Professional Documents

Culture Documents

PRIA FAR - 016 Share-Based Payments (PFRS 2) Notes and Solution

PRIA FAR - 016 Share-Based Payments (PFRS 2) Notes and Solution

Uploaded by

Enrique Hills RiveraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PRIA FAR - 016 Share-Based Payments (PFRS 2) Notes and Solution

PRIA FAR - 016 Share-Based Payments (PFRS 2) Notes and Solution

Uploaded by

Enrique Hills RiveraCopyright:

Available Formats

PHILIPPINE REVIEW INSTITUTE FOR ACCOUNTANCY, INC

MAY 2020 CPALE (BATCH NO. 05)

Financial Accounting and Reporting (FAR) Nenita S. Robles/ Floyd C. Paguio

SHARE-BASED PAYMENTS

(PFRS 2)

CLASSROOM DISCUSSION QUESTIONS

Employee share option plans

1. Required

a. The compensation expense for 20x1 is:

b. The compensation expense in 20x4 assuming one officer leaves the company in December 20x4 and that the

company expects that no other employee will leave by the end of the 6th year:

Suggested solution

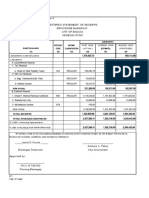

1 Share options granted 200.00

No. of employees 10.00

No. of options granted 2,000.00

FV of each option at grant date 15.00

Total compensation expense for 6 years 30,000.00

Vesting period in years 6.00

Compensation expense - 2018 5,000.00

2 Share options granted 200.00

No. of employees entitled 9.00

No. of options granted 1,800.00

FV of each option at grant date 15.00

Total compensation expense for 6 years 27,000.00

Vested period (4/6) 18,000.00

Expense recognized in 2018 to 2020 15,000.00

Compensation expense - 2021 3,000.00

Service/ performance condition

2. Required

a. What is the amount recognized as expense in 2018?

b. Assuming that 5 employees left the company by the end of 2019, and it was estimated that another 10 employees

will leave by the end of 2016, furthermore, the actual revenue growth rate in 2019 was at 32.5% and that the

company expects that this rate will be sustained over the following year, what is the amount recognized as expense

in 2019?

c. Assuming that a total of 30 employees actually left the company in 2020, and the actual revenue growth rate in

2020 was at 62.5%, what is the amount recognized as expense in 2020?

d. Based on the previous item, assuming that half of the options vested were exercised in 2021, how much is the

credit to share premium account?

Suggested solution

1 Share options granted 100.00

No. of employees 500.00

No. of options granted 50,000.00

FV of each option at grant date 12.00

Total compensation expense for 6 years 600,000.00

Vesting period in years 3.00

Compensation expense - 2018 200,000.00

2 Revenue growth rate

2018 25.00%

2019 32.50%

2020 32.50%

PRIA: Share Based Payments (HO. No. 16)

Page 1 of 4

PHILIPPINE REVIEW INSTITUTE FOR ACCOUNTANCY, INC

MAY 2020 CPALE (BATCH NO. 05)

Financial Accounting and Reporting (FAR) Nenita S. Robles/ Floyd C. Paguio

Average 30.00%

Share options granted 125.00

No. of employees entitled 485.00

No. of options granted 60,625.00

FV of each option at grant date 12.00

Total compensation expense for 6 years 727,500.00

Vested period (2/3) 485,000.00

Expense recognized in 2018 200,000.00

Compensation expense - 2019 285,000.00

3 Revenue growth rate

2018 25.00%

2019 32.50%

2020 62.50%

Average 40.00%

Share options granted 150.00

No. of employees entitled 465.00

No. of options granted 69,750.00

FV of each option at grant date 12.00

Total compensation expense for 6 years 837,000.00

Vested period (3/3) 837,000.00

Expense recognized in 2018 485,000.00

Compensation expense - 2019 352,000.00

4 Share options outstanding 418,500.00

APIC 174,375.00

Total 592,875.00

Share appreciation rights

3. Required

a. Assuming the estimates do not change during Year 1, the compensation expense in Year 1 is

b. At the end of Year 2, the average revenue growth projection over the three-year vesting period is 11% and 32

employees are expected to remain in the entity’s employ. The fair value of each SAR is ¥70. The compensation

expense in Year 2 is

c. At the end of Year 3, the average revenue growth over the three-year vesting period is 13% and 36 employees did

not leave the company. The fair value of each SAR is ¥80. The compensation expense in Year 3 is

Suggested solution

1 SARS granted 1,000.00

No. of employees 24.00

No. of options granted 24,000.00

FV of each SAR 60.00

Total compensation expense for 3 years 1,440,000.00

Vesting period in years 3.00

Compensation expense - Year 1 480,000.00

2 SARS granted 2,000.00

No. of employees 32.00

PRIA: Share Based Payments (HO. No. 16)

Page 2 of 4

PHILIPPINE REVIEW INSTITUTE FOR ACCOUNTANCY, INC

MAY 2020 CPALE (BATCH NO. 05)

Financial Accounting and Reporting (FAR) Nenita S. Robles/ Floyd C. Paguio

No. of options granted 64,000.00

FV of each SAR 70.00

Total compensation expense for 3 years 4,480,000.00

Vested period (2/3) 2,986,666.67

Expense recognized in 2014 480,000.00

Compensation expense - Year 2 2,506,666.67

3 SARS granted 2,000.00

No. of employees 36.00

No. of options granted 72,000.00

FV of each SAR 80.00

Total compensation expense for 3 years 5,760,000.00

Vested period (3/3) 5,760,000.00

Expense recognized in 2014 2,986,666.67

Compensation expense - Year 3 2,773,333.33

Stock options/ warrants

4. Required

a. What is the credit to the Share premium account related to the issuance of ordinary shares through the exercise

of options on 3/30?

b. What amount should have been allocated to the Share warrants outstanding account as a result of the issuance

of the bonds with the detachable warrants?

c. What amount should be credited to the Share premium account as a result of the issuance of shares through the

rights exercised by stockholders?

d. What is the credit to the Share premium account from the exercise of warrants which were originally attached to

the bonds?

e. What is the adjusted balance of the Ordinary share options outstanding?

f. What is the balance of the of the Ordinary share warrants outstanding?

Suggested solution

1 Share options outstanding 11,250.00

APIC 72,000.00

Total 83,250.00

2 Issue Price 1,050,000.00

FV of Bonds without the warrants 998,000.00

FV of warrants 52,000.00

3 No. of rights issued 124,250.00

No. of rights needed for one share 10.00

No. of share issued 12,425.00

Par over exercise price 37.00

APIC 459,725.00

4 Share warrants outstanding 52,000.00

Par over exercise price 74,000.00

APIC 126,000.00

5 Share options outstanding 75,000.00

Exercised 11,250.00

PRIA: Share Based Payments (HO. No. 16)

Page 3 of 4

PHILIPPINE REVIEW INSTITUTE FOR ACCOUNTANCY, INC

MAY 2020 CPALE (BATCH NO. 05)

Financial Accounting and Reporting (FAR) Nenita S. Robles/ Floyd C. Paguio

Balance 63,750.00

6 Nil

DO-IT-YOURSELF (DIY)

1. D 11. C

2. D 12. C

3. C 13. C

4. B 14. A

5. C 15. C

6. C 16. A

7. D 17. C

8. D 18. A

9. A 19. A

10. D 20. A

***

"Keep on going, and the chances are that you will stumble on something, perhaps

when you are least expecting it. I never heard of anyone ever stumbling on

something sitting down."

-- Charles F. Kettering

PRIA: Share Based Payments (HO. No. 16)

Page 4 of 4

You might also like

- The Psychology of Ethical Leadership in Organisations Implications of Group Processes 1St Ed Edition Catarina Morais Ebook Full ChapterDocument52 pagesThe Psychology of Ethical Leadership in Organisations Implications of Group Processes 1St Ed Edition Catarina Morais Ebook Full Chapterharold.young447100% (19)

- Autonomy PitchbookDocument23 pagesAutonomy PitchbookZerohedge100% (29)

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- (TEST BANK and SOL) Current LiabilitiesDocument5 pages(TEST BANK and SOL) Current LiabilitiesJhazz DoNo ratings yet

- A Proposed Business Plan For Tricycle (Keke), Buses For Transportation Business - Feasibility Study - Martins LibraryDocument15 pagesA Proposed Business Plan For Tricycle (Keke), Buses For Transportation Business - Feasibility Study - Martins LibraryFrankie50% (2)

- Postemployment Benefits: Employee's Employee Employee Obligation DecemberDocument25 pagesPostemployment Benefits: Employee's Employee Employee Obligation DecemberGabriel PanganNo ratings yet

- Quiz in AE 09 (Current Liabilities)Document2 pagesQuiz in AE 09 (Current Liabilities)Arlene Dacpano0% (1)

- RECENSEO 2020 Comprehensive Examination Reviewer Material PDFDocument124 pagesRECENSEO 2020 Comprehensive Examination Reviewer Material PDFCamille CastroNo ratings yet

- FAR-04 Share Based PaymentsDocument3 pagesFAR-04 Share Based PaymentsKim Cristian Maaño0% (1)

- Ist Preboard: D) None of The AboveDocument10 pagesIst Preboard: D) None of The AboveAsNo ratings yet

- Class 12 Mock Test AccountancyDocument13 pagesClass 12 Mock Test AccountancyLPS ANJALI SHARMANo ratings yet

- Financial Accounting 3.1Document6 pagesFinancial Accounting 3.1Tawanda HerbertNo ratings yet

- 591617884861 (1)Document9 pages591617884861 (1)YashviNo ratings yet

- Accountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsDocument2 pagesAccountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsBella IlaganNo ratings yet

- Mid Sem Sample Exam ABDADocument11 pagesMid Sem Sample Exam ABDALeah StonesNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Dethzaida AsebuqueNo ratings yet

- ACC402-2023-IfRS 2-Study Guide and Review QuestionsDocument3 pagesACC402-2023-IfRS 2-Study Guide and Review QuestionsBilliee ButccherNo ratings yet

- Class - XII CommerceDocument8 pagesClass - XII CommercehardikNo ratings yet

- Accounts Question Paper 2022Document12 pagesAccounts Question Paper 2022chgokulsinghNo ratings yet

- Class Test Fundamentals and Goodwill Set A 01.05.2023 1Document2 pagesClass Test Fundamentals and Goodwill Set A 01.05.2023 1ANTECNo ratings yet

- Financial Accounting 3.2Document7 pagesFinancial Accounting 3.2Tawanda HerbertNo ratings yet

- Blossom Senior Secondary School 1Document8 pagesBlossom Senior Secondary School 1raviNo ratings yet

- MaterialityDocument9 pagesMaterialityBenedict KaruruNo ratings yet

- Accountancy SQPDocument12 pagesAccountancy SQPSnigdha RohillaNo ratings yet

- ExtAud 3 Quiz 4 Wo AnswersDocument5 pagesExtAud 3 Quiz 4 Wo AnswersJANET ILLESESNo ratings yet

- EXAM TIME: 6:00 TO 7:30 Time Allowance For Mailing of 30 MinDocument12 pagesEXAM TIME: 6:00 TO 7:30 Time Allowance For Mailing of 30 MinNikky Bless LeonarNo ratings yet

- MLM Xii Accountancy 22-23 PDFDocument34 pagesMLM Xii Accountancy 22-23 PDFayush5sharma805No ratings yet

- Corporate Reporting Paper 3.1Document27 pagesCorporate Reporting Paper 3.1Obeng CliffNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Kate PaquizNo ratings yet

- LiabilitiesDocument3 pagesLiabilitiesFrederick AbellaNo ratings yet

- British American Tobacco Bangladesh2019 2020Document7 pagesBritish American Tobacco Bangladesh2019 2020Zaref IslamNo ratings yet

- Numbers 36 and 37 (Installment Sales)Document2 pagesNumbers 36 and 37 (Installment Sales)elsana philipNo ratings yet

- bcom-CORPORATE ACCOUNTING I - JAN 23Document5 pagesbcom-CORPORATE ACCOUNTING I - JAN 23xyxx1221No ratings yet

- 12 Accounts 2020 21 Practice Paper 4Document14 pages12 Accounts 2020 21 Practice Paper 4Vijey RamalingamNo ratings yet

- Investments: Problem 1Document4 pagesInvestments: Problem 1Frederick AbellaNo ratings yet

- Financial Reporting Paper 2.1nov 2019Document25 pagesFinancial Reporting Paper 2.1nov 2019e.asafu-adjayeNo ratings yet

- Assessment of FIrms AssignmentDocument8 pagesAssessment of FIrms Assignmentsuhask890No ratings yet

- Partnership Operation Quiz 2Document2 pagesPartnership Operation Quiz 2cabbigatcrisanta04No ratings yet

- Xii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021Document6 pagesXii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021mekavinashNo ratings yet

- Accounting - UCO Bank - Assignment2Document1 pageAccounting - UCO Bank - Assignment2KummNo ratings yet

- Module 4 - Shareholders' EquityDocument13 pagesModule 4 - Shareholders' Equityreyeselis0823No ratings yet

- Guideline Answers: Executive ProgrammeDocument70 pagesGuideline Answers: Executive ProgrammeRiya GoyalNo ratings yet

- Gr12ACC 2020 21 B1 & B2 Online Exam Midterm3 Full Portion TillDocument22 pagesGr12ACC 2020 21 B1 & B2 Online Exam Midterm3 Full Portion TillAviNo ratings yet

- FM Eco Q Mtp2 Inter Nov21Document7 pagesFM Eco Q Mtp2 Inter Nov21rridhigolchha15No ratings yet

- Book-Keeping & Accountancy: All Baches Study Camp: Prelim. ExamDocument9 pagesBook-Keeping & Accountancy: All Baches Study Camp: Prelim. Exampanchalmahek301911No ratings yet

- Goodwill QuestionsDocument7 pagesGoodwill QuestionsTanisha JainNo ratings yet

- Arid Agriculture University, Rawalpindi: Pirmehr Ali ShahDocument3 pagesArid Agriculture University, Rawalpindi: Pirmehr Ali ShahSami UllahNo ratings yet

- Accounts Test - Chapter 1 and 3Document5 pagesAccounts Test - Chapter 1 and 3Vikram KatariaNo ratings yet

- MA Submit-3Document19 pagesMA Submit-3KaiQiNo ratings yet

- Module 16 Share-Based PaymentDocument8 pagesModule 16 Share-Based PaymentryanNo ratings yet

- XII - Accountancy U.T - 1 Set 1Document4 pagesXII - Accountancy U.T - 1 Set 1tanu1304262No ratings yet

- XII Commerce Q.papersDocument14 pagesXII Commerce Q.papersDesai VivekNo ratings yet

- Paper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaDocument31 pagesPaper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaVarun reddyNo ratings yet

- INP - 2211 - Account - SUGGESTED ANSWERSDocument15 pagesINP - 2211 - Account - SUGGESTED ANSWERSSachin ChourasiyaNo ratings yet

- Answers - Partnership OperationsDocument18 pagesAnswers - Partnership OperationsAllondra DapengNo ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- AP-200 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document5 pagesAP-200 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Fella GultianoNo ratings yet

- @ProCA - Inter Adv Accounts (New) Must Do List Dec21Document109 pages@ProCA - Inter Adv Accounts (New) Must Do List Dec21Sonu SharmaNo ratings yet

- Class XII Accounts Term 1Document5 pagesClass XII Accounts Term 1Kanika TambiNo ratings yet

- CBCS 3.3.3 Corporate Valuation and Restructuring 2020Document4 pagesCBCS 3.3.3 Corporate Valuation and Restructuring 2020Bharath MNo ratings yet

- Assessment 2 2Document6 pagesAssessment 2 2Thảo NguyễnNo ratings yet

- Acctg334-Auditing Assurance: Concepts & Applications 2 Quiz-Employee Benefits & Accounting For Income TaxDocument12 pagesAcctg334-Auditing Assurance: Concepts & Applications 2 Quiz-Employee Benefits & Accounting For Income TaxMichale JacomillaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- PRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionDocument7 pagesPRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionEnrique Hills RiveraNo ratings yet

- PRIA FAR - 018 Financial Statements (PAS 1, Etc.) Notes and SolutionDocument12 pagesPRIA FAR - 018 Financial Statements (PAS 1, Etc.) Notes and SolutionEnrique Hills RiveraNo ratings yet

- PRIA FAR - 012 Provisions and Contingencies (PAS 37) Notes and SolutionDocument4 pagesPRIA FAR - 012 Provisions and Contingencies (PAS 37) Notes and SolutionEnrique Hills RiveraNo ratings yet

- PRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionDocument7 pagesPRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionEnrique Hills RiveraNo ratings yet

- PRIA FAR - 017 Earnings Per Share (PAS 33) Notes and SolutionDocument2 pagesPRIA FAR - 017 Earnings Per Share (PAS 33) Notes and SolutionEnrique Hills RiveraNo ratings yet

- PRIA FAR - 015 Employee Benefits (PAS 19) Notes and SolutionDocument5 pagesPRIA FAR - 015 Employee Benefits (PAS 19) Notes and SolutionEnrique Hills RiveraNo ratings yet

- Course List MusthafaDocument4 pagesCourse List Musthafamusthafakalathil9No ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument34 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaSumeetNo ratings yet

- Insurance Breach of WarrantyDocument7 pagesInsurance Breach of Warrantybhargavi mishraNo ratings yet

- Past Year Current Year Budget Year (Actual) (Proposed)Document16 pagesPast Year Current Year Budget Year (Actual) (Proposed)Saphire DonsolNo ratings yet

- To Human Resources Cover LetterDocument7 pagesTo Human Resources Cover Lettermklfhaegf100% (1)

- Hingna Road, Wanadongri, Nagpur - 441 110Document2 pagesHingna Road, Wanadongri, Nagpur - 441 110Prasad AurangabadkarNo ratings yet

- Financial Technology (Fintech) - Its Uses and Impact On Our LivesDocument10 pagesFinancial Technology (Fintech) - Its Uses and Impact On Our Livessharafernando2No ratings yet

- ACON InviteDocument17 pagesACON InviteOM PRAKASHNo ratings yet

- Tips and Tricks For Building ERP Interfaces in MIIDocument19 pagesTips and Tricks For Building ERP Interfaces in MIInetra14520100% (1)

- Amp MMP CamaDocument8 pagesAmp MMP CamajdpardoNo ratings yet

- Polyetherether Ketone PEEKversus Metallic Kennedy Class IIIRemovable Partial Dentures Evaluationof Retention ForceDocument133 pagesPolyetherether Ketone PEEKversus Metallic Kennedy Class IIIRemovable Partial Dentures Evaluationof Retention Force陳司瀚No ratings yet

- New LLM Corporate PDFDocument20 pagesNew LLM Corporate PDFshubhambulbule7274No ratings yet

- Early TQM Successes: - Nashua - Xerox - Motorola - Intel - Dayton-Hudson - Corning - Hewlett-PackardDocument31 pagesEarly TQM Successes: - Nashua - Xerox - Motorola - Intel - Dayton-Hudson - Corning - Hewlett-Packardrocks tusharNo ratings yet

- Basics of Share and DebentureDocument14 pagesBasics of Share and DebentureChaman SinghNo ratings yet

- Integrity Rules...Document1 pageIntegrity Rules...Sushant NigamNo ratings yet

- What Is Stop LossDocument2 pagesWhat Is Stop LossTest TestNo ratings yet

- Miles CPA RoadmapDocument72 pagesMiles CPA Roadmaproopa raniNo ratings yet

- Oracle GoldenGate 12c Fundamentals For Oracle D84357GC10 1080544 USDocument4 pagesOracle GoldenGate 12c Fundamentals For Oracle D84357GC10 1080544 USJinendraabhi0% (2)

- Ringkasan Materi BAB 1, Manajemen StrategiDocument4 pagesRingkasan Materi BAB 1, Manajemen StrategiHaren Servis PrinterNo ratings yet

- Swot Analysis of Hayleys Company LTD PDFDocument20 pagesSwot Analysis of Hayleys Company LTD PDFShehani WijayawardenaNo ratings yet

- DPR DcoconutDocument29 pagesDPR DcoconutPRAVEEN KUMARNo ratings yet

- Business Communication PDFDocument4 pagesBusiness Communication PDFjakke harshavardhiniNo ratings yet

- NEOM-NQM-POL - 001 - 01.00 - ETSD Quality PolicyDocument1 pageNEOM-NQM-POL - 001 - 01.00 - ETSD Quality PolicyAlaa MohamedNo ratings yet

- Robert Heller's: Business MasterclassesDocument7 pagesRobert Heller's: Business MasterclassesasrankaNo ratings yet

- TRATON Customer Requirements: Quality Assurance Agreement For Purchased Parts & OrganisationsDocument27 pagesTRATON Customer Requirements: Quality Assurance Agreement For Purchased Parts & OrganisationsLeandro RodriguesNo ratings yet

- tb1 Pengauditan 2Document6 pagestb1 Pengauditan 2shindy novita sariNo ratings yet