Professional Documents

Culture Documents

Strategic Planning 6a

Strategic Planning 6a

Uploaded by

Baher WilliamCopyright:

Available Formats

You might also like

- Mini Case Chapter 7 Bunyan Lumber LLCDocument9 pagesMini Case Chapter 7 Bunyan Lumber LLCricky setiawan100% (2)

- Excel For AuditorsDocument53 pagesExcel For AuditorsJESSICA100% (1)

- Strategy Map of Domestic Auto Parts PDFDocument1 pageStrategy Map of Domestic Auto Parts PDFMacarena Bahamondes ArroyoNo ratings yet

- Financial Statement Analysis FIN658Document1 pageFinancial Statement Analysis FIN658azwan ayop50% (2)

- Equity Research Methodology 031604Document1 pageEquity Research Methodology 031604vardashahid100% (1)

- 2019 Level I Mock C (AM) QuestionsDocument22 pages2019 Level I Mock C (AM) QuestionsshNo ratings yet

- AI StrategyDocument31 pagesAI StrategyHans CasteelsNo ratings yet

- Question PapersDocument3 pagesQuestion PapersAlii ArshadNo ratings yet

- Flexi Cap Fund - Leaflet 1 0Document2 pagesFlexi Cap Fund - Leaflet 1 0shubhamchavan8411No ratings yet

- Yustika Adiningsih-F0319141-Mindmap SPM A Chapter 6 Dan 7Document2 pagesYustika Adiningsih-F0319141-Mindmap SPM A Chapter 6 Dan 7yes iNo ratings yet

- Investor - Job Map: Stages in Getting The Job Done Define Identify Entry Order Modify Exit Micro JobsDocument1 pageInvestor - Job Map: Stages in Getting The Job Done Define Identify Entry Order Modify Exit Micro JobsrishiCR78No ratings yet

- Romeo Power Stock Analysis OverviewDocument8 pagesRomeo Power Stock Analysis OverviewdbsuppNo ratings yet

- UIPath CFRA Analyst ReportDocument9 pagesUIPath CFRA Analyst Reportdxlew10No ratings yet

- Inco 070606Document3 pagesInco 070606Cristiano DonzaghiNo ratings yet

- Financial Statement Analysis RatiosDocument4 pagesFinancial Statement Analysis RatiosAmelieNo ratings yet

- IA Mini One Pager-1Document6 pagesIA Mini One Pager-1Himanshu MalikNo ratings yet

- Birla Sun Life MNC FundDocument1 pageBirla Sun Life MNC Fundellyacool2319No ratings yet

- Ratio Analysis FormulaeDocument22 pagesRatio Analysis FormulaeDhrupal TripathiNo ratings yet

- Blank DiagramDocument1 pageBlank DiagramNishita AppanaNo ratings yet

- ISA 520 FlowchartDocument2 pagesISA 520 Flowchartehteshamanwar444No ratings yet

- Strategic Planning Works: Resources & StructureDocument1 pageStrategic Planning Works: Resources & StructureBaher WilliamNo ratings yet

- Measuring and Evaluate Bank PerformanceDocument1 pageMeasuring and Evaluate Bank PerformanceNguyen Hoai HuongNo ratings yet

- Strategy in Business Context: People Motivation InteractionDocument1 pageStrategy in Business Context: People Motivation InteractionBaher WilliamNo ratings yet

- Strategic Systems: Educati On Smart Gover NanceDocument2 pagesStrategic Systems: Educati On Smart Gover NanceRavindra JoshiNo ratings yet

- Adobe Systems Inc: Stock Report - August 12, 2017 - NNM Symbol: ADBE - ADBE Is in The S&P 500Document9 pagesAdobe Systems Inc: Stock Report - August 12, 2017 - NNM Symbol: ADBE - ADBE Is in The S&P 500Santi11052009No ratings yet

- IPRs Investment Performance Reports Business Process Current StateDocument1 pageIPRs Investment Performance Reports Business Process Current StateKilty ONealNo ratings yet

- Reports CRMDocument11 pagesReports CRMderek_2010No ratings yet

- Proposal Thesis - Thesis FrameworkDocument2 pagesProposal Thesis - Thesis Frameworkarrizky ayu faradila purnamaNo ratings yet

- 30 Minute High Level Overview of R2RDocument24 pages30 Minute High Level Overview of R2Rdaluan2No ratings yet

- Financial Management - San Miguel Foods and Beverage Inc.Document124 pagesFinancial Management - San Miguel Foods and Beverage Inc.Rechelle R. ValerioNo ratings yet

- ExpeditorsDocument11 pagesExpeditorsderek_2010100% (1)

- Financial Asset ManagementDocument26 pagesFinancial Asset ManagementDayani MasNo ratings yet

- Setup Task Lists and TasksDocument11 pagesSetup Task Lists and TasksManu SethumadhavanNo ratings yet

- Comparable Company Transaction AnalysisDocument31 pagesComparable Company Transaction Analysismisha bansalNo ratings yet

- Power Generation Financial ModelDocument56 pagesPower Generation Financial ModelArun Munjal20% (5)

- Framework Profitability Smarthveer Sidana 1Document1 pageFramework Profitability Smarthveer Sidana 1adityaNo ratings yet

- PAS 16 PAS 40: Useful Life Systematic BasisDocument4 pagesPAS 16 PAS 40: Useful Life Systematic Basisjhell dela cruzNo ratings yet

- Applying Information Economics: IKI83407T - IT Investment ManagementDocument27 pagesApplying Information Economics: IKI83407T - IT Investment ManagementRona Putra PNNo ratings yet

- Parameter Tuning - Prediction of Supply Chain Parameters Such As Lead Time and YieldDocument1 pageParameter Tuning - Prediction of Supply Chain Parameters Such As Lead Time and YieldPriyam DasNo ratings yet

- Description: Tags: Fy05reportDocument4 pagesDescription: Tags: Fy05reportanon-168746No ratings yet

- Product Vision & StrategyDocument1 pageProduct Vision & StrategyTeddy MartadinataNo ratings yet

- Strategic Planning 6bDocument1 pageStrategic Planning 6bBaher WilliamNo ratings yet

- 2018 Spgi Ifb IndicesDocument10 pages2018 Spgi Ifb IndicesBrian HNo ratings yet

- CosoDocument85 pagesCosomullazakNo ratings yet

- Reports F SLRDocument11 pagesReports F SLRderek_2010No ratings yet

- Stelco Scotia DDocument9 pagesStelco Scotia DForexliveNo ratings yet

- Conversion Framework InbounderDocument1 pageConversion Framework InboundergalpadillaNo ratings yet

- Oracle Manufacturing Operations Center (MOC) : - What's New and Customer Case StudiesDocument32 pagesOracle Manufacturing Operations Center (MOC) : - What's New and Customer Case StudiesDzung PhanNo ratings yet

- Financial Product Prototype: Asset ClassDocument1 pageFinancial Product Prototype: Asset ClassRuwan WijemanneNo ratings yet

- Cfa TopicsDocument1 pageCfa Topicshanzenda2511No ratings yet

- LR 1Document35 pagesLR 1cherukurichaitanya99No ratings yet

- Reman Wiring Harness Injector: Story SheetDocument25 pagesReman Wiring Harness Injector: Story SheetRizqiNo ratings yet

- Us Sustainable Value MapDocument1 pageUs Sustainable Value Mapfethi aslanNo ratings yet

- Value Creation Model InfosysDocument1 pageValue Creation Model InfosysAbhishek RajNo ratings yet

- HRM Lecture 4 Slides OnlyDocument16 pagesHRM Lecture 4 Slides Only晓冬亚军的二舅姥爷No ratings yet

- Part 147Document19 pagesPart 147AMMAR AHMEDNo ratings yet

- (Example) Risk & Opportunities Register - YDIDocument5 pages(Example) Risk & Opportunities Register - YDIRudy Halim100% (1)

- Production Cost Analysis: September 2017Document18 pagesProduction Cost Analysis: September 2017khaled HussienNo ratings yet

- Combined Safe LeanDocument1 pageCombined Safe LeanHARISH BHARADWAJNo ratings yet

- 财务、企业理财、权益、其他Document110 pages财务、企业理财、权益、其他Ariel MengNo ratings yet

- FR - Interpretation 1Document1 pageFR - Interpretation 1Zubair JallohNo ratings yet

- GMAT First Reading and SolutionDocument6 pagesGMAT First Reading and SolutionBaher WilliamNo ratings yet

- CV TemplateDocument2 pagesCV TemplateBaher WilliamNo ratings yet

- Jean-Baptiste de La Salle: Background StoryDocument3 pagesJean-Baptiste de La Salle: Background StoryBaher WilliamNo ratings yet

- Math Tests Part 2 Math Tests Part 1Document1 pageMath Tests Part 2 Math Tests Part 1Baher WilliamNo ratings yet

- Technology and ScienceDocument4 pagesTechnology and ScienceBaher WilliamNo ratings yet

- Function S 1 .1: (Math Level 1)Document5 pagesFunction S 1 .1: (Math Level 1)Baher WilliamNo ratings yet

- Module 4 PDFDocument1 pageModule 4 PDFBaher WilliamNo ratings yet

- ScheduleDocument1 pageScheduleBaher WilliamNo ratings yet

- Module 12k PDFDocument1 pageModule 12k PDFBaher WilliamNo ratings yet

- Module 2k PDFDocument1 pageModule 2k PDFBaher WilliamNo ratings yet

- Revision Exercise 2 - Int Rates + Capl Budgeting - SolutionsDocument25 pagesRevision Exercise 2 - Int Rates + Capl Budgeting - SolutionsBaher WilliamNo ratings yet

- Macro Environmental Trends - (PESTED) : 2. Environmental Analyisis Guides Marketing Decison MakingDocument1 pageMacro Environmental Trends - (PESTED) : 2. Environmental Analyisis Guides Marketing Decison MakingBaher WilliamNo ratings yet

- The Customer 6 Categories of Industrial Goods and Services: Understanding Organisational Markets and Buying BehaviourDocument1 pageThe Customer 6 Categories of Industrial Goods and Services: Understanding Organisational Markets and Buying BehaviourBaher WilliamNo ratings yet

- Module 12 - Option Pricing - Binomial - Black Scholes - How To Do It - UPDATEDDocument20 pagesModule 12 - Option Pricing - Binomial - Black Scholes - How To Do It - UPDATEDBaher WilliamNo ratings yet

- Module 3 - 6 - Capital Budgeting - CF From Acs - APV - Leasing - EAC - International ProjectsDocument15 pagesModule 3 - 6 - Capital Budgeting - CF From Acs - APV - Leasing - EAC - International ProjectsBaher WilliamNo ratings yet

- Afm Past Papers (2002 - 2019)Document137 pagesAfm Past Papers (2002 - 2019)peterNo ratings yet

- Bfi 4301 Financial Management Paper 1Document10 pagesBfi 4301 Financial Management Paper 1Paul AtariNo ratings yet

- 7 Additional Q in 6th Edition Book PDFDocument25 pages7 Additional Q in 6th Edition Book PDFBikash KandelNo ratings yet

- Alemayehu MetallicDocument20 pagesAlemayehu Metallicmuluken walelgnNo ratings yet

- Final Project KasahunDocument40 pagesFinal Project KasahunMehmoud Husen0% (1)

- Economics of Higher Planting Density in Oil Palm PlantationsDocument8 pagesEconomics of Higher Planting Density in Oil Palm PlantationsMyan AtomedaNo ratings yet

- Chapter 12Document40 pagesChapter 12AdelCh82% (11)

- Economics of Strategy: Pepsico Changchun Joint VentureDocument6 pagesEconomics of Strategy: Pepsico Changchun Joint VentureBanuchandar BalakrishnanNo ratings yet

- CF Assignment 2 Group 9Document35 pagesCF Assignment 2 Group 9rishabh tyagiNo ratings yet

- 27 Temesgen AssefaDocument80 pages27 Temesgen AssefaaderawNo ratings yet

- Free Cash Flow Valuation AnswersDocument3 pagesFree Cash Flow Valuation AnswersJenny Chua100% (1)

- Investment Office ANRSDocument27 pagesInvestment Office ANRSSHASHI SHEKARNo ratings yet

- Assignment First Semester (January To June) 2019Document3 pagesAssignment First Semester (January To June) 2019Saurabh singhNo ratings yet

- Pioneer Petroleum AnalysisDocument10 pagesPioneer Petroleum AnalysisAdan Fernando Valencia FuentesNo ratings yet

- Ma2 Mock 3Document10 pagesMa2 Mock 3yashwant ashokNo ratings yet

- Terms in This SetDocument31 pagesTerms in This SetAnna AldaveNo ratings yet

- 1 Assignment-1Document4 pages1 Assignment-1Tushar Gupta100% (1)

- Practice Problems - Capital Budgeting PDFDocument2 pagesPractice Problems - Capital Budgeting PDFRamainne RonquilloNo ratings yet

- CHAPTER 8 Analyzing Financial Statements and Creating ProjectionsDocument13 pagesCHAPTER 8 Analyzing Financial Statements and Creating Projectionscharrygaborno100% (1)

- Business Plan On Electronic and Communication Equipments Operation Repair and Maintenance ServiceDocument19 pagesBusiness Plan On Electronic and Communication Equipments Operation Repair and Maintenance Servicebiru mulugetaNo ratings yet

- Advanced Financial Management May 2019 Past Paper and Suggested Answers ZvqqzeDocument20 pagesAdvanced Financial Management May 2019 Past Paper and Suggested Answers ZvqqzekaragujsNo ratings yet

- FINC 430 TA Review Session 1 Solutions: Marco SammonDocument9 pagesFINC 430 TA Review Session 1 Solutions: Marco Sammonishuch24No ratings yet

- Presentation Connectivity, LTA, MTOA PsdasDocument65 pagesPresentation Connectivity, LTA, MTOA Psdasdebajyoti ghoshNo ratings yet

- Financial Management: Subject Code: IMT-59Document5 pagesFinancial Management: Subject Code: IMT-59Shail SondhiNo ratings yet

- Integrated Energy-Environment Modeling and LEAP: Charlie Heaps SEI-Boston and Tellus InstituteDocument44 pagesIntegrated Energy-Environment Modeling and LEAP: Charlie Heaps SEI-Boston and Tellus InstitutePaula BorbaNo ratings yet

- Tomato Paste and SauceDocument14 pagesTomato Paste and Saucekassahun mesele100% (1)

- Corporate Finance SummaryDocument44 pagesCorporate Finance SummaryZoë BackbierNo ratings yet

- M o D U L e - 2 - Investment DecisionDocument70 pagesM o D U L e - 2 - Investment DecisionKeyur PopatNo ratings yet

Strategic Planning 6a

Strategic Planning 6a

Uploaded by

Baher WilliamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Strategic Planning 6a

Strategic Planning 6a

Uploaded by

Baher WilliamCopyright:

Available Formats

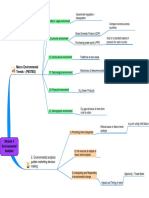

investigate potential outcome from course of action

Investigation of scenarios

ID crucial variables

Sensitivity analysis

ID unexpected threaths

ID combination of circumstances -> success

Approx. compare with competitors

info from annual reports

Benchmarking

find/use info for strategic advantage

Unlikely to reveal how to get comp advantage

ROI - Return On Invest

RONA - Return On Net Asset

Best alt to foregone ROCE - Return On Capital Employed

opportunity cost Module 6 A Id potential weakness reduce amount of info ROTA - Return On Total Asset

balance/ trade off NPV & RISK

Value Added

Does not vary with output

Fixed EPS - Earnings Per Share

Irrelevant

Gearing Ratio

Already taken

Sunk cost retained earnings

not recoverable - irrelevant Costs

to keep flexibility

equity issue

vary with output Cost types

Accounting ratios 3 sources Availability constrains strategic capabilities?

Finance - future resource allocation

(no of workers x wage rate) + (units of take advantage of opportunity

capital x price) + (units of material x price) No optimal ratio

= outlay Variable loans

relevant

outlay / output

= unit cost Historic cost?

replacement cost?

Asset valuation

marginal cost vary Current book value?

productivity vary Accounting - efficiency of past allocation problems

CBU inflation adjusted?

optimum allocation Diminishing marginal product

leased?

marginal prod 1 = marginal prod 2 allocation of resources Which assets

Factors determining cost

competing SBU's

Internal analysis Cost & profit

Time to recover startup cost

compare MC with MR economist MC Payback period

MC vs AC alt - discounted payback

all cost must be considered accountants AC

historical cost only guidance fixed cost / net contribution per unit

economist exclude sunk cost break even =

Production cost

future vs historical cost break even analysis

otherwise biased view concentrate on volume output

accountant incl. all historical cost

focus on factors affecting pot. total sales

What external factors affect cost?

marginal cost

e.g. work & input cost of one more unit

"impossible" to disentangle input relevant cost

Joint production Marginal analysis MR= sales price of one more

allocated cost

Activity Based Costing (ABC) price > maginal cost - keep producing revenue maximising

maybe irrelevant in decision making Right price

market knowledge

what are additional expected cost?

Framework Average Cost reduced with volume output

What are additional expected return Profit maximisation

MR = MC econ of scale first mover advantage

significant in some industries

market leader advantage

Economies of scale Experience curve Average Cost reduced from output to date

experience curve effect decline with time

learning

first mover advantage

Combination gives first mover advantage in new markets

share inputs

good reputation

Reduced unit cost with no of products

R & D spill over effects

Economies of scope coordinated strategy

~ synergy

but more often diseconomies

diversification success

Mod 6a.mmap - 30/11/2011 - Rev. 13 - - prepared by Carl Olav Staff / Rune Fjellvang

Page 1 of 1

You might also like

- Mini Case Chapter 7 Bunyan Lumber LLCDocument9 pagesMini Case Chapter 7 Bunyan Lumber LLCricky setiawan100% (2)

- Excel For AuditorsDocument53 pagesExcel For AuditorsJESSICA100% (1)

- Strategy Map of Domestic Auto Parts PDFDocument1 pageStrategy Map of Domestic Auto Parts PDFMacarena Bahamondes ArroyoNo ratings yet

- Financial Statement Analysis FIN658Document1 pageFinancial Statement Analysis FIN658azwan ayop50% (2)

- Equity Research Methodology 031604Document1 pageEquity Research Methodology 031604vardashahid100% (1)

- 2019 Level I Mock C (AM) QuestionsDocument22 pages2019 Level I Mock C (AM) QuestionsshNo ratings yet

- AI StrategyDocument31 pagesAI StrategyHans CasteelsNo ratings yet

- Question PapersDocument3 pagesQuestion PapersAlii ArshadNo ratings yet

- Flexi Cap Fund - Leaflet 1 0Document2 pagesFlexi Cap Fund - Leaflet 1 0shubhamchavan8411No ratings yet

- Yustika Adiningsih-F0319141-Mindmap SPM A Chapter 6 Dan 7Document2 pagesYustika Adiningsih-F0319141-Mindmap SPM A Chapter 6 Dan 7yes iNo ratings yet

- Investor - Job Map: Stages in Getting The Job Done Define Identify Entry Order Modify Exit Micro JobsDocument1 pageInvestor - Job Map: Stages in Getting The Job Done Define Identify Entry Order Modify Exit Micro JobsrishiCR78No ratings yet

- Romeo Power Stock Analysis OverviewDocument8 pagesRomeo Power Stock Analysis OverviewdbsuppNo ratings yet

- UIPath CFRA Analyst ReportDocument9 pagesUIPath CFRA Analyst Reportdxlew10No ratings yet

- Inco 070606Document3 pagesInco 070606Cristiano DonzaghiNo ratings yet

- Financial Statement Analysis RatiosDocument4 pagesFinancial Statement Analysis RatiosAmelieNo ratings yet

- IA Mini One Pager-1Document6 pagesIA Mini One Pager-1Himanshu MalikNo ratings yet

- Birla Sun Life MNC FundDocument1 pageBirla Sun Life MNC Fundellyacool2319No ratings yet

- Ratio Analysis FormulaeDocument22 pagesRatio Analysis FormulaeDhrupal TripathiNo ratings yet

- Blank DiagramDocument1 pageBlank DiagramNishita AppanaNo ratings yet

- ISA 520 FlowchartDocument2 pagesISA 520 Flowchartehteshamanwar444No ratings yet

- Strategic Planning Works: Resources & StructureDocument1 pageStrategic Planning Works: Resources & StructureBaher WilliamNo ratings yet

- Measuring and Evaluate Bank PerformanceDocument1 pageMeasuring and Evaluate Bank PerformanceNguyen Hoai HuongNo ratings yet

- Strategy in Business Context: People Motivation InteractionDocument1 pageStrategy in Business Context: People Motivation InteractionBaher WilliamNo ratings yet

- Strategic Systems: Educati On Smart Gover NanceDocument2 pagesStrategic Systems: Educati On Smart Gover NanceRavindra JoshiNo ratings yet

- Adobe Systems Inc: Stock Report - August 12, 2017 - NNM Symbol: ADBE - ADBE Is in The S&P 500Document9 pagesAdobe Systems Inc: Stock Report - August 12, 2017 - NNM Symbol: ADBE - ADBE Is in The S&P 500Santi11052009No ratings yet

- IPRs Investment Performance Reports Business Process Current StateDocument1 pageIPRs Investment Performance Reports Business Process Current StateKilty ONealNo ratings yet

- Reports CRMDocument11 pagesReports CRMderek_2010No ratings yet

- Proposal Thesis - Thesis FrameworkDocument2 pagesProposal Thesis - Thesis Frameworkarrizky ayu faradila purnamaNo ratings yet

- 30 Minute High Level Overview of R2RDocument24 pages30 Minute High Level Overview of R2Rdaluan2No ratings yet

- Financial Management - San Miguel Foods and Beverage Inc.Document124 pagesFinancial Management - San Miguel Foods and Beverage Inc.Rechelle R. ValerioNo ratings yet

- ExpeditorsDocument11 pagesExpeditorsderek_2010100% (1)

- Financial Asset ManagementDocument26 pagesFinancial Asset ManagementDayani MasNo ratings yet

- Setup Task Lists and TasksDocument11 pagesSetup Task Lists and TasksManu SethumadhavanNo ratings yet

- Comparable Company Transaction AnalysisDocument31 pagesComparable Company Transaction Analysismisha bansalNo ratings yet

- Power Generation Financial ModelDocument56 pagesPower Generation Financial ModelArun Munjal20% (5)

- Framework Profitability Smarthveer Sidana 1Document1 pageFramework Profitability Smarthveer Sidana 1adityaNo ratings yet

- PAS 16 PAS 40: Useful Life Systematic BasisDocument4 pagesPAS 16 PAS 40: Useful Life Systematic Basisjhell dela cruzNo ratings yet

- Applying Information Economics: IKI83407T - IT Investment ManagementDocument27 pagesApplying Information Economics: IKI83407T - IT Investment ManagementRona Putra PNNo ratings yet

- Parameter Tuning - Prediction of Supply Chain Parameters Such As Lead Time and YieldDocument1 pageParameter Tuning - Prediction of Supply Chain Parameters Such As Lead Time and YieldPriyam DasNo ratings yet

- Description: Tags: Fy05reportDocument4 pagesDescription: Tags: Fy05reportanon-168746No ratings yet

- Product Vision & StrategyDocument1 pageProduct Vision & StrategyTeddy MartadinataNo ratings yet

- Strategic Planning 6bDocument1 pageStrategic Planning 6bBaher WilliamNo ratings yet

- 2018 Spgi Ifb IndicesDocument10 pages2018 Spgi Ifb IndicesBrian HNo ratings yet

- CosoDocument85 pagesCosomullazakNo ratings yet

- Reports F SLRDocument11 pagesReports F SLRderek_2010No ratings yet

- Stelco Scotia DDocument9 pagesStelco Scotia DForexliveNo ratings yet

- Conversion Framework InbounderDocument1 pageConversion Framework InboundergalpadillaNo ratings yet

- Oracle Manufacturing Operations Center (MOC) : - What's New and Customer Case StudiesDocument32 pagesOracle Manufacturing Operations Center (MOC) : - What's New and Customer Case StudiesDzung PhanNo ratings yet

- Financial Product Prototype: Asset ClassDocument1 pageFinancial Product Prototype: Asset ClassRuwan WijemanneNo ratings yet

- Cfa TopicsDocument1 pageCfa Topicshanzenda2511No ratings yet

- LR 1Document35 pagesLR 1cherukurichaitanya99No ratings yet

- Reman Wiring Harness Injector: Story SheetDocument25 pagesReman Wiring Harness Injector: Story SheetRizqiNo ratings yet

- Us Sustainable Value MapDocument1 pageUs Sustainable Value Mapfethi aslanNo ratings yet

- Value Creation Model InfosysDocument1 pageValue Creation Model InfosysAbhishek RajNo ratings yet

- HRM Lecture 4 Slides OnlyDocument16 pagesHRM Lecture 4 Slides Only晓冬亚军的二舅姥爷No ratings yet

- Part 147Document19 pagesPart 147AMMAR AHMEDNo ratings yet

- (Example) Risk & Opportunities Register - YDIDocument5 pages(Example) Risk & Opportunities Register - YDIRudy Halim100% (1)

- Production Cost Analysis: September 2017Document18 pagesProduction Cost Analysis: September 2017khaled HussienNo ratings yet

- Combined Safe LeanDocument1 pageCombined Safe LeanHARISH BHARADWAJNo ratings yet

- 财务、企业理财、权益、其他Document110 pages财务、企业理财、权益、其他Ariel MengNo ratings yet

- FR - Interpretation 1Document1 pageFR - Interpretation 1Zubair JallohNo ratings yet

- GMAT First Reading and SolutionDocument6 pagesGMAT First Reading and SolutionBaher WilliamNo ratings yet

- CV TemplateDocument2 pagesCV TemplateBaher WilliamNo ratings yet

- Jean-Baptiste de La Salle: Background StoryDocument3 pagesJean-Baptiste de La Salle: Background StoryBaher WilliamNo ratings yet

- Math Tests Part 2 Math Tests Part 1Document1 pageMath Tests Part 2 Math Tests Part 1Baher WilliamNo ratings yet

- Technology and ScienceDocument4 pagesTechnology and ScienceBaher WilliamNo ratings yet

- Function S 1 .1: (Math Level 1)Document5 pagesFunction S 1 .1: (Math Level 1)Baher WilliamNo ratings yet

- Module 4 PDFDocument1 pageModule 4 PDFBaher WilliamNo ratings yet

- ScheduleDocument1 pageScheduleBaher WilliamNo ratings yet

- Module 12k PDFDocument1 pageModule 12k PDFBaher WilliamNo ratings yet

- Module 2k PDFDocument1 pageModule 2k PDFBaher WilliamNo ratings yet

- Revision Exercise 2 - Int Rates + Capl Budgeting - SolutionsDocument25 pagesRevision Exercise 2 - Int Rates + Capl Budgeting - SolutionsBaher WilliamNo ratings yet

- Macro Environmental Trends - (PESTED) : 2. Environmental Analyisis Guides Marketing Decison MakingDocument1 pageMacro Environmental Trends - (PESTED) : 2. Environmental Analyisis Guides Marketing Decison MakingBaher WilliamNo ratings yet

- The Customer 6 Categories of Industrial Goods and Services: Understanding Organisational Markets and Buying BehaviourDocument1 pageThe Customer 6 Categories of Industrial Goods and Services: Understanding Organisational Markets and Buying BehaviourBaher WilliamNo ratings yet

- Module 12 - Option Pricing - Binomial - Black Scholes - How To Do It - UPDATEDDocument20 pagesModule 12 - Option Pricing - Binomial - Black Scholes - How To Do It - UPDATEDBaher WilliamNo ratings yet

- Module 3 - 6 - Capital Budgeting - CF From Acs - APV - Leasing - EAC - International ProjectsDocument15 pagesModule 3 - 6 - Capital Budgeting - CF From Acs - APV - Leasing - EAC - International ProjectsBaher WilliamNo ratings yet

- Afm Past Papers (2002 - 2019)Document137 pagesAfm Past Papers (2002 - 2019)peterNo ratings yet

- Bfi 4301 Financial Management Paper 1Document10 pagesBfi 4301 Financial Management Paper 1Paul AtariNo ratings yet

- 7 Additional Q in 6th Edition Book PDFDocument25 pages7 Additional Q in 6th Edition Book PDFBikash KandelNo ratings yet

- Alemayehu MetallicDocument20 pagesAlemayehu Metallicmuluken walelgnNo ratings yet

- Final Project KasahunDocument40 pagesFinal Project KasahunMehmoud Husen0% (1)

- Economics of Higher Planting Density in Oil Palm PlantationsDocument8 pagesEconomics of Higher Planting Density in Oil Palm PlantationsMyan AtomedaNo ratings yet

- Chapter 12Document40 pagesChapter 12AdelCh82% (11)

- Economics of Strategy: Pepsico Changchun Joint VentureDocument6 pagesEconomics of Strategy: Pepsico Changchun Joint VentureBanuchandar BalakrishnanNo ratings yet

- CF Assignment 2 Group 9Document35 pagesCF Assignment 2 Group 9rishabh tyagiNo ratings yet

- 27 Temesgen AssefaDocument80 pages27 Temesgen AssefaaderawNo ratings yet

- Free Cash Flow Valuation AnswersDocument3 pagesFree Cash Flow Valuation AnswersJenny Chua100% (1)

- Investment Office ANRSDocument27 pagesInvestment Office ANRSSHASHI SHEKARNo ratings yet

- Assignment First Semester (January To June) 2019Document3 pagesAssignment First Semester (January To June) 2019Saurabh singhNo ratings yet

- Pioneer Petroleum AnalysisDocument10 pagesPioneer Petroleum AnalysisAdan Fernando Valencia FuentesNo ratings yet

- Ma2 Mock 3Document10 pagesMa2 Mock 3yashwant ashokNo ratings yet

- Terms in This SetDocument31 pagesTerms in This SetAnna AldaveNo ratings yet

- 1 Assignment-1Document4 pages1 Assignment-1Tushar Gupta100% (1)

- Practice Problems - Capital Budgeting PDFDocument2 pagesPractice Problems - Capital Budgeting PDFRamainne RonquilloNo ratings yet

- CHAPTER 8 Analyzing Financial Statements and Creating ProjectionsDocument13 pagesCHAPTER 8 Analyzing Financial Statements and Creating Projectionscharrygaborno100% (1)

- Business Plan On Electronic and Communication Equipments Operation Repair and Maintenance ServiceDocument19 pagesBusiness Plan On Electronic and Communication Equipments Operation Repair and Maintenance Servicebiru mulugetaNo ratings yet

- Advanced Financial Management May 2019 Past Paper and Suggested Answers ZvqqzeDocument20 pagesAdvanced Financial Management May 2019 Past Paper and Suggested Answers ZvqqzekaragujsNo ratings yet

- FINC 430 TA Review Session 1 Solutions: Marco SammonDocument9 pagesFINC 430 TA Review Session 1 Solutions: Marco Sammonishuch24No ratings yet

- Presentation Connectivity, LTA, MTOA PsdasDocument65 pagesPresentation Connectivity, LTA, MTOA Psdasdebajyoti ghoshNo ratings yet

- Financial Management: Subject Code: IMT-59Document5 pagesFinancial Management: Subject Code: IMT-59Shail SondhiNo ratings yet

- Integrated Energy-Environment Modeling and LEAP: Charlie Heaps SEI-Boston and Tellus InstituteDocument44 pagesIntegrated Energy-Environment Modeling and LEAP: Charlie Heaps SEI-Boston and Tellus InstitutePaula BorbaNo ratings yet

- Tomato Paste and SauceDocument14 pagesTomato Paste and Saucekassahun mesele100% (1)

- Corporate Finance SummaryDocument44 pagesCorporate Finance SummaryZoë BackbierNo ratings yet

- M o D U L e - 2 - Investment DecisionDocument70 pagesM o D U L e - 2 - Investment DecisionKeyur PopatNo ratings yet