Professional Documents

Culture Documents

Strategic Planning 7

Strategic Planning 7

Uploaded by

Baher WilliamCopyright:

Available Formats

You might also like

- Problem 15-1 (AICPA Adapted) : Solution 15 - 1 Answer ADocument37 pagesProblem 15-1 (AICPA Adapted) : Solution 15 - 1 Answer AAldrin Lozano87% (15)

- Mindmap High Tech Supply Chain 4.0Document1 pageMindmap High Tech Supply Chain 4.0Juliana Castañeda Jimenez67% (3)

- Projects - 2024 01 09 SERCDocument27 pagesProjects - 2024 01 09 SERCdckien2002No ratings yet

- Projects - 2023 09 26 SERCDocument24 pagesProjects - 2023 09 26 SERCcute biterNo ratings yet

- Strategic Planning Works: Resources & StructureDocument1 pageStrategic Planning Works: Resources & StructureBaher WilliamNo ratings yet

- Buffer StockpilesDocument1 pageBuffer StockpilesRicardo Contreras BNo ratings yet

- Mindmap Continuous Learning InvolvationDocument1 pageMindmap Continuous Learning InvolvationEdison Reus SilveiraNo ratings yet

- Mapping Matrik PenelitianDocument2 pagesMapping Matrik PenelitianKatarina BernardaNo ratings yet

- MindMap Cobit 5 Dan Audit Sistem Informa PDFDocument6 pagesMindMap Cobit 5 Dan Audit Sistem Informa PDFMoch IrwanNo ratings yet

- Chapter 5 Design of Goods and Services OpmDocument1 pageChapter 5 Design of Goods and Services Opmnurfarhana6789No ratings yet

- The 2008 IAM Competences Framework: Defining Competence Requirements For People Working in Asset ManagementDocument2 pagesThe 2008 IAM Competences Framework: Defining Competence Requirements For People Working in Asset ManagementColorinNadaMasNo ratings yet

- MindMap - Waste ManagementDocument1 pageMindMap - Waste ManagementRafidah RashidNo ratings yet

- ERP Trends Macola 021617Document1 pageERP Trends Macola 021617Tarik MudrovNo ratings yet

- AWS Cloud PracticionerDocument1 pageAWS Cloud PracticionerwejsiNo ratings yet

- Strategic Planning 6bDocument1 pageStrategic Planning 6bBaher WilliamNo ratings yet

- Higher: Achieving A Level ofDocument2 pagesHigher: Achieving A Level ofYRMA GARCIANo ratings yet

- IPM Rubrics MBA 2022-24Document7 pagesIPM Rubrics MBA 2022-24venkatesh sharmaNo ratings yet

- Dess8e Ch06 InstructorPPT FINAL4TODocument5 pagesDess8e Ch06 InstructorPPT FINAL4TOErjonaNo ratings yet

- Pres FN17 VIA - TSNDocument23 pagesPres FN17 VIA - TSNAlex Mikail BernatzkyNo ratings yet

- Description: Tags: 08cfoDocument9 pagesDescription: Tags: 08cfoanon-696737No ratings yet

- HP0906 Gonzalez PDFDocument5 pagesHP0906 Gonzalez PDFBesan LaduNo ratings yet

- CLM Template Commercial Cooking NC IIIDocument4 pagesCLM Template Commercial Cooking NC IIIJennifer Ruth WongNo ratings yet

- Start With A Strong Foundation Data Importation: Four-X Analyser™Document2 pagesStart With A Strong Foundation Data Importation: Four-X Analyser™Ricardo Contreras BNo ratings yet

- Part Iv Ipcrf Development NeedsDocument2 pagesPart Iv Ipcrf Development NeedsLivy PadriqueNo ratings yet

- Iogp Report 476 Chart Nov 2019Document1 pageIogp Report 476 Chart Nov 2019Aseem KumarNo ratings yet

- Description: Tags: 08commadminDocument11 pagesDescription: Tags: 08commadminanon-408015No ratings yet

- Mindmap For Operational Transparency in SAP: Supply Chain MindmappingDocument1 pageMindmap For Operational Transparency in SAP: Supply Chain MindmappingobNo ratings yet

- Unified Process: Introduction To TheDocument8 pagesUnified Process: Introduction To TheSevNo ratings yet

- Wholesale Retail - Main PanelDocument1 pageWholesale Retail - Main PanelMuhammad Amri IdrisNo ratings yet

- (HRM-DH45ISB-1) Nguyễn Minh Thảo - Mindmap Session 5 - 31191022307Document1 page(HRM-DH45ISB-1) Nguyễn Minh Thảo - Mindmap Session 5 - 31191022307Ng. Minh ThảoNo ratings yet

- System Thinking ChartDocument1 pageSystem Thinking ChartNova AndrianaNo ratings yet

- Entrepreneurial Competency PDFDocument12 pagesEntrepreneurial Competency PDFShiela OchoaNo ratings yet

- Compenng On Resources (1) Compenng On ResourcesDocument1 pageCompenng On Resources (1) Compenng On ResourcescocoNo ratings yet

- An Efficient Presentation-Architecture For Personalized ContentDocument10 pagesAn Efficient Presentation-Architecture For Personalized ContentCarsten UllrichNo ratings yet

- EBI DiagramaDocument1 pageEBI DiagramaJULIAN MENESESNo ratings yet

- Fidp FabmDocument5 pagesFidp FabmEve Intapaya100% (2)

- Description: Tags: 08aidawareDocument11 pagesDescription: Tags: 08aidawareanon-905483No ratings yet

- Imf - FidpDocument3 pagesImf - FidpAustin Capal Dela CruzNo ratings yet

- Chapter 12Document1 pageChapter 12Phạm TrangNo ratings yet

- Description: Tags: 08ombudDocument1 pageDescription: Tags: 08ombudanon-463337No ratings yet

- TNA TemplateDocument4 pagesTNA TemplateSwapon KumarNo ratings yet

- INFS5000 Skills MatrixDocument5 pagesINFS5000 Skills MatrixhaipeiNo ratings yet

- Mindmap For Pharma Supply ChainsDocument1 pageMindmap For Pharma Supply ChainsNgoc PhamNo ratings yet

- Exfo Reference-Poster 5g-Ran v1 enDocument2 pagesExfo Reference-Poster 5g-Ran v1 enDjnsilva SilvaNo ratings yet

- Highere Ducation Business Reference ModelDocument2 pagesHighere Ducation Business Reference ModelGabrielGarciaOrjuelaNo ratings yet

- BEADS Blockchain-Empowered Auction in Decentralized StorageDocument6 pagesBEADS Blockchain-Empowered Auction in Decentralized StoragexNo ratings yet

- Proficiently Delivers Various Speeches Using The Principles of Effective Speech DeliveryDocument3 pagesProficiently Delivers Various Speeches Using The Principles of Effective Speech DeliveryJunjoy CalimzonNo ratings yet

- #Itsheresomewhere: Iinformation Overload/loss of Message NotDocument2 pages#Itsheresomewhere: Iinformation Overload/loss of Message Notzarmeen durraniNo ratings yet

- Mindmap Supply Chain Network Redesign Chainalytics 2020Document1 pageMindmap Supply Chain Network Redesign Chainalytics 2020Ngoc PhamNo ratings yet

- FIDP Template (Blank)Document2 pagesFIDP Template (Blank)julitoNo ratings yet

- Cost Audit and Its Excellences What WhyDocument1 pageCost Audit and Its Excellences What WhyJKonsultoresNo ratings yet

- Cost Audit and Its Excellences What Why PDFDocument1 pageCost Audit and Its Excellences What Why PDFFahmida AkhterNo ratings yet

- ESRI-The Open GIS Platform: Information Technology Defense/Intelligence Technology GeospatialDocument2 pagesESRI-The Open GIS Platform: Information Technology Defense/Intelligence Technology GeospatialShipra SuhasiniNo ratings yet

- Module 8Document1 pageModule 8Amr AdelNo ratings yet

- Region7 Business and Consumer Loans Group 5 PDFDocument3 pagesRegion7 Business and Consumer Loans Group 5 PDFKimberlyn GranzoNo ratings yet

- Data 11052022Document1 pageData 11052022aljarrahcs2431No ratings yet

- Mobility Hubs PamphletDocument2 pagesMobility Hubs Pamphletسمية علي بوخزامNo ratings yet

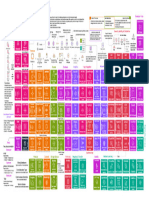

- AWS Periodic TableDocument1 pageAWS Periodic Tabledouglas.dvferreiraNo ratings yet

- Fra 1Document1 pageFra 1khaipham7302No ratings yet

- 1 s2.0 S1877050920308851 MainDocument11 pages1 s2.0 S1877050920308851 Mainp31202302586No ratings yet

- Jean-Baptiste de La Salle: Background StoryDocument3 pagesJean-Baptiste de La Salle: Background StoryBaher WilliamNo ratings yet

- GMAT First Reading and SolutionDocument6 pagesGMAT First Reading and SolutionBaher WilliamNo ratings yet

- CV TemplateDocument2 pagesCV TemplateBaher WilliamNo ratings yet

- Technology and ScienceDocument4 pagesTechnology and ScienceBaher WilliamNo ratings yet

- Math Tests Part 2 Math Tests Part 1Document1 pageMath Tests Part 2 Math Tests Part 1Baher WilliamNo ratings yet

- Function S 1 .1: (Math Level 1)Document5 pagesFunction S 1 .1: (Math Level 1)Baher WilliamNo ratings yet

- ScheduleDocument1 pageScheduleBaher WilliamNo ratings yet

- Module 12k PDFDocument1 pageModule 12k PDFBaher WilliamNo ratings yet

- Module 2k PDFDocument1 pageModule 2k PDFBaher WilliamNo ratings yet

- The Customer 6 Categories of Industrial Goods and Services: Understanding Organisational Markets and Buying BehaviourDocument1 pageThe Customer 6 Categories of Industrial Goods and Services: Understanding Organisational Markets and Buying BehaviourBaher WilliamNo ratings yet

- Macro Environmental Trends - (PESTED) : 2. Environmental Analyisis Guides Marketing Decison MakingDocument1 pageMacro Environmental Trends - (PESTED) : 2. Environmental Analyisis Guides Marketing Decison MakingBaher WilliamNo ratings yet

- Module 4 PDFDocument1 pageModule 4 PDFBaher WilliamNo ratings yet

- Revision Exercise 2 - Int Rates + Capl Budgeting - SolutionsDocument25 pagesRevision Exercise 2 - Int Rates + Capl Budgeting - SolutionsBaher WilliamNo ratings yet

- Module 12 - Option Pricing - Binomial - Black Scholes - How To Do It - UPDATEDDocument20 pagesModule 12 - Option Pricing - Binomial - Black Scholes - How To Do It - UPDATEDBaher WilliamNo ratings yet

- Module 3 - 6 - Capital Budgeting - CF From Acs - APV - Leasing - EAC - International ProjectsDocument15 pagesModule 3 - 6 - Capital Budgeting - CF From Acs - APV - Leasing - EAC - International ProjectsBaher WilliamNo ratings yet

- Younity's 3 Year Young Anniv Flash Sale PDFDocument1 pageYounity's 3 Year Young Anniv Flash Sale PDFIvy NinjaNo ratings yet

- Parcor Proj (Version 1)Document33 pagesParcor Proj (Version 1)Jwhll MaeNo ratings yet

- Project Honda Customers Satisfaction of Two WheelerDocument49 pagesProject Honda Customers Satisfaction of Two Wheelerjaientp2017No ratings yet

- Chapter 1editedDocument13 pagesChapter 1editedMuktar jiboNo ratings yet

- Brand MasteryDocument2 pagesBrand Mastery44 Koundinya KvsNo ratings yet

- OM 5 Resource Planning - SingarDocument40 pagesOM 5 Resource Planning - SingarNishant UpadhyayNo ratings yet

- The Importance of SEO in Digital MarketingDocument7 pagesThe Importance of SEO in Digital MarketingSamriNo ratings yet

- Assessing The Effectiveness of Accounting Information Systems in The Era of COVID-19 Pandemic (Al-Okaily, 2021)Document19 pagesAssessing The Effectiveness of Accounting Information Systems in The Era of COVID-19 Pandemic (Al-Okaily, 2021)Will TannerNo ratings yet

- IBK Bank - AR SR 2022 - 230512 - 20230605.101636.632Document368 pagesIBK Bank - AR SR 2022 - 230512 - 20230605.101636.632Ivena Oriana 201210003No ratings yet

- Tds On Provison of Expenses (Tax Gls Open For Direct Manual Posting On 17.04.23 & 18.04.23 Only by Corporate Office) Urgent & Statuary ComplianceDocument1 pageTds On Provison of Expenses (Tax Gls Open For Direct Manual Posting On 17.04.23 & 18.04.23 Only by Corporate Office) Urgent & Statuary ComplianceArvind Kumar GuptaNo ratings yet

- A Project Report ON: Youth Attraction in Bikano at BikanervalaDocument31 pagesA Project Report ON: Youth Attraction in Bikano at Bikanervalamanoj kumar Das67% (3)

- Project On Tata MotorsDocument15 pagesProject On Tata Motorsayush kumar singh95% (37)

- FORM - Customer Request All in One and Compliance FormDocument2 pagesFORM - Customer Request All in One and Compliance Formgoodluckakah45No ratings yet

- Grace Corporation: Statement of Management's Responsibility For Financial StatementsDocument14 pagesGrace Corporation: Statement of Management's Responsibility For Financial StatementsLaiza Joyce Sales100% (2)

- TX - Mock Test - Đáp ÁnDocument12 pagesTX - Mock Test - Đáp ÁnPhán Tiêu Tiền100% (1)

- Industrial VisitDocument8 pagesIndustrial VisitmarySibiliaNo ratings yet

- Institute of Finance Management Ifm InduDocument25 pagesInstitute of Finance Management Ifm InduDANIEL ROBERT MAHENGENo ratings yet

- BLAW20001 Corporate Law Study NotesDocument26 pagesBLAW20001 Corporate Law Study NotesSayTing Toon100% (2)

- Hitachi Content Platform DatasheetDocument2 pagesHitachi Content Platform DatasheetVimal MaharajNo ratings yet

- Sutherland Shift 2 Reg. Name ListDocument4 pagesSutherland Shift 2 Reg. Name ListNithish 2867 shift 2No ratings yet

- True False False True True True False True True True True True True True True True True False False True True True False True TrueDocument5 pagesTrue False False True True True False True True True True True True True True True True False False True True True False True TrueDong RoselloNo ratings yet

- JP 4-0 Joint Logistic 18jun2008Document124 pagesJP 4-0 Joint Logistic 18jun2008Bryan FenclNo ratings yet

- Aircon Company Profile PDFDocument15 pagesAircon Company Profile PDFOsama RizwanNo ratings yet

- Study - Id64376 - e Commerce in SpainDocument43 pagesStudy - Id64376 - e Commerce in SpainMª Ignacia Ramirez DobudNo ratings yet

- Business Name: Davao Sugar Central Corporations (DASUCECO)Document3 pagesBusiness Name: Davao Sugar Central Corporations (DASUCECO)FloredelNo ratings yet

- Allotment Policy For Govt HousesDocument3 pagesAllotment Policy For Govt HousesAwais Farrukh Butt100% (1)

- HO-Venn Diagram: Directions For Questions 1 and 5: Answer The Questions On The Basis of The Following DataDocument4 pagesHO-Venn Diagram: Directions For Questions 1 and 5: Answer The Questions On The Basis of The Following Dataankit singhNo ratings yet

- Export Market Selection Methods PDFDocument41 pagesExport Market Selection Methods PDFAbahnya UkasyahNo ratings yet

- Rubric For Junior Developer AssessmentDocument4 pagesRubric For Junior Developer AssessmentMihn MihnNo ratings yet

Strategic Planning 7

Strategic Planning 7

Uploaded by

Baher WilliamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Strategic Planning 7

Strategic Planning 7

Uploaded by

Baher WilliamCopyright:

Available Formats

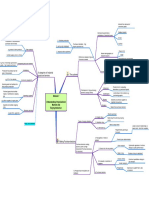

economies of scope across SBU's

1. Scrutinised company objectives use core competence in new SBU

relatedness among assets

2. Evaluated macro environment Utilise core competence, create new strategic asset

related /unrelated diversification expand pool of competence

3. Analysed market - ETOP Structure for rational choice

4. Examined company - SAP already exploited

may not be possible

No automatic course of action Basis for an informed choice competitive legislation

Backward

protect current market position

forward

company strengths Essential first step vertigral integration

identify potential strategic thrust captive company

market opportunities

SWOT Does it add value?

SAP - Strategic Advantage Profile

matching environmental & company recognising unrealised value

Opportunities from ETOP charactheristics

buying market share

= SWOT Strategy variations

reduce competitve preasure

Acquisitions

synergy

relatively small performance gaps

balancing portfolio

markets are mature

core competence

Increased efficiency

Internal weaknesses

Just-In-Time JIT Strategic alliance is a poor substitue for merger

Alliances & joint ventures

unstable finacial history Stability - analysis result

Poor economic prospetcs focus on competitive advantage that can be transferred

Competitve threat Volatile exhange rates relative factor costs vary by country

Perceived cost of change

International expansion government protect home industry

managers averse to risk productivity varies among countries

Diversifying risk Economies move in different pace/steps

culture var fundamentally

Searching for competencies

Module 7 economies of scale

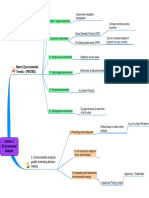

Expansion uncertain future - predict with some certainty

Experience effect Corporate level complexity

strategy concerned with means & ends

building advance capacity

mangerial motivation remuneration - revenue retrenchment

maximise shareholder wealth stable

expand

NPV comparison

Downsizing delayering restructuring

PLC resource allocation vs value creation

Dogs Retrenchment

expand

losing money on some customers

Overextended markets gap identifies which generic strategy to pursue stable

retrenchment

multiple SBU company pursue different performance gaps

strategies compared to induvidual SBU Gap indicates significant reallocation of

Choices among strategies resources to close gap

pursue different generic policy sequentially

combination concentrate internal or external

Opportunity cost

product portfolio eliminate dogs

select optimum portfolio stars to replace questions marks

effective explotation of individual product market

focus balanced but linked portfolio

achieve comp advantage in a given market

Corporate management

strategic response to competitors

lower unit cost / higher profit economies of generic strategies alternatives

scale / experience effect project appraisal complete PLCS

Overall cost leadership new ventures

Investment process - resource allocation Choose on NPV

increase profit by segmentation different achieve comp advantage on chosen product

price in each market market share impact on ROI

quality type of market to aim at

service perceived characteristics differentiation method to achieve relatively low unit cost

image SBU level

Strategy choice total market, market share & price

different not lower cost Porters generic strategies SBU management scenario framework unit cost, contribution

avoid confrontation with competitors Cumulative CF & NPV

identify niche markets not high volume Project appraisal

focus on cost or differentiation sensitivity analysis

focus

Priority not on market share - Find ID crucial variables

unsatisfied customers clarifies pay-offs from different potential

courses of action

no distinctive strategy

relative poor performance no strategy - stuck in the middle subjective probability

trade off between return & possible failure

confused marketing perspective on risk

v attitude to managers of risk

new market opportunity

prospector uncertainty cannot be quantified because

growth by differentiation or low cost Risk & uncertainty analysis future event cannot be foreseen

spohisticated internal info systems technical - minimize probability of loss due to risk

analyser strategy to cope with a wide variety of scenarios

does not enter new markets without info / experience contingency planning strategic response to major unpredictable events

decision maker

keep options open as long as possible

maintain current market position

defender

mature markets / cash cows External dependence

minimax criterion

deals with it as they arise attitudes to risk

reactor

possible future disaster - no change

generic strategy is MEAN - company previous strategies

performance ENDS managerial perceptions

profitability relates to value added by alternatives principal / agent

generic stragey & company performance managerial power relationships

scientific method & hypotheses testing in no

options for conclusions paradox of voting - A better than B better

than C better than A

consensus decisions

- 30/11/2011 - - - prepared by Carl Olav Staff / Rune Fjellvang

Page 1 of 1

You might also like

- Problem 15-1 (AICPA Adapted) : Solution 15 - 1 Answer ADocument37 pagesProblem 15-1 (AICPA Adapted) : Solution 15 - 1 Answer AAldrin Lozano87% (15)

- Mindmap High Tech Supply Chain 4.0Document1 pageMindmap High Tech Supply Chain 4.0Juliana Castañeda Jimenez67% (3)

- Projects - 2024 01 09 SERCDocument27 pagesProjects - 2024 01 09 SERCdckien2002No ratings yet

- Projects - 2023 09 26 SERCDocument24 pagesProjects - 2023 09 26 SERCcute biterNo ratings yet

- Strategic Planning Works: Resources & StructureDocument1 pageStrategic Planning Works: Resources & StructureBaher WilliamNo ratings yet

- Buffer StockpilesDocument1 pageBuffer StockpilesRicardo Contreras BNo ratings yet

- Mindmap Continuous Learning InvolvationDocument1 pageMindmap Continuous Learning InvolvationEdison Reus SilveiraNo ratings yet

- Mapping Matrik PenelitianDocument2 pagesMapping Matrik PenelitianKatarina BernardaNo ratings yet

- MindMap Cobit 5 Dan Audit Sistem Informa PDFDocument6 pagesMindMap Cobit 5 Dan Audit Sistem Informa PDFMoch IrwanNo ratings yet

- Chapter 5 Design of Goods and Services OpmDocument1 pageChapter 5 Design of Goods and Services Opmnurfarhana6789No ratings yet

- The 2008 IAM Competences Framework: Defining Competence Requirements For People Working in Asset ManagementDocument2 pagesThe 2008 IAM Competences Framework: Defining Competence Requirements For People Working in Asset ManagementColorinNadaMasNo ratings yet

- MindMap - Waste ManagementDocument1 pageMindMap - Waste ManagementRafidah RashidNo ratings yet

- ERP Trends Macola 021617Document1 pageERP Trends Macola 021617Tarik MudrovNo ratings yet

- AWS Cloud PracticionerDocument1 pageAWS Cloud PracticionerwejsiNo ratings yet

- Strategic Planning 6bDocument1 pageStrategic Planning 6bBaher WilliamNo ratings yet

- Higher: Achieving A Level ofDocument2 pagesHigher: Achieving A Level ofYRMA GARCIANo ratings yet

- IPM Rubrics MBA 2022-24Document7 pagesIPM Rubrics MBA 2022-24venkatesh sharmaNo ratings yet

- Dess8e Ch06 InstructorPPT FINAL4TODocument5 pagesDess8e Ch06 InstructorPPT FINAL4TOErjonaNo ratings yet

- Pres FN17 VIA - TSNDocument23 pagesPres FN17 VIA - TSNAlex Mikail BernatzkyNo ratings yet

- Description: Tags: 08cfoDocument9 pagesDescription: Tags: 08cfoanon-696737No ratings yet

- HP0906 Gonzalez PDFDocument5 pagesHP0906 Gonzalez PDFBesan LaduNo ratings yet

- CLM Template Commercial Cooking NC IIIDocument4 pagesCLM Template Commercial Cooking NC IIIJennifer Ruth WongNo ratings yet

- Start With A Strong Foundation Data Importation: Four-X Analyser™Document2 pagesStart With A Strong Foundation Data Importation: Four-X Analyser™Ricardo Contreras BNo ratings yet

- Part Iv Ipcrf Development NeedsDocument2 pagesPart Iv Ipcrf Development NeedsLivy PadriqueNo ratings yet

- Iogp Report 476 Chart Nov 2019Document1 pageIogp Report 476 Chart Nov 2019Aseem KumarNo ratings yet

- Description: Tags: 08commadminDocument11 pagesDescription: Tags: 08commadminanon-408015No ratings yet

- Mindmap For Operational Transparency in SAP: Supply Chain MindmappingDocument1 pageMindmap For Operational Transparency in SAP: Supply Chain MindmappingobNo ratings yet

- Unified Process: Introduction To TheDocument8 pagesUnified Process: Introduction To TheSevNo ratings yet

- Wholesale Retail - Main PanelDocument1 pageWholesale Retail - Main PanelMuhammad Amri IdrisNo ratings yet

- (HRM-DH45ISB-1) Nguyễn Minh Thảo - Mindmap Session 5 - 31191022307Document1 page(HRM-DH45ISB-1) Nguyễn Minh Thảo - Mindmap Session 5 - 31191022307Ng. Minh ThảoNo ratings yet

- System Thinking ChartDocument1 pageSystem Thinking ChartNova AndrianaNo ratings yet

- Entrepreneurial Competency PDFDocument12 pagesEntrepreneurial Competency PDFShiela OchoaNo ratings yet

- Compenng On Resources (1) Compenng On ResourcesDocument1 pageCompenng On Resources (1) Compenng On ResourcescocoNo ratings yet

- An Efficient Presentation-Architecture For Personalized ContentDocument10 pagesAn Efficient Presentation-Architecture For Personalized ContentCarsten UllrichNo ratings yet

- EBI DiagramaDocument1 pageEBI DiagramaJULIAN MENESESNo ratings yet

- Fidp FabmDocument5 pagesFidp FabmEve Intapaya100% (2)

- Description: Tags: 08aidawareDocument11 pagesDescription: Tags: 08aidawareanon-905483No ratings yet

- Imf - FidpDocument3 pagesImf - FidpAustin Capal Dela CruzNo ratings yet

- Chapter 12Document1 pageChapter 12Phạm TrangNo ratings yet

- Description: Tags: 08ombudDocument1 pageDescription: Tags: 08ombudanon-463337No ratings yet

- TNA TemplateDocument4 pagesTNA TemplateSwapon KumarNo ratings yet

- INFS5000 Skills MatrixDocument5 pagesINFS5000 Skills MatrixhaipeiNo ratings yet

- Mindmap For Pharma Supply ChainsDocument1 pageMindmap For Pharma Supply ChainsNgoc PhamNo ratings yet

- Exfo Reference-Poster 5g-Ran v1 enDocument2 pagesExfo Reference-Poster 5g-Ran v1 enDjnsilva SilvaNo ratings yet

- Highere Ducation Business Reference ModelDocument2 pagesHighere Ducation Business Reference ModelGabrielGarciaOrjuelaNo ratings yet

- BEADS Blockchain-Empowered Auction in Decentralized StorageDocument6 pagesBEADS Blockchain-Empowered Auction in Decentralized StoragexNo ratings yet

- Proficiently Delivers Various Speeches Using The Principles of Effective Speech DeliveryDocument3 pagesProficiently Delivers Various Speeches Using The Principles of Effective Speech DeliveryJunjoy CalimzonNo ratings yet

- #Itsheresomewhere: Iinformation Overload/loss of Message NotDocument2 pages#Itsheresomewhere: Iinformation Overload/loss of Message Notzarmeen durraniNo ratings yet

- Mindmap Supply Chain Network Redesign Chainalytics 2020Document1 pageMindmap Supply Chain Network Redesign Chainalytics 2020Ngoc PhamNo ratings yet

- FIDP Template (Blank)Document2 pagesFIDP Template (Blank)julitoNo ratings yet

- Cost Audit and Its Excellences What WhyDocument1 pageCost Audit and Its Excellences What WhyJKonsultoresNo ratings yet

- Cost Audit and Its Excellences What Why PDFDocument1 pageCost Audit and Its Excellences What Why PDFFahmida AkhterNo ratings yet

- ESRI-The Open GIS Platform: Information Technology Defense/Intelligence Technology GeospatialDocument2 pagesESRI-The Open GIS Platform: Information Technology Defense/Intelligence Technology GeospatialShipra SuhasiniNo ratings yet

- Module 8Document1 pageModule 8Amr AdelNo ratings yet

- Region7 Business and Consumer Loans Group 5 PDFDocument3 pagesRegion7 Business and Consumer Loans Group 5 PDFKimberlyn GranzoNo ratings yet

- Data 11052022Document1 pageData 11052022aljarrahcs2431No ratings yet

- Mobility Hubs PamphletDocument2 pagesMobility Hubs Pamphletسمية علي بوخزامNo ratings yet

- AWS Periodic TableDocument1 pageAWS Periodic Tabledouglas.dvferreiraNo ratings yet

- Fra 1Document1 pageFra 1khaipham7302No ratings yet

- 1 s2.0 S1877050920308851 MainDocument11 pages1 s2.0 S1877050920308851 Mainp31202302586No ratings yet

- Jean-Baptiste de La Salle: Background StoryDocument3 pagesJean-Baptiste de La Salle: Background StoryBaher WilliamNo ratings yet

- GMAT First Reading and SolutionDocument6 pagesGMAT First Reading and SolutionBaher WilliamNo ratings yet

- CV TemplateDocument2 pagesCV TemplateBaher WilliamNo ratings yet

- Technology and ScienceDocument4 pagesTechnology and ScienceBaher WilliamNo ratings yet

- Math Tests Part 2 Math Tests Part 1Document1 pageMath Tests Part 2 Math Tests Part 1Baher WilliamNo ratings yet

- Function S 1 .1: (Math Level 1)Document5 pagesFunction S 1 .1: (Math Level 1)Baher WilliamNo ratings yet

- ScheduleDocument1 pageScheduleBaher WilliamNo ratings yet

- Module 12k PDFDocument1 pageModule 12k PDFBaher WilliamNo ratings yet

- Module 2k PDFDocument1 pageModule 2k PDFBaher WilliamNo ratings yet

- The Customer 6 Categories of Industrial Goods and Services: Understanding Organisational Markets and Buying BehaviourDocument1 pageThe Customer 6 Categories of Industrial Goods and Services: Understanding Organisational Markets and Buying BehaviourBaher WilliamNo ratings yet

- Macro Environmental Trends - (PESTED) : 2. Environmental Analyisis Guides Marketing Decison MakingDocument1 pageMacro Environmental Trends - (PESTED) : 2. Environmental Analyisis Guides Marketing Decison MakingBaher WilliamNo ratings yet

- Module 4 PDFDocument1 pageModule 4 PDFBaher WilliamNo ratings yet

- Revision Exercise 2 - Int Rates + Capl Budgeting - SolutionsDocument25 pagesRevision Exercise 2 - Int Rates + Capl Budgeting - SolutionsBaher WilliamNo ratings yet

- Module 12 - Option Pricing - Binomial - Black Scholes - How To Do It - UPDATEDDocument20 pagesModule 12 - Option Pricing - Binomial - Black Scholes - How To Do It - UPDATEDBaher WilliamNo ratings yet

- Module 3 - 6 - Capital Budgeting - CF From Acs - APV - Leasing - EAC - International ProjectsDocument15 pagesModule 3 - 6 - Capital Budgeting - CF From Acs - APV - Leasing - EAC - International ProjectsBaher WilliamNo ratings yet

- Younity's 3 Year Young Anniv Flash Sale PDFDocument1 pageYounity's 3 Year Young Anniv Flash Sale PDFIvy NinjaNo ratings yet

- Parcor Proj (Version 1)Document33 pagesParcor Proj (Version 1)Jwhll MaeNo ratings yet

- Project Honda Customers Satisfaction of Two WheelerDocument49 pagesProject Honda Customers Satisfaction of Two Wheelerjaientp2017No ratings yet

- Chapter 1editedDocument13 pagesChapter 1editedMuktar jiboNo ratings yet

- Brand MasteryDocument2 pagesBrand Mastery44 Koundinya KvsNo ratings yet

- OM 5 Resource Planning - SingarDocument40 pagesOM 5 Resource Planning - SingarNishant UpadhyayNo ratings yet

- The Importance of SEO in Digital MarketingDocument7 pagesThe Importance of SEO in Digital MarketingSamriNo ratings yet

- Assessing The Effectiveness of Accounting Information Systems in The Era of COVID-19 Pandemic (Al-Okaily, 2021)Document19 pagesAssessing The Effectiveness of Accounting Information Systems in The Era of COVID-19 Pandemic (Al-Okaily, 2021)Will TannerNo ratings yet

- IBK Bank - AR SR 2022 - 230512 - 20230605.101636.632Document368 pagesIBK Bank - AR SR 2022 - 230512 - 20230605.101636.632Ivena Oriana 201210003No ratings yet

- Tds On Provison of Expenses (Tax Gls Open For Direct Manual Posting On 17.04.23 & 18.04.23 Only by Corporate Office) Urgent & Statuary ComplianceDocument1 pageTds On Provison of Expenses (Tax Gls Open For Direct Manual Posting On 17.04.23 & 18.04.23 Only by Corporate Office) Urgent & Statuary ComplianceArvind Kumar GuptaNo ratings yet

- A Project Report ON: Youth Attraction in Bikano at BikanervalaDocument31 pagesA Project Report ON: Youth Attraction in Bikano at Bikanervalamanoj kumar Das67% (3)

- Project On Tata MotorsDocument15 pagesProject On Tata Motorsayush kumar singh95% (37)

- FORM - Customer Request All in One and Compliance FormDocument2 pagesFORM - Customer Request All in One and Compliance Formgoodluckakah45No ratings yet

- Grace Corporation: Statement of Management's Responsibility For Financial StatementsDocument14 pagesGrace Corporation: Statement of Management's Responsibility For Financial StatementsLaiza Joyce Sales100% (2)

- TX - Mock Test - Đáp ÁnDocument12 pagesTX - Mock Test - Đáp ÁnPhán Tiêu Tiền100% (1)

- Industrial VisitDocument8 pagesIndustrial VisitmarySibiliaNo ratings yet

- Institute of Finance Management Ifm InduDocument25 pagesInstitute of Finance Management Ifm InduDANIEL ROBERT MAHENGENo ratings yet

- BLAW20001 Corporate Law Study NotesDocument26 pagesBLAW20001 Corporate Law Study NotesSayTing Toon100% (2)

- Hitachi Content Platform DatasheetDocument2 pagesHitachi Content Platform DatasheetVimal MaharajNo ratings yet

- Sutherland Shift 2 Reg. Name ListDocument4 pagesSutherland Shift 2 Reg. Name ListNithish 2867 shift 2No ratings yet

- True False False True True True False True True True True True True True True True True False False True True True False True TrueDocument5 pagesTrue False False True True True False True True True True True True True True True True False False True True True False True TrueDong RoselloNo ratings yet

- JP 4-0 Joint Logistic 18jun2008Document124 pagesJP 4-0 Joint Logistic 18jun2008Bryan FenclNo ratings yet

- Aircon Company Profile PDFDocument15 pagesAircon Company Profile PDFOsama RizwanNo ratings yet

- Study - Id64376 - e Commerce in SpainDocument43 pagesStudy - Id64376 - e Commerce in SpainMª Ignacia Ramirez DobudNo ratings yet

- Business Name: Davao Sugar Central Corporations (DASUCECO)Document3 pagesBusiness Name: Davao Sugar Central Corporations (DASUCECO)FloredelNo ratings yet

- Allotment Policy For Govt HousesDocument3 pagesAllotment Policy For Govt HousesAwais Farrukh Butt100% (1)

- HO-Venn Diagram: Directions For Questions 1 and 5: Answer The Questions On The Basis of The Following DataDocument4 pagesHO-Venn Diagram: Directions For Questions 1 and 5: Answer The Questions On The Basis of The Following Dataankit singhNo ratings yet

- Export Market Selection Methods PDFDocument41 pagesExport Market Selection Methods PDFAbahnya UkasyahNo ratings yet

- Rubric For Junior Developer AssessmentDocument4 pagesRubric For Junior Developer AssessmentMihn MihnNo ratings yet