Professional Documents

Culture Documents

Portfolio Diversification

Portfolio Diversification

Uploaded by

lajwanti jethwani0 ratings0% found this document useful (0 votes)

12 views3 pagesOriginal Title

portfolio diversification.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views3 pagesPortfolio Diversification

Portfolio Diversification

Uploaded by

lajwanti jethwaniCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 3

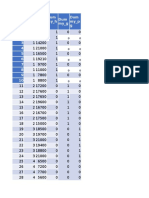

AXP HD BNS SBUX

-0.13894 -0.13354 0.01052 -0.04914

0.03368 0.06297 -0.05790 -0.02671 An investor has $100,000 to invest in th

0.10255 0.02983 0.05391 -0.07279 Developing a stock portfolio made up o

-0.03482 -0.04988 0.04885 0.12098 (NYSE), the Toronto Stock Exchange (TS

-0.18728 -0.13717 -0.07364 -0.13490 American Express (AXP) and Home Dep

-0.01022 0.01766 0.06344 -0.06636 (BNS) (TSX) and Starbucks (SBUX) (NASD

0.06875 0.13790 -0.05594 0.05899 much to invest in each one. She wants t

-0.10712 -0.03729 0.00079 -0.04430 to minimize the risk. She has computed

-0.21985 -0.08891 -0.26382 -0.11728 a 60-month period (January 2008 to De

-0.15220 -0.02029 -0.17189 -0.31981 choices down to the following three. W

-0.20430 0.00690 -0.02063 0.05965 1. $25,000 in each stock

-0.09048 -0.06464 -0.10487 -0.00221 2. American Express: $10,000, Home De

-0.27907 -0.02984 -0.06176 -0.03097 Starbucks: $40,000

0.12993 0.14193 0.08882 0.21461 3. American Express: $10,000, Home De

0.87550 0.11720 0.17850 0.30169 Starbucks: $20,000

-0.01438 -0.12014 0.23249 -0.00505

-0.05792 0.02981 0.06905 -0.03483

0.21903 0.09757 0.15173 0.27444

0.19387 0.05232 -0.01798 0.07316

0.00751 -0.01576 0.08689 0.08741

0.02795 -0.05832 -0.07391 -0.08089

0.20060 0.09071 0.10423 0.15347

-0.03145 0.06597 0.02335 0.05293

-0.06651 -0.03188 -0.09945 -0.05480

0.01419 0.11391 0.07922 0.05127

0.08507 0.04452 0.10109 0.05925

0.11786 0.08924 0.02761 0.07487

-0.13552 -0.03883 -0.10310 -0.00320

0.00000 -0.16539 0.00779 -0.06145

0.12457 0.01563 0.10053 0.02268

-0.10682 -0.01576 -0.03887 -0.07071

0.05419 0.13877 0.10624 0.11211

-0.00890 -0.02477 0.01301 0.11781

0.04239 -0.01476 -0.02915 0.07606

-0.00694 0.16063 0.11046 0.04981

0.01494 0.04893 -0.01021 -0.01860

0.00427 0.01889 0.09247 0.05031

0.03734 -0.00421 -0.00735 0.12006

0.09023 0.00254 0.00300 -0.02027

0.05141 -0.02335 0.00474 0.02012

0.00557 0.00576 -0.01014 0.07335

-0.03202 -0.03552 -0.05669 0.01501

-0.00674 -0.03742 -0.01666 -0.03315

-0.09663 -0.01512 -0.09254 -0.03429

0.13200 0.08897 0.04910 0.13576

-0.05107 0.10414 -0.04260 0.03054

-0.01801 0.07191 -0.00084 0.05811

0.06688 0.05591 0.03032 0.04146

0.05480 0.07159 0.05073 0.01694

0.09394 0.06423 0.04944 0.15098

0.04434 0.02927 -0.01031 0.02660

-0.07283 -0.04158 -0.07940 -0.04036

0.04271 0.07387 0.02505 -0.02865

-0.00521 -0.01524 0.00768 -0.15069

0.01012 0.09327 0.01623 0.09973

-0.02470 0.06372 0.04464 0.02227

-0.01204 0.01664 -0.00810 -0.09485

-0.00125 0.06498 0.02507 0.13476

0.02818 -0.04949 0.04855 0.03393

0.05098 0.02215 0.01037 0.03711

r has $100,000 to invest in the stock market. She is interested in

g a stock portfolio made up of stocks on the New York Stock Exchange

e Toronto Stock Exchange (TSX), and the NASDAQ. The stocks are

Express (AXP) and Home Depot (HD) (NYSE), Bank of Nova Scotia

) and Starbucks (SBUX) (NASDAQ). However, she doesn’t know how

vest in each one. She wants to maximize her return, but she would also like

e the risk. She has computed the monthly returns for all four stocks during

h period (January 2008 to December 2012) Xm07-00. She narrowed her

wn to the following three. What should she do?

in each stock

n Express: $10,000, Home Depot: $20,000, Bank of Nova Scotia: $30,000,

n Express: $10,000, Home Depot: $50,000, Bank of Nova Scotia: $20,000,

You might also like

- 4 G 69Document18 pages4 G 69dhikomo100% (2)

- Case 3 - Regression - Final DataDocument95 pagesCase 3 - Regression - Final DataShouib MehreyarNo ratings yet

- Georg Henrik Von Wright Norm and Action 0Document201 pagesGeorg Henrik Von Wright Norm and Action 0Garai Zsolt100% (1)

- Portfolio DiversificationDocument3 pagesPortfolio Diversificationkumar030290No ratings yet

- Xm07 000Document3 pagesXm07 000priyamNo ratings yet

- MMult Function and Demo of ROIDocument6 pagesMMult Function and Demo of ROIJITESHNo ratings yet

- Trabajo de SismosDocument2,630 pagesTrabajo de SismosArturo SuarezNo ratings yet

- Loads On Final RCC Lining1Document4 pagesLoads On Final RCC Lining1Engineering CivilMantraNo ratings yet

- Boussinesq EsfuerzosDocument52 pagesBoussinesq EsfuerzosAlanNo ratings yet

- Matched SanFernDocument103 pagesMatched SanFernajay shresthaNo ratings yet

- PerfilDocument2 pagesPerfilRodrigo MuñíoNo ratings yet

- S. No. Educ Ation Salar y Dum My - H S Dum My - G Dum My - P GDocument5 pagesS. No. Educ Ation Salar y Dum My - H S Dum My - G Dum My - P GKhushboo RajNo ratings yet

- Matched NorthriDocument68 pagesMatched Northrirajendra moktanNo ratings yet

- Đầu Tư Tài Chính Index and Full Covariance.Document19 pagesĐầu Tư Tài Chính Index and Full Covariance.thuynkn21404aNo ratings yet

- Chord LengthDocument6 pagesChord Lengthshivaprasad047No ratings yet

- K Cof K Cof K Cof K Cof K Cof K Cof K Cof K Cof K Cof K Cof KDocument3 pagesK Cof K Cof K Cof K Cof K Cof K Cof K Cof K Cof K Cof K Cof KdickiNo ratings yet

- 33 5Document536 pages33 52qr56jhfpsNo ratings yet

- Period T (S) Elastic Accelerations Elastic Displacement Design Accelerations Design Displacement S (G) S (M) S (M/S) S (M)Document10 pagesPeriod T (S) Elastic Accelerations Elastic Displacement Design Accelerations Design Displacement S (G) S (M) S (M/S) S (M)Flat EarthNo ratings yet

- Matched Friuli.Document62 pagesMatched Friuli.rajendra moktanNo ratings yet

- Table: Modal Participating Mass Ratios Case Mode Period Ux Uy Uz SumuxsumuysumuzDocument2 pagesTable: Modal Participating Mass Ratios Case Mode Period Ux Uy Uz SumuxsumuysumuzcrvishnuramNo ratings yet

- Rene Bos r2 (161-164)Document4 pagesRene Bos r2 (161-164)FRANCO RICARDO GUERRON QUIROZNo ratings yet

- S1046 ProfileDocument4 pagesS1046 ProfilevrajendraupadhyayNo ratings yet

- Final CorrelationDocument1 pageFinal CorrelationUrushaNo ratings yet

- Bahan UTS Pelabuhan - Lampiran Tabel A-1 PelabuhanDocument22 pagesBahan UTS Pelabuhan - Lampiran Tabel A-1 PelabuhanAliudinNo ratings yet

- Table 10.6: Variation of A With Z/R and R/RDocument2 pagesTable 10.6: Variation of A With Z/R and R/RJohnclaude ChamandiNo ratings yet

- AberrationsDocument3 pagesAberrationsMansour AchaourNo ratings yet

- Monthly Return DataDocument3 pagesMonthly Return DataSubrata Chanda UthpalNo ratings yet

- Monthly Return DataDocument3 pagesMonthly Return DataSubrata Chanda UthpalNo ratings yet

- Perbandingan Hasil Solusi NumerikDocument42 pagesPerbandingan Hasil Solusi NumerikMAROSYANA AYU FEBRIANINo ratings yet

- Annex 2Document2 pagesAnnex 2Harshad SavantNo ratings yet

- Matched TrinidaDocument37 pagesMatched Trinidarajendra moktanNo ratings yet

- M SL SR Rotation V Moment RotationDocument4 pagesM SL SR Rotation V Moment RotationRavi SalimathNo ratings yet

- Tirzah Tugas MANPORTDocument10 pagesTirzah Tugas MANPORTTirzah FebiolaNo ratings yet

- Dokumen PDF 2Document51 pagesDokumen PDF 2HAFNI KHAIRANI SIREGARNo ratings yet

- Métodos Numéricos, F (X) 2 Raiz (X) 10x 5Document8 pagesMétodos Numéricos, F (X) 2 Raiz (X) 10x 5Maria LauraNo ratings yet

- Naca 2418Document6 pagesNaca 2418B๖๒๒๗๐๐๕ Jitlada AumpiromNo ratings yet

- Bessel Table: Ngu N: K60 - ĐTVT ĐH Bách Khoa Hà N IDocument1 pageBessel Table: Ngu N: K60 - ĐTVT ĐH Bách Khoa Hà N ILộc LýNo ratings yet

- Chart TitleDocument126 pagesChart TitleIagar OanaNo ratings yet

- New Text DocumentDocument3 pagesNew Text DocumentmaxNo ratings yet

- Quality Assign 2Document8 pagesQuality Assign 2Vy ThoaiNo ratings yet

- FXLV 152 ProfileDocument8 pagesFXLV 152 ProfilevrajendraupadhyayNo ratings yet

- Monte Carlo Simulation of The CER Model and RW Asset (Log) Prices Model Parameters Sample Size Simulated Values T Mean P R M + eDocument52 pagesMonte Carlo Simulation of The CER Model and RW Asset (Log) Prices Model Parameters Sample Size Simulated Values T Mean P R M + eZhou YunxiuNo ratings yet

- Datos para Modelo CAPMDocument5 pagesDatos para Modelo CAPMSANTIAGO FELIPE LEON SALAMANCANo ratings yet

- Leon Silva Edin 1410200412: T Vs X (T)Document48 pagesLeon Silva Edin 1410200412: T Vs X (T)Kevin Medina RamosNo ratings yet

- Leon Silva Edin 1410200412: T Vs X (T)Document48 pagesLeon Silva Edin 1410200412: T Vs X (T)Kevin Medina RamosNo ratings yet

- TABLE: Modal Participating Mass Ratios Case Mode Period UX UY UZ Sum Ux Sum Uy Sum UZ Modal 1 Modal 2 Modal 3Document2 pagesTABLE: Modal Participating Mass Ratios Case Mode Period UX UY UZ Sum Ux Sum Uy Sum UZ Modal 1 Modal 2 Modal 3Juan Gabriel CaillaguaNo ratings yet

- 8 - DATA - Conjuntos de Dados1Document12 pages8 - DATA - Conjuntos de Dados1Juliana Barbosa de Souza GodoyNo ratings yet

- IEEE 10 Generator 39 Bus System: General OutlineDocument7 pagesIEEE 10 Generator 39 Bus System: General Outlineadau100% (1)

- Horten Airfoil Creator: Input Values in Yellow Fields Thickness Chamber Don'T Change Fields BellowDocument7 pagesHorten Airfoil Creator: Input Values in Yellow Fields Thickness Chamber Don'T Change Fields BellowprivateaerospaceNo ratings yet

- Two Stocks Decision Template (Wip2)Document4 pagesTwo Stocks Decision Template (Wip2)Firas Ammar AkbarNo ratings yet

- DX DX M XF T DT DT: Damped Driven OscillatorDocument84 pagesDX DX M XF T DT DT: Damped Driven OscillatorKevin CárdenasNo ratings yet

- DbsDocument1 pageDbswongweiwen77No ratings yet

- AeaaaDocument34 pagesAeaaaYuryPaniaguaNo ratings yet

- PTĐTCK TMHDocument7 pagesPTĐTCK TMHKhánh Tô MinhNo ratings yet

- Sistema Estructural de Tres Capas (Jones)Document4 pagesSistema Estructural de Tres Capas (Jones)Andrés VacaNo ratings yet

- Tabel Binomial IndividualDocument4 pagesTabel Binomial IndividualFerdiawan Hadi SusantoNo ratings yet

- R Spectra BmeriahDocument15 pagesR Spectra BmeriahDavid SaranaNo ratings yet

- Assignment 8 6331 PDFDocument11 pagesAssignment 8 6331 PDFALIKNFNo ratings yet

- UntitledDocument2 pagesUntitledPaulo Henrique FerreiraNo ratings yet

- Date Dis Ge GM Ibm MSFT XomDocument6 pagesDate Dis Ge GM Ibm MSFT XomtoammelNo ratings yet

- Is 82 1973 PDFDocument31 pagesIs 82 1973 PDFKalpesh KatuvaNo ratings yet

- TRM 50 TRM 50Document8 pagesTRM 50 TRM 50Randerson MoraisNo ratings yet

- Soal Uts Akm2 (2020-2021)Document2 pagesSoal Uts Akm2 (2020-2021)Fania AmbarwantiNo ratings yet

- Agronomy 10 00702 v2 PDFDocument18 pagesAgronomy 10 00702 v2 PDFLuella LukenNo ratings yet

- Sense Amplifier For SRAMDocument28 pagesSense Amplifier For SRAMPrateek AgrawalNo ratings yet

- FIDES BearingCapacityDocument29 pagesFIDES BearingCapacitystingu.emanuelNo ratings yet

- HTK (v.3.1) : Basic Tutorial: ContentDocument18 pagesHTK (v.3.1) : Basic Tutorial: ContentJanković MilicaNo ratings yet

- A Creep Life Assessment Method For Boiler Pipes Using Small Punch Creep TestDocument6 pagesA Creep Life Assessment Method For Boiler Pipes Using Small Punch Creep TestAndrea CalderaNo ratings yet

- Queueing Theory - SlidesDocument40 pagesQueueing Theory - Slidesanjanadas2701No ratings yet

- Actchem 85 85 RST 8-15Document1 pageActchem 85 85 RST 8-15rivrsideNo ratings yet

- Sliding Mode Control Strategy For A 6 DOF Quadrotor HelicopterDocument7 pagesSliding Mode Control Strategy For A 6 DOF Quadrotor HelicopternaderjsaNo ratings yet

- Infra-Red CAR-KEY Transmitter: OM1058 in Case SO-8Document4 pagesInfra-Red CAR-KEY Transmitter: OM1058 in Case SO-8José SilvaNo ratings yet

- Acquired Diseases of Teeth, Dental Materials and Dental Radiography in Small AnimalsDocument97 pagesAcquired Diseases of Teeth, Dental Materials and Dental Radiography in Small AnimalsgangaNo ratings yet

- Making Your Sailor S1303 Free-RunningDocument15 pagesMaking Your Sailor S1303 Free-Runningmrservice7782No ratings yet

- Mobile Harbour Crane PDFDocument7 pagesMobile Harbour Crane PDFJatin KumarNo ratings yet

- DS Lab4 UnlockedDocument2 pagesDS Lab4 UnlockedSri JulapallyNo ratings yet

- Mca 105Document2 pagesMca 105kola0123No ratings yet

- Interpreting Topographical MapsDocument20 pagesInterpreting Topographical MapsBinu Kumar SNo ratings yet

- Bosco Public School: Invitation For Virtual Fest-'Spectrum 2021'Document9 pagesBosco Public School: Invitation For Virtual Fest-'Spectrum 2021'Mehul KapoorNo ratings yet

- SamsoniteDocument17 pagesSamsoniteDeepak Nayak100% (1)

- MS3D-Legend-Create Customized Map Key 200908Document2 pagesMS3D-Legend-Create Customized Map Key 200908Kenny CasillaNo ratings yet

- 1MA1 3F Rms 20240111Document20 pages1MA1 3F Rms 20240111jorgeivan3458No ratings yet

- Dr. Ahmed Elemam Inorganic Chemistry 2020Document13 pagesDr. Ahmed Elemam Inorganic Chemistry 2020Hamada MahmoudNo ratings yet

- Building ITK-SNAP On WindowsDocument5 pagesBuilding ITK-SNAP On WindowsAkshatBordiaNo ratings yet

- HM-1.2T Carbon Fiber Laminate Technical Data SheetDocument12 pagesHM-1.2T Carbon Fiber Laminate Technical Data SheetLuis FloresNo ratings yet

- The Bass Player's Companion: A G Uide To S Ound, C Oncepts, and T Echnique For The E Lectric BassDocument55 pagesThe Bass Player's Companion: A G Uide To S Ound, C Oncepts, and T Echnique For The E Lectric BassBassman BronNo ratings yet

- Cummins K19 Maintainence ScheduleDocument13 pagesCummins K19 Maintainence Schedulesxturbo100% (1)

- AB1014 - Performance Tuning - v2.0Document46 pagesAB1014 - Performance Tuning - v2.0sameer1562000No ratings yet