Professional Documents

Culture Documents

Private Equity Teaching Manual PDF

Private Equity Teaching Manual PDF

Uploaded by

shreshth12Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Private Equity Teaching Manual PDF

Private Equity Teaching Manual PDF

Uploaded by

shreshth12Copyright:

Available Formats

Private Equity: Teaching Manual

Author(s): Amit Shrivastava

Source: The Journal of Private Equity , SPRING 2014, Vol. 17, No. 2 (SPRING 2014), pp.

84-92

Published by: Euromoney Institutional Investor PLC

Stable URL: http://www.jstor.com/stable/43503799

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide

range of content in a trusted digital archive. We use information technology and tools to increase productivity and

facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at

https://about.jstor.org/terms

is collaborating with JSTOR to digitize, preserve and extend access to The Journal of Private

Equity

This content downloaded from

35.154.106.89 on Fri, 26 Jun 2020 20:14:41 UTC

All use subject to https://about.jstor.org/terms

Prívate Equity: Teaching Manual

Amit Shrivastava

Amit Shrivastava participants the chance to re-examine cases

is an assistant professor been introduced and experienced with the decision sheets that they had pre-

of finance & accounting at

Adani Institute

by many premier business schools pared for assigned cases.

of Infrastructure The been by in India. Private manyin Iinditroduced

a. Professorpremi

VinayerB.Professor

Nair Equity and business (PE) Vinay experienced course B. schools Nair has The purpose of this note is to introduce

from Wharton Business School introduced and explain private equity teaching techniques

Management (AHM) in

Ahmedabad (Gujarat), this course in 2004 at Indian School of Busi-

for better course delivery. This note focuses

India.

ness (ISB) Hyderabad for the post-graduate on teaching pedagogy, content of the course,

amit.shrivastava@aiim.ac.in

program in management. Thereafter it wasand the way it can be delivered. Eleven steps

dramitiima@gmail.com

shared and co-taught by few other visitingare suggested for the better delivery of the

and full-time faculties at ISB. Professor course in post-graduate programs and execu-

Thomas Hellmann from Sauder School of tive programs of management.

Business, Professor Amit Bubna (ISB), and

many others faculties contributed to develop

STEPI

and strengthen the PE course.

Indian Institute of Management, Instructor may offer a course in part

Ahmedabad (IIMA) introduced the PE nership with the Centre for Incubation In

course during 20071 in its post-graduate vation and Entrepreneurship (CUE) or wi

program (PGP-2) [Trimester VI] for second- any department or cell related with incu

year students (academic years 2006-2008). tion related activities (see Exhibit 1).

It got approved as a fully credited course (25 The first requirement of the course is t

sessions) at IIMA in 2007. Course and fac- assess how entrepreneurs manage their bu

ulty feedback was highly appreciative, with nesses and finances. Participants in the cours

a course rating of 9.48 on a 10-point scale. may be encouraged to visit incubation cent

Course contents, teaching pedagogy, and before starting the sessions.

delivery of the topics contributed to its suc-

cess. The instructor of the course, Professor STEP 2

Ramesh Bhat,2 delivered sessions effectively

and also brought experts from industry with The fundamental aim of the course is

15 unique interaction sessions.3 He had expe- to understand investments.

rienced success earlier during interaction The core issue highlighted in class is

sessions in other courses, including Strategic "nature of investments." Normally PGP-2

Financial Management (SFM).The objective participants are familiar with this kind of

of the Interaction sessions was to give course

84 Private Equity: Teaching Manual Spring 2014

This content downloaded from

35.154.106.89 on Fri, 26 Jun 2020 20:14:41 UTC

All use subject to https://about.jstor.org/terms

Exhibit 1 The methods used may cause some confusion, as

it is difficult to adopt normal finance terminology that

has been taught and with which participants are familiar,

The maini.e., CAPM model, discounted cash flow, and so on.

objective of

technological

Perhaps both instructor andand kno

participants face difficulties

from professionals be

Specific

in this sector due to significantly

areas of

reduced or no informa-

activ

tion. Often there is a huge information gap between the

• Project planning: F

provided various stakeholders, beginning with the person plan

project who is

design, willing to invest, and intermediaries who

strategy are form

transfer-

• Businessring moneyplanning

to enterprises. This complicates the situation

planning and develop

with reference to looking at valuation issues, examining

plan, a marketing pla

• Venture fundraisin

the business and proposals, and so on. Consequently, the

various participants have to look for some alternativeinclu

sources, methods

and other funding

of assessment to figure out the suitability of the business a

• Acceleration:

proposal for the investor. IC als

through partner dev

Ultimately, the class would comprehend the com-

plexities of different businesses through case studies

investment and are able to differentiate it from direct

while orienting themselves to face such different situ-

investment.

ations. Please see Exhibit 2 for a comprehensive list of

The focus is on business investments or ventures,the cases to be selected for the course.

which are indirect investments through certain interme-

diaries. The general mobilization of resources from theSTEP 4

investors collectively investing in ventures is called the

fund investing process and is different from direct invest- Normally, finance courses have primarily depended

ment. This particular form of capital is very significanton market and market information or valuation given

for new businesses as well as for established companies.by the market, which guided the risk assessment process

India is an upcoming favored destination for PE (please see Exhibit 3 for finance courses and contents).

funds which accept global finance for operations in India Such support is not available in this instance; therefore,

and abroad.

it requires a different approach.

It is essential to observe the foreign and domestic

funds in India, which are being routed toward newLACK OF LIQUIDITY

investment opportunities.

In India, the focus of PE is on return on equity, The projects under consideration are highly liquid,

which is generated in approximate percentages and canbecause it is not possible to find out values or ideas from

be compared with PE funds generation in the U.S. the market, as no market is available. Investment in this

The instructor may consider deals concerned withtype of business faces a very high level of intangibles.

IT, which is a popular sector, along with services. How- Example: The private equity person interacts with

ever, there is a lot of interest in health care, pharmaceu- the IIT (Indian Institute of Technology) student having

ticals, travel, biotechnology, and infrastructure. some awareness of PE. The person initially puts a value

of $2 million, but later reduces it to $1 million, noticing

STEP 3 the student's lack of knowledge even while preparing for

exam. In another instance, he puts a value of $5 million

The unique characteristics of this private equity for a person from IIMA, but later deducts $1 million

finance course must be deliberated upon. It is totally dif-

as the person was perhaps sleeping while attending the

ferent from what participants have experienced in class.other

finance courses, including Corporate Finance, FinancialConsequently, the valuation of such intangibles is

Management, Strategic Financial Management (SFM), very difficult.

or other finance courses.

Spring 2014 The Journal of Private Equity 85

This content downloaded from

35.154.106.89 on Fri, 26 Jun 2020 20:14:41 UTC

All use subject to https://about.jstor.org/terms

Exhibit 2

A: Comprehensive List of the Cases to be Selected for the Private Equity Cou

1 . Martin Smith: January 2002 (HBS-298076)

2. The Venture Capital Method: Valuation Problem Set (HBS-802 1 62)

3. Term Sheet Negotiation for Trendsetter Inc. (HBS-801358)

4. Spiñy Term Ine: January 2000 (SM 86, March 2001, Graduate School of Busi

5. Asia Renal Care (HBS-800243)

6. Iron Gate Technology (Chicago GSB 2003)

7. Orchid Partners: A Venture Capital Startup (HBS-804 138)

8. Yale University Investments Office, June 2003 (HBS-204055)

9. Acme Investment Trust (HBS-296042)

10. Grove Street Advisors (HBS-804050)

1 1 . Gold Hill Venture Lending (HBS-804083)

12. Adam Capital Management, March 2002 (HBS-803 1 43)

1 3 . AIT Group Pic (HBS-803 1 04) or Brazos Partners: The CoMark LBO (HBS-202090)

1 4. Endeca Technologies (HBS-802 141)

1 5 . Apax Partners and Xerium SA (HBS-804084)

1 6. Between a Rock and a Hard Place: Valuation and Distribution in Private Equity (HBS-803 161)

1 7. Chengwei Ventures and the HDTInvestment (HBS-802089)

B: Comprehensive List of the Topics to be Covered for the Private Equity Course

Module 1: Private Equity Context (2 sessions)

1 session Overview and Introduction

1 session Understanding Dynamics of PE Markets

Module 2: Venture Valuation and Term Sheet Analysis (7 sessions)

1 session Venture Valuation

2 sessions Term Sheet Analysis and Negotiations

1 session Term Sheet and Venture Valuation Issues

1 session Evaluating a Business Plan

2 sessions Due Diligence and Term Sheet

Module 3: Dynamics of Private Equity Finance: Fundraising (5 sessions)

1 session A Venture Capital Startup

1 session Perspective of Institutional Investor

1 session Limited Partners in PE Industry

1 session Intermediaries in Private Equity Industry

1 session Alternative to Equity Financing

Module 4: Investing and Managing Portfolio Companies (6 sessions)

s2 sessions Assessing and Managing Portfolio Companies & Deal Evaluation Process

s2 sessions Due Diligence and Valuation

2 sessions Financing in Down Cycle

Module §: Investment Exit (3 sessions)

2 sessions Evaluation Exit Options

1 session Perspectives on Valuation and Distribution

Module 6: Private Equity in Emerging Economies (2 sessions)

1 session PE in Emerging Markets

1 session PEVF Investment Regime and Future of PE in India

(Last session)

86 Private Equity: Teaching Manual Spring 2014

This content downloaded from

35.154.106.89 on Fri, 26 Jun 2020 20:14:41 UTC

All use subject to https://about.jstor.org/terms

Exhibit 3 outflow of money, as well as the financial and opera-

tional strategy of the key players.

STEP 6

Financial Analytics/Corporate Fi

The venture capital method is one way to deal

in the first year of the two-year

being Financialwith the issue of this sector, i.e., pre- and post-money

Management (Fi

The Finance 1 valuation and the

course required

starts rate of returnwith

from the

from the venture. Refer to "A Note

perspective ofon Valuation of Venture

firms. T

concepts useful in mapping and

Capital Deals" by Thomas Hellmann (E-95 Date:

It covers: Time Value of Money

Valuation:

03/14/01, Revised Discount

Dividend

04/20/06). M

FCF Approach; RiskAn in-depth understanding

Return of the term struc-An

Markets: Yield and Conventions

ture is in some sense the beginning of the partner-

Structure of Interest Rates and R

Exchange Rate ship between a PE firm and

Parity the new venture. It is

Condition

Put-Call Parity; desirable

Bounds to comprehend how theandPE would like to

Bino

Finance 2 see the company

covers some managing its

of business.the ba

accounting and Finance 1. This co

The relationship between PE and the new

corporate context. It covers key

Liquidity and enterprise is at the core. The term

Working structure relates to

Capital M

Follow-up the term sheet, which

Methods; focuses on various rights

Cash Manag given

Assets and Risk in Capital Budg

to different parties, including cash flow right, con-

Dividend Decisions; Long-term F

i trol right, liquidation right, anti-dilution protection,

Source: Course outlines, Indian Insti ute of Management, Ahmedabad, Indian and governance issues. The association of a person

Institute of Management, Bangalore, fand Indian Institute of Management, from the CIIE/incubation center for the purpose of

Calcutta.

a real-life term sheet would be preferable.

STEP 5

STEP 7

Attention must be paid to evolving regulatory pro-

Negotiation is another important part of the treaty

visions governing how the government is going to treat

process. The PE firm proposes a term sheet and entre-

the proposal for the foreign PE fund.

preneurs reflect on it. Often, entrepreneurs seek help

There are numerous investors who cannot invest

from financial experts or lawyers to discuss and under-

directly in real estate or in infrastructure. The treatment

stand the implications for further detailed negotiations.

for domestic and foreign investors differs.

An important component of the discussion would be to

The regulatory scenario is making things moresee whether the interests of the different stakeholders

complex.

are aligned properly, as sometimes all provisions made

Some ventures have neither history nor any infor-

in the term sheet may not correctly give proper incen-

mation about their performance.

tives to the entrepreneur or to the investor or partner

Countries in which PE has been popular for a long

in the process.

time have the advantage of a database. Such an experi-

ence is missing in India, so it is difficult to structure

STEP 8

the deal and to deal with this kind of higher-risk situ-

ation. Again, it is very difficult to find a standard text

The fundraising initiative is another important

that actually provides information for the Indian PE

aspect of the structure where information is required

scenario.

about the people who provide the money and their per-

So, sufficient time must be given to understand

spectives. Basically, it is the intermediaries who pro-

the dynamics of the industry in terms of the players, key

vide money to the enterprises. It is important to know

stakeholders, industry structure, participants, inflow and

Spring 2014 The Journal of Private Equity 87

This content downloaded from

35.154.106.89 on Fri, 26 Jun 2020 20:14:41 UTC

All use subject to https://about.jstor.org/terms

how the partnership is formed and how money is raised Suggested steps for the participants for case study:

from the different investors for investing in the enter-

prises. The investors can be institutional investors like A. Participants can select any case based on their

banks, pension funds, investment banks, or large insur- understanding. For a comprehensive list, they

ance companies. may refer to (a) a list of key PE firms that have

These are some of the institutions which provide invested in India during the period, or (b) a list

money to a firm investing in new enterprises. of a few PE Firms that have raised - or are in the

Further, there are some ordinary investors without process of raising - funds for investing in India.4

institutional backgrounds, known as limited partners, Basically, they are supposed to refer a list of com-

whose limited role is giving money to general partners panies which have been financed earlier by PE

for investing in enterprises. companies.

B. Certain key issues should be covered by the case

STEP 9 study:

1. PE company which is making the proposal

Investing and managing a portfolio is another 2. The source of the idea

important area. In private equity, to ensure the reli-

3. What were the key choice decisions faced by

ability of an investment, PE firms would handle the

the PE company?

portfolio creation, management, assessment of the deal,

4. What was the environment at that point in

and in-depth detailing such as due diligence. time?

For a structured discussion, refer to "How Venture

5. What were the total finance requirements?

Capitalists Evaluate Potential Venture Opportunities"

6. How did PE companies try to fund these

by Michael J. Roberts, Lauren Barley (HBS-805019), ventures?

and reading note "Towards a Global Model of Venture

7. Why did they enter that industry (overall

Capital" by William L. Megginson, Journal of Applied

philosophy)?

Corporate Finance , 2004.

8. What are the outcomes and performance?

9. What is the way to go forward?

STEP 10

Thus main writing can be for 8-10 pages, excluding

Case studies should highlight the possible strategiesexhibits.

in the down cycle along with the implications. When the

enterprises are not doing well, they need more money

STEP 11

from PE firms. Such a situation can be experienced by

a large number of companies. The class may look for a

The last, and very important, step is feedback on

possible solution through case studies.

the course. A comprehensive feedback on the PE course

Private equity would not be interested in remaining

enables improvement/modification for the benefit of

invested in perpetuity; it would like to get out from its

future participants. Participants may be requested to take

investment at some point in time. And in most cases, the

some time and give their views. The best approach is

time horizon for getting out may be 5 to 7 years or, at

one in which all associated faculty members interact

the most, 10 years. Therefore, looking for exit options,

with the participants for their input on the course. A

issues, and preparations is important.

questionnaire could be prepared for feedback (please see

The last session can be designed for PE in emerging

Exhibit 4 for suggested questionnaire).

economies, particularly India and China, with special

The questionnaire can be divided into six parts:

reference to regulatory perspectives, and so on.

course objective, course contents, pedagogy, self and

Participants may undertake case writing related to

peer evaluation, instructor evaluation, and overall

PE deals. With reference to case structure, there should

assessment.

not be any problem with last-trimester students, as they

are well conversant with learning through case.

88 Private Equity: Teaching Manual Spring 2014

This content downloaded from

35.154.106.89 on Fri, 26 Jun 2020 20:14:41 UTC

All use subject to https://about.jstor.org/terms

COURSE REQUIREMENTS Post-lunch learning and teaching is a very cha

lenging experience. If food is available, this pro

The course structure should be adequately sup- can be resolved; otherwise, involvement in the case

ported by case studies. For each case assignment, ques-

should be maximized. Most of the second-year courses

tions can be provided. These questions are expected toin post-graduate programs start after lunch and are

guide participants in preparing for the class and leadleast productive for participants. The facilitator or

discussion. This process attaches significant importance

instructor should concentrate on what is uncovered, and

to team effort in the process of evaluating options and

participants should concentrate on what is unlearned.

arriving at decisions. Each group may submit a one- To create decision-making skill in participants, some

page report of their analysis, application, and learning

portion should be uncovered. This leads to resolving

at the end of the case discussion or before the start of

problems related with the campus placements. Partici-

the next session.

pants should be informed about multitasking in terms

Term sheet analysis and valuation forms are impor- of placement in PE firms.5 Most of the participants from

tant tools in this course. Participants may be instructed premier business schools have high expectations. PE

to formally prepare and submit a term sheet for a new firms do not expect 20 PowerPoints, but they do expect

venture.

a one-page note on problems and recommendations

As far as case writing is concerned, eachwith

group can

a note on why the recommendations should be

be instructed to submit a brief write-up onfollowed.

their case-

writing proposal.

Exhibit 4

Questionnaire

Course Objective

Not at all Very Well

How well did the course on

the whole achieve the 0 1 2 3 4 5

objectives?

Do you think the objectives

of the course need to be YES NO

changed?

If YES, what changes would

you suggest, and why?

Course Content

Sessions were organized in terms of modules. Do you think the time allotted to various mod

adequate?

Modules Sessions Devoted Desired Sessions Remarks

1-

2.

3.

4.

5.

Total

Spring 2014 The Journal of Private Equity 89

This content downloaded from

35.154.106.89 on Fri, 26 Jun 2020 20:14:41 UTC

All use subject to https://about.jstor.org/terms

Please mention which cases in your opinion offered you the most/least learning in the course (indicate name

of case or cases).

Cases Most Learning Least Learning Remarks

~7. ~ ~

_2.

3.

4.

5.

_6.

7.

8.

_9.

JO.

Read

Pedagogy

The class sessions primarily consisted of case discussions supported by reading materials. To what extent did

the pedagogy achieve the stated objectives of the course? (Circle appropriate number.)

Not at all Well Very Well

Case Discussion 0 1 2 3 4 5

Group Presentations (in class) 0 1 2 3 4 5

Group Submissions 0 1 2 3 4 5

Decisions Sheet Submission 0 1 2 3 4 5

The class sessions were grouped into 6 m

priate number.)

Modules Not at all Well Very Well

~ Õ Ī 2 3 4

9 0 12 3 4

_

0 12 3 4

0 12 3 4

4 5

0 12 3 4

0 12 3 4

J*

90 Private Equity: Teaching Manual Spring 2014

This content downloaded from

35.154.106.89 on Fri, 26 Jun 2020 20:14:41 UTC

All use subject to https://about.jstor.org/terms

Self and Peer Evaluation

An important part of learning occurs through the contribution of participants before, during, and after the clas

How would you rate the contribution of the following toward your overall learning? (Circle appropriate num

Very Poor Substantial

Peer contribution through participation in classes 0 1 2 3 4 5

Peer contribution through before/after class discussion 0 1 2 3 4 5

Peer contribution to assignments 0 1 2 3 4 5

Your own contribution through participation in classes

Your own contribution through before and after class 0 1 2 3 4 5

discussion

Your own contribution to assignments 0 1 2 3 4 5

Suggest ways to further improve the peer learning.

Decision Sheet

Post-reflection and preparation of discussion sheet were made an integral part of the pedagogy.

To what extent do you think the decision sheet will be useful in reflecting on?

Very Low Very High

Major decisions

Ongoing learning

Instructor Effectiveness

Please evaluate the instructor's handling of the course with respect to the following (circle appropriate

number).

Very Poor Very Good

Preparation 0 1 2 3 4 5

Control over class discussion 0 1 2 3 4 5

Interest in course and teaching 0 1 2 3 4 5

Ability to clarify concepts 0 1 2 3 4 5

Effectiveness in class 0

Effectiveness in non-class interaction 0

Overall evaluation

Spring 2014 The Journal of Private Equity 91

This content downloaded from

35.154.106.89 on Fri, 26 Jun 2020 20:14:41 UTC

All use subject to https://about.jstor.org/terms

Overall Assessment of the Course

Very Low Very High

Intrinsic usefulness of course 0 1 2 3 4 5

Overall effectiveness of course 0 1 2 3 4 5

Usefulness of cases and teaching materials 0 1 2 3 4 5

Overall learning 0 1 2 3 4 5

Any other constructive commen

Source:

Feedback structure isbased on the feedb

Ahmedabad, by Professor Ramesh Bhat (Marc

ENDNOTES

before 2007, PE-related learning was restricted to two

sessions, which were covered in the Management of Finan-

cial Institutions (MFI) course. MFI is a 25-session course at

IIMA and includes 2 sessions on PE. These two sessions are

delivered by PE consult ants, and industry experts.

2 An alumnus of Harvard University and the University

of Delhi with more than 30 years of professional and academic

experience.

3These sessions were apart from mainstream sessions

of 25.

4You may suggest that participants refer to "The Pri-

vate Equity Market in India" (Appendix A & B) by Dr. Alok

Aggarwal, Chairman, Evalueserve Inc., and Private Equity

Annual Roundup 2012-India, Ernst & Young, February 12,

2013.

5Most of the PE firms are relatively small, often with

fewer than 14 professionals. Staff members are expected to

be expert in multiple dimensions.

6One session is equivalent to 70 minutes (one full credit

course requires 30 hours of classroom learning).

To order reprints of this article, please contact Dewey Palmieri

at dpalmieri@iijournals.com or 212-224-3675.

92 Private Equity: Teaching Manual Spring 2014

This content downloaded from

35.154.106.89 on Fri, 26 Jun 2020 20:14:41 UTC

All use subject to https://about.jstor.org/terms

You might also like

- Yale University Investments Office Case AnalysisDocument15 pagesYale University Investments Office Case Analysisjen1861275% (4)

- Softonic PE CaseDocument1 pageSoftonic PE CaseClarisse LamNo ratings yet

- An Investment MemoDocument3 pagesAn Investment MemoIlyass El-MansouryNo ratings yet

- EMPEA Emerging Markets Mezzanine Report May 2014 WEBDocument32 pagesEMPEA Emerging Markets Mezzanine Report May 2014 WEBJurgenNo ratings yet

- UBS M&A PitchbookDocument19 pagesUBS M&A Pitchbookspuiszis100% (2)

- Private EquityDocument26 pagesPrivate Equityina100% (1)

- Elevator Pitch DraftDocument2 pagesElevator Pitch DraftJack JacintoNo ratings yet

- A Note On Venture Capital IndustryDocument9 pagesA Note On Venture Capital Industryneha singhNo ratings yet

- Reading 45-Private Equity Valuation-QuestionDocument20 pagesReading 45-Private Equity Valuation-QuestionThekkla Zena100% (1)

- WSO Resume - DemolishedDocument1 pageWSO Resume - DemolishedJack JacintoNo ratings yet

- Ninepoint Tec Private Credit Fund OmDocument86 pagesNinepoint Tec Private Credit Fund OmleminhptnkNo ratings yet

- PIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsFrom EverandPIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsNo ratings yet

- HVS - 2015-European-Hotel-Transactions PDFDocument16 pagesHVS - 2015-European-Hotel-Transactions PDFMarco PoloNo ratings yet

- Pennsylvania State Pension StudyDocument393 pagesPennsylvania State Pension StudyReading_EagleNo ratings yet

- A Guide To Venture CapitalDocument4 pagesA Guide To Venture CapitalgargramNo ratings yet

- Partners Group - FoF BenefitsDocument8 pagesPartners Group - FoF BenefitsJose M Terrés-NícoliNo ratings yet

- Warren Buffett On AcquisitionsDocument38 pagesWarren Buffett On AcquisitionsVarnit AgnihotriNo ratings yet

- Hostile TakeoverDocument15 pagesHostile TakeoverKiran MankodiNo ratings yet

- Capital Structure, The Determinants and FeaturesDocument5 pagesCapital Structure, The Determinants and FeaturesRianto StgNo ratings yet

- 04 - VC Fund PerformanceDocument22 pages04 - VC Fund Performancejkkkkkkkkkretretretr100% (1)

- Private EquityDocument104 pagesPrivate EquityFiDi007100% (1)

- CEO Private Equity 6-06Document16 pagesCEO Private Equity 6-06dysertNo ratings yet

- Angel and Venture CapitaDocument36 pagesAngel and Venture CapitaprachiNo ratings yet

- Limited PartnersDocument2 pagesLimited PartnersDavid TollNo ratings yet

- Distressed Debt InvestingDocument5 pagesDistressed Debt Investingjt322No ratings yet

- Private Equity Unchained: Strategy Insights for the Institutional InvestorFrom EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNo ratings yet

- Session 1 Part 0 Private Equity Class InstructionsDocument12 pagesSession 1 Part 0 Private Equity Class InstructionseruditeaviatorNo ratings yet

- Wso CoverletterDocument1 pageWso CoverletterJack JacintoNo ratings yet

- Ascend Hedge Fund Investment Due Diligence Report 0811redactedDocument17 pagesAscend Hedge Fund Investment Due Diligence Report 0811redactedJoshua ElkingtonNo ratings yet

- Private Equity E BookDocument318 pagesPrivate Equity E Bookdoshiron243No ratings yet

- Ê, in Finance, Is AnDocument11 pagesÊ, in Finance, Is AnJome MathewNo ratings yet

- GE Corporate Venture EffortsDocument8 pagesGE Corporate Venture EffortsApolline MorelleNo ratings yet

- Compensation Guide 03 2023Document12 pagesCompensation Guide 03 2023Haiyun ChenNo ratings yet

- Private Equity BookDocument138 pagesPrivate Equity BookSibt Ul HasnainNo ratings yet

- PE VC Funding An OverviewDocument20 pagesPE VC Funding An OverviewGautam MehtaNo ratings yet

- Practitioner's Guide To Cost of Capital & WACC Calculation: EY Switzerland Valuation Best PracticeDocument23 pagesPractitioner's Guide To Cost of Capital & WACC Calculation: EY Switzerland Valuation Best PracticeAli Gokhan KocanNo ratings yet

- ERH PreparingAVentureCapitalTermSheet ELSCDeskbookDocument16 pagesERH PreparingAVentureCapitalTermSheet ELSCDeskbookboka987No ratings yet

- Venture Capital Deal TermsDocument53 pagesVenture Capital Deal TermsTrang Tran0% (1)

- Private Equity 2015Document47 pagesPrivate Equity 2015Apurva SoodNo ratings yet

- Wisdom From Seth Klarman - Part 1Document3 pagesWisdom From Seth Klarman - Part 1suresh420No ratings yet

- SBIC Program OverviewDocument26 pagesSBIC Program OverviewAnibal WadihNo ratings yet

- Getting A Job in VCDocument9 pagesGetting A Job in VCKristie GanNo ratings yet

- Guide To Capital AllocationDocument5 pagesGuide To Capital AllocationUmbyisNo ratings yet

- Leveraged Buyout (LBO) Private EquityDocument4 pagesLeveraged Buyout (LBO) Private EquityAmit Kumar RathNo ratings yet

- Private Equity BookDocument141 pagesPrivate Equity BookBob Li100% (1)

- Spinoff Investing Checklist: - Greggory Miller, Author of Spinoff Investing Simplified Available OnDocument2 pagesSpinoff Investing Checklist: - Greggory Miller, Author of Spinoff Investing Simplified Available OnmikiNo ratings yet

- Investment ChecklistDocument4 pagesInvestment ChecklistlowbankNo ratings yet

- 7 MA Docs DemystifiedDocument30 pages7 MA Docs Demystifiedwhaza789No ratings yet

- Structuring Venture Capital, Private Equity, and Entrepreneural Transactions (Review)Document3 pagesStructuring Venture Capital, Private Equity, and Entrepreneural Transactions (Review)wclonnNo ratings yet

- Private Equity Insiders GuideDocument13 pagesPrivate Equity Insiders GuidemsmetoNo ratings yet

- 2007VICW PabraiDocument19 pages2007VICW PabraiAshish AgrawalNo ratings yet

- LBO GuideDocument1 pageLBO GuideTashaNo ratings yet

- Venture Capital ProjectDocument102 pagesVenture Capital ProjectAliya KhanNo ratings yet

- Nuveen - A Good Time For Private DebtDocument3 pagesNuveen - A Good Time For Private Debtramachandra rao sambangiNo ratings yet

- GoBuyside 2019 North American Private Equity Compensation StudyDocument9 pagesGoBuyside 2019 North American Private Equity Compensation StudyGreg finchNo ratings yet

- Venture Capital in Emerging MarketsDocument2 pagesVenture Capital in Emerging Marketscamilo nietoNo ratings yet

- Venture Debt QsDocument1 pageVenture Debt QsLenny LiNo ratings yet

- Hedge Fund Basics - IRSDocument21 pagesHedge Fund Basics - IRSmejocoba82No ratings yet

- Careers in Venture CapitalDocument80 pagesCareers in Venture Capitalanton88be100% (1)

- Valuing Startup VenturesDocument4 pagesValuing Startup VenturesJonhmark AniñonNo ratings yet

- Morningstar Learning ResourcesDocument1 pageMorningstar Learning ResourcesLouisSigneNo ratings yet

- Venture CapitalDocument88 pagesVenture Capitaldipsi123No ratings yet

- Behind the Curve: An Analysis of the Investment Behavior of Private Equity FundsFrom EverandBehind the Curve: An Analysis of the Investment Behavior of Private Equity FundsNo ratings yet

- JP Morgan Emerging MarketsDocument404 pagesJP Morgan Emerging Marketsvini1984100% (1)

- Kotak Bank Company ProfileDocument17 pagesKotak Bank Company Profilemohammed khayyumNo ratings yet

- IPO PortoDocument23 pagesIPO PortoBayuRedgiantchildNo ratings yet

- BogaziciDocument106 pagesBogazicimanishjethva2009No ratings yet

- Byron Carlyle RFP Submittal - Pacific StarDocument30 pagesByron Carlyle RFP Submittal - Pacific StarNone None NoneNo ratings yet

- GSM687Document11 pagesGSM687icdawar0% (1)

- 9 Factors To Consider When Comparing McKinsey - Bain - BCG - Management ConsultedDocument7 pages9 Factors To Consider When Comparing McKinsey - Bain - BCG - Management ConsultedTarekNo ratings yet

- Germany BranchDocument2 pagesGermany BranchparuNo ratings yet

- Private Equity Permira Annual Review 2007Document44 pagesPrivate Equity Permira Annual Review 2007AsiaBuyoutsNo ratings yet

- Pe VC Trendbook 2021Document111 pagesPe VC Trendbook 2021meenaldutiaNo ratings yet

- Polish VC Market Outlook Q3 2022Document31 pagesPolish VC Market Outlook Q3 2022start-up.roNo ratings yet

- Private Equity Basics by - Shahid AnwarDocument8 pagesPrivate Equity Basics by - Shahid Anwarvinaymaladi24No ratings yet

- ASIA IVALUE Business ProfileDocument9 pagesASIA IVALUE Business ProfileDidiek PriambudiNo ratings yet

- Am ItDocument63 pagesAm Itpeter198686No ratings yet

- 2421 - SBC Company ProfileDocument10 pages2421 - SBC Company ProfileWinengku100% (1)

- Managing The Family BusinessDocument385 pagesManaging The Family BusinessSittie Atteha SolaimanNo ratings yet

- Hedge Funds GuideDocument224 pagesHedge Funds GuideisranidilipNo ratings yet

- Mif Brochure PDFDocument28 pagesMif Brochure PDFcommerce.academy.bamNo ratings yet

- The State of U.S. Corporate Governance: What's Right and What's Wrong?Document39 pagesThe State of U.S. Corporate Governance: What's Right and What's Wrong?Niaz AliNo ratings yet

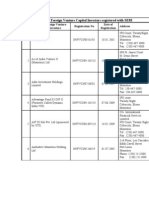

- A-List of Foreign Venture Capital Investors Registered With SEBIDocument24 pagesA-List of Foreign Venture Capital Investors Registered With SEBIVipul ParekhNo ratings yet

- LA Tech Venture Capital AlmanacDocument102 pagesLA Tech Venture Capital AlmanacAGjjjjkjjNo ratings yet

- Leveraged BuyoutDocument8 pagesLeveraged Buyoutmanoraman0% (1)

- Overview of Current Investment Scenario in IndiaDocument7 pagesOverview of Current Investment Scenario in IndiakarnvatsNo ratings yet

- GTDC Report - Tech Distribution 2025 1Document14 pagesGTDC Report - Tech Distribution 2025 1Afif Al FattahNo ratings yet

- Annual Dealtracker 2019 V6Document100 pagesAnnual Dealtracker 2019 V6AninditaGoldarDuttaNo ratings yet