ratings yet

- Is Participant - Simplified v3Document7 pagesIs Participant - Simplified v3Ajith V0% (1)

- Red Light Camera Effectiveness EvaluationDocument33 pagesRed Light Camera Effectiveness EvaluationRochester Democrat and ChronicleNo ratings yet

- Exin Handbook Fo Scrum MastersDocument202 pagesExin Handbook Fo Scrum Mastersmunaft100% (2)

- Muet 2006 To 2019 Past PapersDocument148 pagesMuet 2006 To 2019 Past PapersUmaid Ali Keerio100% (2)

- FMI Sample Model For AFM 2115Document17 pagesFMI Sample Model For AFM 2115RENJiiiNo ratings yet

- Private Equity Model Template For InvestorsDocument12 pagesPrivate Equity Model Template For InvestorsousmaneNo ratings yet

- Complete Private Equity ModelDocument16 pagesComplete Private Equity ModelMichel MaryanovichNo ratings yet

- Company Name: Financial ModelDocument13 pagesCompany Name: Financial ModelGabriel AntonNo ratings yet

- Assessment-3b-2 (1) (AutoRecovered)Document6 pagesAssessment-3b-2 (1) (AutoRecovered)Trúc NguyễnNo ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- HCL Company Analysis - Udit GurnaniDocument7 pagesHCL Company Analysis - Udit GurnaniUdit GurnaniNo ratings yet

- Enph EstimacionDocument38 pagesEnph EstimacionPablo Alejandro JaldinNo ratings yet

- SiemensDocument9 pagesSiemensCam SNo ratings yet

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2dikshapatil6789No ratings yet

- Dimaano CaseStudyPresentationDocument13 pagesDimaano CaseStudyPresentationRJ DimaanoNo ratings yet

- Dcf-Analysis Calculator (Edit Items in Blue)Document4 pagesDcf-Analysis Calculator (Edit Items in Blue)Christopher GuidryNo ratings yet

- AFM Mini Exam - SolutionDocument6 pagesAFM Mini Exam - SolutionHamid KhanNo ratings yet

- Atento Reports Fiscal 2020 First Quarter ResultsDocument16 pagesAtento Reports Fiscal 2020 First Quarter Resultsgns1234567890100% (1)

- AR2018 EngDocument83 pagesAR2018 Engomkar kadamNo ratings yet

- 2020-09-02-SHJ - AX-Moelis Australia Sec-SHINE CORPORATE - Back in Growth Mode-89665112Document5 pages2020-09-02-SHJ - AX-Moelis Australia Sec-SHINE CORPORATE - Back in Growth Mode-89665112ssdebNo ratings yet

- Investors - Presentation - 11-02-2021 Low MarginDocument32 pagesInvestors - Presentation - 11-02-2021 Low Marginravi.youNo ratings yet

- Model Content: Input Capital Schedules Capital Expenditures & Depreciation Operational Expenses Revenue CalculationDocument41 pagesModel Content: Input Capital Schedules Capital Expenditures & Depreciation Operational Expenses Revenue Calculationavinash singhNo ratings yet

- 3 Statement Model - BlankDocument6 pages3 Statement Model - BlankAina Michael100% (1)

- 波士顿 人工智能和下一波转型Document31 pages波士顿 人工智能和下一波转型bin liuNo ratings yet

- Q3 2022 Earnings Release SnowDocument14 pagesQ3 2022 Earnings Release SnowCode BeretNo ratings yet

- Creating Winning Event Proposals SecretsDocument16 pagesCreating Winning Event Proposals SecretsAnonymous 5z7ZOpNo ratings yet

- Apple 10-K Report 2022 AnalysisDocument9 pagesApple 10-K Report 2022 AnalysiscarsonkjonesNo ratings yet

- Is Participant - Simplified v3Document7 pagesIs Participant - Simplified v3Ritvik SharmaNo ratings yet

- IS Participant - Simplified v3Document7 pagesIS Participant - Simplified v3luaiNo ratings yet

- AbbVie 20210806 (BetterInvesting)Document5 pagesAbbVie 20210806 (BetterInvesting)professorsanchoNo ratings yet

- SGL Carbon H1 2021 EN 12 08 2021 SDocument32 pagesSGL Carbon H1 2021 EN 12 08 2021 SAhmed ZamanNo ratings yet

- Discounted Cash Flow-Model For ValuationDocument9 pagesDiscounted Cash Flow-Model For ValuationPCM StresconNo ratings yet

- Angiodynamics: Fourth Quarter 2018 Earnings Presentation July 11, 2018Document10 pagesAngiodynamics: Fourth Quarter 2018 Earnings Presentation July 11, 2018medtechyNo ratings yet

- Accounting Project 2Document8 pagesAccounting Project 2api-661554832No ratings yet

- ExcelDocument12 pagesExcelangel guptaNo ratings yet

- Stmicro - Q4-Fy2018 PR - FinalDocument12 pagesStmicro - Q4-Fy2018 PR - Finalakshay kumarNo ratings yet

- 2023-03-14 VolkswagenAG JPK Long FinalDocument42 pages2023-03-14 VolkswagenAG JPK Long Finalsuanshu15No ratings yet

- Analisis FinancieroDocument124 pagesAnalisis FinancieroJesús VelázquezNo ratings yet

- Equity Valuation Report - Corticeira AmorimDocument3 pagesEquity Valuation Report - Corticeira AmorimFEPFinanceClubNo ratings yet

- AFFLE - Investor Presentation - FY21Document19 pagesAFFLE - Investor Presentation - FY21Abhishek MurarkaNo ratings yet

- Uol Group Fy2020 Results 26 FEBRUARY 2021Document33 pagesUol Group Fy2020 Results 26 FEBRUARY 2021Pat KwekNo ratings yet

- Chapter 3 - Financial Statement AnalysisDocument36 pagesChapter 3 - Financial Statement AnalysisQuang NguyễnNo ratings yet

- 2017 7 Q1-2018 Investor PresentationDocument73 pages2017 7 Q1-2018 Investor PresentationMEGNo ratings yet

- Results-Presentation 2019Document32 pagesResults-Presentation 2019Shahin AlamNo ratings yet

- Presentación User Valuation DamodaranDocument42 pagesPresentación User Valuation Damodaranfrank bautistaNo ratings yet

- IS Participant - Simplified v3Document7 pagesIS Participant - Simplified v3Art EuphoriaNo ratings yet

- Udemy Reports First Quarter 2024 ResultsDocument7 pagesUdemy Reports First Quarter 2024 Resultsbsnonline107No ratings yet

- Lombard Fy19Document21 pagesLombard Fy19Sriram RajaramNo ratings yet

- Banco Santander Chile 3Q18 Earnings Report: October 31, 2018Document32 pagesBanco Santander Chile 3Q18 Earnings Report: October 31, 2018manuel querolNo ratings yet

- IS Excel Participant (Risit Savani) - Simplified v2Document9 pagesIS Excel Participant (Risit Savani) - Simplified v2risitsavaniNo ratings yet

- Vanguard Global Stock Index FundDocument4 pagesVanguard Global Stock Index FundjorgeperezsidecarshotmailomNo ratings yet

- Seya-Industries-Result-Presentation - Q1FY201 Seya IndustriesDocument24 pagesSeya-Industries-Result-Presentation - Q1FY201 Seya Industriesabhishek kalbaliaNo ratings yet

- Earnings Presentation: Bse Code: 524558 - Nse Symbol: Neulandlab - Bloomberg: Nll:In - Reuters: Neul - NsDocument34 pagesEarnings Presentation: Bse Code: 524558 - Nse Symbol: Neulandlab - Bloomberg: Nll:In - Reuters: Neul - Nssunil.dasarath jadhavNo ratings yet

- Anand Rural Electrification Corp Buy 25oct10Document2 pagesAnand Rural Electrification Corp Buy 25oct10bhunkus1327No ratings yet

- Financial Statement PresentationDocument26 pagesFinancial Statement Presentationsaud80No ratings yet

- Greenply Industries Ltd. - Result Presentation Q2H1 FY 2019Document21 pagesGreenply Industries Ltd. - Result Presentation Q2H1 FY 2019Peter MichaleNo ratings yet

- EricssonDocument47 pagesEricssonRafa Borges100% (1)

- Equity Valuation Report - TwitterDocument3 pagesEquity Valuation Report - TwitterFEPFinanceClubNo ratings yet

- JJG Co: Financial AnalysisDocument10 pagesJJG Co: Financial AnalysisJoe AndrewNo ratings yet

- Learn2Invest Session 10 - Asian Paints ValuationsDocument8 pagesLearn2Invest Session 10 - Asian Paints ValuationsMadhur BathejaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Pinterest MagicDocument20 pagesPinterest MagicmunaftNo ratings yet

- Kuwait Real Estate IndustryDocument12 pagesKuwait Real Estate IndustrymunaftNo ratings yet

- Digital Marketing Packages v2Document9 pagesDigital Marketing Packages v2munaftNo ratings yet

- Budget Balanced Scorecard Measurement Target Actions Initiative Strategy Map Overall Objectives ObjectivesDocument3 pagesBudget Balanced Scorecard Measurement Target Actions Initiative Strategy Map Overall Objectives ObjectivesmunaftNo ratings yet

- The Sharia-Conscious Consumer: Driving DemandDocument37 pagesThe Sharia-Conscious Consumer: Driving DemandmunaftNo ratings yet

- 309 Markaz Kuwait RE Feb 08Document41 pages309 Markaz Kuwait RE Feb 08munaftNo ratings yet

- GCC Real Estate Update - May 2020Document10 pagesGCC Real Estate Update - May 2020munaft100% (1)

- AFM Exam Structure - August 2018Document2 pagesAFM Exam Structure - August 2018munaftNo ratings yet

- Doing Business in Kuwait 2019Document30 pagesDoing Business in Kuwait 2019munaftNo ratings yet

- Level 1:: Advanced Financial Modeler (Afm)Document23 pagesLevel 1:: Advanced Financial Modeler (Afm)munaftNo ratings yet

- Treasury Analysis Worksheet: (Company Name)Document3 pagesTreasury Analysis Worksheet: (Company Name)munaftNo ratings yet

- Doing Business in Kuwait 2019Document30 pagesDoing Business in Kuwait 2019munaftNo ratings yet

- Intelligentspas Spamarketoverview Kuwait 2015 July PDFDocument13 pagesIntelligentspas Spamarketoverview Kuwait 2015 July PDFmunaftNo ratings yet

- Franchise Biz Out Look 2015Document27 pagesFranchise Biz Out Look 2015munaftNo ratings yet

- Introduction Private-Equity enDocument20 pagesIntroduction Private-Equity enseph8765No ratings yet

- GCC Construction Contractors ReportDocument12 pagesGCC Construction Contractors ReportmunaftNo ratings yet

- HS-PS201: Simple ManualDocument6 pagesHS-PS201: Simple ManualCambiando CaminosNo ratings yet

- 2018 Weekly CalendarDocument3 pages2018 Weekly CalendarFabian FebianoNo ratings yet

- g8 With Answer SheetDocument4 pagesg8 With Answer SheetMICHAEL REYESNo ratings yet

- Title of Project:-Military Hospital Report Management SystemDocument4 pagesTitle of Project:-Military Hospital Report Management SystemAkbar AliNo ratings yet

- Oliveira Et Al 2010Document8 pagesOliveira Et Al 2010Rômulo AlvesNo ratings yet

- Form Service A40gDocument1 pageForm Service A40gBrando ImanuelNo ratings yet

- Z19 Tnoo 000517 PDFDocument1 pageZ19 Tnoo 000517 PDFGuna RajNo ratings yet

- Uji Chi SquareDocument5 pagesUji Chi Squareeldiya yuliSNo ratings yet

- (Shuangzhu Jia Et Al 2020) Study On The Preparing and Mechanism of Chitosan-Based Nanomesoporous Carbons by Hydrothermal MethodDocument21 pages(Shuangzhu Jia Et Al 2020) Study On The Preparing and Mechanism of Chitosan-Based Nanomesoporous Carbons by Hydrothermal MethodSilvia Devi Eka PutriNo ratings yet

- Full Chapter Embracing Modern C Safely 1St Edition Lakos PDFDocument53 pagesFull Chapter Embracing Modern C Safely 1St Edition Lakos PDFjeffery.rosseau147No ratings yet

- Georgina Smith - Resume 1Document3 pagesGeorgina Smith - Resume 1api-559062488No ratings yet

- Ultrasonic InterferometerDocument22 pagesUltrasonic InterferometerakshatguptaNo ratings yet

- Murphy'S Laws: Anything That Can Go Wrong Will Go WrongDocument2 pagesMurphy'S Laws: Anything That Can Go Wrong Will Go WrongAshwin ReddyNo ratings yet

- In Search of Colonial El Ni No Events and A Brief History of Meteorology in EcuadorDocument7 pagesIn Search of Colonial El Ni No Events and A Brief History of Meteorology in EcuadorDanielNo ratings yet

- J.the Reproduction and Husbandry of The Water Monitor Varanus Salvator at The Gladys Porter Zoo, BrownsvilleDocument7 pagesJ.the Reproduction and Husbandry of The Water Monitor Varanus Salvator at The Gladys Porter Zoo, BrownsvilleAhmad MigifatoniNo ratings yet

- South Oil Company (SOC) : SOC Contract No.: CSSP-ITT-04Document19 pagesSouth Oil Company (SOC) : SOC Contract No.: CSSP-ITT-04Kingsley BaptistaNo ratings yet

- Written RequestDocument2 pagesWritten Requestcarvazro100% (1)

- Revisit of Harriott's Method For Process ControlDocument3 pagesRevisit of Harriott's Method For Process ControlkiddhoNo ratings yet

- Worksheet Research-Title FINALDocument3 pagesWorksheet Research-Title FINALJierroe EvangelistaNo ratings yet

- BNVD Eaufrance Metadonnees Vente 20230130Document16 pagesBNVD Eaufrance Metadonnees Vente 20230130moussaouiNo ratings yet

- Chemical Fume Hood HandbookDocument11 pagesChemical Fume Hood Handbookkumar123rajuNo ratings yet

- ADM Marketing Module 4 Lesson 4 Promotional ToolsDocument20 pagesADM Marketing Module 4 Lesson 4 Promotional ToolsMariel Santos75% (8)

- Housekeeping Management Practices and Standards of Selected Hotels and Restaurants of Ilocos Sur, PhilippinesDocument8 pagesHousekeeping Management Practices and Standards of Selected Hotels and Restaurants of Ilocos Sur, PhilippinesMehwish FatimaNo ratings yet

- Checkpoint Enterprise Security Framework Whitepaper v2Document34 pagesCheckpoint Enterprise Security Framework Whitepaper v2hoangtruc.ptitNo ratings yet

- Ent Secretory Otitis MediaDocument3 pagesEnt Secretory Otitis MediaIrena DayehNo ratings yet

- The First Vertebrates, Jawless Fishes, The Agnathans: 2.1 OstracodermsDocument22 pagesThe First Vertebrates, Jawless Fishes, The Agnathans: 2.1 OstracodermsAlejandro Tepoz TelloNo ratings yet

- Jambajuicelv-Application-0618 1Document2 pagesJambajuicelv-Application-0618 1api-526082107No ratings yet

- Experimental and Numerical Modeling of Cavitation ErosionDocument11 pagesExperimental and Numerical Modeling of Cavitation ErosionКонстантин ФинниковNo ratings yet