Professional Documents

Culture Documents

401 (K) Plan Fees and Expenses: Type of Plan Administrative Fee Amount

401 (K) Plan Fees and Expenses: Type of Plan Administrative Fee Amount

Uploaded by

Jay LewisOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

401 (K) Plan Fees and Expenses: Type of Plan Administrative Fee Amount

401 (K) Plan Fees and Expenses: Type of Plan Administrative Fee Amount

Uploaded by

Jay LewisCopyright:

Available Formats

401(k) Plan Fees and Expenses

Effective January 2016, the following fees may be deducted from your account.

• Asset-based fees

• Plan administrative fees and expenses

• Individual fees and expenses

Asset-Based Fees

Asset-based fees reflect an investment option's total annual operating expenses and include

management and other fees. They are often the largest component of retirement plan costs and are paid

by all shareholders of the investment option. Typically, asset-based fees are reflected as a percentage of

assets invested in the option and often are referred to as an “expense ratio.” You may multiply the

expense ratio by your balance in the investment option to estimate the annual expenses associated with

your holdings.

Asset-based fees are deducted from an investment option’s assets, thereby reducing its investment

return. Fee levels can vary widely among investment options, depending in part on the type of investment

option, its management (including whether it is active or passive), and the risks and complexities of the

option’s strategy. There is not necessarily a correlation between fees and investment performance, and

fees are just one component to consider when determining which investment options are right for you.

Plan Administrative Fees and Expenses

Plan administrative fees may include legal, accounting, trustee, recordkeeping, and other administrative

fees and expenses associated with maintaining the Plan. In some instances, they may be deducted from

individual accounts in the Plan, either equally from all accounts or proportionally based on account

balance.

Based on the information and direction Fidelity had on file at the time this document was prepared, the

following Plan administrative fee may be deducted from Plan accounts. As you review this information,

please keep in mind that fees are subject to change and that certain Plan administrative fees may not be

deducted from accounts in some circumstances.

Type of Plan Administrative Fee Amount

Recordkeeping Fee $47 per year ($11.75 per quarter).

If any Plan administrative fees are actually deducted from your account, they will be aggregated

on your Plan’s account statement in the Administrative Fees line item. Please keep in mind that

fees are subject to change.

Individual Fees and Expenses

Individual fees and expenses include those associated with a service or transaction that an individual may

select. In some instances, they may be deducted from the accounts of those individuals who utilize the

service or engage in the transaction.

If you have an account in the Plan, and you select or execute one or more of the following services or

transactions, the following fees may be deducted from your account based on the information and

direction Fidelity had at the time this notice was prepared. As you review this information, please keep in

mind that fees are subject to change and that certain individual fees may not be deducted in certain

circumstances.

Type of Individual Fee Amount

Loan Setup Fee $50 per loan

Loan Maintenance Fee $0

In-Service Withdrawal $25 per transaction

Overnight Mailing Fee $25 per transaction

Return of Excess Contribution Fee $25 per transaction

®

Fidelity Personalized Planning and Net advisory fee based on percentage of the average daily

Advice balance of eligible assets in your account, per year, per plan

If any individual fees are actually deducted from your account, they will be reflected on your

Plan’s account statement.

Right to Direct Investments

To access your Plan account with Fidelity, make any changes to your investment options, direct any

future contributions, or seek additional information, log on to www.netbenefits.com/tva or call

800-354-7121.

Exercising Voting, Tender, and Similar Rights

You have the right to exercise voting, tender, and similar rights related to the shares/units of mutual funds

you may have in your Plan account. You will receive information regarding such rights and how to

exercise them at the time of a vote, tender, or other event.

Restrictions

There may be certain restrictions, as summarized below, on how investment directions may be made in

the plan.

• There is no minimum amount for direct payroll contributions into your BrokerageLink account, but

there is an initial minimum investment of $2,500 to open an account

• Additional exchanges into BrokerageLink require a $1,000 minimum.

• Exchanges into Fidelity® Money Market Trust Retirement Government Money Market Portfolio are

not allowed. Investment elections for Fidelity® Money Market Trust Retirement Government

Money Market Portfolio are not allowed.

Keep in mind that restrictions are subject to change.

Fidelity Investments Institutional Operations Company, Inc. 245 Summer Street, Boston, MA 02210

© 2015-2018 FMR LLC. All rights reserved. 747773.2.1

You might also like

- Tiger Global BrochureDocument27 pagesTiger Global Brochureanandoiyer9100% (2)

- Credit Card Agreement For Consumer Cards in Capital One N.ADocument8 pagesCredit Card Agreement For Consumer Cards in Capital One N.AChisom ChidiNo ratings yet

- Fidelity 529 Unique PlanDocument75 pagesFidelity 529 Unique PlanJohn MichalakisNo ratings yet

- Sample Financial PlanDocument26 pagesSample Financial PlanrajsalgyanNo ratings yet

- Credit Card Agreement For Consumer Cards in Capital One Bank (USA), N.ADocument8 pagesCredit Card Agreement For Consumer Cards in Capital One Bank (USA), N.Ajeremywright100% (1)

- Pitch Deck Sebastian AmievaDocument9 pagesPitch Deck Sebastian AmievaJay LewisNo ratings yet

- COVID-19 Relief For Small Business: West Virginia District Office Wvinfo@sba - Gov WWW - Sba.gov/wvDocument37 pagesCOVID-19 Relief For Small Business: West Virginia District Office Wvinfo@sba - Gov WWW - Sba.gov/wvJay LewisNo ratings yet

- Kelompok 4Document9 pagesKelompok 4luthfia suciNo ratings yet

- Understanding Fees and Expenses in Your Workplace Savings PlanDocument4 pagesUnderstanding Fees and Expenses in Your Workplace Savings PlanrawsureshNo ratings yet

- This Document Answers Common Questions That Employees Have About 401 (K) Plans. Source: U.S. Department of LaborDocument10 pagesThis Document Answers Common Questions That Employees Have About 401 (K) Plans. Source: U.S. Department of LaborHOSAM HUSSEINNo ratings yet

- A Look at 401k Plan FeesDocument17 pagesA Look at 401k Plan Feesanalystc onsensusNo ratings yet

- A Look at 401 (K) Plan Fees US DPT of LaborDocument8 pagesA Look at 401 (K) Plan Fees US DPT of Laborambasyapare1No ratings yet

- Vanguard California Municipal Money Market Fund Summary ProspectusDocument8 pagesVanguard California Municipal Money Market Fund Summary Prospectus76132No ratings yet

- Fee DisclosureDocument15 pagesFee Disclosureteehee291291No ratings yet

- Generations Super and Pension Product Disclosure StatementDocument39 pagesGenerations Super and Pension Product Disclosure StatementNick KNo ratings yet

- Fidelity Personalized Planning & Advice at Work Terms and ConditionsDocument54 pagesFidelity Personalized Planning & Advice at Work Terms and ConditionsRCNo ratings yet

- Introduction To Financial Accounting ProjectDocument12 pagesIntroduction To Financial Accounting ProjectYannick HarveyNo ratings yet

- Discounted Cash Flows MethodDocument22 pagesDiscounted Cash Flows Methodjoahn.rocreo1234No ratings yet

- Financial Statement Analysis CourseworkDocument8 pagesFinancial Statement Analysis Courseworkpqltufajd100% (2)

- Investment Management Sample Business PlanDocument6 pagesInvestment Management Sample Business PlanWilde RosnyNo ratings yet

- ADM 401 (K) and ESOP For Salaried Employees: Required Disclosure InformationDocument13 pagesADM 401 (K) and ESOP For Salaried Employees: Required Disclosure InformationAnonymous pKu7M7bBpSNo ratings yet

- OneAnswer SOA TemplateDocument46 pagesOneAnswer SOA TemplateDalia AlkhateebNo ratings yet

- Discounted Cash Flows MethodDocument36 pagesDiscounted Cash Flows Methodjoahn.rocreo1234No ratings yet

- 2024.03 FLA Form CRS - FinalDocument2 pages2024.03 FLA Form CRS - FinalfleurmodafemininaNo ratings yet

- Novia Global Key FactsDocument6 pagesNovia Global Key FactsmNo ratings yet

- Adv Part 2 Brochure 2014Document16 pagesAdv Part 2 Brochure 2014api-245170369No ratings yet

- Cash Flow StatementDocument10 pagesCash Flow Statementhitesh26881No ratings yet

- Discounted Cash Flow Method Group 3Document44 pagesDiscounted Cash Flow Method Group 3Zariah GtNo ratings yet

- Fidelity South-East Asia Fund, A Sub-Fund of Fidelity Investment Funds, A Accumulation Shares (ISIN: GB0003879185)Document2 pagesFidelity South-East Asia Fund, A Sub-Fund of Fidelity Investment Funds, A Accumulation Shares (ISIN: GB0003879185)Nais BNo ratings yet

- The Complete Guide To Portfolio ShieldDocument15 pagesThe Complete Guide To Portfolio ShieldRalph YoungNo ratings yet

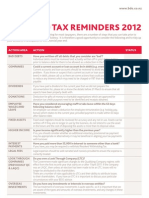

- Year-End Tax Reminders 2012: Action Area Action StatusDocument2 pagesYear-End Tax Reminders 2012: Action Area Action Statusapi-129279783No ratings yet

- ACC 291 Final Ratio Analysis MemoDocument5 pagesACC 291 Final Ratio Analysis MemoFadi HadiNo ratings yet

- Financial Accounting and AnalysisDocument10 pagesFinancial Accounting and AnalysisVidhath C GowdaNo ratings yet

- Taxes Summary Test NotesDocument10 pagesTaxes Summary Test NotesfemiadegbayoNo ratings yet

- 05-Discounted Cash Flows MethodDocument45 pages05-Discounted Cash Flows Methodsantosashleymay7No ratings yet

- Form CRSDocument2 pagesForm CRSRussell ConwayNo ratings yet

- PT CAP BasicBankingDocument3 pagesPT CAP BasicBankingRayan PaulNo ratings yet

- Fund Accounting Interview QuestionsDocument4 pagesFund Accounting Interview Questionsajay100% (1)

- Financial Planning and Wealth Management Software, Wealth Eoffice Demo PresentationDocument30 pagesFinancial Planning and Wealth Management Software, Wealth Eoffice Demo Presentationbabar_2002No ratings yet

- Lecture 1 On Cash Flow StatementsDocument21 pagesLecture 1 On Cash Flow StatementsERICK MLINGWANo ratings yet

- Cash Flow Statement: Dr.K.Baranidharan, SRI SAIRAM INSTITUTE OF TECHNOLOGY, CHENNAI 44Document17 pagesCash Flow Statement: Dr.K.Baranidharan, SRI SAIRAM INSTITUTE OF TECHNOLOGY, CHENNAI 44Dr.K.BaranidharanNo ratings yet

- Assignment: Prepared For: Md. Sajib Hossain, CFA Assistant Professor Department of Finance University of DhakaDocument9 pagesAssignment: Prepared For: Md. Sajib Hossain, CFA Assistant Professor Department of Finance University of DhakaMd Ohidur RahmanNo ratings yet

- Week6 - PresentationDocument10 pagesWeek6 - PresentationFarhan ThaibNo ratings yet

- Account Opening DisclosuresDocument8 pagesAccount Opening DisclosuresEliseu Simplicio de OliveiraNo ratings yet

- Financial ReportingDocument1 pageFinancial ReportingJINKY TOLENTINONo ratings yet

- Personal Checking Accounts: Additional Banking Services and Fees For Personal Accounts Deposit Account AgreementDocument15 pagesPersonal Checking Accounts: Additional Banking Services and Fees For Personal Accounts Deposit Account AgreementClobbersaurus DNo ratings yet

- MyNorth SuperPension PDSDocument67 pagesMyNorth SuperPension PDSoscar.tianNo ratings yet

- Five Strategies For Tax-Efficient Investing: Meet Our TeamDocument4 pagesFive Strategies For Tax-Efficient Investing: Meet Our TeamRudi MaulanaNo ratings yet

- Capital StructureDocument21 pagesCapital StructurevedanandeNo ratings yet

- 2015 Annual Plan Fee Disclosure NoticeDocument13 pages2015 Annual Plan Fee Disclosure NoticeSrujitha MullapudiNo ratings yet

- Cash Flow StatementDocument21 pagesCash Flow StatementthejojoseNo ratings yet

- Crs 144076Document5 pagesCrs 144076twin.fire5500No ratings yet

- How Banks Use Financial Ratios To Measure Your PerformanceDocument4 pagesHow Banks Use Financial Ratios To Measure Your PerformanceEmelyNo ratings yet

- Assignment 2Document6 pagesAssignment 2kamoosh2006No ratings yet

- Coventure Management, LLC: Form Adv Part 2ADocument18 pagesCoventure Management, LLC: Form Adv Part 2Ahult.elliot90No ratings yet

- Disclosure.28589.en USDocument5 pagesDisclosure.28589.en USminhajraza128No ratings yet

- Understanding & Using Financial Statements (As Business Tools For Nonprofits)Document66 pagesUnderstanding & Using Financial Statements (As Business Tools For Nonprofits)CBIZ Inc.No ratings yet

- Disclosure 26339 en-USDocument5 pagesDisclosure 26339 en-USjeremyallan6969No ratings yet

- II. Factors To ConsiderDocument5 pagesII. Factors To ConsiderKyla Capis BascoNo ratings yet

- Overdraft Privilege PolicyDocument4 pagesOverdraft Privilege Policyeigomez95No ratings yet

- Cash Flow Statement 1Document5 pagesCash Flow Statement 1furqanNo ratings yet

- Summary - Capital Structure and TaxationDocument3 pagesSummary - Capital Structure and TaxationRoshineeNo ratings yet

- US Choice Auto Rental SystemsDocument4 pagesUS Choice Auto Rental SystemsJay LewisNo ratings yet

- ITIL 4 Foundation Certification _ AxelosDocument2 pagesITIL 4 Foundation Certification _ AxelosJay LewisNo ratings yet

- The Acquisition PlaybookDocument57 pagesThe Acquisition PlaybookJay LewisNo ratings yet

- Land Buying Checklist: How To Research A Parcel of Land BEFORE YOU BUY!Document11 pagesLand Buying Checklist: How To Research A Parcel of Land BEFORE YOU BUY!Jay LewisNo ratings yet

- MFU Patented Design Technical Specifications: Tricon IV Triple Con ExDocument2 pagesMFU Patented Design Technical Specifications: Tricon IV Triple Con ExJay LewisNo ratings yet

- Simple Cost of Customer Acquisition Calculation Input VariablesDocument2 pagesSimple Cost of Customer Acquisition Calculation Input VariablesJay LewisNo ratings yet

- Instructions Online Label Record: Usps Tracking #Document1 pageInstructions Online Label Record: Usps Tracking #Jay Lewis100% (1)

- Instructions Online Label Record: Usps Tracking #Document1 pageInstructions Online Label Record: Usps Tracking #Jay LewisNo ratings yet

- Tac3S LT Tactical Plate: Level IIIDocument1 pageTac3S LT Tactical Plate: Level IIIJay LewisNo ratings yet

- Instructions Online Label Record: Usps Tracking #Document1 pageInstructions Online Label Record: Usps Tracking #Jay LewisNo ratings yet

- Disaster Playbook One-Pager 8.1.18 Logo V1 PDFDocument2 pagesDisaster Playbook One-Pager 8.1.18 Logo V1 PDFJay LewisNo ratings yet

- Microsoft Azure: Bringing Cloud To Your EnterpriseDocument53 pagesMicrosoft Azure: Bringing Cloud To Your EnterpriseJay LewisNo ratings yet

- Bulla: First CourseDocument3 pagesBulla: First CourseJay LewisNo ratings yet

- The Falls at Crismon CommonsDocument70 pagesThe Falls at Crismon CommonsJay LewisNo ratings yet

- SampleDocument46 pagesSampleJay LewisNo ratings yet

- Business Plan: Creating Solid Investments Through Refurbishing ApartmentsDocument56 pagesBusiness Plan: Creating Solid Investments Through Refurbishing ApartmentsJay LewisNo ratings yet

- 12 Credit Lines & Cards: You Can Get FORDocument9 pages12 Credit Lines & Cards: You Can Get FORJay Lewis100% (2)

- Model Sst1 Jogger/Bike Trailer: Owner's Manual Should Be Kept For Future ReferenceDocument10 pagesModel Sst1 Jogger/Bike Trailer: Owner's Manual Should Be Kept For Future ReferenceJay LewisNo ratings yet

- Artemis PDFDocument45 pagesArtemis PDFJay LewisNo ratings yet

- Axa XL - Insights From Our Experts - 2020Document19 pagesAxa XL - Insights From Our Experts - 2020Jay LewisNo ratings yet

- Fas Artworks Product Sheet Axa-Xl Us CaDocument2 pagesFas Artworks Product Sheet Axa-Xl Us CaJay LewisNo ratings yet

- Financial Management: Liquidity DecisionsDocument10 pagesFinancial Management: Liquidity Decisionsaryanboxer786No ratings yet

- Analysis of Profit/Loss Account, Balance Sheet, Statement in Changes in Equity and Cash Flow Statement of Any Listed CompanyDocument25 pagesAnalysis of Profit/Loss Account, Balance Sheet, Statement in Changes in Equity and Cash Flow Statement of Any Listed CompanyMuhammad Hassaan AliNo ratings yet

- 70 Enderta Bread Bakery Business PlanDocument35 pages70 Enderta Bread Bakery Business PlanAwetahegn HagosNo ratings yet

- 004 - Fiduciarie State For Morocco WhynantDocument5 pages004 - Fiduciarie State For Morocco Whynantlio MwaniaNo ratings yet

- Bali Brown Tang 2016 Dec Is Economic Uncertainty Priced in The Cross-Section of Stock ReturnsDocument51 pagesBali Brown Tang 2016 Dec Is Economic Uncertainty Priced in The Cross-Section of Stock Returnsroblee1No ratings yet

- Form 1Document1 pageForm 1Ntizz ShndrNo ratings yet

- Financial Statement AnalysisDocument32 pagesFinancial Statement AnalysisShruti JainNo ratings yet

- Money MarketDocument15 pagesMoney MarketNithin Joseph PanickerNo ratings yet

- Administer Subsidiary Accounts and LedgersDocument43 pagesAdminister Subsidiary Accounts and LedgersrameNo ratings yet

- TIF History and Performance Report, Wichita 2011Document23 pagesTIF History and Performance Report, Wichita 2011Bob WeeksNo ratings yet

- 10 The History of Derivatives - A Few MilestonesDocument9 pages10 The History of Derivatives - A Few MilestonesmirceaNo ratings yet

- Coinlend ReportDocument14 pagesCoinlend Reportlautaro oyuelaNo ratings yet

- Fundamentals of Accounting II, Chapter 4Document71 pagesFundamentals of Accounting II, Chapter 4Mohammed AbdulselamNo ratings yet

- Finance Applications and Theory 4th Edition Cornett Test Bank 1Document23 pagesFinance Applications and Theory 4th Edition Cornett Test Bank 1harry100% (49)

- New Price ListDocument1 pageNew Price ListrajeshNo ratings yet

- Share Market. The Project of BmsDocument53 pagesShare Market. The Project of BmsAsif AliNo ratings yet

- Chapter 5Document53 pagesChapter 5임재영No ratings yet

- CTHartford01b POSDocument345 pagesCTHartford01b POSrealhartfordNo ratings yet

- Personal Loan AgreementDocument3 pagesPersonal Loan AgreementAnse FraiwinNo ratings yet

- Residential Status & Scope of Total IncomeDocument23 pagesResidential Status & Scope of Total IncomeKartikNo ratings yet

- Louh v. Bank of The Philippine IslandsDocument3 pagesLouh v. Bank of The Philippine IslandsKim B.No ratings yet

- BESR - Quarter 4 MODULE 4Document14 pagesBESR - Quarter 4 MODULE 4ANGELO AHORRONo ratings yet

- Banking in A Unique WayDocument55 pagesBanking in A Unique WayNandini Mehrotra100% (1)

- Bank SecDocument93 pagesBank SecKrisha FayeNo ratings yet

- e-StatementBRImo 007101021908533 Jun2023 20230711 223750-1Document14 pagese-StatementBRImo 007101021908533 Jun2023 20230711 223750-1biasasajaa59No ratings yet

- Growth & Changing Structure of Non-Banking Financial InstitutionsDocument14 pagesGrowth & Changing Structure of Non-Banking Financial InstitutionsPuneet KaurNo ratings yet

- Sec 24.0 MC Measuring The Cost of LivingDocument3 pagesSec 24.0 MC Measuring The Cost of LivingKhang Nguyen DuyNo ratings yet

- Nature of AccountingDocument2 pagesNature of AccountingRivera, Erica HazelNo ratings yet

- Gold Not Oil InflationDocument8 pagesGold Not Oil Inflationpderby1No ratings yet