Professional Documents

Culture Documents

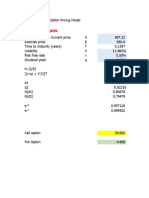

Black-Scholes Model Input: Intermediate Calculations-Do Not Change

Black-Scholes Model Input: Intermediate Calculations-Do Not Change

Uploaded by

Greg Aubin0 ratings0% found this document useful (0 votes)

16 views1 pageThis document contains inputs and outputs for the Black-Scholes options pricing model. The inputs include a time to expiration of 0.3333 years, volatility of 25%, stock price of $30, and interest rate of 5%. The model outputs a call price of $2.53, delta of 0.66, elasticity of 7.62, and put price of $1.05.

Original Description:

Original Title

black+scholes

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains inputs and outputs for the Black-Scholes options pricing model. The inputs include a time to expiration of 0.3333 years, volatility of 25%, stock price of $30, and interest rate of 5%. The model outputs a call price of $2.53, delta of 0.66, elasticity of 7.62, and put price of $1.05.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

16 views1 pageBlack-Scholes Model Input: Intermediate Calculations-Do Not Change

Black-Scholes Model Input: Intermediate Calculations-Do Not Change

Uploaded by

Greg AubinThis document contains inputs and outputs for the Black-Scholes options pricing model. The inputs include a time to expiration of 0.3333 years, volatility of 25%, stock price of $30, and interest rate of 5%. The model outputs a call price of $2.53, delta of 0.66, elasticity of 7.62, and put price of $1.05.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 1

Black-Scholes Model

Using the example on notes

Input

T 0.333333333 Time(years) Change these parameters

Sigma 25.00% Volatility ( %)

S 30.00 Stock Price

r 5.00% Interest Rate (%)

K 29.00 Exercise Price

OUTPUT PANEL:

C 2.53 Black-Scholes Call Price

Delta 0.66 Delta (Hedge Ratio)

E 7.62 Elasticity*

P 1.05 Black-Scholes Put Price

*Percent change in call from a one percent change in the stock price

Intermediate Calculations- Do not change

Tau 0.33

SQRT(Tau) 0.5774

r*Tau 0.0167

Exp(-rTau) 0.9835

Sigma*SQRT(Tau) 0.1443

ln(S/K) 0.0339

d1 0.4225

d2 0.2782

N(d1) 0.66367567

N(d2) 0.609562181

You might also like

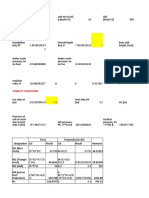

- Type of Option Exercise (Strike) Price (K) Time To Maturity (In Years) (T) Annual Risk Free Rate (R) Option Price $ 2.84 Stock Price (S)Document2 pagesType of Option Exercise (Strike) Price (K) Time To Maturity (In Years) (T) Annual Risk Free Rate (R) Option Price $ 2.84 Stock Price (S)GolamMostafaNo ratings yet

- B - S ModelDocument3 pagesB - S ModelMos MasNo ratings yet

- Option Calculator MainDocument10 pagesOption Calculator MainVarinder AnandNo ratings yet

- P 4Document3 pagesP 4Miguel Jesús Díaz RodríguezNo ratings yet

- FD CheatsheetDocument11 pagesFD CheatsheetHarleen KaurNo ratings yet

- Steel CalcsDocument3 pagesSteel Calcsloc khaNo ratings yet

- Apparent AssignmetDocument115 pagesApparent AssignmetMahlet EshetuNo ratings yet

- Experiment 1 Linear and Radial Heat Conduction (Spreadsheet)Document10 pagesExperiment 1 Linear and Radial Heat Conduction (Spreadsheet)Jing ZeNo ratings yet

- Black Scholes Formulas: C SN (D1) - Xe - RTN (D2)Document4 pagesBlack Scholes Formulas: C SN (D1) - Xe - RTN (D2)girish1palariyaNo ratings yet

- α (m) (m) (t/m2) (m) (m) (kN/m2) : Depth l (thickness) Soil Layer N p A CuDocument17 pagesα (m) (m) (t/m2) (m) (m) (kN/m2) : Depth l (thickness) Soil Layer N p A CuNaldo LumbantoruanNo ratings yet

- Black Scholes PricerDocument3 pagesBlack Scholes PricerlineNo ratings yet

- Design of RCC BuildingDocument5 pagesDesign of RCC Buildingshreejay maneNo ratings yet

- 34greeks V3Document214 pages34greeks V3Rashid MalikNo ratings yet

- Ejercicio 1Document1 pageEjercicio 1Anonymous 2PjTORlNo ratings yet

- Vent Dispersion Calc - OptionalDocument4 pagesVent Dispersion Calc - OptionalPeddy Nesa0% (1)

- Calculation of Gear Dimensions - KHKDocument23 pagesCalculation of Gear Dimensions - KHKvinan44482No ratings yet

- Retaining WallsDocument21 pagesRetaining Wallskiran raghukiranNo ratings yet

- BASE BLOCK CALCULATION (3308) .OdsDocument3 pagesBASE BLOCK CALCULATION (3308) .OdsShubham BhamareNo ratings yet

- PC2 - CorregidaDocument8 pagesPC2 - CorregidaCONDORI GARCIA CHRISTOPHERNo ratings yet

- Lahan Luas Harga C Lo (M) 1 0.082 0.72 400 2 0.022 0.72 200 3 0.042 0.82 300Document4 pagesLahan Luas Harga C Lo (M) 1 0.082 0.72 400 2 0.022 0.72 200 3 0.042 0.82 300Zia Ulhaq Al-MuqtafiNo ratings yet

- II Test Running Record: 2.1 Vibration Data No LoadDocument10 pagesII Test Running Record: 2.1 Vibration Data No LoadberkahharianNo ratings yet

- Tolerance For ThreadDocument15 pagesTolerance For ThreadthilipkumarNo ratings yet

- Raft Xls - ProjectDocument10 pagesRaft Xls - ProjectDilon TkhomaNo ratings yet

- Wind Design - ASCE 7-16Document22 pagesWind Design - ASCE 7-16Nguyen Tan PhatNo ratings yet

- Quantity P1Document28 pagesQuantity P1Minh LinhTinhNo ratings yet

- Earthquake EgyptDocument13 pagesEarthquake EgyptMostafa SeyamNo ratings yet

- Base ShearDocument15 pagesBase ShearNiranjan ShresthaNo ratings yet

- Appendex (A)Document2 pagesAppendex (A)حسنين محمد عبدالرضا فليحNo ratings yet

- Rigid Pavement Design Normal WeightDocument6 pagesRigid Pavement Design Normal WeightAmmad AlizaiNo ratings yet

- Earthquake EgyptDocument11 pagesEarthquake Egyptkhaled nasrNo ratings yet

- Rigid Pavement Design Bowzer WeightDocument6 pagesRigid Pavement Design Bowzer WeightAmmad AlizaiNo ratings yet

- Health Club SUN Load Estimation: Total Resistance of WALLSDocument5 pagesHealth Club SUN Load Estimation: Total Resistance of WALLSAhmed Mohamed GadoNo ratings yet

- Oneeq 19 BDocument3 pagesOneeq 19 Bjunaidmateen2345No ratings yet

- S3979, S3931, S3932, S1352, S3270: One-Dimensional PSDDocument4 pagesS3979, S3931, S3932, S1352, S3270: One-Dimensional PSDSeba RodNo ratings yet

- SB3Document1 pageSB3abhijitkolheNo ratings yet

- Spur GearsDocument7 pagesSpur GearsAkshay JadhavNo ratings yet

- Spatial Positioning: (We Know It's There, But Where Is It?)Document149 pagesSpatial Positioning: (We Know It's There, But Where Is It?)Prarthana PasrichaNo ratings yet

- Calculation of Gear Dimensions - KHK Gears PDFDocument25 pagesCalculation of Gear Dimensions - KHK Gears PDFlawlawNo ratings yet

- Torre Empacada Datos Formula: PlatosDocument6 pagesTorre Empacada Datos Formula: PlatoslolaNo ratings yet

- Identifikasi Aldehida Dan KetonDocument11 pagesIdentifikasi Aldehida Dan KetonRisqa IzzatulNo ratings yet

- 230 600 3.975 S2 Shorter Edge S5 Shorter Edge: Mulim 0.36 FCK B Xulim (d-0.42 Xulim)Document4 pages230 600 3.975 S2 Shorter Edge S5 Shorter Edge: Mulim 0.36 FCK B Xulim (d-0.42 Xulim)Mustafa RupawalaNo ratings yet

- Calculation of Gear DimensionsDocument22 pagesCalculation of Gear DimensionsdressfeetNo ratings yet

- 211260-MOM Lab 4-ADocument7 pages211260-MOM Lab 4-ASalahuddin Muhammad AbdullahNo ratings yet

- Kinds of GearsDocument51 pagesKinds of GearsIrfanNo ratings yet

- Turnout Design CalDocument3 pagesTurnout Design CalPuneet AggarwalNo ratings yet

- University of South Pacific CV211: Solid Mechanics IDocument6 pagesUniversity of South Pacific CV211: Solid Mechanics IKrish ChandNo ratings yet

- 1 CH16 UuDocument12 pages1 CH16 UumemyselfandINo ratings yet

- 4 - Combined FootingDocument2 pages4 - Combined FootingABAMELANo ratings yet

- Screw Conveyor CalculationDocument5 pagesScrew Conveyor Calculationkranthijust4uNo ratings yet

- Screw Conveyor Calcultation SheetDocument11 pagesScrew Conveyor Calcultation Sheethardik033No ratings yet

- A) Calculate The T B) by Using This Period, Determine The Total Equivalent SeismicDocument3 pagesA) Calculate The T B) by Using This Period, Determine The Total Equivalent SeismicAlper DumanNo ratings yet

- ME 307 Mechanical Measurements Laboratory Department of Mechanical Engineering I.I.T.BombayDocument5 pagesME 307 Mechanical Measurements Laboratory Department of Mechanical Engineering I.I.T.Bombayarvind muraliNo ratings yet

- CRD 717Document4 pagesCRD 717Ju Naid MalikNo ratings yet

- S3979, S3931, S3932, S1352, S3270: One-Dimensional PSDDocument4 pagesS3979, S3931, S3932, S1352, S3270: One-Dimensional PSDmoyali25176750No ratings yet

- Unequal Wilkinsonpower DivisionDocument8 pagesUnequal Wilkinsonpower DivisionmurthyNo ratings yet

- Flu Jog RamaDocument61 pagesFlu Jog RamaKevin Oscar Lopez CantorinNo ratings yet

- Swing Angle CalculationDocument4 pagesSwing Angle CalculationRajas Alshi100% (1)

- API Casing Collapse CalcsDocument8 pagesAPI Casing Collapse CalcsJay SadNo ratings yet

- Johannesburg Securities Exchange 2Document4 pagesJohannesburg Securities Exchange 2Greg AubinNo ratings yet

- The Investment Environment & Asset Classes Prof. de JagerDocument5 pagesThe Investment Environment & Asset Classes Prof. de JagerGreg AubinNo ratings yet

- Johannesburg Securities Exchange 1Document16 pagesJohannesburg Securities Exchange 1Greg AubinNo ratings yet

- How Securities Are TradedDocument23 pagesHow Securities Are TradedGreg AubinNo ratings yet

- Week 7 Openness in Goods and Financial MarketsDocument49 pagesWeek 7 Openness in Goods and Financial MarketsGreg AubinNo ratings yet

- What Are Shares? Prof. de JagerDocument11 pagesWhat Are Shares? Prof. de JagerGreg AubinNo ratings yet

- ECO2004S Macroeconomics Ii: The Facts of GrowthDocument38 pagesECO2004S Macroeconomics Ii: The Facts of GrowthGreg AubinNo ratings yet

- Week 8: The Goods Markets in An Open EconomyDocument51 pagesWeek 8: The Goods Markets in An Open EconomyGreg AubinNo ratings yet

- Exports and Imports As % of GDP From 2011 To 2015Document1 pageExports and Imports As % of GDP From 2011 To 2015Greg AubinNo ratings yet

- Investment, Productivity & Growth: Perkins Et Al., Chapter 10, Pp. 349-357Document21 pagesInvestment, Productivity & Growth: Perkins Et Al., Chapter 10, Pp. 349-357Greg AubinNo ratings yet