Professional Documents

Culture Documents

ExecutiveSummary November RBRA

ExecutiveSummary November RBRA

Uploaded by

ChaCopyright:

Available Formats

You might also like

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- Unit 3 Study GuideDocument3 pagesUnit 3 Study Guide高瑞韩No ratings yet

- Credtrans Activity CasesDocument5 pagesCredtrans Activity CasesChaNo ratings yet

- Resolución Caso AmeritradeDocument39 pagesResolución Caso AmeritradeHernan EscuderoNo ratings yet

- B. LabRel-MCQs-Jan 22Document48 pagesB. LabRel-MCQs-Jan 22ChaNo ratings yet

- Labor Relations MCQ Questions (Week 1-January 15) : Section ADocument23 pagesLabor Relations MCQ Questions (Week 1-January 15) : Section AChaNo ratings yet

- Wolfson - Friedrich Meinecke (1862-1954) PDFDocument16 pagesWolfson - Friedrich Meinecke (1862-1954) PDFDarek SikorskiNo ratings yet

- Anglo Norwegian Fisheries CaseDocument8 pagesAnglo Norwegian Fisheries CaseJessamine Orioque100% (1)

- Attitudinal Loyalty A Mixed Method Study of Apple Fandom PDFDocument274 pagesAttitudinal Loyalty A Mixed Method Study of Apple Fandom PDFManoranjan DashNo ratings yet

- 17 Philguarantee2021 Part4b Akpf FsDocument4 pages17 Philguarantee2021 Part4b Akpf FsYenNo ratings yet

- With Comparative Figures For CY 2019Document8 pagesWith Comparative Figures For CY 2019Leo SindolNo ratings yet

- ALFA HAUL FY2021Document9 pagesALFA HAUL FY2021Nathan Fredrick OlingaNo ratings yet

- Report of The Auditor-General On The Accounts of Lagos Island Local Government For The Year Ended 31St December, 2020Document7 pagesReport of The Auditor-General On The Accounts of Lagos Island Local Government For The Year Ended 31St December, 2020Chinwe GloryNo ratings yet

- FS - Ramos, Josefina M. 2020Document17 pagesFS - Ramos, Josefina M. 2020Ma Teresa B. CerezoNo ratings yet

- (Amounts in Philippine Peso) : See Notes To Financial StatementsDocument9 pages(Amounts in Philippine Peso) : See Notes To Financial StatementsBSA3Tagum MariletNo ratings yet

- FS - Rayos, Martin Joseph M. 2020Document3 pagesFS - Rayos, Martin Joseph M. 2020Ma Teresa B. CerezoNo ratings yet

- Current Assets: (See Accompanying Notes To Financial Statements)Document7 pagesCurrent Assets: (See Accompanying Notes To Financial Statements)Alicia NhsNo ratings yet

- 07 PUP2020 - Part1 FSDocument5 pages07 PUP2020 - Part1 FSMiss_AccountantNo ratings yet

- 08 MWSS2020 - Part1 FSDocument6 pages08 MWSS2020 - Part1 FSGabriel OrolfoNo ratings yet

- Masbate-Executive-Summary-2023 SadiasaDocument8 pagesMasbate-Executive-Summary-2023 SadiasaFranz SyNo ratings yet

- Xyz Company Jetro Cabanero - THE PROPRIETOR Statements Financial Position DECEMBER 31, 2020 AND 2019Document8 pagesXyz Company Jetro Cabanero - THE PROPRIETOR Statements Financial Position DECEMBER 31, 2020 AND 2019BSA3Tagum MariletNo ratings yet

- XYZ TagumDocument8 pagesXYZ TagumBSA3Tagum MariletNo ratings yet

- Miriams Kitchen 9.30.21 FS 1Document21 pagesMiriams Kitchen 9.30.21 FS 1Kundai NellyNo ratings yet

- Announcement June 2020 - tcm387-605455Document2 pagesAnnouncement June 2020 - tcm387-605455Valamunis DomingoNo ratings yet

- 2020 FS The American Scandinavian FoundationDocument25 pages2020 FS The American Scandinavian FoundationPhạm KhánhNo ratings yet

- ITR ExampleDocument6 pagesITR ExampledalemisamisNo ratings yet

- Fs - Aguilar Golden Harvest MPC 2020Document37 pagesFs - Aguilar Golden Harvest MPC 2020Ma Teresa B. CerezoNo ratings yet

- 02 BacarraIN2020 FSDocument9 pages02 BacarraIN2020 FSRichard MendezNo ratings yet

- Bida-Tech Company Statement of Financial Position: (See Notes To Financial Statements)Document27 pagesBida-Tech Company Statement of Financial Position: (See Notes To Financial Statements)Trisha Mae Mendoza MacalinoNo ratings yet

- Jaiz Bank PLC: Unaudited Financial Statements For The Quarter Ended 31 MARCH 2019Document44 pagesJaiz Bank PLC: Unaudited Financial Statements For The Quarter Ended 31 MARCH 2019Musodiq AbolarinNo ratings yet

- Financial Analysis - Mini Case-Norbrook-Group BDocument2 pagesFinancial Analysis - Mini Case-Norbrook-Group BErrol ThompsonNo ratings yet

- Hy RFL 2019Document2 pagesHy RFL 2019anup dasNo ratings yet

- Unaudited Audited: (Amounts in Philippine Peso)Document40 pagesUnaudited Audited: (Amounts in Philippine Peso)Louie SalazarNo ratings yet

- Annex A 1 FCGI and Subsidiary Proforma Consolidated FS June 30 2021 2020 2019 1Document81 pagesAnnex A 1 FCGI and Subsidiary Proforma Consolidated FS June 30 2021 2020 2019 1psevangelioNo ratings yet

- Financial White Lotus Motors PVT - LTD - For The FY 2078-79Document117 pagesFinancial White Lotus Motors PVT - LTD - For The FY 2078-79Roshan PoudelNo ratings yet

- Module 2 FINANCIAL STATEMENTS New 1Document30 pagesModule 2 FINANCIAL STATEMENTS New 1Trisha Mae Mendoza MacalinoNo ratings yet

- Ratio Analysis of Lanka Ashok Leyland PLCDocument6 pagesRatio Analysis of Lanka Ashok Leyland PLCThe MutantzNo ratings yet

- Nabil Bank Q1 FY 2021Document28 pagesNabil Bank Q1 FY 2021Raj KarkiNo ratings yet

- FS - Rayos, Martin Joseph M. 2020Document20 pagesFS - Rayos, Martin Joseph M. 2020Ma Teresa B. CerezoNo ratings yet

- Financial Reporting Mcom 3 Semester: AssetsDocument2 pagesFinancial Reporting Mcom 3 Semester: AssetsYasir AminNo ratings yet

- Fs - Ventigan, Doroteo M. 2020Document32 pagesFs - Ventigan, Doroteo M. 2020Ma Teresa B. CerezoNo ratings yet

- Case Study - Financial Statements & Future ProspectsDocument8 pagesCase Study - Financial Statements & Future Prospectsmm3289No ratings yet

- Kosofe Consolidated GPFS 2020Document6 pagesKosofe Consolidated GPFS 2020Oluranti SijuwolaNo ratings yet

- TUNADocument18 pagesTUNAOra et LaboraNo ratings yet

- FS - Baltazar, Fatima S. 2020Document50 pagesFS - Baltazar, Fatima S. 2020Ma Teresa B. CerezoNo ratings yet

- Prime Bank 1st ICB AMCL MF 31.12.2019 PDFDocument2 pagesPrime Bank 1st ICB AMCL MF 31.12.2019 PDFAbrar FaisalNo ratings yet

- Financial StatementsDocument6 pagesFinancial StatementsMohammad AdilNo ratings yet

- Complete Financial Statements With SCF Direcdt MethodDocument23 pagesComplete Financial Statements With SCF Direcdt MethodJuja FlorentinoNo ratings yet

- 08 PuertoPrincesaCity2019 Part1 FSDocument7 pages08 PuertoPrincesaCity2019 Part1 FSkQy267BdTKNo ratings yet

- Statements of Financial Position As at December 31 Assets Current AssetsDocument8 pagesStatements of Financial Position As at December 31 Assets Current AssetsCalix CasanovaNo ratings yet

- In Philippine PesoDocument5 pagesIn Philippine PesoJan Carlo SanchezNo ratings yet

- Cash Flow QuestionDocument2 pagesCash Flow QuestionomairNo ratings yet

- Ikeja ConsolidatedDocument6 pagesIkeja ConsolidatedChinwe GloryNo ratings yet

- BDO-2-merged (1) - MergedDocument22 pagesBDO-2-merged (1) - Mergedbsu.gurlsNo ratings yet

- BDO 2 MergedDocument22 pagesBDO 2 Mergedbsu.gurlsNo ratings yet

- Brothers Maharjan Itta & Tile Udhayog Pvt. LTD.: Balance SheetDocument36 pagesBrothers Maharjan Itta & Tile Udhayog Pvt. LTD.: Balance SheetMenuka SiwaNo ratings yet

- A Wholly-Owned Subsidiary of Philippine National Oil CompanyDocument4 pagesA Wholly-Owned Subsidiary of Philippine National Oil CompanyLolita CalaycayNo ratings yet

- Vicariato of Sto. Nino de Tondo: Cash and Cash Equivalent P Trade and Other Receivables, Net PDocument5 pagesVicariato of Sto. Nino de Tondo: Cash and Cash Equivalent P Trade and Other Receivables, Net PEdgardo Pajo CulturaNo ratings yet

- Formal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument3 pagesFormal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDominic Dela VegaNo ratings yet

- Part F - Additional QuestionsDocument9 pagesPart F - Additional QuestionsDesmond Grasie ZumankyereNo ratings yet

- Vuico Printing ServicesDocument18 pagesVuico Printing ServicesRoseinthedark TiuNo ratings yet

- Invesco Oppenheimer Developing Markets Fund: Kunal Gupta 19BSP3512Document5 pagesInvesco Oppenheimer Developing Markets Fund: Kunal Gupta 19BSP3512KUNAL GUPTANo ratings yet

- Apr 2023Document1 pageApr 2023gaurav sharmaNo ratings yet

- Bdo 2Document22 pagesBdo 2bsu.gurlsNo ratings yet

- Acctng FinalsDocument27 pagesAcctng FinalsErika Mae LegaspiNo ratings yet

- 21 Problems - and - Answers - Reclassification - of - Financial - AssetDocument30 pages21 Problems - and - Answers - Reclassification - of - Financial - AssetSheila Grace BajaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Civ Pro NotesDocument14 pagesCiv Pro NotesChaNo ratings yet

- Crisologo V Singson, 4 SCRA 491Document3 pagesCrisologo V Singson, 4 SCRA 491ChaNo ratings yet

- Civpro Notes Jd2a - Module 1Document9 pagesCivpro Notes Jd2a - Module 1ChaNo ratings yet

- Nego Lecture NotesDocument15 pagesNego Lecture NotesChaNo ratings yet

- 20201111report Financial Report December 2020 TheresidencesatbrentDocument18 pages20201111report Financial Report December 2020 TheresidencesatbrentChaNo ratings yet

- Pil Lecture Notes - FinalsDocument72 pagesPil Lecture Notes - FinalsChaNo ratings yet

- Pil Lecture Notes 1.2Document19 pagesPil Lecture Notes 1.2ChaNo ratings yet

- 20201216report Executive Summary December 2020 TheresidencesatbrentDocument2 pages20201216report Executive Summary December 2020 TheresidencesatbrentChaNo ratings yet

- Report - Financial Report - January 2021 - TheresidencesatbrentDocument19 pagesReport - Financial Report - January 2021 - TheresidencesatbrentChaNo ratings yet

- Sample SLP 2019Document2 pagesSample SLP 2019ChaNo ratings yet

- 00 Nego Lecture NotesDocument18 pages00 Nego Lecture NotesChaNo ratings yet

- Report Executive Summary January 2021 TheresidencesatbrentDocument2 pagesReport Executive Summary January 2021 TheresidencesatbrentChaNo ratings yet

- Credtrans Activity CasesDocument6 pagesCredtrans Activity CasesChaNo ratings yet

- C. Labrel - MCQs-Jan 29Document52 pagesC. Labrel - MCQs-Jan 29ChaNo ratings yet

- Credtrans - NoteDocument1 pageCredtrans - NoteChaNo ratings yet

- Credtrans - NoteDocument38 pagesCredtrans - NoteChaNo ratings yet

- Parties To Civil Actions (Rule 3) (Four Hours) Lesson OutlineDocument26 pagesParties To Civil Actions (Rule 3) (Four Hours) Lesson OutlineChaNo ratings yet

- Lesson Outline:: See ReviewerDocument8 pagesLesson Outline:: See ReviewerChaNo ratings yet

- Admin Law, Lpo & Elec LawDocument14 pagesAdmin Law, Lpo & Elec LawChaNo ratings yet

- Module 6Document14 pagesModule 6ChaNo ratings yet

- Nil Case DigestsDocument83 pagesNil Case DigestsCha100% (2)

- Credtrans - NoteDocument1 pageCredtrans - NoteChaNo ratings yet

- 04.CNOOC Engages With Canadian Stakeholders PDFDocument14 pages04.CNOOC Engages With Canadian Stakeholders PDFAdilNo ratings yet

- An Arabic-To-English Translation of The Religious Debate Between The Nestorian Patriarch Timothy ... (PDFDrive)Document157 pagesAn Arabic-To-English Translation of The Religious Debate Between The Nestorian Patriarch Timothy ... (PDFDrive)SimeonNo ratings yet

- Startup CompaniesDocument11 pagesStartup CompanieskillerNo ratings yet

- Developing A Quadcopter Frame and Its Structural AnalysisDocument6 pagesDeveloping A Quadcopter Frame and Its Structural AnalysisInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Box & Spoon: "Have You Prepared Your Manger?"Document19 pagesBox & Spoon: "Have You Prepared Your Manger?"Holy Anargyroi Greek Orthodox ChurchNo ratings yet

- Acronyms: Choose A Letter See Also The Following Link To Shell Wiki (Abbreviations)Document16 pagesAcronyms: Choose A Letter See Also The Following Link To Shell Wiki (Abbreviations)fadhil AbdullahNo ratings yet

- Too Many ChoicesDocument11 pagesToo Many ChoicesLisa Mielke100% (1)

- Health Economics - Lecture Ch12Document61 pagesHealth Economics - Lecture Ch12Katherine SauerNo ratings yet

- If Only U Sleep-Walking Americans Have A Thousand Men Like This Joe CortinaDocument19 pagesIf Only U Sleep-Walking Americans Have A Thousand Men Like This Joe CortinaYusuf (Joe) Jussac, Jr. a.k.a unclejoeNo ratings yet

- Revenue Memorandum Order No. 25-2020Document1 pageRevenue Memorandum Order No. 25-2020Cliff DaquioagNo ratings yet

- AacDocument4 pagesAacjanhaviNo ratings yet

- SEO Training - Get Free Traffic To Your Website With SEODocument1 pageSEO Training - Get Free Traffic To Your Website With SEOsundevil2010usa4605No ratings yet

- Formation of All India Muslim LeagueDocument2 pagesFormation of All India Muslim LeagueAnum Goher Ali 2460-FET/BSEE/F15No ratings yet

- Court DiaryDocument29 pagesCourt DiarySwati KishoreNo ratings yet

- Komunikasi Kepemimpinan Silde 2Document11 pagesKomunikasi Kepemimpinan Silde 2RamlahBegumUmerkuttyNo ratings yet

- Human Act Act of Man Versus Human ActDocument2 pagesHuman Act Act of Man Versus Human Actgiezele ballatanNo ratings yet

- Definition of Capital AllowancesDocument9 pagesDefinition of Capital AllowancesAdesolaNo ratings yet

- The Tax Code of The PhilippinesDocument3 pagesThe Tax Code of The PhilippinesjurisNo ratings yet

- 51 Circular 2019 PDFDocument6 pages51 Circular 2019 PDFAnonymous 7rOWIeNo ratings yet

- Signs Symbols JudaismDocument8 pagesSigns Symbols JudaismgrgNo ratings yet

- Practice Quiz 2Document2 pagesPractice Quiz 2Jatin PreparationNo ratings yet

- Hostel Manual PDFDocument139 pagesHostel Manual PDFRajesh Kumar ThakurNo ratings yet

- World Cup 2014 Brazil Wall Chart PDF Fixture Schedule Brasil Eastern Time Timezone V.2 Smartcoder 247Document1 pageWorld Cup 2014 Brazil Wall Chart PDF Fixture Schedule Brasil Eastern Time Timezone V.2 Smartcoder 247Francesco BeniniNo ratings yet

- Innistrad Checklists PDF3Document1 pageInnistrad Checklists PDF3bcbuyer86No ratings yet

- EulaDocument5 pagesEulaCristian Fuentes TapiaNo ratings yet

- Celtic MonasticismDocument17 pagesCeltic MonasticismStrand Philips100% (1)

ExecutiveSummary November RBRA

ExecutiveSummary November RBRA

Uploaded by

ChaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ExecutiveSummary November RBRA

ExecutiveSummary November RBRA

Uploaded by

ChaCopyright:

Available Formats

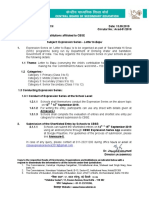

The Residents of Brent Residences Association

Financial Highlights

January 2020

I. Statement of Financial Position

Increase

ASSETS JANUARY '20 DECEMBER '19 (Decrease)

CURRENT ASSET 10,231,139 8,306,385 1,924,753

NONCURRENT ASSET 186,400.43 192,353.43 (5,953)

TOTAL ASSET 10,417,539 8,498,739 1,918,800

LIABILITIES AND FUND BALANCE

LIABILITIES

Current Liabilities 2,691,520 877,047 1,814,473

Non-current liabilities 6,500,000 6,500,000 -

Total 9,191,520 7,377,047 1,814,473

FUND BALANCE

Fund Balance, beginning 543,743 543,743 -

Surplus 682,276 577,949 104,327

FUND BALANCE, END 1,226,019 1,121,692 104,327

TOTAL LIABILITIES AND FUND BALANCE 10,417,539 8,498,739 1,918,800

One of the factors that led to an increase in current assets is the increase in the money market fund due to the increase in the fair

value per unit from Php 125.77 to 126.15 in December 2019 and January 2020, respectively. No additional investment to money

market fund was made and the total investment to date amounts to Php 6,811,437.78.

Decrease in the non-current asset is related to the depreciation expense incurred for the month. Also, no additional non-current

assets were purchased.

The significant increase in current liabilities is due the association dues of the residents collected in advance.

II. Statement of Activities (Accrual)

JANUARY '20 DECEMBER '19

Receipts from operations 438,121.47 475,320.27

Less: Expenses 355,207.39 412,061.59

Surplus from operations 82,914.08 63,258.68

Add: Unrealized gains/losses 20,527.60 18,366.80

Surplus 103,441.68 81,625.48

Less: Provision for income tax 35,914.22 6,523.95

Net Surplus 67,527.45 75,101.53

Provision for Tax

Although a non-stock not-for-profit organization is generally exempted from income tax, the provision for tax was still presented

due to the absence of the association’s tax exemption certificate. Under the existing rules of BIR, failure to present a valid

Certificate of Tax Exemption (CTE) will make a non-stock and nonprofit organizations to be taxable. It was ruled out however in

the Court of Tax Appeals and in a BIR Ruling that a nonstock nonprofit educational institution is not mandated to secure CTEs,

there is no mention about nonstock nonprofit homeowners/ condominium owners’ association. This is subsection is also presented

to let the management of the Association plan, discuss, and strategize any income tax provision for the taxable year 2020. The

computed month-to-date provision for income tax already amounted to Php200,942.81 as at January 31, 2020, granting the

association is treated as a taxable organization.

III. Statement of Cash Flows

JANUARY '20 DECEMBER '19

CASH, BEG INNING 1,218,725.79 1,711,525.74

CASH PRO VIDED (USED) FRO M O PERATING ACTIVITIES 2,009,032.66 (470,490 .04)

CASH PRO VIDED (USED) FRO M INVESTING ACTIVITIES - ( 22,309.91)

CASH PRO VIDED (USED) FRO M FINANCING ACTIVITIES ( 50,000.00) -

CASH ENDING 3,177,758.45 1,218,725.79

The significant increase in cash is due to the advance collection of association dues mentioned in section 1. The amount included

in the financing activity amounting to Php 50,000.00 is attributed to the Construction Bond for the renovation at Hamilton Hall.

IV. Association Dues Collection Efficiency and Aging

Aging of Receivables – Association Dues

As of January 31, 2020 Current Due Past Due

Hamilton 19,980.00 29,610.00

Hacket 24,120.00 51,574.20

Forbes 34,740.00 78,720.00

Total Receivables 78,840.00 159,904.20

Collection Efficiency in Percentage (%)

THE RESIDENCES AT BRENT RESIDENTS ASSOCIATION INC.

BALANCE SHEET (UNAUDITED)

AS OF JUNE 30, 2019

(In Philippine Peso)

ASSETS

You might also like

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- Unit 3 Study GuideDocument3 pagesUnit 3 Study Guide高瑞韩No ratings yet

- Credtrans Activity CasesDocument5 pagesCredtrans Activity CasesChaNo ratings yet

- Resolución Caso AmeritradeDocument39 pagesResolución Caso AmeritradeHernan EscuderoNo ratings yet

- B. LabRel-MCQs-Jan 22Document48 pagesB. LabRel-MCQs-Jan 22ChaNo ratings yet

- Labor Relations MCQ Questions (Week 1-January 15) : Section ADocument23 pagesLabor Relations MCQ Questions (Week 1-January 15) : Section AChaNo ratings yet

- Wolfson - Friedrich Meinecke (1862-1954) PDFDocument16 pagesWolfson - Friedrich Meinecke (1862-1954) PDFDarek SikorskiNo ratings yet

- Anglo Norwegian Fisheries CaseDocument8 pagesAnglo Norwegian Fisheries CaseJessamine Orioque100% (1)

- Attitudinal Loyalty A Mixed Method Study of Apple Fandom PDFDocument274 pagesAttitudinal Loyalty A Mixed Method Study of Apple Fandom PDFManoranjan DashNo ratings yet

- 17 Philguarantee2021 Part4b Akpf FsDocument4 pages17 Philguarantee2021 Part4b Akpf FsYenNo ratings yet

- With Comparative Figures For CY 2019Document8 pagesWith Comparative Figures For CY 2019Leo SindolNo ratings yet

- ALFA HAUL FY2021Document9 pagesALFA HAUL FY2021Nathan Fredrick OlingaNo ratings yet

- Report of The Auditor-General On The Accounts of Lagos Island Local Government For The Year Ended 31St December, 2020Document7 pagesReport of The Auditor-General On The Accounts of Lagos Island Local Government For The Year Ended 31St December, 2020Chinwe GloryNo ratings yet

- FS - Ramos, Josefina M. 2020Document17 pagesFS - Ramos, Josefina M. 2020Ma Teresa B. CerezoNo ratings yet

- (Amounts in Philippine Peso) : See Notes To Financial StatementsDocument9 pages(Amounts in Philippine Peso) : See Notes To Financial StatementsBSA3Tagum MariletNo ratings yet

- FS - Rayos, Martin Joseph M. 2020Document3 pagesFS - Rayos, Martin Joseph M. 2020Ma Teresa B. CerezoNo ratings yet

- Current Assets: (See Accompanying Notes To Financial Statements)Document7 pagesCurrent Assets: (See Accompanying Notes To Financial Statements)Alicia NhsNo ratings yet

- 07 PUP2020 - Part1 FSDocument5 pages07 PUP2020 - Part1 FSMiss_AccountantNo ratings yet

- 08 MWSS2020 - Part1 FSDocument6 pages08 MWSS2020 - Part1 FSGabriel OrolfoNo ratings yet

- Masbate-Executive-Summary-2023 SadiasaDocument8 pagesMasbate-Executive-Summary-2023 SadiasaFranz SyNo ratings yet

- Xyz Company Jetro Cabanero - THE PROPRIETOR Statements Financial Position DECEMBER 31, 2020 AND 2019Document8 pagesXyz Company Jetro Cabanero - THE PROPRIETOR Statements Financial Position DECEMBER 31, 2020 AND 2019BSA3Tagum MariletNo ratings yet

- XYZ TagumDocument8 pagesXYZ TagumBSA3Tagum MariletNo ratings yet

- Miriams Kitchen 9.30.21 FS 1Document21 pagesMiriams Kitchen 9.30.21 FS 1Kundai NellyNo ratings yet

- Announcement June 2020 - tcm387-605455Document2 pagesAnnouncement June 2020 - tcm387-605455Valamunis DomingoNo ratings yet

- 2020 FS The American Scandinavian FoundationDocument25 pages2020 FS The American Scandinavian FoundationPhạm KhánhNo ratings yet

- ITR ExampleDocument6 pagesITR ExampledalemisamisNo ratings yet

- Fs - Aguilar Golden Harvest MPC 2020Document37 pagesFs - Aguilar Golden Harvest MPC 2020Ma Teresa B. CerezoNo ratings yet

- 02 BacarraIN2020 FSDocument9 pages02 BacarraIN2020 FSRichard MendezNo ratings yet

- Bida-Tech Company Statement of Financial Position: (See Notes To Financial Statements)Document27 pagesBida-Tech Company Statement of Financial Position: (See Notes To Financial Statements)Trisha Mae Mendoza MacalinoNo ratings yet

- Jaiz Bank PLC: Unaudited Financial Statements For The Quarter Ended 31 MARCH 2019Document44 pagesJaiz Bank PLC: Unaudited Financial Statements For The Quarter Ended 31 MARCH 2019Musodiq AbolarinNo ratings yet

- Financial Analysis - Mini Case-Norbrook-Group BDocument2 pagesFinancial Analysis - Mini Case-Norbrook-Group BErrol ThompsonNo ratings yet

- Hy RFL 2019Document2 pagesHy RFL 2019anup dasNo ratings yet

- Unaudited Audited: (Amounts in Philippine Peso)Document40 pagesUnaudited Audited: (Amounts in Philippine Peso)Louie SalazarNo ratings yet

- Annex A 1 FCGI and Subsidiary Proforma Consolidated FS June 30 2021 2020 2019 1Document81 pagesAnnex A 1 FCGI and Subsidiary Proforma Consolidated FS June 30 2021 2020 2019 1psevangelioNo ratings yet

- Financial White Lotus Motors PVT - LTD - For The FY 2078-79Document117 pagesFinancial White Lotus Motors PVT - LTD - For The FY 2078-79Roshan PoudelNo ratings yet

- Module 2 FINANCIAL STATEMENTS New 1Document30 pagesModule 2 FINANCIAL STATEMENTS New 1Trisha Mae Mendoza MacalinoNo ratings yet

- Ratio Analysis of Lanka Ashok Leyland PLCDocument6 pagesRatio Analysis of Lanka Ashok Leyland PLCThe MutantzNo ratings yet

- Nabil Bank Q1 FY 2021Document28 pagesNabil Bank Q1 FY 2021Raj KarkiNo ratings yet

- FS - Rayos, Martin Joseph M. 2020Document20 pagesFS - Rayos, Martin Joseph M. 2020Ma Teresa B. CerezoNo ratings yet

- Financial Reporting Mcom 3 Semester: AssetsDocument2 pagesFinancial Reporting Mcom 3 Semester: AssetsYasir AminNo ratings yet

- Fs - Ventigan, Doroteo M. 2020Document32 pagesFs - Ventigan, Doroteo M. 2020Ma Teresa B. CerezoNo ratings yet

- Case Study - Financial Statements & Future ProspectsDocument8 pagesCase Study - Financial Statements & Future Prospectsmm3289No ratings yet

- Kosofe Consolidated GPFS 2020Document6 pagesKosofe Consolidated GPFS 2020Oluranti SijuwolaNo ratings yet

- TUNADocument18 pagesTUNAOra et LaboraNo ratings yet

- FS - Baltazar, Fatima S. 2020Document50 pagesFS - Baltazar, Fatima S. 2020Ma Teresa B. CerezoNo ratings yet

- Prime Bank 1st ICB AMCL MF 31.12.2019 PDFDocument2 pagesPrime Bank 1st ICB AMCL MF 31.12.2019 PDFAbrar FaisalNo ratings yet

- Financial StatementsDocument6 pagesFinancial StatementsMohammad AdilNo ratings yet

- Complete Financial Statements With SCF Direcdt MethodDocument23 pagesComplete Financial Statements With SCF Direcdt MethodJuja FlorentinoNo ratings yet

- 08 PuertoPrincesaCity2019 Part1 FSDocument7 pages08 PuertoPrincesaCity2019 Part1 FSkQy267BdTKNo ratings yet

- Statements of Financial Position As at December 31 Assets Current AssetsDocument8 pagesStatements of Financial Position As at December 31 Assets Current AssetsCalix CasanovaNo ratings yet

- In Philippine PesoDocument5 pagesIn Philippine PesoJan Carlo SanchezNo ratings yet

- Cash Flow QuestionDocument2 pagesCash Flow QuestionomairNo ratings yet

- Ikeja ConsolidatedDocument6 pagesIkeja ConsolidatedChinwe GloryNo ratings yet

- BDO-2-merged (1) - MergedDocument22 pagesBDO-2-merged (1) - Mergedbsu.gurlsNo ratings yet

- BDO 2 MergedDocument22 pagesBDO 2 Mergedbsu.gurlsNo ratings yet

- Brothers Maharjan Itta & Tile Udhayog Pvt. LTD.: Balance SheetDocument36 pagesBrothers Maharjan Itta & Tile Udhayog Pvt. LTD.: Balance SheetMenuka SiwaNo ratings yet

- A Wholly-Owned Subsidiary of Philippine National Oil CompanyDocument4 pagesA Wholly-Owned Subsidiary of Philippine National Oil CompanyLolita CalaycayNo ratings yet

- Vicariato of Sto. Nino de Tondo: Cash and Cash Equivalent P Trade and Other Receivables, Net PDocument5 pagesVicariato of Sto. Nino de Tondo: Cash and Cash Equivalent P Trade and Other Receivables, Net PEdgardo Pajo CulturaNo ratings yet

- Formal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument3 pagesFormal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDominic Dela VegaNo ratings yet

- Part F - Additional QuestionsDocument9 pagesPart F - Additional QuestionsDesmond Grasie ZumankyereNo ratings yet

- Vuico Printing ServicesDocument18 pagesVuico Printing ServicesRoseinthedark TiuNo ratings yet

- Invesco Oppenheimer Developing Markets Fund: Kunal Gupta 19BSP3512Document5 pagesInvesco Oppenheimer Developing Markets Fund: Kunal Gupta 19BSP3512KUNAL GUPTANo ratings yet

- Apr 2023Document1 pageApr 2023gaurav sharmaNo ratings yet

- Bdo 2Document22 pagesBdo 2bsu.gurlsNo ratings yet

- Acctng FinalsDocument27 pagesAcctng FinalsErika Mae LegaspiNo ratings yet

- 21 Problems - and - Answers - Reclassification - of - Financial - AssetDocument30 pages21 Problems - and - Answers - Reclassification - of - Financial - AssetSheila Grace BajaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Civ Pro NotesDocument14 pagesCiv Pro NotesChaNo ratings yet

- Crisologo V Singson, 4 SCRA 491Document3 pagesCrisologo V Singson, 4 SCRA 491ChaNo ratings yet

- Civpro Notes Jd2a - Module 1Document9 pagesCivpro Notes Jd2a - Module 1ChaNo ratings yet

- Nego Lecture NotesDocument15 pagesNego Lecture NotesChaNo ratings yet

- 20201111report Financial Report December 2020 TheresidencesatbrentDocument18 pages20201111report Financial Report December 2020 TheresidencesatbrentChaNo ratings yet

- Pil Lecture Notes - FinalsDocument72 pagesPil Lecture Notes - FinalsChaNo ratings yet

- Pil Lecture Notes 1.2Document19 pagesPil Lecture Notes 1.2ChaNo ratings yet

- 20201216report Executive Summary December 2020 TheresidencesatbrentDocument2 pages20201216report Executive Summary December 2020 TheresidencesatbrentChaNo ratings yet

- Report - Financial Report - January 2021 - TheresidencesatbrentDocument19 pagesReport - Financial Report - January 2021 - TheresidencesatbrentChaNo ratings yet

- Sample SLP 2019Document2 pagesSample SLP 2019ChaNo ratings yet

- 00 Nego Lecture NotesDocument18 pages00 Nego Lecture NotesChaNo ratings yet

- Report Executive Summary January 2021 TheresidencesatbrentDocument2 pagesReport Executive Summary January 2021 TheresidencesatbrentChaNo ratings yet

- Credtrans Activity CasesDocument6 pagesCredtrans Activity CasesChaNo ratings yet

- C. Labrel - MCQs-Jan 29Document52 pagesC. Labrel - MCQs-Jan 29ChaNo ratings yet

- Credtrans - NoteDocument1 pageCredtrans - NoteChaNo ratings yet

- Credtrans - NoteDocument38 pagesCredtrans - NoteChaNo ratings yet

- Parties To Civil Actions (Rule 3) (Four Hours) Lesson OutlineDocument26 pagesParties To Civil Actions (Rule 3) (Four Hours) Lesson OutlineChaNo ratings yet

- Lesson Outline:: See ReviewerDocument8 pagesLesson Outline:: See ReviewerChaNo ratings yet

- Admin Law, Lpo & Elec LawDocument14 pagesAdmin Law, Lpo & Elec LawChaNo ratings yet

- Module 6Document14 pagesModule 6ChaNo ratings yet

- Nil Case DigestsDocument83 pagesNil Case DigestsCha100% (2)

- Credtrans - NoteDocument1 pageCredtrans - NoteChaNo ratings yet

- 04.CNOOC Engages With Canadian Stakeholders PDFDocument14 pages04.CNOOC Engages With Canadian Stakeholders PDFAdilNo ratings yet

- An Arabic-To-English Translation of The Religious Debate Between The Nestorian Patriarch Timothy ... (PDFDrive)Document157 pagesAn Arabic-To-English Translation of The Religious Debate Between The Nestorian Patriarch Timothy ... (PDFDrive)SimeonNo ratings yet

- Startup CompaniesDocument11 pagesStartup CompanieskillerNo ratings yet

- Developing A Quadcopter Frame and Its Structural AnalysisDocument6 pagesDeveloping A Quadcopter Frame and Its Structural AnalysisInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Box & Spoon: "Have You Prepared Your Manger?"Document19 pagesBox & Spoon: "Have You Prepared Your Manger?"Holy Anargyroi Greek Orthodox ChurchNo ratings yet

- Acronyms: Choose A Letter See Also The Following Link To Shell Wiki (Abbreviations)Document16 pagesAcronyms: Choose A Letter See Also The Following Link To Shell Wiki (Abbreviations)fadhil AbdullahNo ratings yet

- Too Many ChoicesDocument11 pagesToo Many ChoicesLisa Mielke100% (1)

- Health Economics - Lecture Ch12Document61 pagesHealth Economics - Lecture Ch12Katherine SauerNo ratings yet

- If Only U Sleep-Walking Americans Have A Thousand Men Like This Joe CortinaDocument19 pagesIf Only U Sleep-Walking Americans Have A Thousand Men Like This Joe CortinaYusuf (Joe) Jussac, Jr. a.k.a unclejoeNo ratings yet

- Revenue Memorandum Order No. 25-2020Document1 pageRevenue Memorandum Order No. 25-2020Cliff DaquioagNo ratings yet

- AacDocument4 pagesAacjanhaviNo ratings yet

- SEO Training - Get Free Traffic To Your Website With SEODocument1 pageSEO Training - Get Free Traffic To Your Website With SEOsundevil2010usa4605No ratings yet

- Formation of All India Muslim LeagueDocument2 pagesFormation of All India Muslim LeagueAnum Goher Ali 2460-FET/BSEE/F15No ratings yet

- Court DiaryDocument29 pagesCourt DiarySwati KishoreNo ratings yet

- Komunikasi Kepemimpinan Silde 2Document11 pagesKomunikasi Kepemimpinan Silde 2RamlahBegumUmerkuttyNo ratings yet

- Human Act Act of Man Versus Human ActDocument2 pagesHuman Act Act of Man Versus Human Actgiezele ballatanNo ratings yet

- Definition of Capital AllowancesDocument9 pagesDefinition of Capital AllowancesAdesolaNo ratings yet

- The Tax Code of The PhilippinesDocument3 pagesThe Tax Code of The PhilippinesjurisNo ratings yet

- 51 Circular 2019 PDFDocument6 pages51 Circular 2019 PDFAnonymous 7rOWIeNo ratings yet

- Signs Symbols JudaismDocument8 pagesSigns Symbols JudaismgrgNo ratings yet

- Practice Quiz 2Document2 pagesPractice Quiz 2Jatin PreparationNo ratings yet

- Hostel Manual PDFDocument139 pagesHostel Manual PDFRajesh Kumar ThakurNo ratings yet

- World Cup 2014 Brazil Wall Chart PDF Fixture Schedule Brasil Eastern Time Timezone V.2 Smartcoder 247Document1 pageWorld Cup 2014 Brazil Wall Chart PDF Fixture Schedule Brasil Eastern Time Timezone V.2 Smartcoder 247Francesco BeniniNo ratings yet

- Innistrad Checklists PDF3Document1 pageInnistrad Checklists PDF3bcbuyer86No ratings yet

- EulaDocument5 pagesEulaCristian Fuentes TapiaNo ratings yet

- Celtic MonasticismDocument17 pagesCeltic MonasticismStrand Philips100% (1)