Professional Documents

Culture Documents

Investing in Asia Pacific

Investing in Asia Pacific

Uploaded by

aw333Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investing in Asia Pacific

Investing in Asia Pacific

Uploaded by

aw333Copyright:

Available Formats

A monthly guide to investing in Asia Pacific financial markets

Investing in Asia Pacific

August 2020

Chief Investment Office GWM

Investment Research

Next steps in the

recovery

Investing in Asia Pacific

Investing in Asia Pacific

This report has been prepared by UBS AG Singapore Branch,

UBS AG Hong Kong Branch and UBS Switzerland AG

Editor-in-chief

Wayne Gordon Editorial deadline

17 July 2020

Product management

Rajesh Donthula* Languages

Sita Chavali Published in English, Chinese (Traditional and Simplified)

Delwin Kurnia Limas Translations

Editors Rachel Lee

Aaron Kreuscher Bianhua Gao

Murugesan Suppayyan Danjun Zheng

Desktop publishing Contact

Pavan Mekala* ubs.com/cio

Pictures

Gettyimages * An employee of Cognizant Group.

Cover image: For illustrative purposes only. Cognizant staff provides support services to UBS.

UBS CIO GWM August 2020 2

Investing in Asia Pacific

Contents

04 Editorial

06 Asia monthly outlook

Positioning for the consumption recovery

11 Tactical views

12 Asset allocation

13 Equities

14 Japanese equities

15 Bonds

16 Currencies

17 Commodities

19 UBS APAC forecasts

21 Investment spotlight

Asian high yield bonds and long Indian rupee

Important disclosure

Please see the important disclaimer at the end of the document.

Please note there may be changes to our house view strategies prior to the next edition of Investing in Asia Pacific. For all updated views, please

refer to the UBS House View Monthly Extended at any time of the month or contact your advisor.

UBS CIO GWM August 2020 3

Investing in Asia Pacific

Editorial

Dear reader,

Asia's recovery continues to outpace its peers, and investors are rewarding the

region accordingly. The Asia ex-Japan benchmark stock index has outperformed

the S&P 500 by 6% since mid-June, with domestic Chinese stocks leading the

charge—the onshore CSI 300 Index is up 29% since its March low.

We see more upside ahead. Asia, in our view, is entering the next phase of its

recovery, with trade and consumption likely to power growth in 2H20. Recent

macroeconomic data supports this view. China's purchasing manager index and

industrial output numbers are back to pre-COVID levels, with consumption on the Mark Haefele

rise (consumer credit and housing) and trade returning to year-on-year growth. Chief Investment Officer

Global Wealth Management

Virus outbreaks are still red flags. The good news is that governments are acting

swiftly, and data suggests that infection rates in South and Southeast Asia could

be close to peaking or have already peaked. The situation in the US is concerning

and needs to be closely monitored, but broad restrictions are unlikely to be

imposed again.

Further progress on vaccine development is heartening. In the US, we expect policy

support to be robust regardless of who wins the US presidential election. Still,

volatility is bound to rise in the run-up to November as the policy platforms of both

parties are unveiled.

This backdrop, overall, gives us confidence to stay risk-on in the region and

Min Lan Tan

globally. We see further upside in China despite the strong rally, but expect gains

Head Chief Investment Office APAC

going forward to be more in line with regional equities. Elsewhere, we see value in Global Wealth Management

laggards—India and Singapore are most preferred, while Hong Kong, Malaysia,

and Thailand are least preferred.

Sector-wise, we expect tech to stay in the driver’s seat with the pandemic

accelerating long-term trends, and consumer discretionary to rise to the fore. We Follow us on

see tactical opportunities in Singapore’s banks and favor the key beneficiaries—

i.e., those that stand the most to gain—of further economic reopening.

linkedin.com/in/markhaefele

The search for yield should underpin further spread tightening in Asia investment linkedin.com/in/minlantan

grade credit. We also like high yield, particularly China property. And in currencies,

the INR and the KRW are most preferred.

twitter.com/UBS_CIO

Strained US-China relations bear watching. But we see more to gain by staying

invested and weathering the uncertainty than sitting on the sidelines. We also like

gold as a diversifier in a low-yield world.

Mark Haefele Min Lan Tan

UBS CIO GWM August 2020 4

Investing in Asia Pacific

Key investment ideas

Asset allocation Equities

• Asia ex-Japan equities most preferred • Quality cyclicals (IT,

• Asian IG bonds most preferred communication services and

• Singapore and India most preferred, while consumer discretionary)

Hong Kong, Malaysia and Thailand least • Select laggards which are

preferred positioned to benefit from

easing restrictions

• Structural themes such as

China’s intelligent infrastructure

and ASEAN’s new economy

Currencies

• Long INR vs. USD: We like the

INR for its attractive yield carry

and catch-up potential

• Long KRW and JPY vs. TWD to

Japanese equities position for a global economic

growth rebound

• Buy Japan’s recovering • Short USD vs. JPY to position

consumption for broader USD weakness

• Japan’s new mobility to

gain traction next year

• Japanese REITs are

beneficiaries of low

interest rates

Bonds

• China property sector in

HY– look for better quality

names Commodities

• BBB-rated corporate bonds

in Asia IG • Long gold

• Select corporate perpetuals • Long base metals

in Asia IG • Volatility selling in crude oil

UBS CIO GWM August 2020 5

Investing in Asia Pacific

Asia monthly outlook

Positioning for the consumption

recovery

UBS CIO GWM August 2020 6

Investing in Asia Pacific

Asia monthly outlook

Positioning for the consumption

recovery

The strategy of holding quality cyclicals should work for investors seeking growth

and long-term secular business models. China and Taiwan offer the highest

exposure to quality cyclicals, whereas ASEAN's shift to the new economy is only

now starting to take off.

Philip Wyatt, Economist; Sundeep Gantori, Analyst; Kathy Li, Analyst; Valerie Chan, Analyst; Delwin Kurnia Limas, Analyst;

Adrian Zuercher, Head APAC Asset Allocation; Jon Gordon, Analyst

Asia’s economies are opening up, marking an end to the Three steps to recovery

lockdown era that defined the first half of the year. Asia's revival has not been synchronized. Mainland China is

Although some markets are further along than others— clearly ahead with Taiwan and Korea close behind. ASEAN

North Asia is in the lead, South and Southeast Asia are and India's recoveries have lagged due to greater

lagging—people across the region are now generally able challenges in containing the virus and less fiscal headroom,

to dine out and shop. So with savings accumulated from and as the IT-driven upturn this year has mostly bypassed

the months holed up at home, the conditions are ripening these markets.

for a consumption-driven recovery in 2H.

The regional recovery should follow three steps:

Risks remain, such as new outbreaks, US-China tensions 1. Monetary and fiscal easing to protect incomes,

and US presidential elections, but we expect the reopening employment and credit markets.

story to be the key driver of markets in the months ahead.

2. Easing of restrictions that allow people to return to

We advise positioning in advance of this spending windfall.

work, dine out and visit shops.

Quality cyclicals—consumer discretionary, information

technology, communication services—should perform well. 3. A broad lift in confidence that underpins a recovery in

We see further upside in China despite the strong rally, but trade, business sentiment and retail sales.

expect gains going forward to be more in line with

regional equities. Singapore and India are our preferred The first two steps happened in 2Q, and we expect the

equity markets. third to become more evident in 3Q. China’s exports have

held up better than expected, and the recovery in trade

We’re upbeat on risk overall, in the region and globally, should broaden out to other markets in the region in 2H as

and recommend investors to see the second half with a the global economy continues to open up.

glass-half-full lens. After all, policy is supportive, earnings

are recovering and virus containment in Asia is advancing.

“ With savings accumulated

from the months holed up at

home, the conditions are

ripening for a consumption-

driven recovery in 2H.”

UBS CIO GWM August 2020 7

Investing in Asia Pacific

China surprises positively, ASEAN to join the

recovery

China’s economy appears to have staged an impressive Regional policy to remain easy

comeback since mid-March, with 2Q GDP returning to China’s strong 2Q recovery will not reverse the overall

growth (+3.2% y/y) after a historic slump in 1Q (–6.8% y/y). policy easing stance for 2H, in our view, given the uneven

Production-related activity, such as industrial production and nature of the recovery, second wave risks and US-China

investment, picked up first. Consumption and retail/travel- tensions. In China, we see an extra 100–300bps of reserve

related sectors are still lagging, though they’re catching up requirement cuts and 10–40bps of medium-term lending

as lockdown measures ease. We believe the trend will facility cuts by year-end as well as other targeted support

continue, affirming our view for a V-shaped recovery and a for SMEs.

more visible rebound to 5%–6% y/y growth in 2H driven by

policy support and the global recovery. Malaysia, Indonesia and the Philippines cut policy rates

again this month and Indonesia rolled out a bolder central

ASEAN and India are behind mainland China, Taiwan and bank government bond purchase program. We see

Korea in controlling the virus and the economic recovery that incremental easing continuing through 2H. This backdrop

follows. It will take a few months to go from lifting restrictions gives us the confidence to stay risk-on, as we anticipate a

to normal mobility due to lags in transport re-opening, weak broadening out of the stock recovery from just tech to

confidence, second waves, etc. But as ASEAN and India include quality cyclicals like consumer discretionary.

further loosen restrictions from 3Q onward, sentiment should

improve and consumption should rebound.

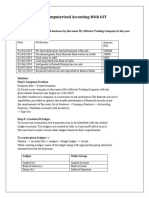

ASEAN to return from deeper dip in 2H

Economy Activity Index (z-score)

1

“ We’re upbeat on risk overall -

0

Jun

policy is supportive, earnings

-1

are recovering and virus

containment in Asia is

-2 advancing.”

-3 May

-4

2013 2014 2015 2016 2017 2018 2019 2020

ASEAN Korea & Taiwan

China

Source: CEIC, UBS, as of July 2020

Navigating US elections

The US presidential election in November is a key risk on Furthermore, a Biden presidency’s greener agenda would

the horizon. Regardless of who wins the White House, a favor environmentally friendly cars, where Japanese

strategy of China containment looks set to continue, producers and Asian battery and equipment providers are

driven not so much by protectionism but by national world leading. Chinese solar companies should benefit

security considerations. Investors should be positioned from the US quest for carbon neutrality by 2050. Asia ex-

for a future of increasing structural decoupling between Japan ESG leaders should also see added momentum, as

the two economies. should our China smart infrastructure theme.

UBS CIO GWM August 2020 8

Investing in Asia Pacific

Focus on quality cyclicals

Last month marked a milestone for the region: in June, While the growth dynamics clearly favor quality cyclicals, it

Asia became the first region globally where quality cyclicals is worth highlighting that they are not cheap; AxJ quality

represent more than half of the overall benchmark index. cyclicals trade at a 40% premium to the region (17.6x

While the US market is not far away, the greater focus on 2021 P/E vs. AxJ’s 10.5x). However, we believe the

quality cyclicals puts the region in a superior position given valuations are reasonable given superior growth prospects.

that growth will be increasingly driven by structural drivers. Hence, we continue to see a favorable risk-reward for this

segment.

We expect Asia ex-Japan (AxJ) earnings to decline by 0.8%

in 2020 and to rebound strongly by 18% in 2021. Quality The strategy of holding quality cyclicals should work for

cyclicals, in contrast, are forecast to post resilient earnings investors seeking growth and long-term secular business

growth of 8.8% in 2020 and an even more robust 26.1% models. China and Taiwan offer the highest exposure to

in 2021. IT and communication services have led this year quality cyclicals, whereas ASEAN's shift to the new

due to stay-at-home trends, but we expect consumer economy is only now starting to take off.

discretionary to take the helm next year and record 35%

earnings growth thanks to easing mobility restrictions. In Meanwhile, we see tactical opportunities in areas that are

comparison, we expect the earnings of the other sectors in expected to benefit from potential easing of mobility

the region to shrink 5.1% in 2020 and grow only 14.5% in restrictions. Singapore and India, our most preferred

2021, thus lagging the overall region. markets, offer large exposure to the sectors positioned to

benefit for reopening and are supported by relatively

attractive valuations.

Asia ex-Japan leads the global race for quality Premium valuations justified for Asia ex-Japan’s

cyclicals quality cyclicals

Combined weight of IT, consumer discretionary and communication services in P/E for 2021 estimated EPS

benchmark indices

60% 20

18

50%

16

40%

14

30% 12

10

20%

8

10%

6

0% 4

Asia ex-Japan US Eurozone JP Global

2

Jun-15 Dec-19

0

Jun-20 Quality cyclicals Rest of the market Asia ex Japan

Source: Bloomberg, Factset, UBS, as of July 2020 Source: Bloomberg, Factset, UBS, as of July 2020

UBS CIO GWM August 2020 9

Investing in Asia Pacific

Other opportunities in Asia

Within credit, China property remains our preferred

exposure in high yield. We like good-quality BB rated

bonds that have sold off, as well as shorter-dated bonds.

The spreads in the BBB rated investment grade segment

appear wide compared to historical levels. We see

particular value in state-owned names.

In FX, the Fed’s ultra-accommodative policy stance should

weigh on the USD and set up a conducive environment for “ We still like gold from a

select yield-carry strategies in Asia. The high-yielding INR, diversification angle.”

which has underperformed year-to-date, has room to

rebound over the medium term. Also, we’re positioned for

an ongoing lift in growth by being long the KRW and JPY

versus the TWD. Separately, we’re long the JPY versus the

USD.

We shifted commodities to most preferred as conditions

set for tighter market balances, not just in industrial metals

but also in crude oil. We still like gold from a diversification

angle.

UBS CIO GWM August 2020 10

Investing in Asia Pacific

Tactical views

Asset allocation

Equities

Japanese equities

Bonds

Currencies

Commodities

UBS CIO GWM August 2020 11

Investing in Asia Pacific

Tactical view

Asset allocation

Adrian Zuercher, Head APAC Asset Allocation

Crystal Zhao, Strategist

Current positions and changes

Asia ex-Japan equities most preferred

Asian IG bonds most preferred

Singapore and India most preferred, while Hong

Kong, Malaysia and Thailand least preferred

Asia investment thesis

• We continue to like Asian equities, as macro

fundamentals in the region further improve on a

sequential basis. Asia ex-Japan is up 40% since the

trough in late March, making near-term consolidation a

possibility. But the strong credit impulse and M1 growth

offer support for valuations at this initial stage of

recovery.

• In fixed income, we like Asian investment grade Earnings revision and PMI are moving in the right

bonds. The credit rating migration trend has stabilized, direction

and we believe the fallen angel risk is manageable amid Fundamental is catching up with valuation

strong fiscal and monetary support. Asia’s IG valuation 0.6 60

remains attractive, with spreads around the 75th

percentile. 0.4

55

• In equities, we like Singapore and India for their 0.2

50

value and quality. Second virus wave concerns globally

0.0

have put a pause on the style rotation, and growth

45

sectors have led the rally again. But we expect value

-0.2

markets (Singapore) to recover once such concerns

40

abate. Current positioning in growth sectors has become -0.4

very crowded. That said, we see less upside for Hong

Kong, Malaysia and Thailand. New daily confirmed cases 35

-0.6

in Hong Kong have bounced close to the March/April

high with more local transmission, putting its -0.8 30

2010 2012 2014 2016 2018 2020

consumption recovery under question as consumer

sentiment cools down again. Thailand continues to suffer Earnings revision breadth (4wma) for MSCI Asia ex-Japan (LHS)

from the standstill in international travel and weak Global manufacturing PMI (RHS)

exports. And Malaysia’s earnings momentum is still Source: Datastream, Bloomberg, UBS, as of July 2020

trailing the region's average.

UBS CIO GWM August 2020 12

Investing in Asia Pacific

Tactical view

Asia ex-Japan equities

Sundeep Gantori, Analyst

Delwin Kurnia Limas, Analyst

Key trends

• Broad-based growth expected in 2021. After a likely

0.8% contraction in earnings this year, we expect 18.0% Related reports

growth for Asia ex-Japan companies next year. India will • ASEAN's New Economy, 13 July 2020

likely lead the recovery next year, with a strong 28% • Enabling a smart China: Intelligent infrastructure,

bottom-line growth. We also expect other markets to 16 June 2020

show robust growth. North Asian markets will likely see • What do the latest restrictions on Huawei mean

a 19% rise in earnings next year, and ASEAN 16%. for its supply chain?, 18 May 2020

• FAQs from APAC investors, 11 May 2020

• Quality cyclicals to maintain the growth lead. • US-China tensions weigh on markets, 4 May 2020

Quality cyclical sectors such as IT, communication Some reports may not be available for US clients.

services and consumer discretionary will likely see their

earnings grow by 26.1% in 2021, after a projected 8.8%

rise in 2020, supported by resilient top-line growth and

margin expansion. We expect these quality cyclicals to

maintain their growth dominance versus other sectors,

which are only likely to grow by 14.5% in 2021, after a

5.1% contraction this year.

• Barbell portfolio of select laggards and quality

cyclicals continues to offer attractive risk-reward. We expect all markets to see double-digit growth

While select laggards will continue to benefit from easing next year

restrictions in the near term, we prefer a diversified CIO earnings growth forecast

exposure with quality cyclical names. Leaders from these

40%

industries will likely continue to benefit from above-region

30%

growth, supported by their scale dominance.

20%

Key investment ideas 10%

0%

Quality cyclicals: With a likely continued growth

-10%

dominance next year, we maintain our preference for

leaders in quality cyclicals (IT, communication services -20%

and consumer discretionary). -30%

-40%

Select laggards: We see tactical opportunities in

Korea

Singapore

Taiwan

China

Malaysia

Indonesia

India

Asia ex-Japan

Hong Kong

Philippines

Thailand

companies with beaten-down valuations which are

positioned to benefit from easing restrictions. These

include companies in industrials, financials, and staples.

2020

Structural themes such as China's intelligent 2021

infrastructure and ASEAN's new economy will likely get Source: Bloomberg, Factset, UBS, as of July 2020

a secular boost from the COVID-19 pandemic.

UBS CIO GWM August 2020 13

Investing in Asia Pacific

Tactical view

Japanese equities

Toru Ibayashi, Head Japan Equity

Daiju Aoki, Regional Chief Investment Officer & Chief Japan Economist

Chisa Kobayashi, Analyst

Key trends

• Corporate earnings are recovering. In the March

2020 quarter, Japanese companies lost 93% of their net Related reports

profit from the previous quarter. We expect earnings to • Japan's new mobility - Earnings drop likely short

start recovering from the June quarter into next year. and sharp, 7 May 2020

• Upside limited for next six months, 29 May 2020

• Investors already looking to next year and seeking • Four strategies to navigate the market, 25 June 2020

oversold stocks. With our expectation of 68% net Some reports may not be available for US clients.

profit recovery in the second half of this fiscal year,

investors are seeking cyclical stocks that would benefit

demand recovery.

Key investment ideas Japanese equities is driven by valuation expansion

High-quality retail companies. After the re-opening of top 10% stocks

of the economy, we think strong players will get even TOPIX500 P/BV ratio

stronger. Japanese consumer companies are offering 3.0

online promotions and opening real stores.

2.5

Avoid overvalued stocks. As liquidity in the

2.0

market has boosted large-cap stocks, we think some

top performers are over-valued. We prefer Japanese 1.5

auto firms, as they have stronger balance sheets and

are leaders in HV/EV technology. 1.0

More digital transformation is needed. As more 0.5

Jan-19

Jul-13

Aug-15

Apr-16

Sep-17

Dec-16

May-18

Jun-20

Nov-12

Oct-19

Mar-14

Nov-14

office workers need to work from home,

conferences and many business processes will likely

be moved online. This offers opportunities for TOP50 mkt cap

Japanese software companies. TOPIX500 450 mkt cap P/BV ratio

Source: Bloomberg, UBS., as of July 2020

UBS CIO GWM August 2020 14

Investing in Asia Pacific

Tactical view

Bonds

Timothy Tay, Head APAC Credit

Devinda Paranathanthri, Analyst

Key trends

• Supply back in the market. Primary market activity has

been picking up, with total issuance rising from USD 24bn Related reports

in May to USD 35bn in June. More importantly, HY • Asia HY: Go for the yield, 11 June 2020

issuance more than doubled from USD 2.4bn in May to Some reports may not be available for US clients.

USD 6.7bn in June. This is encouraging, particularly for the

lower-rated issuers to term out their debt maturities.

• Rating actions to stabilize. Negative rating actions

continued in June, led by the India sovereign downgrade.

We expect fewer negative rating actions in the coming

months, as rating agencies have completed their initial

reviews of the coronavirus's impact. We maintain our IG and HY spreads still look wide vs. recent history

default forecast at 4–5% for 2020. Spreads in bps

500 1100

• Spreads to tighten. We expect spreads to continue 450

1000

tightening in the coming months, driven by the laggards.

400

Our year-end target for IG is 220bps (vs. 253bps now) and 900

for HY is 650bps (vs. 735bps now). 350

800

300

Key investment ideas 250 700

200

China property remains our preferred exposure in 600

HY. Focus on good quality BB rated bonds that have 150

500

sold off, as well as shorter-dated bonds. May and 100

June sales have been better than the market’s toned 50

400

down expectations. Onshore and offshore bond

0 300

markets are now open for developers. Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20

BBB bonds in IG: The spreads in the BBB segment JACI IG spread (LHS, bps)

appear wide compared to historical levels. We JACI HY spread (RHS, bps)

believe there is value, particularly in state-owned Source: Bloomberg, UBS, as of 5 July 2020

names.

UBS CIO GWM August 2020 15

Investing in Asia Pacific

Tactical view

Currencies

Dominic Schnider, Head Commodities and APAC FX

Teck Leng Tan, Analyst

Key trends

• APAC currencies’ appreciation has slowed since

mid-June amid fears a second virus wave could stall the Related reports

global growth recovery. An increase in virus infections is • Long INR vs. USD: Yield carry with catch-up

likely as economies reopen, but any rise should be potential, 3 July 2020

mitigated by social control measures. So we expect the

global growth recovery is to stay on track and keep

APAC currencies on an appreciation path.

• Broad USD weakness remains the dominant

medium-term driver. The Federal Reserve has clearly

signaled that monetary policy will remain highly

accommodative for the coming years. This should keep

the USD under pressure and underpin a global growth

recovery, which bodes well for the trade-oriented APAC

region.

Key investment ideas

Yield carry with catch-up potential – Long INR

versus USD. We expect the Fed’s ultra-

Asia-Pacific currencies’ performance (versus the USD)

accommodative policy stance to weigh on the USD year-to-date

and set up a conducive environment for select yield- In %

carry strategies. The high-yielding INR, which has 3%

underperformed year-to-date, has room to rebound

2%

over the medium term.

1%

Position for growth rebound – Long KRW and

0%

JPY versus TWD. The KRW should outperform

when economic growth rebounds, given its highly -1%

pro-cyclical nature. The JPY, besides being

-2%

attractively valued, serves as a hedge against

potential risk-off sentiment. The TWD should lag the -3%

KRW in a growth rebound, and is an attractive

-4%

financing currency due to its low yield.

-5%

Short USD versus JPY. We expect broad USD

weakness and JPY appreciation. With the USD -6%

JPY

CNY

MYR

AUD

NZD

IDR

INR

PHP

SGD

Average

KRW

THB

TWD

having lost much of its yield advantage, we see room

for USDJPY to drift lower in the coming months. The

JPY is also a valuable addition to investors’ portfolios, Source: Bloomberg, UBS, as of 13 July 2020

given its safe-haven quality during market selloffs.

UBS CIO GWM August 2020 16

Investing in Asia Pacific

Tactical view

Commodities

Dominic Schnider, Head Commodities and APAC FX

Giovanni Staunovo, Analyst

Wayne Gordon, Analyst

Key trends

• We hold a low-teen return stance on commodities

over the next 12 months. Related reports

• Gold: Lifting the gold forecast, 2 July 2020

• Cyclical commodities such as energy and base • Base metals: Riding the growth recovery,

metals should drive the overall performance, 29 June 2020

benefiting from the broadening economic recovery.

Agriculture and livestock prices, overall, should stay

largely stable or move higher.

• On a more granular level, we like to be long gold,

base metals and livestock. Oil, precious metals and

select base metals can be used for volatility-selling

strategies.

Key investment ideas

Gold has been the best-performing asset this

year in US dollar terms. A number of uncertainties Market balances to tighten into 2021

make us increasingly convinced that the gold price Values in % of annual demand

can keep rising. We expect the yellow metal to trade 8%

at USD 1,900/oz in 2H20. Risks such as new waves

6%

of COVID-19, further policy tweaks by the Fed, and

rising tensions between the US and China underpin 4%

our view. Hence, we remain long gold and continue

to see it as a valuable insurance asset. 2%

0%

Better-than-expected macroeconomic data

across the globe and ongoing production -2%

challenges have tightened market balances and

supported base metal prices since late March. -4%

With a rather firm economic bounce likely in 2H20,

-6%

albeit from very depressed levels in 1H20, conditions

are set for tighter market balances, not just in the -8%

metals but also in crude oil, and higher prices ahead, Aluminum Copper Nickel Zinc Lead

in our view. We recommend investors to take on 2018 2019

broad base metal exposure via second generation 2020E 2021E

commodity indexes. Also, we continue to see value

Source: Wood Mackenzie, UBS, as of July 2020

in selling the downside price risks in nickel.

UBS CIO GWM August 2020 17

Investing in Asia Pacific

Asset class preferences

As of 17 July 2020

Least preferred Neutral Most preferred

Liquidity

Global equities

Equities total

United States

Eurozone

Switzerland

Emerging markets

Japan

United Kingdom

Asian equities

Asia ex-Japan equities

China

Hong Kong

India

Indonesia

South Korea

Malaysia

Philippines

Singapore

Taiwan

Thailand

Bonds

Bonds total

High grade bonds

High yield bonds

Investment grade bonds

Emerging market bonds

Asian investment grade bonds (USD)

Asian high yield bonds (USD)

Commodities

Commodities total

Oil

Gold

Foreign exchange

USD

EUR

JPY

GBP

CHF

Note: These preferences are designed for a global investor who can hedge foreign currency fluctuations. For models that are tailored to US investors, please see UBS House View:

Investment Strategy Guide.

Source: UBS

UBS CIO GWM August 2020 18

Investing in Asia Pacific

UBS APAC forecasts

APAC economic forecasts

% change y/y

GDP CPI

2018 2019 2020E 2021E 2018 2019 2020E 2021E

Australia 2.8 1.8 –4.2 3.0 1.9 1.6 0.3 1.0

New Zealand 3.2 2.3 –9.3 7.8 1.6 1.6 1.1 0.8

China 6.7 6.1 1.5 7.5 2.1 2.9 2.4 1.9

Vietnam 7.1 7.0 2.0 7.1 3.5 2.8 3.2 2.8

Indonesia 5.2 5.0 –3.0 4.5 3.3 2.8 2.6 2.9

Malaysia 4.8 4.3 –5.5 5.2 1.0 0.7 –1.6 0.9

Philippines 6.3 6.0 –10.2 8.0 5.2 2.5 2.3 2.5

Thailand 4.2 2.4 –5.1 6.0 1.1 0.7 –2.1 0.2

South Korea 2.7 2.0 –2.0 4.8 1.5 0.4 0.7 1.4

Taiwan 2.6 2.7 –1.4 3.6 1.3 0.6 1.5 1.3

India 6.1 4.2 –5.8 7.3 3.4 4.8 3.8 4.1

Singapore 3.4 0.7 –7.3 7.0 0.4 0.6 –0.5 1.0

Hong Kong 3.0 –1.2 –6.8 4.9 2.4 2.9 0.3 0.9

Japan 0.3 0.7 –5.8 2.8 1.0 0.5 –0.1 –0.2

Asia ex-Japan 6.0 5.1 –1.4 6.9 2.4 3.0 2.4 2.4

APAC 5.3 4.6 –1.9 6.5 2.3 2.7 2.1 2.1

Source: UBS, as of 15 July 2020

UBS CIO GWM August 2020 19

Investing in Asia Pacific

UBS APAC forecasts

APAC currencies versus the USD

We expect APAC currencies to strengthen gradually versus the greenback

13-Jul-20 Sep-20 Dec-20 Mar-21 Jun-21

USDCNY 7.00 6.80 6.80 6.70 6.70

USDINR 75.1 77.0 75.0 73.0 73.0

USDIDR 14,445 14,600 14,400 14,200 14,000

USDKRW 1,201 1,180 1,160 1,140 1,140

USDMYR 4.26 4.35 4.25 4.20 4.20

USDPHP 49.4 50.5 50.5 50.5 50.5

USDSGD 1.39 1.40 1.39 1.38 1.38

USDTWD 29.5 30.0 29.8 29.6 29.4

USDTHB 31.3 32.5 32.5 32.0 32.0

AUDUSD 0.70 0.70 0.71 0.72 0.73

NZDUSD 0.66 0.62 0.64 0.66 0.67

USDJPY 107 104 104 104 104

Source: Bloomberg, UBS, as of 13 July 2020

UBS CIO GWM August 2020 20

Investing in Asia Pacific

Investment spotlight

Asian high yield bonds and

long Indian rupee

Current valuations for the INR remain attractive as India’s idiosyncratic risks

relating to virus containment, its rating downgrade, and its current account deficit

have been priced in.

Carl Berrisford, Analyst

Asia high yield bonds offer an attractive yield spread of We have become positive on the Indian rupee, which has

about 735bps, which is historically elevated. We expect it lagged other APAC currencies in recent months. We

to tighten further, driven by the global cyclical recovery as recommend going long INR versus the USD, with a 7%

economies continue to gradually re-open and the rally forecast return over the next 12months, half of which will be

broadens to lower-rated, more cyclical segments. We yield carry and the other half spot appreciation. We think the

foresee the spread tightening to 650bps by December yield carry environment in Asia has improved with the Fed

2020. Global monetary and fiscal policy support has helped likely to remain accommodative for some time. Current

to ensure liquidity issues do not become solvency issues for valuations for the INR remain attractive as India’s idiosyncratic

companies that were viable before the crisis. In particular, risks relating to virus containment, its rating downgrade, and

the Fed's pledge of unlimited quantitative easing (QE), the its current account deficit have been priced in.

roll-out of USD swap lines and credit market programs

have eased global USD liquidity concerns and reduced the Historically, sharp INR depreciation has been precipitated

tail-risk for credit. And while we expect default rates to by high inflation and deeply negative current account

increase to 4–5% over the coming 12 months, this has dynamics. Our outlook for the CPI is in the mid-single

been priced in. Key stressed sectors are oil and gas and digits, while the current account is expected to remain only

cyclicals, as well as some of the single-B segments modestly negative in the low-single digits. Historically,

comprising just 13% of the index. The core of the index going short USDINR on large rallies has delivered positive

exposure is to China with an index weighting of close to 12-month total returns.

60%, where we hold a more stable view, particularly on

the Chinese property sector. We expect Asia HY to deliver

returns of around 12% in our base case over the coming

12 months. USDINR exchange rate, forward rate, and forecasts

We expect USDINR to drift lower toward 73 over the next 12 months

80

78

76

We have become positive on Indian 74

rupee, which has lagged other 72

APAC currencies year-to-date and 70

forecast a 7% return over 12 months. 68

66

• The INR's yield carry will likely improve as the 64

Fed is likely to remain accommodative for an 62

extended period 60

Jun-16 Jun-17 Jun-18 Jun-19 Jun-20 Jun-21

• India's CPI and current account deficit are USDINR USDINR forecast

forecast to remain modest USDINR forward rate

Source: Bloomberg, UBS, as of July 2020

UBS CIO GWM August 2020 21

Investing in Asia Pacific

Emerging Market Investments

Investors should be aware that Emerging Market assets are subject to, amongst others, potential risks linked to currency volatility, abrupt

changes in the cost of capital and the economic growth outlook, as well as regulatory and socio-political risk, interest rate risk and higher credit

risk. Assets can sometimes be very illiquid and liquidity conditions can abruptly worsen. CIO GWM generally recommends only those securities it

believes have been registered under Federal U.S. registration rules (Section 12 of the Securities Exchange Act of 1934) and individual State

registration rules (commonly known as “Blue Sky” laws). Prospective investors should be aware that to the extent permitted under US law, CIO

GWM may from time to time recommend bonds that are not registered under US or State securities laws. These bonds may be issued in

jurisdictions where the level of required disclosures to be made by issuers is not as frequent or complete as that required by US laws.

For more background on emerging markets generally, see the CIO GWM Education Notes, Emerging Market Bonds: Understanding Emerging

Market Bonds, 12 August 2009 and Emerging Markets Bonds: Understanding Sovereign Risk, 17 December 2009.

Investors interested in holding bonds for a longer period are advised to select the bonds of those sovereigns with the highest credit ratings (in the

investment grade band). Such an approach should decrease the risk that an investor could end up holding bonds on which the sovereign has

defaulted. Sub-investment grade bonds are recommended only for clients with a higher risk tolerance and who seek to hold higher yielding

bonds for shorter periods only.

UBS Chief Investment Office's ("CIO") investment views are prepared and published by the Global Wealth Management business of UBS

Switzerland AG (regulated by FINMA in Switzerland) or its affiliates ("UBS").

The investment views have been prepared in accordance with legal requirements designed to promote the independence of investment

research.

Generic investment research – Risk information:

This publication is for your information only and is not intended as an offer, or a solicitation of an offer, to buy or sell any investment or other

specific product. The analysis contained herein does not constitute a personal recommendation or take into account the particular investment

objectives, investment strategies, financial situation and needs of any specific recipient. It is based on numerous assumptions. Different

assumptions could result in materially different results. Certain services and products are subject to legal restrictions and cannot be offered

worldwide on an unrestricted basis and/or may not be eligible for sale to all investors. All information and opinions expressed in this document

were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its

accuracy or completeness (other than disclosures relating to UBS). All information and opinions as well as any forecasts, estimates and market

prices indicated are current as of the date of this report, and are subject to change without notice. Opinions expressed herein may differ or be

contrary to those expressed by other business areas or divisions of UBS as a result of using different assumptions and/or criteria.

In no circumstances may this document or any of the information (including any forecast, value, index or other calculated amount ("Values")) be

used for any of the following purposes (i) valuation or accounting purposes; (ii) to determine the amounts due or payable, the price or the value

of any financial instrument or financial contract; or (iii) to measure the performance of any financial instrument including, without limitation, for

the purpose of tracking the return or performance of any Value or of defining the asset allocation of portfolio or of computing performance fees.

By receiving this document and the information you will be deemed to represent and warrant to UBS that you will not use this document or

otherwise rely on any of the information for any of the above purposes. UBS and any of its directors or employees may be entitled at any time to

hold long or short positions in investment instruments referred to herein, carry out transactions involving relevant investment instruments in the

capacity of principal or agent, or provide any other services or have officers, who serve as directors, either to/for the issuer, the investment

instrument itself or to/for any company commercially or financially affiliated to such issuers. At any time, investment decisions (including whether

to buy, sell or hold securities) made by UBS and its employees may differ from or be contrary to the opinions expressed in UBS research

publications. Some investments may not be readily realizable since the market in the securities is illiquid and therefore valuing the investment and

identifying the risk to which you are exposed may be difficult to quantify. UBS relies on information barriers to control the flow of information

contained in one or more areas within UBS, into other areas, units, divisions or affiliates of UBS. Futures and options trading is not suitable for

every investor as there is a substantial risk of loss, and losses in excess of an initial investment may occur. Past performance of an investment is no

guarantee for its future performance. Additional information will be made available upon request. Some investments may be subject to sudden

and large falls in value and on realization you may receive back less than you invested or may be required to pay more. Changes in foreign

exchange rates may have an adverse effect on the price, value or income of an investment. The analyst(s) responsible for the preparation of this

report may interact with trading desk personnel, sales personnel and other constituencies for the purpose of gathering, synthesizing and

interpreting market information.

Tax treatment depends on the individual circumstances and may be subject to change in the future. UBS does not provide legal or tax advice and

makes no representations as to the tax treatment of assets or the investment returns thereon both in general or with reference to specific client's

circumstances and needs. We are of necessity unable to take into account the particular investment objectives, financial situation and needs of

our individual clients and we would recommend that you take financial and/or tax advice as to the implications (including tax) of investing in any

of the products mentioned herein.

This material may not be reproduced or copies circulated without prior authority of UBS. Unless otherwise agreed in writing UBS expressly

prohibits the distribution and transfer of this material to third parties for any reason. UBS accepts no liability whatsoever for any claims or

lawsuits from any third parties arising from the use or distribution of this material. This report is for distribution only under such circumstances as

may be permitted by applicable law. For information on the ways in which CIO manages conflicts and maintains independence of its investment

views and publication offering, and research and rating methodologies, please visit www.ubs.com/research. Additional information on the

relevant authors of this publication and other CIO publication(s) referenced in this report; and copies of any past reports on this topic; are

available upon request from your client advisor.

UBS CIO GWM August 2020 22

Investing in Asia Pacific

Options and futures are not suitable for all investors, and trading in these instruments is considered risky and may be appropriate only for

sophisticated investors. Prior to buying or selling an option, and for the complete risks relating to options, you must receive a copy of

"Characteristics and Risks of Standardized Options". You may read the document at https://www.theocc.com/about/publications/character-

risks.jsp or ask your financial advisor for a copy.

Investing in structured investments involves significant risks. For a detailed discussion of the risks involved in investing in any particular structured

investment, you must read the relevant offering materials for that investment. Structured investments are unsecured obligations of a particular

issuer with returns linked to the performance of an underlying asset. Depending on the terms of the investment, investors could lose all or a

substantial portion of their investment based on the performance of the underlying asset. Investors could also lose their entire investment if the

issuer becomes insolvent. UBS Financial Services Inc. does not guarantee in any way the obligations or the financial condition of any issuer or the

accuracy of any financial information provided by any issuer. Structured investments are not traditional investments and investing in a structured

investment is not equivalent to investing directly in the underlying asset. Structured investments may have limited or no liquidity, and investors

should be prepared to hold their investment to maturity. The return of structured investments may be limited by a maximum gain, participation

rate or other feature. Structured investments may include call features and, if a structured investment is called early, investors would not earn any

further return and may not be able to reinvest in similar investments with similar terms. Structured investments include costs and fees which are

generally embedded in the price of the investment. The tax treatment of a structured investment may be complex and may differ from a direct

investment in the underlying asset. UBS Financial Services Inc. and its employees do not provide tax advice. Investors should consult their own tax

advisor about their own tax situation before investing in any securities.

Important Information About Sustainable Investing Strategies: Sustainable investing strategies aim to consider and incorporate environmental,

social and governance (ESG) factors into investment process and portfolio construction. Strategies across geographies and styles approach ESG analysis

and incorporate the findings in a variety of ways. Incorporating ESG factors or Sustainable Investing considerations may inhibit the portfolio manager’s

ability to participate in certain investment opportunities that otherwise would be consistent with its investment objective and other principal investment

strategies. The returns on a portfolio consisting primarily of sustainable investments may be lower or higher than portfolios where ESG factors, exclusions,

or other sustainability issues are not considered by the portfolio manager, and the investment opportunities available to such portfolios may differ.

Companies may not necessarily meet high performance standards on all aspects of ESG or sustainable investing issues; there is also no guarantee that any

company will meet expectations in connection with corporate responsibility, sustainability, and/or impact performance.

Distributed to US persons by UBS Financial Services Inc. or UBS Securities LLC, subsidiaries of UBS AG. UBS Switzerland AG, UBS Europe SE, UBS Bank, S.A.,

UBS Brasil Administradora de Valores Mobiliarios Ltda, UBS Asesores Mexico, S.A. de C.V., UBS Securities Japan Co., Ltd, UBS Wealth Management Israel Ltd

and UBS Menkul Degerler AS are affiliates of UBS AG. UBS Financial Services Incorporated of Puerto Rico is a subsidiary of UBS Financial Services Inc. UBS

Financial Services Inc. accepts responsibility for the content of a report prepared by a non-US affiliate when it distributes reports to US

persons. All transactions by a US person in the securities mentioned in this report should be effected through a US-registered broker dealer

affiliated with UBS, and not through a non-US affiliate. The contents of this report have not been and will not be approved by any securities

or investment authority in the United States or elsewhere. UBS Financial Services Inc. is not acting as a municipal advisor to any municipal

entity or obligated person within the meaning of Section 15B of the Securities Exchange Act (the "Municipal Advisor Rule") and the opinions

or views contained herein are not intended to be, and do not constitute, advice within the meaning of the Municipal Advisor Rule.

External Asset Managers / External Financial Consultants: In case this research or publication is provided to an External Asset Manager or

an External Financial Consultant, UBS expressly prohibits that it is redistributed by the External Asset Manager or the External Financial Consultant

and is made available to their clients and/or third parties.

Austria: This publication is not intended to constitute a public offer under Austrian law. It is distributed only for information purposes to clients of UBS

Europe SE, Niederlassung Österreich, with place of business at Wächtergasse 1, A-1010 Wien. UBS Europe SE, Niederlassung Österreich is subject to the

joint supervision of the European Central Bank ("ECB"), the German Central Bank (Deutsche Bundesbank), the German Federal Financial Services

Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht), as well as of the Austrian Financial Market Authority (Finanzmarktaufsicht), to

which this publication has not been submitted for approval. UBS Europe SE is a credit institution constituted under German law in the form of a Societas

Europaea, duly authorized by the ECB. Bahrain: UBS is a Swiss bank not licensed, supervised or regulated in Bahrain by the Central Bank of Bahrain and

does not undertake banking or investment business activities in Bahrain. Therefore, clients have no protection under local banking and investment services

laws and regulations. Brazil: This publication is not intended to constitute a public offer under Brazilian law or a research analysis report as per the

definition contained under the Comissão de Valores Mobiliários ("CVM") Instruction 598/2018. It is distributed only for information purposes to clients of

UBS Brasil Administradora de Valores Mobiliários Ltda. and/or of UBS Consenso Investimentos Ltda., entities regulated by CVM. Canada: In Canada, this

publication is distributed to clients of UBS Wealth Management Canada by UBS Investment Management Canada Inc.. China: This report is prepared by

UBS Switzerland AG or its offshore subsidiary or affiliate (collectively as "UBS Offshore"). UBS Offshore is an entity incorporated out of China and is not

licensed, supervised or regulated in China to carry out banking or securities business. The recipient should not contact the analysts or UBS Offshore which

produced this report for advice as they are not licensed to provide securities investment advice in China. UBS Investment Bank (including Research) has its

own wholly independent research and views which at times may vary from the views of UBS Global Wealth Management. This report shall not be

regarded as providing specific securities related analysis. The recipient should not use this document or otherwise rely on any of the information contained

in this report in making investment decisions and UBS takes no responsibility in this regard. Czech Republic: UBS is not a licensed bank in the Czech

Republic and thus is not allowed to provide regulated banking or investment services in the Czech Republic. Please notify UBS if you do not wish to

receive any further correspondence. Denmark: This publication is not intended to constitute a public offer under Danish law. It is distributed only for

information purposes to clients of UBS Europe SE, Denmark Branch, filial af UBS Europe SE, with place of business at Sankt Annae Plads 13, 1250

Copenhagen, Denmark, registered with the Danish Commerce and Companies Agency, under No. 38 17 24 33. UBS Europe SE, Denmark Branch, filial af

UBS Europe SE is subject to the joint supervision of the European Central Bank ("ECB"), the German Central Bank (Deutsche Bundesbank), the German

Federal Financial Services Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht), as well as of the Danish Financial Supervisory Authority

(Finanstilsynet), to which this publication has not been submitted for approval. UBS Europe SE is a credit institution constituted under German law in the

form of a Societas Europaea, duly authorized by the ECB. France: This publication is distributed by UBS (France) S.A., French "société anonyme" with

share capital of € 132.975.556, 69, boulevard Haussmann F-75008 Paris, R.C.S. Paris B 421 255 670, to its clients and prospects. UBS (France) S.A. is a

provider of investment services duly authorized according to the terms of the "Code Monétaire et Financier", regulated by French banking and financial

authorities as the "Autorité de Contrôle Prudentiel et de Résolution". Germany: This publication is not intended to constitute a public offer under

German law. It is distributed only for information purposes to clients of UBS Europe SE, Germany, with place of business at Bockenheimer Landstrasse 2-

UBS CIO GWM August 2020 23

Investing in Asia Pacific

4, 60306 Frankfurt am Main. UBS Europe SE is a credit institution constituted under German law in the form of a Societas Europaea, duly authorized by

the European Central Bank ("ECB"), and supervised by the ECB, the German Central Bank (Deutsche Bundesbank) and the German Federal Financial

Services Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht), to which this publication has not been submitted for approval.

Greece: UBS Switzerland AG and its affiliates (UBS) are not licensed as a bank or financial institution under Greek legislation and do not provide banking

and financial services in Greece. Consequently, UBS provides such services from branches outside of Greece, only. This document may not be considered

as a public offering made or to be made to residents of Greece. Hong Kong: This publication is distributed to clients of UBS AG Hong Kong Branch by

UBS AG Hong Kong Branch, a licensed bank under the Hong Kong Banking Ordinance and a registered institution under the Securities and Futures

Ordinance. UBS AG Hong Kong Branch is incorporated in Switzerland with limited liability. India: UBS Securities India Private Ltd. (Corporate Identity

Number U67120MH1996PTC097299) 2/F, 2 North Avenue, Maker Maxity, Bandra Kurla Complex, Bandra (East), Mumbai (India) 400051. Phone:

+912261556000. It provides brokerage services bearing SEBI Registration Number INZ000259830; merchant banking services bearing SEBI Registration

Number: INM000010809 and Research Analyst services bearing SEBI Registration Number: INH000001204. UBS AG, its affiliates or subsidiaries may have

debt holdings or positions in the subject Indian company/companies. Within the past 12 months, UBS AG, its affiliates or subsidiaries may have received

compensation for non-investment banking securities-related services and/or non-securities services from the subject Indian company/companies. The

subject company/companies may have been a client/clients of UBS AG, its affiliates or subsidiaries during the 12 months preceding the date of distribution

of the research report with respect to investment banking and/or non-investment banking securities-related services and/or non-securities services. With

regard to information on associates, please refer to the Annual Report at:

http://www.ubs.com/global/en/about_ubs/investor_relations/annualreporting.html. Indonesia, Malaysia, Philippines, Thailand: This material was

provided to you as a result of a request received by UBS from you and/or persons entitled to make the request on your behalf. Should you have received

the material erroneously, UBS asks that you kindly destroy/delete it and inform UBS immediately. Any and all advice provided and/or trades executed by

UBS pursuant to the material will only have been provided upon your specific request or executed upon your specific instructions, as the case may be, and

may be deemed as such by UBS and you. The material may not have been reviewed, approved, disapproved or endorsed by any financial or regulatory

authority in your jurisdiction. The relevant investments will be subject to restrictions and obligations on transfer as set forth in the material, and by

receiving the material you undertake to comply fully with such restrictions and obligations. You should carefully study and ensure that you understand

and exercise due care and discretion in considering your investment objective, risk appetite and personal circumstances against the risk of the investment.

You are advised to seek independent professional advice in case of doubt. Israel: UBS is a premier global financial firm offering wealth management,

asset management and investment banking services from its headquarters in Switzerland and its operations in over 50 countries worldwide to individual,

corporate and institutional investors. In Israel, UBS Switzerland AG is registered as Foreign Dealer in cooperation with UBS Wealth Management Israel Ltd.,

a wholly owned UBS subsidiary. UBS Wealth Management Israel Ltd. is a Portfolio Manager licensee which engages also in Investment Marketing and is

regulated by the Israel Securities Authority. This publication is intended for information only and is not intended as an offer to buy or solicitation of an

offer. Furthermore, this publication is not intended as an investment advice and/or investment marketing and is not replacing any investment advice

and/or investment marketing provided by the relevant licensee which is adjusted to each person needs. The word "advice" and/or any of its derivatives

shall be read and construed in conjunction with the definition of the term "investment marketing" as defined under the Israeli Regulation of Investment

Advice, Investment Marketing and Portfolio Management Law, 1995.Italy: This publication is not intended to constitute a public offer under Italian law. It

is distributed only for information purposes to clients of UBS Europe SE, Succursale Italia, with place of business at Via del Vecchio Politecnico, 3-20121

Milano. UBS Europe SE, Succursale Italia is subject to the joint supervision of the European Central Bank ("ECB"), the German Central Bank (Deutsche

Bundesbank), the German Federal Financial Services Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht), as well as of the Bank of Italy

(Banca d’Italia) and the Italian Financial Markets Supervisory Authority (CONSOB - Commissione Nazionale per le Società e la Borsa), to which this

publication has not been submitted for approval. UBS Europe SE is a credit institution constituted under German law in the form of a Societas Europaea,

duly authorized by the ECB. Jersey: UBS AG, Jersey Branch, is regulated and authorized by the Jersey Financial Services Commission for the conduct of

banking, funds and investment business. Where services are provided from outside Jersey, they will not be covered by the Jersey regulatory regime. UBS

AG, Jersey Branch is a branch of UBS AG a public company limited by shares, incorporated in Switzerland whose registered offices are at Aeschenvorstadt

1, CH-4051 Basel and Bahnhofstrasse 45, CH 8001 Zurich. UBS AG, Jersey Branch's principal place business is 1, IFC Jersey, St Helier, Jersey, JE2 3BX.

Luxembourg: This publication is not intended to constitute a public offer under Luxembourg law. It is distributed only for information purposes to clients

of UBS Europe SE, Luxembourg Branch, with place of business at 33A, Avenue J. F. Kennedy, L-1855 Luxembourg. UBS Europe SE, Luxembourg Branch is

subject to the joint supervision of the European Central Bank ("ECB"), the German Central bank (Deutsche Bundesbank), the German Federal Financial

Services Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht), as well as of the Luxembourg supervisory authority (Commission de

Surveillance du Secteur Financier), to which this publication has not been submitted for approval. UBS Europe SE is a credit institution constituted under

German law in the form of a Societas Europaea, duly authorized by the ECB. Mexico: This information is distributed by UBS Asesores México, S.A. de

C.V. ("UBS Asesores"), an affiliate of UBS Switzerland AG, incorporated as a non-independent investment advisor under the Securities Market Law due to

the relation with a Foreign Bank. UBS Asesores is a regulated entity and it is subject to the supervision of the Mexican Banking and Securities Commission

("CNBV"), which exclusively regulates UBS Asesores regarding the rendering of portfolio management, as well as on securities investment advisory

services, analysis and issuance of individual investment recommendations, so that the CNBV has no surveillance faculties nor may have over any other

service provided by UBS Asesores. UBS Asesores is registered before CNBV under Registry number 30060. You are being provided with this UBS

publication or material because you have indicated to UBS Asesores that you are a Sophisticated Qualified Investor located in Mexico. The compensation

of the analyst(s) who prepared this report is determined exclusively by research management and senior management of any entity of UBS Group to

which such analyst(s) render services. Nigeria: UBS Switzerland AG and its affiliates (UBS) are not licensed, supervised or regulated in Nigeria by the

Central Bank of Nigeria or the Nigerian Securities and Exchange Commission and do not undertake banking or investment business activities in Nigeria.

Poland: UBS is a premier global financial services firm offering wealth management services to individual, corporate and institutional investors. UBS is

established in Switzerland and operates under Swiss law and in over 50 countries and from all major financial centres. UBS Switzerland AG is not licensed

as a bank or as an investment firm under Polish legislation and is not permitted to provide banking and financial services in Poland.

Portugal: UBS Switzerland AG is not licensed to conduct banking and financial activities in Portugal nor is UBS Switzerland AG supervised by the

portuguese regulators (Bank of Portugal "Banco de Portugal" and Portuguese Securities Exchange Commission "Comissão do Mercado de Valores

Mobiliários"). Singapore: This material was provided to you as a result of a request received by UBS from you and/or persons entitled to make the

request on your behalf. Should you have received the material erroneously, UBS asks that you kindly destroy/delete it and inform UBS immediately. Clients

of UBS AG Singapore branch are asked to please contact UBS AG Singapore branch, an exempt financial adviser under the Singapore Financial Advisers

Act (Cap. 110) and a wholesale bank licensed under the Singapore Banking Act (Cap. 19) regulated by the Monetary Authority of Singapore, in respect of

any matters arising from, or in connection with, the analysis or report. Spain: This publication is not intended to constitute a public offer under Spanish

law. It is distributed only for information purposes to clients of UBS Europe SE, Sucursal en España, with place of business at Calle María de Molina 4, C.P.

28006, Madrid. UBS Europe SE, Sucursal en España is subject to the joint supervision of the European Central Bank ("ECB"), the German Central bank

(Deutsche Bundesbank), the German Federal Financial Services Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht), as well as of the

UBS CIO GWM August 2020 24

Investing in Asia Pacific

Spanish supervisory authority (Banco de España), to which this publication has not been submitted for approval. Additionally it is authorized to provide

investment services on securities and financial instruments, regarding which it is supervised by the Comisión Nacional del Mercado de Valores as well. UBS

Europe SE, Sucursal en España is a branch of UBS Europe SE, a credit institution constituted under German law in the form of a Societas Europaea, duly

authorized by the ECB. Sweden: This publication is not intended to constitute a public offer under Swedish law. It is distributed only for information

purposes to clients of UBS Europe SE, Sweden Bankfilial, with place of business at Regeringsgatan 38, 11153 Stockholm, Sweden, registered with the

Swedish Companies Registration Office under Reg. No 516406-1011. UBS Europe SE, Sweden Bankfilial is subject to the joint supervision of the European

Central Bank ("ECB"), the German Central bank (Deutsche Bundesbank), the German Federal Financial Services Supervisory Authority (Bundesanstalt für

Finanzdienstleistungsaufsicht), as well as of the Swedish supervisory authority (Finansinspektionen), to which this publication has not been submitted for

approval. UBS Europe SE is a credit institution constituted under German law in the form of a Societas Europaea, duly authorized by the ECB. Taiwan:

This material is provided by UBS AG, Taipei Branch in accordance with laws of Taiwan, in agreement with or at the request of clients/prospects. UAE: UBS

is not licensed in the UAE by the Central Bank of UAE or by the Securities & Commodities Authority. The UBS AG Dubai Branch is licensed in the DIFC by

the Dubai Financial Services Authority as an authorised firm. UK: This document is issued by UBS Wealth Management, a division of UBS AG which is

authorised and regulated by the Financial Market Supervisory Authority in Switzerland. In the United Kingdom, UBS AG is authorised by the Prudential

Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details

about the extent of regulation by the Prudential Regulation Authority are available from us on request. A member of the London Stock Exchange. This

publication is distributed to retail clients of UBS Wealth Management.

Version A/2020. CIO82652744

UBS 2020. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved.

UBS CIO GWM August 2020 25

You might also like

- BFC2751 2021 S1 Final Exam FeedbackDocument3 pagesBFC2751 2021 S1 Final Exam FeedbackYiyun ZhuNo ratings yet

- Mushroom ProductionDocument34 pagesMushroom ProductionFELIX PAULINO III SARAUSOSNo ratings yet

- CIOInsights 3 Q21Document156 pagesCIOInsights 3 Q21Zack TangNo ratings yet

- India Outlook StanC 10sep22Document14 pagesIndia Outlook StanC 10sep22Piyush PatilNo ratings yet

- DBS Flash: Asia Rates: Flows, Positioning & Valuation (June 2022)Document10 pagesDBS Flash: Asia Rates: Flows, Positioning & Valuation (June 2022)AdamZawNo ratings yet

- A Macro Summer 1716818199Document27 pagesA Macro Summer 1716818199AschNo ratings yet

- AI - Asia Insights: Thinking The UnthinkableDocument15 pagesAI - Asia Insights: Thinking The Unthinkableapi-3758934No ratings yet

- CIO Monthly Extended - en - 1599738Document46 pagesCIO Monthly Extended - en - 1599738mark.qianNo ratings yet

- India - A Land of Many (Re) Turns: EquitiesDocument2 pagesIndia - A Land of Many (Re) Turns: EquitiesSaad AliNo ratings yet

- A Bos 20155Document37 pagesA Bos 20155Nurul Lang HastraNo ratings yet

- India: Financial Services: Still Amid Choppy Waters Stocks Not Yet Ready For UpturnDocument25 pagesIndia: Financial Services: Still Amid Choppy Waters Stocks Not Yet Ready For UpturnPranjayNo ratings yet

- BCA - Gis So 2014 12 12 PDFDocument32 pagesBCA - Gis So 2014 12 12 PDFJBNo ratings yet

- Alliance Bank PublicationDocument13 pagesAlliance Bank PublicationThomas Neo AndersonNo ratings yet

- India Monthly Outlook by UBSDocument7 pagesIndia Monthly Outlook by UBSSumanth GururajNo ratings yet

- Standard Chartered Q2 Quarterly Outlook 2024 1712522269Document35 pagesStandard Chartered Q2 Quarterly Outlook 2024 1712522269Ranny ChooNo ratings yet

- GS - Asia Credit Line - 2022 Outlook - Mostly Low Returns, Managing China Property Exposure The DifferentiatorDocument20 pagesGS - Asia Credit Line - 2022 Outlook - Mostly Low Returns, Managing China Property Exposure The Differentiator献文No ratings yet

- CMO BofA 02-12-2024 AdaDocument8 pagesCMO BofA 02-12-2024 AdaAlejandroNo ratings yet

- Asia-Pac Credit Insights Get Ready For A Bumpy SummerDocument106 pagesAsia-Pac Credit Insights Get Ready For A Bumpy SummerGeeta ShahNo ratings yet

- NewsDocument7 pagesNewsJignesh Jagjivanbhai PatelNo ratings yet

- Japan - A Land of Mystery A Land of Opportunity For Property InvestorsDocument4 pagesJapan - A Land of Mystery A Land of Opportunity For Property InvestorsMuhammad Faisal Bin MahmoodNo ratings yet

- APAC Outlook2013Document32 pagesAPAC Outlook2013Goro ZhouNo ratings yet

- Sanctum - Investment-Outlook - 2020Document68 pagesSanctum - Investment-Outlook - 2020digbijay22No ratings yet

- Advisor BrochureDocument8 pagesAdvisor Brochurepanwar.vipin@gmail.comNo ratings yet

- Global FX StrategyDocument3 pagesGlobal FX StrategyFarhan ShariarNo ratings yet

- PVB Global Market Outlook in Brief Playing It Safe 16 December 2022Document10 pagesPVB Global Market Outlook in Brief Playing It Safe 16 December 2022DBANo ratings yet

- DSP Anup Maheshwari QuestionnaireDocument1 pageDSP Anup Maheshwari QuestionnaireAditya BahlNo ratings yet

- 529 Plans Quarterly CommentaryDocument4 pages529 Plans Quarterly CommentaryLưuVănViếtNo ratings yet

- Global Market Outlook: H2 Outlook: Should I Stay, or ?Document21 pagesGlobal Market Outlook: H2 Outlook: Should I Stay, or ?wesamNo ratings yet

- 19th ANNUAL CEO TRACK RECORDDocument91 pages19th ANNUAL CEO TRACK RECORDChetan ChouguleNo ratings yet

- Annualreport16 17 1Document312 pagesAnnualreport16 17 1Anonymous DfSizzc4lNo ratings yet

- (Internal Use Only) Factsheet - DBSDocument2 pages(Internal Use Only) Factsheet - DBSGuan JooNo ratings yet

- GreatlinkenhancerfundDocument2 pagesGreatlinkenhancerfundswifthawkNo ratings yet

- Insights IndiaDocument7 pagesInsights IndialifeNo ratings yet

- HSL - Invest Right - March 2020 - New - 1-202003171449089436761Document14 pagesHSL - Invest Right - March 2020 - New - 1-202003171449089436761faizahamed111No ratings yet

- BOFA Market Outlook (2 May 2022)Document8 pagesBOFA Market Outlook (2 May 2022)Li Man KitNo ratings yet

- Think FundsIndia October 2018Document10 pagesThink FundsIndia October 2018dahigaonkarNo ratings yet

- White Star Capital - Japan VC ReportDocument35 pagesWhite Star Capital - Japan VC ReportWhite Star CapitalNo ratings yet

- UBS IBD Asia Pacific ViewDocument16 pagesUBS IBD Asia Pacific Viewvishwasmaheshwari10No ratings yet

- Information Bite 15mar8Document4 pagesInformation Bite 15mar8information.biteNo ratings yet

- BNP Paribas Mid Cap Fund: Young Spark Today. Grandmaster TomorrowDocument2 pagesBNP Paribas Mid Cap Fund: Young Spark Today. Grandmaster TomorrowPrasad Dhondiram Zinjurde PatilNo ratings yet

- Fidelity International: Market OutlookDocument5 pagesFidelity International: Market Outlooklordmaster65No ratings yet

- Annual Market Outlook 2019 RWMLDocument33 pagesAnnual Market Outlook 2019 RWMLBhavesh UmraniaNo ratings yet

- Capital Market OutlookDocument8 pagesCapital Market OutlookrockerhoonNo ratings yet

- Aia Annual Funds Report 2021Document182 pagesAia Annual Funds Report 2021Navin IndranNo ratings yet

- CMO BofA 07-24-2023 AdaDocument8 pagesCMO BofA 07-24-2023 AdaAlejandroNo ratings yet

- PC - India Growth Model - Nov 2023 20231121123839Document60 pagesPC - India Growth Model - Nov 2023 20231121123839Deepul WadhwaNo ratings yet

- Marketing Brochure TradePlus S&P New China Tracker - July 2019 (English)Document14 pagesMarketing Brochure TradePlus S&P New China Tracker - July 2019 (English)Alyssa AnnNo ratings yet

- IB Directory 2010Document73 pagesIB Directory 2010Ruchik Doshi0% (1)

- SPM Sisop Strategy Sep 2022Document4 pagesSPM Sisop Strategy Sep 2022Ally Bin AssadNo ratings yet

- Tracking The World Economy... - 09/04/2010Document2 pagesTracking The World Economy... - 09/04/2010Rhb InvestNo ratings yet

- Colliers APAC Hotel Insights Q2 2021 - Updated0604Document20 pagesColliers APAC Hotel Insights Q2 2021 - Updated0604nguyen minhanhNo ratings yet

- J.P. Morgan Private Bank Outlook 2021Document79 pagesJ.P. Morgan Private Bank Outlook 2021FredNo ratings yet

- What We Are Reading - Volume 2.097Document88 pagesWhat We Are Reading - Volume 2.097Dhar RakulNo ratings yet

- Niveshak October 2009Document28 pagesNiveshak October 2009sarvshwetNo ratings yet

- Maybank - Six Themes For 2018Document218 pagesMaybank - Six Themes For 2018HaMy TranNo ratings yet

- Bajaj Finance Plans To Raise $1.2 Billion - The Economic TimesDocument2 pagesBajaj Finance Plans To Raise $1.2 Billion - The Economic TimeslalitNo ratings yet

- 21 11 2014 011Document1 page21 11 2014 011Anudeep ChappaNo ratings yet

- UBS View PDFDocument32 pagesUBS View PDFcarlosdanielocanavegaNo ratings yet

- World Bank East Asia and Pacific Economic Update, October 2013: Rebuilding Policy Buffers, Reinvigorating GrowthFrom EverandWorld Bank East Asia and Pacific Economic Update, October 2013: Rebuilding Policy Buffers, Reinvigorating GrowthNo ratings yet

- World Bank East Asia and Pacific Economic Update, April 2013: A Fine BalanceFrom EverandWorld Bank East Asia and Pacific Economic Update, April 2013: A Fine BalanceRating: 3 out of 5 stars3/5 (1)

- 制定一个高效的作业时间表Document6 pages制定一个高效的作业时间表g69pcj6hNo ratings yet

- FM Unit 5Document14 pagesFM Unit 5Rizwana BegumNo ratings yet

- Tally GST Module Question Set-1Document3 pagesTally GST Module Question Set-1Boni HalderNo ratings yet

- J Applied Corp Finance - 2015 - Hoyt - Evidence of The Value of Enterprise Risk ManagementDocument9 pagesJ Applied Corp Finance - 2015 - Hoyt - Evidence of The Value of Enterprise Risk ManagementBasant WaheedNo ratings yet

- SCM Budget BSA2ADocument3 pagesSCM Budget BSA2AKaymark Lorenzo0% (2)

- Evaluating A Change Management ProposalDocument3 pagesEvaluating A Change Management ProposalPranoyCHNo ratings yet

- Thesis Organisational CultureDocument4 pagesThesis Organisational Culturekatyallenrochester100% (2)

- 2021 Disney CSR ReportDocument83 pages2021 Disney CSR ReportNazmul HasanNo ratings yet

- Sop 8Document4 pagesSop 8MadhuriNikamNo ratings yet

- N Legalising MSP in India: What Is The WTO Peace Clause'?Document2 pagesN Legalising MSP in India: What Is The WTO Peace Clause'?yajar20No ratings yet

- Amos Obadiah Cat 2 KebsDocument8 pagesAmos Obadiah Cat 2 KebsAmos MogereNo ratings yet

- By: Rakim L. Perez BSBA 3BDocument66 pagesBy: Rakim L. Perez BSBA 3BLovely Rizziah Dajao CimafrancaNo ratings yet

- The Business Cycle: Theories and EvidenceDocument220 pagesThe Business Cycle: Theories and EvidenceLucas Jean de Miranda CoelhoNo ratings yet

- AshutoshDocument1 pageAshutoshAshutosh MishraNo ratings yet

- Market Trends - Assessment 1 - v6.2Document5 pagesMarket Trends - Assessment 1 - v6.2Gabriel ZuanettiNo ratings yet

- Business in Inf Age1newDocument13 pagesBusiness in Inf Age1newarchana_sree13No ratings yet

- CN23 PDFDocument2 pagesCN23 PDFRajeev KhullarNo ratings yet

- Redbook Vol1part1 PDFDocument789 pagesRedbook Vol1part1 PDFYalem AlemayehuNo ratings yet

- Ardan LM TP2Document2 pagesArdan LM TP2Jhennifer AlmeroNo ratings yet

- Code of Ethics of UNDPDocument13 pagesCode of Ethics of UNDPhassanNo ratings yet

- Lim Tong Lim vs. Philippine Fishing Gear Industries Inc., 317 SCRA 728 - 1999Document9 pagesLim Tong Lim vs. Philippine Fishing Gear Industries Inc., 317 SCRA 728 - 1999Dianne BalagsoNo ratings yet

- Code of ConductDocument6 pagesCode of ConductPrabu PappuNo ratings yet

- Presentation On MR Azim PremjiDocument13 pagesPresentation On MR Azim PremjiAnkur BhatiNo ratings yet

- TIME: 2!110VJR: 4. E Uit ShareholdersDocument10 pagesTIME: 2!110VJR: 4. E Uit ShareholdersAditi VengurlekarNo ratings yet

- Richfield - Terms and Conditions - 2024Document7 pagesRichfield - Terms and Conditions - 2024MrNo ratings yet

- Membership: AgreementDocument6 pagesMembership: AgreementMichael KennedyNo ratings yet

- Dwarka Exp Project DataDocument8 pagesDwarka Exp Project DataAlam KhanNo ratings yet

- 3-John Bellamy Foster - Ecology Against Capitalism-Monthly Review Press (2002)Document180 pages3-John Bellamy Foster - Ecology Against Capitalism-Monthly Review Press (2002)Cengiz YılmazNo ratings yet