Professional Documents

Culture Documents

IntroductiontoRenewableEnergyFinance Donovan

IntroductiontoRenewableEnergyFinance Donovan

Uploaded by

tolossa assefaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IntroductiontoRenewableEnergyFinance Donovan

IntroductiontoRenewableEnergyFinance Donovan

Uploaded by

tolossa assefaCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/300478817

Introduction to Renewable Energy Finance

Chapter · August 2015

DOI: 10.1142/9781783267774_0001

CITATION READS

1 1,649

1 author:

Charles W Donovan

Imperial College London

5 PUBLICATIONS 36 CITATIONS

SEE PROFILE

All content following this page was uploaded by Charles W Donovan on 17 August 2018.

The user has requested enhancement of the downloaded file.

b2126 Renewable Energy Finance

Introduction to Renewable

Energy Finance

Charles Donovan, Principal Teaching Fellow,

Imperial College Business School

http://www.worldscientific.com/worldscibooks/10.1142/P1030#t=toc

RENEWABLE ENERGY FINANCE: POWERING THE FUTURE

©Charles W. Donovan.No further distribution is allowed.

Following a steep fall in the oil price in the early 1980s, the renewable

energy industry was nearly decimated. Significant investments by

large oil companies such as Exxon in solar photovoltaics (PVs) were

sold off or abandoned and interest in the sector stagnated for nearly

two decades. At the end of the last century, only two countries, Japan

and the US, were producers of solar PV panels and total investment

in the renewable energy sector as a whole bordered on trivial.

Fast forward to the present day and we see a much more promis-

ing landscape. Rising energy security concerns, mounting ecological

problems, and remarkable technological innovation have reshaped

perceptions about solar and other forms of renewable energy.

Countries are now competing fiercely to establish themselves as play-

ers in the global supply chain for renewable energy equipment. China,

nowhere on the scene 15 years ago, now invests more in renewable

energy than the whole of Europe. Renewable energy, excluding large

hydropower, attracts more than US$200 billion in annual investment

(BNEF, 2014), within striking distance of the gross amount invested

in fossil fuel power generation plants each year. Yet despite many posi-

tive indicators, there remains a real risk of a reversal in fortunes. Will

lower oil prices, government austerity, and the lack of a meaningful

b2126_Introduction.indd 3 5/28/2015 3:25:14 PM

b2126 Renewable Energy Finance

4 Renewable Energy Finance

international political agreement on climate change yet again darken

the outlook for renewables?

The core motivation for Renewable Energy Finance is to bring to

a wider audience the challenges associated with continued growth of

investment in non-fossil fuel energy. Lofty goals, such as those made

by the United Nations, calling for a tripling of the annual rate of

investment in renewable energy within the coming decade, will not in

of themselves deliver results. Numerous stakeholders, including gov-

ernment, industry and civil society, are responsible for the work

needed to make a transition towards a clean energy future. The per-

spectives of leading academics and finance executives contained in this

book will contribute to a deeper understanding of the magnitude of

the task ahead and a sense of optimism that the job can be done.

http://www.worldscientific.com/worldscibooks/10.1142/P1030#t=toc

RENEWABLE ENERGY FINANCE: POWERING THE FUTURE

This introductory chapter is intended as a primer on renewable

©Charles W. Donovan.No further distribution is allowed.

energy finance for non-specialists. As such, it provides useful back-

ground and helps frame information for the ensuing chapters. It has

been written with the following objectives:

• Define recurring terms used throughout the book.

• Describe the concept of risk and return and its role in financial

decision-making.

• Identify some of the key difficulties of financing renewable energy

at scale.

• Highlight the major topics to be explored by other chapter

authors.

Historically, the energy sector has been comprised of state-owned

companies. This situation began to change in the 1990s, as privatiza-

tion and liberalization induced a shift from governments to compa-

nies as the primary source of sector investment. The trend is highly

pronounced in the field of renewable energy, where it is private sector

investors, generating profits for shareholders, who are the major

actors in financing new renewable energy projects. The renewable

energy industry is still in the process of building relationships with

these providers of capital. Making green energy the mainstream

choice for new energy infrastructure will require expanding access to

b2126_Introduction.indd 4 5/28/2015 3:25:14 PM

b2126 Renewable Energy Finance

Introduction to Renewable Energy Finance 5

a diverse spectrum of private sector investors around the world. An

important premise of this book is that a better understanding of inves-

tors and their motives may help reduce the risk of another false dawn

for a future powered by renewable energy.

Defining the Landscape

Understanding renewable energy from a financial point of view requires

the definition of key terms. Finance has its own language, and it seems

no matter where you go in the world these days, that language reflects

the trends of globalization. In short, money speaks English. But

although the language of finance has a common tongue, it remains

poorly understood and commonly confused. Academics, practitioners,

http://www.worldscientific.com/worldscibooks/10.1142/P1030#t=toc

RENEWABLE ENERGY FINANCE: POWERING THE FUTURE

and the media may use the same words, but often mean different things.

©Charles W. Donovan.No further distribution is allowed.

An investment involves an exchange of money for a claim on

benefits to be generated by some asset. Investments can be made as

equity (a form of partial ownership) or as debt (money loaned by one

party to another). Assets can be defined in many different ways, fol-

lowing academic or popular conventions. For the present discussion,

we shall identify assets in one of two ways, as either real or financial.

Real assets are those which come most readily to mind: steel struc-

tures, tracts of land, and heavy machinery. They are the foundations

upon which all economic activity is built. Financial assets are less

tangible, often having no physical properties whatsoever. Financial

assets constitute a form of agreement between parties. They range

from the straightforward (a certificate of deposit at your local savings

bank) to the highly exotic (equity derivatives structured by a global

investment bank).

Investors are buyers of real and financial assets. While investors

may be government or private sector entities, the primary focus in this

book is on those in the private sector. Examples of private sector

investors include:

• Corporations (electric utilities, oil and gas, consumer-facing

industries).

• Retail Investors (individuals, family offices).

b2126_Introduction.indd 5 5/28/2015 3:25:15 PM

b2126 Renewable Energy Finance

6 Renewable Energy Finance

• Investment partnerships (hedge funds, private equity firms).

• Financial intermediaries (banks, insurance companies, pension

funds).

• Endowment funds (foundations, universities).

Private sector investors in renewables have, historically, been made

up of companies with an existing presence in the energy sector.

Commonly referred to as strategic investors, these market partici-

pants often see a tight pairing between renewable energy and their

core lines of business. Strategic investors may also refer to newly estab-

lished companies for whom renewable energy is their core activity.

Financial investors have also been involved since the early days of the

industry, but their involvement was often limited to project-based

http://www.worldscientific.com/worldscibooks/10.1142/P1030#t=toc

RENEWABLE ENERGY FINANCE: POWERING THE FUTURE

loans offered by commercial banks. One of the most important devel-

©Charles W. Donovan.No further distribution is allowed.

opments in the renewable energy sector over the past decade is how

this situation has begun to change. Hedge funds and private equity

firms are now frequent participants, and there is increasing action

amongst insurance companies, pension funds, and endowment funds.

Unlike strategic investors, financial investors usually have no specific

impetus for getting involved in renewable energy and have not been

obligated by governments to do so. As funding sources, they are

quickly prone to flight during turbulent market conditions.

The key factor that sets financial investors apart from strategic

investors is their preference for financial assets versus real assets.

Financial investors also typically maintain a portfolio of investments in

more than one asset class. An asset class is a grouping of assets that

share similar risk/return characteristics. Major asset classes include:

• Equities.

• Fixed income.

• Real estate.

• Commodities.

• Derivatives.

Investments in the renewable energy sector span multiple asset

classes. Investors may, for example, buy shares in publicly traded

b2126_Introduction.indd 6 5/28/2015 3:25:15 PM

b2126 Renewable Energy Finance

Introduction to Renewable Energy Finance 7

renewable energy companies (equities), lend directly to clean energy

projects (fixed income), have ownership in manufacturing and pro-

duction facilities (real estate), and speculate on the price of outputs

such as electricity, liquid fuel or emissions allowances (commodities).

Renewable energy is, therefore, not as an asset class itself, but rather

a sub-category within several asset classes. Thinking of clean energy

investment as a set of asset class categories is helpful in positioning

the sector more exactly within the universe of investment opportuni-

ties available to large capital providers.

The Guiding Principles of Risk and Return

Investors use risk and financial return as their primary criteria for

http://www.worldscientific.com/worldscibooks/10.1142/P1030#t=toc

RENEWABLE ENERGY FINANCE: POWERING THE FUTURE

deciding whether to invest in a particular asset class. Some market

©Charles W. Donovan.No further distribution is allowed.

participants are constrained by strategic aims or may have specific

fiduciary responsibilities preventing certain types of investments.

Many more will simply be on the sidelines, waiting for the data about

risk and return in an asset class to become clear. For all investors, the

key question about a new investment prospect is one of valuation:

Does the price at which the asset is trading today offer a good prospect for

capital appreciation over time? To answer this question, investment

decision-makers choose an appropriate means of asset pricing.

Asset pricing methods differ according to the asset class being

analyzed, and investor sophistication. A large hedge fund does not,

for example, evaluate sovereign bonds in the same way that a retiree

would examine equities. Nonetheless, there is a generalized analytical

process undertaken in asset pricing, represented by Cochrane (2005)

as follows:

Pt = E (mt+1 xt+1)

Where

Pt = asset price,

xt+1 = asset payoff, and

mt+1 = stochastic discount factor.

The equation describes the price of an asset as a function of its

expected payoff (i.e. the anticipated cash flows) and a discount rate.

b2126_Introduction.indd 7 5/28/2015 3:25:15 PM

b2126 Renewable Energy Finance

8 Renewable Energy Finance

There are a range of analytical techniques for estimating a discount

rate, some employing mind-boggling computational methods. But

regardless of how complicated, a discount rate has embedded within

it two basic judgements. The first is an estimation of the time value

of money. This element of the discount rate compensates an investor

for receiving a secure payment at some date in the future, rather than

today. The second judgement is about the likelihood and timing of

receiving the expected future payment1. We refer to this as the risk

premium.

While there is broad consensus that risk and return are the pri-

mary measures used by investors to evaluating investment attractive-

ness, there is considerable debate about the precise method for

accurately measuring investment risk. We summarize here two of the

http://www.worldscientific.com/worldscibooks/10.1142/P1030#t=toc

RENEWABLE ENERGY FINANCE: POWERING THE FUTURE

most well-known schools of thought.

©Charles W. Donovan.No further distribution is allowed.

Among the most basic tenets of portfolio theory (Markowitz,

1959) is that investors hold a diversified bundle of financial assets and

that investment risk is shaped by this diversification. Portfolio theory

later gave rise to the capital asset pricing model (Sharpe, 1964;

Lintner, 1965), in which investment risk is represented by a single

mathematical coefficient. This coefficient, known as Beta, measures

how the financial payoff from a specific asset varies in relation to the

payoff from all assets in the market as a whole. Beta represents an

asset’s sensitivity to systematic risks faced by all investors. The capital

asset pricing model (CAPM) is an analytical tool taught to nearly all

aspiring finance practitioners around the world and cited as the most

popular method amongst corporate finance directors for estimating

company discount rates (Bruner et al., 1998).

In contrast to the CAPM approach, arbitrage pricing theory

(Ross, 1976) holds that discount rates are a function of multiple risk

factors. Whereas using CAPM, investment risk varies according to just

a single Beta term, arbitrage pricing theory (APT) places no restric-

tions on the number of risk factors to be used. The factors of an APT

asset pricing model may include generic macroeconomic indicators

1

In the interest of simplicity we do not differentiate between payments in the form

of interest, dividends or capital gains.

b2126_Introduction.indd 8 5/28/2015 3:25:15 PM

b2126 Renewable Energy Finance

Introduction to Renewable Energy Finance 9

such as government bond rates, oil prices and various forms of infla-

tion, as well as asset-specific risk indicators, such as liquidity. Arbitrage

pricing theory allows greater analyst discretion in representing the

complexity of the real world of investing. This analytical discretion

does, however, come with a cost — namely the loss of simplicity, rep-

licability and standardization.

No matter what approach one takes to asset pricing, the basic

analytical challenge remains the same. Investors must estimate their

financial payoff by forecasting future cash flows from the asset. They

must also compute an appropriate discount rate for the investment,

taking into account investment risk. Stated most simply, the question

of valuation asks whether the expected financial return is sufficient to

compensate for the prevailing level of risk.

http://www.worldscientific.com/worldscibooks/10.1142/P1030#t=toc

RENEWABLE ENERGY FINANCE: POWERING THE FUTURE

©Charles W. Donovan.No further distribution is allowed.

Renewable Energy as an Investment Type

Due to the numerous ways in which investments in the sector can be

made and overlaps with other industrial sectors, renewable energy is

challenging to characterize as an investment type. Renewable energy

bears resemblance to other types of infrastructure investment, such as

those in the water and transportation sectors. Like all these public

services, the supply of energy from wind, solar, and biomass resources

is regulated and subsidized. Renewable energy also has aspects in

common with conventional energy developments, like oil and gas

exploration. As with conventional energy, non-fossil fuel projects are

capital intensive, requiring much of the life-cycle investment costs to

be made upfront.

As an asset class category, renewable energy is most often com-

pared to the conventional electric power sector. For some investors,

electric power still carries the legacy of a chequered past. High-profile

debacles such as the Dabhol gas-fired power project in India and the

spate of bankruptcies that followed in the aftermath of the implosion

at Enron have created long-lasting memories about getting burned in

the power sector.

In addition to perceptions that spill over from other sectors,

renewable energy has its own characteristics. By and large, investors

b2126_Introduction.indd 9 5/28/2015 3:25:15 PM

b2126 Renewable Energy Finance

10 Renewable Energy Finance

are still in the process of recognizing the unique facts about renewa-

ble energy technologies, such as:

• With the exception of biomass, they have no fuel costs, leading to

complex price interactions with fossil fuel technologies in marginal

cost-driven markets.

• They generate commodities that may be costly to transport and/

or difficult to store.

• They encompass a broad range of technologies, each with distinct

value chains, often having little technical resemblance to one

another.

• Some rely upon the highly centralized energy networks for their

viability, while others pose a competitive threat to them.

http://www.worldscientific.com/worldscibooks/10.1142/P1030#t=toc

RENEWABLE ENERGY FINANCE: POWERING THE FUTURE

• Each renewable energy technology is at a different level of com-

©Charles W. Donovan.No further distribution is allowed.

mercial readiness and cost competitiveness.

There are numerous implications that investors can draw about

renewable energy in reaction to its inherent diversity and complexity.

In the long term, many of these characteristics are what give renew-

able energy the potential to induce a radical shift in the current energy

market paradigm. But in the short term, these sources of complexity

have created confusion amongst investors regarding the predictability

of risk and return for renewable energy investments.

Financing Renewable Energy at Scale

Strategic investors, such as electric utilities, do not have the scale of

financial resources at their disposal to meet the challenge of scaling up

investment in clean energy at three to four times its current level. It

is also becoming clear that renewable energy poses a direct competi-

tive threat to the conventional utility business plan, straining the

financial position of traditionally large players (Gillis, 2014). Awareness

is growing that increased funding by financial investors will be neces-

sary to meet renewable energy investment goals. But rather than

replacing the investments being made by energy companies, direct

funding from the capital markets should be viewed as complementary.

b2126_Introduction.indd 10 5/28/2015 3:25:15 PM

b2126 Renewable Energy Finance

Introduction to Renewable Energy Finance 11

Increased participation by financial investors will help unburden util-

ity balance sheets and encourage redeployment of funds into early-

stage development projects.

Packaging mature investments with relatively stable risk–return

profiles to large financial investors, while still embryonic, is a rapidly

growing area of renewable energy finance. As stated previously, many

large investors — regulated financial intermediaries, in particular —

tend to prefer financial assets, as these assets tend to offer important

benefits to investors, namely:

• Scale (the capacity to absorb sizable capital inflows/outflows).

• Liquidity (frequent trading that allows securities to be bought or

sold immediately).

http://www.worldscientific.com/worldscibooks/10.1142/P1030#t=toc

RENEWABLE ENERGY FINANCE: POWERING THE FUTURE

©Charles W. Donovan.No further distribution is allowed.

Investing in real assets, for example via direct ownership of an

offshore wind farm, does not offer the necessary scale or liquidity that

many investors need to adequately manage an investment portfolio.

While an offshore wind farm may be quite large, the investment

opportunity is capped by the size of a single project. Furthermore, the

investor is effectively stuck in the project until a subsequent buyer can

be found. Contrast this situation with the market for large govern-

ment bonds, which offer supply far greater than any single investor

could absorb, and transactions to buy or sell occur in a matter of

seconds.

A growing trend in the renewable energy investment is for real

assets to be transformed into financial assets. It is a form of commod-

itization playing out across nearly all fields of environmental protec-

tion and ecological restoration (Sandor et al., 2013). Making

investment in clean power and renewable fuels available to investors

as financial assets has the potential to unlock access to a US$600 tril-

lion pool of global finance capital, nearly three times greater than the

stock of real assets that underpin all economic activity in the global

economy (Bain & Company, 2012).

The transformation of geothermal power stations, biofuel refiner-

ies and solar energy facilities into financial assets can be accomplished

through packaging of asset backed securities (ABS). As their name

b2126_Introduction.indd 11 5/28/2015 3:25:15 PM

b2126 Renewable Energy Finance

12 Renewable Energy Finance

implies, ABS are financial assets whose income is generated from a

collection of real assets. They are difficult to define precisely, as their

exact nature depends upon the regulations of the country in which

they are issued. In the US, the world’s deepest capital market, renew-

able energy assets have been used as collateral to create real estate

investment trusts (REIT), C-Corporations (‘Yield Co’), and sector-

specific debt securities (climate bonds). Common to all these forms of

financing is their direct link to the capital markets.

Having stable cash flows and no fuel price risk, the returns from

renewable energy financial assets may be weakly correlated or entirely

uncorrelated to those of the major asset classes. For portfolio inves-

tors, weak correlations are a favorable indicator of attractiveness as

they reduce measured risk. It is incumbent upon the industry to dem-

http://www.worldscientific.com/worldscibooks/10.1142/P1030#t=toc

RENEWABLE ENERGY FINANCE: POWERING THE FUTURE

onstrate a track record of performance that firmly establishes whether

©Charles W. Donovan.No further distribution is allowed.

it offers a diversification benefit to portfolio investors. To the degree

it does, renewable energy will be attract sizable investment at extraor-

dinarily low discount rates (Awerbuch, 2007).

Laying Conceptual Foundations for a Renewable

Energy Future

One of the key messages of this introductory chapter is that the

required rate of return for private sector investors is a function of risk.

Although most investors have by now turned over the task of risk

assessment to highly intelligent machines, risk will never be defined

solely by data. Risk is a product not just of numbers, but also of ideas.

Even in the realm of highly quantitative finance, it remains a judge-

ment shaped by interpretations and beliefs. No amount of data or

sophisticated modelling will ever provide a complete answer to the

question about what rate of return investors will demand from renew-

able energy projects in exchange for their money. Policymakers, aca-

demics, the investment community and the general public all play a

role in shaping the idea of risk that ends up being held in an invest-

ment decision-maker’s mind.

There is nonetheless, a purely objective aspect of risk assessment

that cannot be avoided. Information about risk and return on

b2126_Introduction.indd 12 5/28/2015 3:25:15 PM

b2126 Renewable Energy Finance

Introduction to Renewable Energy Finance 13

common asset classes such as equities, bonds and commodities are

available to investors instantaneously at any time of day, in any lan-

guage, all over the world. As an asset class category, renewable energy

is still in the very early days of establishing itself. A key task ahead is

for the industry to generate a history of investment performance.

Although historical returns are not always a reliable guide to the

future, transparency about past investment performance will be neces-

sary for investors — financial investors, in particular — to understand

and articulate a story about risk and return in the renewable energy

sector to their investment committees.

Looking Forward

http://www.worldscientific.com/worldscibooks/10.1142/P1030#t=toc

RENEWABLE ENERGY FINANCE: POWERING THE FUTURE

The volume of capital needed for a widespread transition towards a

©Charles W. Donovan.No further distribution is allowed.

renewable energy economy will require increasing participation of

financial investors and continued adoption of innovative financing

techniques. This need not undermine the importance of the continued

role for strategic investors. It is, after all, within utilities, project devel-

opment companies, and network operators that most of the technical

knowledge about renewable energy is to be found. But it is also evi-

dent that for a step-change to occur in capital flows to the sector going

forward, funding must increasingly come from financial investors.

These new players will need to be brought into the game, while retain-

ing the core investors who have brought the industry to its current

level. The thirteen chapters of Renewable Energy Finance tell impor-

tant elements of the story of how to achieve this new balance.

The chapters in Section One lay the groundwork by defining key

terms and exploring the major drivers for the expansion of renewable

energy. Section One will be of particular interest to readers looking

for an in-depth explanation of the characteristics of the heterogeneous

set of technologies that make up renewable energy. These initial chap-

ters consider the costs of different forms of renewable energy and

their prospects for competitive dominance in wholesale and retail

energy markets.

A common theme to all the chapters in Section Two is the

inextricable link between energy markets and government policy. The

b2126_Introduction.indd 13 5/28/2015 3:25:15 PM

b2126 Renewable Energy Finance

14 Renewable Energy Finance

authors describe the main ways in which governments support renew-

able energy, and identify general principles of how policy influences

investment decisions. Lessons learned over two decades of govern-

ment support for renewables are drawn out, with a particular focus on

experiences to date in China and developing countries. The section

closes with a study of the impact of carbon pricing policies on inves-

tors in Europe.

Section Three delves into the real world of investing and consid-

ers the challenges and opportunities for commercial banks, private

equity funds, institutional asset managers, and retail investors. The

authors of these chapters take up the difficult work of sorting through

the changes that have occurred since the financial crisis of 2008 and

charting the future direction for specific investors. The collection of

http://www.worldscientific.com/worldscibooks/10.1142/P1030#t=toc

RENEWABLE ENERGY FINANCE: POWERING THE FUTURE

chapters in Section Three touch upon recent innovations in renewable

©Charles W. Donovan.No further distribution is allowed.

energy financing such as leasing and crowdfunding, as well as the

adaptation of long-time corporate and project funders to the evolving

dynamics of the financing market.

In all, the three sections of this book seek to illuminate the foun-

dations upon which a renewable energy future can be built. There are

many actions to be taken in the years ahead to broaden the investor

base for renewable energy in the future. We hope that readers will find

Renewable Energy Finance to be a resource that they return to many

times over the ensuing years to deepen their understanding of this

important topic — and hence, their courage to act.

References

Awerbuch, S. (2007). Unpublished book manuscript. Available at: http://

www.awerbuch.com [accessed 17 April 2012].

Bain & Company, Inc. (2012). ‘A World Awash in Money: Capital Trends

through 2020’. Available at: http://www.bain.com/publications/

articles/a-world-awash-in-money.aspx [accessed 19 December 2014].

Bloomberg New Energy Finance (2014). ‘Global Trends in Renewable

Energy Investment 2014’. Available at: http://fs-unep-centre.org/pub-

lications/gtr-2014 [accessed 22 December 2014].

b2126_Introduction.indd 14 6/26/2015 11:08:32 AM

b2126 Renewable Energy Finance

Introduction to Renewable Energy Finance 15

Bruner, R. F., Eades, K. M., Harris, R. S. and Higgins, R. C. (1998). ‘Best

practices in estimating the cost of capital: Survey and synthesis’, Financial

Practice and Education, 8, 13–28.

Cochrane, J. (2005). Asset Pricing (Revised Edition), Princeton University

Press, Princeton.

Gillis, J. (2014). ‘Sun and Wind Alter Global Landscape, Leaving Utilities

Behind’, The New York Times. Available at: http://www.nytimes.com

[accessed 10 October 2014].

Lintner, J. (1965). ‘Security Prices, Risk, and Maximal Gains from

Diversification’, Journal of Finance, 20(4), 587–615.

Markowitz, H. M. (1959). Portfolio Selection: Efficient Diversification of

Investments, John Wiley and Sons, New York.

Ross, S. A. (1976). ‘The Arbitrage Theory of Capital Asset Pricing’, Journal

of Economic Theory, 13, 341–360.

http://www.worldscientific.com/worldscibooks/10.1142/P1030#t=toc

RENEWABLE ENERGY FINANCE: POWERING THE FUTURE

Sharpe, W. F. (1964). ‘Capital Asset Prices: A Theory of Market Equilibrium

©Charles W. Donovan.No further distribution is allowed.

under Conditions of Risk, Journal of Finance, 19(3), 425–442.

Sandor, R., Clark, N., Kanakasabai, M. and Marques, R. (2013).

‘Environmental Markets: A New Asset Class’, CFA Institute Research

Foundation. Available at: www.cfainstitute.org/foundation [accessed 5

November 2014].

b2126_Introduction.indd 15 5/28/2015 3:25:15 PM

View publication stats

You might also like

- Nedbank Investment Statement - 28 Oct 2023Document2 pagesNedbank Investment Statement - 28 Oct 2023mabuyisizakeleNo ratings yet

- Divorce Forms - AlishaDocument52 pagesDivorce Forms - AlishaCrystal Fairy-Dust100% (2)

- Using Section 609 of The Fair CreditDocument4 pagesUsing Section 609 of The Fair CreditFreedomofMind95% (19)

- E-Book - Apples and Oranges - Finance For Non-Finance in DistrubitionDocument33 pagesE-Book - Apples and Oranges - Finance For Non-Finance in DistrubitionyusufNo ratings yet

- Wiley - Handbook of Large Hydro Generators - Operation and Maintenance - 978!1!119-52416-8Document3 pagesWiley - Handbook of Large Hydro Generators - Operation and Maintenance - 978!1!119-52416-8Fayaz ShaikNo ratings yet

- More Thoughts On The Uwe Jarck DeviceDocument5 pagesMore Thoughts On The Uwe Jarck DeviceMladen MuskinjaNo ratings yet

- PB Thermal Station CostsDocument20 pagesPB Thermal Station CostsJosé SánchezNo ratings yet

- CSEC Pob Past PaperDocument9 pagesCSEC Pob Past PaperDaphneNo ratings yet

- Unit 2 - Accommodation Management Aspects .Document13 pagesUnit 2 - Accommodation Management Aspects .Mandeep KaurNo ratings yet

- Houtan Afkhami Jeremy Brown Patrick Bydume James WalshDocument49 pagesHoutan Afkhami Jeremy Brown Patrick Bydume James WalshAdio FosterNo ratings yet

- Why The United States Needs A National Power GridDocument6 pagesWhy The United States Needs A National Power GridThe American Security ProjectNo ratings yet

- Stator Differential Protection During Transformer Inrush Conditions in The 489Document4 pagesStator Differential Protection During Transformer Inrush Conditions in The 489meraatNo ratings yet

- Review of Electrical Energy Storage Technologies, Materials and Systems: Challenges and Prospects For Large-Scale Grid StorageDocument155 pagesReview of Electrical Energy Storage Technologies, Materials and Systems: Challenges and Prospects For Large-Scale Grid StorageAnonymous oFjwtrgrNo ratings yet

- 3 VHP - Packaging - Guide - 6 30 v4Document222 pages3 VHP - Packaging - Guide - 6 30 v4Alfred Lam100% (1)

- When Bad Things Happen To Good TurbinesDocument85 pagesWhen Bad Things Happen To Good Turbinesshilton1989100% (1)

- EEE 488 Renewable and Alternate Energy Systems: Lecture 1:introductionDocument40 pagesEEE 488 Renewable and Alternate Energy Systems: Lecture 1:introductionkamran kamiNo ratings yet

- Ida Fahani MD Jaye - Renewable, Local Electricity Generation From Palm Oil Mill Residues A Case Study From Peninsular MalaysiaDocument289 pagesIda Fahani MD Jaye - Renewable, Local Electricity Generation From Palm Oil Mill Residues A Case Study From Peninsular MalaysiaFred LukeNo ratings yet

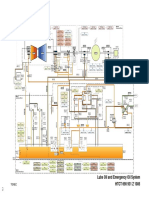

- Lube Oil and Emergency Oil SystemDocument1 pageLube Oil and Emergency Oil SystemAdetunji Babatunde TaiwoNo ratings yet

- Power Cables: TM 5-683/NAVFAC MO-116/AFJMAN 32-1083Document9 pagesPower Cables: TM 5-683/NAVFAC MO-116/AFJMAN 32-1083dadyjoshNo ratings yet

- Natural Gas 130KW GeneratorDocument6 pagesNatural Gas 130KW Generatorrechtman1289No ratings yet

- Particle Effect On Breakdown Voltage of Mineral and Ester Based Transformer OilsDocument5 pagesParticle Effect On Breakdown Voltage of Mineral and Ester Based Transformer Oilsrasheed313No ratings yet

- Study The Mechanical Behaviour of Al 7075 With Silicon Nitride by Computer Analysis & Stir CastingDocument4 pagesStudy The Mechanical Behaviour of Al 7075 With Silicon Nitride by Computer Analysis & Stir CastingInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Chevron Y Texaco TablaDocument40 pagesChevron Y Texaco TablasofelsbabaNo ratings yet

- Beckett Af BurnerDocument12 pagesBeckett Af Burnertrykonxlgold75100% (1)

- Air Circuit Breakers DW Series PDFDocument102 pagesAir Circuit Breakers DW Series PDFDeny PradanaNo ratings yet

- Energy Economics: After Reading This Chapter, You Should Be Able ToDocument26 pagesEnergy Economics: After Reading This Chapter, You Should Be Able ToMohamed Abashar MusmarNo ratings yet

- Integration of CCGT Plant and LNG TerminalDocument28 pagesIntegration of CCGT Plant and LNG Terminalcicko45100% (1)

- Pump Start-Up Backpressure - Industrial Professionals - Cheresources - Com CommunityDocument7 pagesPump Start-Up Backpressure - Industrial Professionals - Cheresources - Com Communityjayrolling dollazNo ratings yet

- VaccumCircuitBreaker SelectionListDocument52 pagesVaccumCircuitBreaker SelectionListahmad fauzanNo ratings yet

- Issue 67 FullDocument108 pagesIssue 67 FullMariano Salomon PaniaguaNo ratings yet

- Taiwan MacroeconomicsDocument8 pagesTaiwan MacroeconomicsLinh TranNo ratings yet

- Safety in Electrical Low Voltage Installations Vol-1 Basics of LV Earthing System-1Document83 pagesSafety in Electrical Low Voltage Installations Vol-1 Basics of LV Earthing System-1baboo singh100% (1)

- Static ElectricDocument28 pagesStatic Electricunijhon100% (1)

- A Game Theory Approach To The Analysis of Land and Property Development ProcessesDocument15 pagesA Game Theory Approach To The Analysis of Land and Property Development ProcessesHatim NathdwaraNo ratings yet

- Reactive Power Compensation Using Capacitor BanksDocument82 pagesReactive Power Compensation Using Capacitor BanksARVIND100% (1)

- YS 700W Bifacial Solar PanelDocument2 pagesYS 700W Bifacial Solar PanelDaniel RodriguezNo ratings yet

- Reactive PowerDocument10 pagesReactive PowerLevelUp PresentsNo ratings yet

- F Class Inspection Maintenance Fact SheetDocument1 pageF Class Inspection Maintenance Fact SheetMartinNo ratings yet

- 1.HSK78 2MW DatasheetDocument6 pages1.HSK78 2MW Datasheetnunukidsshop 0869478221No ratings yet

- Gas Turbines:: Moving To Prime TimeDocument4 pagesGas Turbines:: Moving To Prime TimeBharatSubramonyNo ratings yet

- Exhaust Gas Temperature Capabilities Now in System 1 SoftwareDocument2 pagesExhaust Gas Temperature Capabilities Now in System 1 Softwarescribdkhatn100% (3)

- Textbook HYDRODocument52 pagesTextbook HYDROEder Francisco Paredes GodoyNo ratings yet

- Transformer Oil SamplingDocument3 pagesTransformer Oil SamplingfaarigNo ratings yet

- Duval Triangle Paper Permana - 2018 - IOP - Conf. - Ser. - Mater. - Sci. - Eng. - 384 - 012065Document8 pagesDuval Triangle Paper Permana - 2018 - IOP - Conf. - Ser. - Mater. - Sci. - Eng. - 384 - 012065Mauricio BerbeoNo ratings yet

- PB ReciprocatingEnginesDocument29 pagesPB ReciprocatingEngines_guybrush_100% (1)

- Microgrid Modelling Simulation PDFDocument81 pagesMicrogrid Modelling Simulation PDFVitor Seger ZeniNo ratings yet

- NEMA 250 Type 4 Enclosures PDFDocument4 pagesNEMA 250 Type 4 Enclosures PDFMike SantiagoNo ratings yet

- Varistroke 26727 G PDFDocument135 pagesVaristroke 26727 G PDFsurawutwijarnNo ratings yet

- Biaya PembangkitanDocument28 pagesBiaya Pembangkitanblackzeny100% (1)

- Gas Engine Oil Analysis (Wear Check)Document2 pagesGas Engine Oil Analysis (Wear Check)anibal_rios_rivasNo ratings yet

- Maintenance Preventive / Preventive Maintenance Lot Rep QT REF DesignationDocument1 pageMaintenance Preventive / Preventive Maintenance Lot Rep QT REF DesignationMedjahdi RafikNo ratings yet

- Megger-A Stich in TimeDocument68 pagesMegger-A Stich in TimeluiscotaNo ratings yet

- Value of Lost LoadDocument7 pagesValue of Lost LoadLuis AntonioNo ratings yet

- A Survey On Renewable Energy For Electric GenerationDocument327 pagesA Survey On Renewable Energy For Electric GenerationKasım ZORNo ratings yet

- Livening Up NotesDocument1 pageLivening Up NotesAceel FitchNo ratings yet

- Session 1-2 - Energy in Transition Into A Decarbonized FutureDocument30 pagesSession 1-2 - Energy in Transition Into A Decarbonized FutureShashank Tyagi100% (1)

- Fdocuments - in Presentation On Substation 220 KVDocument37 pagesFdocuments - in Presentation On Substation 220 KVShivangi Goyal100% (1)

- IntroductiontoRenewableEnergyFinance DonovanDocument14 pagesIntroductiontoRenewableEnergyFinance DonovanhendroshadiNo ratings yet

- A29 Wuestenhagen Menichetti EnPol 2012Document10 pagesA29 Wuestenhagen Menichetti EnPol 2012Edwin Urrea GómezNo ratings yet

- Scan Record Plus Annotated Bibliography LSC2223Document4 pagesScan Record Plus Annotated Bibliography LSC2223Salman ArshadNo ratings yet

- Base Paper 3Document15 pagesBase Paper 3kiranjuwNo ratings yet

- Financing Carbon Lock in in Developing Countries Bilateral Fina 2021 ApplieDocument11 pagesFinancing Carbon Lock in in Developing Countries Bilateral Fina 2021 ApplieHaseeb AminNo ratings yet

- J Enpol 2016 05 035Document9 pagesJ Enpol 2016 05 035ngothuphuong.mktNo ratings yet

- Ceo Briefing Renewable Energy 2004Document8 pagesCeo Briefing Renewable Energy 2004gilbertociroNo ratings yet

- Renewable Energy in IndiaDocument22 pagesRenewable Energy in Indiatiyas biswasNo ratings yet

- Huang 2020Document8 pagesHuang 2020Fiorella Estrella Barzola ChaucaNo ratings yet

- Harambe University Project Logistics and Contract Administration NOVEMBER, 2013Document17 pagesHarambe University Project Logistics and Contract Administration NOVEMBER, 2013tolossa assefaNo ratings yet

- Intelligent Accident Detection and Alert System For Emergency Medical AssistanceDocument7 pagesIntelligent Accident Detection and Alert System For Emergency Medical Assistancetolossa assefaNo ratings yet

- Intelligent Accident Detection and Alert System For Emergency Medical AssistanceDocument7 pagesIntelligent Accident Detection and Alert System For Emergency Medical Assistancetolossa assefaNo ratings yet

- Dvantages Isadvantages: Technology / Features 4G 5G Start/Deployment Peak Data Rate Standards LatencyDocument2 pagesDvantages Isadvantages: Technology / Features 4G 5G Start/Deployment Peak Data Rate Standards Latencytolossa assefaNo ratings yet

- Chapter Five TQM Tools and The Improvement CycleDocument37 pagesChapter Five TQM Tools and The Improvement Cycletolossa assefaNo ratings yet

- A Review of The Strategic Management Literature: The Importance of Intellectual Capital in The Non-Profit SectorDocument3 pagesA Review of The Strategic Management Literature: The Importance of Intellectual Capital in The Non-Profit Sectortolossa assefaNo ratings yet

- Chapter Three: Total Quality Management and Iso-9000Document33 pagesChapter Three: Total Quality Management and Iso-9000tolossa assefaNo ratings yet

- Harambee University College Faculty of Business & Economics Post Graduate Program (Fitche Campus) Project Total Quality ManagementDocument24 pagesHarambee University College Faculty of Business & Economics Post Graduate Program (Fitche Campus) Project Total Quality Managementtolossa assefaNo ratings yet

- CH 2Document34 pagesCH 2tolossa assefaNo ratings yet

- Conversion of A Hexadecimal Number To A Binary Number: Method 1Document10 pagesConversion of A Hexadecimal Number To A Binary Number: Method 1tolossa assefaNo ratings yet

- Harambee University CollegeDocument6 pagesHarambee University Collegetolossa assefaNo ratings yet

- Harambee University CollegeDocument6 pagesHarambee University Collegetolossa assefaNo ratings yet

- Harame University College Department of Management: AssignmentDocument8 pagesHarame University College Department of Management: Assignmenttolossa assefaNo ratings yet

- Sataticis PDFDocument25 pagesSataticis PDFtolossa assefaNo ratings yet

- ECE6203 Analytical and Computational Methods in Engineering: Dr. Rajaveerappa DevadossDocument61 pagesECE6203 Analytical and Computational Methods in Engineering: Dr. Rajaveerappa Devadosstolossa assefaNo ratings yet

- CH 06Document20 pagesCH 06tolossa assefaNo ratings yet

- AbbreviationsDocument3 pagesAbbreviationstolossa assefaNo ratings yet

- Introduction To Optics and Optical CommunicationsDocument4 pagesIntroduction To Optics and Optical Communicationstolossa assefaNo ratings yet

- Fsa AnswersDocument22 pagesFsa AnswersManan GuptaNo ratings yet

- Form 10 Cash Advances For Field Activity and Intelligence - Confidential ExpensesDocument1 pageForm 10 Cash Advances For Field Activity and Intelligence - Confidential ExpensesShaira BalindongNo ratings yet

- Acf - Merger ProjectDocument30 pagesAcf - Merger Projectpranita mundraNo ratings yet

- Chapter 16 Ppe (Part 2)Document27 pagesChapter 16 Ppe (Part 2)honeyjoy salapantanNo ratings yet

- Adr & GDRDocument18 pagesAdr & GDRAnonymous rtmAeygNo ratings yet

- Chapter 1 Nature of Management Accounting MA vs. FA Macaraeg MarcelinoDocument24 pagesChapter 1 Nature of Management Accounting MA vs. FA Macaraeg MarcelinoJohn BernabeNo ratings yet

- FR15. Provision, Contingent Liab & Assets (Practice)Document4 pagesFR15. Provision, Contingent Liab & Assets (Practice)duong duongNo ratings yet

- X04 Cost Volume Profit RelationshipsDocument39 pagesX04 Cost Volume Profit Relationshipschiji chzzzmeowNo ratings yet

- Japanese Investment and Job Creation in The UsDocument3 pagesJapanese Investment and Job Creation in The Us黄珮珊No ratings yet

- Bank of America Case StudyDocument3 pagesBank of America Case StudyVidhi singhNo ratings yet

- Accounting Fundamentals: Lesson 1Document8 pagesAccounting Fundamentals: Lesson 1egimmelNo ratings yet

- Clark Vs Sellner DigestDocument1 pageClark Vs Sellner Digestjim jim100% (1)

- Taylor, L. and S. O'Connell (1985), "A Minsky Crisis,"Document16 pagesTaylor, L. and S. O'Connell (1985), "A Minsky Crisis,"jpr82No ratings yet

- Law On Sales Lecture JaqDocument81 pagesLaw On Sales Lecture Jaqmicoleq903385100% (1)

- R.K. Dalmia vs. Delhi Administration PDFDocument64 pagesR.K. Dalmia vs. Delhi Administration PDFSandeep Kumar VermaNo ratings yet

- Alternative Methods of Trade FinancingDocument4 pagesAlternative Methods of Trade Financingrahulramgoolam291193No ratings yet

- Oyo BookingDocument4 pagesOyo BookingEricKankarNo ratings yet

- Assignment For Quantitative AnalysisDocument3 pagesAssignment For Quantitative AnalysisPhat Minh Huynh0% (1)

- List of ShareholdersDocument1 pageList of ShareholderskaminiNo ratings yet

- Group 7 Stirling - Sir's EvalDocument4 pagesGroup 7 Stirling - Sir's EvalKenneth Jules GarolNo ratings yet

- Budget Its CoverageDocument36 pagesBudget Its CoveragenicahNo ratings yet

- Bcip 2022Document241 pagesBcip 2022Akuntansi DhianNo ratings yet

- 168-Acting Comm. of Customs v. Manila Electric Co., 77 SCRA 469Document3 pages168-Acting Comm. of Customs v. Manila Electric Co., 77 SCRA 469Jopan SJNo ratings yet

- Chapter 9 Building A New Venture Team Compatibility ModeDocument26 pagesChapter 9 Building A New Venture Team Compatibility ModeSharif Md. Yousuf BhuiyanNo ratings yet