Professional Documents

Culture Documents

MA112 Assign 1 Question

MA112 Assign 1 Question

Uploaded by

Gikamo GasingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MA112 Assign 1 Question

MA112 Assign 1 Question

Uploaded by

Gikamo GasingCopyright:

Available Formats

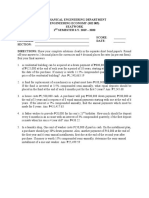

Department of Mathematics and Computer Science

Course: MA112 Quantitative Methods II

Assignment 1, Semester 2, 2018, Due: Friday 10 August 2018 before 12:00 noon

Name:_________________________________ID:______________Group:___________

Instructions: There are six questions for this task. You are required to answer all

questions but four selected questions will be marked. Completed assignment must be

returned to Maths and Computer Science Department main office before 12 noon.

Assignment returned directly to tutor/lecturer or returned after 12 noon will not be marked.

Question 1 [5 Marks]

The price of a new motor car increases in line with inflation. If over the years 2003, 2004,

2005 and 2006 the indices of inflation were 114, 108, 110, and 107.3, and a new 4WD

single cab Ute was priced at K55700 at the beginning of 2003, find the expected price of a

similar new vehicle at the beginning of 2007.

Question 2 [5 5 10 Marks]

K95 is invested into an account at the end of every 4 months for 2 years and 8 months at

15% p.a. compounded every 4 months.

a) Calculate how much you would have in this account at the end of this period?

b) Calculate the present value?

Question 3 [5 Marks]

What lump sum would you need to invest at 7.5% p.a. compounded annually if K250 is

invested into an account at the beginning of each year for a period of 5 years?

Question 4 [5 5 10 Marks]

Brian Bell & Co. is selling micro-oven for K4000 by cash. If this item is purchased on an

installments basis, the method of repayment is to deposit K500 followed by equal semi-

annually repayments of K900 for three years.

a) Calculate the flat rate of interest charged if this item is bought on an installments

basis.

b) Calculate the total amount paid at the end of 3 years if this item is bought on

installments basis.

Question 5 [5 5 5 5 20 Marks]

At a reducing balance interest rate of 15% p.a. compounded monthly, K2 500 is borrowed.

The method of loan repayment is to make equal monthly repayments of K300.

a) How long would it take to completely pay off the loan?

b) Construct a (full) loan repayment schedule.

c) Calculate the amount paid off in the first 5 periods.

d) Calculate the balance of loan owing at the end of the 7 th month.

Question 6 [5 5 10 Marks]

Mr. Bean borrows K9000 to purchase a duplex. He is required to repay the loan in equal

monthly installments over a five-year period, interest being 9.5% p.a. compounded

monthly at a reducing balance loan model.

a) What are his monthly repayments?

b) What termination payment is required to terminate the loan after 2 years?

You might also like

- Grade 7 EMS QP and Answer Sheets - Midyear 2022Document8 pagesGrade 7 EMS QP and Answer Sheets - Midyear 2022Life MakhubelaNo ratings yet

- ProblemSet 1Document2 pagesProblemSet 1Kasra Ladjevardi0% (1)

- GLCA DA MS Excel HBFC Project Modified-1Document3 pagesGLCA DA MS Excel HBFC Project Modified-1Subhan Ahmad KhanNo ratings yet

- CIMA Practice QnsDocument261 pagesCIMA Practice QnsInnocent Won AberNo ratings yet

- Chapter 4: Equilibrium Output and Multiplier EffectDocument27 pagesChapter 4: Equilibrium Output and Multiplier EffectChristian Jumao-as MendozaNo ratings yet

- Corporate Finance 1 (Finance 1 in Short) 2007/2008 EXAMDocument6 pagesCorporate Finance 1 (Finance 1 in Short) 2007/2008 EXAMGranataNo ratings yet

- Corporate Finance 1 (Finance 1 in Short) 2008/2009 EXAMDocument7 pagesCorporate Finance 1 (Finance 1 in Short) 2008/2009 EXAMGranataNo ratings yet

- Continuous Evaluation AssignmentDocument8 pagesContinuous Evaluation AssignmentLavish 15No ratings yet

- Assignment 2022 Sem 2 PDFDocument9 pagesAssignment 2022 Sem 2 PDFPathumini PereraNo ratings yet

- Indian Institute of Management Kozhikode: Financial Management 1 EPGP Kochi Campus Batch 09Document35 pagesIndian Institute of Management Kozhikode: Financial Management 1 EPGP Kochi Campus Batch 09juilee bhoirNo ratings yet

- 125.230 Test1 - (0801)Document6 pages125.230 Test1 - (0801)Tong PanNo ratings yet

- Econ Assignment 2Document2 pagesEcon Assignment 2PrerNo ratings yet

- Alsiyabi353 Version 7 3Document5 pagesAlsiyabi353 Version 7 3rajguptaNo ratings yet

- Exam FileDocument14 pagesExam FileAbelNo ratings yet

- Highercollege of Technology Department: Business StudiesDocument5 pagesHighercollege of Technology Department: Business StudiesrajguptaNo ratings yet

- MATDCB1 - Semester Test 1 2019Document8 pagesMATDCB1 - Semester Test 1 2019mbalironelmakubungNo ratings yet

- Quiz 1 - Engineering EconomicsDocument2 pagesQuiz 1 - Engineering EconomicsraudenNo ratings yet

- Chapter 1 - ProblemsDocument9 pagesChapter 1 - ProblemsTSARNo ratings yet

- AF102 Sem 2Document10 pagesAF102 Sem 2horse9118No ratings yet

- ECON1202 2004 S2 PaperDocument8 pagesECON1202 2004 S2 Paper1234x3No ratings yet

- P2 Mar 2012 Exam PaperDocument16 pagesP2 Mar 2012 Exam Papermigueljorge007No ratings yet

- Certificate in Advanced Business Calculations: Series 4 Examination 2008Document6 pagesCertificate in Advanced Business Calculations: Series 4 Examination 2008Apollo YapNo ratings yet

- PreposttestDocument3 pagesPreposttestapi-253385147No ratings yet

- Deferred AnnuityDocument1 pageDeferred AnnuityChristian MonvilleNo ratings yet

- Money - Time Relationships and Equivalence: Name of Student/s: Dickinson, Sigienel Gabriel, Neil Patrick ADocument12 pagesMoney - Time Relationships and Equivalence: Name of Student/s: Dickinson, Sigienel Gabriel, Neil Patrick ASasuke UchichaNo ratings yet

- FM212 2018 PaperDocument5 pagesFM212 2018 PaperSam HanNo ratings yet

- MTH302 Spring 2006 Mid Term Paper Session 2Document3 pagesMTH302 Spring 2006 Mid Term Paper Session 2AsifNo ratings yet

- Final EXAM 1Document2 pagesFinal EXAM 1Marilou MonsantoNo ratings yet

- P2-Quiz 4 - Deferred Annuity and Perpetuity Answer KeyDocument8 pagesP2-Quiz 4 - Deferred Annuity and Perpetuity Answer Keyromulodumagit25No ratings yet

- Deakin University Faculty of Business and Law MMP211 - Statutory Valuation Examination Trimester 1, 2021Document3 pagesDeakin University Faculty of Business and Law MMP211 - Statutory Valuation Examination Trimester 1, 2021Ochweda JnrNo ratings yet

- Quiz Gen Math AnnuitiesDocument1 pageQuiz Gen Math AnnuitiesAnalyn Briones100% (2)

- Quiz Gen Math AnnuitiesDocument1 pageQuiz Gen Math AnnuitiesJaymark B. UgayNo ratings yet

- University of Cambridge International Examinations General Certificate of Education Ordinary LevelDocument8 pagesUniversity of Cambridge International Examinations General Certificate of Education Ordinary Levelmstudy123456No ratings yet

- Depreciation - Extra Practice QuestionsDocument1 pageDepreciation - Extra Practice QuestionsSailesh GoenkkaNo ratings yet

- Engineering Economics ME-325: Assignment-1Document1 pageEngineering Economics ME-325: Assignment-1Get-Set-Go100% (1)

- Sem IV (Internal 2010)Document15 pagesSem IV (Internal 2010)anandpatel2991No ratings yet

- Molla E Majid, School of Business, NSUDocument5 pagesMolla E Majid, School of Business, NSUEmdadul Haq RahulNo ratings yet

- AE - Tapas Sir - 6CMDocument2 pagesAE - Tapas Sir - 6CMShivam KumarNo ratings yet

- MGT 885 Spring 2024 Final ExamDocument4 pagesMGT 885 Spring 2024 Final Examsean1109251609No ratings yet

- Level 3 ABC 2021Document54 pagesLevel 3 ABC 2021Ami KayNo ratings yet

- Exercises 1 and 2Document3 pagesExercises 1 and 2Raymond Gicalde RementillaNo ratings yet

- FinanceDocument10 pagesFinanceHaley Hamill100% (1)

- JC Mathematics Unit 3 AssignmentDocument7 pagesJC Mathematics Unit 3 AssignmentalbertgwarimboNo ratings yet

- EMBA - Takehome - Final Spring 23Document11 pagesEMBA - Takehome - Final Spring 23touatiabrahamNo ratings yet

- Math M P3 2013 QuestionDocument6 pagesMath M P3 2013 QuestionMasnah HussenNo ratings yet

- 14-EC-1 - Version Anglaise - Novembre 2020 - CopieDocument6 pages14-EC-1 - Version Anglaise - Novembre 2020 - CopieleonevessNo ratings yet

- SpringDocument12 pagesSpringEmma Zhang0% (2)

- Canadian Tax Principles 2014 2015 Edition Volume I and Volume II 1st Edition Byrd Test BankDocument7 pagesCanadian Tax Principles 2014 2015 Edition Volume I and Volume II 1st Edition Byrd Test Bankdrkevinlee03071984jki100% (26)

- Imt 59Document3 pagesImt 59Prabhjeet Singh GillNo ratings yet

- Performance Task QuizDocument3 pagesPerformance Task QuizRhobie CuaresmaNo ratings yet

- Financial Reporting Exam BAFEDocument3 pagesFinancial Reporting Exam BAFEUsman BalochNo ratings yet

- PRELIM ExercisesDocument4 pagesPRELIM Exercisescuajohnpaull.schoolbackup.002No ratings yet

- BFC2140 Semester2 2016 Tutorial QuestionsDocument9 pagesBFC2140 Semester2 2016 Tutorial QuestionsRhys CosmoNo ratings yet

- AC3202 - 20202021B - Exam PaperDocument9 pagesAC3202 - 20202021B - Exam PaperlawlokyiNo ratings yet

- PROBLEM SET 2 AbmDocument2 pagesPROBLEM SET 2 AbmBuddy OverthinkerNo ratings yet

- Assignment 2 SolutionsDocument12 pagesAssignment 2 SolutionsJona ThanNo ratings yet

- Final ExamDocument7 pagesFinal ExamOnat PNo ratings yet

- ACC208 Sem 2 2021Document3 pagesACC208 Sem 2 202120220354No ratings yet

- IEECONO Q1 T1 2022 Set B With Answer Key 1Document9 pagesIEECONO Q1 T1 2022 Set B With Answer Key 1Janry ArezaNo ratings yet

- Real Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsFrom EverandReal Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsNo ratings yet

- KATLEGO JAMES BOIKANYO - aCsgOADN - ArchivedDocument4 pagesKATLEGO JAMES BOIKANYO - aCsgOADN - Archivedfarnaasadams801No ratings yet

- Accounting For Partnership Firm-FundamentalsDocument28 pagesAccounting For Partnership Firm-FundamentalsTushNo ratings yet

- The Kolkata Municipal Corporation Act, 2022Document506 pagesThe Kolkata Municipal Corporation Act, 2022Rahul SarkarNo ratings yet

- Practice Set JEV and GJ For January and February - Onaro, Kevin T. BSMA 3-1Document23 pagesPractice Set JEV and GJ For January and February - Onaro, Kevin T. BSMA 3-1Kevin T. OnaroNo ratings yet

- MTP Case Analysis 1. Bharat Engineering Works Limited: 2. The Assistant Business ManagerDocument12 pagesMTP Case Analysis 1. Bharat Engineering Works Limited: 2. The Assistant Business ManagerMelsew BelachewNo ratings yet

- Chapter 17 - Financial Planning and ForecastingDocument7 pagesChapter 17 - Financial Planning and ForecastingAnaNo ratings yet

- DTI (Objectives and Authorities)Document5 pagesDTI (Objectives and Authorities)Adan EveNo ratings yet

- Romania Energy PDFDocument7 pagesRomania Energy PDFCezarina Iulia PopescuNo ratings yet

- Swot AnalysisDocument9 pagesSwot Analysisdeborah romeroNo ratings yet

- Vol 141Document104 pagesVol 141Rendi100% (1)

- CBDT - E-Filing - ITR 3 - Validation Rules - V 1.0Document61 pagesCBDT - E-Filing - ITR 3 - Validation Rules - V 1.09o6.atharvamNo ratings yet

- Packing List: Ship-To PartyDocument7 pagesPacking List: Ship-To PartySeb EgnNo ratings yet

- Starbucks Supply Chain ManagementDocument11 pagesStarbucks Supply Chain ManagementVicky NguyenNo ratings yet

- April 2020Document706 pagesApril 2020Saran BaskarNo ratings yet

- Joint VentureDocument6 pagesJoint VentureAditya RajNo ratings yet

- Group-2-PROBLEM SOLVING STRATEGIESDocument53 pagesGroup-2-PROBLEM SOLVING STRATEGIESApple DocasaoNo ratings yet

- The Mint (7 May 2024)Document17 pagesThe Mint (7 May 2024)kent75534No ratings yet

- 8-15. Public Accounting Firm (Modeling Human Resource Management)Document2 pages8-15. Public Accounting Firm (Modeling Human Resource Management)Wally BayolaNo ratings yet

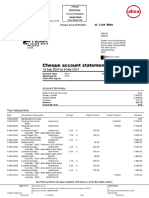

- CASA Statement 1675166411863Document4 pagesCASA Statement 1675166411863I Putu GedeNo ratings yet

- Template - QE - BLT For Incoming 4th YrDocument12 pagesTemplate - QE - BLT For Incoming 4th YrJykx SiaoNo ratings yet

- Orbico Beauty Ulica BB Lužansko Polje 7Document1 pageOrbico Beauty Ulica BB Lužansko Polje 7OmerNo ratings yet

- Hedge Fund Overview PPT NewDocument40 pagesHedge Fund Overview PPT NewMonica NallathambiNo ratings yet

- Analysis of Starbucks CorporationDocument17 pagesAnalysis of Starbucks CorporationSimran ChaudharyNo ratings yet

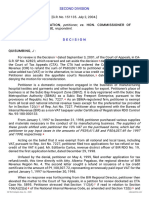

- Contex Corp. v. Commissioner of InternalDocument9 pagesContex Corp. v. Commissioner of InternalCamshtNo ratings yet

- History of GoldDocument5 pagesHistory of GoldJoshua JNo ratings yet

- The Impact of Psak 73 Implementation On Leases in Indonesia Telecommunication CompaniesDocument17 pagesThe Impact of Psak 73 Implementation On Leases in Indonesia Telecommunication CompaniesAnin YusufNo ratings yet

- Modular L Product Profile ECPEN18-416 EnglishDocument8 pagesModular L Product Profile ECPEN18-416 EnglishIorgu CristacheNo ratings yet

- How Cios in China Can Make I 237609Document13 pagesHow Cios in China Can Make I 237609Juan PerezNo ratings yet