Professional Documents

Culture Documents

Management and Finance, 1 PDF

Management and Finance, 1 PDF

Uploaded by

Mehedi HasanCopyright:

Available Formats

You might also like

- Assignment On: Banking Companies Act, 1991Document11 pagesAssignment On: Banking Companies Act, 1991Mehedi Hasan100% (4)

- Daftar PustakaDocument17 pagesDaftar Pustaka062 A'imatus AzizahNo ratings yet

- T1 - 232019069 - Daftar PustakaDocument8 pagesT1 - 232019069 - Daftar PustakaLISA ANJARSARINo ratings yet

- Daftar PustakaDocument4 pagesDaftar PustakaFitriani VeenaNo ratings yet

- S2 2021 447870 BibliographyDocument9 pagesS2 2021 447870 Bibliographylensi susiantiNo ratings yet

- Daftar PustakaDocument5 pagesDaftar PustakaBisnis Muda ZulaekhaNo ratings yet

- Daftar ReferensiDocument4 pagesDaftar ReferensiMarvella GabrielleNo ratings yet

- Curriculum Vitae-Han Jiang 2023Document5 pagesCurriculum Vitae-Han Jiang 2023api-670894258No ratings yet

- S1 2022 425436 BibliographyDocument8 pagesS1 2022 425436 BibliographyYesi DwiariantiNo ratings yet

- Usefulness of Integrated Reporting For Businesses and Their StakeholdersDocument20 pagesUsefulness of Integrated Reporting For Businesses and Their StakeholdersSheraz KhanNo ratings yet

- ReferensiDocument4 pagesReferensiFadliNo ratings yet

- ReferenceDocument7 pagesReferenceDrSankar CNo ratings yet

- Matriks Corporate Governance For Audit Internal 54Document11 pagesMatriks Corporate Governance For Audit Internal 54Nicolas ErnestoNo ratings yet

- Draft Daftar PustakaDocument5 pagesDraft Daftar PustakamnajibdriveNo ratings yet

- Aom Panel Symposium 2024docxDocument4 pagesAom Panel Symposium 2024docxAkshay KumarNo ratings yet

- Analisa Hexagon FraudDocument4 pagesAnalisa Hexagon FraudWilly WNo ratings yet

- ReferencesDocument2 pagesReferencesAngela DucusinNo ratings yet

- JK SharmaDocument2 pagesJK SharmaTalha SiddiquiNo ratings yet

- DafpusDocument3 pagesDafpusRonny WijayaNo ratings yet

- Reference ListDocument3 pagesReference Listtulikabiswas6825.2No ratings yet

- Do ESG Ratings Mediate The Relationship Between Board Gender Diversity and Firm Financial Performance Evidence From The U.S. MarketDocument9 pagesDo ESG Ratings Mediate The Relationship Between Board Gender Diversity and Firm Financial Performance Evidence From The U.S. MarketrifdanadifahNo ratings yet

- 06 Daftar PustakaDocument3 pages06 Daftar PustakacecepmalismaulanaNo ratings yet

- QuestionsDocument3 pagesQuestionsumerzaman1299No ratings yet

- Ijmmr V8N2 2015 4Document13 pagesIjmmr V8N2 2015 4agusSanz13No ratings yet

- 49-Research Paper-328-1-10-20191101Document14 pages49-Research Paper-328-1-10-20191101Devy RahmawatiNo ratings yet

- Chapter2 FMDocument10 pagesChapter2 FMchandoraNo ratings yet

- Pembagian Tugas KelompokDocument5 pagesPembagian Tugas KelompokAgan gantengNo ratings yet

- Research in International Business and Finance: Full Length ArticleDocument9 pagesResearch in International Business and Finance: Full Length ArticleMuhammad RamzanNo ratings yet

- Journal Article Mah Noor SSRN-id3538699Document20 pagesJournal Article Mah Noor SSRN-id3538699Silambarasu KaruppiahNo ratings yet

- Daftar PustakaDocument17 pagesDaftar PustakaGain GainNo ratings yet

- Additional References JMDocument6 pagesAdditional References JMJenalyn Miranda Cayanan - MarayagNo ratings yet

- Daftar PustakaDocument5 pagesDaftar PustakaVidella Anisa FirdausNo ratings yet

- Daftar PustakaDocument10 pagesDaftar PustakaRidwan HalimNo ratings yet

- Challenges and Trends in Sustainable Corporate Finance: A Bibliometric Systematic ReviewDocument27 pagesChallenges and Trends in Sustainable Corporate Finance: A Bibliometric Systematic ReviewKishan MishraNo ratings yet

- T-Daftar Pustaka-12010119420093Document11 pagesT-Daftar Pustaka-12010119420093Almunawir ZiregarNo ratings yet

- ReferencesDocument2 pagesReferencesMary Beth Ed MartelNo ratings yet

- Surse TrimiseDocument3 pagesSurse TrimiseCristiana AmarieiNo ratings yet

- Wa0014.Document2 pagesWa0014.haiqa malikNo ratings yet

- NCKH 2023Document7 pagesNCKH 2023K59 Pham Ngoc AnhNo ratings yet

- References: Journals & Research ArticlesDocument18 pagesReferences: Journals & Research ArticlesKajal GoswamiNo ratings yet

- Tugas Seminar K, Referensi ArtikelDocument17 pagesTugas Seminar K, Referensi ArtikelTheodora MarsiskaNo ratings yet

- The Effect of Profitability, Firm Size, and Environmental Performance On Firm Value (Studies in Mining Companies Listed On The Indonesia Stock Exchange in 2017-2020)Document8 pagesThe Effect of Profitability, Firm Size, and Environmental Performance On Firm Value (Studies in Mining Companies Listed On The Indonesia Stock Exchange in 2017-2020)AJHSSR JournalNo ratings yet

- Poster and BriefingDocument5 pagesPoster and BriefingAlana BridgemohanNo ratings yet

- WP 13 02 A Majoch Why Do Asset Managers Sign The PRI A Reexamination of Stakeholder Salience Theory DraftDocument23 pagesWP 13 02 A Majoch Why Do Asset Managers Sign The PRI A Reexamination of Stakeholder Salience Theory DraftPrince McGershonNo ratings yet

- s825569 ReferencesDocument8 pagess825569 Referencesamirasyraf32No ratings yet

- Chen1 20qqqDocument5 pagesChen1 20qqqDessy meirenaNo ratings yet

- Corporate Social Responsibility Investment, Third-Party Assurance and Firm Performance in IndiaDocument22 pagesCorporate Social Responsibility Investment, Third-Party Assurance and Firm Performance in IndiaDwi TamaraNo ratings yet

- Murray State's Digital Commons Murray State's Digital CommonsDocument42 pagesMurray State's Digital Commons Murray State's Digital Commonsnadersaeed980No ratings yet

- Article Becg 1Document13 pagesArticle Becg 1Nurul Alya AthirahNo ratings yet

- REFERENCESDocument17 pagesREFERENCESJacquelou Gumapac ModarNo ratings yet

- ReferenceDocument1 pageReferenceMd. Real MiahNo ratings yet

- Daftar ReferensiDocument4 pagesDaftar ReferensiHAMIZAR YUSRINo ratings yet

- 2018 (Ming Et Al) Institutional Investors and CEO Pay Performance in Malaysian FirmsDocument17 pages2018 (Ming Et Al) Institutional Investors and CEO Pay Performance in Malaysian FirmsPutri lianitaNo ratings yet

- Financial Performance, Institutional Ownership, Size, and Firm Value: A Structural Equation Modeling ApproachDocument14 pagesFinancial Performance, Institutional Ownership, Size, and Firm Value: A Structural Equation Modeling ApproachDani RahmanNo ratings yet

- BilioDocument5 pagesBiliomessqNo ratings yet

- Research ProposalDocument7 pagesResearch ProposalHassan TariqNo ratings yet

- Precis - LPT - Vinit Shah (21566278)Document3 pagesPrecis - LPT - Vinit Shah (21566278)Vinit ShahNo ratings yet

- 60-Article Text-155-1-10-20210607Document11 pages60-Article Text-155-1-10-20210607angga ramdaniNo ratings yet

- Daftar PustakaDocument4 pagesDaftar PustakaMuhamad Reza RamadhaniNo ratings yet

- The Effect of Corporate Governance On The Quality of Financial Report With The Capital Structure As Moderating VariableDocument10 pagesThe Effect of Corporate Governance On The Quality of Financial Report With The Capital Structure As Moderating VariableMaya AyaNo ratings yet

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- Brexit ProjectDocument27 pagesBrexit ProjectMehedi HasanNo ratings yet

- A Review Analysis On "Merger & Acquisition": Prepared For: Prepared byDocument18 pagesA Review Analysis On "Merger & Acquisition": Prepared For: Prepared byMehedi HasanNo ratings yet

- Overview of SME: Rowshonara Akter Akhi Lecturer Jahangirnagar UniversityDocument30 pagesOverview of SME: Rowshonara Akter Akhi Lecturer Jahangirnagar UniversityMehedi HasanNo ratings yet

- Merchant Banking & Investment Lecture 01Document198 pagesMerchant Banking & Investment Lecture 01Mehedi HasanNo ratings yet

- Fundamentals of LeasingDocument27 pagesFundamentals of LeasingMehedi HasanNo ratings yet

- BoP IMF PoliticsDocument22 pagesBoP IMF PoliticsMehedi HasanNo ratings yet

- Assignment On Leasing Companies Operating in Bangladesh: Submitted ToDocument3 pagesAssignment On Leasing Companies Operating in Bangladesh: Submitted ToMehedi HasanNo ratings yet

- JamshedDocument2 pagesJamshedMehedi HasanNo ratings yet

- Money Markets: © 2003 South-Western/Thomson LearningDocument52 pagesMoney Markets: © 2003 South-Western/Thomson LearningMehedi HasanNo ratings yet

- Assignment: Palash SahaDocument6 pagesAssignment: Palash SahaMehedi HasanNo ratings yet

- SIPA Pro Mujer Capstone Final ReportDocument81 pagesSIPA Pro Mujer Capstone Final ReportRosario KhouriNo ratings yet

- Chapter 8 Computation of Total Income and Tax PayableDocument8 pagesChapter 8 Computation of Total Income and Tax PayablePrabhjot KaurNo ratings yet

- Public BankDocument4 pagesPublic BankKhairul AslamNo ratings yet

- Insurance Law-Insurable InterestDocument18 pagesInsurance Law-Insurable InterestDavid Fong100% (1)

- Barangay Budget FormsDocument31 pagesBarangay Budget FormsNonielyn Sabornido100% (1)

- IRS TaxDocument28 pagesIRS TaxAntonio MolinaNo ratings yet

- Week Two - Application AssignmentDocument1 pageWeek Two - Application AssignmentluisbetoxNo ratings yet

- Advanced Accounting Baker Test Bank - Chap004Document56 pagesAdvanced Accounting Baker Test Bank - Chap004donkazotey90% (10)

- Paparan Realisasi Investasi Triwulan I 2023 Bahasa InggrisDocument29 pagesPaparan Realisasi Investasi Triwulan I 2023 Bahasa InggrisBobby KusumoNo ratings yet

- XI Account Questions PDFFDocument9 pagesXI Account Questions PDFFnazwaniiharshNo ratings yet

- Banking PrinciplesDocument3 pagesBanking PrinciplesNathalieNo ratings yet

- YouWiN! - Youth Enterprise With Innovation in Nigeria PDFDocument4 pagesYouWiN! - Youth Enterprise With Innovation in Nigeria PDFElias Idowu DurosinmiNo ratings yet

- Financial LiteracyDocument4 pagesFinancial LiteracyMae Althea TidalgoNo ratings yet

- Implementing Guidelines For The Distribution of National Rice Program Hybrid Rice Seed Assistance For Rice Farmers - AEWs Virtual Meeting 02.21.2024Document29 pagesImplementing Guidelines For The Distribution of National Rice Program Hybrid Rice Seed Assistance For Rice Farmers - AEWs Virtual Meeting 02.21.2024Red MildNo ratings yet

- Case Digest in BankingDocument4 pagesCase Digest in BankingJong PerrarenNo ratings yet

- Book Review: Glen Arnold, The Deals of Warren Buffett: The First $100mDocument2 pagesBook Review: Glen Arnold, The Deals of Warren Buffett: The First $100mAmira KareemNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument65 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancePardeep KumarNo ratings yet

- CHOICEDocument9 pagesCHOICEtegegn mogessieNo ratings yet

- CH 16Document39 pagesCH 16Novi WulandariNo ratings yet

- EN Analyzing The Impact of Brand Equity Tow PDFDocument11 pagesEN Analyzing The Impact of Brand Equity Tow PDFAdnan AbdullahNo ratings yet

- Cutting Edge Pre-Int Unit 14Document10 pagesCutting Edge Pre-Int Unit 14AngelaNo ratings yet

- Hotel Security Service AgreementDocument2 pagesHotel Security Service AgreementmaolewiNo ratings yet

- Talwalkars Better Value Fitness LTDDocument4 pagesTalwalkars Better Value Fitness LTDAnonymous T8VqeaNo ratings yet

- A Guide To Use Credit CardsDocument4 pagesA Guide To Use Credit CardsMuhammad UsmanNo ratings yet

- Sarvagya Institute of CommerceDocument44 pagesSarvagya Institute of CommerceadhishcaNo ratings yet

- Lease Contract For CondoDocument3 pagesLease Contract For Condoamiel pugat0% (1)

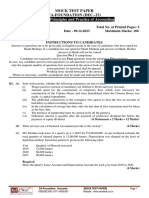

- Qus. MTP Accounts - 09.12.23Document5 pagesQus. MTP Accounts - 09.12.23karann021003No ratings yet

- CA Inter Adv Acc CompilerDocument1,306 pagesCA Inter Adv Acc CompilerAnanya SharmaNo ratings yet

- In Re Right of InspectionDocument3 pagesIn Re Right of InspectionClarissa de VeraNo ratings yet

- q3 2022 Report PDFDocument53 pagesq3 2022 Report PDFCristina SantiniNo ratings yet

Management and Finance, 1 PDF

Management and Finance, 1 PDF

Uploaded by

Mehedi HasanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Management and Finance, 1 PDF

Management and Finance, 1 PDF

Uploaded by

Mehedi HasanCopyright:

Available Formats

1. Anthony, M. U. G. O. (2019).

Effects of merger and acquisition on financial

performance: case study of commercial banks. International Journal of Business

Management and Finance, 1(1). PDF

2. Dezi, L., Battisti, E., Ferraris, A., & Papa, A. (2018). The link between mergers and

acquisitions and innovation. Management Research Review. PDF

3. Hassan, I., Ghauri, P. N., & Mayrhofer, U. (2018). Merger and acquisition motives and

outcome assessment. Thunderbird International Business Review, 60(4), 709-718.

4. Malmendier, U., Moretti, E., & Peters, F. S. (2018). Winning by losing: evidence on the

long-run effects of mergers. The Review of Financial Studies, 31(8), 3212-3264.

5. Masulis, R. W., & Simsir, S. A. (2018). Deal initiation in mergers and

acquisitions. Journal of Financial and Quantitative Analysis, 53(6), 2389-2430.

6. Pandya, V. U., Street, L., & Street, L. (2018). Mergers and Acquisitions Trends—The

Indian Experience. International Journal of Business Administration, 9(1), 44-54. PDF

7. Sankar, B. P., & Leepsa, N. M. (2018). Payment methods in mergers and acquisitions: A

theoretical framework. International Journal of Accounting and Financial Reporting,

International Journal of Accounting and Financial Reporting, ISSN, 2162-3082. PDF

8. Spiegel, M., & Tookes, H. (2013). Dynamic competition, valuation, and merger

activity. The Journal of Finance, 68(1), 125-172. PDF

9. Wang, W. (2018). Bid anticipation, information revelation, and merger gains. Journal of

Financial Economics, 128(2), 320-343. PDF

10. Renneboog, L., & Vansteenkiste, C. (2019). Failure and success in mergers and

acquisitions. Journal of Corporate Finance, 58, 650-699.

11. Renneboog, L., Szilagyi, P. G., & Vansteenkiste, C. (2017). Creditor rights, claims enforcement,

and bond performance in mergers and acquisitions. Journal of International Business

Studies, 48(2), 174-194.

12. Basri, Y. Z., & Arafah, W. (2020). The effect of acquisition synergy on firm performance

moderated by firm reputation. PDF

13. Hu, M., Mou, J., & Tuilautala, M. (2020). How trade credit affects mergers and

acquisitions. International Review of Economics & Finance, 67, 1-12.

14. Bonaime, A., Gulen, H., & Ion, M. (2018). Does policy uncertainty affect mergers and

acquisitions? Journal of Financial Economics, 129(3), 531-558.

15. Li, K., Qiu, B., & Shen, R. (2018). Organization capital and mergers and acquisitions. Journal of

Financial and Quantitative Analysis, 53(4), 1871-1909.

16. Wu, C., Yu, X., & Zheng, Y. (2020). The Spillover Effect of Financial Information in Mergers and

Acquisitions. The British Accounting Review, 100879.

17. Rao, U., & Mishra, T. (2020). Posterior analysis of mergers and acquisitions in the international

financial market: A re-appraisal. Research in International Business and Finance, 51, 101062. PDF

18. Lee, D. (2017). Cross-border mergers and acquisitions with heterogeneous firms: Technology vs.

market motives. The North American Journal of Economics and Finance, 42, 20-37.

19. Ott, C. (2020). The risks of mergers and acquisitions—Analyzing the incentives for risk reporting

in Item 1A of 10-K filings. Journal of Business Research, 106, 158-181. PDF

You might also like

- Assignment On: Banking Companies Act, 1991Document11 pagesAssignment On: Banking Companies Act, 1991Mehedi Hasan100% (4)

- Daftar PustakaDocument17 pagesDaftar Pustaka062 A'imatus AzizahNo ratings yet

- T1 - 232019069 - Daftar PustakaDocument8 pagesT1 - 232019069 - Daftar PustakaLISA ANJARSARINo ratings yet

- Daftar PustakaDocument4 pagesDaftar PustakaFitriani VeenaNo ratings yet

- S2 2021 447870 BibliographyDocument9 pagesS2 2021 447870 Bibliographylensi susiantiNo ratings yet

- Daftar PustakaDocument5 pagesDaftar PustakaBisnis Muda ZulaekhaNo ratings yet

- Daftar ReferensiDocument4 pagesDaftar ReferensiMarvella GabrielleNo ratings yet

- Curriculum Vitae-Han Jiang 2023Document5 pagesCurriculum Vitae-Han Jiang 2023api-670894258No ratings yet

- S1 2022 425436 BibliographyDocument8 pagesS1 2022 425436 BibliographyYesi DwiariantiNo ratings yet

- Usefulness of Integrated Reporting For Businesses and Their StakeholdersDocument20 pagesUsefulness of Integrated Reporting For Businesses and Their StakeholdersSheraz KhanNo ratings yet

- ReferensiDocument4 pagesReferensiFadliNo ratings yet

- ReferenceDocument7 pagesReferenceDrSankar CNo ratings yet

- Matriks Corporate Governance For Audit Internal 54Document11 pagesMatriks Corporate Governance For Audit Internal 54Nicolas ErnestoNo ratings yet

- Draft Daftar PustakaDocument5 pagesDraft Daftar PustakamnajibdriveNo ratings yet

- Aom Panel Symposium 2024docxDocument4 pagesAom Panel Symposium 2024docxAkshay KumarNo ratings yet

- Analisa Hexagon FraudDocument4 pagesAnalisa Hexagon FraudWilly WNo ratings yet

- ReferencesDocument2 pagesReferencesAngela DucusinNo ratings yet

- JK SharmaDocument2 pagesJK SharmaTalha SiddiquiNo ratings yet

- DafpusDocument3 pagesDafpusRonny WijayaNo ratings yet

- Reference ListDocument3 pagesReference Listtulikabiswas6825.2No ratings yet

- Do ESG Ratings Mediate The Relationship Between Board Gender Diversity and Firm Financial Performance Evidence From The U.S. MarketDocument9 pagesDo ESG Ratings Mediate The Relationship Between Board Gender Diversity and Firm Financial Performance Evidence From The U.S. MarketrifdanadifahNo ratings yet

- 06 Daftar PustakaDocument3 pages06 Daftar PustakacecepmalismaulanaNo ratings yet

- QuestionsDocument3 pagesQuestionsumerzaman1299No ratings yet

- Ijmmr V8N2 2015 4Document13 pagesIjmmr V8N2 2015 4agusSanz13No ratings yet

- 49-Research Paper-328-1-10-20191101Document14 pages49-Research Paper-328-1-10-20191101Devy RahmawatiNo ratings yet

- Chapter2 FMDocument10 pagesChapter2 FMchandoraNo ratings yet

- Pembagian Tugas KelompokDocument5 pagesPembagian Tugas KelompokAgan gantengNo ratings yet

- Research in International Business and Finance: Full Length ArticleDocument9 pagesResearch in International Business and Finance: Full Length ArticleMuhammad RamzanNo ratings yet

- Journal Article Mah Noor SSRN-id3538699Document20 pagesJournal Article Mah Noor SSRN-id3538699Silambarasu KaruppiahNo ratings yet

- Daftar PustakaDocument17 pagesDaftar PustakaGain GainNo ratings yet

- Additional References JMDocument6 pagesAdditional References JMJenalyn Miranda Cayanan - MarayagNo ratings yet

- Daftar PustakaDocument5 pagesDaftar PustakaVidella Anisa FirdausNo ratings yet

- Daftar PustakaDocument10 pagesDaftar PustakaRidwan HalimNo ratings yet

- Challenges and Trends in Sustainable Corporate Finance: A Bibliometric Systematic ReviewDocument27 pagesChallenges and Trends in Sustainable Corporate Finance: A Bibliometric Systematic ReviewKishan MishraNo ratings yet

- T-Daftar Pustaka-12010119420093Document11 pagesT-Daftar Pustaka-12010119420093Almunawir ZiregarNo ratings yet

- ReferencesDocument2 pagesReferencesMary Beth Ed MartelNo ratings yet

- Surse TrimiseDocument3 pagesSurse TrimiseCristiana AmarieiNo ratings yet

- Wa0014.Document2 pagesWa0014.haiqa malikNo ratings yet

- NCKH 2023Document7 pagesNCKH 2023K59 Pham Ngoc AnhNo ratings yet

- References: Journals & Research ArticlesDocument18 pagesReferences: Journals & Research ArticlesKajal GoswamiNo ratings yet

- Tugas Seminar K, Referensi ArtikelDocument17 pagesTugas Seminar K, Referensi ArtikelTheodora MarsiskaNo ratings yet

- The Effect of Profitability, Firm Size, and Environmental Performance On Firm Value (Studies in Mining Companies Listed On The Indonesia Stock Exchange in 2017-2020)Document8 pagesThe Effect of Profitability, Firm Size, and Environmental Performance On Firm Value (Studies in Mining Companies Listed On The Indonesia Stock Exchange in 2017-2020)AJHSSR JournalNo ratings yet

- Poster and BriefingDocument5 pagesPoster and BriefingAlana BridgemohanNo ratings yet

- WP 13 02 A Majoch Why Do Asset Managers Sign The PRI A Reexamination of Stakeholder Salience Theory DraftDocument23 pagesWP 13 02 A Majoch Why Do Asset Managers Sign The PRI A Reexamination of Stakeholder Salience Theory DraftPrince McGershonNo ratings yet

- s825569 ReferencesDocument8 pagess825569 Referencesamirasyraf32No ratings yet

- Chen1 20qqqDocument5 pagesChen1 20qqqDessy meirenaNo ratings yet

- Corporate Social Responsibility Investment, Third-Party Assurance and Firm Performance in IndiaDocument22 pagesCorporate Social Responsibility Investment, Third-Party Assurance and Firm Performance in IndiaDwi TamaraNo ratings yet

- Murray State's Digital Commons Murray State's Digital CommonsDocument42 pagesMurray State's Digital Commons Murray State's Digital Commonsnadersaeed980No ratings yet

- Article Becg 1Document13 pagesArticle Becg 1Nurul Alya AthirahNo ratings yet

- REFERENCESDocument17 pagesREFERENCESJacquelou Gumapac ModarNo ratings yet

- ReferenceDocument1 pageReferenceMd. Real MiahNo ratings yet

- Daftar ReferensiDocument4 pagesDaftar ReferensiHAMIZAR YUSRINo ratings yet

- 2018 (Ming Et Al) Institutional Investors and CEO Pay Performance in Malaysian FirmsDocument17 pages2018 (Ming Et Al) Institutional Investors and CEO Pay Performance in Malaysian FirmsPutri lianitaNo ratings yet

- Financial Performance, Institutional Ownership, Size, and Firm Value: A Structural Equation Modeling ApproachDocument14 pagesFinancial Performance, Institutional Ownership, Size, and Firm Value: A Structural Equation Modeling ApproachDani RahmanNo ratings yet

- BilioDocument5 pagesBiliomessqNo ratings yet

- Research ProposalDocument7 pagesResearch ProposalHassan TariqNo ratings yet

- Precis - LPT - Vinit Shah (21566278)Document3 pagesPrecis - LPT - Vinit Shah (21566278)Vinit ShahNo ratings yet

- 60-Article Text-155-1-10-20210607Document11 pages60-Article Text-155-1-10-20210607angga ramdaniNo ratings yet

- Daftar PustakaDocument4 pagesDaftar PustakaMuhamad Reza RamadhaniNo ratings yet

- The Effect of Corporate Governance On The Quality of Financial Report With The Capital Structure As Moderating VariableDocument10 pagesThe Effect of Corporate Governance On The Quality of Financial Report With The Capital Structure As Moderating VariableMaya AyaNo ratings yet

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- Brexit ProjectDocument27 pagesBrexit ProjectMehedi HasanNo ratings yet

- A Review Analysis On "Merger & Acquisition": Prepared For: Prepared byDocument18 pagesA Review Analysis On "Merger & Acquisition": Prepared For: Prepared byMehedi HasanNo ratings yet

- Overview of SME: Rowshonara Akter Akhi Lecturer Jahangirnagar UniversityDocument30 pagesOverview of SME: Rowshonara Akter Akhi Lecturer Jahangirnagar UniversityMehedi HasanNo ratings yet

- Merchant Banking & Investment Lecture 01Document198 pagesMerchant Banking & Investment Lecture 01Mehedi HasanNo ratings yet

- Fundamentals of LeasingDocument27 pagesFundamentals of LeasingMehedi HasanNo ratings yet

- BoP IMF PoliticsDocument22 pagesBoP IMF PoliticsMehedi HasanNo ratings yet

- Assignment On Leasing Companies Operating in Bangladesh: Submitted ToDocument3 pagesAssignment On Leasing Companies Operating in Bangladesh: Submitted ToMehedi HasanNo ratings yet

- JamshedDocument2 pagesJamshedMehedi HasanNo ratings yet

- Money Markets: © 2003 South-Western/Thomson LearningDocument52 pagesMoney Markets: © 2003 South-Western/Thomson LearningMehedi HasanNo ratings yet

- Assignment: Palash SahaDocument6 pagesAssignment: Palash SahaMehedi HasanNo ratings yet

- SIPA Pro Mujer Capstone Final ReportDocument81 pagesSIPA Pro Mujer Capstone Final ReportRosario KhouriNo ratings yet

- Chapter 8 Computation of Total Income and Tax PayableDocument8 pagesChapter 8 Computation of Total Income and Tax PayablePrabhjot KaurNo ratings yet

- Public BankDocument4 pagesPublic BankKhairul AslamNo ratings yet

- Insurance Law-Insurable InterestDocument18 pagesInsurance Law-Insurable InterestDavid Fong100% (1)

- Barangay Budget FormsDocument31 pagesBarangay Budget FormsNonielyn Sabornido100% (1)

- IRS TaxDocument28 pagesIRS TaxAntonio MolinaNo ratings yet

- Week Two - Application AssignmentDocument1 pageWeek Two - Application AssignmentluisbetoxNo ratings yet

- Advanced Accounting Baker Test Bank - Chap004Document56 pagesAdvanced Accounting Baker Test Bank - Chap004donkazotey90% (10)

- Paparan Realisasi Investasi Triwulan I 2023 Bahasa InggrisDocument29 pagesPaparan Realisasi Investasi Triwulan I 2023 Bahasa InggrisBobby KusumoNo ratings yet

- XI Account Questions PDFFDocument9 pagesXI Account Questions PDFFnazwaniiharshNo ratings yet

- Banking PrinciplesDocument3 pagesBanking PrinciplesNathalieNo ratings yet

- YouWiN! - Youth Enterprise With Innovation in Nigeria PDFDocument4 pagesYouWiN! - Youth Enterprise With Innovation in Nigeria PDFElias Idowu DurosinmiNo ratings yet

- Financial LiteracyDocument4 pagesFinancial LiteracyMae Althea TidalgoNo ratings yet

- Implementing Guidelines For The Distribution of National Rice Program Hybrid Rice Seed Assistance For Rice Farmers - AEWs Virtual Meeting 02.21.2024Document29 pagesImplementing Guidelines For The Distribution of National Rice Program Hybrid Rice Seed Assistance For Rice Farmers - AEWs Virtual Meeting 02.21.2024Red MildNo ratings yet

- Case Digest in BankingDocument4 pagesCase Digest in BankingJong PerrarenNo ratings yet

- Book Review: Glen Arnold, The Deals of Warren Buffett: The First $100mDocument2 pagesBook Review: Glen Arnold, The Deals of Warren Buffett: The First $100mAmira KareemNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument65 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancePardeep KumarNo ratings yet

- CHOICEDocument9 pagesCHOICEtegegn mogessieNo ratings yet

- CH 16Document39 pagesCH 16Novi WulandariNo ratings yet

- EN Analyzing The Impact of Brand Equity Tow PDFDocument11 pagesEN Analyzing The Impact of Brand Equity Tow PDFAdnan AbdullahNo ratings yet

- Cutting Edge Pre-Int Unit 14Document10 pagesCutting Edge Pre-Int Unit 14AngelaNo ratings yet

- Hotel Security Service AgreementDocument2 pagesHotel Security Service AgreementmaolewiNo ratings yet

- Talwalkars Better Value Fitness LTDDocument4 pagesTalwalkars Better Value Fitness LTDAnonymous T8VqeaNo ratings yet

- A Guide To Use Credit CardsDocument4 pagesA Guide To Use Credit CardsMuhammad UsmanNo ratings yet

- Sarvagya Institute of CommerceDocument44 pagesSarvagya Institute of CommerceadhishcaNo ratings yet

- Lease Contract For CondoDocument3 pagesLease Contract For Condoamiel pugat0% (1)

- Qus. MTP Accounts - 09.12.23Document5 pagesQus. MTP Accounts - 09.12.23karann021003No ratings yet

- CA Inter Adv Acc CompilerDocument1,306 pagesCA Inter Adv Acc CompilerAnanya SharmaNo ratings yet

- In Re Right of InspectionDocument3 pagesIn Re Right of InspectionClarissa de VeraNo ratings yet

- q3 2022 Report PDFDocument53 pagesq3 2022 Report PDFCristina SantiniNo ratings yet