Professional Documents

Culture Documents

Declaration No PE in India.175145431

Declaration No PE in India.175145431

Uploaded by

Steven LeachOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Declaration No PE in India.175145431

Declaration No PE in India.175145431

Uploaded by

Steven LeachCopyright:

Available Formats

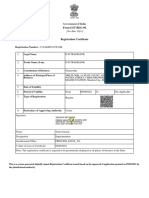

Declaration of no PE in India

Declaration required u/s 9 of income tax act, and for claiming relief under an agreement

referred to in section 90 and 90A

( for claiming the benefit of DTAA - Double Tax Avoidance Treaties )

To

Microsoft India R&D Pte Ltd

Phase I Building,

9th Floor,

Hyderabad, 500033

India

Declaration : no PE in India

Sir,

The Following letter is given to satisfy your country's income tax law requirements.

In terms of requirements of Indian Income tax Act and Rules, we wish to clarify that

a) We are a company based in Malaysia (Country)

b) The income from business with you in taxable is USD 13, 836.75.

We are a regular Income tax assessee in our country as per our rules.

Our Income Tax Registration number in our country is W10-1809-32001051

b) We do not have any Permanent Establishment in India, ( as defined under the

Section 92F(iiia) of the Income Tax Act, ). Hence this money is not taxable in India

c) Hence, we affirm that our income neither accrues in India, nor arises in India, from a

Permanent Establishment / Business Connection in India, hence, is not taxable in india,

d) We shall hold you indemnified, if in future, any thing is found contrary to the above

and your company faces any issues in Indian income taxes for non deduction of tax

Signature / Stamp of the Assessee

Sign

Name MARTIN BRUCE AXE

Designation DIRECTOR

Address #01-01 Crown Regency,

12 Jalan P Ramlee

City Kuala Lumpur

Country Malaysia

Date 10 August 2020

for any related matters, you may contact MLG Associates Team at India

www.mlgassociates.in

www.mlgassociates.org

Handheld phone number +919312608426

You might also like

- Declaration No PE in India.175145431Document3 pagesDeclaration No PE in India.175145431Pallavi MaggonNo ratings yet

- PVT LTD Booklet V3 Portal McaDocument127 pagesPVT LTD Booklet V3 Portal Mcahefej87733No ratings yet

- No PE in India DeclarationDocument1 pageNo PE in India Declarationparthi20No ratings yet

- Expense Claim Form NEW - 2 PagDocument2 pagesExpense Claim Form NEW - 2 PagGabriel Vasile MarinescuNo ratings yet

- Hytera PD40X VHF1&UHF1 Service Manual V00Document123 pagesHytera PD40X VHF1&UHF1 Service Manual V00A&A LABORATORIO100% (1)

- Deem ConveyanceDocument81 pagesDeem ConveyanceKaran DoshiNo ratings yet

- Form 10FDocument2 pagesForm 10FRajeev AttriNo ratings yet

- GST Certificate PDFDocument3 pagesGST Certificate PDFAryan BhushanNo ratings yet

- MSMED DeclarationDocument2 pagesMSMED DeclarationSikandar AlamNo ratings yet

- A.M (Aircraft Maintenance) : February 2018Document10 pagesA.M (Aircraft Maintenance) : February 2018anmol singhNo ratings yet

- ProgramDirNAm Aug 2022Document13 pagesProgramDirNAm Aug 2022Uriel ReyesNo ratings yet

- Undertaking For Not BlacklistedDocument1 pageUndertaking For Not BlacklistedHemsingh RajputNo ratings yet

- 2 - 1862473 - Salary - Annexure - 6 - 5 - 2021 12 - 46 - 56 AMDocument1 page2 - 1862473 - Salary - Annexure - 6 - 5 - 2021 12 - 46 - 56 AMMohammad MAAZNo ratings yet

- Geo Pave Tech Notes 53Document2 pagesGeo Pave Tech Notes 53Jean PajueloNo ratings yet

- GS20025681Document10 pagesGS20025681rvsing200No ratings yet

- MSME DeclarationDocument2 pagesMSME Declarationsystummmhang986No ratings yet

- (#) in Calculating The Investment in Plant & Machinery, The Cost of Pollution Control, Research and DevelopmentDocument1 page(#) in Calculating The Investment in Plant & Machinery, The Cost of Pollution Control, Research and DevelopmentKantiSutharNo ratings yet

- How To Quickly Configure The OLT Huawei MA5608T With ONT HuaweiDocument5 pagesHow To Quickly Configure The OLT Huawei MA5608T With ONT HuaweiAbdulfatah Kasim Iman100% (1)

- Msme Declaration FormDocument1 pageMsme Declaration Formshrinath corporationNo ratings yet

- Invoice PDFDocument2 pagesInvoice PDFEkta RaiNo ratings yet

- Restructre Letter NewDocument2 pagesRestructre Letter NewBP SharmaNo ratings yet

- Ind AS at A GlanceDocument100 pagesInd AS at A GlanceSanjayNo ratings yet

- BRM - FSSAI 23Document6 pagesBRM - FSSAI 23VenuNo ratings yet

- ESIC SPECIMEN - Form-1 Declaration FormDocument2 pagesESIC SPECIMEN - Form-1 Declaration FormnimishshrivastavNo ratings yet

- Franchise AgreementDocument7 pagesFranchise AgreementJake FuentesNo ratings yet

- Form A1 For Import Payment (By Surendra)Document4 pagesForm A1 For Import Payment (By Surendra)surenksinghal100% (5)

- FBR PDFDocument118 pagesFBR PDFNaeem AkhtarNo ratings yet

- Section 195 and Form 15CBDocument53 pagesSection 195 and Form 15CBVALTIM09No ratings yet

- Appointment of Compliance OfficerDocument1 pageAppointment of Compliance OfficerYasminLinaNo ratings yet

- AkashCSuresh - 1422087 - OfferLetter - HDBMB 2018 07 17 11 11 24 027Document4 pagesAkashCSuresh - 1422087 - OfferLetter - HDBMB 2018 07 17 11 11 24 027AKASH C SURESHNo ratings yet

- HP DGS&DDocument35 pagesHP DGS&DsanbarunNo ratings yet

- Employee Registration FormDocument4 pagesEmployee Registration FormjasmeenNo ratings yet

- Form - 25 - Half Yearly ReturnDocument3 pagesForm - 25 - Half Yearly Returnhdpanchal86No ratings yet

- Specimen Copy of Declaration Regarding Registration Under The MSMED Act For Section 43B (H) of Income Tax ActDocument2 pagesSpecimen Copy of Declaration Regarding Registration Under The MSMED Act For Section 43B (H) of Income Tax ActMahavir KapsheNo ratings yet

- Ad Code FormateDocument3 pagesAd Code FormateUtopia Instrumentation AutomationNo ratings yet

- Resignation Cum Relieving LetterDocument2 pagesResignation Cum Relieving LetterVivek PandeyNo ratings yet

- TECQ OID-118499 Quote Technica - LOC R7 Platinum Renewal 01dec2015 - 30nov2016...Document37 pagesTECQ OID-118499 Quote Technica - LOC R7 Platinum Renewal 01dec2015 - 30nov2016...aniruddha_ratilNo ratings yet

- HRM Ir3Document12 pagesHRM Ir3Husaini MohamadNo ratings yet

- Transfer PricingDocument53 pagesTransfer PricingkannnamreddyeswarNo ratings yet

- Rules of Merger - Demeerger FOR CA FIRMSDocument5 pagesRules of Merger - Demeerger FOR CA FIRMSPrikshit Wadhwa100% (1)

- PE Format (1) (1) (00000003)Document1 pagePE Format (1) (1) (00000003)Fiza HairunaNo ratings yet

- MilkaDocument1 pageMilkavilge rogesonNo ratings yet

- GSTCERTIFICATEDocument3 pagesGSTCERTIFICATEnavneet enterprisesNo ratings yet

- Saf Conuts Certificate of IncorporationDocument1 pageSaf Conuts Certificate of IncorporationSakthivel SNo ratings yet

- CIN No of CWES Cambridge School AssociationDocument1 pageCIN No of CWES Cambridge School Associationpravatk2010No ratings yet

- D.H.Tradelink Mumbai GST CertificateDocument3 pagesD.H.Tradelink Mumbai GST CertificateMukesh ChaudhariNo ratings yet

- Government of India Ministry of Corporate Affairs: Signature Not VerifiedDocument1 pageGovernment of India Ministry of Corporate Affairs: Signature Not VerifiedSuman Kalyan SarkarNo ratings yet

- GST Delhi New - 19.2.22Document3 pagesGST Delhi New - 19.2.22sushil.ublNo ratings yet

- KWTL GST Amended CertificateDocument3 pagesKWTL GST Amended CertificateMadhavan SankaranNo ratings yet

- Certificate of Incorporation-5Document1 pageCertificate of Incorporation-5Kumar TNo ratings yet

- Aa090922001177c RC09092022Document3 pagesAa090922001177c RC09092022kkaghhhNo ratings yet

- Aryan TelecomDocument3 pagesAryan Telecomkmevada586No ratings yet

- Vendor RegistrationDocument3 pagesVendor RegistrationvijaymandiNo ratings yet

- Consent Letter BMPLDocument1 pageConsent Letter BMPLVidhi GurjarNo ratings yet

- SPICE + Part B - Approval Letter - AA6522948Document1 pageSPICE + Part B - Approval Letter - AA6522948kitchencloud2022No ratings yet

- SPICE + Part B Approval Letter AA5855768Document1 pageSPICE + Part B Approval Letter AA5855768ranjithroshan143No ratings yet

- GST Cerificate APDocument3 pagesGST Cerificate APGST BACANo ratings yet

- Form GST REG-06: (Amended)Document3 pagesForm GST REG-06: (Amended)nikunjrnanavatiNo ratings yet

- The New India Assurance Co. Ltd. (Government of India Undertaking)Document7 pagesThe New India Assurance Co. Ltd. (Government of India Undertaking)srikarNo ratings yet

- Prabheesh PVDocument2 pagesPrabheesh PVcfo.dammamNo ratings yet