Professional Documents

Culture Documents

RECEIVABLES

RECEIVABLES

Uploaded by

Razel TercinoCopyright:

Available Formats

You might also like

- Bank Statement Nov-DecDocument7 pagesBank Statement Nov-DecUS BANK ONLINE TRANSFERS100% (6)

- Activity 3Document5 pagesActivity 3Keith Joshua GabiasonNo ratings yet

- The Red Book of Appin Translated by Scarabaeus - Black Magic and Try From The CollectionDocument26 pagesThe Red Book of Appin Translated by Scarabaeus - Black Magic and Try From The CollectionLukas85% (13)

- ACCCOB2 Chapter 3 RECEIVABLES PROBLEM SOLVINGDocument15 pagesACCCOB2 Chapter 3 RECEIVABLES PROBLEM SOLVINGAyanna CameroNo ratings yet

- QUIZ 2. Audit of Receivables ManuscriptDocument3 pagesQUIZ 2. Audit of Receivables ManuscriptJulie Mae Caling Malit67% (3)

- Chapter 3 Receivables Exercises T1AY2021Document6 pagesChapter 3 Receivables Exercises T1AY2021Cale Robert RascoNo ratings yet

- Management Information Systems: Course ManualDocument157 pagesManagement Information Systems: Course ManualRazel TercinoNo ratings yet

- Contract of Sale: Franklin Lopez Accounting Education Department Rmmc-MiDocument14 pagesContract of Sale: Franklin Lopez Accounting Education Department Rmmc-MiRazel Tercino100% (2)

- Mathematics of InvestmentsDocument2 pagesMathematics of InvestmentsShiera Saletrero SimbajonNo ratings yet

- Orca Share Media1554082908907Document2 pagesOrca Share Media1554082908907Joshua Tansengco Guitering100% (1)

- AttachmentDocument8 pagesAttachmentchintya milathania100% (1)

- 2.1 Assignment - Audit of Sales and ReceivablesDocument4 pages2.1 Assignment - Audit of Sales and ReceivablesORIEL RICKY IGNACIO GALLARDONo ratings yet

- LSPU Quiz No. 3Document4 pagesLSPU Quiz No. 3Jamie Rose AragonesNo ratings yet

- AP-5906 ReceivablesDocument5 pagesAP-5906 ReceivablesAngelieNo ratings yet

- Auditing Seatworknot Recorded With AnswersDocument6 pagesAuditing Seatworknot Recorded With AnswersJessa HerreraNo ratings yet

- Drilll 7 ReceivablesDocument4 pagesDrilll 7 ReceivablesEDELYN PoblacionNo ratings yet

- A. 3d PROBLEM 17Document5 pagesA. 3d PROBLEM 17shuzoNo ratings yet

- Quiz Audit of ReceivablesDocument4 pagesQuiz Audit of ReceivableswesNo ratings yet

- 1 PartnershipDocument9 pages1 PartnershipLJBernardo100% (1)

- AUDP DIS02 Receivables Key-AnswersDocument7 pagesAUDP DIS02 Receivables Key-AnswersKristina KittyNo ratings yet

- Jepretan Layar 2023-08-21 Pada 10.18.32Document2 pagesJepretan Layar 2023-08-21 Pada 10.18.32Joy SitompulNo ratings yet

- Cacc011 - Main Exam 2020 (QP) Final For StudentsDocument8 pagesCacc011 - Main Exam 2020 (QP) Final For StudentsPusheletso MashiloNo ratings yet

- Answer Key Activity 39Document15 pagesAnswer Key Activity 39MAXINE CLAIRE CUTINGNo ratings yet

- Auditing AssignmentDocument8 pagesAuditing AssignmentApril ManjaresNo ratings yet

- Partnership 1Document7 pagesPartnership 1asamoahfredrica5No ratings yet

- Take Home - Final Exam Part 1Document12 pagesTake Home - Final Exam Part 1Recto Malayo Sr.No ratings yet

- Chapter 3 Receivables Exercises Answer Guide Summer AY2122 PDFDocument11 pagesChapter 3 Receivables Exercises Answer Guide Summer AY2122 PDFwavyastroNo ratings yet

- ACC304-IAS 1 Final AccountsDocument4 pagesACC304-IAS 1 Final AccountsGeorge AdjeiNo ratings yet

- Accounts Receivable and AFBDDocument18 pagesAccounts Receivable and AFBDeia aieNo ratings yet

- AP - Loans & ReceivablesDocument11 pagesAP - Loans & ReceivablesDiane PascualNo ratings yet

- Chart of AccDocument9 pagesChart of Acccfo6779No ratings yet

- BUSS 102 AssignmentDocument11 pagesBUSS 102 AssignmentDr. Mohammad Noor AlamNo ratings yet

- Ap103 ReceivablesDocument5 pagesAp103 Receivablesbright SpotifyNo ratings yet

- F5 Bafs 2 QueDocument13 pagesF5 Bafs 2 Queouo So方No ratings yet

- Final - Canton - Part 1 - Competitive AssessmentDocument15 pagesFinal - Canton - Part 1 - Competitive AssessmentAdam CuencaNo ratings yet

- Member - Loan - Ledger - 2023-03-09T111908.134 PDFDocument3 pagesMember - Loan - Ledger - 2023-03-09T111908.134 PDFMaricon D.No ratings yet

- Ac 101 Nov 2013 - 1Document5 pagesAc 101 Nov 2013 - 1Sahid Afrid AnwahNo ratings yet

- CPAR AP - Audit of ReceivablesDocument3 pagesCPAR AP - Audit of ReceivablesJohn Carlo CruzNo ratings yet

- Audit of Cash Module 1Document5 pagesAudit of Cash Module 1calliemozartNo ratings yet

- AACONAPPS2 A433 - Audit of ReceivablesDocument23 pagesAACONAPPS2 A433 - Audit of ReceivablesDawson Dela CruzNo ratings yet

- Cordillera Career Development CollegeDocument12 pagesCordillera Career Development CollegeDonalyn BannagaoNo ratings yet

- Home Work Intermediate2 Week 11Document2 pagesHome Work Intermediate2 Week 11NABILA SARINo ratings yet

- Chapter 2Document8 pagesChapter 2imel100% (3)

- Global Marketing Export Strategy AssignmentDocument19 pagesGlobal Marketing Export Strategy AssignmentYisfalem AlemayehuNo ratings yet

- October 5 Review PDFDocument5 pagesOctober 5 Review PDFLeah Mae NolascoNo ratings yet

- Repayment ScheduleDocument5 pagesRepayment ScheduleshivamNo ratings yet

- Test 10 - Problem 1Document4 pagesTest 10 - Problem 1YhamNo ratings yet

- AUDITING Pre-Board 1 Instructions: Select The Correct Answer For Each of The Following Questions. Mark OnlyDocument12 pagesAUDITING Pre-Board 1 Instructions: Select The Correct Answer For Each of The Following Questions. Mark OnlyKathrine Gayle BautistaNo ratings yet

- Metal TechDocument49 pagesMetal Techanon_267863693No ratings yet

- Aud Rev - Accounts ReceivableDocument4 pagesAud Rev - Accounts ReceivablexjammerNo ratings yet

- Final Assignment No 3 Acctg 121Document4 pagesFinal Assignment No 3 Acctg 121Pler WiezNo ratings yet

- CAG Financials 2020Document4 pagesCAG Financials 2020AzliGhaniNo ratings yet

- Receivable - Q2Document3 pagesReceivable - Q2Dymphna Ann CalumpianoNo ratings yet

- Nama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure InternalDocument6 pagesNama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure Internalmelvina siregarNo ratings yet

- 03 Receivables PDFDocument13 pages03 Receivables PDFReyn Saplad PeralesNo ratings yet

- Far FPBDocument16 pagesFar FPBMae Marcos SaguipedNo ratings yet

- Partnership Worksheet 7Document4 pagesPartnership Worksheet 7Timo wernereNo ratings yet

- Biilling Address 1St Dunning Notice: Customer Number Dunning Date Dunning Run Period 06/20/2018 Acctg ClerkDocument2 pagesBiilling Address 1St Dunning Notice: Customer Number Dunning Date Dunning Run Period 06/20/2018 Acctg ClerkNag GuptaNo ratings yet

- HybridCalculationCalculator RRFDocument4 pagesHybridCalculationCalculator RRFJamesNo ratings yet

- Petunia Reposteria: Detalle de Formas de Pago en VentasDocument10 pagesPetunia Reposteria: Detalle de Formas de Pago en VentasBlack Bambi StudioNo ratings yet

- Act1104 Quiz No. 3 Problem 1Document6 pagesAct1104 Quiz No. 3 Problem 1DyenNo ratings yet

- Quiz - Accounts ReceivableDocument3 pagesQuiz - Accounts ReceivableSamuel Bandibas0% (1)

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- QUIZ - RemovalDocument2 pagesQUIZ - RemovalRazel TercinoNo ratings yet

- Science 4.3 Theory of Plate TectonicsDocument16 pagesScience 4.3 Theory of Plate TectonicsRazel TercinoNo ratings yet

- Answers Chapter 13 Quiz.f13Document2 pagesAnswers Chapter 13 Quiz.f13Razel TercinoNo ratings yet

- No Last Name First Name Prelim Midterm Final Grade RemarksDocument1 pageNo Last Name First Name Prelim Midterm Final Grade RemarksRazel TercinoNo ratings yet

- Phases in Total Quality Management ImplementationDocument20 pagesPhases in Total Quality Management ImplementationRazel TercinoNo ratings yet

- Law On Sales OverviewDocument5 pagesLaw On Sales OverviewRazel TercinoNo ratings yet

- Government AccountingDocument28 pagesGovernment AccountingRazel TercinoNo ratings yet

- Unit 1.6: Earth and Space Science - Plate Tectonics: DiagramDocument10 pagesUnit 1.6: Earth and Space Science - Plate Tectonics: DiagramRazel TercinoNo ratings yet

- 27 Fruit Crops Final - 0 PDFDocument4 pages27 Fruit Crops Final - 0 PDFRazel TercinoNo ratings yet

- Summary Notes - PpeDocument5 pagesSummary Notes - PpeRazel Tercino100% (1)

- Psax SR 2020 16 PDFDocument8 pagesPsax SR 2020 16 PDFRazel TercinoNo ratings yet

- Summary Note. Introduction To Statistical InferenceDocument2 pagesSummary Note. Introduction To Statistical InferenceRazel Tercino100% (1)

- Contract of Sale: Franklin Lopez Accounting Education Department Rmmc-MiDocument15 pagesContract of Sale: Franklin Lopez Accounting Education Department Rmmc-MiRazel TercinoNo ratings yet

- SPECIAL RELEASE - 2018 003-Population Results On City of Koronadal PDFDocument5 pagesSPECIAL RELEASE - 2018 003-Population Results On City of Koronadal PDFRazel TercinoNo ratings yet

- Growth Rate Q4 2016 - Q4 2017: NotesDocument2 pagesGrowth Rate Q4 2016 - Q4 2017: NotesRazel TercinoNo ratings yet

- Summary Note. Land - Building.machineryDocument3 pagesSummary Note. Land - Building.machineryRazel TercinoNo ratings yet

- Contract of Sale: Franklin D. Lopez Accounting Education Department Rmmc-MiDocument6 pagesContract of Sale: Franklin D. Lopez Accounting Education Department Rmmc-MiRazel TercinoNo ratings yet

- Ancillary Costs Incurred in Connection With The Arrangement of BorrowingDocument2 pagesAncillary Costs Incurred in Connection With The Arrangement of BorrowingRazel TercinoNo ratings yet

- Contract of Sale: Franklin D. Lopez Accounting Education Department Rmmc-MiDocument6 pagesContract of Sale: Franklin D. Lopez Accounting Education Department Rmmc-MiRazel TercinoNo ratings yet

- Financial Analysis of Everest BankDocument27 pagesFinancial Analysis of Everest BankRazel TercinoNo ratings yet

- Project Management: To AccompanyDocument66 pagesProject Management: To AccompanyRazel TercinoNo ratings yet

- ICICI BANK AND ITS PARTNERSHIP LINKAGES IN INDIA1 A Case StudyDocument8 pagesICICI BANK AND ITS PARTNERSHIP LINKAGES IN INDIA1 A Case StudyRazel Tercino0% (1)

- LP Modeling Applications With Computer Analyses in Excel and QM For WindowsDocument87 pagesLP Modeling Applications With Computer Analyses in Excel and QM For WindowsgogoshicaNo ratings yet

- Case Study - Financial MarketsDocument3 pagesCase Study - Financial MarketsRazel TercinoNo ratings yet

- Forecasting: To AccompanyDocument61 pagesForecasting: To AccompanyRazel TercinoNo ratings yet

- Regression Models: To AccompanyDocument39 pagesRegression Models: To AccompanyRazel TercinoNo ratings yet

- 7 - LP-Graphical& Computer MethodsDocument93 pages7 - LP-Graphical& Computer MethodsRazel TercinoNo ratings yet

- Dynamics of Machinery Oral Question BankDocument22 pagesDynamics of Machinery Oral Question BankSurajKahateRajputNo ratings yet

- $pace The Final FrontierDocument9 pages$pace The Final FrontierWilliam RiveraNo ratings yet

- BSI BCI Horizon Scan Report 2016 PDFDocument32 pagesBSI BCI Horizon Scan Report 2016 PDFSandraNo ratings yet

- 11 Business Studies SP 1Document11 pages11 Business Studies SP 1Meldon17No ratings yet

- Brandi PPT For BrandingDocument27 pagesBrandi PPT For BrandingShah ParinNo ratings yet

- Womens EssentialsDocument50 pagesWomens EssentialsNoor-uz-Zamaan AcademyNo ratings yet

- GST/HST Credit Application For Individuals Who Become Residents of CanadaDocument4 pagesGST/HST Credit Application For Individuals Who Become Residents of CanadaAndrea Dr FanisNo ratings yet

- Identifying Figures of Speech (Simile, Metaphor, and Personification)Document10 pagesIdentifying Figures of Speech (Simile, Metaphor, and Personification)khem ConstantinoNo ratings yet

- Petition For Writ of Kalikasan (Marj)Document4 pagesPetition For Writ of Kalikasan (Marj)Myka FloresNo ratings yet

- Reactor and Regenerator System of FCCDocument67 pagesReactor and Regenerator System of FCCDai NamNo ratings yet

- Direct Object: Subjec T Verb ObjectDocument6 pagesDirect Object: Subjec T Verb ObjectHaerani Ester SiahaanNo ratings yet

- LED Large Digital Stopwatch Timer - Electronics USADocument5 pagesLED Large Digital Stopwatch Timer - Electronics USAmrdadeNo ratings yet

- Primary Gingival Squamous Cell CarcinomaDocument7 pagesPrimary Gingival Squamous Cell CarcinomaMandyWilsonNo ratings yet

- NG-PHC-PHC: C-DTP-DSRDocument4 pagesNG-PHC-PHC: C-DTP-DSRBisi AgomoNo ratings yet

- Research Methodology This Chapter Presents The Research MethodDocument9 pagesResearch Methodology This Chapter Presents The Research MethodKristineanne FrondaNo ratings yet

- ModulationDocument7 pagesModulationSyeda MiznaNo ratings yet

- Prospectus19 20 Part2 PDFDocument76 pagesProspectus19 20 Part2 PDFSanand M KNo ratings yet

- APP Modified Bituminous Waterproofing and Damp-Proofing Membrane With Polyester Reinforcement - SpecificationDocument15 pagesAPP Modified Bituminous Waterproofing and Damp-Proofing Membrane With Polyester Reinforcement - Specificationjitendra0% (1)

- EPM-1183 Ethics, Code of Conduct & Professional PracticeDocument41 pagesEPM-1183 Ethics, Code of Conduct & Professional PracticeDev ThackerNo ratings yet

- Piano Solo XXDocument6 pagesPiano Solo XXschweyermatthieuNo ratings yet

- Task #10 Tarquino MauricioDocument2 pagesTask #10 Tarquino MauricioMauricio Tarquino FloresNo ratings yet

- Karakteristik Material Baja St.37 Dengan Temperatur Dan Waktu Pada Uji Heat Treatment Menggunakan FurnaceDocument14 pagesKarakteristik Material Baja St.37 Dengan Temperatur Dan Waktu Pada Uji Heat Treatment Menggunakan FurnaceYudii NggiNo ratings yet

- Mauro Giuliani: Etudes Instructives, Op. 100Document35 pagesMauro Giuliani: Etudes Instructives, Op. 100Thiago Camargo Juvito de Souza100% (1)

- Project On SunsilkDocument16 pagesProject On Sunsilkiilm00282% (22)

- # Pembagian Kelas Alkes Per KategoriDocument41 pages# Pembagian Kelas Alkes Per KategoriR.A.R TVNo ratings yet

- Schon Product List PDF 1Document8 pagesSchon Product List PDF 1vishal vishalNo ratings yet

- Reblex AnswersDocument17 pagesReblex AnswersAerol Buenaventura100% (1)

- Unit 8 Our World Heritage Sites Lesson 3 ReadingDocument41 pagesUnit 8 Our World Heritage Sites Lesson 3 ReadingThái HoàngNo ratings yet

RECEIVABLES

RECEIVABLES

Uploaded by

Razel TercinoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RECEIVABLES

RECEIVABLES

Uploaded by

Razel TercinoCopyright:

Available Formats

RECEIVABLES

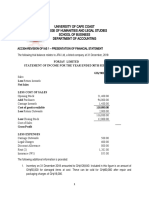

You are auditing the Accounts Receivable of LOPEZ Inc. as of December 31, 2018. You found the following

information in the general journal:

Accounts Receivable P1,466,720

Less: AFDA (46,720)

Accounts Receivable, net P1,420,000

The accounts receivable subsidiary ledger had the following details:

Customers Invoice date Amount Balance

Escorido 09/12/18 139,200 139,200

Alamada 12/12/18 153,600

12/02/18 99,200 252,800

Dulay 11/17/18 185,120

10/08/18 176,000 361,120

Ello 12/08/18 160,000

10/25/18 44,800

08/20/18 40,000 244,800

Sampan 09/27/18 96,000 96,000

Sangid 08/20/18 71,360 71,360

Porcadilla 12/06/18 112,000

11/29/18 169,440 281,440

Total 1,446,720

Additional Info:

a. You discovered based on your review of subsequent events that Sangid recently went bankrupt, thus

you suggested that the amount receivable from the same shall be written off.

b. You also discovered that the invoice dated 12/02/18 has already been settled by Alamada per OR

number 34675. This amount however has been erroneously posted against Dulay’s subsidiary ledger

as a settlement for an invoice dated 11/05/18 for the same amount.

c. The estimated bad debt rates below are based on the company’s receivable collection experience:

Age of accounts % of collectability

0-30 days 98%

31-60 days 95%

61-90 days 90%

91-120 days 80%

Over 120 days 50%

Requirements:

1. If there were no other entries to the allowance for doubtful accounts, what is the correct bad debt expense

for the year?

2. What is the correct allowance for bad debt expense for the year ended December 31, 2018?

3. What is the net adjustment to the Accounts Receivable in the general ledger?

4. What is the carrying value of the company’s accounts receivable as of December 31, 2018?

5. What is the necessary adjusting entry to adjust any unallocated difference between Subsidiary Ledger and

General Ledger?

You might also like

- Bank Statement Nov-DecDocument7 pagesBank Statement Nov-DecUS BANK ONLINE TRANSFERS100% (6)

- Activity 3Document5 pagesActivity 3Keith Joshua GabiasonNo ratings yet

- The Red Book of Appin Translated by Scarabaeus - Black Magic and Try From The CollectionDocument26 pagesThe Red Book of Appin Translated by Scarabaeus - Black Magic and Try From The CollectionLukas85% (13)

- ACCCOB2 Chapter 3 RECEIVABLES PROBLEM SOLVINGDocument15 pagesACCCOB2 Chapter 3 RECEIVABLES PROBLEM SOLVINGAyanna CameroNo ratings yet

- QUIZ 2. Audit of Receivables ManuscriptDocument3 pagesQUIZ 2. Audit of Receivables ManuscriptJulie Mae Caling Malit67% (3)

- Chapter 3 Receivables Exercises T1AY2021Document6 pagesChapter 3 Receivables Exercises T1AY2021Cale Robert RascoNo ratings yet

- Management Information Systems: Course ManualDocument157 pagesManagement Information Systems: Course ManualRazel TercinoNo ratings yet

- Contract of Sale: Franklin Lopez Accounting Education Department Rmmc-MiDocument14 pagesContract of Sale: Franklin Lopez Accounting Education Department Rmmc-MiRazel Tercino100% (2)

- Mathematics of InvestmentsDocument2 pagesMathematics of InvestmentsShiera Saletrero SimbajonNo ratings yet

- Orca Share Media1554082908907Document2 pagesOrca Share Media1554082908907Joshua Tansengco Guitering100% (1)

- AttachmentDocument8 pagesAttachmentchintya milathania100% (1)

- 2.1 Assignment - Audit of Sales and ReceivablesDocument4 pages2.1 Assignment - Audit of Sales and ReceivablesORIEL RICKY IGNACIO GALLARDONo ratings yet

- LSPU Quiz No. 3Document4 pagesLSPU Quiz No. 3Jamie Rose AragonesNo ratings yet

- AP-5906 ReceivablesDocument5 pagesAP-5906 ReceivablesAngelieNo ratings yet

- Auditing Seatworknot Recorded With AnswersDocument6 pagesAuditing Seatworknot Recorded With AnswersJessa HerreraNo ratings yet

- Drilll 7 ReceivablesDocument4 pagesDrilll 7 ReceivablesEDELYN PoblacionNo ratings yet

- A. 3d PROBLEM 17Document5 pagesA. 3d PROBLEM 17shuzoNo ratings yet

- Quiz Audit of ReceivablesDocument4 pagesQuiz Audit of ReceivableswesNo ratings yet

- 1 PartnershipDocument9 pages1 PartnershipLJBernardo100% (1)

- AUDP DIS02 Receivables Key-AnswersDocument7 pagesAUDP DIS02 Receivables Key-AnswersKristina KittyNo ratings yet

- Jepretan Layar 2023-08-21 Pada 10.18.32Document2 pagesJepretan Layar 2023-08-21 Pada 10.18.32Joy SitompulNo ratings yet

- Cacc011 - Main Exam 2020 (QP) Final For StudentsDocument8 pagesCacc011 - Main Exam 2020 (QP) Final For StudentsPusheletso MashiloNo ratings yet

- Answer Key Activity 39Document15 pagesAnswer Key Activity 39MAXINE CLAIRE CUTINGNo ratings yet

- Auditing AssignmentDocument8 pagesAuditing AssignmentApril ManjaresNo ratings yet

- Partnership 1Document7 pagesPartnership 1asamoahfredrica5No ratings yet

- Take Home - Final Exam Part 1Document12 pagesTake Home - Final Exam Part 1Recto Malayo Sr.No ratings yet

- Chapter 3 Receivables Exercises Answer Guide Summer AY2122 PDFDocument11 pagesChapter 3 Receivables Exercises Answer Guide Summer AY2122 PDFwavyastroNo ratings yet

- ACC304-IAS 1 Final AccountsDocument4 pagesACC304-IAS 1 Final AccountsGeorge AdjeiNo ratings yet

- Accounts Receivable and AFBDDocument18 pagesAccounts Receivable and AFBDeia aieNo ratings yet

- AP - Loans & ReceivablesDocument11 pagesAP - Loans & ReceivablesDiane PascualNo ratings yet

- Chart of AccDocument9 pagesChart of Acccfo6779No ratings yet

- BUSS 102 AssignmentDocument11 pagesBUSS 102 AssignmentDr. Mohammad Noor AlamNo ratings yet

- Ap103 ReceivablesDocument5 pagesAp103 Receivablesbright SpotifyNo ratings yet

- F5 Bafs 2 QueDocument13 pagesF5 Bafs 2 Queouo So方No ratings yet

- Final - Canton - Part 1 - Competitive AssessmentDocument15 pagesFinal - Canton - Part 1 - Competitive AssessmentAdam CuencaNo ratings yet

- Member - Loan - Ledger - 2023-03-09T111908.134 PDFDocument3 pagesMember - Loan - Ledger - 2023-03-09T111908.134 PDFMaricon D.No ratings yet

- Ac 101 Nov 2013 - 1Document5 pagesAc 101 Nov 2013 - 1Sahid Afrid AnwahNo ratings yet

- CPAR AP - Audit of ReceivablesDocument3 pagesCPAR AP - Audit of ReceivablesJohn Carlo CruzNo ratings yet

- Audit of Cash Module 1Document5 pagesAudit of Cash Module 1calliemozartNo ratings yet

- AACONAPPS2 A433 - Audit of ReceivablesDocument23 pagesAACONAPPS2 A433 - Audit of ReceivablesDawson Dela CruzNo ratings yet

- Cordillera Career Development CollegeDocument12 pagesCordillera Career Development CollegeDonalyn BannagaoNo ratings yet

- Home Work Intermediate2 Week 11Document2 pagesHome Work Intermediate2 Week 11NABILA SARINo ratings yet

- Chapter 2Document8 pagesChapter 2imel100% (3)

- Global Marketing Export Strategy AssignmentDocument19 pagesGlobal Marketing Export Strategy AssignmentYisfalem AlemayehuNo ratings yet

- October 5 Review PDFDocument5 pagesOctober 5 Review PDFLeah Mae NolascoNo ratings yet

- Repayment ScheduleDocument5 pagesRepayment ScheduleshivamNo ratings yet

- Test 10 - Problem 1Document4 pagesTest 10 - Problem 1YhamNo ratings yet

- AUDITING Pre-Board 1 Instructions: Select The Correct Answer For Each of The Following Questions. Mark OnlyDocument12 pagesAUDITING Pre-Board 1 Instructions: Select The Correct Answer For Each of The Following Questions. Mark OnlyKathrine Gayle BautistaNo ratings yet

- Metal TechDocument49 pagesMetal Techanon_267863693No ratings yet

- Aud Rev - Accounts ReceivableDocument4 pagesAud Rev - Accounts ReceivablexjammerNo ratings yet

- Final Assignment No 3 Acctg 121Document4 pagesFinal Assignment No 3 Acctg 121Pler WiezNo ratings yet

- CAG Financials 2020Document4 pagesCAG Financials 2020AzliGhaniNo ratings yet

- Receivable - Q2Document3 pagesReceivable - Q2Dymphna Ann CalumpianoNo ratings yet

- Nama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure InternalDocument6 pagesNama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure Internalmelvina siregarNo ratings yet

- 03 Receivables PDFDocument13 pages03 Receivables PDFReyn Saplad PeralesNo ratings yet

- Far FPBDocument16 pagesFar FPBMae Marcos SaguipedNo ratings yet

- Partnership Worksheet 7Document4 pagesPartnership Worksheet 7Timo wernereNo ratings yet

- Biilling Address 1St Dunning Notice: Customer Number Dunning Date Dunning Run Period 06/20/2018 Acctg ClerkDocument2 pagesBiilling Address 1St Dunning Notice: Customer Number Dunning Date Dunning Run Period 06/20/2018 Acctg ClerkNag GuptaNo ratings yet

- HybridCalculationCalculator RRFDocument4 pagesHybridCalculationCalculator RRFJamesNo ratings yet

- Petunia Reposteria: Detalle de Formas de Pago en VentasDocument10 pagesPetunia Reposteria: Detalle de Formas de Pago en VentasBlack Bambi StudioNo ratings yet

- Act1104 Quiz No. 3 Problem 1Document6 pagesAct1104 Quiz No. 3 Problem 1DyenNo ratings yet

- Quiz - Accounts ReceivableDocument3 pagesQuiz - Accounts ReceivableSamuel Bandibas0% (1)

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- QUIZ - RemovalDocument2 pagesQUIZ - RemovalRazel TercinoNo ratings yet

- Science 4.3 Theory of Plate TectonicsDocument16 pagesScience 4.3 Theory of Plate TectonicsRazel TercinoNo ratings yet

- Answers Chapter 13 Quiz.f13Document2 pagesAnswers Chapter 13 Quiz.f13Razel TercinoNo ratings yet

- No Last Name First Name Prelim Midterm Final Grade RemarksDocument1 pageNo Last Name First Name Prelim Midterm Final Grade RemarksRazel TercinoNo ratings yet

- Phases in Total Quality Management ImplementationDocument20 pagesPhases in Total Quality Management ImplementationRazel TercinoNo ratings yet

- Law On Sales OverviewDocument5 pagesLaw On Sales OverviewRazel TercinoNo ratings yet

- Government AccountingDocument28 pagesGovernment AccountingRazel TercinoNo ratings yet

- Unit 1.6: Earth and Space Science - Plate Tectonics: DiagramDocument10 pagesUnit 1.6: Earth and Space Science - Plate Tectonics: DiagramRazel TercinoNo ratings yet

- 27 Fruit Crops Final - 0 PDFDocument4 pages27 Fruit Crops Final - 0 PDFRazel TercinoNo ratings yet

- Summary Notes - PpeDocument5 pagesSummary Notes - PpeRazel Tercino100% (1)

- Psax SR 2020 16 PDFDocument8 pagesPsax SR 2020 16 PDFRazel TercinoNo ratings yet

- Summary Note. Introduction To Statistical InferenceDocument2 pagesSummary Note. Introduction To Statistical InferenceRazel Tercino100% (1)

- Contract of Sale: Franklin Lopez Accounting Education Department Rmmc-MiDocument15 pagesContract of Sale: Franklin Lopez Accounting Education Department Rmmc-MiRazel TercinoNo ratings yet

- SPECIAL RELEASE - 2018 003-Population Results On City of Koronadal PDFDocument5 pagesSPECIAL RELEASE - 2018 003-Population Results On City of Koronadal PDFRazel TercinoNo ratings yet

- Growth Rate Q4 2016 - Q4 2017: NotesDocument2 pagesGrowth Rate Q4 2016 - Q4 2017: NotesRazel TercinoNo ratings yet

- Summary Note. Land - Building.machineryDocument3 pagesSummary Note. Land - Building.machineryRazel TercinoNo ratings yet

- Contract of Sale: Franklin D. Lopez Accounting Education Department Rmmc-MiDocument6 pagesContract of Sale: Franklin D. Lopez Accounting Education Department Rmmc-MiRazel TercinoNo ratings yet

- Ancillary Costs Incurred in Connection With The Arrangement of BorrowingDocument2 pagesAncillary Costs Incurred in Connection With The Arrangement of BorrowingRazel TercinoNo ratings yet

- Contract of Sale: Franklin D. Lopez Accounting Education Department Rmmc-MiDocument6 pagesContract of Sale: Franklin D. Lopez Accounting Education Department Rmmc-MiRazel TercinoNo ratings yet

- Financial Analysis of Everest BankDocument27 pagesFinancial Analysis of Everest BankRazel TercinoNo ratings yet

- Project Management: To AccompanyDocument66 pagesProject Management: To AccompanyRazel TercinoNo ratings yet

- ICICI BANK AND ITS PARTNERSHIP LINKAGES IN INDIA1 A Case StudyDocument8 pagesICICI BANK AND ITS PARTNERSHIP LINKAGES IN INDIA1 A Case StudyRazel Tercino0% (1)

- LP Modeling Applications With Computer Analyses in Excel and QM For WindowsDocument87 pagesLP Modeling Applications With Computer Analyses in Excel and QM For WindowsgogoshicaNo ratings yet

- Case Study - Financial MarketsDocument3 pagesCase Study - Financial MarketsRazel TercinoNo ratings yet

- Forecasting: To AccompanyDocument61 pagesForecasting: To AccompanyRazel TercinoNo ratings yet

- Regression Models: To AccompanyDocument39 pagesRegression Models: To AccompanyRazel TercinoNo ratings yet

- 7 - LP-Graphical& Computer MethodsDocument93 pages7 - LP-Graphical& Computer MethodsRazel TercinoNo ratings yet

- Dynamics of Machinery Oral Question BankDocument22 pagesDynamics of Machinery Oral Question BankSurajKahateRajputNo ratings yet

- $pace The Final FrontierDocument9 pages$pace The Final FrontierWilliam RiveraNo ratings yet

- BSI BCI Horizon Scan Report 2016 PDFDocument32 pagesBSI BCI Horizon Scan Report 2016 PDFSandraNo ratings yet

- 11 Business Studies SP 1Document11 pages11 Business Studies SP 1Meldon17No ratings yet

- Brandi PPT For BrandingDocument27 pagesBrandi PPT For BrandingShah ParinNo ratings yet

- Womens EssentialsDocument50 pagesWomens EssentialsNoor-uz-Zamaan AcademyNo ratings yet

- GST/HST Credit Application For Individuals Who Become Residents of CanadaDocument4 pagesGST/HST Credit Application For Individuals Who Become Residents of CanadaAndrea Dr FanisNo ratings yet

- Identifying Figures of Speech (Simile, Metaphor, and Personification)Document10 pagesIdentifying Figures of Speech (Simile, Metaphor, and Personification)khem ConstantinoNo ratings yet

- Petition For Writ of Kalikasan (Marj)Document4 pagesPetition For Writ of Kalikasan (Marj)Myka FloresNo ratings yet

- Reactor and Regenerator System of FCCDocument67 pagesReactor and Regenerator System of FCCDai NamNo ratings yet

- Direct Object: Subjec T Verb ObjectDocument6 pagesDirect Object: Subjec T Verb ObjectHaerani Ester SiahaanNo ratings yet

- LED Large Digital Stopwatch Timer - Electronics USADocument5 pagesLED Large Digital Stopwatch Timer - Electronics USAmrdadeNo ratings yet

- Primary Gingival Squamous Cell CarcinomaDocument7 pagesPrimary Gingival Squamous Cell CarcinomaMandyWilsonNo ratings yet

- NG-PHC-PHC: C-DTP-DSRDocument4 pagesNG-PHC-PHC: C-DTP-DSRBisi AgomoNo ratings yet

- Research Methodology This Chapter Presents The Research MethodDocument9 pagesResearch Methodology This Chapter Presents The Research MethodKristineanne FrondaNo ratings yet

- ModulationDocument7 pagesModulationSyeda MiznaNo ratings yet

- Prospectus19 20 Part2 PDFDocument76 pagesProspectus19 20 Part2 PDFSanand M KNo ratings yet

- APP Modified Bituminous Waterproofing and Damp-Proofing Membrane With Polyester Reinforcement - SpecificationDocument15 pagesAPP Modified Bituminous Waterproofing and Damp-Proofing Membrane With Polyester Reinforcement - Specificationjitendra0% (1)

- EPM-1183 Ethics, Code of Conduct & Professional PracticeDocument41 pagesEPM-1183 Ethics, Code of Conduct & Professional PracticeDev ThackerNo ratings yet

- Piano Solo XXDocument6 pagesPiano Solo XXschweyermatthieuNo ratings yet

- Task #10 Tarquino MauricioDocument2 pagesTask #10 Tarquino MauricioMauricio Tarquino FloresNo ratings yet

- Karakteristik Material Baja St.37 Dengan Temperatur Dan Waktu Pada Uji Heat Treatment Menggunakan FurnaceDocument14 pagesKarakteristik Material Baja St.37 Dengan Temperatur Dan Waktu Pada Uji Heat Treatment Menggunakan FurnaceYudii NggiNo ratings yet

- Mauro Giuliani: Etudes Instructives, Op. 100Document35 pagesMauro Giuliani: Etudes Instructives, Op. 100Thiago Camargo Juvito de Souza100% (1)

- Project On SunsilkDocument16 pagesProject On Sunsilkiilm00282% (22)

- # Pembagian Kelas Alkes Per KategoriDocument41 pages# Pembagian Kelas Alkes Per KategoriR.A.R TVNo ratings yet

- Schon Product List PDF 1Document8 pagesSchon Product List PDF 1vishal vishalNo ratings yet

- Reblex AnswersDocument17 pagesReblex AnswersAerol Buenaventura100% (1)

- Unit 8 Our World Heritage Sites Lesson 3 ReadingDocument41 pagesUnit 8 Our World Heritage Sites Lesson 3 ReadingThái HoàngNo ratings yet