Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

10 viewsPerformance

Performance

Uploaded by

Ashutosh BiswalThe portfolio outperformed its benchmark by 1.37%. Asset allocation contributed 0.31% to excess return, while security selection contributed 1.06% primarily from outperformance in equities. The portfolio had higher weightings in equities and cash, and lower in bonds compared to the benchmark. Equities contributed most to excess return through a 1.47% performance excess versus the index.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You might also like

- Group 3 CFEV 5th Assignment-Hansson-Private-LabelDocument10 pagesGroup 3 CFEV 5th Assignment-Hansson-Private-LabelShashwat JhaNo ratings yet

- Coinbase IPO Financial ModelDocument61 pagesCoinbase IPO Financial ModelHaysam TayyabNo ratings yet

- Is Excel Participant - Simplified v2Document10 pagesIs Excel Participant - Simplified v2Aaron Pool0% (2)

- NYSF Leveraged Buyout Model Solution Part ThreeDocument23 pagesNYSF Leveraged Buyout Model Solution Part ThreeBenNo ratings yet

- Portfolio Performance Evaluation Attribution Analysis Excess Return: Managed Portfolio Vs BenchmarkDocument4 pagesPortfolio Performance Evaluation Attribution Analysis Excess Return: Managed Portfolio Vs BenchmarkAshutosh BiswalNo ratings yet

- Attribution PerformanceDocument4 pagesAttribution Performancekren24No ratings yet

- Sun Pharmaceutical IndustriesDocument2 pagesSun Pharmaceutical Industriessharmasumeet1987No ratings yet

- Ratio Practice QuestionDocument1 pageRatio Practice Question7dvybtdg8rNo ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- Discounted Cash Flow-Model For ValuationDocument9 pagesDiscounted Cash Flow-Model For ValuationPCM StresconNo ratings yet

- Analysis (In Millions) 2007 2006 InformationDocument18 pagesAnalysis (In Millions) 2007 2006 InformationGustin PrayogoNo ratings yet

- Analysis (In Millions) 2007 2006 InformationDocument18 pagesAnalysis (In Millions) 2007 2006 InformationGustin PrayogoNo ratings yet

- DCF Modelling - WACC - CompletedDocument1 pageDCF Modelling - WACC - Completed2203037No ratings yet

- Ratio Analysis TemplateDocument3 pagesRatio Analysis Templateعمر El KheberyNo ratings yet

- Industry Median 2018 2017 2016 2015 2014 2013 2012Document10 pagesIndustry Median 2018 2017 2016 2015 2014 2013 2012AnuragNo ratings yet

- Financial Management: AssignmentDocument7 pagesFinancial Management: AssignmentAlysaad LasiNo ratings yet

- Calculation of Cost of Equity 3. Calculation For Equity CapitalDocument4 pagesCalculation of Cost of Equity 3. Calculation For Equity Capitalshivam chughNo ratings yet

- Chapter 24Document7 pagesChapter 24JosuaNo ratings yet

- Earnings Quality Score 28 20: State Bank of India - Income Statement 11-Sep-2021 21:30Document36 pagesEarnings Quality Score 28 20: State Bank of India - Income Statement 11-Sep-2021 21:30Naman KalraNo ratings yet

- DCF Modelling - WACC - CompletedDocument6 pagesDCF Modelling - WACC - Completedkukrejanikhil70No ratings yet

- BoeingDocument11 pagesBoeingPreksha GulatiNo ratings yet

- Ratio Analysis TemplateDocument3 pagesRatio Analysis TemplateTom CatNo ratings yet

- Pe RatiosDocument6 pagesPe RatiosRakesh SharmaNo ratings yet

- Finratio BTW F1Document2 pagesFinratio BTW F1saptophs.fatNo ratings yet

- Ratio Analysis: Growth Ratios 2016Document3 pagesRatio Analysis: Growth Ratios 2016radulescuandrei100No ratings yet

- Hisar Spinning Mills LTD Ratios Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Per Share RatiosDocument5 pagesHisar Spinning Mills LTD Ratios Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Per Share Ratiossmartmegha8116947No ratings yet

- NYSF Leveraged Buyout Model Solution Part TwoDocument20 pagesNYSF Leveraged Buyout Model Solution Part TwoBenNo ratings yet

- Exercise On Factor AnalysisDocument4 pagesExercise On Factor AnalysisFCNo ratings yet

- Masonite Corp DCF Analysis FinalDocument5 pagesMasonite Corp DCF Analysis FinaladiNo ratings yet

- DCF ModelingDocument8 pagesDCF Modelingramanshekhawat719No ratings yet

- Eps N LevrageDocument7 pagesEps N LevrageShailesh SuranaNo ratings yet

- ICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument2 pagesICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjNo ratings yet

- Safari - 26-Feb-2018 at 3:42 PM-1Document1 pageSafari - 26-Feb-2018 at 3:42 PM-1Hesamuddin KhanNo ratings yet

- Arun 1Document2 pagesArun 1Nishanth RioNo ratings yet

- Basf RatiosDocument2 pagesBasf Ratiosprajaktashirke49No ratings yet

- Group 6 Project MADocument32 pagesGroup 6 Project MAPhạm Kỳ DuyênNo ratings yet

- Adani Ports Financial RatiosDocument2 pagesAdani Ports Financial RatiosTaksh DhamiNo ratings yet

- Nerolac - On Ratio - SolvedDocument6 pagesNerolac - On Ratio - Solvedricha krishnaNo ratings yet

- Ratios 1Document2 pagesRatios 1Bhavesh RathodNo ratings yet

- July 2009 Return SheetsDocument3 pagesJuly 2009 Return SheetsbentleyinvestmentgroupNo ratings yet

- Particulars Amount ($ Millions) Interest Rate (%) Long Term DebtDocument10 pagesParticulars Amount ($ Millions) Interest Rate (%) Long Term DebtShrishti GoyalNo ratings yet

- Previous Years : L&T Finance Holding SDocument6 pagesPrevious Years : L&T Finance Holding Srahul gargNo ratings yet

- IIFL Finance Q1FY24 Data BookDocument11 pagesIIFL Finance Q1FY24 Data Bookvishwesheswaran1No ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Dupont Analysis ModelDocument278 pagesDupont Analysis ModelKartikay GoswamiNo ratings yet

- DCF Modelling - 12Document24 pagesDCF Modelling - 12sujal KumarNo ratings yet

- Airtel DividdendDocument6 pagesAirtel DividdendRishab KatariaNo ratings yet

- Financial Synergy Valuation Template 1Document2 pagesFinancial Synergy Valuation Template 1Luthfi MNo ratings yet

- 2.valuation - TDM - WITHOUT - SOLUTIONS Slim FinalDocument55 pages2.valuation - TDM - WITHOUT - SOLUTIONS Slim FinalMeriam HaouesNo ratings yet

- MahindraDocument13 pagesMahindrashrikant.colonelNo ratings yet

- AC First Project RatiosDocument1 pageAC First Project RatiosRobert IronsNo ratings yet

- Fixed Income Attribution AnalysisDocument21 pagesFixed Income Attribution AnalysisJaz MNo ratings yet

- Book 11Document79 pagesBook 11usman12345678No ratings yet

- Wip Ro Key Financial Ratios - in Rs. Cr.Document4 pagesWip Ro Key Financial Ratios - in Rs. Cr.Priyanck VaisshNo ratings yet

- Portfolio Performance Analysis: Group 8Document8 pagesPortfolio Performance Analysis: Group 8AYUSHI NAGARNo ratings yet

- The Warren Buffett Spreadsheet v16 - PreviewDocument589 pagesThe Warren Buffett Spreadsheet v16 - PreviewNikhil SharmaNo ratings yet

- Ratio 10-09Document1 pageRatio 10-09honeygoel13No ratings yet

- RatiosDocument31 pagesRatiosAMegoz 25No ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisSEHWAG MATHAVANNo ratings yet

- Quantitative Finance: Its Development, Mathematical Foundations, and Current ScopeFrom EverandQuantitative Finance: Its Development, Mathematical Foundations, and Current ScopeNo ratings yet

Performance

Performance

Uploaded by

Ashutosh Biswal0 ratings0% found this document useful (0 votes)

10 views4 pagesThe portfolio outperformed its benchmark by 1.37%. Asset allocation contributed 0.31% to excess return, while security selection contributed 1.06% primarily from outperformance in equities. The portfolio had higher weightings in equities and cash, and lower in bonds compared to the benchmark. Equities contributed most to excess return through a 1.47% performance excess versus the index.

Original Description:

Original Title

performance.xls

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe portfolio outperformed its benchmark by 1.37%. Asset allocation contributed 0.31% to excess return, while security selection contributed 1.06% primarily from outperformance in equities. The portfolio had higher weightings in equities and cash, and lower in bonds compared to the benchmark. Equities contributed most to excess return through a 1.47% performance excess versus the index.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

10 views4 pagesPerformance

Performance

Uploaded by

Ashutosh BiswalThe portfolio outperformed its benchmark by 1.37%. Asset allocation contributed 0.31% to excess return, while security selection contributed 1.06% primarily from outperformance in equities. The portfolio had higher weightings in equities and cash, and lower in bonds compared to the benchmark. Equities contributed most to excess return through a 1.47% performance excess versus the index.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 4

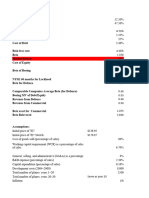

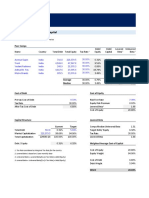

Portfolio Performance Evaluation

Attribution Analysis

Excess Return: Managed Portfolio vs Benchmark

Benchmark Return of Index

Component Weight during Period Performance

Equity (FUSEX) 60% 5.81% 3.49%

Bonds (VUSTX) 30% 1.45% 0.44%

Cash 10% 0.48% 0.05%

Bogey (Benchmark Portfolio) Return 3.97%

Return of Managed Portfolio 5.34%

Excess return of managed portfolio 1.37%

Contribution of Asset Allocation to Performance

(1) (2) (3) (4) (3)x(4)

Component

Managed Benchmark Return minus

Portfolio Portfolio Excess Total Benchmark Contribution to

Component Weights Weights Weight Return Performance

Equity 70% 60% 10% 1.84% 0.184%

Bonds 7% 30% -23% -2.52% 0.579%

Cash 23% 10% 13% -3.49% -0.454%

Contribution of Asset Allocation 0.310%

Contribution of Security Selection to Performance

(1) (2) (3) (4) (3)x(4)

Managed Component

Portfolio Index Excess Managed Portfolio Contribution to

Component Performance Performance Performance Weight Performance

Equity 7.28% 5.81% 1.47% 70.00% 1.029%

Bonds 1.89% 1.45% 0.44% 7.00% 0.031%

Cash 0.48% 0.48% 0.00% 23.00% 0.000%

Contribution of Security Selection 1.060%

Portfolio Attribution Summary

Contribution

1 Asset Allocation 0.310%

2 Selection

1 Equity excess return 1.029%

2 Bonds excess return 0.031%

3 Cash excess return 0.000% 1.060%

Total excess return on portfolio 1.370%

You might also like

- Group 3 CFEV 5th Assignment-Hansson-Private-LabelDocument10 pagesGroup 3 CFEV 5th Assignment-Hansson-Private-LabelShashwat JhaNo ratings yet

- Coinbase IPO Financial ModelDocument61 pagesCoinbase IPO Financial ModelHaysam TayyabNo ratings yet

- Is Excel Participant - Simplified v2Document10 pagesIs Excel Participant - Simplified v2Aaron Pool0% (2)

- NYSF Leveraged Buyout Model Solution Part ThreeDocument23 pagesNYSF Leveraged Buyout Model Solution Part ThreeBenNo ratings yet

- Portfolio Performance Evaluation Attribution Analysis Excess Return: Managed Portfolio Vs BenchmarkDocument4 pagesPortfolio Performance Evaluation Attribution Analysis Excess Return: Managed Portfolio Vs BenchmarkAshutosh BiswalNo ratings yet

- Attribution PerformanceDocument4 pagesAttribution Performancekren24No ratings yet

- Sun Pharmaceutical IndustriesDocument2 pagesSun Pharmaceutical Industriessharmasumeet1987No ratings yet

- Ratio Practice QuestionDocument1 pageRatio Practice Question7dvybtdg8rNo ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- Discounted Cash Flow-Model For ValuationDocument9 pagesDiscounted Cash Flow-Model For ValuationPCM StresconNo ratings yet

- Analysis (In Millions) 2007 2006 InformationDocument18 pagesAnalysis (In Millions) 2007 2006 InformationGustin PrayogoNo ratings yet

- Analysis (In Millions) 2007 2006 InformationDocument18 pagesAnalysis (In Millions) 2007 2006 InformationGustin PrayogoNo ratings yet

- DCF Modelling - WACC - CompletedDocument1 pageDCF Modelling - WACC - Completed2203037No ratings yet

- Ratio Analysis TemplateDocument3 pagesRatio Analysis Templateعمر El KheberyNo ratings yet

- Industry Median 2018 2017 2016 2015 2014 2013 2012Document10 pagesIndustry Median 2018 2017 2016 2015 2014 2013 2012AnuragNo ratings yet

- Financial Management: AssignmentDocument7 pagesFinancial Management: AssignmentAlysaad LasiNo ratings yet

- Calculation of Cost of Equity 3. Calculation For Equity CapitalDocument4 pagesCalculation of Cost of Equity 3. Calculation For Equity Capitalshivam chughNo ratings yet

- Chapter 24Document7 pagesChapter 24JosuaNo ratings yet

- Earnings Quality Score 28 20: State Bank of India - Income Statement 11-Sep-2021 21:30Document36 pagesEarnings Quality Score 28 20: State Bank of India - Income Statement 11-Sep-2021 21:30Naman KalraNo ratings yet

- DCF Modelling - WACC - CompletedDocument6 pagesDCF Modelling - WACC - Completedkukrejanikhil70No ratings yet

- BoeingDocument11 pagesBoeingPreksha GulatiNo ratings yet

- Ratio Analysis TemplateDocument3 pagesRatio Analysis TemplateTom CatNo ratings yet

- Pe RatiosDocument6 pagesPe RatiosRakesh SharmaNo ratings yet

- Finratio BTW F1Document2 pagesFinratio BTW F1saptophs.fatNo ratings yet

- Ratio Analysis: Growth Ratios 2016Document3 pagesRatio Analysis: Growth Ratios 2016radulescuandrei100No ratings yet

- Hisar Spinning Mills LTD Ratios Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Per Share RatiosDocument5 pagesHisar Spinning Mills LTD Ratios Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Per Share Ratiossmartmegha8116947No ratings yet

- NYSF Leveraged Buyout Model Solution Part TwoDocument20 pagesNYSF Leveraged Buyout Model Solution Part TwoBenNo ratings yet

- Exercise On Factor AnalysisDocument4 pagesExercise On Factor AnalysisFCNo ratings yet

- Masonite Corp DCF Analysis FinalDocument5 pagesMasonite Corp DCF Analysis FinaladiNo ratings yet

- DCF ModelingDocument8 pagesDCF Modelingramanshekhawat719No ratings yet

- Eps N LevrageDocument7 pagesEps N LevrageShailesh SuranaNo ratings yet

- ICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument2 pagesICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjNo ratings yet

- Safari - 26-Feb-2018 at 3:42 PM-1Document1 pageSafari - 26-Feb-2018 at 3:42 PM-1Hesamuddin KhanNo ratings yet

- Arun 1Document2 pagesArun 1Nishanth RioNo ratings yet

- Basf RatiosDocument2 pagesBasf Ratiosprajaktashirke49No ratings yet

- Group 6 Project MADocument32 pagesGroup 6 Project MAPhạm Kỳ DuyênNo ratings yet

- Adani Ports Financial RatiosDocument2 pagesAdani Ports Financial RatiosTaksh DhamiNo ratings yet

- Nerolac - On Ratio - SolvedDocument6 pagesNerolac - On Ratio - Solvedricha krishnaNo ratings yet

- Ratios 1Document2 pagesRatios 1Bhavesh RathodNo ratings yet

- July 2009 Return SheetsDocument3 pagesJuly 2009 Return SheetsbentleyinvestmentgroupNo ratings yet

- Particulars Amount ($ Millions) Interest Rate (%) Long Term DebtDocument10 pagesParticulars Amount ($ Millions) Interest Rate (%) Long Term DebtShrishti GoyalNo ratings yet

- Previous Years : L&T Finance Holding SDocument6 pagesPrevious Years : L&T Finance Holding Srahul gargNo ratings yet

- IIFL Finance Q1FY24 Data BookDocument11 pagesIIFL Finance Q1FY24 Data Bookvishwesheswaran1No ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Dupont Analysis ModelDocument278 pagesDupont Analysis ModelKartikay GoswamiNo ratings yet

- DCF Modelling - 12Document24 pagesDCF Modelling - 12sujal KumarNo ratings yet

- Airtel DividdendDocument6 pagesAirtel DividdendRishab KatariaNo ratings yet

- Financial Synergy Valuation Template 1Document2 pagesFinancial Synergy Valuation Template 1Luthfi MNo ratings yet

- 2.valuation - TDM - WITHOUT - SOLUTIONS Slim FinalDocument55 pages2.valuation - TDM - WITHOUT - SOLUTIONS Slim FinalMeriam HaouesNo ratings yet

- MahindraDocument13 pagesMahindrashrikant.colonelNo ratings yet

- AC First Project RatiosDocument1 pageAC First Project RatiosRobert IronsNo ratings yet

- Fixed Income Attribution AnalysisDocument21 pagesFixed Income Attribution AnalysisJaz MNo ratings yet

- Book 11Document79 pagesBook 11usman12345678No ratings yet

- Wip Ro Key Financial Ratios - in Rs. Cr.Document4 pagesWip Ro Key Financial Ratios - in Rs. Cr.Priyanck VaisshNo ratings yet

- Portfolio Performance Analysis: Group 8Document8 pagesPortfolio Performance Analysis: Group 8AYUSHI NAGARNo ratings yet

- The Warren Buffett Spreadsheet v16 - PreviewDocument589 pagesThe Warren Buffett Spreadsheet v16 - PreviewNikhil SharmaNo ratings yet

- Ratio 10-09Document1 pageRatio 10-09honeygoel13No ratings yet

- RatiosDocument31 pagesRatiosAMegoz 25No ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisSEHWAG MATHAVANNo ratings yet

- Quantitative Finance: Its Development, Mathematical Foundations, and Current ScopeFrom EverandQuantitative Finance: Its Development, Mathematical Foundations, and Current ScopeNo ratings yet