Professional Documents

Culture Documents

PRIA FAR - 015 Employee Benefits (PAS 19) Notes and Solution

PRIA FAR - 015 Employee Benefits (PAS 19) Notes and Solution

Uploaded by

Enrique Hills RiveraCopyright:

Available Formats

You might also like

- CHAPTER 5 (Accounting For Service)Document26 pagesCHAPTER 5 (Accounting For Service)lc100% (1)

- ParCor Chapter3 BuenaventuraDocument19 pagesParCor Chapter3 BuenaventuraAnonn100% (3)

- ParcorDocument12 pagesParcoreys shop100% (1)

- Acctg 2Document2 pagesAcctg 2Shayne EsmeroNo ratings yet

- Chopra Scm5 Tif Ch13Document23 pagesChopra Scm5 Tif Ch13Madyoka RaimbekNo ratings yet

- Chatime Analysis Paper - Group 7Document17 pagesChatime Analysis Paper - Group 7Sunny50% (4)

- Baird - Euroland Foods CaseDocument5 pagesBaird - Euroland Foods CaseKyleNo ratings yet

- CASE STUDY 2-3 University of GhanaDocument2 pagesCASE STUDY 2-3 University of GhanaEwura Esi Eyram Aboagyewaa67% (9)

- Illustrative Problem PayrollDocument23 pagesIllustrative Problem PayrollSophia VistanNo ratings yet

- PA T322WSB 5 - Group Assignment (Solution)Document8 pagesPA T322WSB 5 - Group Assignment (Solution)Hoang Khanh Linh NguyenNo ratings yet

- Ia3 22 23Document5 pagesIa3 22 23Gabriel Trinidad SonielNo ratings yet

- Exercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostDocument5 pagesExercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostKailah CalinogNo ratings yet

- Partnership OperationsDocument9 pagesPartnership OperationsJay Mark Marcial JosolNo ratings yet

- Acctng FinalsDocument27 pagesAcctng FinalsErika Mae LegaspiNo ratings yet

- PPE1&2Document3 pagesPPE1&2Kailah CalinogNo ratings yet

- ACCO 20053 Lecture Notes 6 - Notes ReceivableDocument7 pagesACCO 20053 Lecture Notes 6 - Notes ReceivableVincent Luigil AlceraNo ratings yet

- Answer Key Activity 39Document15 pagesAnswer Key Activity 39MAXINE CLAIRE CUTINGNo ratings yet

- CH 19Document4 pagesCH 19Nickey DickeyNo ratings yet

- Accounts Receivable and AFBDDocument18 pagesAccounts Receivable and AFBDeia aieNo ratings yet

- ACCT1100 PA1 AssignmentSolutionManual 1Document6 pagesACCT1100 PA1 AssignmentSolutionManual 1Chi IuvianamoNo ratings yet

- Quit 2 SolutionsDocument2 pagesQuit 2 Solutions賴昱宏No ratings yet

- Name: Edmalyn R. Canton - BSA 1 - BE 302 Morning Subject/course: 892 - Acc 111 Activity 34Document6 pagesName: Edmalyn R. Canton - BSA 1 - BE 302 Morning Subject/course: 892 - Acc 111 Activity 34Adam CuencaNo ratings yet

- mgt101 Questions With AnswersDocument11 pagesmgt101 Questions With AnswersKinza LaiqatNo ratings yet

- Loan Receivable ProblemsDocument6 pagesLoan Receivable ProblemsKathleen Frondozo100% (1)

- BANGI, Joshua Celton - Assign2.Document7 pagesBANGI, Joshua Celton - Assign2.Joshua BangiNo ratings yet

- A 4Document5 pagesA 4Thùy NguyễnNo ratings yet

- Act5 Topia Acctg2Document2 pagesAct5 Topia Acctg2devy mar topiaNo ratings yet

- Jawaban Mid Test Praktik Dagang 2022Document14 pagesJawaban Mid Test Praktik Dagang 2022Rahmal SimarangkirNo ratings yet

- DecemberDocument7 pagesDecembercindy pecañaNo ratings yet

- WorkshitDocument12 pagesWorkshitLukman ArimartaNo ratings yet

- Jawaban Siklus AkuntansiDocument9 pagesJawaban Siklus AkuntansiRendyyyNo ratings yet

- Ae21 Finals 20231Document2 pagesAe21 Finals 20231dan.nics19No ratings yet

- Trial Balance General Fund Code No. 101: Republic of The Philippines City of Ilagan As of October 31, 2020Document106 pagesTrial Balance General Fund Code No. 101: Republic of The Philippines City of Ilagan As of October 31, 2020elisethmaddara1411No ratings yet

- 534316 SALARY APRIL 2024Document1 page534316 SALARY APRIL 2024Aditya PalNo ratings yet

- Ae 112 CPDocument8 pagesAe 112 CPRica Ann RoxasNo ratings yet

- AACONAPPS2 A433 - Audit of ReceivablesDocument23 pagesAACONAPPS2 A433 - Audit of ReceivablesDawson Dela CruzNo ratings yet

- MHODocument4 pagesMHOSum WhosinNo ratings yet

- Lalita Christi Kumalasari 44321116 KU1B Work SheetDocument3 pagesLalita Christi Kumalasari 44321116 KU1B Work SheetLalita ChristiKU1BNo ratings yet

- Assignment ACT201 SMR1Document15 pagesAssignment ACT201 SMR1Md.sabir 1831620030No ratings yet

- Problem 1 Journal EntryDocument4 pagesProblem 1 Journal EntrySarah Nelle PasaoNo ratings yet

- UAS PA 2020-2021 Ganjil - JawabanDocument27 pagesUAS PA 2020-2021 Ganjil - JawabanNuruddin AsyifaNo ratings yet

- Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollDocument2 pagesIncome Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollShiva098No ratings yet

- Account Title Unadjusted Trial Balance Adjustments Adjusted Trial Balance Debit Credit Debit Credit DebitDocument15 pagesAccount Title Unadjusted Trial Balance Adjustments Adjusted Trial Balance Debit Credit Debit Credit DebitTwins VinesNo ratings yet

- ANSWER KEY Quiz On Tax On Compensation PDFDocument6 pagesANSWER KEY Quiz On Tax On Compensation PDFMeg CruzNo ratings yet

- Cash Flow NewDocument4 pagesCash Flow NewAnkur GoyalNo ratings yet

- July SalaryslipDocument1 pageJuly SalaryslipParveen SainiNo ratings yet

- Receivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesDocument3 pagesReceivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesGlance BautistaNo ratings yet

- Payroll Summary Feb25-Mar10 2013Document27 pagesPayroll Summary Feb25-Mar10 2013Adriana CarinanNo ratings yet

- Discussion Answers On Employee BenefitsDocument33 pagesDiscussion Answers On Employee BenefitsJoeneil DamalerioNo ratings yet

- 2021 Answer Chapter 4 PDFDocument9 pages2021 Answer Chapter 4 PDFRianne NavidadNo ratings yet

- ExamDocument3 pagesExamTrung Kiên NguyễnNo ratings yet

- ACCT 2208 - Final Review (Ch. 18, 22, 23)Document16 pagesACCT 2208 - Final Review (Ch. 18, 22, 23)MitchieNo ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- MDRRMODocument4 pagesMDRRMOSum WhosinNo ratings yet

- Tugas Pengantar Akuntansi - Timotius Siagian 1 C3Document8 pagesTugas Pengantar Akuntansi - Timotius Siagian 1 C3Timotius SiagianNo ratings yet

- FM 1Document18 pagesFM 1huleNo ratings yet

- Assignment in Partnership DissolutionDocument4 pagesAssignment in Partnership DissolutionLalaine Keendra GonzagaNo ratings yet

- P4 5BDocument15 pagesP4 5BAngel JNo ratings yet

- Randall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Document5 pagesRandall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Diane MagnayeNo ratings yet

- Modern Advanced Accounting - Assignment 3Document12 pagesModern Advanced Accounting - Assignment 3Anita Kharod ChaudharyNo ratings yet

- Audit of ReceivablesDocument33 pagesAudit of ReceivablesannyeongchinguNo ratings yet

- Lesson 9 - T AccountsDocument15 pagesLesson 9 - T AccountsNicole Austria NazarenoNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Coactg1-Chapter 4 Graded Prob3Document5 pagesCoactg1-Chapter 4 Graded Prob3AGATHA REINNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- PRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionDocument7 pagesPRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionEnrique Hills RiveraNo ratings yet

- PRIA FAR - 012 Provisions and Contingencies (PAS 37) Notes and SolutionDocument4 pagesPRIA FAR - 012 Provisions and Contingencies (PAS 37) Notes and SolutionEnrique Hills RiveraNo ratings yet

- PRIA FAR - 018 Financial Statements (PAS 1, Etc.) Notes and SolutionDocument12 pagesPRIA FAR - 018 Financial Statements (PAS 1, Etc.) Notes and SolutionEnrique Hills RiveraNo ratings yet

- PRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionDocument7 pagesPRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionEnrique Hills RiveraNo ratings yet

- PRIA FAR - 016 Share-Based Payments (PFRS 2) Notes and SolutionDocument4 pagesPRIA FAR - 016 Share-Based Payments (PFRS 2) Notes and SolutionEnrique Hills RiveraNo ratings yet

- PRIA FAR - 017 Earnings Per Share (PAS 33) Notes and SolutionDocument2 pagesPRIA FAR - 017 Earnings Per Share (PAS 33) Notes and SolutionEnrique Hills RiveraNo ratings yet

- 2023.07.07 HS PaeDocument2 pages2023.07.07 HS Paehanis0% (1)

- TOT AgreementDocument138 pagesTOT Agreementchinnadurai33No ratings yet

- Punjab Fabricators: About OwnersDocument4 pagesPunjab Fabricators: About OwnersDinesh ChahalNo ratings yet

- Bookkeeping (Second Part)Document38 pagesBookkeeping (Second Part)Thuzar Lwin100% (3)

- Venture Capital in India Research PaperDocument8 pagesVenture Capital in India Research Paperhkdxiutlg100% (1)

- Group 5 Taxation 1 SampleDocument46 pagesGroup 5 Taxation 1 SamplePEÑARANDA PS OPERATIONNo ratings yet

- Quiz No. 1 Discount SeriesDocument2 pagesQuiz No. 1 Discount SeriesAngelicaHermoParas100% (1)

- Impact of Covid-19 On Loan Performance A Study On Sonali Bank Limited (Savar Cantonment Branch)Document6 pagesImpact of Covid-19 On Loan Performance A Study On Sonali Bank Limited (Savar Cantonment Branch)Abdullah Al MamunNo ratings yet

- Mission StatementDocument3 pagesMission StatementPutri LoaderNo ratings yet

- Model Canevas 3Document10 pagesModel Canevas 3Hind Nia BenbrahimNo ratings yet

- Sage 50 To Sage 200 UpgradeDocument8 pagesSage 50 To Sage 200 UpgradeGavin BiggsNo ratings yet

- No 5.1.fourth Generation Evalution Research (Qualitative Research Design)Document4 pagesNo 5.1.fourth Generation Evalution Research (Qualitative Research Design)Eko Wahyu ApriliantoNo ratings yet

- Money Quiz: Starting U PDocument6 pagesMoney Quiz: Starting U PSfar Khouloud Ca100% (1)

- 814001-Gabriela GeorgescuDocument86 pages814001-Gabriela GeorgescuJeremiah PacerNo ratings yet

- Bill of Materials - BOMDocument12 pagesBill of Materials - BOMIbnouachir AbderrazakNo ratings yet

- Tax Invoice: Description of Services HSN Code Taxable Amount Igst Rate AmountDocument2 pagesTax Invoice: Description of Services HSN Code Taxable Amount Igst Rate AmountSunil PatelNo ratings yet

- Sample 4Document97 pagesSample 4Salma FarozeNo ratings yet

- HP t5000 Product Overview Jan07Document8 pagesHP t5000 Product Overview Jan07meharNo ratings yet

- Marketing Strategy of HCL Infosystem LTDDocument2 pagesMarketing Strategy of HCL Infosystem LTDjadeja indravijaysinhNo ratings yet

- 2 Power System Economics 1-58Document87 pages2 Power System Economics 1-58Rudraraju Chaitanya100% (1)

- Procurement IR35 Presentation For CompaniesDocument26 pagesProcurement IR35 Presentation For CompaniesMark CoulsonNo ratings yet

- Reflection Paper - Pledge 1% Model - Ronan VillagonzaloDocument1 pageReflection Paper - Pledge 1% Model - Ronan Villagonzaloronan.villagonzaloNo ratings yet

- Ig2 Risk Assessment Self Evaluation ChecklistDocument2 pagesIg2 Risk Assessment Self Evaluation ChecklistprinceNo ratings yet

- Introduction of HRMDocument19 pagesIntroduction of HRM428SHUBHASHEESH SAXENANo ratings yet

- Medical Device and Pharmaceutical: Value Stream Mapping: The Map of Your Journey To Becoming "Lean"Document4 pagesMedical Device and Pharmaceutical: Value Stream Mapping: The Map of Your Journey To Becoming "Lean"Brendan CrowleyNo ratings yet

PRIA FAR - 015 Employee Benefits (PAS 19) Notes and Solution

PRIA FAR - 015 Employee Benefits (PAS 19) Notes and Solution

Uploaded by

Enrique Hills RiveraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PRIA FAR - 015 Employee Benefits (PAS 19) Notes and Solution

PRIA FAR - 015 Employee Benefits (PAS 19) Notes and Solution

Uploaded by

Enrique Hills RiveraCopyright:

Available Formats

PHILIPPINE REVIEW INSTITUTE FOR ACCOUNTANCY, INC

MAY 2020 CPALE (BATCH NO. 05)

Financial Accounting and Reporting (FAR) Nenita S. Robles/ Floyd C. Paguio

EMPLOYEE BENEFITS (2011)

(PAS 19)

CLASSROOM DISCUSSION QUESTIONS

Short-term compensated absences

1. Required:

1. Determine the accrued vacation and sick leave benefits as of January 1, 20A1, December 31, 20A1, and the amount

of used vacation and sick leave benefits in 20A1.

2. Assume that the sick and vacation leave credits are not allowed to be carried over in the subsequent year. Prepare

all the journal entries for 20A1 in the books of PRIA.

Notes and solution

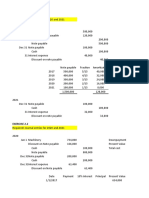

Requirement No. 1

Days Daily rate, Amount

Employee accrued 20A1 accrued

Andres 30 1,200 36,000

Bayani 25 1,500 37,500

Crisanto 20 1,100 22,000

Damian 5 1,000 5,000

ElPAS 45 1,400 63,000

Frito 1,250 -

Accrued, January 1, 20A1 163,500

Days Days Daily

accrued, Days accrued, rate, Amount

Employee Jan Days earned taken Balance Dec 20A2 accrued

Andres 30 25 35 20 20 1,320 26,400

Bayani 25 25 20 30 30 1,650 49,500

Crisanto 20 12 12 20 20 1,210 24,200

Damian 5 25 20 10 10 1,100 11,000

ElPAS 45 25 15 55 50 1,540 77,000

Frito 0 13 6 7 7 1,375 9,625

Accrued, December 31, 20A1 197,725

Days Daily rate, Amount

Employee taken 20A1 paid

Andres 35 1,200 42,000

Bayani 20 1,500 30,000

Crisanto 12 1,100 13,200

Damian 20 1,000 20,000

ElPAS 15 1,400 21,000

Frito 6 1,250 7,500

Amount paid, 20A1 133,700

Vacation and sick leave benefits payable 133,700

Cash 133,700

Vacation and sick leave benefits expense 167,925

Vacation and sick leave benefits payable 167,925

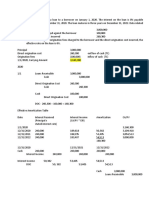

Requirement No. 2

Vacation and sick leave benefits expense 121,700

Cash 121,700

Days Paid Daily rate, Amount

Employee taken Maximum leave 20A1 paid

PRIA: Employee Benefits (HO. No. 15)

Page 1 of 5

PHILIPPINE REVIEW INSTITUTE FOR ACCOUNTANCY, INC

MAY 2020 CPALE (BATCH NO. 05)

Financial Accounting and Reporting (FAR) Nenita S. Robles/ Floyd C. Paguio

Andres 35 25 25 1,200 30,000

Bayani 20 25 20 1,500 30,000

Crisanto 12 25 12 1,100 13,200

Damian 20 25 20 1,000 20,000

ElPAS 15 25 15 1,400 21,000

Frito 6 25 6 1,250 7,500

Amount paid, 20A1 121,700

Profit sharing and bonus plans

2. Required: Compute the amount of bonus using the cases below

a. Bonus is computed before bonus and before tax

b. Bonus is computed after bonus and before tax

c. Bonus is computed before bonus and after tax

d. Bonus is computed after bonus and after tax

Notes and solution

a. 100,000 x 10% = 10,000

b. 100,000 – 1,000,000/ 110% = 9,091

c. 100,000 x (1 – 30%)/ (1/10% - 30%) = 7,217

d. 100,000 x (70%)/ (10 – 30% + 1) = 6,542

Defined contribution plans

3. Required:

1. Prepare all the journal entries for 20A1 and 20A2 in the books of PRIA.

2. Determine the carrying amount of Prepaid/accrued pension cost as of December 31, 20A1 and December 31, 20A2.

Notes and solution

Requirement No. 1

20A1 Pension expense 400,000

Prepaid/Accrued pension cost 400,000

Prepaid/Accrued pension cost 300,000

Cash 300,000

20A2 Pension expense 550,000

Prepaid/Accrued pension cost 550,000

Prepaid/Accrued pension cost 700,000

Cash 700,000

Requirement No. 2

Carrying amount of Prepaid/Accrued pension cost

Dr Cr

December 31, 20A1 100,000

December 31, 20A2 50,000

Current service cost; interest cost; past service cost; lump sum pension payment

4. Required:

1. Determine PRIA’s projected benefit obligation (PBO) as of January 1, 20A1 with respect to John Bo.

2. Determine the portion of John Bo’s annual retirement payments attributable to 20A1 service.

3. Determine PRIA’s current service cost and interest cost, and the amount of pension cost to be charged to profit

and loss for the year ended December 31, 20A1 with respect to John Bo.

4. Determine PRIA’s projected benefit obligation (PBO) as of December 31, 20A1 with respect to John Bo.

5. Determine PRIA’s past service cost as of January 1, 20A2 with respect to John Bo after the amendment.

6. Determine PRIA’s current service cost and interest cost, and the amount of pension cost to be charged to profit

and loss for the year ended December 31, 20A2 with respect to John Bo.

7. Determine PRIA’s projected benefit obligation (PBO) as of December 31, 20A2 with respect to John Bo.

PRIA: Employee Benefits (HO. No. 15)

Page 2 of 5

PHILIPPINE REVIEW INSTITUTE FOR ACCOUNTANCY, INC

MAY 2020 CPALE (BATCH NO. 05)

Financial Accounting and Reporting (FAR) Nenita S. Robles/ Floyd C. Paguio

Requirement No. 1

Annual salary 1,000,000

FV factor, 8%, 20 years 4.6610

Future salary after 20 years 4,661,000

Rate of pension 5%

Pension benefit for one year service 233,050

Years of service 15

Total pension 3,495,750

PV factor, 7%, 20 years 0.2584

PBO, Jan 1 903,302

Requirement No. 2

Future salary after 20 years 4,661,000

Rate of pension 5%

Pension benefit for one year service 233,050

Year of service for 20A1 1

Pension for 20A1 service 233,050

Requirement No. 3

Current service cost

Pension for 20A1 service 233,050

PV factor, 7%, 19 years 0.2765

Current service cost 64,438

Interest cost

Projected benefit obligation, Jan 1 903,302

Discount rate 7%

Interest cost 63,231

Amount charged to P&L 127,669

Requirement No. 4

PBO, Jan 1 903,302

Current service cost 64,438

Interest cost 63,231

PBO, Dec 31 1,030,971

Check:

Pension benefit for one year service 233,050

Years of service 16

Total pension 3,728,800

PV factor, 7%, 19 years 0.2765

PBO, Dec 31 1,030,971 (42)

Requirement No. 5

Future salary after 20 years 4,661,000

Rate of pension 1%

Pension benefit for one year service 46,610

Years of service 16

Total pension 745,760

PV factor, 7%, 19 years 0.2765

Past service cost 206,245

PRIA: Employee Benefits (HO. No. 15)

Page 3 of 5

PHILIPPINE REVIEW INSTITUTE FOR ACCOUNTANCY, INC

MAY 2020 CPALE (BATCH NO. 05)

Financial Accounting and Reporting (FAR) Nenita S. Robles/ Floyd C. Paguio

Check:

Future salary after 20 years 4,661,000

Rate of pension 6%

Pension benefit for one year service 279,660

Years of service 16

Total pension 4,474,560

PV factor, 7%, 19 years 0.2765

PBO, after amendment 1,237,216

PBO, before amendment 1,030,971

Past service cost 206,245

Requirement No. 6

Current service cost

Pension for 20A2 service 279,660

PV factor, 7%, 18 years 0.2959

Current service cost 82,751

Interest cost

Projected benefit obligation, Jan 1 1,237,216

Discount rate 7%

Interest cost 86,605

Past service cost 206,245

Amount charged to P&L 375,601

Requirement No. 7

PBO, Dec 31, 20A1 1,030,971

Past service cost 206,245

Current service cost 82,751

Interest cost 86,605

PBO, Dec 31 1,406,572

Check:

Pension benefit for one year service 279,660

Years of service 17

Total pension 4,754,220

PV factor, 7%, 18 years 0.2959

PBO, Dec 31 1,406,572 (243)

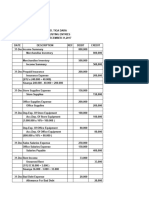

Defined benefit plan, remeasurement OCI

5. Required:

1. Employee benefit expense to be recognized in the statement of income.

2. Net remeasurement gain (loss).

3. PBO – December 31, 20x1

4. FVPA – December 31, 20x1

5. Journal entry

Notes and solution

General Journal Debit (Credit)

Remeasure- Benefit

ment OCI expense Cash FVPA PBO

P&L

Balances – Jan. 1 5,000,000 (7,000,000

Current service cost 1,200,000 (1,200,000)

Past service cost 300,000 (300,000)

Interest expense on PBO 700,000 (700,000)

PRIA: Employee Benefits (HO. No. 15)

Page 4 of 5

PHILIPPINE REVIEW INSTITUTE FOR ACCOUNTANCY, INC

MAY 2020 CPALE (BATCH NO. 05)

Financial Accounting and Reporting (FAR) Nenita S. Robles/ Floyd C. Paguio

Interest income on FVPA (500,000) 500,000

Contribution to the plan (1,000,000) 1,000,000

Benefits paid (500,000) 500,000

Actuarial loss on PBO 900,000 (900,000)

Remeasurement gain on plan assets (300,000) 300,000

Balances – Dec. 31 600,000 1,700,000 (1,000,000) 6,300,000 (9,600,000)

(2) (1) (4) (3)

20x1

Dec. 31

Employee benefits expense 1,700,000

Net remeasurement loss – OCI 600,000

Cash 1,000,000

Prepaid/ accrued benefit cost 1,300,000

DO-IT-YOURSELF (DIY)

1. C 11. A 21. B

2. C 12. C 22. C

3. B 13. D 23. A

4. B 14. B 24. C

5. C 15. D 25. C

6. D 16. A 26. A

7. B 17. D 27. A

8. A 18. A 28. B

9. D 19. C 29. A

10. A 20. D 30. A

***

"Stop chasing the money and start chasing the passion."

-- Tony Hsieh

PRIA: Employee Benefits (HO. No. 15)

Page 5 of 5

You might also like

- CHAPTER 5 (Accounting For Service)Document26 pagesCHAPTER 5 (Accounting For Service)lc100% (1)

- ParCor Chapter3 BuenaventuraDocument19 pagesParCor Chapter3 BuenaventuraAnonn100% (3)

- ParcorDocument12 pagesParcoreys shop100% (1)

- Acctg 2Document2 pagesAcctg 2Shayne EsmeroNo ratings yet

- Chopra Scm5 Tif Ch13Document23 pagesChopra Scm5 Tif Ch13Madyoka RaimbekNo ratings yet

- Chatime Analysis Paper - Group 7Document17 pagesChatime Analysis Paper - Group 7Sunny50% (4)

- Baird - Euroland Foods CaseDocument5 pagesBaird - Euroland Foods CaseKyleNo ratings yet

- CASE STUDY 2-3 University of GhanaDocument2 pagesCASE STUDY 2-3 University of GhanaEwura Esi Eyram Aboagyewaa67% (9)

- Illustrative Problem PayrollDocument23 pagesIllustrative Problem PayrollSophia VistanNo ratings yet

- PA T322WSB 5 - Group Assignment (Solution)Document8 pagesPA T322WSB 5 - Group Assignment (Solution)Hoang Khanh Linh NguyenNo ratings yet

- Ia3 22 23Document5 pagesIa3 22 23Gabriel Trinidad SonielNo ratings yet

- Exercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostDocument5 pagesExercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostKailah CalinogNo ratings yet

- Partnership OperationsDocument9 pagesPartnership OperationsJay Mark Marcial JosolNo ratings yet

- Acctng FinalsDocument27 pagesAcctng FinalsErika Mae LegaspiNo ratings yet

- PPE1&2Document3 pagesPPE1&2Kailah CalinogNo ratings yet

- ACCO 20053 Lecture Notes 6 - Notes ReceivableDocument7 pagesACCO 20053 Lecture Notes 6 - Notes ReceivableVincent Luigil AlceraNo ratings yet

- Answer Key Activity 39Document15 pagesAnswer Key Activity 39MAXINE CLAIRE CUTINGNo ratings yet

- CH 19Document4 pagesCH 19Nickey DickeyNo ratings yet

- Accounts Receivable and AFBDDocument18 pagesAccounts Receivable and AFBDeia aieNo ratings yet

- ACCT1100 PA1 AssignmentSolutionManual 1Document6 pagesACCT1100 PA1 AssignmentSolutionManual 1Chi IuvianamoNo ratings yet

- Quit 2 SolutionsDocument2 pagesQuit 2 Solutions賴昱宏No ratings yet

- Name: Edmalyn R. Canton - BSA 1 - BE 302 Morning Subject/course: 892 - Acc 111 Activity 34Document6 pagesName: Edmalyn R. Canton - BSA 1 - BE 302 Morning Subject/course: 892 - Acc 111 Activity 34Adam CuencaNo ratings yet

- mgt101 Questions With AnswersDocument11 pagesmgt101 Questions With AnswersKinza LaiqatNo ratings yet

- Loan Receivable ProblemsDocument6 pagesLoan Receivable ProblemsKathleen Frondozo100% (1)

- BANGI, Joshua Celton - Assign2.Document7 pagesBANGI, Joshua Celton - Assign2.Joshua BangiNo ratings yet

- A 4Document5 pagesA 4Thùy NguyễnNo ratings yet

- Act5 Topia Acctg2Document2 pagesAct5 Topia Acctg2devy mar topiaNo ratings yet

- Jawaban Mid Test Praktik Dagang 2022Document14 pagesJawaban Mid Test Praktik Dagang 2022Rahmal SimarangkirNo ratings yet

- DecemberDocument7 pagesDecembercindy pecañaNo ratings yet

- WorkshitDocument12 pagesWorkshitLukman ArimartaNo ratings yet

- Jawaban Siklus AkuntansiDocument9 pagesJawaban Siklus AkuntansiRendyyyNo ratings yet

- Ae21 Finals 20231Document2 pagesAe21 Finals 20231dan.nics19No ratings yet

- Trial Balance General Fund Code No. 101: Republic of The Philippines City of Ilagan As of October 31, 2020Document106 pagesTrial Balance General Fund Code No. 101: Republic of The Philippines City of Ilagan As of October 31, 2020elisethmaddara1411No ratings yet

- 534316 SALARY APRIL 2024Document1 page534316 SALARY APRIL 2024Aditya PalNo ratings yet

- Ae 112 CPDocument8 pagesAe 112 CPRica Ann RoxasNo ratings yet

- AACONAPPS2 A433 - Audit of ReceivablesDocument23 pagesAACONAPPS2 A433 - Audit of ReceivablesDawson Dela CruzNo ratings yet

- MHODocument4 pagesMHOSum WhosinNo ratings yet

- Lalita Christi Kumalasari 44321116 KU1B Work SheetDocument3 pagesLalita Christi Kumalasari 44321116 KU1B Work SheetLalita ChristiKU1BNo ratings yet

- Assignment ACT201 SMR1Document15 pagesAssignment ACT201 SMR1Md.sabir 1831620030No ratings yet

- Problem 1 Journal EntryDocument4 pagesProblem 1 Journal EntrySarah Nelle PasaoNo ratings yet

- UAS PA 2020-2021 Ganjil - JawabanDocument27 pagesUAS PA 2020-2021 Ganjil - JawabanNuruddin AsyifaNo ratings yet

- Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollDocument2 pagesIncome Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollShiva098No ratings yet

- Account Title Unadjusted Trial Balance Adjustments Adjusted Trial Balance Debit Credit Debit Credit DebitDocument15 pagesAccount Title Unadjusted Trial Balance Adjustments Adjusted Trial Balance Debit Credit Debit Credit DebitTwins VinesNo ratings yet

- ANSWER KEY Quiz On Tax On Compensation PDFDocument6 pagesANSWER KEY Quiz On Tax On Compensation PDFMeg CruzNo ratings yet

- Cash Flow NewDocument4 pagesCash Flow NewAnkur GoyalNo ratings yet

- July SalaryslipDocument1 pageJuly SalaryslipParveen SainiNo ratings yet

- Receivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesDocument3 pagesReceivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesGlance BautistaNo ratings yet

- Payroll Summary Feb25-Mar10 2013Document27 pagesPayroll Summary Feb25-Mar10 2013Adriana CarinanNo ratings yet

- Discussion Answers On Employee BenefitsDocument33 pagesDiscussion Answers On Employee BenefitsJoeneil DamalerioNo ratings yet

- 2021 Answer Chapter 4 PDFDocument9 pages2021 Answer Chapter 4 PDFRianne NavidadNo ratings yet

- ExamDocument3 pagesExamTrung Kiên NguyễnNo ratings yet

- ACCT 2208 - Final Review (Ch. 18, 22, 23)Document16 pagesACCT 2208 - Final Review (Ch. 18, 22, 23)MitchieNo ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- MDRRMODocument4 pagesMDRRMOSum WhosinNo ratings yet

- Tugas Pengantar Akuntansi - Timotius Siagian 1 C3Document8 pagesTugas Pengantar Akuntansi - Timotius Siagian 1 C3Timotius SiagianNo ratings yet

- FM 1Document18 pagesFM 1huleNo ratings yet

- Assignment in Partnership DissolutionDocument4 pagesAssignment in Partnership DissolutionLalaine Keendra GonzagaNo ratings yet

- P4 5BDocument15 pagesP4 5BAngel JNo ratings yet

- Randall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Document5 pagesRandall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Diane MagnayeNo ratings yet

- Modern Advanced Accounting - Assignment 3Document12 pagesModern Advanced Accounting - Assignment 3Anita Kharod ChaudharyNo ratings yet

- Audit of ReceivablesDocument33 pagesAudit of ReceivablesannyeongchinguNo ratings yet

- Lesson 9 - T AccountsDocument15 pagesLesson 9 - T AccountsNicole Austria NazarenoNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Coactg1-Chapter 4 Graded Prob3Document5 pagesCoactg1-Chapter 4 Graded Prob3AGATHA REINNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- PRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionDocument7 pagesPRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionEnrique Hills RiveraNo ratings yet

- PRIA FAR - 012 Provisions and Contingencies (PAS 37) Notes and SolutionDocument4 pagesPRIA FAR - 012 Provisions and Contingencies (PAS 37) Notes and SolutionEnrique Hills RiveraNo ratings yet

- PRIA FAR - 018 Financial Statements (PAS 1, Etc.) Notes and SolutionDocument12 pagesPRIA FAR - 018 Financial Statements (PAS 1, Etc.) Notes and SolutionEnrique Hills RiveraNo ratings yet

- PRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionDocument7 pagesPRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionEnrique Hills RiveraNo ratings yet

- PRIA FAR - 016 Share-Based Payments (PFRS 2) Notes and SolutionDocument4 pagesPRIA FAR - 016 Share-Based Payments (PFRS 2) Notes and SolutionEnrique Hills RiveraNo ratings yet

- PRIA FAR - 017 Earnings Per Share (PAS 33) Notes and SolutionDocument2 pagesPRIA FAR - 017 Earnings Per Share (PAS 33) Notes and SolutionEnrique Hills RiveraNo ratings yet

- 2023.07.07 HS PaeDocument2 pages2023.07.07 HS Paehanis0% (1)

- TOT AgreementDocument138 pagesTOT Agreementchinnadurai33No ratings yet

- Punjab Fabricators: About OwnersDocument4 pagesPunjab Fabricators: About OwnersDinesh ChahalNo ratings yet

- Bookkeeping (Second Part)Document38 pagesBookkeeping (Second Part)Thuzar Lwin100% (3)

- Venture Capital in India Research PaperDocument8 pagesVenture Capital in India Research Paperhkdxiutlg100% (1)

- Group 5 Taxation 1 SampleDocument46 pagesGroup 5 Taxation 1 SamplePEÑARANDA PS OPERATIONNo ratings yet

- Quiz No. 1 Discount SeriesDocument2 pagesQuiz No. 1 Discount SeriesAngelicaHermoParas100% (1)

- Impact of Covid-19 On Loan Performance A Study On Sonali Bank Limited (Savar Cantonment Branch)Document6 pagesImpact of Covid-19 On Loan Performance A Study On Sonali Bank Limited (Savar Cantonment Branch)Abdullah Al MamunNo ratings yet

- Mission StatementDocument3 pagesMission StatementPutri LoaderNo ratings yet

- Model Canevas 3Document10 pagesModel Canevas 3Hind Nia BenbrahimNo ratings yet

- Sage 50 To Sage 200 UpgradeDocument8 pagesSage 50 To Sage 200 UpgradeGavin BiggsNo ratings yet

- No 5.1.fourth Generation Evalution Research (Qualitative Research Design)Document4 pagesNo 5.1.fourth Generation Evalution Research (Qualitative Research Design)Eko Wahyu ApriliantoNo ratings yet

- Money Quiz: Starting U PDocument6 pagesMoney Quiz: Starting U PSfar Khouloud Ca100% (1)

- 814001-Gabriela GeorgescuDocument86 pages814001-Gabriela GeorgescuJeremiah PacerNo ratings yet

- Bill of Materials - BOMDocument12 pagesBill of Materials - BOMIbnouachir AbderrazakNo ratings yet

- Tax Invoice: Description of Services HSN Code Taxable Amount Igst Rate AmountDocument2 pagesTax Invoice: Description of Services HSN Code Taxable Amount Igst Rate AmountSunil PatelNo ratings yet

- Sample 4Document97 pagesSample 4Salma FarozeNo ratings yet

- HP t5000 Product Overview Jan07Document8 pagesHP t5000 Product Overview Jan07meharNo ratings yet

- Marketing Strategy of HCL Infosystem LTDDocument2 pagesMarketing Strategy of HCL Infosystem LTDjadeja indravijaysinhNo ratings yet

- 2 Power System Economics 1-58Document87 pages2 Power System Economics 1-58Rudraraju Chaitanya100% (1)

- Procurement IR35 Presentation For CompaniesDocument26 pagesProcurement IR35 Presentation For CompaniesMark CoulsonNo ratings yet

- Reflection Paper - Pledge 1% Model - Ronan VillagonzaloDocument1 pageReflection Paper - Pledge 1% Model - Ronan Villagonzaloronan.villagonzaloNo ratings yet

- Ig2 Risk Assessment Self Evaluation ChecklistDocument2 pagesIg2 Risk Assessment Self Evaluation ChecklistprinceNo ratings yet

- Introduction of HRMDocument19 pagesIntroduction of HRM428SHUBHASHEESH SAXENANo ratings yet

- Medical Device and Pharmaceutical: Value Stream Mapping: The Map of Your Journey To Becoming "Lean"Document4 pagesMedical Device and Pharmaceutical: Value Stream Mapping: The Map of Your Journey To Becoming "Lean"Brendan CrowleyNo ratings yet