Professional Documents

Culture Documents

Glosario de Términos

Glosario de Términos

Uploaded by

ROSA TOLEDO0 ratings0% found this document useful (0 votes)

30 views2 pagesThis document defines various accounting and financial terms:

1. Credit is the part of an account where increases or decreases in obligations are recorded. Paying credits corresponding items to a current account and makes records in the credit of an account.

2. Cash refers to funds available immediately in cash, checks, and credit card receipts in national or foreign currency.

3. An account is a formal record of transactions expressed in money or other units, used to systematically record transactions.

Original Description:

Original Title

GLOSARIO DE TÉRMINOS

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document defines various accounting and financial terms:

1. Credit is the part of an account where increases or decreases in obligations are recorded. Paying credits corresponding items to a current account and makes records in the credit of an account.

2. Cash refers to funds available immediately in cash, checks, and credit card receipts in national or foreign currency.

3. An account is a formal record of transactions expressed in money or other units, used to systematically record transactions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

30 views2 pagesGlosario de Términos

Glosario de Términos

Uploaded by

ROSA TOLEDOThis document defines various accounting and financial terms:

1. Credit is the part of an account where increases or decreases in obligations are recorded. Paying credits corresponding items to a current account and makes records in the credit of an account.

2. Cash refers to funds available immediately in cash, checks, and credit card receipts in national or foreign currency.

3. An account is a formal record of transactions expressed in money or other units, used to systematically record transactions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

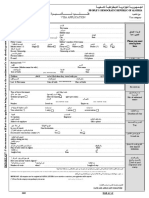

STACY ALICIA LLAIQUE TOLEDO 2°A

ACCOUNTING TERMS

1. Paying: Credit corresponding items to a current account. 2. Make records in the

credit of an account.

2. Credit: Part of an account where increases or decreases in obligations are recorded.

3. Cash: Funds in cash, checks and credit card payment receipts, in national or foreign

currency, available immediately.

4. Capital: Amount invested in a company by the owners, partners or shareholders.

5. Account: Formal record of a particular type of transaction expressed in money or

other unit of measure. Element of the accounting information system used to record

transactions in a systematic and homogeneous manner.

6. Disbursement: Outflow of cash. Payment in current currency or cheque.

7. Tax evasion: Illegal activity to avoid paying taxes.

8. Tax expenditure: Expenditure made by all institutions included in that sector,

including the Government, ministries and all those entities producing public goods or

services.

9. Auditor: Person who AUDITS financial accounts and records kept by others.

Includes both public accounting firms registered with the PCAOB and associated persons

thereof.

10. Book Value: Amount, net or CONTRA ACCOUNT balances, that an ASSET or

LIABILITY shows on the BALANCE SHEET of acompany. Also known as CARRYING

VALUE.

11. Cash Flows: Net of cash receipts and cash disbursements relating to a particular

activity during a specified accounting period.

12. Commodities: Bulk goods such as grains, metals, and foods traded on a

commodities exchange or on the SPOT MARKET.

13. Commission: Percentage of the selling price of the property, paid by the seller.

14. Commercial Paper: A way of borrowing money by using unsecured short-term

loans sold directly to the public, usually through professionally managed investments firms.

15. Control Risk: Measure of risk that errors exceeding a tolerable amount will not be

prevented or detected by an entity's internal controls.

16. Cost of Capital: Rate of return that a business could earn if it chose

another investment with equivalent risk.

17. Exchanges: Transfer of money, property or services in exchange for any

combination of these items.

18. Firm: A business partnership, especially when it is unincorporated.

19. Guaranty: Legal arrangement involving a promise by one person to perform the

obligations of a second person to a third person, in the event the second person fails to

perform.

20. Inflation: Rise in the prices of goods and services, as happens when spending

increases relative to the supply of goods on the market.

You might also like

- Proposal Indonesia International Travel Show 2018Document21 pagesProposal Indonesia International Travel Show 2018farid_maxiorg100% (1)

- CallRecord LogDocument17 pagesCallRecord LogLela SokhateriNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Accounting Research Proposal (Otw To Final)Document31 pagesAccounting Research Proposal (Otw To Final)Astrid99100% (4)

- Case Study Becton Dickinson and The Needle SticksDocument16 pagesCase Study Becton Dickinson and The Needle Stickssimping100% (4)

- Page 1 of 5Document5 pagesPage 1 of 5khandakeralihossainNo ratings yet

- Your Guide To The Definitions of Common Business TermsDocument33 pagesYour Guide To The Definitions of Common Business Termsshaikh javedNo ratings yet

- Términos Contables en InglesDocument11 pagesTérminos Contables en InglesNicky JamesNo ratings yet

- Fabm DictionaryDocument9 pagesFabm DictionarypfeyperdizNo ratings yet

- ACCOUNTING VOCABULARY IN ENGLISH - EstudianteDocument3 pagesACCOUNTING VOCABULARY IN ENGLISH - EstudianteoswaldoNo ratings yet

- HOMEWORKDocument3 pagesHOMEWORKFranklin FiencoNo ratings yet

- PH Gam - Revenues and Other ReceiptsDocument7 pagesPH Gam - Revenues and Other ReceiptsNabelah OdalNo ratings yet

- DitionaryDocument13 pagesDitionaryCANDY MORALESNo ratings yet

- MGT211 Shortnotes 1 To 45 LecDocument12 pagesMGT211 Shortnotes 1 To 45 LecEngr Imtiaz Hussain GilaniNo ratings yet

- Ilovepdf MergedDocument18 pagesIlovepdf MergedEva GarvNo ratings yet

- 2013 - 3.1 Business Terms-FinDocument5 pages2013 - 3.1 Business Terms-Finsunny756No ratings yet

- MGT211 - Introduction To Business Glossary by WWW - Virtualians.pk PDFDocument17 pagesMGT211 - Introduction To Business Glossary by WWW - Virtualians.pk PDFAqib GNo ratings yet

- Glossary of Business Terms CssDocument39 pagesGlossary of Business Terms CssDanyal TariqNo ratings yet

- Basic Terms and Definitions of AccountingDocument7 pagesBasic Terms and Definitions of AccountingZohaib ChandioNo ratings yet

- MG T 401 Short Notes by Khalid BilalDocument33 pagesMG T 401 Short Notes by Khalid BilalhayyaNo ratings yet

- Accounting DefinationsDocument2 pagesAccounting Definationsbboit031No ratings yet

- Principles of International Finance and Open Economy MacroeconomicsDocument48 pagesPrinciples of International Finance and Open Economy MacroeconomicsJeferson PortelaNo ratings yet

- Accounting TermDocument6 pagesAccounting TermShubhangi AsthanaNo ratings yet

- Accounting BasicsDocument6 pagesAccounting BasicsanishtomanishNo ratings yet

- Basics of Accounts11Document40 pagesBasics of Accounts11Vinay BehraniNo ratings yet

- Business Math Assign 2Document4 pagesBusiness Math Assign 2cedricXXXNo ratings yet

- Principles of AccountingDocument7 pagesPrinciples of AccountingayyazmNo ratings yet

- F & A - Basic Accounting TermsDocument3 pagesF & A - Basic Accounting TermsAbdul Azeez 312No ratings yet

- Revenue and Other Receipts: Revenue From Exchange TransactionsDocument6 pagesRevenue and Other Receipts: Revenue From Exchange TransactionsMaria Cecilia ReyesNo ratings yet

- Senior Auditor NotesDocument26 pagesSenior Auditor NotesZia Ud Din90% (10)

- MGT401 Short Notes Lec 1 - 45Document33 pagesMGT401 Short Notes Lec 1 - 45HRrehmanNo ratings yet

- Chapter 4 Revenues and Other ReceiptsDocument10 pagesChapter 4 Revenues and Other ReceiptsKyree VladeNo ratings yet

- Accounting Basics and Interview Questions AnswersDocument30 pagesAccounting Basics and Interview Questions AnswersSuresh SingamsettyNo ratings yet

- CCC Agnpo Lesson4 2021 2022Document4 pagesCCC Agnpo Lesson4 2021 2022Jr PedidaNo ratings yet

- Finance Material IQDocument29 pagesFinance Material IQ063 Bhavana NendrallaNo ratings yet

- Accountancy Material: 1.definition of Accounting: "The Art of Recording, Classifying and SummarizingDocument34 pagesAccountancy Material: 1.definition of Accounting: "The Art of Recording, Classifying and SummarizingvijayNo ratings yet

- Finance Key TermsDocument113 pagesFinance Key TermsSatheesh MiryalaNo ratings yet

- SITXFIN002 Interpret Financial InformationDocument12 pagesSITXFIN002 Interpret Financial Informationsampath lewkeNo ratings yet

- Actividad en Ingles 1Document3 pagesActividad en Ingles 1Cristian David Caipe OlivaNo ratings yet

- Al-Samnan Academy of Commerce and ScienceDocument7 pagesAl-Samnan Academy of Commerce and ScienceMian NajamNo ratings yet

- Chapter 4Document4 pagesChapter 4luzespinosa602No ratings yet

- ESP234Document19 pagesESP234HaziNo ratings yet

- Management InterviewDocument4 pagesManagement InterviewRahul SrivatsaNo ratings yet

- Accounting Basics and Interview Questions AnswersDocument35 pagesAccounting Basics and Interview Questions Answersavinash83% (6)

- Revenues and Other ReceiptsDocument45 pagesRevenues and Other ReceiptsFrank James100% (1)

- Basic Accounting Terms To Remember Autosaved DeepaDocument3 pagesBasic Accounting Terms To Remember Autosaved Deepasonu alamNo ratings yet

- Chapter 1 Statement of Financial PositionDocument3 pagesChapter 1 Statement of Financial PositionMartha Nicole MaristelaNo ratings yet

- Finance MeterialDocument244 pagesFinance MeterialMohammad FazalahamadNo ratings yet

- ACTG316EA2Document5 pagesACTG316EA2A. MagnoNo ratings yet

- Accounts All Definitions PDFDocument19 pagesAccounts All Definitions PDFAnvith ShettyNo ratings yet

- Accounting MaterialDocument161 pagesAccounting MaterialMithun Nair MNo ratings yet

- Basic DefinitionsDocument5 pagesBasic DefinitionsHamza KhaliqNo ratings yet

- 1.1 - Dicționar de Termeni de BusinessDocument15 pages1.1 - Dicționar de Termeni de BusinessTeodora TudorNo ratings yet

- HandoutDocument4 pagesHandoutZack CullenNo ratings yet

- Andrea Carolina Gonzalez RinconDocument3 pagesAndrea Carolina Gonzalez RinconedwinNo ratings yet

- Glossary of Financial AccountingDocument11 pagesGlossary of Financial Accountingnadimahmmed36No ratings yet

- 01 Some Basic TermsDocument3 pages01 Some Basic Termsadiphadnis1217No ratings yet

- Account and Finance1Document100 pagesAccount and Finance1MurthyNo ratings yet

- Accounting 1 - Module 7Document38 pagesAccounting 1 - Module 7CATHNo ratings yet

- Accounting - Basic Definitions Summary NotesDocument14 pagesAccounting - Basic Definitions Summary NotesbhavnaredlaNo ratings yet

- Accounting - : Basic Terms in Accounting - 1. TransactionDocument14 pagesAccounting - : Basic Terms in Accounting - 1. TransactionKaran Singh RathoreNo ratings yet

- Glosario de InglésDocument6 pagesGlosario de InglésLeyra Ediith GoveaNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Lecture 4Document48 pagesLecture 4mohsinNo ratings yet

- An Epistle From Ed: by Ed Cadwallader, PastorDocument4 pagesAn Epistle From Ed: by Ed Cadwallader, PastorBradford Woods ChurchNo ratings yet

- Eddy AxialDocument20 pagesEddy Axialandrea19711971No ratings yet

- DAT7002 - Data Visualisation Interpretation - Part 1 (1109)Document9 pagesDAT7002 - Data Visualisation Interpretation - Part 1 (1109)Anshu MauryaNo ratings yet

- Lifebuoy - Superfast Handwash - WarcDocument13 pagesLifebuoy - Superfast Handwash - WarcVaishaliNo ratings yet

- Presentation 1Document27 pagesPresentation 1Nayab SyedNo ratings yet

- Index MC Sept 2018Document21 pagesIndex MC Sept 2018Everson Jumao-as100% (1)

- Liebert CRV With Icom User Manual 00Document156 pagesLiebert CRV With Icom User Manual 00juan guerreroNo ratings yet

- Spek AlatDocument4 pagesSpek AlatIshen Simamora100% (1)

- AIDARDocument183 pagesAIDARRaj DhingraNo ratings yet

- Algeriavisa 2Document1 pageAlgeriavisa 2yaimara iimenezNo ratings yet

- Eastern Europe, Western Power and Neoliberalism - Peter GowanDocument12 pagesEastern Europe, Western Power and Neoliberalism - Peter GowanpeterVoterNo ratings yet

- Insurance ChecklistDocument3 pagesInsurance ChecklistKemuntoEdwardNo ratings yet

- SIW Application in MicrowaveDocument29 pagesSIW Application in MicrowavedurgaNo ratings yet

- Infrared Portable Space Heater: Model No.: DR-968Document16 pagesInfrared Portable Space Heater: Model No.: DR-968sigilum_deiNo ratings yet

- Research Paper Topics LeadershipDocument7 pagesResearch Paper Topics Leadershipgz45tyye100% (1)

- How To Use Asset Management (Theft Deterrent)Document102 pagesHow To Use Asset Management (Theft Deterrent)tiagokentaNo ratings yet

- Notable Filipino Dramas: Philippine Popular Culture: Television and FilmDocument45 pagesNotable Filipino Dramas: Philippine Popular Culture: Television and FilmIngrid Fritz CortezNo ratings yet

- Ecs 1azDocument21 pagesEcs 1azjamesNo ratings yet

- Incident Record FormDocument2 pagesIncident Record FormMark Joel AguilaNo ratings yet

- Etray2 Solutions PDFDocument28 pagesEtray2 Solutions PDFThuyDuongNo ratings yet

- United States v. Robert Williams, 3rd Cir. (2012)Document9 pagesUnited States v. Robert Williams, 3rd Cir. (2012)Scribd Government DocsNo ratings yet

- ASTM D 2487 - 06 Soil Clasification PDFDocument12 pagesASTM D 2487 - 06 Soil Clasification PDFcatalina_tudosa100% (3)

- Afar Corporate LiquidationDocument3 pagesAfar Corporate LiquidationClyde RamosNo ratings yet

- Steam Turbine PowerpointDocument25 pagesSteam Turbine PowerpointD.P. MishraNo ratings yet

- Open Automation SoftwareDocument54 pagesOpen Automation SoftwareYisel Antonia HerreraNo ratings yet