Professional Documents

Culture Documents

The Maturing of Grameen Bank: Eviews

The Maturing of Grameen Bank: Eviews

Uploaded by

Gaurav Saini0 ratings0% found this document useful (0 votes)

21 views3 pages1) The book analyzes changes to the Grameen Bank model known as Grameen II.

2) Grameen faced repayment problems after devastating floods in 1998 and was criticized in a 2001 WSJ article for bad loans, though the book does not acknowledge this criticism.

3) Grameen II represents a shift from the original rigid model to a more flexible banking system that better serves the evolving needs of borrowers.

Original Description:

Original Title

The_Maturing_of_Grameen_Bank

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The book analyzes changes to the Grameen Bank model known as Grameen II.

2) Grameen faced repayment problems after devastating floods in 1998 and was criticized in a 2001 WSJ article for bad loans, though the book does not acknowledge this criticism.

3) Grameen II represents a shift from the original rigid model to a more flexible banking system that better serves the evolving needs of borrowers.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

21 views3 pagesThe Maturing of Grameen Bank: Eviews

The Maturing of Grameen Bank: Eviews

Uploaded by

Gaurav Saini1) The book analyzes changes to the Grameen Bank model known as Grameen II.

2) Grameen faced repayment problems after devastating floods in 1998 and was criticized in a 2001 WSJ article for bad loans, though the book does not acknowledge this criticism.

3) Grameen II represents a shift from the original rigid model to a more flexible banking system that better serves the evolving needs of borrowers.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

Reviews

The Maturing of through a zero level tolerance even for a

possible genuine default.

Grameen Bank Changed Borrowers

That is why we find angst in the bor-

rowers’ voices even when it is recorded

repayment” (p xiii). While Grameen re- by insiders of Grameen. The angst is about

The Poor Always Pay Back: sponded to this jolt, the contours of starting income generating micro-enter-

The Grameen II Story change were not widely known. prises to service and repay the loan. It is

by Asif Dowla and Dipal Barua; Another jolt came from an article in the about the fear that one may not be able

Kumarian Press, Connecticut, 2006; Wall Street Journal by Daniel Pearl in to live up to the exacting standards of

pp 296, price not specified. November 2001. The article appeared from discipline of Grameen. The stories of

a place where Grameen had gained its Sakhina or Fuljan in Jorimon and Others

legitimacy – the western world. It was a clearly echo the fear of inability to repay

M S SRIRAM jolt because Grameen was on a high at that and thus wanting to be away from the

point after the Global Microcredit Summit clutches of Grameen. While the Indian

T here is substantial interest across the

world about Grameen. 1 With its

founder Muhammad Yunus winning the

in 1997. The summit put microcredit and

Grameen on a global map, with the likes

of Hillary Clinton and the queen of Spain

self-help groups leverage intra-commu-

nity trust as a surrogate for documentation

and physical collateral – reducing trans-

Nobel Prize there is an enhanced interest lending their name and presence to en- action costs and increasing compliance –

in its operations. It has now become an dorse the microcredit movement. Pearl’s the Grameen system possibly used social

icon in the targeting of financial services article highlighted what the book now collateral in a coercive manner.2 Thus,

to the poor, drawing attention of devel- acknowledges – that there were signifi- symbolism of the Grameen had aspects

opment practitioners and venture capital- cant bad loans and they were being re- that reinforced discipline, censure of people

ists alike. While much has been written scheduled. However, the book surpris- who deviated and in the recitation of

about Grameen by scholars, this new book ingly does not even make a passing ref- pledges. Grameen turned out to be a credit

is a narrative from within. Dipal Barua is erence to this article which triggered a hot treadmill that made it difficult for people

the deputy managing director of Grameen debate on most of the development to get off because you could never be a

and Asif Dowla a former student of Yunus listserves and also called for the entire member of a group unless you were a

and an integral part of the initial Grameen correspondence between Pearl and Yunus borrower.

team. Therefore readers’ expectations from to be put on the Grameen website. This system worked as long as the failures

the book are not about a balanced critical In Banker to the Poor Yunus talked of the underlying micro-enterprises were

view, but a narrative of the changes that about how they perfected the Grameen isolated because the group as a whole was

have happened in the past few years. methodology. Starting from the initial able to absorb the losses and move ahead.

This book is to be seen in conjunction experiments in the credit market by ex- There was a critical mass of people who

with two other narratives from within – tending loans in Jobra village it was a long kept this treadmill going. However, the

the autobiography of Yunus, Banker to the learning curve that Yunus and his friends flood of 1998 changed the rules of the

Poor and a set of case studies Jorimon went through. It is evident from the book game significantly because a large part of

and Others. Both narrate the early days that there were significant design flaws the borrowing population suffered a col-

of Grameen. While Banker to the Poor initially, and there was indeed uncertainty lateral damage. The group mechanism was

talks about the convictions and experiment- about the most effective procedure for bound to crack and affected the credit

ations of Yunus in the evolution of loan recovery. Eventually, the essence of treadmill significantly.

Grameen, Jorimon and Others indicates Grameen was distilled in two simple and Grameen II was a response to the issues

the problems that Grameen would even- essential elements of banking – the fre- that the original design would have faced

tually face. Unfortunately, when a pro- quency of contact and discipline. Fre- at some point in time. Grameen reacted

gramme is successful, the proponents fail quency of contact gave early warning to a situation while it could have pro-

to read the sub-text of their own writings signals about the state of borrowers and actively looked at its model, when there

and will have to be woken up with a jolt. discipline took care of any possible de- was widespread criticism about it opera-

The jolt admittedly came. “After the dev- fault. Given that the formal credit system tions from the outside world. But when

astating flood of 1998, when two-thirds was in a mess in Bangladesh, it was quite they did respond they did so very cre-

of the country was under water for 11 natural that the antidote provided by atively. This was only after the flood hit

weeks, the bank was facing repayment Grameen was extreme. They went over- the books of Grameen. Grameen II as a

problems in certain areas. Although 80 per board on both these elements – contact model turns the original assumptions on

cent of the borrowers were repaying on established through weekly repayment its head and moves ahead towards a proper

time, 20 per cent became irregular in their meetings, and discipline established banking system.

1914 Economic and Political Weekly May 26, 2007

While Grameen may like to claim that always having entry level customers while nature of how boardrooms are designed

its borrowers have become sophisticated those graduating from the Grameen would in large corporates. This indeed is a pow-

over time, their needs have grown, their move on to the formal commercial insti- erful symbol that indicates how things

absorptive capacity is better, all these tutions. Indeed this is an aspect captured have emerged over a period of time and

calling for a change in the methodology, brilliantly by Maheshwari3 in her study on comments about the transition. There

there is more to it than just the borrowers older self-help groups in Ajmer. She finds are other initiatives that address the loan

becoming better. Under Grameen most of that members who have been risks – including a loan insurance that

the risk costs were transferred to the entrepreneurially successful find that the takes care of losses due to deaths. We see

borrowing groups by having in-built group is unable to meet their requirements that as Grameen gets more sophisticated

mechanisms like compulsory savings and and form something called “companies” even their risks are being integrated

group tax. This took care of minor defaults – self-liquidating groups that rotate sav- with the larger demographics rather than

and unforeseen blips in the borrowers’ ings and credit for an annual cycle with being absorbed at the local level. These

cash flows that put the repayment of an much larger amounts of payments than risk mitigation products are also offered

instalment to risk. It allowed Grameen to what an average SHG would do. for subscription on a voluntary basis

keep its books clean and show little default If Grameen adapts itself to the rules of rather than pushing it as a compulsory

– though there could have been a larger the market, the only caveat then would be precondition.

default not captured due to the cushioning to ensure that it does not suffer from a Grameen II also represents the maturing

mechanism provided by the system. The mission drift and remains knitted to its of Grameen from a microcredit organisation

Grameen loan products were all similar – original objective of servicing the fringes to a microfinance organisation. Not only

having a pre-specified interest rate irre- left out by the formal system. Grameen II has Grameen introduced savings as a

spective of the purpose, an equated weekly is a brave attempt at trying to reorient and measure of loan risk mitigation, it has also

instalment and a fixed interest rate, thus redesign towards the markets – by being taken care of capital build up of its bor-

taking the fungibility argument to the almost like a mainstream bank, while rowers. Thus one sees that there are newer

extreme. This helped Grameen to keep its continuing to focus on the poor. The book products that aim at long-term capital build

systems simple, administer its programme argues that while the key features of up including a pension scheme. The cus-

efficiently and replicate it widely. Grameen II are different in terms of design tomers also have an opportunity to buy

Grameen II is actually the story of the and delivery of products, the essence of mutual fund units and thus participate in

organisation itself maturing and moving Grameen is retained by its organisational the capital markets.

ahead. It might be the result of some issues structure where the borrowers continue to The other paradigm shift in Grameen II

that they had to grapple with – the borrowers be shareholders and also have significant is that they have also started accessing

including the likes of Jorimon – becoming presence in the governance system of non-borrower deposits. This is the ulti-

sophisticated over time. In such a situation the bank. mate acknowledgement that the institution

the following questions are relevant: In Grameen II we can see that the system has indeed become a bank. This means

– What does Grameen do with borrowers, of checks and balances are more sophis- Grameen would have to come in for a

who can no longer be classified as poor? ticated. The group concept has been aban- greater regulatory environment as public

Do they let them out of the system or grow doned. There is more of self-insurance savings would be involved. However, this

with the customer and offer diversified through a compulsory savings account aspect actually almost completes the pic-

and sophisticated financial services? Data instead of group collateral. Unlike the group ture of an institution that would be pro-

indicates that 58.4 per cent of Grameen tax in the old model, where a good bor- viding well rounded financial services,

borrowers have moved out of poverty on rower possibly ended up compensating for with a focus on the poor and not just a

the basis of their 10 indicators (p 43). Thus the default of a bad borrower, in Grameen micro-credit treadmill. This indicates that

a majority of the borrowers are not “poor”. II the borrowers save for themselves. There Grameen is on a steep learning curve on

– What do they do when borrowers think is scope for withdrawal of personal sav- its second phase. With the Nobel in their

that meeting once a week and undertaking ings accumulated, provided the borrower kitty they have to remember that they would

the pledge is too transaction intensive and is not having a “bridge” or a “flexible” loan be watched even more closely – both by

they no longer have the time-slack to attend – a euphemism for default. There are checks sceptics and admirers alike.

such meetings? and balances within the system that deals The story of Grameen II on how the

– What do they do with increasing need with each customer as an independent entity transition was actually implemented is

for resources to cater to larger customer with their own transaction history. How- documented in detail in the book. Given

base – the traditional sources of donor ever, the importance of Grameen II is that

money not designed to keep pace with a it continues to look at the customer as an

commercial level growth? integrated unit rather than classify them as Our Book on First War of Independence

borrowers and depositors. This linkage on

the lending side honours discipline in a Rebellion 1857 : A Symposium

Adapting to the Market

sophisticated manner. The frequency of ed. by P C Joshi

Obviously Grameen had to attend to this contact is still maintained through group

issue on a priority basis. It was also clear meetings. However, the interesting aspect Reprinted 1986, Rs. 150.00 (Post free)

that Grameen was becoming a significant is the change in the seating pattern at the

K P BAGCHI & COMPANY

player in the overall market and it had to meetings. Earlier the seating pattern used 286, B B Ganguli Street, Kolkata - 700 012

adapt itself to the rules of the markets. If to be like a file formation. Now it is in E-mail: kpbagchi@hotmail.com

it did not, then it would be at the cost of the shape of a horse-shoe more in the

Economic and Political Weekly May 26, 2007 1915

the new global interest in microfinance Notes

this book would certainly be an important

1 The term Grameen is used in literature to mean

resource book is not only for curious aca- both the organisation – Grameen Bank as well

demics interested in design of organisations as the methodology adopted by them. In this

and sub-systems, but also for the practi- essay we use the term Grameen interchangeably

tioners of microfinance to introspect and to refer to the institution, the methodology

and the philosophy, while we use the term

reflect on the second phase of the growth Grameen II to represent the current model used

of microfinance movement in a “mature” by Grameen Bank.

market like Bangladesh. Possibly it is time 2 M S Sriram, ‘Information Asymmetry and

for Grameen to rightfully use its name Trust: A Framework for Studying Microfinance

in India’, Vikalpa, 30(4), pp 77-85, 2005.

“Grameen Bank”. EPW 3 Neelam Maheshwari, Access to Credit:

Determinants for an SHG Member, PRADAN,

Email: mssriram@iimahd.ernet.in New Delhi (mimeo), 2004.

1916 Economic and Political Weekly May 26, 2007

You might also like

- Credit & CollectionDocument22 pagesCredit & CollectionFrancisco CabidesNo ratings yet

- A Syndicated Loan Primer PDFDocument27 pagesA Syndicated Loan Primer PDFmilinddhandeNo ratings yet

- Predictive Modeling Business ReportDocument69 pagesPredictive Modeling Business Reportpreeti100% (3)

- Configuration MOP Aircel ICRDocument7 pagesConfiguration MOP Aircel ICRKaran ParmarNo ratings yet

- Normalizer Transformation OverviewDocument20 pagesNormalizer Transformation OverviewyprajuNo ratings yet

- Irm Risk and The Financial Crisis Summer 2009Document8 pagesIrm Risk and The Financial Crisis Summer 2009Mazen AlbsharaNo ratings yet

- The Stony Brook Press - Volume 30, Issue 10Document32 pagesThe Stony Brook Press - Volume 30, Issue 10The Stony Brook PressNo ratings yet

- Commoning Against Debt: by Silvia FedericiDocument1 pageCommoning Against Debt: by Silvia FedericiLeandro ModoloNo ratings yet

- Subprime - PrimerDocument14 pagesSubprime - PrimerShailendraNo ratings yet

- Micro Finance: G. Devanathan MBA-II Year Manakula Vinayagar Institute of Technology Mobile Number: 8870100804Document9 pagesMicro Finance: G. Devanathan MBA-II Year Manakula Vinayagar Institute of Technology Mobile Number: 8870100804ganapathyNo ratings yet

- Microfinance and Its Discontents Women in Debt in ... - (3. The Everyday Mediations of Microfinance)Document30 pagesMicrofinance and Its Discontents Women in Debt in ... - (3. The Everyday Mediations of Microfinance)Bmo RecruitNo ratings yet

- Visa Covid 19 Authorization ManagementDocument9 pagesVisa Covid 19 Authorization Managementstan nedNo ratings yet

- The Grameen Bank Model Corporate Success PDFDocument11 pagesThe Grameen Bank Model Corporate Success PDFSamreet Singh100% (1)

- Finma164 Credit and CollectionDocument18 pagesFinma164 Credit and Collectioncjjzm4tj96No ratings yet

- Credit Decision and Rationing Rules: A Study of Informal Lenders in The PhilippinesDocument10 pagesCredit Decision and Rationing Rules: A Study of Informal Lenders in The PhilippinesVenjo NarcisoNo ratings yet

- OR1 - Public and Corporate Governance After The Crisis - UnlockedDocument5 pagesOR1 - Public and Corporate Governance After The Crisis - UnlockedMegrin AilaniNo ratings yet

- A Crusader For Organic Kavita KarunagathiDocument1 pageA Crusader For Organic Kavita KarunagathiSumittSinghNo ratings yet

- Microfinance ReportDocument23 pagesMicrofinance ReportLee HunnieNo ratings yet

- Segmenting The BOPDocument6 pagesSegmenting The BOPThais BarretoNo ratings yet

- 2018 QRFM MahfuzurDocument18 pages2018 QRFM MahfuzurmohamedNo ratings yet

- Topic 5Document3 pagesTopic 5KyNo ratings yet

- Thesun 2009-01-14 Page12 A Tussle To WatchDocument1 pageThesun 2009-01-14 Page12 A Tussle To WatchImpulsive collectorNo ratings yet

- Internet Based Social Lending: Harsh - Dhand@oba - Co.uk Daniel - Dickens@oba - Co.ukDocument6 pagesInternet Based Social Lending: Harsh - Dhand@oba - Co.uk Daniel - Dickens@oba - Co.ukviveknautiyalNo ratings yet

- INTERBRAND - Best - Global - Brands 2020-Technology-DesktopDocument25 pagesINTERBRAND - Best - Global - Brands 2020-Technology-DesktopNaveed AhmedNo ratings yet

- CGAP Focus Note Savings Mobilization Strategies Lessons From Four Experiences Aug 1998Document4 pagesCGAP Focus Note Savings Mobilization Strategies Lessons From Four Experiences Aug 1998michael odiemboNo ratings yet

- Rural Credit - DevarajaDocument39 pagesRural Credit - DevarajaAnnaNo ratings yet

- The Banking Sector Under Financial Stability: Article InformationDocument11 pagesThe Banking Sector Under Financial Stability: Article Informationkawther FerhatNo ratings yet

- Visa Vca The Top Trends InfographicDocument1 pageVisa Vca The Top Trends Infographicstan nedNo ratings yet

- The Microfinance Crisis in Andhra Pradesh, India: A Window On Rural Distress?Document6 pagesThe Microfinance Crisis in Andhra Pradesh, India: A Window On Rural Distress?Shivangi AgrawalNo ratings yet

- Jason Summer 2010 Final HRIDocument4 pagesJason Summer 2010 Final HRIjcarrierNo ratings yet

- Case Study - The Grameen Bank of BangladeshDocument12 pagesCase Study - The Grameen Bank of BangladeshArif ShaikNo ratings yet

- Credit & Collection ReviewerDocument4 pagesCredit & Collection ReviewerChantelle IshiNo ratings yet

- TheSun 2008-12-10 Page12 Tribune Files For BankruptcyDocument1 pageTheSun 2008-12-10 Page12 Tribune Files For BankruptcyImpulsive collectorNo ratings yet

- Dear Neighbor,: Inside This IssueDocument4 pagesDear Neighbor,: Inside This IssuejcarrierNo ratings yet

- 4 Predictions For Mortgage Industry in 2011: Pam Wilhelm, RealtorDocument4 pages4 Predictions For Mortgage Industry in 2011: Pam Wilhelm, RealtorPam Clark-WilhelmNo ratings yet

- Problem Solution Unique Value Proposition Unfair Advantage Customer SegmentsDocument2 pagesProblem Solution Unique Value Proposition Unfair Advantage Customer SegmentsEden Mae DeGuzmanNo ratings yet

- Dear Neighbor,: Inside This IssueDocument4 pagesDear Neighbor,: Inside This IssuejldhokieNo ratings yet

- What Is Riba - DR Khalid ZaheerDocument1 pageWhat Is Riba - DR Khalid ZaheerMuhammad QamarNo ratings yet

- Reflections On Finance and The Good Society: Obert HillerDocument9 pagesReflections On Finance and The Good Society: Obert HillerPrasanth KumarNo ratings yet

- (Wiley Finance Series) Ciby Joseph - Advanced Credit Risk Analysis and Management-Wiley (2013) (1) (021-040) EsDocument41 pages(Wiley Finance Series) Ciby Joseph - Advanced Credit Risk Analysis and Management-Wiley (2013) (1) (021-040) EsGustavo Felipe Campos CarocaNo ratings yet

- Prelim Topic 2Document8 pagesPrelim Topic 2Sairah Camille ArandiaNo ratings yet

- Managing Credit RiskDocument13 pagesManaging Credit RiskSyed RizNo ratings yet

- Getting Out of PovertyDocument4 pagesGetting Out of PovertyTerrance HarringtonNo ratings yet

- AP Crisis and MFI LandscapeDocument15 pagesAP Crisis and MFI LandscapeRajni Mahesh VidhaniNo ratings yet

- The Next Chapter in Consumer Lending: A New Way ForwardDocument4 pagesThe Next Chapter in Consumer Lending: A New Way ForwardTBPInvictusNo ratings yet

- Mauritius Times EPaper Friday 10 February 2023Document24 pagesMauritius Times EPaper Friday 10 February 2023Ramesh DharNo ratings yet

- Causes and Control of Loan Default/Delinquency in Microfinance Institutions in GhanaDocument10 pagesCauses and Control of Loan Default/Delinquency in Microfinance Institutions in GhanaMotiram paudelNo ratings yet

- 1.1. Background of The StudyDocument20 pages1.1. Background of The Studyraeq109No ratings yet

- Teaching Finance Ethics Using The Case of The Subprime Mortgage MeltdownDocument20 pagesTeaching Finance Ethics Using The Case of The Subprime Mortgage MeltdownRoentgen Djon Kaiser IgnacioNo ratings yet

- Concept of Micro CreditDocument16 pagesConcept of Micro CreditSyed Wahidur RahmanNo ratings yet

- LEHMANBROTHERSDocument26 pagesLEHMANBROTHERSAkankshaNo ratings yet

- Organizing Paragraphs Using The Different PatternsDocument21 pagesOrganizing Paragraphs Using The Different PatternsDonna MenesesNo ratings yet

- 597-Article Text-1141-1-10-20171231Document14 pages597-Article Text-1141-1-10-20171231Estevao SalvadorNo ratings yet

- James - Mediating Indebtedness in South AfricaDocument3 pagesJames - Mediating Indebtedness in South AfricaEthanNo ratings yet

- Writing Business PlansDocument18 pagesWriting Business PlansTien ELNo ratings yet

- Throwing in The TowelDocument26 pagesThrowing in The ToweldanrozasNo ratings yet

- Assignment 2.microfinanceDocument6 pagesAssignment 2.microfinanceAUE19No ratings yet

- Inside This Issue: Dear NeighborDocument4 pagesInside This Issue: Dear Neighboradebok100% (1)

- English TestDocument1 pageEnglish TestrahimdaudaniNo ratings yet

- Session01 MicrocreditsDocument37 pagesSession01 MicrocreditsAnastasija EpsteinNo ratings yet

- Small Loans, Big Dreams, 2022 Edition: Grameen Bank and the Microfinance Revolution in Bangladesh, America, and BeyondFrom EverandSmall Loans, Big Dreams, 2022 Edition: Grameen Bank and the Microfinance Revolution in Bangladesh, America, and BeyondNo ratings yet

- Confessions of a Subprime Lender: An Insider's Tale of Greed, Fraud, and IgnoranceFrom EverandConfessions of a Subprime Lender: An Insider's Tale of Greed, Fraud, and IgnoranceRating: 3 out of 5 stars3/5 (7)

- Debt for Sale: A Social History of the Credit TrapFrom EverandDebt for Sale: A Social History of the Credit TrapRating: 4.5 out of 5 stars4.5/5 (3)

- S3-Information AsymmetryDocument9 pagesS3-Information AsymmetryGaurav SainiNo ratings yet

- Big Data Analytics: Indian Institute of Management BangaloreDocument8 pagesBig Data Analytics: Indian Institute of Management BangaloreGaurav SainiNo ratings yet

- Finance For Livelihoods at The Margins: Moneylender Credit in A Rajasthan Village (Draft Notes - Not For Quotation)Document14 pagesFinance For Livelihoods at The Margins: Moneylender Credit in A Rajasthan Village (Draft Notes - Not For Quotation)Gaurav SainiNo ratings yet

- What Is Bigquery: Enterprise Data WarehouseDocument2 pagesWhat Is Bigquery: Enterprise Data WarehouseGaurav SainiNo ratings yet

- What Is DockerDocument3 pagesWhat Is DockerGaurav SainiNo ratings yet

- Apache Spark On Docker: 1. Pull The Image From Docker RepositoryDocument3 pagesApache Spark On Docker: 1. Pull The Image From Docker RepositoryGaurav SainiNo ratings yet

- Duality Notes and ProblemsDocument12 pagesDuality Notes and ProblemsGaurav SainiNo ratings yet

- DualityDocument31 pagesDualityGaurav SainiNo ratings yet

- What Is Operations Research (Management Science) ?Document11 pagesWhat Is Operations Research (Management Science) ?Gaurav SainiNo ratings yet

- Evaluate Investment Option in GARDEN CITY PROJECT Using Net Present ValueDocument7 pagesEvaluate Investment Option in GARDEN CITY PROJECT Using Net Present ValueGaurav SainiNo ratings yet

- Chap 4 BMADocument38 pagesChap 4 BMAGaurav SainiNo ratings yet

- How To Calculate Present Values?: Abhinav Anand (IIM Bangalore)Document50 pagesHow To Calculate Present Values?: Abhinav Anand (IIM Bangalore)Gaurav SainiNo ratings yet

- CGARCHDocument43 pagesCGARCHLavinia IoanaNo ratings yet

- Exadata Consolidation 522500 PDFDocument35 pagesExadata Consolidation 522500 PDFbprasadreddyinNo ratings yet

- Class Xii MCQ HHWDocument11 pagesClass Xii MCQ HHWYug RajputNo ratings yet

- Hindu Endowments-1Document58 pagesHindu Endowments-1sabirNo ratings yet

- Short Circuit Currents.Document11 pagesShort Circuit Currents.Shiju Kp.No ratings yet

- Budget Briefs: Swachh Bharat Mission - Gramin (SBM-G)Document10 pagesBudget Briefs: Swachh Bharat Mission - Gramin (SBM-G)Sonmani ChoudharyNo ratings yet

- MQ SP P 5011 PDFDocument25 pagesMQ SP P 5011 PDFjaseelNo ratings yet

- CatalogueDocument32 pagesCatalogueRobert SandorovNo ratings yet

- Accounting For Labor Part 2Document11 pagesAccounting For Labor Part 2Ghillian Mae GuiangNo ratings yet

- Setting of CementDocument15 pagesSetting of Cementverma jiNo ratings yet

- Angola Mineral ResourcesDocument18 pagesAngola Mineral ResourcesOladipo Ojo100% (1)

- Hydra 70Document2 pagesHydra 70Tin Ko AungNo ratings yet

- TR 67aDocument2 pagesTR 67aJosafatNo ratings yet

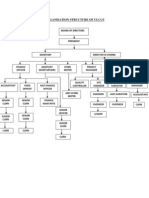

- Organisation Structure of Ulccs: Director in ChargeDocument1 pageOrganisation Structure of Ulccs: Director in ChargeMohamed RiyasNo ratings yet

- Topographic Map of LemingDocument1 pageTopographic Map of LemingHistoricalMapsNo ratings yet

- Allgon Coverage Systems - Repeater Catalogue - ALGPC0201Document23 pagesAllgon Coverage Systems - Repeater Catalogue - ALGPC0201Virgil Peiulescu0% (1)

- Bragg Diffraction ExperimentDocument5 pagesBragg Diffraction ExperimentVedniveadNo ratings yet

- Personal Development PlanDocument2 pagesPersonal Development PlanOliver ConnollyNo ratings yet

- Transfer Functions and Block Diagrams PDFDocument21 pagesTransfer Functions and Block Diagrams PDFJuliana NepembeNo ratings yet

- Freeman V ReyesDocument7 pagesFreeman V ReyesEzekiel T. MostieroNo ratings yet

- Tips On Applying For Nonimmigrant US VisaDocument2 pagesTips On Applying For Nonimmigrant US VisaclickvisaNo ratings yet

- Cy17b PH Technical Trial System Protocols v5Document16 pagesCy17b PH Technical Trial System Protocols v5Glenn Cabance LelinaNo ratings yet

- Lecture6 FinalDocument43 pagesLecture6 FinalcmlimNo ratings yet

- CH 12 Consumer ProtectionDocument78 pagesCH 12 Consumer Protectionleena shijuNo ratings yet

- Review For The Second TestDocument7 pagesReview For The Second TestMati MoralesNo ratings yet

- CBEprom Data BookDocument65 pagesCBEprom Data BookChelle2100% (2)