Professional Documents

Culture Documents

Audit Probs 4 (Final Exam)

Audit Probs 4 (Final Exam)

Uploaded by

YameteKudasaiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Probs 4 (Final Exam)

Audit Probs 4 (Final Exam)

Uploaded by

YameteKudasaiCopyright:

Available Formats

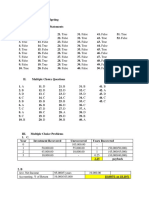

SUMMARY OF ANSWERS

FINAL EXAMINATION

1. C 11. D 21. C 31. D 41. C 51. C 61. C 71. D 81. D 91. B

2. B 12. A 22. A 32. C 42. C 52. A 62. D 72. B 82. B 92. C

3. A 13. D 23. A 33. D 43. C 53. B 63. B 73. D 83. C 93. B

4. C 14. C 24. A 34. C 44. B 54. A 64. D 74. A 84. C 94. B

5. C 15. D 25. A 35. B 45. B 55. A 65. C 75. A 85. D 95. A

6. C 16. C 26. B 36. B 46. A 56. A 66. D 76. B 86. C 96. C

7. C. 17. C 27. A 37. C 47. C 57. A 67. A 77. C 87. C 97. D

8. A 18. D 28. E 38. C 48. A 58. D 68. B 78. B 88. B 98. A

9. C 19. B 29. D 39. C 49. D 59. D 69. B 79. A 89. A 99. C

10. C 20. C 30. D 40. B 50. C 60. A 70. D 80. D 90. D 100. A

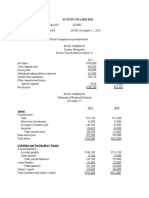

Solutions:

1. Initial Payments per Child #1 P 7,500

Add: Initial Payment per Child #2 2400

Multiply: 8/12 8/12

TOTAL DEFERRED REVENUE P 6,600

2. Accounts Payable 2000

Utilities Payable 7000

Accrued Interest Expense 6000

Cash Dividend Payable 4000

Fixed Obligation 10000

Discount – Bonds Payable (15000)

Bonds Payable 120000

Finance Lease Liability 35000

Security Deposit 2000

Preference Shares- Redeemable 14000

TOTAL FINANCIAL LIABILITY P 185,000

3. Initial recognition = P 100,000

4. Purchase price P 220,000

Discount (5000)

INITIAL MEASUREMENT P 215,000

5. Present Value (250,000 x 3.4011830) P 850,458

Payment (250000)

Total P 600,458

Multiply: Interest Rate of 12% 12%

INTEREST INCOME P 72,054.96

6. Present Value (Squeezed) P 1,026,296

Payments (600000)

Interest Expense (10%) 102630

TOTAL Carrying Amount P 528,926

7. Present Value P 1,000,000

Interest Income (1,000,000 x 6.2695%) 62,695

TOTAL Carrying Amount P 1,062,695

8. Future Cash Flow P 1,000,000

Present Value (1,000,000 x .71178) (711,780)

TOTAL Unrealized Gain P 288,220

9. Present Value (Squeezed) P 783,835

Amortization (94,060 – 30,000) 64,060

TOTAL CARRYING AMOUNT P 847,895

10. Borrowed Amount P 100,000

Rate 12%

Time 1/12

INTEREST EXPENSE P 1000

11. Credit Interest Payable = P 260

20. Issue Price P 2,600,000

FV of debt instrument (2,040,000)

EQUITY COMPONENT P 560,000

21. Total Damages (160,000+320,000) P 480,000

PV of 1 @ 10% 0.90909

TOTAL P 436,363

Risk Adjustment (100% + 7%) 107%

TOTAL P 466,909

Probability of Settlement 70%

PROVISION FOR LAWSUIT P 326,836

22. Total Amount of repairs (120,000+720,000) P 840,000

PV Factor 0.95238

Total P 800,000

Risk Adjustment 106%

Total P 848,000

Percentage of amount to be settled in 20x2 50%

WARRANTY PROVISION P 424,000

23. Termination of benefits due to closure = P 4,000,000

24. Units Sold 5,000 u

Warranty Cost/unit P 400

WARRANTY EXPENSE P 2,000,000

25. Total estimated warranty costs (800,000+2M) P 2,800,000

Actual Warranty Cost (1,240,000)

BALANCE, Dec 31 P 1,560,00

26. Unit sales 500,000 u

Percentage of estimate of wrappers redeemed 40%

Estimated wrappers for redemption 200,000 u

Required number of wrappers for redemption 10

Estimated number of premiums 20,000

Multiply: Net cost/ premium (800-200) 600

PREMIUM EXPENSE P 12,000,000

27. Provision to be recognized = P 4,000,000

30. [(20 employees x 1 day x 12 months) – 150 days] x P 1000 X 105% = P 94,500

32. [(20 employees x 1 day x 12 months) – 150 days] x P 1000 X 105% x 80% = P 75,600

35. PV of DBO P 2,900,000

FVPA (2,600,000)

DEFICIT P 300,000

36. Service Cost P 400,000

Net interest 20,000

DEFINED BENEFIT COST COMPONENT P 420,000

37. Actuarial Losses (gains) P 200,000

Plan Asset amount difference (180K-120K) 60,000

TOTAL P 260,000

38. NDBF, Beg. (1,500,000-1,200,000) P 300,000

NDBF, End (1,800,000-1,310,000) (490,000)

Increase P 190,000

44. Annual Rent P 100,000

PV factor 6.15

PV of Minimum lease payments P 615,000

45. Payment P 100,000

Multiply: PV of ordn. Annuity of 1 @ 10%, n=10

TOTAL P 614,500

46. Total Consideration P 52,000

Payment (2000)

Lease Payments P 50,000

PV Factor 6.5348

Total P 326,740

Advanced Payment (50,000)

LEASE LIABILITY P 276,740

*Answer is P 280,000; the nearest to the computed lease liability above

47. PV of annuity due @ 12% P 63,282

PV of 1 3220

TOTAL P 66,502

48. PV of annuity due P 55,116

PV of 1 6,499

Total P 61, 615

Paid amount due immediately (13,000)

LEASE LIABILITY P 48,615

49. Total lease paid from 2011 to 2014 plus lease bonus (squeeze) P 51,410

Divide: 4 4

Annual Lease Expense P 12,853

50. Lease Payment P 100,000

Term 3

GROSS INVESTMENT P 300,000

51. Fixed Lease Payments P 100,000

PV Factor 2.48685

NET INVESTMENT P 248,685

52. Gross Investment P 300,000

Net Investment (248,685)

UNEARNED INTEREST INCOME P 51,315

58. Excess of CA of software over tax base P 500,000

Excess of CA of machinery over tax base 400,000

Taxable Temporary Difference P 900,000

Multiply: Tax Rate 30%

DEFERRED TAX LIABILITY P 270,000

59. Excess of CA of accrued liability P 200,000

Tax rate 30%

DEFERRED TAX ASSET P 60,000

60. Deferred Tax Liability Increase (P 270,000)

Deferred Tax Asset Increase 60,000

DEFERRED TAX EXPENSE (P 210,000

61. Income tax expense P 300,000

Deferred Tax Liability Increase (P 270,000)

Deferred Tax Asset Increase 60,000

CURRENT TAX EXPENSE P 90,000

62. Taxable Profit P 100,000

Depreciation Excess (10,000)

Bad Debts @ Allowance Method (15,000)

Accrued Revenues net of tax 40,000

Subject to Tax Amount P 115,000

Goodwill Impairment Loss 6000

Non-deductible expense (35,000)

PRETAX INCOME P 86,000

70. Balance, Dec 31 P 2,700,000

Share premium on original issuance (2,700,000 x 0.11) 300,000

SHARE PREMIUM, Jan 2 P 2,400,000

Balance, Dec 31 P 1,300,000

Retained Earnings 500,000

RETAINED EARNINGS, Jan 2 P 800,000

71. Jan 5 Share Premium P 100,000

Dec 27 Share Premium – Treasury Shares 15,000

SHARE PREMIUM IN EXCESS OF PAR P 115,000

72. Treasury Shares (3000 x 18) P 54,000

Treasury Shares (3000 x 18) P 54,000

Cash paid (3000 x 25) (75,000)

SHARE PREMIUM – TREASURY SHARES P 21,000

75.

76. Declared cash dividend Issued Shares Outstanding Shares

Shares Issued

P 44,000 until year end 100,000 100,000

Treasury Shares

Preference Shareatdividends

year end[(4000x100x6%)+12000] (5000)

Reissuance

(36,000) of treasury shares 1000

New shares issued

ORDINARY SHARE DIVIDENDS 10,000 10,000

TOTAL

P 8,000 110,000 106,000

Share split Nov transaction 2 2

77. END BALANCE

Ordinary Shares (Basic Allocation) (200k x 1 x 220,000

5%) 212,000

P 10,000

Ordinary Shares (Participation) (75,000 x 2/5) 30,000

DIVIDENDS TO ORDINARY SHAREHOLDERS P 40,000

78. Small Dividend @ FV P 15,000

Large Dividend @ par 30,800

RETAINED EARNINGS DEBIT P 45,800

83. 20x5 [(600x100x100) x 94% x 2/3] P 3,760,000

20x4 [(600x100x100) x 95% x 1/3] (1,900,000)

SALARIES EXPENSE P 1,860,000

84. [(10,000x72%) x 15 x 2/3] – [(10,000x75%) x 15 x 1/3] P 34,500

85. [(10,000x72%) x 15 x 2/3] – [(10,000x75%) x 15 x 1/3] – 34,500 P 42,000

86. (750x16x3/3) – (800x15x2/3) – (900x12x1/3) P 4,000

87. Dec 31 20x1 (900x12x1/3) P 3,600

Dec 31 20x3 (750x16x3/3) 4,400

ACCRUED SALARIES PAYABLE P 8,000

88. Ordinary Shareholders Equity [(4.68M+60K)-(10000x120)-(1Mx10%x3)] 3,240,000

Divide: No, of ordinary shares outstanding [(3M/100)+(100k/par)-2000] 29,000

BOOK VALUE PER SHARE P 111.72

89. Ordinary Shareholders Equity [(4.68M+60K)-(10000x120)-(1Mx10%x1)] 3,440,000

Divide: No, of ordinary shares outstanding [(3M/100)+(100k/par)-2000] 29,000

BOOK VALUE PER SHARE P 118.62

90. Ordinary Shareholders Equity [(4.68M+60K)-(10000x120)] 3,540,000

Divide: No, of ordinary shares outstanding [(3M/100)+(100k/par)-2000] 29,000

BOOK VALUE PER SHARE P 122.07

91. Ordinary SHE (7.5M+600,000+1,915,000) 10,015,000

Divide: Outstanding Shares 50,000

Book Value Per Share P 200.30

93. [2,800,000-(100,000x10x10%)/158,000] P 17.09

94. {[800,000+(2,000,000x12%x70%)]/[100,000+[(2,000,000/1000)x30]} P 6.05

98. [(-1,000,000)-50,000]/100,000 -P1,050,000

Divide: 100,000 100,000

BASIC EARNINGS (LOSS) -P10.5

99. 20x2 20x1

Profit after tax 2,200,000 1,800,000

Weighted Ave. No. of Out, Sh 473,000 440,000

(Adjusted) SQUEEZE

BASIC EPS 4.65 4.09

100. Profit per year P 2,900,000

Divide: Weighted Ave. No. of Shares (Adjusted)(70,588+160,000) 230,588

BASIC EPS P 12.58

You might also like

- Fin420.540 Jan 2018 Q2-5Document8 pagesFin420.540 Jan 2018 Q2-5Amar AzuanNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Intermediate Accounting 2 Millan 221013 124345Document233 pagesIntermediate Accounting 2 Millan 221013 124345Krazy Butterfly100% (1)

- FARPW ProbDocument9 pagesFARPW ProbYameteKudasai100% (1)

- Acctg 201A Midterm Exam 1st Sem 20-21 QuestionsDocument10 pagesAcctg 201A Midterm Exam 1st Sem 20-21 QuestionsYameteKudasaiNo ratings yet

- Parle G Marketing ProjectDocument63 pagesParle G Marketing ProjectHrdk Dve88% (8)

- Summary of Answers Acctg 9A Requirement No. 5 AnswersDocument3 pagesSummary of Answers Acctg 9A Requirement No. 5 AnswersYameteKudasaiNo ratings yet

- Summary of Answers PPE Part 2 Theory QuestionsDocument3 pagesSummary of Answers PPE Part 2 Theory QuestionsYameteKudasaiNo ratings yet

- Chapter 1 - Contingent LiabilitiesDocument6 pagesChapter 1 - Contingent LiabilitiesJoshua AbanalesNo ratings yet

- CPA Review School of The Philippines ManilaDocument4 pagesCPA Review School of The Philippines ManilaSophia PerezNo ratings yet

- Ass.1 Acctng. For Special TransactionDocument17 pagesAss.1 Acctng. For Special TransactionJea Ann CariñozaNo ratings yet

- ACC-132 Quiz 4 Answer KeyDocument3 pagesACC-132 Quiz 4 Answer KeyG18 Yna RecintoNo ratings yet

- AFAR ANSWER KeyDocument6 pagesAFAR ANSWER KeyCheska JaplosNo ratings yet

- Provisions, Contingencies and Other Liabilities ProblemsDocument7 pagesProvisions, Contingencies and Other Liabilities ProblemsGiander100% (1)

- Cpa Review School of The Philippines.2Document6 pagesCpa Review School of The Philippines.2Snow TurnerNo ratings yet

- PRTC 1stPB - 05.22 Sol AFARDocument4 pagesPRTC 1stPB - 05.22 Sol AFARCiatto SpotifyNo ratings yet

- 93 - Final Preaboard AFAR SolutionsDocument11 pages93 - Final Preaboard AFAR SolutionsLeiNo ratings yet

- Problem 6 - Partnership OperationDocument5 pagesProblem 6 - Partnership OperationShaira UntalanNo ratings yet

- Answer - Capital BudgetingDocument19 pagesAnswer - Capital Budgetingchowchow123No ratings yet

- FAR Problem Quiz 2Document3 pagesFAR Problem Quiz 2Ednalyn CruzNo ratings yet

- Sol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aJenny Joy Alcantara0% (1)

- Sol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aYamateNo ratings yet

- Final Exam Far1Document4 pagesFinal Exam Far1Chloe CatalunaNo ratings yet

- Lagrimas, Sarah Nicole S. - Provisions, Contingencies & Other Liabilities PDFDocument3 pagesLagrimas, Sarah Nicole S. - Provisions, Contingencies & Other Liabilities PDFSarah Nicole S. LagrimasNo ratings yet

- Final Assignment AstDocument6 pagesFinal Assignment AstAngelica CerioNo ratings yet

- SET B Starts at No. 33Document7 pagesSET B Starts at No. 33Nico BalleberNo ratings yet

- RecFin AnswerKeySolutionsDocument3 pagesRecFin AnswerKeySolutionsHannah Jane UmbayNo ratings yet

- Ap Prob 11Document2 pagesAp Prob 11jhobsNo ratings yet

- Diagnostic Level 3 AccountingDocument17 pagesDiagnostic Level 3 AccountingRobert CastilloNo ratings yet

- MTP 19 53 Answers 1713511058Document19 pagesMTP 19 53 Answers 1713511058prathammishra1809No ratings yet

- Corporate Liquidation and Joint ArrangementDocument7 pagesCorporate Liquidation and Joint ArrangementPaupauNo ratings yet

- AFAR Preboards SolutionsDocument27 pagesAFAR Preboards SolutionsIrra May GanotNo ratings yet

- CH 9 Capital Budgeting PayongayongDocument5 pagesCH 9 Capital Budgeting PayongayongNadi Hood100% (1)

- Project AppraisalMBA L 1 1 1Document15 pagesProject AppraisalMBA L 1 1 1sikdar9403No ratings yet

- Answer Key Discussion of Sir Paul of PreweekDocument2 pagesAnswer Key Discussion of Sir Paul of PreweekElaine Joyce GarciaNo ratings yet

- Homework SolutionsDocument5 pagesHomework SolutionsAnonymous CuUAaRSNNo ratings yet

- CA Inter FM SM A MTP 2 May 2024 Castudynotes ComDocument19 pagesCA Inter FM SM A MTP 2 May 2024 Castudynotes ComsanjanavijjapuNo ratings yet

- 1-1hkg 2002 Dec ADocument8 pages1-1hkg 2002 Dec AWing Yan KatieNo ratings yet

- Afar SolutionsDocument8 pagesAfar Solutionspopsie tulalianNo ratings yet

- ReSA SLU AFAR Midterm Exam ANSWER KEYDocument10 pagesReSA SLU AFAR Midterm Exam ANSWER KEYAira Mugal OwarNo ratings yet

- Chapter 18 Answer KeyDocument9 pagesChapter 18 Answer KeyNCT100% (1)

- ACTY04 s.2020 2021Document3 pagesACTY04 s.2020 2021Gelay MagatNo ratings yet

- CMPC 131 SolutionsDocument3 pagesCMPC 131 SolutionsNhel AlvaroNo ratings yet

- Review of The Accounting Process Problems 2-1. (Tiger Company)Document5 pagesReview of The Accounting Process Problems 2-1. (Tiger Company)Joana MagtuboNo ratings yet

- Review of The Accounting Process Problems 2-1. (Tiger Company)Document5 pagesReview of The Accounting Process Problems 2-1. (Tiger Company)HohohoNo ratings yet

- Auditing Problem SolutionsDocument13 pagesAuditing Problem SolutionsjhobsNo ratings yet

- Quiz 2 Receivables - Solution GuideDocument8 pagesQuiz 2 Receivables - Solution GuideMaricar PinedaNo ratings yet

- Final PB87 Sol. MASDocument2 pagesFinal PB87 Sol. MASLJ AggabaoNo ratings yet

- CA-Inter-Costing-A-MTP-2-May 2023Document13 pagesCA-Inter-Costing-A-MTP-2-May 2023karnimasoni12No ratings yet

- 06 Notes Receivable Sec 2 MCPDocument3 pages06 Notes Receivable Sec 2 MCPkyle mandaresioNo ratings yet

- AUD Answer Key With SolutionsDocument5 pagesAUD Answer Key With SolutionsJerome MadrigalNo ratings yet

- Chapter 15 - Working Capital and The Financing Decision Problem 1Document6 pagesChapter 15 - Working Capital and The Financing Decision Problem 1Carrina ZapicoNo ratings yet

- 1 2021 FAR FinalsDocument6 pages1 2021 FAR FinalsZatsumono YamamotoNo ratings yet

- UntitledDocument13 pagesUntitledAbhinav SharmaNo ratings yet

- Mas Test Bank SolutionDocument14 pagesMas Test Bank SolutionLyzaNo ratings yet

- Mas Test Bank SolutionDocument14 pagesMas Test Bank SolutionGem Alcos NicdaoNo ratings yet

- Afar Final PBDocument6 pagesAfar Final PBFloriza Cuevas RagudoNo ratings yet

- Review of The Accounting Process Problems 2-1. (Tiger Company)Document5 pagesReview of The Accounting Process Problems 2-1. (Tiger Company)Pauline Kisha CastroNo ratings yet

- Ia Forcadela Part IIIDocument5 pagesIa Forcadela Part IIIMary Joanne forcadelaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 1700 Reverse CodeDocument4 pages1700 Reverse CodeYameteKudasaiNo ratings yet

- Unified Financial Statements 2019. 123119.10PM - JonaDocument208 pagesUnified Financial Statements 2019. 123119.10PM - JonaYameteKudasaiNo ratings yet

- Uadc Financial Statements 2019. 123119.10PM - JonaDocument263 pagesUadc Financial Statements 2019. 123119.10PM - JonaYameteKudasaiNo ratings yet

- SolutionDocument3 pagesSolutionYameteKudasaiNo ratings yet

- 2.0 Years 2.6 Years 213,745 34.9% 1.4Document5 pages2.0 Years 2.6 Years 213,745 34.9% 1.4YameteKudasaiNo ratings yet

- Taxation Integration 1 Chapter 6-11 Answers: Activity 1Document6 pagesTaxation Integration 1 Chapter 6-11 Answers: Activity 1YameteKudasaiNo ratings yet

- Module 4 Cat Level 1Document3 pagesModule 4 Cat Level 1YameteKudasaiNo ratings yet

- HUM 1 Unsubmitted Files (Compressed)Document6 pagesHUM 1 Unsubmitted Files (Compressed)YameteKudasaiNo ratings yet

- UNIFIED Income StatementDocument97 pagesUNIFIED Income StatementYameteKudasaiNo ratings yet

- Lesson 1 ActivityDocument2 pagesLesson 1 ActivityYameteKudasaiNo ratings yet

- Uadc Monthly Report 2019Document73 pagesUadc Monthly Report 2019YameteKudasaiNo ratings yet

- List of Expenses: Cash Flow Report Expenses - From January To AprilDocument1 pageList of Expenses: Cash Flow Report Expenses - From January To AprilYameteKudasaiNo ratings yet

- Uadc Financial Statements 2018. 123118.10PM - JonaDocument76 pagesUadc Financial Statements 2018. 123118.10PM - JonaYameteKudasaiNo ratings yet

- Diagnostic Clinic: Monthly SalesDocument2 pagesDiagnostic Clinic: Monthly SalesYameteKudasaiNo ratings yet

- Summary of Answers PPE Part 2 Theory QuestionsDocument3 pagesSummary of Answers PPE Part 2 Theory QuestionsYameteKudasaiNo ratings yet

- UADC SALARY LOGBOOK UpdatedDocument4 pagesUADC SALARY LOGBOOK UpdatedYameteKudasaiNo ratings yet

- UADC 2020 Interim Income Statement (FINAL)Document2 pagesUADC 2020 Interim Income Statement (FINAL)YameteKudasaiNo ratings yet

- Acctg 202A Final ExamDocument8 pagesAcctg 202A Final ExamYameteKudasaiNo ratings yet

- Acctg 205A Midterm Examinations Problem 1Document1 pageAcctg 205A Midterm Examinations Problem 1YameteKudasaiNo ratings yet

- Acctg 201a Final Exam Questions 1st Sem 20-21Document7 pagesAcctg 201a Final Exam Questions 1st Sem 20-21YameteKudasaiNo ratings yet

- Summary of Answers PPE Part 1 Theory QuestionsDocument2 pagesSummary of Answers PPE Part 1 Theory QuestionsYameteKudasaiNo ratings yet

- Summary of Answers Acctg 9A Requirement No. 5 AnswersDocument3 pagesSummary of Answers Acctg 9A Requirement No. 5 AnswersYameteKudasaiNo ratings yet

- Boleyley, Janus C. Business Policy 300 August 29, 2020 Bsac-5 Student Evaluation/Activities (Module 1)Document1 pageBoleyley, Janus C. Business Policy 300 August 29, 2020 Bsac-5 Student Evaluation/Activities (Module 1)YameteKudasaiNo ratings yet

- ACCTG 202 Midterm ExamDocument9 pagesACCTG 202 Midterm ExamYameteKudasaiNo ratings yet

- Audit Probs 2 Cash and Bank ReconDocument3 pagesAudit Probs 2 Cash and Bank ReconYameteKudasaiNo ratings yet

- Quiz Part 2 (Bank Reconciliation)Document2 pagesQuiz Part 2 (Bank Reconciliation)YameteKudasaiNo ratings yet

- Primate Cities and The Rank-Size RuleDocument21 pagesPrimate Cities and The Rank-Size Ruleapi-369449529No ratings yet

- 5882 - Stated Preference Survey ReportDocument54 pages5882 - Stated Preference Survey Reportshwetaplanner7959No ratings yet

- Accounting Rate of ReturnDocument3 pagesAccounting Rate of ReturnKelly HermanNo ratings yet

- Practice Problems For Mid TermDocument6 pagesPractice Problems For Mid TermMohit ChawlaNo ratings yet

- RKBM TranslateDocument1 pageRKBM TranslateRevita AzilaNo ratings yet

- 1991 Indian Economic Crisis - WikipediaDocument4 pages1991 Indian Economic Crisis - WikipediaChasity WrightNo ratings yet

- Utc8n65 PDFDocument8 pagesUtc8n65 PDFGerson FelipeNo ratings yet

- Standard Costing: A Managerial Control ToolDocument48 pagesStandard Costing: A Managerial Control Toolria oktavia indrianiNo ratings yet

- 6 Budgetary ControlDocument24 pages6 Budgetary ControlVishal R. SuvarnaNo ratings yet

- Panipat ElevatedExpresswayProjectDocument6 pagesPanipat ElevatedExpresswayProjectzindafive1No ratings yet

- CMPTR StyDocument11 pagesCMPTR StyWell WisherNo ratings yet

- Crossing The Bridge The Effects of Time Varying Tolls On Curbing Congestion 2016 Transportation Research Part A Policy and PracticeDocument19 pagesCrossing The Bridge The Effects of Time Varying Tolls On Curbing Congestion 2016 Transportation Research Part A Policy and PracticeZen ZeeNo ratings yet

- Deed of Assignment-StockDocument2 pagesDeed of Assignment-StockMartin MartelNo ratings yet

- Profit and LossDocument51 pagesProfit and LossDin Dupur100% (1)

- Soal Kuis Ch.11Document3 pagesSoal Kuis Ch.11Siti Robi'ahNo ratings yet

- Catalog Mobilier UrbanDocument128 pagesCatalog Mobilier UrbanBomis_srlNo ratings yet

- Introduction Feasibility Study Hotel ConstructionDocument4 pagesIntroduction Feasibility Study Hotel ConstructionEckae Valiente100% (2)

- Grand Cuisines Banquets Pvt. LTD Profit & Loss Statement Yashraj StudiosDocument53 pagesGrand Cuisines Banquets Pvt. LTD Profit & Loss Statement Yashraj StudiossubhashNo ratings yet

- Tourism Is Travel For RecreationalDocument8 pagesTourism Is Travel For Recreationalpaul_xvrNo ratings yet

- Cambridge Associates Manager GuideDocument24 pagesCambridge Associates Manager GuideDavidRHansonNo ratings yet

- Entrepreneurs and Informal InvestorsDocument25 pagesEntrepreneurs and Informal InvestorsAnam Abdul QayyumNo ratings yet

- CH 4 NotesDocument34 pagesCH 4 NotesAffan HassanNo ratings yet

- IB Economics FINAL EXAM REVIEWDocument6 pagesIB Economics FINAL EXAM REVIEWkrip2nite918100% (4)

- Handloom Weavers CooperativesDocument2 pagesHandloom Weavers Cooperativeshsktangirala2007yahoNo ratings yet

- Bow Tow Crow Grow 1. 6.: A. Colour The Correct Answer. (10 Marks)Document6 pagesBow Tow Crow Grow 1. 6.: A. Colour The Correct Answer. (10 Marks)vilash7134No ratings yet

- Overview IAS 16 - PPEDocument7 pagesOverview IAS 16 - PPEjustjade100% (1)

- ISC Accounts Stream Weekly Test 2Document4 pagesISC Accounts Stream Weekly Test 2abhishek123456No ratings yet

- Table Etiquette and Cultural Differences: Chef Julie Ruth Cabatuando-SubaDocument23 pagesTable Etiquette and Cultural Differences: Chef Julie Ruth Cabatuando-SubaKashien Arianna ReglosNo ratings yet

- Operational Analysis Questionnaire: Accounts ReceivableDocument14 pagesOperational Analysis Questionnaire: Accounts Receivablealfred_vzz1No ratings yet