Professional Documents

Culture Documents

Break-Even Analysis1

Break-Even Analysis1

Uploaded by

Mustafa AlyasseriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Break-Even Analysis1

Break-Even Analysis1

Uploaded by

Mustafa AlyasseriCopyright:

Available Formats

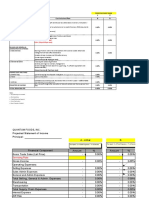

Break-Even Analysis

Enter your company name here

Cost Description Fixed Costs ($) Variable Expenses (%) Instructions

Inventory or Materials $ - 0.0

Note: You may want to print

Direct labor (includes payroll taxes) - 0.0 this information to use as

Other expenses - 0.0 reference later. To delete

these instructions, click the

Other expenses - 0.0 border of this text box and

Salaries (includes payroll taxes) - 0.0 then press the DELETE key.

Supplies - 0.0 Using figures from your

Repairs & maintenance - 0.0 Profit and Loss Projection,

enter expected annual fixed

Advertising - 0.0

and variable costs.

Car, delivery and travel - 0.0

Fixed costs are those that

Accounting and legal - 0.0

remain the same regardless

Rent - 0.0 of your sales volume. They

are expressed in dollars.

Telephone - 0.0

Rent, insurance and real

Utilities - 0.0 estate taxes, for example,

are usually fixed.

Insurance - 0.0

Taxes (Real estate, etc.) - 0.0 Variable costs are those

Interest - 0.0 which change as your

volume of business

Depreciation - 0.0 changes. They are

Other (specify) - 0.0 expressed as a percent of

sales. Inventory, raw

Other (specify) - 0.0 materials and direct

Miscellaneous expenses - 0.0 production labor, for

example, are usually

Principal portion of debt payment - 0.0 variable costs.

Owner's draw - 0.0

Under the variable

expenses column, use

Total Fixed Expenses $ - whole numbers as a

Total Variable Expenses 0.0 percentage, not decimal

numbers. For example, use

Breakeven Sales level = $ - 45%, rather than .45%.

For your business, each

Suggestions category of expense may

either be fixed or variable,

Note: You may want to print this information to use as reference later. To delete but not both.

these instructions, click the border of this text box and then press the DELETE

key.

The categories of expense shown above are just suggestions. Change the labels

to reflect your own accounting systems and type of business. Breakeven is a "big

picture" kind of tool; we recommend that you combine expense categories to stay

within the 22 lines that this template allows.

One of the best uses of breakeven analysis is to play with various scenarios. For

instance, if you add another person to the payroll, how many extra sales dollars

will be needed to recover the extra salary expense? If you borrow, how much will

be needed to cover the increased principal and interest payments? Many owners,

especially retailers, like to calculate a daily breakdown. This gives everyone a

target to shoot at for the day.

You might also like

- 12 Month Profit and Loss ProjectionDocument3 pages12 Month Profit and Loss ProjectionBadoiu LiviuNo ratings yet

- Project Status DashboardDocument12 pagesProject Status DashboardMustafa Alyasseri100% (1)

- Break Even AnalysisDocument1 pageBreak Even Analysisbaderf75No ratings yet

- Break Even Analysis2Document1 pageBreak Even Analysis2Vinay TungeNo ratings yet

- Breakeven Analysis: Enter Your Company Name HereDocument1 pageBreakeven Analysis: Enter Your Company Name HereMisscreant EveNo ratings yet

- Breakeven - Analysis ExampleDocument1 pageBreakeven - Analysis ExampleKamera RightNo ratings yet

- Breakeven Analysis2 1Document1 pageBreakeven Analysis2 1Kyle PerezNo ratings yet

- Breakeven Analysis: Enter Your Company Name HereDocument1 pageBreakeven Analysis: Enter Your Company Name HereAnonymous fcqc0EsXHNo ratings yet

- Breakeven Analysis: Enter Your Company Name HereDocument1 pageBreakeven Analysis: Enter Your Company Name Hereiamsudiro7674No ratings yet

- Breakeven and Profit-Volume-Cost AnalysisDocument4 pagesBreakeven and Profit-Volume-Cost AnalysisNu SNo ratings yet

- Income Statement PDFDocument4 pagesIncome Statement PDFMargarete DelvalleNo ratings yet

- Nonprofit PDFDocument3 pagesNonprofit PDFrengkujeffry5323No ratings yet

- DBP Sheet Nexa Orissa & ChhatisgarhDocument26 pagesDBP Sheet Nexa Orissa & ChhatisgarhSameer AgrawalNo ratings yet

- 12 Month Cash Flow - 0Document4 pages12 Month Cash Flow - 0LulaNo ratings yet

- Principal Evaluation TemplateDocument10 pagesPrincipal Evaluation TemplateMegz Sanchez FloresNo ratings yet

- Liquidity Plan enDocument5 pagesLiquidity Plan enSteve KennedyNo ratings yet

- Break-Even Sales Analysis:: For The Next 12 MonthsDocument3 pagesBreak-Even Sales Analysis:: For The Next 12 MonthsMochamad ChandraNo ratings yet

- Revenue: Profit and Loss Statement Notes and DescriptionsDocument1 pageRevenue: Profit and Loss Statement Notes and DescriptionsNahom AsamenewNo ratings yet

- Annual Budget: First Quarter January February March RevenueDocument12 pagesAnnual Budget: First Quarter January February March RevenueasdvdNo ratings yet

- Business Budget Template 14Document12 pagesBusiness Budget Template 14MohamedNo ratings yet

- Business Budget Template 14Document12 pagesBusiness Budget Template 14asdvdNo ratings yet

- Business Budget Template 14Document12 pagesBusiness Budget Template 14asdvdNo ratings yet

- Business Budget Template 14Document12 pagesBusiness Budget Template 14MohamedNo ratings yet

- QBO Generated Account List RestaurantsDocument4 pagesQBO Generated Account List RestaurantsTAX PAYERNo ratings yet

- Finsas: Financial Statement Analysis SpreadsheetDocument25 pagesFinsas: Financial Statement Analysis SpreadsheetDharm Veer RathoreNo ratings yet

- What-If Analysis TemplateDocument18 pagesWhat-If Analysis TemplateDardan DeskuNo ratings yet

- Comparable Company TemplateDocument5 pagesComparable Company Templatersfgfgn fhhsdzfgvNo ratings yet

- Expenses-Spreadsheet نموذج جدول النفقاتDocument11 pagesExpenses-Spreadsheet نموذج جدول النفقاتkingNo ratings yet

- 12 Month Cash Flow StatementDocument1 page12 Month Cash Flow StatementiPakistan100% (2)

- Expense Budget: Personnel Budget Actual Difference ( ) Difference (%)Document8 pagesExpense Budget: Personnel Budget Actual Difference ( ) Difference (%)william oliveiraNo ratings yet

- Instructions: Business Startup Cash Flow TemplateDocument14 pagesInstructions: Business Startup Cash Flow TemplatedlcpakNo ratings yet

- Profit Loss Statement TemplateDocument1 pageProfit Loss Statement TemplategfcbcNo ratings yet

- 2021MREA Bus Plan Clinic Oct XcelDocument10 pages2021MREA Bus Plan Clinic Oct XcelnikolaNo ratings yet

- Free Business TemplatesDocument3 pagesFree Business Templateshowieg43100% (9)

- Profit and Loss Statement Multi StepDocument1 pageProfit and Loss Statement Multi StepDevyani SharmaNo ratings yet

- Profit and Loss Statement (With Logo) 1Document6 pagesProfit and Loss Statement (With Logo) 1gaojesse6No ratings yet

- 5.7 Income Statement TemplateDocument2 pages5.7 Income Statement TemplateTRan TrinhNo ratings yet

- Cap - Expend - To - S Ales: Capital Expenditu Res To SalesDocument6 pagesCap - Expend - To - S Ales: Capital Expenditu Res To SalesDkNo ratings yet

- Divided by The Contribution Margin Ratio: Break-Even Point in DollarsDocument2 pagesDivided by The Contribution Margin Ratio: Break-Even Point in DollarsTatag Adi SasonoNo ratings yet

- 8 Projected BalanceDocument2 pages8 Projected BalanceShubham JhaNo ratings yet

- Free Business Budget TemplateDocument5 pagesFree Business Budget TemplateRiver HouseNo ratings yet

- CashflowDocument2 pagesCashflowElgaNurhikmahNo ratings yet

- Financial Templates For Grant Applicants Explanatory NotesDocument7 pagesFinancial Templates For Grant Applicants Explanatory Notesamornrat kampitthayakulNo ratings yet

- CH 11Document5 pagesCH 11hai0% (1)

- ProFormaDivisionProfitability Q2Document2 pagesProFormaDivisionProfitability Q2drashteeNo ratings yet

- Break EvenAnalysisDocument1 pageBreak EvenAnalysisr.jeyashankar9550No ratings yet

- VU Accounting Lesson 29Document4 pagesVU Accounting Lesson 29ranawaseemNo ratings yet

- Document 0Document16 pagesDocument 0Ruby QienNo ratings yet

- INF-1.1.8 Informe-Libro-de-Compras-y-Ventas.Document15 pagesINF-1.1.8 Informe-Libro-de-Compras-y-Ventas.ramon riquelme navarroNo ratings yet

- Profit and Loss Projection, 1yrDocument1 pageProfit and Loss Projection, 1yrKatu2010No ratings yet

- ARR Cost Impact 1702825090Document2 pagesARR Cost Impact 1702825090soringodenotNo ratings yet

- W10 Financial Phase Presentation 1Document9 pagesW10 Financial Phase Presentation 1Dave John LavariasNo ratings yet

- Sales Break-Even CalculationDocument5 pagesSales Break-Even CalculationTaranum RandhawaNo ratings yet

- Chương 1011Document7 pagesChương 1011Lê Thị Phương NhungNo ratings yet

- Acquisitions by Robert Bruner For A Discussion of This Analysis. To Use The Model, PleaseDocument17 pagesAcquisitions by Robert Bruner For A Discussion of This Analysis. To Use The Model, PleasevyasmusicNo ratings yet

- Break Even PointDocument11 pagesBreak Even Pointrahi4ever86% (7)

- ROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.From EverandROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.No ratings yet

- 2006 Calendar On Multiple Worksheets1Document26 pages2006 Calendar On Multiple Worksheets1Mustafa AlyasseriNo ratings yet

- S-Curve: Monthly Comulative Monthly % Comulative %Document1 pageS-Curve: Monthly Comulative Monthly % Comulative %Mustafa AlyasseriNo ratings yet

- C&P Compliance Review (Pre-Contract) : Business Unit NameDocument4 pagesC&P Compliance Review (Pre-Contract) : Business Unit NameMustafa AlyasseriNo ratings yet

- Controls & Planning Management PlanDocument15 pagesControls & Planning Management PlanMustafa AlyasseriNo ratings yet

- Construction Monthly Report: Project Title: Riyadh Clean Transportation FuelDocument14 pagesConstruction Monthly Report: Project Title: Riyadh Clean Transportation FuelMustafa AlyasseriNo ratings yet