Professional Documents

Culture Documents

HO Inventory-Estimation

HO Inventory-Estimation

Uploaded by

Al Francis GuillermoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HO Inventory-Estimation

HO Inventory-Estimation

Uploaded by

Al Francis GuillermoCopyright:

Available Formats

Handout: Inventory Estimation FAR0_1st Sem_AY2019-20

Methods of Inventory Estimation

1. Gross profit method

2. Retail inventory method

GROSS PROFIT (GP) METHOD

1. This inventory estimation method assumes that the rate of gross profit remains approximately the same from period to

period.

2. Accordingly, the ratio of cost of sales to net sales is also assumed to be relatively constant from period to period.

3. Basic formula under the GP method:

Beginning inventory xx

Add: Net cost of purchases

Purchases xx

Freight in xx

Purchase returns & allowances (xx)

Purchase discounts (xx) xx

Total cost of goods available for sale xx

Less: Estimated cost of sales (see Item No. 4) xx

Estimated cost of ending inventory xx

4. The estimated cost of sales is computed as follows:

a. Gross profit rate is based on sales / selling price:

Estimated cost of sales = Net sales x (100% - GP rate)

b. Gross profit rate is based on cost:

Net sales

Estimated cost of sales =

100% + GP rate

5. The Net Sales, for purposes of inventory estimation, is equal to Gross Sales reduced by any Sales Return during the period.

Sales allowances and discounts, which do not result to physical reduction in units sold, are ignored (not deducted from

gross sales) in the determination of net sales.

RETAIL INVENTORY METHOD

1. This method is often used in the retail industry for measuring inventory of large number of rapidly changing items with

similar margin.

2. It is commonly employed by department stores, supermarkets and other retail concerns which maintain a wide variety of

goods in its inventory.

3. Required information to support the use of the retail inventory method:

a. Beginning inventory at cost and at retail price;

b. Purchases during the period at cost and at retail price;

c. Adjustments to the original retail price such as additional mark up, mark up cancelation, markdown and

markdown cancelation; and

d. Other adjustments such as departmental transfers, breakages, shrinkage, theft, damaged goods and employee

discounts.

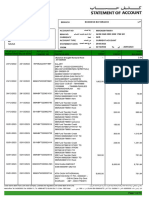

4. Basic formula under the Retail Inventory Method:

Particulars Cost Retail

Beginning Inventory xx xx

Net purchases xx xx

Total goods available for sale (TGAFS) xx xx

*Cost ratio (TGAFS @cost divided by TGAFS @ retail)

Net sales (xx)

Ending inventory at retail xx

Ending inventory at cost [ EI @ retail multiplied by the cost ratio*] xx

Approaches in the use of retail inventory method

1. Conservative or conventional or lower of cost and net realizable value approach

Lowest cost of ending inventory and highest cost of sales value.

Includes net mark ups and excludes net mark downs for purposes of cost ratio computations

2. Average approach

Higher cost of ending inventory and lower cost of sales value than the conservative approach

Includes net mark ups and net mark downs for purposes of cost ratio computations

3. FIFO retail approach

Disregards beginning inventory information in the determination of the cost ratio.

Assumes that the cost of the ending inventory is reasonably sourced from the current purchases (FIFO)

Includes net mark ups and net mark downs for purposes of the cost ratio computations

You might also like

- PAS 1 Statement of Comprehensive IncomeDocument21 pagesPAS 1 Statement of Comprehensive Incomepanda 1100% (2)

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EFrom EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/ERating: 4.5 out of 5 stars4.5/5 (6)

- Financial Accounting and Reporting - Problems ReviewDocument5 pagesFinancial Accounting and Reporting - Problems ReviewARIS100% (1)

- Accounting Assignments Week 1Document12 pagesAccounting Assignments Week 1Taufan Putra100% (1)

- CAF7 FAR2 QB 2017-Castar - PKDocument232 pagesCAF7 FAR2 QB 2017-Castar - PKYousaf JamalNo ratings yet

- P&G-Vertical AnalysisDocument15 pagesP&G-Vertical AnalysisComedy Royal PhilippinesNo ratings yet

- Fas 141 R PDFDocument2 pagesFas 141 R PDFToniaNo ratings yet

- Far 6815 - Gross Profit Method Far 6816 - Retail Inventory MethodDocument2 pagesFar 6815 - Gross Profit Method Far 6816 - Retail Inventory MethodKent Raysil PamaongNo ratings yet

- FARAP-4403 (Inventories)Document14 pagesFARAP-4403 (Inventories)Dizon Ropalito P.No ratings yet

- Farap 4503Document12 pagesFarap 4503Marya Nvlz100% (1)

- Week 08 - 02 - Module 19 - Accounting For InventoriesDocument17 pagesWeek 08 - 02 - Module 19 - Accounting For Inventories지마리No ratings yet

- Audit of InventoriesDocument57 pagesAudit of Inventoriessethdrea officialNo ratings yet

- Inventories Wit Ans Key (Pria)Document22 pagesInventories Wit Ans Key (Pria)Samantha Marie Arevalo100% (2)

- Week 08 - 01 - Module 18 - Accounting For InventoriesDocument10 pagesWeek 08 - 01 - Module 18 - Accounting For Inventories지마리No ratings yet

- Inventory EstimationDocument3 pagesInventory EstimationdayanNo ratings yet

- 4 Inventory Estimation Intermediate Accounting Reviewer 4 Inventory Estimation Intermediate Accounting ReviewerDocument4 pages4 Inventory Estimation Intermediate Accounting Reviewer 4 Inventory Estimation Intermediate Accounting ReviewerDalia ElarabyNo ratings yet

- BA 114.1 - Module2 - Inventories - Handout PDFDocument9 pagesBA 114.1 - Module2 - Inventories - Handout PDFKurt OrfanelNo ratings yet

- Accounting Cycle of Merchandising BusinessDocument3 pagesAccounting Cycle of Merchandising Businesskimingyuse1010No ratings yet

- Inventory: Audit ProblemDocument26 pagesInventory: Audit Problemjovelyn labordoNo ratings yet

- Chapter 14 - Retail Inventory Method PDFDocument9 pagesChapter 14 - Retail Inventory Method PDFTurksNo ratings yet

- 07 Lecture Notes - Gross Profit and Retail Method PDFDocument1 page07 Lecture Notes - Gross Profit and Retail Method PDFJobelle Gallardo AgasNo ratings yet

- EC 1 - Acctg Cycle Part 2 ConceptsDocument3 pagesEC 1 - Acctg Cycle Part 2 ConceptsChelay EscarezNo ratings yet

- Inventories - : Methods For Inventory WritedownDocument5 pagesInventories - : Methods For Inventory WritedownBryan NatadNo ratings yet

- 2305 InventoryDocument6 pages2305 InventoryDexterNo ratings yet

- Chapter 16 - InventoryDocument23 pagesChapter 16 - InventoryGuadzNo ratings yet

- Business Transactions and Their Analysis - MerchandisingDocument3 pagesBusiness Transactions and Their Analysis - MerchandisingCHARVIE KYLE RAMIREZNo ratings yet

- WatatapsDocument29 pagesWatatapsjessa mae zerdaNo ratings yet

- InventoriesDocument7 pagesInventoriesRomlan Akman DuranoNo ratings yet

- Marginal & Absorption Costing ST Academy With SolutionDocument14 pagesMarginal & Absorption Costing ST Academy With SolutionFaisal KhanNo ratings yet

- Intermediate-Accounting Handout Chap 13Document2 pagesIntermediate-Accounting Handout Chap 13Joanne Rheena BooNo ratings yet

- FR Shield - Ind As 2 - InventoriesDocument4 pagesFR Shield - Ind As 2 - InventoriesTanvi jain100% (1)

- Ind As 2: Inventories: (I) MeaningDocument6 pagesInd As 2: Inventories: (I) MeaningDinesh KumarNo ratings yet

- MerchandisingDocument7 pagesMerchandisingtwice onceNo ratings yet

- Intermediate-Accounting Handout Chap 14Document3 pagesIntermediate-Accounting Handout Chap 14Joanne Rheena BooNo ratings yet

- Variable CostingDocument2 pagesVariable CostingMutia Novita SariNo ratings yet

- Merchandising BusinessDocument9 pagesMerchandising BusinessSean Justin EspinaNo ratings yet

- Absorption MarginalDocument17 pagesAbsorption MarginalSHIVANSH BANSALNo ratings yet

- Practical Accounting 2: Theory & Practice Advanced Accounting Installment SalesDocument65 pagesPractical Accounting 2: Theory & Practice Advanced Accounting Installment Salesclarence dominic espino0% (1)

- ACCOUNTING FOR SPECIAL TRANSACTIONS - ReviewerDocument10 pagesACCOUNTING FOR SPECIAL TRANSACTIONS - ReviewerJohn Carlo DelorinoNo ratings yet

- Section VI: NRV Vs Fair Value: ExampleDocument5 pagesSection VI: NRV Vs Fair Value: ExamplebinuNo ratings yet

- Act CH 9 QuizDocument5 pagesAct CH 9 QuizLamia AkterNo ratings yet

- Far 06-04 Ias 2 Inventory PDFDocument9 pagesFar 06-04 Ias 2 Inventory PDFZee MarvsNo ratings yet

- Chapter 7 Inventories InventoriesDocument24 pagesChapter 7 Inventories InventoriesharumanNo ratings yet

- Unit 1: Inventories: Special Valuation MethodsDocument10 pagesUnit 1: Inventories: Special Valuation Methodssosina eseyewNo ratings yet

- Other Cost Incurred in Bringing The Inventories To Their Present Location andDocument3 pagesOther Cost Incurred in Bringing The Inventories To Their Present Location andMarianne SironNo ratings yet

- Chapter 14 Retail Inventory MethodDocument2 pagesChapter 14 Retail Inventory MethodDanielleNo ratings yet

- Chapter 5 InventoriesDocument12 pagesChapter 5 InventoriesMelvin OngNo ratings yet

- 05 - Accounting For Merchandising Operations (Notes) PDFDocument6 pages05 - Accounting For Merchandising Operations (Notes) PDFJamie ToriagaNo ratings yet

- Fabm1 Grade-11 Qtr4 Module6 Week-6Document6 pagesFabm1 Grade-11 Qtr4 Module6 Week-6Crestina Chu BagsitNo ratings yet

- sheet (6) ازهر E1Document10 pagessheet (6) ازهر E1magdy kamelNo ratings yet

- Retail Invty MethodDocument8 pagesRetail Invty MethodMichael CorvinNo ratings yet

- IA Chap13-14Document20 pagesIA Chap13-14Patrick Jayson VillademosaNo ratings yet

- AS 2 Valuation of InventoriesDocument18 pagesAS 2 Valuation of InventoriesRENU PALINo ratings yet

- CAPE U1 Preparing Financial Statemt IAS 1Document34 pagesCAPE U1 Preparing Financial Statemt IAS 1Nadine DavidsonNo ratings yet

- Installment SalesDocument5 pagesInstallment SalesBryan ReyesNo ratings yet

- Aaca Chap 12Document3 pagesAaca Chap 12Eidel PantaleonNo ratings yet

- Features of Marginal CostingDocument3 pagesFeatures of Marginal CostingBarno NicholusNo ratings yet

- FAR - Estimating Inventory - StudentDocument3 pagesFAR - Estimating Inventory - StudentPamelaNo ratings yet

- For MidtermDocument107 pagesFor MidtermAngelica RubiosNo ratings yet

- As 2Document7 pagesAs 2sanjay sNo ratings yet

- INVENTORIESDocument11 pagesINVENTORIESGelyn OlayvarNo ratings yet

- Marginal Costs (Extra Reading)Document15 pagesMarginal Costs (Extra Reading)Gabriel BelmonteNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- A Practical Guide to ETF Trading Systems: A systematic approach to trading exchange-traded fundsFrom EverandA Practical Guide to ETF Trading Systems: A systematic approach to trading exchange-traded fundsRating: 5 out of 5 stars5/5 (1)

- Managerial Econ LecDocument31 pagesManagerial Econ LecAl Francis GuillermoNo ratings yet

- HO Inventories IntroDocument2 pagesHO Inventories IntroAl Francis GuillermoNo ratings yet

- Cost Formula Cost of Goods Sold Ending Inventory: Handout: Inventories - Costflow - LCNRV Far0 - 1 Sem - Ay2019-20Document1 pageCost Formula Cost of Goods Sold Ending Inventory: Handout: Inventories - Costflow - LCNRV Far0 - 1 Sem - Ay2019-20Al Francis Guillermo100% (1)

- Handout CceDocument3 pagesHandout CceAl Francis GuillermoNo ratings yet

- Let's Apply The Formula To Our Transaction in The Previous ExampleDocument12 pagesLet's Apply The Formula To Our Transaction in The Previous ExampleAl Francis GuillermoNo ratings yet

- Principles of Managerial Finance Chapters 1Document50 pagesPrinciples of Managerial Finance Chapters 1sacey20.hbNo ratings yet

- CMPC 221 Finals Part 1: Mulitple ChoiceDocument7 pagesCMPC 221 Finals Part 1: Mulitple ChoiceIyarna YasraNo ratings yet

- Stride Ventures Fund III Deck July 2023 - 230920 - 003934Document31 pagesStride Ventures Fund III Deck July 2023 - 230920 - 003934rajanaccNo ratings yet

- Problem 12-2 Cash Flow (LO2) : 1.00 PointsDocument37 pagesProblem 12-2 Cash Flow (LO2) : 1.00 PointsSheep ersNo ratings yet

- Spice House Business PlanDocument9 pagesSpice House Business Plananon_22054856No ratings yet

- Investment in Working Capital and Financial Constraints: Empirical Evidence On Corporate PerformanceDocument27 pagesInvestment in Working Capital and Financial Constraints: Empirical Evidence On Corporate Performancepriyankabatra.nicmNo ratings yet

- Write A Short Note On ICICI LTDDocument12 pagesWrite A Short Note On ICICI LTDbackupsanthosh21 dataNo ratings yet

- SataraDocument3 pagesSataranaresh kayadNo ratings yet

- AS SBM-Business ValuationDocument36 pagesAS SBM-Business Valuationswarna dasNo ratings yet

- Group StatementsDocument8 pagesGroup StatementsZance JordaanNo ratings yet

- Comparative Financial ReportDocument36 pagesComparative Financial ReportShahada SagorNo ratings yet

- 02 RebatesDocument53 pages02 RebatesughaniNo ratings yet

- 1 Financial Statements Cash Flows and TaxesDocument13 pages1 Financial Statements Cash Flows and TaxesAyanleke Julius OluwaseunfunmiNo ratings yet

- Module 3 - SW On MFTG Acctg & CfsDocument2 pagesModule 3 - SW On MFTG Acctg & CfsestebandgonoNo ratings yet

- Material Complementario - Cafes Monte BiancoDocument20 pagesMaterial Complementario - Cafes Monte BiancoGlenda ChiquilloNo ratings yet

- Account StatementDocument10 pagesAccount Statementalihassan459001No ratings yet

- Ias 38Document36 pagesIas 38Hr RuanNo ratings yet

- PHD Thesis On Financial AnalysisDocument10 pagesPHD Thesis On Financial Analysisaliciastoddardprovo100% (2)

- MERGE - Letter of Intent - REYESDocument14 pagesMERGE - Letter of Intent - REYESAileen ReyesNo ratings yet

- Test For Certificate - Coursera - AnswersDocument1 pageTest For Certificate - Coursera - Answersmitochondri0% (1)

- UntitledDocument18 pagesUntitledjake ruthNo ratings yet

- Speech Material - Mrs. Ersa Triwahyuni For PAW 2019Document17 pagesSpeech Material - Mrs. Ersa Triwahyuni For PAW 2019khoirul nasNo ratings yet

- Chapter 13 Managerial AccountingDocument168 pagesChapter 13 Managerial AccountingChandler Schleifs100% (4)

- NTCC ProjectDocument20 pagesNTCC ProjectSaurabh ShuklaNo ratings yet

- MA1 (Mock 3)Document19 pagesMA1 (Mock 3)Jawad LatifNo ratings yet

- Session 9 Ratio Analysis Theory 1634971215859Document30 pagesSession 9 Ratio Analysis Theory 1634971215859PunitNo ratings yet