Professional Documents

Culture Documents

PPSA V CIVIL CODE & CHATTEL MORTGAGE LAW

PPSA V CIVIL CODE & CHATTEL MORTGAGE LAW

Uploaded by

Elaizza ConcepcionOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PPSA V CIVIL CODE & CHATTEL MORTGAGE LAW

PPSA V CIVIL CODE & CHATTEL MORTGAGE LAW

Uploaded by

Elaizza ConcepcionCopyright:

Available Formats

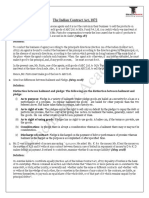

CREDIT TRANSACTIONS

Distinctions between PPSA v Civil Code and Chattel Mortgage Law

From the lectures of Atty. Jazzie Sarona-Lozare

CIVIL CODE PPSA

(RA 11057)

Section 11. Perfection of Security Interest

b. On perfection, a security interest becomes

effective against third parties

“For the mortgage of any motor vehicle to affect

third persons, it should not only be registered in

the chattel mortgage registry but the same

Means of Perfection – Tangible Assets – A security

should also be recorded in the motor vehicle

interest tangible assets may be perfected by either:

office (LTO). The failure of the mortgagee to

a.) Registration of a notice as defined under these

Mortgage of any report the mortgage executed in his favor is

Rules with the Registry; Provided, that a security that

motor vehicle to binding between the mortgagee and the

is not registered remains valid between the parties

affect third mortgagor but ineffective/not binding as against

persons a purchaser in good faith.” (Borlough v Fortune

Enterprises)

NOTE: With the effectivity of the PPSA, it is now

sufficient that you have the mortgage or the security

in interest registered with the register of deeds. That

NOTE: In order to affect third persons, the

is sufficient for its validity. No need for further

mortgage should be recorded also in the LTO.

registration in the LTO because this requirement was

already expressly appealed under the PPSA.

NOTES BY: Elaizza L. Concepcion

CREDIT TRANSACTIONS

Distinctions between PPSA v Civil Code and Chattel Mortgage Law

From the lectures of Atty. Jazzie Sarona-Lozare

CIVIL CODE PPSA

(RA 11057)

IRR – RA 11057

Registration of Notice

“The duties of a register of deeds in respect to the

Section 5.05. Sufficiency of Notice. –

registration of chattel mortgage are of a purely ministerial

(a) An initial notice of security of interest shall not be rejected:

character. The parties to a contract may, by agreement,

i. If it identifies the grantor by an identification number, as

treat as personal property which by nature would be a real

further prescribed in the regulations;

property. A register of deeds has no authority to pass

ii. If it identifies the secured creditor or an agent of the secured

upon the capacity of the parties to a chattel mortgage

creditor by name;

which is presented to him for record. If the mortgage

iii. If it provides an address for the grantor and secured creditor

Duty of the register of property is real instead of personal, the chattel mortgage

or its agent;

deeds in respect to would no doubt be held ineffective as against third

iv. If it describes the collateral;

registration of chattel parties, but this is a question to be determined by the

v. If it states the duration of effectivity of the security interest;

mortgage courts of justice and not by the register of deeds.”

and

(Standard Oil v Jaramillo)

vi. If the prescribed fee has been tendered, or an arrangement

has been made for payment of fees by other means.

NOTE: What is important is it is binding between the

parties involved and no discretion on the part of the

NOTE: If all of these are complied with, the registry of deeds

register of deeds to refuse such registration on the ground

has the duty to register it. In other words, I think the rule would

that what is involved is a real property

still be the same. The duty of the registry of deeds is still purely

ministerial in nature even in the effectivity of the PPSA.

NOTES BY: Elaizza L. Concepcion

CREDIT TRANSACTIONS

Distinctions between PPSA v Civil Code and Chattel Mortgage Law

From the lectures of Atty. Jazzie Sarona-Lozare

THE CHATTEL MORTGAGE LAW PPSA

(ACT 1508) (RA 11057)

Section 4. Validity – “If the property is situated in

a different province from that in which the

mortgagor resides, the mortgage shall be

recorded in the office of the register of deeds of

both the province in which the mortgagor resides

and that in which the property is situated…”

NOTE: This is applicable if what is involved are One registry of properties or personal properties.

Requirement of shares of stock. There’s no problem if the

registration of two corporation who issued the shares of stock is in No similar requirement and no specific provision

different places the same place where the mortgagor resides. that would require registration of two different

places

If the mortgagor resides in a different city or

province and the corporation which issued that

shares is in a different city or province, there must

be registration on both province where the

mortgagor resides and in which the property is

situated (in this case, shares of stock) in which the

corporation which issued the shares has its

principal office.

NOTES BY: Elaizza L. Concepcion

CREDIT TRANSACTIONS

Distinctions between PPSA v Civil Code and Chattel Mortgage Law

From the lectures of Atty. Jazzie Sarona-Lozare

THE CHATTEL MORTGAGE LAW PPSA

(ACT 1508) (RA 11057)

Apply Section 7 of Act 1508 which provides for the

Reasonable Description rule.

Limitation in Section 7: “A chattel mortgage shall cover

only the property described therein and not like or

substitute property thereafter acquired by the mortgagor

and placed in the same depository as the property

originally mortgaged”

Description of the NOTE: Section 7 does not demand a minute and specific

It is enough that you use the term “all personal property, all

property involved in a description of every chattel mortgage in the deal of

equipment, all personal property with generic category”

chattel mortgage mortgage but, only requires that the description be such

as to enable the parties in the mortgage or any other

person after reasonable inquiry and investigation to

identify the same.

The limitation found in Section 7 on the phrase like or

substituted properties make reference to those thereafter

acquired by the mortgagor and placed in the same

depository as the property originally mortgaged and not

to those already existing and originally included at the

deed of the constitution of the chattel mortgage.

NOTES BY: Elaizza L. Concepcion

CREDIT TRANSACTIONS

Distinctions between PPSA v Civil Code and Chattel Mortgage Law

From the lectures of Atty. Jazzie Sarona-Lozare

THE CHATTEL MORTGAGE LAW PPSA

(ACT 1508) (RA 11057)

GENERAL RULE: The general rule under Act 1508 with regard to after

acquired properties is it will not be deemed included.

EXCEPTION: unless it is in the form of substitution or replenishment

Future Property/ Future properties are a valid subject matter provided that the

NOTE: Future property is not allowed under the Chattel Mortgage

After-acquired property Law. Although, as an exception, a stipulation in the mortgage

grantor will have a right over these future properties

extending its scope and effect to after-acquired properties is valid and

binding where such properties, in renewal of or in substitution for

goods on hand such as inventory when the mortgage was executed or

purchased with the proceeds of sale of such goods.

A chattel mortgage can only cover obligations existing at the time the

mortgage is constituted. Although there may be a promise expressed

in a chattel mortgage to include future debts, the security itself does

not come into existence or arise until after a chattel mortgage

agreement covering the newly contracted debt is executed, either

you execute a new chattel mortgage or you amend the old contract If you look at the provisions of the law, as well as the IRR, there is no express

of chattel mortgage. Refusal on the part of the borrower to execute provision that would say that it would cover future obligation. What is

the agreement [so as] to cover the after-incurred obligation can mentioned is the requirement that the security agreement identify the

Future Obligations/ constitute an act of default on the part of the borrower [of the secured obligation. However, if you take a look at the sample documents

After-incurred financing agreement] whereon the promise is written, but remedy of or contracts or security agreement attached as annexes to the IRR, they

obligations foreclosure can only cover the debts extant or existing at the time of mention the coverage of the security interest. It may cover present and

the constitution and during the life of the chattel mortgage that is future obligations. In other words, as long as it is covered by the PPSA, it

sought to be foreclosed. (Acme Shoe v CA) can cover future obligations, but, of course, it must be specifically identified

in the security agreement.

The only effect is that there would be no more chattel mortgage to

foreclose, but the second loan continues to be valid and existing, and

the debtor should, nevertheless, be held liable therefor. What was

lost was only the remedy of foreclosure on the part of the mortgagee.

(Marquez v Elisan)

NOTES BY: Elaizza L. Concepcion

CREDIT TRANSACTIONS

Distinctions between PPSA v Civil Code and Chattel Mortgage Law

From the lectures of Atty. Jazzie Sarona-Lozare

THE CHATTEL MORTGAGE LAW PPSA

(ACT 1508) (RA 11057)

Section 45. Right of Redemption. — (a) Any person who is

entitled to receive a notification of disposition in accordance

No right of redemption after the sales is held to discharge with this Chapter is entitled to redeem the collateral by paying

the obligation. What you have under the chattel mortgage or otherwise performing the secured obligation in full,

law is an equity of redemption. When we talk about equity including the reasonable cost of enforcement.

of redemption, after default but before sale or before (b) The right of redemption may be exercised unless:

registration of the sale. (1) The person entitled to redeem has not, after the default,

waived in writing the right to redeem;

There is no right to redeem of personal property under (2) The collateral is sold or otherwise disposed of, acquired or

the Chattel Mortgage law. In other words, the ownership collected by the secured creditor or until the conclusion of an

is vested upon the highest bidder during the foreclosure agreement by the secured creditor for that purpose; and

sale. There is no one-year period of redemption when it (3) The secured creditor has retained the collateral

comes to a Chattel Mortgage. (Cabral v Evangelista)

Right of redemption

NOTE: It is not really a right of redemption because, technically

NOTE: speaking, as we have seen in the several cases that we have

Relevant here: discussed, when we talk about right of redemption, it is after

• 30-day period: Only after 30-days can the public the registration of sale and we call it equity of redemption,

auction be held. right to pay after default, but essentially, it is after default but

• 10 days notice: The sale, ten days before that, at least before registration of the sale. But if you look at the provisions

you have given notice to the mortgagor-debtor in the PPSA, even if it used the term right of redemption, what

• Public notice: Under the Chattel Mortgage Law, what is we have here is an equity of redemption, pay prior to the sale.

required only is posting of the public notice. No After the sale has already happened or after, as in this case, as

requirement of publication, unlike under Act 3135 for we would recall under PPSA, the secured creditor can retain

extrajudicial foreclosure of real estate mortgage. the collateral upon consent of the grantor, that’s it. It’s

finished. So, there is no redemption.

NOTES BY: Elaizza L. Concepcion

CREDIT TRANSACTIONS

Distinctions between PPSA v Civil Code and Chattel Mortgage Law

From the lectures of Atty. Jazzie Sarona-Lozare

THE CHATTEL MORTGAGE LAW PPSA

(ACT 1508) (RA 11057)

Section 14 of the Chattel Mortgage expressly entitles the mortgagor

to the balance of the proceeds upon satisfaction of the principal

obligation and cause. Since the chattel mortgage bars the creditor

mortgagee from retaining the excess of the sales proceeds, there is a

corollary obligation on the part of the debtor mortgagee to pay the

deficiency in case of reduction. So, if there is an excess, mortgagor is

entitled but if there is deficiency, mortgagee can go after the debtor Differentiate it to PPSA, as to the application of proceeds:

mortgagor. (PAMECA v CA)

1. Apply to the reasonable expenses

2. To the satisfaction of the obligation secured by the security interest

NOTE: you cannot apply 1484 in a mortgage. 1484 is the Recto Law.

3. The satisfaction of the obligation secured by any subordinate security

interest or in the collateral if a written demand and proof of the interest

Remember in 1484, you have three remedies therein:

are received before distribution of the proceeds is completed

1. Specific Performance

2. Cancellation

Deficiency and Excess

3. Foreclosure of mortgage if any What if there is excess?

&

Application of proceeds The secured creditor shall account to the grantor for any surplus and unless

To which, if that remedy is availed of under 1484 paragraph 3 otherwise agreed, the debtor is liable for any deficiency.

(Foreclosure), the vendor is not anymore entitled to any deficiency in

case the price during the foreclosure sale is not sufficient to pay off More or less, it is the same with chattel mortgage law, the only difference

the unpaid purchase price. But again, that is only applicable if what is is the phrase, “unless otherwise agreed”. We do not have that phrase

involved is a sale of personal property in installments that there is under the chattel mortgage law but I think under the old chattel mortgage

chattel mortgage. law, if there is an agreement that the debtor is not liable for any deficiency,

I don’t think it would be much of an issue because remember, the purpose

of this is on the part of the mortgagee to hold an honest sale.

In Section 14, in case of Sale or foreclosure sale, the proceeds will be

applied as follows:

1. The cost and expenses of keeping and sale;

2. Obligation secured by the Chattel Mortgage;

3. Subsequent mortgagees; and

4. if there is excess, to the mortgagor

NOTES BY: Elaizza L. Concepcion

You might also like

- Reviewer Personal Property Security ActDocument34 pagesReviewer Personal Property Security ActSbl Irv100% (17)

- The Borrower Should Repay The Lender-Tom SchaufDocument6 pagesThe Borrower Should Repay The Lender-Tom Schaufrodclassteam100% (7)

- Commodatum Mutuum Deposit LeaseDocument21 pagesCommodatum Mutuum Deposit LeaseJennilyn Tugelida100% (3)

- Banking Laws ReviewerDocument26 pagesBanking Laws ReviewerZtirf Nobag83% (6)

- Understanding RA 11057 and Its Effect With NCC and Prior LawsDocument2 pagesUnderstanding RA 11057 and Its Effect With NCC and Prior LawsKym Algarme100% (2)

- PPSA SummaryDocument9 pagesPPSA Summarykarl100% (17)

- CBP Circular No. 905Document6 pagesCBP Circular No. 905Daniel Danjur Daguman86% (7)

- FRIA Law Reviewer PDFDocument10 pagesFRIA Law Reviewer PDFJaylordPataotao100% (1)

- Deed of Substituted Security - BOS - HalifaxDocument2 pagesDeed of Substituted Security - BOS - HalifaxDamian MikaNo ratings yet

- Revised PPSA V. Chattel Mortgage, Pledge, Preference of CreditDocument8 pagesRevised PPSA V. Chattel Mortgage, Pledge, Preference of CreditJj Jumalon67% (3)

- PPSA V Civil CodeDocument3 pagesPPSA V Civil CodeElaizza ConcepcionNo ratings yet

- Property Security Act", Sec. 4)Document29 pagesProperty Security Act", Sec. 4)Rion Margate60% (5)

- PPSA V Civil CodeDocument3 pagesPPSA V Civil CodeElaizza ConcepcionNo ratings yet

- Obligation and Contrcacts SummaryDocument7 pagesObligation and Contrcacts SummaryRaffy Roncales90% (29)

- Discharging Debt Via HJR 192 - PDF - Trust Law - DebtDocument14 pagesDischarging Debt Via HJR 192 - PDF - Trust Law - DebtLaLa Banks100% (2)

- Notes From Dean Salaos Lecture On Personal Property Security ActDocument9 pagesNotes From Dean Salaos Lecture On Personal Property Security ActCassie GacottNo ratings yet

- Guaranty and SuretyshipDocument14 pagesGuaranty and Suretyshiproansalanga100% (1)

- Credit Transactions: Benefit of ExcussionDocument5 pagesCredit Transactions: Benefit of ExcussionDandan TanNo ratings yet

- IRR - Personal Property Security Act (PPSA)Document38 pagesIRR - Personal Property Security Act (PPSA)acolumnofsmoke33% (3)

- Personal Property Security Act: Section 2. Declaration of PolicyDocument20 pagesPersonal Property Security Act: Section 2. Declaration of PolicyRikka Reyes100% (4)

- Classification of Credits Under The Civil CodeDocument6 pagesClassification of Credits Under The Civil Codedelayinggratification100% (1)

- Case Digest Week 2 CommodatumDocument3 pagesCase Digest Week 2 CommodatumAnonymous b4ycWuoIcNo ratings yet

- Credit Trans PowerPoint inDocument20 pagesCredit Trans PowerPoint inPearl Angeli Quisido CanadaNo ratings yet

- Commodatum & Mutuum CasesDocument87 pagesCommodatum & Mutuum CasesKareen BaucanNo ratings yet

- 106 SCRA 391, July 31, 1981: PalvcaDocument1 page106 SCRA 391, July 31, 1981: PalvcaElaizza ConcepcionNo ratings yet

- Comparison PPSA NCC CMLDocument6 pagesComparison PPSA NCC CMLNur Omar100% (1)

- Cred Trans - PpsaDocument10 pagesCred Trans - PpsaJane Galicia100% (3)

- Ra 11057Document16 pagesRa 11057Rio Sanchez100% (9)

- Atty. WBC - Personal Property Security ActDocument2 pagesAtty. WBC - Personal Property Security ActWarren Barrameda ConcepcionNo ratings yet

- Beda MemAid PPSADocument5 pagesBeda MemAid PPSAJeremiah Ruaro100% (3)

- Personal Property Security Act: Republic Act No. 11057 Section 2. Declaration of PolicyDocument21 pagesPersonal Property Security Act: Republic Act No. 11057 Section 2. Declaration of PolicyRikka Reyes100% (4)

- PPSA NotesDocument3 pagesPPSA NotesKing Badong100% (1)

- Saclolo V MarquitoDocument2 pagesSaclolo V MarquitoDeaNo ratings yet

- RA 11057 vs. Repealed LawsDocument2 pagesRA 11057 vs. Repealed LawsSage Rainelle LingatongNo ratings yet

- Alano Vs Planter'S Development Bank: Whether or Not The Defendant Is A Mortgagee in Good Faith?Document2 pagesAlano Vs Planter'S Development Bank: Whether or Not The Defendant Is A Mortgagee in Good Faith?Kayee KatNo ratings yet

- PPSA Supplemental ReviewerDocument13 pagesPPSA Supplemental ReviewerJohn Paul100% (4)

- Problems in Ppsa and FriaDocument6 pagesProblems in Ppsa and FriaYanaKarununganNo ratings yet

- Trust Receipt Law NotesDocument8 pagesTrust Receipt Law NotesValentine Morales100% (1)

- Notes Ra 11057Document2 pagesNotes Ra 11057Jillian Roy100% (1)

- Sample PpsaDocument3 pagesSample PpsaMaribel Nicole LopezNo ratings yet

- SPCL Case DigestDocument7 pagesSPCL Case DigestlawYearNo ratings yet

- Law On Sales Hector de Leon PDFDocument737 pagesLaw On Sales Hector de Leon PDFMich ElbirNo ratings yet

- 2019 Divina FRIA 070919 MJRSIDocument15 pages2019 Divina FRIA 070919 MJRSIMuhammadIbnSulu100% (3)

- FRIA Case Digests 2020Document21 pagesFRIA Case Digests 2020Mae100% (1)

- ACT NO 3135 With AmendmentsDocument4 pagesACT NO 3135 With AmendmentsChristian Toledo100% (1)

- REM, Antichresis, Chattel Mortgage - Notes and CasesDocument45 pagesREM, Antichresis, Chattel Mortgage - Notes and CasesCelestino LawNo ratings yet

- AGENCY NotesDocument14 pagesAGENCY NotesJoshua Gerard NapoNo ratings yet

- Comparison Chart For Guaranty Pledge and Mortgage 2Document12 pagesComparison Chart For Guaranty Pledge and Mortgage 2denelizaNo ratings yet

- Bir Ruling (Da - (C-104) 328-08)Document3 pagesBir Ruling (Da - (C-104) 328-08)E ENo ratings yet

- RMC 5-01Document3 pagesRMC 5-01Yosef_d0% (1)

- Obligations of The VendorDocument8 pagesObligations of The Vendorlorenceabad07No ratings yet

- Reserva Maxima and Reserva Minima ExplainedDocument2 pagesReserva Maxima and Reserva Minima ExplainedNikki Joanne Armecin LimNo ratings yet

- PNB v. Noah's Ark Sugar RefineryDocument3 pagesPNB v. Noah's Ark Sugar RefineryBrooke Young100% (2)

- Defenses Forgery (2004)Document24 pagesDefenses Forgery (2004)ivan anonuevoNo ratings yet

- Republic Act No 10607Document7 pagesRepublic Act No 10607Romel TorresNo ratings yet

- FRIA LectureDocument25 pagesFRIA LectureErika Angela Galceran100% (1)

- SPCL - 10 04 (Sherlock)Document6 pagesSPCL - 10 04 (Sherlock)salaoNo ratings yet

- PPSADocument3 pagesPPSAMVSNo ratings yet

- Section 114 Recording of Chattel MortgagesDocument4 pagesSection 114 Recording of Chattel MortgagesMaria Hannah Kristen P. RamirezNo ratings yet

- Comm Rev Abella NotesDocument65 pagesComm Rev Abella NotesRoger Montero Jr.No ratings yet

- Consti2-Digest For Kilosbayan Vs GuingonaDocument2 pagesConsti2-Digest For Kilosbayan Vs GuingonaSui100% (1)

- Adobe Scan Mar 5, 2022Document8 pagesAdobe Scan Mar 5, 2022PAULA MENDITANo ratings yet

- PPSA Notes™Document33 pagesPPSA Notes™聖乃明名No ratings yet

- Oblicon Notes Case PrinciplesDocument8 pagesOblicon Notes Case PrinciplesDahlia Claudine May PerralNo ratings yet

- This Study Resource Was: Arts. 2140-2141 Concept (2140 and Act 1508)Document4 pagesThis Study Resource Was: Arts. 2140-2141 Concept (2140 and Act 1508)Jirylyn JoyNo ratings yet

- Chattel MortgageDocument12 pagesChattel MortgageRaven Cael C. GarriguesNo ratings yet

- in The Matter of Petition To Approve The Will of Ruperta PalaganasDocument1 pagein The Matter of Petition To Approve The Will of Ruperta PalaganasElaizza ConcepcionNo ratings yet

- Concepcion - Allied Banking Corp V BPIDocument1 pageConcepcion - Allied Banking Corp V BPIElaizza ConcepcionNo ratings yet

- New Sun Valley V Sangguniang Bayan GR NO. 156686, July 27, 2011Document1 pageNew Sun Valley V Sangguniang Bayan GR NO. 156686, July 27, 2011Elaizza ConcepcionNo ratings yet

- Dynamic BuildersDocument2 pagesDynamic BuildersElaizza ConcepcionNo ratings yet

- UPPC V ACROPOLISDocument2 pagesUPPC V ACROPOLISElaizza ConcepcionNo ratings yet

- NATIONAL BANKA V OLUTANGADocument1 pageNATIONAL BANKA V OLUTANGAElaizza ConcepcionNo ratings yet

- SANTOS V CADocument1 pageSANTOS V CAElaizza ConcepcionNo ratings yet

- Tomawis V Caudang: 1. Was There A Valid Writ of Execution - NODocument2 pagesTomawis V Caudang: 1. Was There A Valid Writ of Execution - NOElaizza ConcepcionNo ratings yet

- Iron Bulk V RemingtonDocument1 pageIron Bulk V RemingtonElaizza ConcepcionNo ratings yet

- GR NO 125817, January 16, 2002: LimvcaDocument1 pageGR NO 125817, January 16, 2002: LimvcaElaizza ConcepcionNo ratings yet

- GR NO. 165647, March 26, 2009: Philippines First V WallemDocument2 pagesGR NO. 165647, March 26, 2009: Philippines First V WallemElaizza ConcepcionNo ratings yet

- Consumido V RosDocument1 pageConsumido V RosElaizza Concepcion0% (1)

- Sarkies Tours V CaDocument1 pageSarkies Tours V CaElaizza ConcepcionNo ratings yet

- Summa Insurance Corp V CaDocument2 pagesSumma Insurance Corp V CaElaizza ConcepcionNo ratings yet

- Converse Rubber Corp V Universal Rubber ProductsDocument2 pagesConverse Rubber Corp V Universal Rubber ProductsElaizza ConcepcionNo ratings yet

- Arada V CaDocument2 pagesArada V CaElaizza ConcepcionNo ratings yet

- Benedicto V IacDocument1 pageBenedicto V IacElaizza ConcepcionNo ratings yet

- Brgy San Roque V Heirs of PastorDocument1 pageBrgy San Roque V Heirs of PastorElaizza ConcepcionNo ratings yet

- Converse Rubber Corp V Universal Rubber ProductsDocument2 pagesConverse Rubber Corp V Universal Rubber ProductsElaizza ConcepcionNo ratings yet

- GR NO. L-9605, September 30, 1957: Erezo V JepteDocument1 pageGR NO. L-9605, September 30, 1957: Erezo V JepteElaizza ConcepcionNo ratings yet

- De Guzman V CaDocument2 pagesDe Guzman V CaElaizza ConcepcionNo ratings yet

- Libra: Laguna Tayabas Bus Co. V Cornista, GR No. L-22193 FactsDocument1 pageLibra: Laguna Tayabas Bus Co. V Cornista, GR No. L-22193 FactsElaizza ConcepcionNo ratings yet

- Ba Finance V CaDocument1 pageBa Finance V CaElaizza ConcepcionNo ratings yet

- Lopez V Pan-AmDocument2 pagesLopez V Pan-AmElaizza ConcepcionNo ratings yet

- Pal V Savillo, GR No. 149547 FactsDocument2 pagesPal V Savillo, GR No. 149547 FactsElaizza ConcepcionNo ratings yet

- Letter Hoa Order For Termination of Contract of StallDocument1 pageLetter Hoa Order For Termination of Contract of StallFret Ramirez Coronia RNNo ratings yet

- DebenturesDocument6 pagesDebenturesSenelwa AnayaNo ratings yet

- Kewenangan Pejabat Pembuat Akta Tanah Dan Kantor Pertanahan Dalam Pelaksanaan Pendaftaran Hak Tanggungan ElektronikDocument17 pagesKewenangan Pejabat Pembuat Akta Tanah Dan Kantor Pertanahan Dalam Pelaksanaan Pendaftaran Hak Tanggungan Elektronikamaliaramdani2_97278No ratings yet

- Indian Contract Act PDFDocument10 pagesIndian Contract Act PDFKunal KuvadiaNo ratings yet

- Chapter 1. The Nature of CreditDocument14 pagesChapter 1. The Nature of CreditcalliemozartNo ratings yet

- Divvy Bike RevolutionDocument4 pagesDivvy Bike Revolutionpahone12No ratings yet

- Asian Cathay Finance Vs Spouses Cesario Gravador 623 SCRA 517 July 5 2010 PDFDocument2 pagesAsian Cathay Finance Vs Spouses Cesario Gravador 623 SCRA 517 July 5 2010 PDFJERROM ABAINZANo ratings yet

- 10.digested Philippine Asset Growth Two Inc. vs. Fastech Synergy Philippines Inc. GR. No. 206528 June 28 2016Document4 pages10.digested Philippine Asset Growth Two Inc. vs. Fastech Synergy Philippines Inc. GR. No. 206528 June 28 2016Arrianne Obias0% (1)

- REPE Case 01 Lyric Apartment AcquisitionDocument17 pagesREPE Case 01 Lyric Apartment AcquisitionDNo ratings yet

- Limitation Ordinance Sarawak Cap 49 ScheDocument9 pagesLimitation Ordinance Sarawak Cap 49 ScheMichelle TeoNo ratings yet

- Residential Real Estate LeaseDocument10 pagesResidential Real Estate LeaseDae MacNo ratings yet

- Colliers Canada Cap Rate Report 2020 Q4Document16 pagesColliers Canada Cap Rate Report 2020 Q4Fabrice NoundouNo ratings yet

- Credit ControlDocument37 pagesCredit ControlArJun SalganiaNo ratings yet

- 22 Hemedes v. CADocument3 pages22 Hemedes v. CAJanine OlivaNo ratings yet

- Accredited Appraisals BrochureDocument2 pagesAccredited Appraisals BrochurestacykmNo ratings yet

- FSBL Makes Advances To Different Sectors For Different Purposes. They Are As FollowsDocument5 pagesFSBL Makes Advances To Different Sectors For Different Purposes. They Are As FollowsRajib DattaNo ratings yet

- Lease Deed (For A Term of Years) Rent Agreement AnandDocument4 pagesLease Deed (For A Term of Years) Rent Agreement AnandANANDNo ratings yet

- BPI Investment Corporation vs. CA, GR 133632Document2 pagesBPI Investment Corporation vs. CA, GR 133632Darlyn BangsoyNo ratings yet

- Oblicon Cases IVDocument370 pagesOblicon Cases IVMaurice PinayNo ratings yet

- Rendered Void When The Execution of Its Terms Is Skewed in Favor of One PartyDocument2 pagesRendered Void When The Execution of Its Terms Is Skewed in Favor of One PartyJepoy FranciscoNo ratings yet

- Lecture NoteS Unit 1 4Document93 pagesLecture NoteS Unit 1 4Rathna SabaNo ratings yet

- Finacle Menu Options 1 PDFDocument16 pagesFinacle Menu Options 1 PDFSuhail88038No ratings yet

- Julia Mae D.S San Juan ACC C301 - 301T Quiz 1 - SolutionDocument3 pagesJulia Mae D.S San Juan ACC C301 - 301T Quiz 1 - SolutionLeona San JuanNo ratings yet

- Guidelines Actual Investment FY 2020-21 RevisedDocument14 pagesGuidelines Actual Investment FY 2020-21 RevisedgovindsinghalNo ratings yet

- Securitization: After Reading This Chapter, You Will Be Conversant WithDocument9 pagesSecuritization: After Reading This Chapter, You Will Be Conversant WithHariNo ratings yet

- Hire PurchaseDocument19 pagesHire PurchaseFaris Hanis100% (1)