Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

15 viewsWalter Schloss 06 Aug 2020 1221

Walter Schloss 06 Aug 2020 1221

Uploaded by

SumitWalter Schloss was a disciple of Benjamin Graham who asserted that looking at the low stock prices over the last few years can indicate how low it may fall during weakness. Additionally, looking at past highs can show how much a stock has declined previously. It is better if management owns a large stake in the company, though their reputation can also impact the stock. Stocks trading at depressed levels need a catalyst to rise.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Supplier Accreditation RequirementsDocument2 pagesSupplier Accreditation RequirementsRamilArtatesNo ratings yet

- G.R. No. L-12582Document8 pagesG.R. No. L-12582Inter_vivosNo ratings yet

- Olympia CaseDocument5 pagesOlympia Caseaa1122No ratings yet

- At All Time High 20 Feb 2024 1524Document24 pagesAt All Time High 20 Feb 2024 1524u9289958896No ratings yet

- Walter Schloss 09 Mar 2023 1717Document6 pagesWalter Schloss 09 Mar 2023 1717minjutNo ratings yet

- Ben Graham 22 Sep 2020 1115Document5 pagesBen Graham 22 Sep 2020 1115Debashish Priyanka SinhaNo ratings yet

- Company Sector Industry DateDocument6 pagesCompany Sector Industry DateApurvAdarshNo ratings yet

- John Neff 09 Mar 2023 1719Document5 pagesJohn Neff 09 Mar 2023 1719minjutNo ratings yet

- Model Portfolio Performance - 15th May 2020Document4 pagesModel Portfolio Performance - 15th May 2020FACTS- WORLDNo ratings yet

- Model Portfolio Performance - 03rd July 2020Document4 pagesModel Portfolio Performance - 03rd July 2020Sandipan DasNo ratings yet

- High Dividend Yield 10 Dec 2022 1430Document6 pagesHigh Dividend Yield 10 Dec 2022 1430Bagya VetriNo ratings yet

- Attractive Bluechips 15 Mar 2023 1425Document5 pagesAttractive Bluechips 15 Mar 2023 1425P.g. SunilkumarNo ratings yet

- Arihant Polycab FLEXIBLE 15th JULY 2020Document1 pageArihant Polycab FLEXIBLE 15th JULY 2020Reference RNo ratings yet

- Attractive Bluechips 19 Aug 2020 1517Document5 pagesAttractive Bluechips 19 Aug 2020 1517rajNo ratings yet

- Private LTD CompaniesDocument16 pagesPrivate LTD CompaniesanjankatamNo ratings yet

- Ben Graham 09 Mar 2023 1718Document5 pagesBen Graham 09 Mar 2023 1718minjutNo ratings yet

- Dynamic DTR Sheet (Nimblr TA)Document9 pagesDynamic DTR Sheet (Nimblr TA)Sharad TaterNo ratings yet

- Your Holding DetailsDocument4 pagesYour Holding DetailsSupriya KarmakarNo ratings yet

- Stocks at All Time High 25 Jul 2023 0846Document40 pagesStocks at All Time High 25 Jul 2023 0846Raju SutradharNo ratings yet

- WMM Mascot Construction CalibrationDocument3 pagesWMM Mascot Construction CalibrationHari PremNo ratings yet

- Klinbac 3Document14 pagesKlinbac 3Compras BPacificoNo ratings yet

- Joel Greenblatt 09 Mar 2023 1719Document8 pagesJoel Greenblatt 09 Mar 2023 1719minjutNo ratings yet

- Quality Stocks Available Cheap 09 Mar 2023 1719Document11 pagesQuality Stocks Available Cheap 09 Mar 2023 1719minjutNo ratings yet

- Klinbac 1-2Document14 pagesKlinbac 1-2Compras BPacificoNo ratings yet

- 3 GVP WeDocument22 pages3 GVP Wemurlikrishna3014887No ratings yet

- John Neff 09 Mar 2023 1719Document2 pagesJohn Neff 09 Mar 2023 1719minjutNo ratings yet

- Hubungan V in Dengan V L (Beban) CVT ADVANCE Hubungan V in Dengan % Regulasi CVT ADVANCEDocument1 pageHubungan V in Dengan V L (Beban) CVT ADVANCE Hubungan V in Dengan % Regulasi CVT ADVANCERahmat SatyawanNo ratings yet

- 06 - Juni - Baseline Performance RooftopDocument13 pages06 - Juni - Baseline Performance Rooftopwahyu krisnaNo ratings yet

- AceDocument3 pagesAcePagama IndonesiaNo ratings yet

- Joel Greenblatt 09 Mar 2023 1719Document2 pagesJoel Greenblatt 09 Mar 2023 1719minjutNo ratings yet

- Watchlist MyTsrDocument10 pagesWatchlist MyTsrshankaran maniNo ratings yet

- GRUPO ADELANTE - Acosta Bonilla FreddyDocument6 pagesGRUPO ADELANTE - Acosta Bonilla FreddyFreddy G. AcostaNo ratings yet

- Canal de Conduccion ConDocument2 pagesCanal de Conduccion ConLUISNo ratings yet

- HNF MISReport081Document28 pagesHNF MISReport081city1212No ratings yet

- Quality Stocks Available Cheap 09 Mar 2023 1719Document2 pagesQuality Stocks Available Cheap 09 Mar 2023 1719minjutNo ratings yet

- Market CapDocument6 pagesMarket Capsabby kNo ratings yet

- Sales Review Aug - 2018 FormatDocument55 pagesSales Review Aug - 2018 FormatLakshita SinghNo ratings yet

- Performance Sheet - HNIDocument3 pagesPerformance Sheet - HNIDanish KhanNo ratings yet

- UPS May Expense Report DetailsDocument11 pagesUPS May Expense Report DetailsKuladeep Naidu PatibandlaNo ratings yet

- Bajaj Auto LTD.: Client Code: 7ik54 Client Name: PRAGNESH RAMESHCHANDRA SHAHDocument6 pagesBajaj Auto LTD.: Client Code: 7ik54 Client Name: PRAGNESH RAMESHCHANDRA SHAHPragnesh ShahNo ratings yet

- Michi Restaurant Cafe: Nro. Doc. Fecha RNCDocument352 pagesMichi Restaurant Cafe: Nro. Doc. Fecha RNCMarinelis Isabel VitikinNo ratings yet

- External Image UrlDocument5 pagesExternal Image Urlrahul sharmaNo ratings yet

- Nifty Calculator Jan 2023Document19 pagesNifty Calculator Jan 2023Shovan GhoshNo ratings yet

- Unrealised Profit and Loss RM - 3223384 - 05 01 24 03 57 09Document2 pagesUnrealised Profit and Loss RM - 3223384 - 05 01 24 03 57 09ErUmangKoyaniNo ratings yet

- 300 Hari Menuju Bebas Financial Target Pips Per Hari: 20 Pips Leverage: 1:200 Margin: 10%Document7 pages300 Hari Menuju Bebas Financial Target Pips Per Hari: 20 Pips Leverage: 1:200 Margin: 10%shah farizNo ratings yet

- Ejercicio Clase 04-09-2023Document8 pagesEjercicio Clase 04-09-2023Jose CariasNo ratings yet

- Plan de Financement 2023 2024Document4 pagesPlan de Financement 2023 2024Rahim DoudouNo ratings yet

- Kanchan Pamnani's Monthly Performance of Portfolio 1Document6 pagesKanchan Pamnani's Monthly Performance of Portfolio 1tejmystNo ratings yet

- India Monthly Import Statistics 2020 - 230723-131449Document6 pagesIndia Monthly Import Statistics 2020 - 230723-131449P'PAT NPPSK.No ratings yet

- Quality Stocks Available Cheap - 22122021 - v1Document65 pagesQuality Stocks Available Cheap - 22122021 - v1rajeshtripathi2004No ratings yet

- NIFTYCALCULATOROctober2018www - Nooreshtech.co .InDocument13 pagesNIFTYCALCULATOROctober2018www - Nooreshtech.co .InbrijsingNo ratings yet

- % Gain Sun Pharma Gail Lupin Cipla Axis Bank Bharti Airtel Tata Motors Icici Bank BPCL NTPC Coal IndiaDocument3 pages% Gain Sun Pharma Gail Lupin Cipla Axis Bank Bharti Airtel Tata Motors Icici Bank BPCL NTPC Coal Indiargrao85No ratings yet

- Project Hierarchy Temporary Table - 638190325499375308Document3 pagesProject Hierarchy Temporary Table - 638190325499375308jowhersadiqNo ratings yet

- Beta Calculation (Risk Factor)Document11 pagesBeta Calculation (Risk Factor)abid aliNo ratings yet

- Book 7Document3 pagesBook 7Vigash DharrsanNo ratings yet

- Unrealised Profit and Loss RM - 3213582 - 05 01 24 03 59 15Document2 pagesUnrealised Profit and Loss RM - 3213582 - 05 01 24 03 59 15ErUmangKoyaniNo ratings yet

- Ben Graham 09 Mar 2023 1718Document2 pagesBen Graham 09 Mar 2023 1718minjutNo ratings yet

- WBL and Caustic Analysis June 14Document7 pagesWBL and Caustic Analysis June 14hemendra499No ratings yet

- XA23472 GlobalP&LStatementof212EquityDerivativeCommodityCurrency 01072022 024852Document6 pagesXA23472 GlobalP&LStatementof212EquityDerivativeCommodityCurrency 01072022 024852Mit NguNo ratings yet

- Ilioara 54 B 202307 Liste - Sc. 1Document1 pageIlioara 54 B 202307 Liste - Sc. 1danieldobre2004No ratings yet

- Price History - 20200927 - 1640Document77 pagesPrice History - 20200927 - 1640Imran AhmadNo ratings yet

- Your Holding Details - S668201Document4 pagesYour Holding Details - S668201prashant PujariNo ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- Nifty & Bank Nifty Daily Aanalysis - SmmryDocument8 pagesNifty & Bank Nifty Daily Aanalysis - SmmrySumitNo ratings yet

- MW NIFTY MIDCAP 150 03 Apr 2023Document8 pagesMW NIFTY MIDCAP 150 03 Apr 2023SumitNo ratings yet

- Investor Diary Beginner Stock Analysis Excel (V-1) : How To Use This Spreadsheet?Document56 pagesInvestor Diary Beginner Stock Analysis Excel (V-1) : How To Use This Spreadsheet?SumitNo ratings yet

- Fundamental Analysis HandoutsDocument68 pagesFundamental Analysis HandoutsSumitNo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectSumitNo ratings yet

- Ind Niftymidcap100Document2 pagesInd Niftymidcap100SumitNo ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 IndexSumitNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50SumitNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50SumitNo ratings yet

- H.j.heinz M & A Kel848-PDF-Eng - UnlockedDocument25 pagesH.j.heinz M & A Kel848-PDF-Eng - UnlockedHasanNo ratings yet

- DILG MC On Brgy Financial ReportDocument18 pagesDILG MC On Brgy Financial ReportDona JojuicoNo ratings yet

- Concord Engineering and Construction LTDDocument36 pagesConcord Engineering and Construction LTDkazi Md. yasin ullahNo ratings yet

- Real Life CaseDocument2 pagesReal Life CaseFahim Shahriar MozumderNo ratings yet

- Ebook KFIC Proven Sales Methodology RoadmapDocument9 pagesEbook KFIC Proven Sales Methodology Roadmapvijayjain347No ratings yet

- PHS AsnDocument10 pagesPHS AsnPurzuNo ratings yet

- The AuditorsDocument1 pageThe AuditorsHenry L BanaagNo ratings yet

- Limited Liability Partnership Act, 2008Document10 pagesLimited Liability Partnership Act, 2008TARUN RAJANINo ratings yet

- Group 5Document14 pagesGroup 5Kearn CercadoNo ratings yet

- An Aasis Training Guide Accounts Payable Basics Logistics InvoicingDocument53 pagesAn Aasis Training Guide Accounts Payable Basics Logistics Invoicingrajkishoresharma_554No ratings yet

- Intermediate Accounting 3 Valix Chapter 12 ProblemsDocument9 pagesIntermediate Accounting 3 Valix Chapter 12 ProblemsAlicia Summer100% (1)

- FTM CIF Quotation of 250TPH Mobile Crushing PlantDocument15 pagesFTM CIF Quotation of 250TPH Mobile Crushing PlantPT. SULAWESI BERLIAN JAYANo ratings yet

- EFF. DT. 02/03/2020 LO# 0831 1 Soc. Sec. No.: Xxx-Xx-680-43-5671 ER NO. E00-00000Document4 pagesEFF. DT. 02/03/2020 LO# 0831 1 Soc. Sec. No.: Xxx-Xx-680-43-5671 ER NO. E00-00000Ismail AhmedNo ratings yet

- BankingDocument50 pagesBankingKishore MallarapuNo ratings yet

- Managing Film Industry AccountingDocument10 pagesManaging Film Industry AccountingPOONAM REMESHNo ratings yet

- Examinerreports Paper1 (6ECA3) January2014Document8 pagesExaminerreports Paper1 (6ECA3) January2014HarryNo ratings yet

- Campus CavinkareDocument15 pagesCampus CavinkareKalpita DhuriNo ratings yet

- Service in Muzaffarpur - RO Water Purifier Service:9297-909192Document7 pagesService in Muzaffarpur - RO Water Purifier Service:9297-909192roservice indiaNo ratings yet

- Blair Wilson 5121 N 8th ST Philadelphia, Pa 19120: Order ID: 112-0126365-5726666Document1 pageBlair Wilson 5121 N 8th ST Philadelphia, Pa 19120: Order ID: 112-0126365-5726666ErineNo ratings yet

- Vertical Analysis of Financial Statements - Pepsi V CokeDocument2 pagesVertical Analysis of Financial Statements - Pepsi V CokeCarneades33% (3)

- B0701C PDF EngDocument5 pagesB0701C PDF EngRohit PanditNo ratings yet

- Information Systems in Global Business Today: © 2010 by Prentice HallDocument39 pagesInformation Systems in Global Business Today: © 2010 by Prentice Hallnayon02duNo ratings yet

- Balance of PaymentDocument15 pagesBalance of PaymentShanaya GiriNo ratings yet

- Submitted To: Anjum Zia Submitted By:: Ambreen Riaz (09) Dania Waheed (29) Advertising BS Mass CommunicationDocument5 pagesSubmitted To: Anjum Zia Submitted By:: Ambreen Riaz (09) Dania Waheed (29) Advertising BS Mass CommunicationAmbreen RiazNo ratings yet

- Food Processing Notes For UPSC CSEDocument14 pagesFood Processing Notes For UPSC CSESuraj Chopade100% (1)

- Estatement Chase MayDocument6 pagesEstatement Chase MayAtta ur Rehman100% (1)

- HR Coca ColaDocument10 pagesHR Coca ColaAli ANo ratings yet

Walter Schloss 06 Aug 2020 1221

Walter Schloss 06 Aug 2020 1221

Uploaded by

Sumit0 ratings0% found this document useful (0 votes)

15 views6 pagesWalter Schloss was a disciple of Benjamin Graham who asserted that looking at the low stock prices over the last few years can indicate how low it may fall during weakness. Additionally, looking at past highs can show how much a stock has declined previously. It is better if management owns a large stake in the company, though their reputation can also impact the stock. Stocks trading at depressed levels need a catalyst to rise.

Original Description:

Original Title

walter-schloss-06-Aug-2020--1221.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentWalter Schloss was a disciple of Benjamin Graham who asserted that looking at the low stock prices over the last few years can indicate how low it may fall during weakness. Additionally, looking at past highs can show how much a stock has declined previously. It is better if management owns a large stake in the company, though their reputation can also impact the stock. Stocks trading at depressed levels need a catalyst to rise.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

15 views6 pagesWalter Schloss 06 Aug 2020 1221

Walter Schloss 06 Aug 2020 1221

Uploaded by

SumitWalter Schloss was a disciple of Benjamin Graham who asserted that looking at the low stock prices over the last few years can indicate how low it may fall during weakness. Additionally, looking at past highs can show how much a stock has declined previously. It is better if management owns a large stake in the company, though their reputation can also impact the stock. Stocks trading at depressed levels need a catalyst to rise.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 6

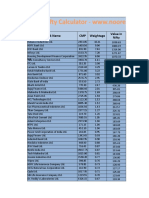

Value Research

Generate on: 06-Aug-2020 12:21

Walter Schloss

Walter J. Schloss was a disciple of the Benjamin Graham. Schloss asserted that the lows of the stock price over the last couple

Company Sector Industry Date

Andhra Paper Ltd. FMCG Paper 2020-08-06

Andhra Sugars Ltd. Diversified Diversified 2020-08-06

Apar Industries Ltd. Engineering Electronic Equipts. 2020-08-06

Banco Products (India) LtAutomobile Auto Ancillaries 2020-08-06

DB Corporation Ltd. FMCG Books & Newspapers 2020-08-06

Force Motors Ltd. Automobile Commercial Vehicles 2020-08-06

GAIL (India) Ltd. Energy Crude Oil & Natural Gas 2020-08-06

Graphite India Ltd. Engineering Welding machinery 2020-08-06

Gujarat Alkalies & ChemicChemicals Caustic Soda 2020-08-06

Gujarat Narmada Valley Fe Chemicals Nitrogenous Fertilizer. 2020-08-06

HEG Ltd. Engineering Welding machinery 2020-08-06

ISGEC Heavy EngineeringEngineering Machine Tools 2020-08-06

Jagran Prakashan Ltd. FMCG Books & Newspapers 2020-08-06

Kirloskar Oil Engines Ltd. Automobile Auto Ancillaries 2020-08-06

LG Balakrishnan & Bros. LAutomobile Auto Ancillaries 2020-08-06

Munjal Showa Ltd. Automobile Auto Ancillaries 2020-08-06

National Aluminium Co. LMetals Aluminium 2020-08-06

NMDC Ltd. Metals Minerals 2020-08-06

Parag Milk Foods Ltd. FMCG Dairy products 2020-08-06

Polyplex Corporation Ltd.Chemicals Plastic Films 2020-08-06

Prakash Industries Ltd. Diversified Diversified 2020-08-06

Sandur Manganese & IronMetals Minerals 2020-08-06

Seshasayee Paper & BoarFMCG Paper 2020-08-06

Tata Steel Long Products Metals Sponge Iron 2020-08-06

Unichem Laboratories LtdHealthcare Drugs & Pharma 2020-08-06

of the stock price over the last couple of years give us a good idea of where the stock can land in case of a weakness and the highs of the p

Price 1 day change(%) 52 Week Low 52 Week High

217.50 0.18 112.00 451.50

332.85 0.63 117.05 392.00

299.05 1.17 239.20 596.70

80.85 2.02 54.10 121.05

74.10 0.68 58.00 163.00

957.00 1.93 591.20 1,504.00

95.95 2.84 65.00 148.75

179.45 -1.05 103.00 384.00

342.00 2.10 180.10 487.35

165.10 0.46 95.55 224.60

780.35 -0.32 409.60 1,474.00

233.90 0.19 205.05 442.00

37.90 0.26 32.10 78.25

107.70 0.23 76.05 199.70

219.30 1.60 145.20 369.90

108.70 2.45 54.00 149.90

34.85 0.72 24.40 49.25

87.30 0.87 61.55 139.70

89.45 0.00 48.50 203.00

689.05 2.57 288.00 696.90

39.15 -0.89 18.55 64.80

594.80 1.64 295.45 922.00

148.70 -0.47 80.00 225.70

271.65 -1.47 164.00 486.80

264.00 1.32 80.00 304.70

se of a weakness and the highs of the past can indicate the level of fall the stock has seen.It is also better if the management owns a lot of

Market Cap(Cr) Enterprise Value(Cr) Debt to Equity Return on Capital Emplo

866.99 811.68 0.02 22.96

911.34 1,023.36 0.27 17.45

1,155.71 1,272.75 0.27 28.65

579.66 433.12 0.05 19.13

1,293.79 1,207.36 0.03 28.25

1,267.56 1,517.08 0.15 12.00

43,162.06 42,900.80 0.05 16.57

3,507.97 2,091.20 0.09 58.69

2,526.23 2,435.09 0.06 18.29

2,565.96 2,524.21 0.04 18.38

3,017.59 3,019.93 0.18 76.06

1,720.59 1,724.41 0.20 19.96

1,067.15 1,132.78 0.22 21.59

1,561.83 1,232.39 0.10 15.47

687.18 790.46 0.17 18.76

433.95 181.71 0.00 17.45

6,455.04 2,935.34 0.01 17.95

26,607.47 22,260.38 0.01 23.51

752.83 979.38 0.29 12.68

2,199.10 2,135.77 0.28 14.37

669.64 1,290.78 0.24 12.77

539.98 393.53 0.00 33.08

940.35 620.42 0.01 26.20

1,244.76 771.34 0.00 17.22

1,845.69 1,031.99 0.08 58.14

etter if the management owns a lot of the company though the management's reputation can be a deal breaker. Depressed stocks need a

Promoter's Stake(%) Price to Book

75.00 0.89

47.03 0.79

59.69 0.99

67.88 0.80

71.66 0.77

61.63 0.65

52.10 0.92

65.34 0.77

46.28 0.55

41.18 0.48

59.62 0.86

62.39 0.91

65.02 0.57

59.44 0.90

47.14 0.98

65.02 0.69

51.50 0.65

69.65 0.96

46.20 0.83

50.03 0.73

42.10 0.23

73.24 0.64

42.65 0.91

75.91 0.66

50.93 0.70

breaker. Depressed stocks need about 4-5 years to turn around. This screener checks for long-standing but undervalued companies with h

undervalued companies with high promoter holdings.

You might also like

- Supplier Accreditation RequirementsDocument2 pagesSupplier Accreditation RequirementsRamilArtatesNo ratings yet

- G.R. No. L-12582Document8 pagesG.R. No. L-12582Inter_vivosNo ratings yet

- Olympia CaseDocument5 pagesOlympia Caseaa1122No ratings yet

- At All Time High 20 Feb 2024 1524Document24 pagesAt All Time High 20 Feb 2024 1524u9289958896No ratings yet

- Walter Schloss 09 Mar 2023 1717Document6 pagesWalter Schloss 09 Mar 2023 1717minjutNo ratings yet

- Ben Graham 22 Sep 2020 1115Document5 pagesBen Graham 22 Sep 2020 1115Debashish Priyanka SinhaNo ratings yet

- Company Sector Industry DateDocument6 pagesCompany Sector Industry DateApurvAdarshNo ratings yet

- John Neff 09 Mar 2023 1719Document5 pagesJohn Neff 09 Mar 2023 1719minjutNo ratings yet

- Model Portfolio Performance - 15th May 2020Document4 pagesModel Portfolio Performance - 15th May 2020FACTS- WORLDNo ratings yet

- Model Portfolio Performance - 03rd July 2020Document4 pagesModel Portfolio Performance - 03rd July 2020Sandipan DasNo ratings yet

- High Dividend Yield 10 Dec 2022 1430Document6 pagesHigh Dividend Yield 10 Dec 2022 1430Bagya VetriNo ratings yet

- Attractive Bluechips 15 Mar 2023 1425Document5 pagesAttractive Bluechips 15 Mar 2023 1425P.g. SunilkumarNo ratings yet

- Arihant Polycab FLEXIBLE 15th JULY 2020Document1 pageArihant Polycab FLEXIBLE 15th JULY 2020Reference RNo ratings yet

- Attractive Bluechips 19 Aug 2020 1517Document5 pagesAttractive Bluechips 19 Aug 2020 1517rajNo ratings yet

- Private LTD CompaniesDocument16 pagesPrivate LTD CompaniesanjankatamNo ratings yet

- Ben Graham 09 Mar 2023 1718Document5 pagesBen Graham 09 Mar 2023 1718minjutNo ratings yet

- Dynamic DTR Sheet (Nimblr TA)Document9 pagesDynamic DTR Sheet (Nimblr TA)Sharad TaterNo ratings yet

- Your Holding DetailsDocument4 pagesYour Holding DetailsSupriya KarmakarNo ratings yet

- Stocks at All Time High 25 Jul 2023 0846Document40 pagesStocks at All Time High 25 Jul 2023 0846Raju SutradharNo ratings yet

- WMM Mascot Construction CalibrationDocument3 pagesWMM Mascot Construction CalibrationHari PremNo ratings yet

- Klinbac 3Document14 pagesKlinbac 3Compras BPacificoNo ratings yet

- Joel Greenblatt 09 Mar 2023 1719Document8 pagesJoel Greenblatt 09 Mar 2023 1719minjutNo ratings yet

- Quality Stocks Available Cheap 09 Mar 2023 1719Document11 pagesQuality Stocks Available Cheap 09 Mar 2023 1719minjutNo ratings yet

- Klinbac 1-2Document14 pagesKlinbac 1-2Compras BPacificoNo ratings yet

- 3 GVP WeDocument22 pages3 GVP Wemurlikrishna3014887No ratings yet

- John Neff 09 Mar 2023 1719Document2 pagesJohn Neff 09 Mar 2023 1719minjutNo ratings yet

- Hubungan V in Dengan V L (Beban) CVT ADVANCE Hubungan V in Dengan % Regulasi CVT ADVANCEDocument1 pageHubungan V in Dengan V L (Beban) CVT ADVANCE Hubungan V in Dengan % Regulasi CVT ADVANCERahmat SatyawanNo ratings yet

- 06 - Juni - Baseline Performance RooftopDocument13 pages06 - Juni - Baseline Performance Rooftopwahyu krisnaNo ratings yet

- AceDocument3 pagesAcePagama IndonesiaNo ratings yet

- Joel Greenblatt 09 Mar 2023 1719Document2 pagesJoel Greenblatt 09 Mar 2023 1719minjutNo ratings yet

- Watchlist MyTsrDocument10 pagesWatchlist MyTsrshankaran maniNo ratings yet

- GRUPO ADELANTE - Acosta Bonilla FreddyDocument6 pagesGRUPO ADELANTE - Acosta Bonilla FreddyFreddy G. AcostaNo ratings yet

- Canal de Conduccion ConDocument2 pagesCanal de Conduccion ConLUISNo ratings yet

- HNF MISReport081Document28 pagesHNF MISReport081city1212No ratings yet

- Quality Stocks Available Cheap 09 Mar 2023 1719Document2 pagesQuality Stocks Available Cheap 09 Mar 2023 1719minjutNo ratings yet

- Market CapDocument6 pagesMarket Capsabby kNo ratings yet

- Sales Review Aug - 2018 FormatDocument55 pagesSales Review Aug - 2018 FormatLakshita SinghNo ratings yet

- Performance Sheet - HNIDocument3 pagesPerformance Sheet - HNIDanish KhanNo ratings yet

- UPS May Expense Report DetailsDocument11 pagesUPS May Expense Report DetailsKuladeep Naidu PatibandlaNo ratings yet

- Bajaj Auto LTD.: Client Code: 7ik54 Client Name: PRAGNESH RAMESHCHANDRA SHAHDocument6 pagesBajaj Auto LTD.: Client Code: 7ik54 Client Name: PRAGNESH RAMESHCHANDRA SHAHPragnesh ShahNo ratings yet

- Michi Restaurant Cafe: Nro. Doc. Fecha RNCDocument352 pagesMichi Restaurant Cafe: Nro. Doc. Fecha RNCMarinelis Isabel VitikinNo ratings yet

- External Image UrlDocument5 pagesExternal Image Urlrahul sharmaNo ratings yet

- Nifty Calculator Jan 2023Document19 pagesNifty Calculator Jan 2023Shovan GhoshNo ratings yet

- Unrealised Profit and Loss RM - 3223384 - 05 01 24 03 57 09Document2 pagesUnrealised Profit and Loss RM - 3223384 - 05 01 24 03 57 09ErUmangKoyaniNo ratings yet

- 300 Hari Menuju Bebas Financial Target Pips Per Hari: 20 Pips Leverage: 1:200 Margin: 10%Document7 pages300 Hari Menuju Bebas Financial Target Pips Per Hari: 20 Pips Leverage: 1:200 Margin: 10%shah farizNo ratings yet

- Ejercicio Clase 04-09-2023Document8 pagesEjercicio Clase 04-09-2023Jose CariasNo ratings yet

- Plan de Financement 2023 2024Document4 pagesPlan de Financement 2023 2024Rahim DoudouNo ratings yet

- Kanchan Pamnani's Monthly Performance of Portfolio 1Document6 pagesKanchan Pamnani's Monthly Performance of Portfolio 1tejmystNo ratings yet

- India Monthly Import Statistics 2020 - 230723-131449Document6 pagesIndia Monthly Import Statistics 2020 - 230723-131449P'PAT NPPSK.No ratings yet

- Quality Stocks Available Cheap - 22122021 - v1Document65 pagesQuality Stocks Available Cheap - 22122021 - v1rajeshtripathi2004No ratings yet

- NIFTYCALCULATOROctober2018www - Nooreshtech.co .InDocument13 pagesNIFTYCALCULATOROctober2018www - Nooreshtech.co .InbrijsingNo ratings yet

- % Gain Sun Pharma Gail Lupin Cipla Axis Bank Bharti Airtel Tata Motors Icici Bank BPCL NTPC Coal IndiaDocument3 pages% Gain Sun Pharma Gail Lupin Cipla Axis Bank Bharti Airtel Tata Motors Icici Bank BPCL NTPC Coal Indiargrao85No ratings yet

- Project Hierarchy Temporary Table - 638190325499375308Document3 pagesProject Hierarchy Temporary Table - 638190325499375308jowhersadiqNo ratings yet

- Beta Calculation (Risk Factor)Document11 pagesBeta Calculation (Risk Factor)abid aliNo ratings yet

- Book 7Document3 pagesBook 7Vigash DharrsanNo ratings yet

- Unrealised Profit and Loss RM - 3213582 - 05 01 24 03 59 15Document2 pagesUnrealised Profit and Loss RM - 3213582 - 05 01 24 03 59 15ErUmangKoyaniNo ratings yet

- Ben Graham 09 Mar 2023 1718Document2 pagesBen Graham 09 Mar 2023 1718minjutNo ratings yet

- WBL and Caustic Analysis June 14Document7 pagesWBL and Caustic Analysis June 14hemendra499No ratings yet

- XA23472 GlobalP&LStatementof212EquityDerivativeCommodityCurrency 01072022 024852Document6 pagesXA23472 GlobalP&LStatementof212EquityDerivativeCommodityCurrency 01072022 024852Mit NguNo ratings yet

- Ilioara 54 B 202307 Liste - Sc. 1Document1 pageIlioara 54 B 202307 Liste - Sc. 1danieldobre2004No ratings yet

- Price History - 20200927 - 1640Document77 pagesPrice History - 20200927 - 1640Imran AhmadNo ratings yet

- Your Holding Details - S668201Document4 pagesYour Holding Details - S668201prashant PujariNo ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- Nifty & Bank Nifty Daily Aanalysis - SmmryDocument8 pagesNifty & Bank Nifty Daily Aanalysis - SmmrySumitNo ratings yet

- MW NIFTY MIDCAP 150 03 Apr 2023Document8 pagesMW NIFTY MIDCAP 150 03 Apr 2023SumitNo ratings yet

- Investor Diary Beginner Stock Analysis Excel (V-1) : How To Use This Spreadsheet?Document56 pagesInvestor Diary Beginner Stock Analysis Excel (V-1) : How To Use This Spreadsheet?SumitNo ratings yet

- Fundamental Analysis HandoutsDocument68 pagesFundamental Analysis HandoutsSumitNo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectSumitNo ratings yet

- Ind Niftymidcap100Document2 pagesInd Niftymidcap100SumitNo ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 IndexSumitNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50SumitNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50SumitNo ratings yet

- H.j.heinz M & A Kel848-PDF-Eng - UnlockedDocument25 pagesH.j.heinz M & A Kel848-PDF-Eng - UnlockedHasanNo ratings yet

- DILG MC On Brgy Financial ReportDocument18 pagesDILG MC On Brgy Financial ReportDona JojuicoNo ratings yet

- Concord Engineering and Construction LTDDocument36 pagesConcord Engineering and Construction LTDkazi Md. yasin ullahNo ratings yet

- Real Life CaseDocument2 pagesReal Life CaseFahim Shahriar MozumderNo ratings yet

- Ebook KFIC Proven Sales Methodology RoadmapDocument9 pagesEbook KFIC Proven Sales Methodology Roadmapvijayjain347No ratings yet

- PHS AsnDocument10 pagesPHS AsnPurzuNo ratings yet

- The AuditorsDocument1 pageThe AuditorsHenry L BanaagNo ratings yet

- Limited Liability Partnership Act, 2008Document10 pagesLimited Liability Partnership Act, 2008TARUN RAJANINo ratings yet

- Group 5Document14 pagesGroup 5Kearn CercadoNo ratings yet

- An Aasis Training Guide Accounts Payable Basics Logistics InvoicingDocument53 pagesAn Aasis Training Guide Accounts Payable Basics Logistics Invoicingrajkishoresharma_554No ratings yet

- Intermediate Accounting 3 Valix Chapter 12 ProblemsDocument9 pagesIntermediate Accounting 3 Valix Chapter 12 ProblemsAlicia Summer100% (1)

- FTM CIF Quotation of 250TPH Mobile Crushing PlantDocument15 pagesFTM CIF Quotation of 250TPH Mobile Crushing PlantPT. SULAWESI BERLIAN JAYANo ratings yet

- EFF. DT. 02/03/2020 LO# 0831 1 Soc. Sec. No.: Xxx-Xx-680-43-5671 ER NO. E00-00000Document4 pagesEFF. DT. 02/03/2020 LO# 0831 1 Soc. Sec. No.: Xxx-Xx-680-43-5671 ER NO. E00-00000Ismail AhmedNo ratings yet

- BankingDocument50 pagesBankingKishore MallarapuNo ratings yet

- Managing Film Industry AccountingDocument10 pagesManaging Film Industry AccountingPOONAM REMESHNo ratings yet

- Examinerreports Paper1 (6ECA3) January2014Document8 pagesExaminerreports Paper1 (6ECA3) January2014HarryNo ratings yet

- Campus CavinkareDocument15 pagesCampus CavinkareKalpita DhuriNo ratings yet

- Service in Muzaffarpur - RO Water Purifier Service:9297-909192Document7 pagesService in Muzaffarpur - RO Water Purifier Service:9297-909192roservice indiaNo ratings yet

- Blair Wilson 5121 N 8th ST Philadelphia, Pa 19120: Order ID: 112-0126365-5726666Document1 pageBlair Wilson 5121 N 8th ST Philadelphia, Pa 19120: Order ID: 112-0126365-5726666ErineNo ratings yet

- Vertical Analysis of Financial Statements - Pepsi V CokeDocument2 pagesVertical Analysis of Financial Statements - Pepsi V CokeCarneades33% (3)

- B0701C PDF EngDocument5 pagesB0701C PDF EngRohit PanditNo ratings yet

- Information Systems in Global Business Today: © 2010 by Prentice HallDocument39 pagesInformation Systems in Global Business Today: © 2010 by Prentice Hallnayon02duNo ratings yet

- Balance of PaymentDocument15 pagesBalance of PaymentShanaya GiriNo ratings yet

- Submitted To: Anjum Zia Submitted By:: Ambreen Riaz (09) Dania Waheed (29) Advertising BS Mass CommunicationDocument5 pagesSubmitted To: Anjum Zia Submitted By:: Ambreen Riaz (09) Dania Waheed (29) Advertising BS Mass CommunicationAmbreen RiazNo ratings yet

- Food Processing Notes For UPSC CSEDocument14 pagesFood Processing Notes For UPSC CSESuraj Chopade100% (1)

- Estatement Chase MayDocument6 pagesEstatement Chase MayAtta ur Rehman100% (1)

- HR Coca ColaDocument10 pagesHR Coca ColaAli ANo ratings yet