Professional Documents

Culture Documents

Individual Fund Factsheet: March 2019

Individual Fund Factsheet: March 2019

Uploaded by

Ram GuggulCopyright:

Available Formats

You might also like

- LLC Subscription AgreementDocument3 pagesLLC Subscription Agreementnworkman100% (1)

- Financial Planning For Individual InvestorDocument83 pagesFinancial Planning For Individual Investorrathodsantosh101100% (2)

- Billet PremiumDocument9 pagesBillet PremiumGiga LimesNo ratings yet

- Mutual Funds NotesDocument6 pagesMutual Funds Notes✬ SHANZA MALIK ✬100% (3)

- IDFC Factsheet November 2020Document62 pagesIDFC Factsheet November 2020dali faceNo ratings yet

- IDFC Factsheet March 2021Document72 pagesIDFC Factsheet March 2021Karambir Singh DhayalNo ratings yet

- One Digital Reckoner_May 2024. (1)Document37 pagesOne Digital Reckoner_May 2024. (1)93zx6rNo ratings yet

- IDFC Factsheet December 2019Document58 pagesIDFC Factsheet December 2019Nishant SinhaNo ratings yet

- Assure FundDocument51 pagesAssure FundAnand K. MouryaNo ratings yet

- Kobi Real Estate Fund 1 PPM 1Document182 pagesKobi Real Estate Fund 1 PPM 1veldanezNo ratings yet

- TATA AIA Fund-Performance-Aug20Document55 pagesTATA AIA Fund-Performance-Aug20Abhijit ChakiNo ratings yet

- IDFC Factsheet April 2021 - 3Document70 pagesIDFC Factsheet April 2021 - 3completebhejafryNo ratings yet

- Bandhan FactsheetDocument84 pagesBandhan FactsheetaniruddhaNo ratings yet

- IDFC Factsheet-Dec-2021Document74 pagesIDFC Factsheet-Dec-2021RUDRAKSH KARNIKNo ratings yet

- Monthly Factsheet - May24Document37 pagesMonthly Factsheet - May24lordsmobile9592No ratings yet

- WeitzFunds Semi-Annual 93017Document68 pagesWeitzFunds Semi-Annual 93017superinvestorbulletiNo ratings yet

- SBI Life ULIP News Letter March 2024Document35 pagesSBI Life ULIP News Letter March 2024Aman KumarNo ratings yet

- SBI Life ULIP News Letter January 2024Document35 pagesSBI Life ULIP News Letter January 2024successinvestment2005No ratings yet

- quant_Factsheet_May_2020Document23 pagesquant_Factsheet_May_2020DEBANJAN DUTTANo ratings yet

- Bsba BP CalderonDocument58 pagesBsba BP CalderonroilesatheaNo ratings yet

- IEPF - Investor Education BookletDocument71 pagesIEPF - Investor Education Bookletahil XO1BDNo ratings yet

- Sbi Mutual Fund FactsheetDocument84 pagesSbi Mutual Fund FactsheetKinjal patilNo ratings yet

- Assure FundDocument51 pagesAssure FundMahesh DivakarNo ratings yet

- Fund Assure Jun20Document58 pagesFund Assure Jun20Riyaz MNo ratings yet

- Construction DeveloperDocument46 pagesConstruction DeveloperIhab Ramlawi100% (1)

- Monthly Factsheet Working All Funds August21Document33 pagesMonthly Factsheet Working All Funds August21Sirish N RaoNo ratings yet

- Bandhan December 2023Document89 pagesBandhan December 2023Diksha DuttaNo ratings yet

- Sector Fund - Risk or Opportunity For InvestorsDocument46 pagesSector Fund - Risk or Opportunity For InvestorsGANESHNo ratings yet

- SBI Life ULIP News Letter February 2024 - V1Document35 pagesSBI Life ULIP News Letter February 2024 - V1praveen kumarNo ratings yet

- IDFC Factsheet August 2022Document72 pagesIDFC Factsheet August 2022anshu pandeyNo ratings yet

- Kotak MF Factsheet July 2021Document80 pagesKotak MF Factsheet July 2021malaysahaNo ratings yet

- Mirae Asset Securities VN - Q32018Document69 pagesMirae Asset Securities VN - Q32018Khoa NguyenNo ratings yet

- Monthly Factsheet - Dec23Document36 pagesMonthly Factsheet - Dec23khanmubin285No ratings yet

- SBI Life ULIP News Letter December 2023 - RevisedDocument35 pagesSBI Life ULIP News Letter December 2023 - RevisedDebmalya GhoshNo ratings yet

- Quant Factsheet March 2021Document34 pagesQuant Factsheet March 2021Raghu RamanNo ratings yet

- Sector Fund - Risk or Opportunity For InvestorsDocument46 pagesSector Fund - Risk or Opportunity For InvestorsGANESHNo ratings yet

- Prospekt BGF PDFDocument150 pagesProspekt BGF PDFreacharunkNo ratings yet

- Mutual Fund Portfolio Insight Report: Mohit GuptaDocument7 pagesMutual Fund Portfolio Insight Report: Mohit GuptaMohit GuptaNo ratings yet

- Ifrs For Smes in Your Pocket: April 2010Document45 pagesIfrs For Smes in Your Pocket: April 2010Glenn Taduran100% (1)

- Tata-Digital-India-Fun0 2222233333333Document42 pagesTata-Digital-India-Fun0 2222233333333yasirNo ratings yet

- Prospectus: Blackrock Global FundsDocument156 pagesProspectus: Blackrock Global FundsInmaNo ratings yet

- FEIA Study MaterialDocument130 pagesFEIA Study MaterialPrajwal100% (1)

- Real Estate Report 2022 CompressedDocument21 pagesReal Estate Report 2022 CompressedpradeepnazreNo ratings yet

- Nutricookie Business Plan: A Feasibility Study: San Fabian National High School Senior High School DepartmentDocument62 pagesNutricookie Business Plan: A Feasibility Study: San Fabian National High School Senior High School DepartmentFranchel Kaye EstayoNo ratings yet

- Fundamental Analysis of Edelweiss Broking Limited V/s IndiaInfoline & Geojit BNP ParibasDocument54 pagesFundamental Analysis of Edelweiss Broking Limited V/s IndiaInfoline & Geojit BNP ParibasAnish Vyas100% (2)

- Tata Value Fund Series 1 SidDocument44 pagesTata Value Fund Series 1 SidAbdul Qadir SaifiNo ratings yet

- It's A Navigator: Kotak Business Cycle FundDocument90 pagesIt's A Navigator: Kotak Business Cycle FundgowthamNo ratings yet

- Monthly Factsheet Working All Funds November20Document33 pagesMonthly Factsheet Working All Funds November20jayand_netNo ratings yet

- Personal Finance 2Nd Edition by Jane King Full ChapterDocument41 pagesPersonal Finance 2Nd Edition by Jane King Full Chaptermargret.brennan669100% (25)

- Family Child Care Business PlanDocument42 pagesFamily Child Care Business PlanChuck Achberger100% (5)

- 2020 First Quarter Non-Life Industry ReportDocument49 pages2020 First Quarter Non-Life Industry ReportPropensity MuyamboNo ratings yet

- Ashika Monthly Insight January 2020Document84 pagesAshika Monthly Insight January 2020Tirthankar DasNo ratings yet

- Getting a Job in Hedge Funds: An Inside Look at How Funds HireFrom EverandGetting a Job in Hedge Funds: An Inside Look at How Funds HireRating: 2 out of 5 stars2/5 (1)

- Summer Internship ReportDocument49 pagesSummer Internship ReportSỡumệŋ MaŋdalNo ratings yet

- TheCryptoCreditReport q2 2019Document26 pagesTheCryptoCreditReport q2 2019ForkLogNo ratings yet

- 2233 AnnualRpt PDFDocument396 pages2233 AnnualRpt PDFWilliam O OkolotuNo ratings yet

- Fast Stocks Fast Money PDFDocument433 pagesFast Stocks Fast Money PDFPrateek Dubey100% (1)

- Investment Approach Key Features & Portfolio AttributesDocument3 pagesInvestment Approach Key Features & Portfolio AttributesAkash JoshiNo ratings yet

- Zereda Poultry Farm Enterprise 2Document47 pagesZereda Poultry Farm Enterprise 2owotiajoshua7No ratings yet

- Tata MF Factsheet - February 2023Document94 pagesTata MF Factsheet - February 2023Diksha DuttaNo ratings yet

- 2016 Preqin Global Private Equity & Venture Capital: Sample PagesDocument15 pages2016 Preqin Global Private Equity & Venture Capital: Sample PagesJZNo ratings yet

- Stop Buying Mutual Funds: Easy Ways to Beat the Pros Investing On Your OwnFrom EverandStop Buying Mutual Funds: Easy Ways to Beat the Pros Investing On Your OwnNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- Hdfs Java Api On Amazon Ec2: PrerequisitesDocument18 pagesHdfs Java Api On Amazon Ec2: PrerequisitesRam GuggulNo ratings yet

- ADD Find Unsorted Array Sorted Array Linked ListDocument27 pagesADD Find Unsorted Array Sorted Array Linked ListRam GuggulNo ratings yet

- Isilon GUI AdministrationDocument434 pagesIsilon GUI AdministrationRam GuggulNo ratings yet

- Install Cloudera Manager Using AMI On Amazon EC2Document39 pagesInstall Cloudera Manager Using AMI On Amazon EC2Ram GuggulNo ratings yet

- Client-Server Based File Processing Application: The Basic Flow of The Application Is The SameDocument3 pagesClient-Server Based File Processing Application: The Basic Flow of The Application Is The SameRam GuggulNo ratings yet

- Running A Pig Program On The CDH Single Node Cluster On An Aws Ec2 InstanceDocument21 pagesRunning A Pig Program On The CDH Single Node Cluster On An Aws Ec2 InstanceRam GuggulNo ratings yet

- Pig Installation On Mac and LinuxDocument2 pagesPig Installation On Mac and LinuxRam GuggulNo ratings yet

- Downloading Pig DatasetsDocument2 pagesDownloading Pig DatasetsRam GuggulNo ratings yet

- Steps To Run A JAVA API On Virtual-BoxDocument5 pagesSteps To Run A JAVA API On Virtual-BoxRam GuggulNo ratings yet

- Multiple Storage Allocations 19 DEC 2017Document1 pageMultiple Storage Allocations 19 DEC 2017Ram GuggulNo ratings yet

- 2017 Storage Arrays Location Total Iops Iops Average Peak Iops Total Capacity (TB) Used (TB)Document24 pages2017 Storage Arrays Location Total Iops Iops Average Peak Iops Total Capacity (TB) Used (TB)Ram GuggulNo ratings yet

- Running A Mapreduce Program On Cloudera Quickstart VM: RequirementsDocument13 pagesRunning A Mapreduce Program On Cloudera Quickstart VM: RequirementsRam Guggul100% (1)

- Basic Linux CommandsDocument24 pagesBasic Linux CommandsRam GuggulNo ratings yet

- m08res01-DD BoostDocument44 pagesm08res01-DD BoostRam GuggulNo ratings yet

- VNX File Shares and Its Capacity DetailsDocument2 pagesVNX File Shares and Its Capacity DetailsRam GuggulNo ratings yet

- DB Servername VNX Project Name (EBS/RMS/APS Etc) Type (Prod or Dev/Test)Document14 pagesDB Servername VNX Project Name (EBS/RMS/APS Etc) Type (Prod or Dev/Test)Ram GuggulNo ratings yet

- NSX NAS SizeDocument9 pagesNSX NAS SizeRam GuggulNo ratings yet

- M09res01-Data SecurityDocument38 pagesM09res01-Data SecurityRam GuggulNo ratings yet

- HPUX oldVMAX InfoDocument4 pagesHPUX oldVMAX InfoRam GuggulNo ratings yet

- S.No Array Name Model Capacity in TB: Phoenix DC Storage SAN DetailsDocument2 pagesS.No Array Name Model Capacity in TB: Phoenix DC Storage SAN DetailsRam GuggulNo ratings yet

- Copying A File From Local To HDFS Using The Java APIDocument10 pagesCopying A File From Local To HDFS Using The Java APIRam GuggulNo ratings yet

- M01res01-Technology OverviewDocument46 pagesM01res01-Technology OverviewRam GuggulNo ratings yet

- Form12BB ZensarDocument2 pagesForm12BB ZensarRam GuggulNo ratings yet

- Hey G, Here Is Your Zestmoney Account Statement As On 01 September, 2019Document2 pagesHey G, Here Is Your Zestmoney Account Statement As On 01 September, 2019Ram GuggulNo ratings yet

- Display Mask Configuration Sheet: Key Mask Name RegionDocument253 pagesDisplay Mask Configuration Sheet: Key Mask Name RegionRam GuggulNo ratings yet

- Philippine Trust Company. FinalDocument3 pagesPhilippine Trust Company. FinalmaxregerNo ratings yet

- Naresh Acl2 ProjDocument86 pagesNaresh Acl2 ProjSiddhu MudigondaNo ratings yet

- Fin622 QuizDocument59 pagesFin622 Quizwqas_akramNo ratings yet

- Bryce Gilmore - Price Action Chronicles Volume 1 PDFDocument209 pagesBryce Gilmore - Price Action Chronicles Volume 1 PDFTDN100% (1)

- 1-31-12 Golden CrossDocument4 pages1-31-12 Golden CrossThe Gold Speculator100% (1)

- P&GDocument10 pagesP&GSameed RiazNo ratings yet

- BBNI Annual Report 2018 ENGDocument1,082 pagesBBNI Annual Report 2018 ENGGilang RakasiwiNo ratings yet

- Sunil Prabhakar Shcil-DepositoryDocument113 pagesSunil Prabhakar Shcil-Depositoryrahulchutia100% (1)

- IchimokuDocument5 pagesIchimokulevanbeo100% (4)

- The Complete Beginner's Guide To Technical AnalysisDocument10 pagesThe Complete Beginner's Guide To Technical AnalysisAngie LeeNo ratings yet

- BIR Ruling No. 015-12Document5 pagesBIR Ruling No. 015-12nikkaremullaNo ratings yet

- IF MCQsDocument6 pagesIF MCQsNaoman ChNo ratings yet

- Initial Public OfferDocument29 pagesInitial Public OfferAjay MadaanNo ratings yet

- Loans and AdvancesDocument9 pagesLoans and AdvancesidealworldNo ratings yet

- Chapter 4-6 - Company LawDocument73 pagesChapter 4-6 - Company LawSu Yi TanNo ratings yet

- IFRS For Small and Medium-Sized Entities (IFRS PDFDocument34 pagesIFRS For Small and Medium-Sized Entities (IFRS PDFAhmed HussainNo ratings yet

- Cost of CapitalDocument35 pagesCost of CapitalgagafikNo ratings yet

- A00093275 - 20190911 - 12345 - Retention STMTDocument1 pageA00093275 - 20190911 - 12345 - Retention STMTJohn BestNo ratings yet

- Income Tax - Capital Gain and Final TaxesDocument4 pagesIncome Tax - Capital Gain and Final TaxesAnie Martinez0% (1)

- Investor Digest: Equity Research - 28 March 2019Document9 pagesInvestor Digest: Equity Research - 28 March 2019Rising PKN STANNo ratings yet

- 116INTDocument4 pages116INTAnonymous rOv67R100% (1)

- Session 7, Reading 22 Financial Statement Analysis - An IntroductionDocument4 pagesSession 7, Reading 22 Financial Statement Analysis - An IntroductionmohamedNo ratings yet

- Cost of Capital October 2018Document13 pagesCost of Capital October 2018Beth Diaz LaurenteNo ratings yet

- HDFC Bank: Project Report OnDocument99 pagesHDFC Bank: Project Report OnSubhash SinghNo ratings yet

- Comparison of Vietnamese and International SecuritiesDocument7 pagesComparison of Vietnamese and International SecuritiesNguyen Le Minh ThuyNo ratings yet

- Designing Loss-Aware Fitness Function For GA-based Algorithmic TradingDocument8 pagesDesigning Loss-Aware Fitness Function For GA-based Algorithmic TradingabcbatataNo ratings yet

- Capital Protection On EUR/CHF Foreign Exchange RateDocument1 pageCapital Protection On EUR/CHF Foreign Exchange Rateapi-25889552No ratings yet

Individual Fund Factsheet: March 2019

Individual Fund Factsheet: March 2019

Uploaded by

Ram GuggulOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Individual Fund Factsheet: March 2019

Individual Fund Factsheet: March 2019

Uploaded by

Ram GuggulCopyright:

Available Formats

Individual Fund Factsheet

March 2019

Life Insurance

Aditya Birla Sun Life

Insurance Company Limited

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

LIFE INSURANCE

Aditya Birla Sun Life Insurance Company Limited PROTECTING INVESTING FINANCING ADVISING

Index Page No.

Market Outlook 1

Fund Management Details 3

Investment Performance 4

Liquid Plus 6

Assure Fund 7

Income Advantage Fund 8

Income Advantage Guaranteed Fund 9

Protector Fund 10

Builder Fund 11

Balancer Fund 12

Enhancer Fund 13

Creator Fund 14

Magnifier Fund 15

Maximiser Fund 16

Maximiser Guaranteed Fund 17

Super 20 Fund 18

Multiplier Fund 19

Pure Equity Fund 20

Value & Momentum Fund 21

Capped Nifty Index Fund 22

Asset Allocation Fund 23

MNC Fund 24

Platinum Plus II Fund 25

Platinum Plus III Fund 26

Platinum Plus IV Fund 27

Platinum Premier Fund 28

Platinum Advantage Fund 29

Foresight Single Pay Fund 30

Foresight 5 Pay Fund 31

Titanium I Fund 32

Titanium II Fund 33

Titanium III Fund 34

Pension Nourish Fund 35

Pension Growth Fund 36

Pension Enrich Fund 37

Annexure 38

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

Market Update

Economy Review

The key events in the month were –

Domestic Factors

a) RBI Bi-Monthly Policy: RBI in its bi-monthly policy on 4th April’19 has cut repo rate by 25bps to 6.00%. Reverse repo and

MSF cut by 25bps each to 5.75% and 6.25% respectively. RBI has maintained a ‘neutral’ stance.

b) Credit Growth: Overall bank credit growth came in at 13.2% in February’19 driven by NBFC and retail segment.

c) Trade Deficit: Trade deficit in February’19 reduced to US$9.6 bn from US$14.7 bn in January’19, best since September’17.

Exports grew 2.4% and imports contracted by 5.4% in February’19.

d) Core Industry Growth: Eight core industries output rises 2.1% in February’19 Vs 1.7% in January’19.

e) Manufacturing PMI: Manufacturing PMI moderated to 52.6 in March’19 from 54.6 in February’19.

Global Factors

a) US PMI: The ISM Manufacturing PMI in the US rose to 55.3 in March’19 vs 54.2 in February’19. Faster increases were seen

for new orders, production and employment.

b) US-China trade talks: As per the US President trade talks with China were going very well. The talks are set to resume again

in Washington led by Vice Premier Liu He.

c) China PMI: The Manufacturing Purchasing Managers Index (PMI) came in at 50.8 for March’19. Manufacturing activity in

China expanded unexpectedly in March at its fastest pace in eight months.

d) Crude Oil: Crude oil prices have risen 27% in CYTD on production cuts by OPEC and Russia as well as disruption in supplies

due to US sanctions on exports from Venezuela.

Domestic macro economic data.

On the economy front, IIP slowed down to 1.7% in January’19 vs 2.6% in December’18. This was led by slowdown in

manufacturing, electricity and capital goods, whereas construction sector witnessed strong growth.

IIP

9

8.4

8

6.9 7.0

7 6.5

6

5.3

5 4.8 4.6

4.5

4 3.8

3 2.6

2 1.7

1

0.3

0

Jan-19

Feb-18

Mar-18

Apr-18

May-18

Jun-18

Jul-18

Aug-18

Sep-18

Oct-18

Nov-18

Dec-18

Source: Tradingeconomics.com

Inflation-CPI rose to 2.6% in February’19 against downward revision of 2.0% in January’19. WPI came in at 2.9% in Febraury’19

vs 2.8% in January’19.

Inflation

6 5.7

5.3 5.1 5.3

4.9 4.9

5 4.8 4.6

4.6 4.5

4.3 4.2

4 3.7 3.7

3.6 3.5

3.4

3 2.7 2.8 2.9

2.6

2.3

2.1 2.0

2

0

Jan-19

Feb-19

Mar-18

Apr-18

May-18

Jun-18

Jul-18

Aug-18

Sep-18

Oct-18

Nov-18

Dec-18

CPI WPI

Source: Tradingeconomics.com

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

Market Update

Outlook for Equities

In March, Nifty rose 7.7% post Pulwama attack retaliation and also opinion polls indicating that BJP will retain power. On the global front,

US-China trade talks continued to show positive undertone with pick up in manufacturing activity in China. On the geo-political front

tensions reduced between India and Pakistan. Election Commission announced the polling dates for 17th Lok Sabha to be conducted in 7

phases from 11th April to 19th May with results to be announced on 23rd May. While there has been some slowdown on the consumption

front reflecting in Auto and Consumer durables sales, industrial recovery seems to be on track due to government spends in certain pockets

like roads, railways, defense, metros and affordable housing.

FIIs remained net buyers in the month of March’19. They bought around $4.8 bn in March’19 taking the YTD total to $7.1 bn. While, DIIs

remained sellers with total outflow of $2.0 bn in March’19, the YTD total standing at net outflows of $1.8 bn.

Markets currently trades at 18.7x, one-year forward earnings, slightly higher than its 10-year average as macro-economic concerns ease

with earnings growth recovery in sight. India’s economic growth is expected to remain strong with RBI reduced its growth forecast to 7.2%

for FY20 and reducing inflation target. We expect earnings growth of over 20% for FY20 driven by traction in core industries like cement,

steel, capital goods & construction along-with corporate banks. Investors in equity funds can continue to invest for long-term as corporate

earnings are expected to revive from the current levels.

BSE NSE

40000 13000

INDEX 29-Mar-19

29-Dec-17 30-Nov-17

28-Feb-19 % Change

39000 12000

38000 Nifty 11623.90 10792.50 7.70%

11000

37000 Sensex 38672.91 35867.44 7.82%

10000

36000

9000 BSE 100 11809.19 10988.69 7.47%

35000

8000 Dow Jones 25928.68 25916.00 0.05%

34000

7000

33000 Nikkei 21205.81 21385.16 -0.84%

32000 6000

Hang Seng 29051.36 28633.18 1.46%

31000 5000

Nasdaq 7729.32 7532.53 2.61%

30000 4000

Jan-19

Feb-19

Mar-19

Apr-18

May-18

Jun-18

Jul-18

Aug-18

Sep-18

Oct-18

Nov-18

Dec-18

Outlook for Debt

April marks the first MPC of the financial year which just about met the expectations of the market. Given the backdrop of softer growth

both domestically and globally room for further easing likely. Rate cuts will be data dependent but RBI has reduced inflation and growth

target for FY20.

Durable liquidity measures such as OMO are unlikely to be conducted in H1FY20 which would lead to yields initially remaining under

pressure as H1 supply hits market. RBI conducted OMO’s of Rs. 2.99 tn in FY19. Liquidity though slipped to a negative of Rs 1.50 tn in end

March, Q1FY20 is likely to see lower liquidity deficit.

Growth and inflation mix point towards lower readings in conjunction with global backdrop. Risks though remain in form of crude prices

inching higher (up 27% in CYTD) and prediction of below normal monsoon.

Yield on the 10 year Government bond, had declined to 7.35% from 7.41% in the month of March. In the near term, we expect yields to be in

the range of 7.20% to 7.50%. Corporate bond spread over G-sec is at 80bps declined from 100bps earlier with likelihood of moving

towards 65bps.

10 Yr G-Sec Yield 5 year AAA Corporate Bond Spread

9.0 210 Key Indices 29-Mar-19 28-Feb-19 % Change

8.0

180 7.35% 7.41% -0.82%

7.0 10 Year G-Sec

6.0 150

Percentage (%)

5 Year G-Sec 6.93% 7.09% -2.31%

5.0

120

bps

4.0

90 Day T Bill 6.14% 6.40% -4.23%

3.0 90

2.0

60 364 Day T-Bill 6.31% 6.51% -3.17%

1.0

0.0 30

6.24% 6.26% -0.32%

Jan-19

Feb-19

Mar-19

Apr-18

May-18

Jun-18

Jul-18

Aug-18

Sep-18

Oct-18

Nov-18

Dec-18

Call Rates

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

Fund Management Details

Debt Funds SFIN No Fund Manager

Liquid Plus ULIF02807/10/11BSLLIQPLUS109 Ms. Richa Sharma

Assure Fund ULIF01008/07/05BSLIASSURE109 Ms. Richa Sharma

Income Advantage Fund ULIF01507/08/08BSLIINCADV109 Ms. Richa Sharma

Income Advantage Guaranteed Fund ULIF03127/08/13BSLIINADGT109 Ms. Richa Sharma

Fund Manager

Balanced Funds SFIN No

Equity Debt

Protector Fund ULIF00313/03/01BSLPROTECT109 Mr. Sandeep Jain Ms. Richa Sharma

Builder Fund ULIF00113/03/01BSLBUILDER109 Mr. Sandeep Jain Ms. Richa Sharma

Balancer Fund ULIF00931/05/05BSLBALANCE109 Mr. Sandeep Jain Ms. Richa Sharma

Enhancer Fund ULIF00213/03/01BSLENHANCE109 Mr. Deven Sangoi Ms. Richa Sharma

Creator Fund ULIF00704/02/04BSLCREATOR109 Mr. Trilok Agarwal Ms. Richa Sharma

Fund Manager

Equity Funds SFIN No

Equity Debt

Magnifier Fund ULIF00826/06/04BSLIIMAGNI109 Mr. Deven Sangoi Ms. Richa Sharma

Maximiser Fund ULIF01101/06/07BSLIINMAXI109 Mr. Sameer Mistry -

Maximiser Guaranteed Fund ULIF03027/08/13BSLIMAXGT109 Mr. Sameer Mistry -

Super 20 Fund ULIF01723/06/09BSLSUPER20109 Mr. Sameer Mistry -

Multiplier Fund ULIF01217/10/07BSLINMULTI109 Mr. Bhaumik Bhatia -

Pure Equity Fund ULIF02707/10/11BSLIPUREEQ109 Mr. Trilok Agarwal -

Value & Momentum Fund ULIF02907/10/11BSLIVALUEM109 Mr. Sandeep Jain -

Capped Nifty Index Fund ULIF03530/10/14BSLICNFIDX109 Mr. Deven Sangoi -

MNC Fund ULIF03722/06/18ABSLIMUMNC109 Mr. Trilok Agarwal Ms. Richa Sharma

Fund Manager

Asset allocation Fund SFIN No

Equity Debt

Asset Allocation Fund ULIF03430/10/14BSLIASTALC109 Mr. Trilok Agarwal Ms. Richa Sharma

Fund Manager

Pension Funds SFIN No

Equity Debt

Pension Nourish Fund ULIF00604/03/03BSLNOURISH109 Mr. Sandeep Jain Ms. Richa Sharma

Pension Growth Fund ULIF00504/03/03BSLIGROWTH109 Mr. Deven Sangoi Ms. Richa Sharma

Pension Enrich Fund ULIF00404/03/03BSLIENRICH109 Mr. Trilok Agarwal Ms. Richa Sharma

Fund Manager

Guaranteed NAV Funds SFIN No

Equity Debt

Platinum Plus II Fund ULIF01425/02/08BSLIIPLAT2109 Mr. Deven Sangoi Ms. Richa Sharma

Platinum Plus III Fund ULIF01628/04/09BSLIIPLAT3109 Mr. Deven Sangoi Ms. Richa Sharma

Platinum Plus IV Fund ULIF01816/09/09BSLIIPLAT4109 Mr. Deven Sangoi Ms. Richa Sharma

Platinum Premier Fund ULIF02203/02/10BSLPLATPR1109 Mr. Deven Sangoi Ms. Richa Sharma

Platinum Advantage Fund ULIF02408/09/10BSLPLATADV109 Mr. Deven Sangoi Ms. Richa Sharma

Foresight Single Pay Fund ULIF02610/02/11BSLFSITSP1109 Mr. Deven Sangoi Ms. Richa Sharma

Foresight 5 Pay Fund ULIF02510/02/11BSLFSIT5P1109 Mr. Deven Sangoi Ms. Richa Sharma

Titanium I Fund ULIF01911/12/09BSLITITAN1109 Mr. Deven Sangoi Ms. Richa Sharma

Titanium II Fund ULIF02011/12/09BSLITITAN2109 Mr. Deven Sangoi Ms. Richa Sharma

Titanium III Fund ULIF02111/12/09BSLITITAN3109 Mr. Deven Sangoi Ms. Richa Sharma

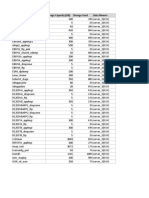

No. of Funds Managed

Fund Manager

Debt Fund Balanced Fund Equity Fund Asset allocation fund Guaranteed NAV Fund Pension Fund

Mr. Deven Sangoi - 1 2 - 10 1

Mr. Sameer Mistry - - 3 - - -

Mr. Trilok Agarwal - 1 2 1 - 1

Mr. Sandeep Jain - 3 1 - - 1

Mr. Bhaumik Bhatia - - 1 - - -

Ms. Richa Sharma 4 5 2 1 10 3

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

Performance at a glance as on 31st March 2019

Individual Funds Figures in percentage (%)

Income

Returns Period Liquid Plus BM Assure BM Income BM BM Protector BM

Advantage

Advantage

Guarantee

1 month 0.68 0.58 1.19 1.18 2.07 1.43 1.97 1.40 2.21 2.11

Absolute 3 months 1.83 1.57 2.44 2.21 2.36 1.64 2.47 1.56 2.73 2.05

6 months 3.74 3.25 5.29 4.96 7.54 5.62 7.29 5.43 7.28 5.87

1 Year 7.11 6.43 7.83 6.35 7.98 5.71 7.62 5.34 7.78 6.27

2 Years 6.70 6.04 7.14 5.67 6.53 5.00 6.17 4.63 6.62 5.48

3 Years 6.91 6.00 7.44 6.40 7.74 6.33 7.23 5.96 8.28 7.12

CAGR

4 Years 7.06 6.21 7.56 6.61 7.48 6.49 7.15 6.12 7.53 6.68

5 Years 7.32 6.52 7.89 7.10 8.88 7.61 8.43 7.23 9.30 8.01

Since Inception 7.51 6.97 8.79 6.94 9.72 7.30 8.49 7.32 8.46 7.40

Returns Period Builder BM Balancer BM Enhancer BM Creator BM Magnifier BM

1 month 2.91 2.68 3.08 2.94 3.89 3.23 4.68 4.37 6.79 6.31

3 months 3.17 2.44 3.08 2.56 3.25 2.76 4.03 3.53 4.85 4.84

Absolute

6 months 7.00 5.81 7.72 5.64 6.36 5.60 6.78 5.46 4.44 4.93

1 Year 8.35 6.90 9.06 6.90 7.34 7.21 9.61 8.38 7.90 10.17

2 Years 7.24 6.08 7.94 6.08 6.91 6.37 8.71 7.50 10.03 9.31

3 Years 9.47 7.86 9.59 7.92 9.20 8.29 11.87 9.70 13.95 11.90

CAGR

4 Years 8.26 6.83 8.21 6.59 7.45 6.65 8.30 6.84 8.38 6.72

5 Years 10.43 8.38 10.47 8.26 9.57 8.43 11.55 9.08 12.54 9.74

Since Inception 10.14 8.26 9.94 7.91 10.91 9.12 11.97 9.29 12.86 12.09

Capped

Returns Period Maximiser BM Maximiser Super 20 BM Multiplier BM Pure Value BM Nifty Asset

MNC

Guarantee Equity Momentum Index Allocation

1 month 7.65 6.65 7.63 7.78 6.97 9.16 8.20 6.50 8.03 6.65 6.55 3.16 1.59

Absolute 3 months 5.55 5.03 4.67 6.48 6.30 4.50 1.78 3.21 3.81 5.03 5.63 2.94 -

6 months 6.50 5.02 4.68 6.00 5.70 7.79 5.42 4.02 1.38 5.02 3.59 7.11 -

1 Year 9.59 10.37 9.57 16.34 14.65 -2.07 -2.93 3.18 -8.99 10.36 12.71 7.99 -

2 Years 11.08 9.49 10.26 12.60 11.91 8.66 2.06 8.30 -2.56 9.49 11.08 9.19 -

3 Years 15.30 12.25 13.26 15.16 12.67 18.00 10.62 14.12 11.48 12.25 13.48 12.86 -

CAGR

4 Years 8.02 6.61 7.82 8.63 6.80 12.92 7.24 9.52 6.63 6.60 - - -

5 Years 13.12 9.95 11.46 12.10 9.58 20.15 13.76 16.59 12.62 9.95 - - -

Since Inception 9.76 7.63 12.17 11.88 9.11 11.82 6.77 16.22 11.52 10.38 10.83 11.44 18.65

Benchmark Composition

Fund Name SFIN

Weightage Index Weightage Index Weightage Index

Liquid Plus - - - - 100% Crisil Liquid Fund Index ULIF02807/10/11BSLLIQPLUS109

Assure - - 100% Crisil Short Term Bond Fund Index - - ULIF01008/07/05BSLIASSURE109

Income Advantage - - 80% Crisil Composite Bond Fund Index 20% Crisil Liquid Fund Index ULIF01507/08/08BSLIINCADV109

Income Advantage Guaranteed - - 80% Crisil Composite Bond Fund Index 20% Crisil Liquid Fund Index ULIF03127/08/13BSLIINADGT109

Protector 10% BSE 100 80% Crisil Composite Bond Fund Index 10% Crisil Liquid Fund Index ULIF00313/03/01BSLPROTECT109

Builder 20% BSE 100 70% Crisil Composite Bond Fund Index 10% Crisil Liquid Fund Index ULIF00113/03/01BSLBUILDER109

Balancer 25% BSE 100 65% Crisil Composite Bond Fund Index 10% Crisil Liquid Fund Index ULIF00931/05/05BSLBALANCE109

Enhancer 30% BSE 100 60% Crisil Composite Bond Fund Index 10% Crisil Liquid Fund Index ULIF00213/03/01BSLENHANCE109

Creator 50% BSE 100 40% Crisil Composite Bond Fund Index 10% Crisil Liquid Fund Index ULIF00704/02/04BSLCREATOR109

Magnifier 85% BSE 100 - - 15% Crisil Liquid Fund Index ULIF00826/06/04BSLIIMAGNI109

Maximiser 90% BSE 100 - - 10% Crisil Liquid Fund Index ULIF01101/06/07BSLIINMAXI109

Maximiser Guaranteed - - - - - - ULIF03027/08/13BSLIMAXGT109

Super 20 90% BSE Sensex - - 10% Crisil Liquid Fund Index ULIF01723/06/09BSLSUPER20109

Multiplier 90% Nifty Midcap 100 - - 10% Crisil Liquid Fund Index ULIF01217/10/07BSLINMULTI109

Pure Equity - - - - - - ULIF02707/10/11BSLIPUREEQ109

Value & Momentum 90% BSE 100 - - 10% Crisil Liquid Fund Index ULIF02907/10/11BSLIVALUEM109

Asset Allocation - - - - - - ULIF03430/10/14BSLIASTALC109

MNC - - - - - - ULIF03722/06/18ABSLIMUMNC109

Capped Nifty Index - - - - - - ULIF03530/10/14BSLICNFIDX109

Disclaimer:

This document is issued by ABSLI. While all reasonable care has been taken in preparing this document, no responsibility or liability is accepted for errors of fact or for any opinion expressed herein. This document is

for information purposes only. It does not constitute any offer, recommendation or solicitation to any person to enter into any transaction or adopt any investment strategy, nor does it constitute any prediction of

likely future movements in NAVs. Past performance is not necessarily indicative of future performance. We have reviewed the report, and in so far as it includes current or historical information, it is believed to be

reliable though its accuracy or completeness cannot be guaranteed. Neither Aditya Birla Sun Life Insurance Company Limited, nor any person connected with it, accepts any liability arising from the use of this

document. You are advised to make your own independent judgment with respect to any matter contained herein. The investment risk in investment portfolio is borne by the policyholder. The name of the funds do

not in any way indicate their quality, future prospects or returns. The premium paid in unit linked life insurance policies are subject to investment risk associated with capital markets and the unit price of the units

may go up or down based on the performance of investment fund and factors influencing the capital market and the policyholder is responsible for his/her decisions Insurance is the subject matter of solicitation.

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS/FRAUDULENT OFFERS: IRDA clarifies to public that IRDA or its officials do not involve inactivities like sale of any kind of insurance or financial

products nor invest premiums. IRDA does not announce any bonus. Public receiving such phone calls are requested to lodge a police complaint along with details of phone call, number.

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

Performance at a glance as on 31st March 2019

Guaranteed NAV Funds Figures in percentage (%)

Returns Period Platinum

Platinum Plus II Platinum Plus III Platinum Plus IV Platinum Premier

Advantage

1 month 0.39 0.49 1.31 1.64 2.50

Absolute 3 months 1.20 1.46 1.94 1.82 2.99

6 months -0.99 0.13 1.11 1.85 3.79

1 Year 4.09 4.93 5.71 5.75 7.17

2 Years 5.31 5.77 6.15 6.11 6.95

3 Years 7.24 7.69 8.05 8.06 8.80

CAGR

4 Years 5.09 5.23 5.29 4.94 5.30

5 Years 8.96 9.14 9.35 9.30 9.97

Since Inception 10.76 8.72 7.83 8.11 7.37

Returns Period Foresight - Foresight -

Titanium I Titanium II Titanium III

Single Pay 5 Pay

1 month 2.77 3.05 2.01 2.91 3.77

Absolute 3 months 3.18 3.30 2.38 2.72 3.51

6 months 4.80 4.78 1.59 1.89 2.33

1 Year 7.83 7.52 7.06 7.23 8.42

2 Years 7.58 7.00 6.93 6.95 7.90

3 Years 9.75 8.88 8.74 8.83 9.74

CAGR

4 Years 5.71 5.96 5.94 5.75 6.53

5 Years 9.71 9.12 10.11 9.97 9.96

Since Inception 8.71 7.47 8.40 8.31 7.48

Pension Funds Figures in percentage (%)

Returns Period Pension - Nourish BM Pension - Growth BM Pension - Enrich BM

1 month 2.29 2.11 2.86 2.68 3.81 3.51

Absolute 3 months 2.82 2.05 2.94 2.44 3.46 2.95

6 months 6.98 5.87 6.65 5.81 6.82 5.57

1 Year 7.98 6.27 8.55 6.90 8.50 7.51

2 Years 6.77 5.48 8.02 6.08 7.69 6.66

3 Years 8.27 7.12 10.02 7.86 10.76 8.64

CAGR

4 Years 7.68 6.68 8.60 6.83 8.58 6.71

5 Years 9.45 8.01 10.52 8.38 11.34 8.60

Since Inception 8.33 7.35 10.12 8.40 11.37 9.71

Benchmark Composition

Fund Name SFIN

Weightage Index Weightage Index Weightage Index

Platinum Plus II - - - - - - ULIF01425/02/08BSLIIPLAT2109

Platinum Plus III - - - - - - ULIF01628/04/09BSLIIPLAT3109

Platinum Plus IV - - - - - - ULIF01816/09/09BSLIIPLAT4109

Platinum Premier - - - - - - ULIF02203/02/10BSLPLATPR1109

Platinum Advantage - - - - - - ULIF02408/09/10BSLPLATADV109

Foresight - Single Pay - - - - - - ULIF02610/02/11BSLFSITSP1109

Foresight - 5 Pay - - - - - - ULIF02510/02/11BSLFSIT5P1109

Titanium I - - - - - - ULIF01911/12/09BSLITITAN1109

Titanium II - - - - - - ULIF02011/12/09BSLITITAN2109

Titanium III - - - - - - ULIF02111/12/09BSLITITAN3109

Pension Nourish 10% BSE 100 80% Crisil Composite Bond Fund Index 10% Crisil Liquid Fund Index ULIF00604/03/03BSLNOURISH109

Pension Growth 20% BSE 100 70% Crisil Composite Bond Fund Index 10% Crisil Liquid Fund Index ULIF00504/03/03BSLIGROWTH109

Pension Enrich 35% BSE 100 55% Crisil Composite Bond Fund Index 10% Crisil Liquid Fund Index ULIF00404/03/03BSLIENRICH109

Disclaimer:

This document is issued by ABSLI. While all reasonable care has been taken in preparing this document, no responsibility or liability is accepted for errors of fact or for any opinion expressed herein. This document is

for information purposes only. It does not constitute any offer, recommendation or solicitation to any person to enter into any transaction or adopt any investment strategy, nor does it constitute any prediction of

likely future movements in NAVs. Past performance is not necessarily indicative of future performance. We have reviewed the report, and in so far as it includes current or historical information, it is believed to be

reliable though its accuracy or completeness cannot be guaranteed. Neither Aditya Birla Sun Life Insurance Company Limited, nor any person connected with it, accepts any liability arising from the use of this

document. You are advised to make your own independent judgment with respect to any matter contained herein. The investment risk in investment portfolio is borne by the policyholder. The name of the funds do

not in any way indicate their quality, future prospects or returns. The premium paid in unit linked life insurance policies are subject to investment risk associated with capital markets and the unit price of the units

may go up or down based on the performance of investment fund and factors influencing the capital market and the policyholder is responsible for his/her decisions Insurance is the subject matter of solicitation.

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS/FRAUDULENT OFFERS: IRDA clarifies to public that IRDA or its officials do not involve inactivities like sale of any kind of insurance or financial

products nor invest premiums. IRDA does not announce any bonus. Public receiving such phone calls are requested to lodge a police complaint along with details of phone call, number.

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

Liquid Plus SFIN No.ULIF02807/10/11BSLLIQPLUS109

About The Fund Date of Inception: 09-Mar-12

OBJECTIVE: To provide superior risk-adjusted returns with low volatility at a high level of safety and liquidity through investments in high quality short

term fixed income instruments – upto one year maturity.

STRATEGY: Fund will invest in high quality short-term fixed income instruments – upto one year maturity. The endeavour will be to optimize returns

while providing liquidity and safety with very low risk profile.

NAV as on 31st March 2019: `16.6747 BENCHMARK: Crisil Liquid Fund Index

Asset held as on 31st March 2019: ` 284.79 Cr FUND MANAGER: Ms. Richa Sharma

Asset Allocation Rating Profile

Liquid Plus BM

MMI, Deposits, G-Secs

CBLO & Others AA- Sovereign

0.85% 0.95%

27.32% 9.66%

A1+

NCD 18.37%

71.83% AAA

71.02%

Mar-15

Jun-15

Sep-15

Dec-15

Mar-19

Mar-17

Jun-17

Sep-17

Dec-17

Mar-18

Mar-16

Jun-18

Sep-18

Dec-18

Jun-16

Sep-16

Dec-16

SECURITIES Holding AUM (in Cr.)

GOVERNMENT SECURITIES 0.85%

364 Days Tbill (MD 10/10/2019) 0.85%

CORPORATE DEBT 71.83% Debt

284.79 (100%)

8.90% Steel Authority Of India (MD 01/05/2019)

Call FR 01/05 7.05%

8.12% ONGC Mangalore Petrochemicals Limited

NCD (MD 10/06/2019) 6.18% Maturity (in years) 0.42

8.50% Nuclear Power Corpn NCD (MD 16/11/2019) 6.02%

7.65% IRFC NCD (MD 30/07/2019) 4.56% Yield to Maturity 7.85%

7.85% NABARD NCD (MD 31/05/2019) 4.56%

9.30% Power Grid Corp (04/09/19) 3.88% Modified Duration 0.17

8.7110% HDB Financial Services Limited NCD

(MD 18/02/2021) 3.58% Maturity Profile

8.35% LIC Housing Finance Ltd.NCD (MD 18/10/2019)

NCD TR 272 3.53% 100.00 %

7.85% Power Finance Corporation Ltd NCD (MD 15/04/2019) 3.51%

7.57% Ultratech Cement Ltd NCD (MD 13/08/2019) 3.51%

Other Corporate Debt 25.46%

MMI, Deposits, CBLO & Others 27.32%

Less than 2 years

Fund Update:

The average maturity of the fund has slightly increased at 0.42 years from

0.38 years on a MOM basis.

Liquid plus fund continues to be predominantly invested in highest rated

fixed income instruments.

Refer annexure for complete portfolio details.

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

Assure Fund SFIN No.ULIF01008/07/05BSLIASSURE109

About The Fund Date of Inception: 12-Sep-05

OBJECTIVE: To provide capital conservation at a high level of safety and liquidity through judicious investments in high quality short-term debt.

STRATEGY: To generate better return with low level of risk through investment into fixed interest securities having short-term maturity profile.

NAV as on 31st March 2019: ` 31.3217 BENCHMARK: Crisil Short Term Bond Fund Index

Asset held as on 31st March 2019: ` 189.51 Cr FUND MANAGER: Ms. Richa Sharma

Asset Allocation Rating Profile

Assure BM

MMI, Deposits, G-Secs A+

Sovereign 2.95% AA+

CBLO & Others 4.24% 4.66% 1.74%

22.30%

AA-

8.63%

AA

9.10%

NCD AAA

73.46% A1+

14.58% 58.35%

Mar-13

Sep-13

Mar-15

Sep-15

Mar-12

Sep-12

Mar-19

Mar-17

Sep-17

Sep-18

Mar-16

Sep-16

Mar-18

Mar-14

Sep-14

SECURITIES Holding AUM (in Cr.)

GOVERNMENT SECURITIES 4.24%

364 Days TBill (MD 20/09/2019) 2.56%

9.23% State Developement -Gujrat 2022 (MD 30/03/2022) 1.03%

9.14% State Developement -Andhra Pradesh 2022 Debt

189.51 ( 100%)

(MD 25/04/2022) 0.65%

CORPORATE DEBT 73.46%

8.90% Steel Authority Of India (MD 01/05/2019) Maturity (in years) 1.61

Call FR 01/05 5.01%

7.90% Nirma Ltd NCD SR III (MD 28/02/2020) 4.22%

Yield to Maturity 7.77%

8.12% ONGC Mangalore Petrochemicals Ltd

NCD (MD 10/06/2019) 3.69%

Modified Duration 1.26

HDB Financial Services Ltd SRS 124 ZCB MD 29/10/2021 2.87%

10.90% AU Small Finance Bank Ltd NCD (MD 30/05/2025) 2.84% Maturity Profile

9.10% Fullerton India Credit Co.Ltd.NCD (15/12/2021)

S-68 Opt-II 2.73%

8.60% ONGC Petro Additions Ltd NCD (MD 11/03/2022) 2.71% 66.94%

8.25% Indian Railway Fin Corp NCD (MD 28/02/2024) 2.69%

9.75% U.P.Power Corp Series B (MD 20/10/20) 2.69% 33.06%

8.30% GAIL (India) Ltd. NCD 2015-SRS-1(A) (MD 23/02/20) 2.68%

Other Corporate Debt 41.33%

MMI, Deposits, CBLO & Others 22.30% Less than 2 years 2 to 7 years

Fund Update:

The average maturity of the fund has slightly decreased to 1.61 years from

1.76 years on a MOM basis.

Assure fund continues to be predominantly invested in highest rated fixed

income instruments.

Refer annexure for complete portfolio details.

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

Income Advantage Fund SFIN No.ULIF01507/08/08BSLIINCADV109

About The Fund Date of Inception: 22-Aug-08

OBJECTIVE: To provide capital preservation and regular income, at a high level of safety over a medium term horizon by investing in high quality debt

instruments.

STRATEGY: To actively manage the fund by building a portfolio of fixed income instruments with medium term duration. The fund will invest in

government securities, high rated corporate bonds, high quality money market instruments and other fixed income securities. The quality of the assets

purchased would aim to minimize the credit risk and liquidity risk of the portfolio. The fund will maintain reasonable level of liquidity.

NAV as on 31st March 2019: ` 26.7642 BENCHMARK: Crisil Composite Bond Fund Index & Crisil Liquid Fund Index

Asset held as on 31st March 2019: ` 663.55 Cr FUND MANAGER: Ms. Richa Sharma

Income Advantage BM Asset Allocation Rating Profile

MMI, Deposits,

CBLO & Others A+ AA+

5.39% AA- 1.65% 1.27%

7.00%

AA

9.32%

NCD

57.64% AAA

41.69%

G-Secs Sovereign

36.97% 39.07%

Mar-13

Sep-13

Mar-15

Sep-15

Mar-12

Sep-12

Mar-19

Mar-17

Sep-17

Sep-18

Mar-16

Sep-16

Mar-18

Mar-14

Sep-14

SECURITIES Holding

AUM (in Cr.)

GOVERNMENT SECURITIES 36.97%

7.95% GOI 2032 (28/08/2032) 6.97%

7.61% GOI 2030 (MD 09/05/2030) 5.30%

7.88% GOI 2030 (MD 19/03/2030) 3.86%

8.15% State Developement Loan-Tamilnadu 2028 Debt

(MD 09/05/2028) 3.79% 663.55 ( 100%)

6.79% GOI 2027 (MD 15/05/2027) 3.62%

364 Days TBill (MD 20/09/2019) 3.22%

8.19% Karnataka SDL (23/01/2029) 1.73% Maturity (in years) 7.09

8.24% GOI 2033 (MD 10/11/2033) 1.73%

7.59% GOI 2029 (MD 20/03/2029) 1.51% Yield to Maturity 7.88%

7.17% GOI 2028 (MD 08/01/2028) 1.48%

Modified Duration 4.73

Other Government Securities 3.75%

CORPORATE DEBT 57.64% Maturity Profile

9.05% Reliance Industries Ltd NCD (MD 17/10/2028) 6.35%

2% Tata Steel Ltd NCD (MD 23/04/2022) 4.30% 56.80%

9.05 HDFC Ltd. NCD Series U-001 (MD 16/10/2028) 3.97%

8.45% IRFC NCD (MD 04/12/2028) 3.82%

23.23%

8.30% NTPC Ltd NCD (MD 15/01/2029) Series 67 3.79% 19.97%

LIC Housing Finance Ltd. ZCB Opt-1 (MD 25/03/2021) 3.15%

HDFC Ltd. ZCB (MD 10/05/2021)Series P-010 2.90%

Less than 2 years 2 to 7 years 7 years & above

10.90% AU Small Finance Bank Ltd NCD (MD 30/05/2025) 2.43%

LIC Housing Finance Ltd. TR 363 ZCB (MD 25/02/2020) 2.37% Fund Update:

8.05% NTPC Ltd NCD (MD 05/05/2026)-Series 60 2.24% Exposure to G-secs has slightly increased to 36.97% from 36.16% and MMI

Other Corporate Debt 22.34% has slightly increased to 5.39% from 5.06% on a MOM basis.

Income Advantage fund continues to be predominantly invested in highest

MMI, Deposits, CBLO & Others 5.39% rated fixed income instruments.

Refer annexure for complete portfolio details.

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

Income Advantage Guaranteed Fund SFIN No.ULIF03127/08/13BSLIINADGT109

About The Fund Date of Inception: 01-Jan-14

OBJECTIVE: To provide capital preservation and regular income, at a high level of safety over a medium term horizon by investing in high quality debt

instruments.

STRATEGY: To actively manage the fund by building a portfolio of fixed income instruments with medium term duration. The fund will invest in

government securities, high rated corporate bonds, high quality money market instruments and other fixed income securities. The quality of the assets

purchased would aim to minimize the credit risk and liquidity risk of the portfolio. The fund will maintain reasonable level of liquidity.

NAV as on 31st March 2019: ` 15.3320 BENCHMARK: Crisil Composite Bond Fund Index & Crisil Liquid Fund Index

Asset held as on 31st March 2019: ` 160.43 Cr FUND MANAGER: Ms. Richa Sharma

Income Advantage Guranteed BM

Asset Allocation Rating Profile

MMI, Deposits,

CBLO & Others AA- AA+

2.54% 3.44% 1.28%

AA Sovereign

15.56%

40.63%

NCD

57.88%

Mar-15

Sep-15

Mar-19

Mar-17

Sep-17

Mar-18

Sep-18

Mar-16

Sep-16

G-Secs AAA

39.58% 39.10%

SECURITIES Holding

GOVERNMENT SECURITIES 39.58% AUM (in Cr.)

7.35% GOI (MD 22/06/2024) 6.33%

7.59% GOI 2029 (MD 20/03/2029) 5.94%

8.17% GOI 2044 (MD 01/12/2044) 3.50%

8.35% State Developement -Gujrat 2029 (MD 06/03/2029) 3.18%

7.59% GOI 2026 (MD 11/01/2026) 3.16% Debt

7.61% GOI 2030 (MD 09/05/2030) 3.13% 160.43 (100%)

8.83% GOI 2041 (MD 12/12/2041) 2.81%

7.95% GOI 2032 (28/08/2032) 2.56%

8.13% GOI 2045 (MD 22/06/2045) 1.98% Maturity (in years)

8.24% GOI 2033 (MD 10/11/2033) 1.90%

7.99

Other Government Securities 5.07%

Yield to Maturity 7.79%

CORPORATE DEBT 57.88%

7.50% Tata Motors Ltd NCD (MD 22/06/2022) 6.12% Modified Duration 4.91

2% Tata Steel Ltd NCD (MD 23/04/2022) 5.73%

8.51% NABARD NCD (MD 19/12/2033) Series LTIF 3C 3.82% Maturity Profile

10.90% AU Small Finance Bank Ltd NCD (MD 30/05/2025) 3.35%

9.475% Aditya Birla Finance Ltd NCD G-8 (MD 18/03/2022) 3.27% 48.47%

8.29% MTNL NCD (MD 28/11/2024) Series IV-D 2014 3.15% 40.34%

7.89% Can Fin Homes Ltd. NCD MD (18/05/2022) Series 6 3.14%

8.12% Export Import Bank Of India NCD 11.19%

(MD 25/04/2031) SR-T02 3.09%

8.14% Nuclear Power Corpn Of India Ltd

(MD 25/03/2026) SR-X 2.50%

Less than 2 years 2 to 7 years 7 years & above

8.72% Kotak Mahindra Bank Ltd NCD (MD 14/01/2022) 1.92%

Other Corporate Debt 21.79% Fund Update:

MMI, Deposits, CBLO & Others Exposure to G-secs has increased to 39.58% from 32.14% and MMI has

2.54% decreased to 2.54% from 7.31% on a MOM basis.

Income Advantage Guaranteed fund continues to be predominantly

invested in highest rated fixed income instruments.

Refer annexure for complete portfolio details.

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

Protector Fund SFIN No.ULIF00313/03/01BSLPROTECT109

About The Fund Date of Inception: 22-Mar-01

OBJECTIVE: To generate consistent returns through active management of a fixed income portfolio and focus on creating a long-term equity portfolio,

which will enhance the yield of the composite portfolio with minimum risk appetite.

STRATEGY: To invest in fixed income securities with marginal exposure to equity up to 10% at low level of risk. This investment fund is suitable for those

who want to preserve their capital and earn steady return on investment through higher exposure to debt securities.

NAV as on 31st March 2019: ` 43.2821 BENCHMARK: BSE 100, Crisil Composite Bond Fund Index & Crisil Liquid Fund Index

Asset held as on 31st March 2019: ` 345.37 Cr FUND MANAGER: Mr. Sandeep Jain (Equity), Ms. Richa Sharma (Debt)

AUM (in Cr.) Asset Allocation Rating Profile

Protector BM

Equity MMI, Deposits, AA+

34.35 (10% ) Equity CBLO & Others AA 1.01%

9.95% 3.66% 13.85%

Sovereign

44.32%

NCD

47.03%

AAA

Debt G-Secs

39.36% 40.82%

311.02 ( 90%)

Mar-13

Sep-13

Mar-15

Sep-15

Mar-12

Sep-12

Mar-19

Mar-17

Sep-17

Mar-16

Sep-16

Mar-18

Sep-18

Mar-14

Sep-14

SECURITIES Holding Sectoral Allocation

GOVERNMENT SECURITIES 39.36%

BANKING 30.12%

7.88% GOI 2030 (MD 19/03/2030) 10.38%

7.59% GOI 2029 (MD 20/03/2029) 5.80% SOFTWARE / IT 12.97%

9.23% GOI 2043 (MD 23/12/2043) 3.23%

7.59% GOI 2026 (MD 11/01/2026) 2.94% OIL AND GAS 10.16%

8.28% GOI 2027 (MD 21/09/2027) 2.28%

8.24% GOI (MD 15/02/2027) 2.21% FINANCIAL SERVICES 9.98%

8.33% GOI 2026 (MD 09/07/2026) 1.98%

8.30% GOI 2042 (MD 31/12/2042) 1.55% FMCG 8.54%

8.60% GOI 2028 (MD 02/06/2028) 1.55%

7.50% GOI 2034 (10/08/2034) 1.45% AUTOMOBILE 3.98%

Other Government Securities 6.00%

RETAILING 3.87%

CORPORATE DEBT 47.03%

PHARMACEUTICALS 3.27%

2% Tata Steel Ltd NCD (MD 23/04/2022) 4.37%

9.57% IRFC NCD (MD 31/05/2021) 3.02% MANUFACTURING 2.88%

9.55% Hindalco Industries Ltd. NCD (MD 25/04/2022) 3.00%

Housing Developement Finance Corp ZCB SR-Q 013 CAPITAL GOODS 2.85%

(MD 09/03/2020) 2.73%

8.51% India Infradebt Ltd NCD (MD 10/05/2021) SR I 2.07% OTHERS 11.38%

7.99% Tata Motors Fin Ltd NCD. Zero Coupon

(7.99% XIRR) NCD 1.68%

9.25% Power Grid Corporation Ltd NCD (MD 09/03/2027) 1.53% Maturity (in years) 6.91

9.61% Power Finance Corporation Ltd (MD 29/06/2021) 1.50%

8.88% Export Import Bank Of India NCD (MD 18/10/2022) 1.50% Yield to Maturity 7.65%

9.40% REC. Ltd. NCD (MD 17/07/2021) 1.50%

Other Corporate Debt 24.13% Modified Duration 4.42

EQUITY 9.95% Maturity Profile

HDFC Bank Limited 1.03%

Reliance Industries Limited 0.92% 44.23%

37.01%

ICICI Bank Limited 0.59%

Housing Development Finance Corporation 0.58%

Infosys Limited 0.56% 18.76%

Tata Consultancy Services Limited 0.44%

ITC Limited 0.39%

Bandhan Bank Ltd 0.35%

Larsen & Toubro Limited 0.28% Less than 2 years 2 to 7 years 7 years & above

Axis Bank Limited 0.26% Fund Update:

Other Equity 4.54% Exposure to G-secs has slightly decreased to 39.36% from 39.53% and MMI

MMI, Deposits, CBLO & Others 3.66% has slightly decreased to 3.66% from 3.89% on a MOM basis.

Protector fund continues to be predominantly invested in highest rated fixed

Refer annexure for complete portfolio details. income instruments.

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

Builder Fund SFIN No.ULIF00113/03/01BSLBUILDER109

About The Fund Date of Inception: 22-Mar-01

OBJECTIVE: To build your capital and generate better returns at moderate level of risk, over a medium or long-term period through a balance of

investment in equity and debt.

STRATEGY: To generate better return with moderate level of risk through active management of fixed income portfolio and focus on creating long term

equity portfolio, which will enhance yield of composite portfolio with low level of risk appetite.

NAV as on 31st March 2019: ` 57.0378 BENCHMARK: BSE 100, Crisil Composite Bond Fund Index & Crisil Liquid Fund Index

Asset held as on 31st March 2019: ` 269.19 Cr FUND MANAGER: Mr. Sandeep Jain (Equity), Ms. Richa Sharma (Debt)

AUM (in Cr.) Asset Allocation Rating

Rating Profile

Builder BM MMI, Deposits, AA-

Equity CBLO & Others AA+

52.87 (20 %) AA 1.51% 0.97%

Equity 4.03% 5.53%

19.64% AAA

47.96%

NCD

G-Secs 42.72%

Sovereign

Debt 33.60% 44.03%

216.31 ( 80 %)

Mar-13

Sep-13

Mar-15

Sep-15

Mar-12

Sep-12

Mar-19

Mar-17

Sep-17

Mar-16

Sep-16

Mar-18

Sep-18

Mar-14

Sep-14

SECURITIES Holding Sectoral Allocation

GOVERNMENT SECURITIES 33.60%

BANKING 30.75%

8.28% GOI 2027 (MD 21/09/2027) 6.33%

6.97% GOI 2026 (MD 06/09/2026) 5.09% SOFTWARE / IT 12.40%

8.17% GOI 2044 (MD 01/12/2044) 3.94%

7.88% GOI 2030 (MD 19/03/2030) 3.80% OIL AND GAS 10.14%

8.24% GOI (MD 15/02/2027) 3.10%

8.32% GOI (MD 02/08/2032) 3.05% FINANCIAL SERVICES 9.95%

7.59% GOI 2026 (MD 11/01/2026) 2.64% FMCG 9.20%

8.24% GOI 2033 (MD 10/11/2033) 1.96%

8.30% GOI 2040 (MD 02/07/2040) 1.38% AUTOMOBILE 4.36%

7.95% GOI 2032 (28/08/2032) 1.24%

Other Government Securities 1.07% RETAILING 3.25%

CORPORATE DEBT 42.72% PHARMACEUTICALS 3.22%

Housing Developement Finance Corp ZCB SR-Q 013

MANUFACTURING 2.80%

(MD09/03/2020) 4.38%

9.25% Power Grid Corporation Ltd NCD (MD 09/03/2027) 3.14% CAPITAL GOODS 2.62%

9.475% Aditya Birla Finance Ltd NCD G-8 (MD 18/03/2022) 3.11%

7.99% Tata Motors Fin Ltd NCD. Zero Coupon OTHERS 11.30%

(7.99% XIRR) NCD 2.15%

8.50% IRFC NCD (MD 22/06/2020) 1.99%

8.85% Axis Bank NCD (MD 05/12/2024) 1.91%

8.50% NHPC Ltd NCD SR-T STRRP D (MD 14/07/2022) 1.90% Maturity (in years) 7.14

8.65% India Infradebt Ltd NCD (MD 21/08/2020) 1.88%

8.29% MTNL NCD (MD 28/11/2024) Series IV-D 2014 1.88%

8.042% Bajaj Finance Ltd NCD (Option I) (MD 10/05/2021) 1.87% Yield to Maturity 7.67%

Other Corporate Debt 18.49%

Modified Duration 4.53

EQUITY 19.64%

HDFC Bank Limited 2.03% Maturity Profile

Reliance Industries Limited 1.82% 47.61%

ICICI Bank Limited 1.20%

Housing Development Finance Corporation 1.14% 27.10%

Infosys Limited 1.06% 25.29%

ITC Limited 0.90%

Tata Consultancy Services Limited 0.87%

Bandhan Bank Ltd 0.70%

Kotak Mahindra Bank Limited 0.58% Less than 2 years 2 to 7 years 7 years & above

Larsen & Toubro Limited 0.52% Fund Update:

Other Equity 8.84% Exposure to NCD has slightly increased to 42.72% from 42.36% and MMI has

MMI, Deposits, CBLO & Others 4.03% decreased to 4.03% from 5.12% on a MOM basis.

Builder fund continues to be predominantly invested in highest rated fixed

Refer annexure for complete portfolio details. income instruments.

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

Balancer Fund SFIN No.ULIF00931/05/05BSLBALANCE109

About The Fund Date of Inception: 18-Jul-05

OBJECTIVE: The objective of this investment fund is to achieve value creation of the policyholder at an average risk level over medium to long-term

period.

STRATEGY: The strategy is to invest predominantly in debt securities with an additional exposure to equity, maintaining medium term duration profile

of the portfolio.

NAV as on 31st March 2019: ` 36.6561 BENCHMARK: BSE 100, Crisil Composite Bond Fund Index & Crisil Liquid Fund Index

Asset held as on 31st March 2019: ` 30.45 Cr FUND MANAGER: Mr. Sandeep Jain (Equity), Ms. Richa Sharma (Debt)

AUM (in Cr.) Asset Allocation Rating Profile

Balancer BM

MMI, Deposits,

Equity CBLO & Others AA-

7.37 (24 %) 7.48% 1.92%

NCD AAA

12.93% 17.01%

Equity G-Secs

24.22% 55.37% Sovereign

Debt 81.07%

23.07 ( 76 %)

Mar-13

Sep-13

Mar-15

Sep-15

Mar-12

Sep-12

Mar-19

Mar-17

Sep-17

Sep-18

Mar-16

Sep-16

Mar-18

Mar-14

Sep-14

SECURITIES Holding Sectoral Allocation

GOVERNMENT SECURITIES 55.37% BANKING 32.37%

8.17% GOI 2044 (MD 01/12/2044) 8.54%

8.33% GOI 2026 (MD 09/07/2026) 6.92% OIL AND GAS 14.54%

8.97% GOI 2030 (MD 05/12/2030) 6.36%

8.20% GOI (MD 15/02/2022) 5.80% SOFTWARE / IT 12.46%

9.23% GOI 2043 (MD 23/12/2043) 5.78% FMCG 9.02%

8.60% GOI 2028 (MD 02/06/2028) 5.27%

7.95% GOI 2032 (28/08/2032) 3.04% FINANCIAL SERVICES 8.58%

8.32% GOI (MD 02/08/2032) 2.09%

8.30% GOI 2042 (MD 31/12/2042) 1.76% CAPITAL GOODS 6.95%

8.79% GOI 2021 (MD 08/11/2021) 1.72% CEMENT 3.83%

Other Government Securities 8.10%

AUTOMOBILE 3.66%

CORPORATE DEBT 12.93%

8.25% Indian Railway Fin Corp NCD (MD 28/02/2024) 3.35% MANUFACTURING 3.53%

9.39% Power Finance Corporation Ltd NCD (MD 27/08/2019) 3.30%

PHARMACEUTICALS 1.85%

9.47% Power Grid Corporation Ltd NCD (MD 31/03/2022) 2.58%

9.35% Power Grid Corporation NCD (MD 29/08/2021) 1.70% OTHERS 3.21%

8.90% Steel Authority Of India (MD 01/05/2019)

Call FR 01/05 1.31%

9.36% Power Finance Corpn. Ltd. NCD (MD 01/08/2021) 0.68%

Maturity (in years) 10.69

EQUITY 24.22%

HDFC Bank Limited 2.60% Yield to Maturity 7.43%

Reliance Industries Limited 2.48%

Housing Development Finance Corporation 1.78% Modified Duration

ITC Limited 1.52%

5.79

ICICI Bank Limited 1.46% Maturity Profile

Infosys Limited 1.24%

Larsen & Toubro Limited 1.08% 55.03%

Kotak Mahindra Bank Limited 1.07%

Tata Consultancy Services Limited 1.03% 29.04%

Axis Bank Limited 0.81% 15.93%

Other Equity 9.15%

MMI, Deposits, CBLO & Others 7.48%

Less than 2 years 2 to 7 years 7 years & above

Fund Update:

Exposure to equities has increased to 24.22% from 23.45% and MMI has

slightly increased to 7.48% from 7.35% on a MOM basis.

Balancer fund continues to be predominantly invested in highest rated fixed

Refer annexure for complete portfolio details. income instruments.

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

Enhancer Fund SFIN No.ULIF00213/03/01BSLENHANCE109

About The Fund Date of Inception: 22-Mar-01

OBJECTIVE: To grow capital through enhanced returns over a medium to long-term period through investments in equity and debt instruments, thereby

providing a good balance between risk and return. This investment fund is suitable for those who want to earn higher return on investment through

balanced exposure to equity and debt securities.

STRATEGY: To earn capital appreciation by maintaining a diversified equity portfolio and seek to earn regular returns on the fixed income portfolio by

active management resulting in wealth creation for policy owners.

NAV as on 31st March 2019: ` 64.7629 BENCHMARK: BSE 100, Crisil Composite Bond Fund Index & Crisil Liquid Fund Index

Asset held as on 31st March 2019: ` 6499.54 Cr FUND MANAGER: Mr. Deven Sangoi (Equity), Ms. Richa Sharma (Debt)

AUM (in Cr.) Asset Allocation Rating Profile

Enhancer BM Equity MMI, Deposits, AA+ AA-

2000.91 (31 %) CBLO & Others NCD 2.15% 1.39% A1+

AA 0.37%

8.97% 32.66%

7.83%

G-Secs Sovereign

27.58% AAA 46.21%

Debt 42.05%

Equity

4498.64 (69 %)

30.79%

Sep-12

Sep-13

Sep-14

Sep-15

Sep-16

Sep-17

Sep-18

Mar-12

Mar-13

Mar-14

Mar-15

Mar-16

Mar-17

Mar-18

Mar-19

SECURITIES Holding Sectoral Allocation

GOVERNMENT SECURITIES 27.58%

9.23% GOI 2043 (MD 23/12/2043) 3.21% BANKING 27.14%

8.60% GOI 2028 (MD 02/06/2028) 2.41%

8.24% GOI (MD 15/02/2027) 1.68% OIL AND GAS 12.76%

7.06% GOI 2046 (MD 10/10/2046) 1.64% SOFTWARE / IT 12.74%

9.20% GOI 2030 (MD 30/09/2030) 1.64%

8.13% GOI 2045 (MD 22/06/2045) 1.59% FINANCIAL SERVICES 10.30%

7.88% GOI 2030 (MD 19/03/2030) 1.34%

6.97% GOI 2026 (MD 06/09/2026) 1.25% FMCG 10.12%

8.17% GOI 2044 (MD 01/12/2044) 1.13% CAPITAL GOODS 4.77%

8.28% GOI (MD 15/02/2032) 0.96%

Other Government Securities 10.72% AUTOMOBILE 3.96%

CORPORATE DEBT 32.66% MANUFACTURING 3.49%

2% Tata Steel Ltd NCD (MD 23/04/2022) 1.32% PHARMACEUTICALS 2.79%

8.90% SBI 10 Year Basel 3 Compliant Tier 2

SR 1(02/11/28) 0.80% METAL 1.86%

9.55% Hindalco Industries Ltd. NCD (MD 25/04/2022) 0.77%

9.05% SBI Perpetual NCD (Call- 27/01/2020) OTHERS 10.07%

Step Up Rate 9.55 0.74%

7.23% Power Finance Corpn. Ltd. NCD

(MD 05/01/2027) (SR:155) 0.58%

9.475% Aditya Birla Finance Ltd NCD G-8 (MD 18/03/2022) 0.52% Maturity (in years) 8.81

9.10% SBI Perpetual NCD Call/Step-Up 25/11/2019 0.47%

7.50% Apollo Tyres Limited Maturity 20Th Oct 2023 0.45% Yield to Maturity 7.71%

9.39% Power Finance Corporation Ltd NCD (MD 27/08/2029) 0.42%

Aditya Birla Fashion & Retail Ltd ZCB (MD 14/08/2021) 0.41% Modified Duration 5.13

Other Corporate Debt 26.18%

EQUITY 30.79% Maturity Profile

HDFC Bank Limited 3.30% 47.53%

Reliance Industries Limited 2.89%

Housing Development Finance Corporation 2.22%

Infosys Limited 1.83% 26.79%

25.68%

ITC Limited 1.83%

ICICI Bank Limited 1.67%

Tata Consultancy Services Limited 1.37%

Larsen & Toubro Limited 1.34% Less than 2 years 2 to 7 years 7 years & above

Axis Bank Limited 0.83%

Kotak Mahindra Bank Limited 0.79% Fund Update:

Other Equity 12.70% Exposure to equities has slightly increased to 30.79% from 30.75% and MMI

has increased to 8.97% from 7.92% on a MOM basis.

MMI, Deposits, CBLO & Others 8.97% Enhancer fund continues to be predominantly invested in highest rated fixed

Refer annexure for complete portfolio details. income instruments.

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

Creator Fund SFIN No.ULIF00704/02/04BSLCREATOR109

About The Fund Date of Inception: 23-Feb-04

OBJECTIVE: To achieve optimum balance between growth and stability to provide long-term capital appreciation with balanced level of risk by investing

in fixed income securities and high quality equity security. This fund option is for those who are willing to take average to high level of risk to earn

attractive returns over a long period of time.

STRATEGY: To invest into fixed income securities & maintaining diversified equity portfolio along with active fund management of the policyholder's

wealth in long run.

NAV as on 31st March 2019: ` 55.2140 BENCHMARK: BSE 100, Crisil Composite Bond Fund Index & Crisil Liquid Fund Index

Asset held as on 31st March 2019: ` 479.80 Cr FUND MANAGER: Mr. Trilok Agarwal (Equity), Ms. Richa Sharma (Debt)

AUM (in Cr.) Asset Allocation Rating Profile

Creator BM

Equity MMI, Deposits,

240.85 (50 %) CBLO & Others AA AA-

3.57% 3.31% 2.03%

AA+

3.38%

G-Secs

20.34% Equity

50.20%

Debt Sovereign AAA

238.96 ( 50 %) NCD 43.99% 47.29%

25.89%

Mar-13

Sep-13

Mar-15

Sep-15

Mar-12

Sep-12

Mar-19

Mar-17

Sep-17

Sep-18

Mar-16

Sep-16

Mar-18

Mar-14

Sep-14

SECURITIES Holding Sectoral Allocation

GOVERNMENT SECURITIES 20.34% BANKING 25.60%

9.23% GOI 2043 (MD 23/12/2043) 3.85%

8.28% GOI 2027 (MD 21/09/2027) 2.73% SOFTWARE / IT 12.48%

8.33% GOI 2026 (MD 09/07/2026) 2.20%

6.97% GOI 2026 (MD 06/09/2026) 2.04% FMCG 10.86%

8.24% GOI (MD 15/02/2027) 1.98% OIL AND GAS 10.72%

8.60% GOI 2028 (MD 02/06/2028) 1.11%

8.24% GOI 2033 (MD 10/11/2033) 1.10% FINANCIAL SERVICES 8.34%

7.88% GOI 2030 (MD 19/03/2030) 1.07%

7.59% GOI 2026 (MD 11/01/2026) 0.95% CAPITAL GOODS 7.68%

8.13% GOI (MD 21/09/2022) 0.70%

RETAILING 3.81%

Other Government Securities 2.61%

CORPORATE DEBT 25.89% AUTOMOBILE 3.55%

9.40% REC. Ltd. NCD (MD 17/07/2021) 3.89% PHARMACEUTICALS 2.90%

8.29% MTNL NCD (MD 28/11/2024) Series IV-D 2014 2.10%

9.475% Aditya Birla Finance Ltd NCD MANUFACTURING 2.32%

G-8 (MD 18/03/2022) 1.53% OTHERS 11.75%

8.51% India Infradebt Ltd NCD (MD 10/05/2021) SR I 1.49%

8.02% BPCL Ltd NCD (MD 11/03/2024) 1.26%

7.69% BPCL Ltd NCD (MD 16/01/2023)-2018–Series I 1.25%

7.55% Tube Investments Of India Ltd NCD Maturity (in years) 7.25

(MD 20/02/2020) 1.15%

8.72% Kotak Mahindra Bank Ltd NCD (MD 14/01/2022) 1.07% Yield to Maturity 7.66%

8.85% Axis Bank NCD (MD 05/12/2024) 1.07%

8.50% NHPC Ltd NCD SR-T STRRP E (MD 14/07/2023) 1.07% Modified Duration 4.45

Other Corporate Debt 10.03%

EQUITY 50.20% Maturity Profile

HDFC Bank Limited 4.92% 41.14%

Reliance Industries Limited 4.34% 39.01%

ITC Limited 2.95%

19.85%

Housing Development Finance Corporation 2.73%

Infosys Limited 2.70%

ICICI Bank Limited 2.29%

Larsen & Toubro Limited 1.84%

Tata Consultancy Services Limited 1.72%

Less than 2 years 2 to 7 years 7 years & above

Kotak Mahindra Bank Limited 1.54%

Axis Bank Limited 1.32% Fund Update:

Other Equity 23.85% Exposure to equities has increased to 50.20% from 48.35% and MMI has

decreased to 3.57% from 5.74% on a MOM basis.

MMI, Deposits, CBLO & Others 3.57% Creator fund continues to be predominantly invested in large cap stocks and

Refer annexure for complete portfolio details.

maintains a well diversified portfolio with investments made across various

sectors.

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

Magnifier Fund SFIN No.ULIF00826/06/04BSLIIMAGNI109

About The Fund Date of Inception: 12-Aug-04

OBJECTIVE: To maximize wealth by actively managing a diversified equity portfolio.

STRATEGY: To invest in high quality equity security to provide long-term capital appreciation with high level of risk. This fund is suitable for those who

want to have wealth maximization over long-term period with equity market dynamics.

NAV as on 31st March 2019: ` 58.7874 BENCHMARK: BSE 100 & Crisil Liquid Fund Index

Asset held as on 31st March 2019: ` 1073.49 Cr FUND MANAGER: Mr. Deven Sangoi (Equity), Ms. Richa Sharma (Debt)

AUM (in Cr.) Asset Allocation Rating Profile

Magnifier BM

Equity MMI, Deposits, G-Secs AA-

811.51 (76 %) 8.09% NCD AAA

CBLO & Others 15.31% 0.12%

13.82% 2.49%

Equity

Debt 75.59% Sovereign

261.99 (24 %) 84.58%

Sep-12

Sep-13

Sep-14

Sep-15

Sep-16

Sep-17

Sep-18

Mar-12

Mar-13

Mar-14

Mar-15

Mar-16

Mar-17

Mar-18

Mar-19

SECURITIES Holding Sectoral Allocation

GOVERNMENT SECURITIES 8.09% BANKING 23.33%

364 Days TBill (MD 05/03/2020) 4.40%

6.65% GOI 2020 (MD 09/04/2020) 1.87% SOFTWARE / IT 13.87%

364 Days TBill (MD 18/07/2019) 1.83% OIL AND GAS 13.07%

FMCG 10.78%

CORPORATE DEBT 2.49%

8.80% Recl Ltd NCD (MD 06/10/2019) 0.94% FINANCIAL SERVICES 9.67%

8.78% Indiabulls Housing Finance Ltd NCD (MD 22/08/2019) 0.47%

CAPITAL GOODS 7.33%

7.085% LIC Housing Finance Ltd NCD TR-348Op-II

(MD 23/04/2019) 0.42% AUTOMOBILE 4.05%

7.85% HDFC Ltd NCD (MD 21/06/2019) 0.28%

7.60% HDFC Ltd NCD-Series R 014 (MD 26/06/2020) 0.19% PHARMACEUTICALS 3.49%

9.02% Rural Electrification Corpn. Ltd. NCD (MD 18/06/2019) 0.09% MANUFACTURING 2.32%

9.40% HDFC Ltd NCD (MD 26/08/2019)

Put 26/08/2016 Series M - 0.04% CEMENT 1.81%

9.51% LIC Housing Finance Ltd NCD (MD 24/07/2019) 0.03%

OTHERS 10.27%

8.70% Power Finance Corpn Ltd NCD (MD 15/01/2020) 0.02%

8.60% Steel Authority Of India (MD 19/11/2019) 0.02%

Other Corporate Debt 0.01%

EQUITY 75.59% Maturity Profile

Reliance Industries Limited 7.25% 100.00 %

HDFC Bank Limited 6.72%

Housing Development Finance Corporation 5.68%

ITC Limited 4.83%

Infosys Limited 4.59%

ICICI Bank Limited 3.92%

Larsen & Toubro Limited 3.77%

Tata Consultancy Services Limited 3.44% Less than 2 years

Axis Bank Limited 2.11%

Fund Update:

Kotak Mahindra Bank Limited 2.02%

Other Equity 31.27% Exposure to equities has decreased to 75.59% from 79.39% and MMI has

increased to 13.82% from 8.96% on a MOM basis.

MMI, Deposits, CBLO & Others 13.82% Magnifier fund continues to be predominantly invested in large cap stocks

and maintains a well diversified portfolio with investments made across

various sectors.

Modified Duration of the Fund is 0.15.

Refer annexure for complete portfolio details.

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

Maximiser Fund SFIN No.ULIF01101/06/07BSLIINMAXI109

About The Fund Date of Inception: 12-Jun-07

OBJECTIVE: To provide long term capital appreciation by actively managing a well-diversified equity portfolio of fundamentally strong blue chip

companies. Further, the fund seeks to provide a cushion against the sudden volatility in the equities through some investments in short term money

market instruments.

STRATEGY: To build and actively manage a well-diversified equity portfolio of value and growth driven stocks by following a research focused

investment approach. While appreciating the high risk associated with equities, the fund would attempt to maximize the risk-return pay off for the long-

term advantage of the policyholders. The fund will also explore the option of having exposure to quality mid cap stocks. The non-equity portion of the

fund will be invested in good rated (P1/A1 & above) money market instruments and fixed deposits. The fund will also maintain a reasonable level of

liquidity.

NAV as on 31st March 2019: ` 30.0321 BENCHMARK: BSE 100 & Crisil Liquid Fund Index

Asset held as on 31st March 2019: ` 1925.27 Cr FUND MANAGER: Mr. Sameer Mistry

Asset Allocation AUM (in Cr.)

Maximiser BM

Equity

MMI, Deposits, 1778.19 ( 92 %)

CBLO & Others

7.64%

Debt

147.08 (8 %)

Equity

Mar-13

Sep-13

Mar-15

Sep-15

Mar-12

Sep-12

Mar-19

Mar-17

Sep-17

Sep-18

Mar-16

Sep-16

Mar-18

Mar-14

Sep-14

92.36%

SECURITIES Holding

Sectoral Allocation

EQUITY 92.36%

HDFC Bank Limited 8.80% BANKING 19.62%

Reliance Industries Limited 8.39%

ITC Limited 5.90% OIL AND GAS 13.30%

Housing Development Finance Corporation 5.69%

Infosys Limited 5.24% SOFTWARE / IT 12.45%

Larsen & Toubro Limited 3.84%

FMCG 11.60%

ICICI Bank Limited 3.74%

Tata Consultancy Services Limited 3.04% CAPITAL GOODS 9.83%

Hindustan Unilever Limited 2.48%

Kotak Mahindra Bank Limited 2.40% FINANCIAL SERVICES 7.32%

Other Equity 42.85%

PHARMACEUTICALS 5.64%

MMI, Deposits, CBLO & Others 7.64%

CEMENT 3.73%

AUTOMOBILE 3.05%

RETAILING 2.26%

OTHERS 11.21%

Maturity Profile

100.00 %

Less than 2 years

Fund Update:

Exposure to equities has slightly decreased to 92.36% from 92.98% and

MMI has slightly increased to 7.64% from 7.02% on a MOM basis.

Maximiser fund is predominantly invested in large cap stocks and maintains

a well diversified portfolio with investments made across various sectors.

Refer annexure for complete portfolio details.

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

Maximiser Guaranteed Fund SFIN No.ULIF03027/08/13BSLIMAXGT109

About The Fund Date of Inception: 01-Jan-14

OBJECTIVE: To provide long term capital appreciation by actively managing a well-diversified equity portfolio of fundamentally strong bluechip

companies. Further, the fund seeks to provide a cushion against the sudden volatility in the equities through some investments in short-term money

market instruments.

STRATEGY: To build and actively manage a well-diversified equity portfolio of value and growth driven stocks by following a research focused

investment approach. While appreciating the high risk associated with equities, the fund would attempt to maximise the risk-return pay off for the long-

term advantage of the policyholders. The fund will also explore the option of having exposure to quality mid-cap stocks. The non-equity portion of the

fund will be invested in good rated (P1/A1 & above) money market instruments and fixed deposits. The fund will also maintain a reasonable level of

liquidity.

NAV as on 31st March 2019: ` 18.2717

Asset held as on 31st March 2019: ` 6.87 Cr FUND MANAGER: Mr. Sameer Mistry

SECURITIES Holding Asset Allocation Rating Profile

EQUITY 94.54%

MMI, Deposits,

Reliance Industries Limited 9.56% CBLO & Others

HDFC Bank Limited 9.36% 5.46%

Infosys Limited 6.26%

ITC Limited 4.93%

Larsen & Toubro Limited 4.63%

ICICI Bank Limited 4.44%

Housing Development Finance Corporation 4.22% Equity Sovereign

Tata Consultancy Services Limited 3.77% 94.54% 100.00%

Mahindra & Mahindra Limited 3.45%

Ultratech Cement Limited 2.64%

Other Equity 41.27%

MMI, Deposits, CBLO & Others 5.46% Sectoral Allocation

AUM (in Cr.) BANKING 20.72%

Equity OIL AND GAS 13.60%

6.49 ( 95 %)

FMCG 11.98%

CAPITAL GOODS 10.80%

Debt

0.38 (5 %) SOFTWARE / IT 10.60%

CEMENT 7.22%

FINANCIAL SERVICES 5.69%

AUTOMOBILE 5.11%

PHARMACEUTICALS 3.20%

POWER 2.43%

OTHERS 8.65%

Maturity Profile

100.00 %

Less than 2 years

Fund Update:

Exposure to equities has decreased to 94.54% from 96.20% and MMI has

increased to 5.46% from 3.80% on a MOM basis.

Maximiser Guaranteed fund is predominantly invested in large cap stocks

and maintains a well diversified portfolio with investments made across

various sectors.

Refer annexure for complete portfolio details.

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

Super 20 Fund SFIN No.ULIF01723/06/09BSLSUPER20109

About The Fund Date of Inception: 06-Jul-09

OBJECTIVE: To generate long-term capital appreciation for policy holders by making investments in fundamentally strong and liquid large cap

companies.

STRATEGY: To build and actively manage an equity portfolio of 20 fundamentally strong large cap stocks in terms of market capitalization by following

an in-depth research-focused investment approach. The fund will attempt to adequately diversify across sectors. The fund will invest in companies

having financial strength, robust, efficient & visionary management, enjoying competitive advantage along with good growth prospects & adequate

market liquidity. The fund will adopt a disciplined yet flexible long-term approach towards investing with a focus on generating long-term capital

appreciation. The non-equity portion of the fund will be invested in high rated money market instruments and fixed deposits. The fund will also maintain

reasonable level of liquidity.

NAV as on 31st March 2019: ` 29.8370 BENCHMARK: BSE Sensex & Crisil Liquid Fund Index

Asset held as on 31st March 2019: ` 1017.56 Cr FUND MANAGER: Mr. Sameer Mistry

Super 20 BM Asset Allocation

MMI, Deposits,

CBLO & Others

8.55%

Equity

91.45%

Mar-13

Sep-13

Mar-15

Sep-15

Mar-12

Sep-12

Mar-19

Mar-17

Sep-17

Sep-18

Mar-16

Sep-16

Mar-18

Mar-14

Sep-14

SECURITIES Holding AUM (in Cr.)

EQUITY 91.45% Equity

930.55 ( 91 %)

ITC Limited 9.02%

HDFC Bank Limited 9.00%

Reliance Industries Limited 9.00%

Infosys Limited 7.21% Debt

Larsen & Toubro Limited 6.23% 87.01 (9 %)

ICICI Bank Limited 5.95%

Housing Development Finance Corporation 5.64%

Tata Consultancy Services Limited 4.36%

Cipla Limited FV 2 3.98%

Sectoral Allocation

Hindustan Unilever Limited 3.87% BANKING 20.82%

Other Equity 27.19%

FMCG 16.80%

MMI, Deposits, CBLO & Others 8.55%

OIL AND GAS 16.36%

SOFTWARE / IT 12.65%

PHARMACEUTICALS 7.05%

CAPITAL GOODS 6.81%

FINANCIAL SERVICES 6.17%

POWER 4.21%

CEMENT 3.71%

AUTOMOBILE 3.34%

OTHERS 2.08%

Fund Update:

Exposure to equities has decreased to 91.45% from 93.24% and MMI has