Professional Documents

Culture Documents

EBLSL Daily Market Update 4th August 2020

EBLSL Daily Market Update 4th August 2020

Uploaded by

Moheuddin SehabOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EBLSL Daily Market Update 4th August 2020

EBLSL Daily Market Update 4th August 2020

Uploaded by

Moheuddin SehabCopyright:

Available Formats

DAILY MARKET REVIEW

Tuesday, August 4, 2020

TODAY'S MARKET COMMENTARY

DSEX, the capital bourse of the country sustained the rally for straight eight consecutive sessions and went up by 27.29 points or 0.64 percent and settled 4299.11 points at the end of the trading session. The index

shown shaky in the early part of the session displaying slight correction but diverted its direction soon after some profit booking period as investors continued buying fresh stocks in the undervalued stocks. The market

has remained cheerful as the Bangladesh Bank declaring an expansionary monetary policy to revive the country’s economy from pandemic fallout. Moreover, investors expected that the banks and financial

institutions would invest in the capital market to get higher profits. Insurance and pharmaceutical companies continued to be the key focus of the investors’ attention. However, investors’ attention were mostly

concentrated on Pharmaceuticals & Chemicals (20.40%), General Insurance (17.95%) and Engineering (9.80%) sectors. PIONEERINS topped the scrip-wise turnover board and contributed 3.55% of the total. All the

sectors exhibited mixed performance today. Among all the sectors Financial Institutions (4.6%), General Insurance (3.1%) and Cement (3.1%) sectors showed highest price appreciation while Life Insurance (-1.1%), IT (-

1.1%) and Paper & Printing (-1.1%) sectors showed highest price correction in today’s session. Out of 354 issues traded, 147 issues advanced, 116 issues declined and 91 issues remain unchanged.

The port city's bourse, Chittagong Stock Exchange also registered upward trend at the end of the session. The selected index, CSCX and CASPI increased by 37.2 and 64.4 points respectively.

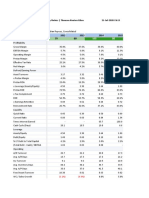

DAY'S SECTOR MOVEMENT DSE MARKET SUMMARY

Sector Return Turnover (mn) % Turnover M.Cap (mn) % of M.Cap P/E (x) P/NAV (x) Today Yday Change %

Bank 1.2% 449.0 6.6% 468,447 16.9% 7.2 0.6 DSEX 4,299 4,272 27.29 0.64%

Cement 3.1% 199.1 2.9% 75,567 2.7% 28.0 1.9 DS30 1,455 1,443 12.10 0.84%

Ceramics 1.0% 72.2 1.1% 20,108 0.7% 151.0 1.4 DSES 1,000 993 6.57 0.66%

Engineering 0.3% 663.1 9.8% 138,195 5.0% 16.9 0.9 Market Cap (BDT bn) 3,312 3,288 24.45 0.74%

Financial Institutions 4.6% 275.2 4.1% 136,946 4.9% 26.5 2.9 Turnover (BDT mn) 6,767 6,724 43.0 0.6%

Food & Allied 0.0% 320.6 4.7% 214,587 7.7% 14.8 5.1 Volume (mn) 251 241 9.9 4%

Fuel & Power 1.5% 456.0 6.7% 391,366 14.1% 11.7 1.2 Market Forward P/E 12.57 12.46

General Insurance 3.1% 1,214.6 18.0% 62,698 2.3% 16.0 1.3

IT -1.1% 276.2 4.1% 22,383 0.8% 19.0 1.9 SCRIP WISE PERFORMANCE

Jute -0.4% 14.8 0.2% 1,811 0.1% 46.0 7.5 No of Issues Advanced No of Issues Declined Issues Unchanged

Life Insurance -1.1% 118.9 1.8% 56,415 2.0% 306.1 n/a 147 116 91

Miscellaneous 0.7% 257.7 3.8% 96,230 3.5% 20.4 1.0

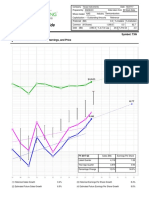

Mutual Fund 0.3% 69.9 1.0% 29,914 1.1% 9.8 0.6 RECENT MARKET MOVEMENT

Paper & Printing -1.1% 34.5 0.5% 14,992 0.5% 53.5 1.1 5100 Turnover in BDT (mn) DSEX Index 30000

4800 25000

Pharma. & Chemicals 0.7% 1,380.1 20.4% 511,574 18.4% 15.5 2.2 4500 20000

4200 15000

Services & Real Estate -0.8% 43.8 0.6% 14,375 0.5% 12.7 0.7 3900

3600 10000

Tannery 0.1% 76.7 1.1% 18,028 0.7% 74.8 1.7 3300 5000

Telecommunication -0.1% 255.3 3.8% 372,954 13.5% 10.1 6.5 3000 0

Apr-20

Apr-20

Apr-20

Jul-20

Jul-20

Jul-20

Jan-20

Jan-20

Jan-20

Jan-20

Mar-20

Mar-20

Mar-20

Mar-20

Jun-20

Jun-20

Jun-20

May-20

May-20

May-20

Feb-20

Feb-20

Textile -0.5% 554.5 8.2% 101,299 3.7% 15.6 0.7

Travel & Leisure 0.0% 34.1 0.5% 24,877 0.9% 27.2 0.7

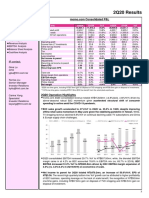

SECTOR RETURN TURNOVER DISTRIBUTION EARNINGS (EPS) UPDATE (BDT)

Name This Yr. Last Yr. Growth Period

Fin Inst 4.6% Pharma 20.40%

Gen Ins 3.1% Gen Ins 17.95% CONFIDCEM 7.90 4.15 90.4% Jul-Mar'20

Cement 3.1% Engineering 9.80% ASIAPACINS 1.51 1.28 18.0% Jan-Jun'20

Fuel & Power 1.5% Textile 8.20% BRACBANK 0.95 2.02 -53.0% Jan-Jun'20

Bank 1.2% Fuel & Power 6.74%

Ceramic 1.0% Bank 6.64%

Pharma 0.7% Food 4.74% DSE NEWS IN BRIEF

Misc 0.7% IT 4.08% REMITTANCES DECLINE BY DUE TO PANDEMIC: Under the worst-case scenario of Covid-19 pandemic

Mutual Fund 0.3% Fin Inst 4.07%

Engineering 0.3% impact, Bangladesh’s remittances could fall by 27.8% in 2020, as job losses mounted and employers

Misc 3.81%

Tannery 0.1% Telecom 3.77% trimmed payrolls, says Asian Development Bank (ADB). During the global financial crisis in 2009, which

Food 0.0% Cement 2.94% resulted in a 2.7% decline in overall remittance inflows to Asia and the Pacific, Bangladesh’s

Travel 0.0% Life Ins 1.76% remittances received by households declined on average by 19.3%.

Telecom -0.1% Tannery 1.13%

Jute -0.4% Ceramic 1.07% TODAY'S WORLD STOCK INDICES

Textile -0.5% Mutual Fund 1.03%

Services -0.8% Services 0.65% Indices Country Today Yday Change % Change

Paper -1.1% Paper 0.51% DJIA USA 26,664 26,428 236.1 0.89%

IT -1.1% Travel 0.50% FTSE 100 UK 6,033 6,033 -0.1 0.00%

Life Ins -1.1% Jute 0.22%

SENSEX India 37,680 36,940 740.8 2.01%

-3.0% -2.0% -1.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 0.0% 15.0% 30.0% 45.0%

Nikkei 225 Japan 22,574 22,195 378.3 1.70%

TOP 15 GAINERS TOP 15 LOSERS TOP 10 TURNOVER* (BDT mn)

FASFIN

Ticker Price Change** 10.00%

Forward P/E Ticker SIMTEX -5.00% Price Change** Forward P/E TICKER Turnover % Turnover Price %∆ in Price

ZEALBANGLA 10.00% COPPERTECH -4.93%

PIONEERINS 9.97% PRIMETEX -4.90% PIONEERINS 240.3 3.55% 62.9 9.97%

SHYAMPSUG 9.89% PROGRESLIF -4.73%

RUPALIBANK 9.84% SQURPHARMA 212.3 3.14% 186.5 -0.27%

DSSL -4.63%

MEGCONMILK 9.84% GQBALLPEN -4.57% BXPHARMA 211.9 3.13% 85.5 -0.23%

MEGHNAPET 9.80% ALIF -4.29%

SILCOPHL 9.76% DACCADYE -4.26%

LHBL 169.3 2.50% 38.0 5.26%

ACTIVEFINE 9.74% SANDHANINS -4.10% GP 161.5 2.39% 263.5 0.00%

USMANIAGL 9.65% KTL -3.88%

PEOPLESINS 9.61% HRTEX -3.79% IBP 121.1 1.79% 21.9 2.82%

INTECH 8.84% BDTHAI -3.77% ACTIVEFINE 103.1 1.52% 16.9 9.74%

AL-HAJTEX 8.47% FINEFOODS -3.53%

IPDC 8.24% POPULARLIF -3.51% KPCL 101.0 1.49% 49.3 -0.20%

BNICL 8.07% SAIFPOWER -3.42% EASTERNINS 98.2 1.45% 84.6 7.77%

0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% -7.0% -6.0% -5.0% -4.0% -3.0% -2.0% -1.0% 0.0%

SILCOPHL 95.2 1.41% 27.0 9.76%

EXCHANGE RATES TOP MKT CAP (BDT) CSE MARKET UPDATES

USD EURO RUPEE GBP Ticker Price M. Cap (mn) % M.Cap Today Yday Change %

84.80 99.77 1.17 110.89 GP 263.5 355,804 12.83% CSCX 7,385 7,348 37.2 0.5%

BATBC 907.6 163,368 5.89% CASPI 12,187 12,122 64.4 0.5%

UPCOMING DIVIDENDS/ RIGHTS OFFERINGS SQURPHARMA 186.5 157,451 5.68% CSI 874 869 4.8 0.6%

Ticker Record Date AGM Date Declaration UPGDCL 233.7 123,159 4.44% Market Cap (BDT bn) 2,618 2,599 19.1 0.7%

ASIAINS 09-Aug-20 20-Sep-20 10%C RENATA 1112 98,511 3.55% Turnover (BDT mn) 170 138 32 23%

NBL 09-Aug-20 12-Oct-20 5%C & 5%B BERGERPBL 1327.6 61,571 2.22% Volume ('000) 8,777 7,120 1,658 23%

Source: DSE, http://www.dsebd.org; http://www.bloomberg.com; EBLSL Research Team Website: www.eblsecurities.com

*Turnover includes block trade; **Changes/ return has calculated based on the dividend adjusted price on record date: PE excludes stocks with negetive earnings e-mail: research@eblsecurities.com

Disclaimer: This document has been prepared by EBL Securities Ltd. (EBLSL) for information only of its clients on the basis of the publicly available information in the market and own research. This document has been prepared for information

purpose only and does not solicit any action based on the material contained herein and should not be construed as an offer or solicitation to buy or sell or subscribe to any security. Neither EBLSL nor any of its directors, shareholders, member of the

management or employee represents or warrants expressly or impliedly that the information or data of the sources used in the documents are genuine, accurate, complete, authentic and correct. However all reasonable care has been taken to

ensure the accuracy of the contents of this document. EBLSL will not take any responsibility for any decisions made by investors based on the information herein.

You might also like

- Ipo Fact SheetDocument18 pagesIpo Fact SheetManali ShahNo ratings yet

- 2005 ASEA Yearbook PDFDocument135 pages2005 ASEA Yearbook PDFAfricanExchangesNo ratings yet

- EBLSL Daily Market Update 5th August 2020Document1 pageEBLSL Daily Market Update 5th August 2020Moheuddin SehabNo ratings yet

- EBLSL Daily Market Update 6th August 2020Document1 pageEBLSL Daily Market Update 6th August 2020Moheuddin SehabNo ratings yet

- EBLSL Daily Market Update - 22nd July 2020Document1 pageEBLSL Daily Market Update - 22nd July 2020Moheuddin SehabNo ratings yet

- Key Ratio Analysis: Profitability RatiosDocument27 pagesKey Ratio Analysis: Profitability RatioskritikaNo ratings yet

- Corporate Accounting ExcelDocument6 pagesCorporate Accounting ExcelshrishtiNo ratings yet

- Key Highlights:: Financial Highlights For Q1 FY22Document3 pagesKey Highlights:: Financial Highlights For Q1 FY22kashyappathak01No ratings yet

- Analysts Meeting BM Q2-2019 (LONG FORM)Document104 pagesAnalysts Meeting BM Q2-2019 (LONG FORM)RadiSujadi24041977No ratings yet

- Stock Screener203229Document3 pagesStock Screener203229Sde BdrNo ratings yet

- SPS Sample ReportsDocument61 pagesSPS Sample Reportsphong.parkerdistributorNo ratings yet

- Performance Summary of The FundDocument1 pagePerformance Summary of The FundSudheer KumarNo ratings yet

- Cigniti - Group 3 - BFBVDocument24 pagesCigniti - Group 3 - BFBVpgdm22srijanbNo ratings yet

- Monthly Activity Reports: Office of Research and Strategic PlanningDocument6 pagesMonthly Activity Reports: Office of Research and Strategic PlanningleejolieNo ratings yet

- Himatsingka Seida LTD.: Ratio Analysis SheetDocument1 pageHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNo ratings yet

- RELAXODocument82 pagesRELAXOFIN GYAANNo ratings yet

- Proximus Consensus Ahead of q1 2023Document4 pagesProximus Consensus Ahead of q1 2023Laurent MillerNo ratings yet

- News Release INDY Result 6M22Document7 pagesNews Release INDY Result 6M22Rama Usaha MandiriNo ratings yet

- ACC DCF ValuationDocument7 pagesACC DCF ValuationJitesh ThakurNo ratings yet

- Starhub FY21Document20 pagesStarhub FY21SurachaiNo ratings yet

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocument2 pagesDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005No ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Momo Operating Report 2Q20Document5 pagesMomo Operating Report 2Q20Wong Kai WenNo ratings yet

- Pakistan State Oil Company Limited (Pso)Document6 pagesPakistan State Oil Company Limited (Pso)Maaz HanifNo ratings yet

- Weekly Wrap For The Week Ended 270919Document1 pageWeekly Wrap For The Week Ended 270919Dilkaran SinghNo ratings yet

- Masonite Corp DCF Analysis FinalDocument5 pagesMasonite Corp DCF Analysis FinaladiNo ratings yet

- Campbell SoupsDocument2 pagesCampbell SoupsBhavesh MotwaniNo ratings yet

- Campbell Soups Company: Year 11 Year 10 Year 9 Net Sales Costs and ExpensesDocument2 pagesCampbell Soups Company: Year 11 Year 10 Year 9 Net Sales Costs and ExpensesBhavesh MotwaniNo ratings yet

- Index ModelDocument1 pageIndex ModelVISHAL PATILNo ratings yet

- GridExport December 8 2022 19 20 38Document4 pagesGridExport December 8 2022 19 20 38FBusinessNo ratings yet

- Y-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesDocument45 pagesY-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesSHIKHA CHAUHANNo ratings yet

- MTCDocument23 pagesMTCsozodaaaNo ratings yet

- Manpasand BeverDocument22 pagesManpasand BeverjenylshahNo ratings yet

- Use 2012 Annual Reports Woolworths Limited Metcash Limited: Pro Forma Financial StatementsDocument3 pagesUse 2012 Annual Reports Woolworths Limited Metcash Limited: Pro Forma Financial StatementsgraceNo ratings yet

- Stock Selection Guide: Symbol: TXNDocument2 pagesStock Selection Guide: Symbol: TXNMayank PatelNo ratings yet

- Hyundai Construction Equipment (IR 4Q20)Document17 pagesHyundai Construction Equipment (IR 4Q20)girish_patkiNo ratings yet

- Market Capitalization (FMCG) : ITC 49% Others 10%Document7 pagesMarket Capitalization (FMCG) : ITC 49% Others 10%Devsom DasNo ratings yet

- 19 4Q - Earning Release of LGEDocument19 pages19 4Q - Earning Release of LGEОverlord 4No ratings yet

- 100 BaggerDocument12 pages100 BaggerRishab WahalNo ratings yet

- CPG Financial Model and Valuation v2Document10 pagesCPG Financial Model and Valuation v2Mohammed YASEENNo ratings yet

- Bear Stearns 4q2005 - TablesDocument4 pagesBear Stearns 4q2005 - Tablesjoeyn414No ratings yet

- Defaultable Fixed Coupon Bond: PricingDocument10 pagesDefaultable Fixed Coupon Bond: PricinggiulioNo ratings yet

- Investment Banking, 3E: Valuation, Lbos, M&A, and IposDocument10 pagesInvestment Banking, 3E: Valuation, Lbos, M&A, and IposBook SittiwatNo ratings yet

- Financial Analysis: ITC Ltd. Ticker: ITC: Prepared By: EdualphaDocument13 pagesFinancial Analysis: ITC Ltd. Ticker: ITC: Prepared By: EdualphaParas LodayaNo ratings yet

- Samsung Electronics: Earnings Release Q2 2016Document8 pagesSamsung Electronics: Earnings Release Q2 2016Syed Mohd AliNo ratings yet

- Stock Screener Database - CROICDocument6 pagesStock Screener Database - CROICJay GalvanNo ratings yet

- DCF Modelling - WACC - CompletedDocument6 pagesDCF Modelling - WACC - Completedkukrejanikhil70No ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument8 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- FedEx (FDX) Financial Ratios and Metrics - Stock AnalysisDocument2 pagesFedEx (FDX) Financial Ratios and Metrics - Stock AnalysisPilly PhamNo ratings yet

- DCF Modelling - 12Document24 pagesDCF Modelling - 12sujal KumarNo ratings yet

- AbbVie 20210806 (BetterInvesting)Document5 pagesAbbVie 20210806 (BetterInvesting)professorsanchoNo ratings yet

- Dupont Analysis ModelDocument278 pagesDupont Analysis ModelKartikay GoswamiNo ratings yet

- Chronos: Kinea Multimercado FI - Maio 2018Document1 pageChronos: Kinea Multimercado FI - Maio 2018Matheus BrandãoNo ratings yet

- Greenply Industries Ltd. - Result Presentation Q2H1 FY 2019Document21 pagesGreenply Industries Ltd. - Result Presentation Q2H1 FY 2019Peter MichaleNo ratings yet

- Ringkasan Finansial Per September 2017Document3 pagesRingkasan Finansial Per September 2017Dwi UdayanaNo ratings yet

- Update Harga: Real-Time: QualityDocument44 pagesUpdate Harga: Real-Time: QualityNul AsashiNo ratings yet

- Pra-Raker Kemendag 2021: Akselerasi Pemulihan Ekonomi Nasional Melalui Peningkatan Peran PerwadagDocument38 pagesPra-Raker Kemendag 2021: Akselerasi Pemulihan Ekonomi Nasional Melalui Peningkatan Peran PerwadagDedy Lampe PRayaNo ratings yet

- DCF Textbook Model ExampleDocument6 pagesDCF Textbook Model ExamplePeterNo ratings yet

- Ratios For SugarDocument4 pagesRatios For SugaromairNo ratings yet

- Fortis Healthcare Limited BSE 532843 FinancialsDocument44 pagesFortis Healthcare Limited BSE 532843 Financialsakumar4uNo ratings yet

- Albermarle Financial ModelDocument38 pagesAlbermarle Financial ModelParas AroraNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- 209 - F - IndiabullsDocument75 pages209 - F - IndiabullsPeacock Live ProjectsNo ratings yet

- Capital and Money MarketDocument17 pagesCapital and Money MarketBalamanichalaBmcNo ratings yet

- Company Law Lecture 2 (Intro Company Law + SECP)Document34 pagesCompany Law Lecture 2 (Intro Company Law + SECP)Faheem buttNo ratings yet

- Introduction FinalDocument23 pagesIntroduction FinalakhilashkhilashNo ratings yet

- Functions of Secondary MarketDocument7 pagesFunctions of Secondary MarketshugugaurNo ratings yet

- Hochfelder Where The Common People Could Speculate, JAH, Sept. 2006Document25 pagesHochfelder Where The Common People Could Speculate, JAH, Sept. 2006Dave HochfelderNo ratings yet

- 2326 Question - QuizDocument66 pages2326 Question - Quizidika123No ratings yet

- Capstone 182051012Document35 pagesCapstone 182051012Kishan YadavNo ratings yet

- Functional Report of Stock ExchangeDocument17 pagesFunctional Report of Stock ExchangeBhavya DayalNo ratings yet

- Internship Report ANURAG NewDocument32 pagesInternship Report ANURAG NewMusic LoverNo ratings yet

- Stock Exchanges - Investments and Derivatives - Questions and Answers PDFDocument120 pagesStock Exchanges - Investments and Derivatives - Questions and Answers PDFkaran sanwalNo ratings yet

- Merchant BankingDocument24 pagesMerchant BankingSweety PawarNo ratings yet

- Research Proposal For The SynopsisDocument10 pagesResearch Proposal For The SynopsisIrfan Malik75% (4)

- Interim Order - Great Overseas Commodeal LimitedDocument11 pagesInterim Order - Great Overseas Commodeal LimitedShyam SunderNo ratings yet

- Group Assignment - Group 1Document36 pagesGroup Assignment - Group 1tia87No ratings yet

- SMART DISHA ACADEMY (Chandkheda, Ahmedabad) Capital Market and Derivative Market (Dealers) Module Test-2019Document7 pagesSMART DISHA ACADEMY (Chandkheda, Ahmedabad) Capital Market and Derivative Market (Dealers) Module Test-2019Vaghela RavisinhNo ratings yet

- 2 Sma SM 1Document12 pages2 Sma SM 1Pondok Pesantren Darunnajah CipiningNo ratings yet

- Capital MarketDocument18 pagesCapital MarketMotiram paudel0% (1)

- FM M1 22mba22Document29 pagesFM M1 22mba22ARUN KUMARNo ratings yet

- Prashant Shinde - SIP PROJECTDocument69 pagesPrashant Shinde - SIP PROJECTshubhamare11No ratings yet

- The Securities Law of The People's Republic of China: An OverviewDocument24 pagesThe Securities Law of The People's Republic of China: An OverviewlauraNo ratings yet

- ARTIFICIAL INTELLIGENCE in FINANCE 7 Things You Should to Know About the Future of Trading With Proven Strategies to Predict Options, Stock and Forex Using Python, Applied Machine Learning, Keras by B (Z-lib.org).eDocument128 pagesARTIFICIAL INTELLIGENCE in FINANCE 7 Things You Should to Know About the Future of Trading With Proven Strategies to Predict Options, Stock and Forex Using Python, Applied Machine Learning, Keras by B (Z-lib.org).eJaime Quiroz100% (1)

- Psb-Role of Capital MarketDocument7 pagesPsb-Role of Capital MarketPSBALARAMNo ratings yet

- SEBI (Prohibition of Insider Trading) Regulations, 2015 - Taxguru - inDocument13 pagesSEBI (Prohibition of Insider Trading) Regulations, 2015 - Taxguru - inshubhendra mishraNo ratings yet

- A Project Report On Sebi As A Regulator of Capital MarketDocument71 pagesA Project Report On Sebi As A Regulator of Capital MarketAlisha MohapatraNo ratings yet

- 'Unit-10 Financial Markets'Document25 pages'Unit-10 Financial Markets'farhaanNo ratings yet

- Blackbook Project Indian Capital MarketDocument68 pagesBlackbook Project Indian Capital MarketRithik ThakurNo ratings yet

- History and Development of Securities Laws in IndiaDocument3 pagesHistory and Development of Securities Laws in IndiaTathagat ShívanshNo ratings yet